Difference between revisions of "Advantages and Disadvantages of PAYGO Approaches"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 329: | Line 329: | ||

<br/> | <br/> | ||

<div> | <div> | ||

| + | |||

== G Policy And Commitmentpolicy Focus To Overcome Market Barriers Depend On Governmental Commitment == | == G Policy And Commitmentpolicy Focus To Overcome Market Barriers Depend On Governmental Commitment == | ||

| − | |||

| − | |||

| − | <br/> | + | </div> Creation of the environment to allow for a rapid market growth through huge investment will not come over night. Governments need to focus their policies on PAYGO and other energy access topics and need to commit to long-term plans to foster scaling up of PAYGO approaches. Furthermore, policies that identify other issues like quality should be included and replicated in many countries.<ref name="Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.">Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.</ref><br/> |

| + | |||

| + | *See also [[Role_of_Supporting_Environment_in_Fostering_Pay-as-you-go_Approaches_(PAYGO)|Role of Supporting Environment in Fostering Pay-as-you-go Approaches (PAYGO)]] | ||

| + | |||

= Comparison of Advantages and Disadvantages of PAYGO Approaches = | = Comparison of Advantages and Disadvantages of PAYGO Approaches = | ||

Revision as of 15:41, 2 February 2018

Overview

Through a variety of Pay-as-you-go (PAYGO) approaches, the solar energy sector has become very dynamic in the recent years: Companies sell solar services or solar products through a pre-paid model (in small instalments) to customers that can afford these services and become potential or actual customers.

This article lists the advantages and disadvantages of PAYGO with detailed results from studies as examples.

Furthermore, it gives a short overview table to contrast the advantages and disadvantages along the following categories:

- Impact on energy access

- Financing possibilities

- Affordability

- Households’ expenses for lighting

- Psychology: decision making

- Financial inclusion

- Policy & Commitment.

Since it is not easy to identify any comments or research about the negative experiences of PAYGO, this article tries to focus rather on the critique and the possible negative implications of PAYGO than the positive outcomes. Please feel free to add your own experiences!

Pay-as-you-go Approach

Definitions: PAYGO

Pay-as-you-go (PAYGO) is a digital financing technology that allows end-users to digitally pay for solar energy in weekly instalments. (Read more on Pay-as-you-go Approaches (PAYGO)). Find an overview of relevant companies and their approaches here. If you are interested in how the PAYGO market developed, read this PAYGO market overview.

Advantages and Positive Experiences with PAYGO

Impact On Energy Access

Key Driver For Energy Access

PAYGO is considered a “key driver of growth for scalable off-grid energy providers” as:[1]

- More people can afford better energy services: “We’ve been thrilled to see how quickly our customers have migrated with d.light from solar lanterns to our larger Pay-Go systems”. d.light[2]

- Systems provided through PAYGO impact also other factors of communities: improving community health, creating employment, fostering self-employment, providing education and skills.[3]

PAYGO Fosters a Commercial, Demand-Driven Approach

PAYGO fosters a commercial, demand-driven approach. Therefore, it is in the companies’ own interest to meet the customers’ needs (quality, after-sales service and customer care).[4]

Competition will stress test energy access business models and reveal successful approaches. [5]

PAYGO allows more people to buy more devices and use the solar electricity: this expansion in terms of goods and services is a growth opportunity. However, alongside the need for clean energy within households for lighting, mobile charging, entertainment and cooling (pure consumption), exists also the need for using solar electricity for productive use (and income generation) in order to contribute to poverty alignment.[4]

PAYGO Allows Private Sector To Step In

According to UNEP DTU Partnership (2016), PAYGO offers the possibility that the private sector can take over to supply even the poorest in the most remote areas. Since rural electrification is still more expensive than in urban areas, development cooperation should focus on improving the general economic conditions of the poorest groups in rural areas and not so much on bringing them the right technology.[6]

PAYGO Reaches Households With Lower Incomes And In Remote Areas Than Traditional Mfi

Traditional banks and MFIs do not target classical PAYGO customers. Some are reluctant to offer credits for SHS only because the credit value is very small and seen as a non-productive asset. PAYGO companies can serve those customers (low-income), that are too risky for MFIs: Customers that have less income (using the shut off technology as collateral); customers that live in very remote areas (using mobile money to lower transaction costs); serve customers with high-end products too expensive for top-up of MFI loans. In Senegal, PAYGO is expected to reach an additional quarter of the target market (10-15% can afford to pay upfront, 15-20% can afford a top-up loan) that otherwise would have stayed untapped.[7]

B Financing Possibilities

Private Financing Increases (For Energy Access)

Companies applying PAYGO approaches manage to raise large-scale working capital from investors to finance up-front costs. Those companies often do not have access to traditional financing institutions like banks, but due to their demand are expected to be served with less expensive loans in the long run.[8]

PAYGO solar is becoming a commercial opportunity: Investments in PAYGO solar companies grew from 3 million USD in 2012 to 223 million USD in 2016. Largest growth in equity financing. The share of grants was largest in 2014.[9]

In the fourth quarter of 2016, private equity firms invested over USD 60 million in Nigerian mobile PAYGO solar provider Mobisol and Lumos Global, which is selling emissions-free electricity services from solar-storage micro-grids.[10]

Both companies sell larger systems than the original PAYGO pioneers.[9] Both companies target relatively well-off customers, with systems up to USD 1,000, rather than the typical USD 150 - 200 for Solar Home Systems (SHS).[9]

Since Lumos is integrated with mobile phone operator MTN, telecom operators are expected to “increasingly use their reach to distribute solar products”.[9]

SunFunder, a US-based lender for small-scale solar companies primarily in Africa, raised USD 21 million in 2016 from OPIC, MCE Social Capital and Rockefeller Foundation, with a view to double that amount in the near future. This dramatically increases the size and range of their debt finance offerings for solar in developing countries.[11]

In East Africa, 17 foundations, 21 impact funds, 4 venture capital funds, 2 corporate venture capital funds, and 8 large companies have invested in PAYGO companies (until 2016).[12]

C Affordability

Small Instalments Overcome Affordability Hurdle

People can afford the small instalments and pay for their solar energy needs: Impact studies showed households using solar systems by Azuri benefit from significantly more hours of light and from the ability to charge phones at home. “Households that adopted Indigo as their sole source of lighting or in combination with others had respectively 1.75 and 2.5 times more lighting time per day than the control group.”[13]

PAYGO Lowers The Credit Risks For Households

PAYGO offers the possibility for clients to lower their risks. After completion of the payment plan, future loans might be perceived not as risky for this group by banks and MFIs as before.[14] Furthermore, they do not have to bare the risk of the full price of the solar product: In case of not complying with the payment, the PAYGO company repossesses the product and the client loses the down payment (and all payments up until that point), however there is no risk in losing the total system price.[15]

D Households’ Expenses For Lighting

Less Expenses For Phone Charging

People can charge their phones at home (and have therefore less expenses and more time at their hands): In Rwanda, mobile owners had to walk for half an hour (including higher theft risk) and wait there for 2-3 hours to get their mobile phone charged. “Sixty percent of the households which own Indigo products charge all their phones at home and have seen the amount paid per week for charging disappear.” Cost for charging a phone were reported to be RWF 200 (approx. USD 0.26) a week.[16] This could be almost one third of the expenses for lighting: Mobile phone owners had almost double the weekly expenses for lighting (+charging) of non-owners: an average of RWF 680 (approx. USD 1) vs. RWF 392 (approx. USD 0.60).[16]

Many use their phones to pay for the instalments, therefore both technologies are interconnected.

PAYGO Is Less Expensive Than Kerosene

Azuri’s research found that PAYGO systems cut customers weekly energy spending by as much as 50 percent. “Whereas residents typically spend $2 per week on kerosene, they might pay $1 per week for the basic PAYGO system. So for half the cost they get proper, clean lighting and the ability to charge mobile phones when they want right at home,” Simon Bransfield-Garth, CEO of Azuri.[17] In Peru, families with a reading light (picoPV for USD 25) will save approximately USD 616 on energy costs in 5 years because they save the 30 Soles per month for traditional lighting. Additionally, they have 3.9 additional hours per day of lighting to work and/or complete household chores.[18]

F Financial Inclusion

Financial Inclusion Via PAYGO

PAYGO offer the possibility to establish a track record of payed back credit. After the purchase via PAYGO of a solar product, the household not only has a good rating with financing institutions, but also a collateral to continue with the same (or similar) amount of instalments to buy other products.[19]

Disadvantages and Negative Experiences with PAYGO

A Impact On Energy Access

Hype: PAYGO Investments Too High

- Investments grow too fast, “for a sector that still has not fully solved core business model issues and may struggle under the high growth expectations and misaligned incentives of many venture capitalists”.[20]

No Profitability Of Remote Distribution With PAYGO

- Sensitivity to a capital-intensive venture model that is applied to rural, physical last-mile distribution: PAYGO service infrastructure is not profitable for businesses serving rural, poorer customers.[20]

- Focus on specific sectors (like energy access) has proven to be arbitrary and unnecessarily limiting for Ceniarth to reach the last mile customers. The impact investor Ceniarth pulled out of the PAYGO businesses and published 5 reasons why. One of them: PAYGO is not suitable to reach the last mile customers.[20]

Early Stage Technology: Companies/Projects Face Difficulties

PAYGO implementation projects have to face “various distribution challenges”, but benefit from the learning process along the way.[13]

A report by Hystra in May 2017 identifies the following 5 challenges for PAYGO companies:[7]

- Maintaining both fast growth rate and high portfolio quality

- Managing tension between end-user affordability and risk exposure

- Recruiting and managing field staff at scale

- Raising significant and appropriate funding

- Replicating in more complex geographies

Other challenges include: payment methods, the local distributor’s limited capacity, changing tax regulations, and also (but to a lesser degree) the technical performance of the product.[13] Furthermore, raising enough capital also leads to lower sales numbers of PAYGO products: GOGLA and Lighting Global report that several cash-sale companies reported declining sales as a result of limited inventory financing, primarily in Tanzania and Ethiopia. Such bottlenecks create opportunities for competitors, primarily generic lantern manufacturers, to capture market share.

Limited Competition: Local Vs. International Companies

Almost all successful PAYGO companies are international ones. They are foreign owned and foreign managed.

Local businesses miss out on this opportunity.[21] Local PAYGO companies often lack the initial resources, as well as the networks and skills, to raise both early-stage capital and develop complex financial structures to raise debt capital from international markets. Local companies are also hesitant to take on foreign currency risk.

The relative lack of access to finance results in fewer companies and less competition in the PAYGO sector. More companies could emerge, as local currency debt gets more available. Increased competition among more companies will probably lower prices and increase sales.[22]

B Financing Possibilities

Funding Depends On Public Funding

All PAYGO companies receive public (international) funding and/or working capital from multilateral and national development agencies.

- ADB announced in 2016 to extend the loans for PAYGO in India, Pakistan and Sri Lanka to 1.1 billion USD.[23]

- Nigeria’s Bank of Industry (BoI) launched a 1 billion Nara (USD 3.1 million) off-grid solar energy fund in January 2017 (Green Energy Project with UNDP). The bank will lend and/or invest the fund’s capital on favourable, concessionary terms to qualified businesses installing mobile pay-go and other forms of off-grid solar energy systems and services across the country.[24]

Private (Debt) Financing Is Still Limited

PAYGO companies need working capital to scale up their activities. Many impact investors limit their investment into infrastructure to an amount below 20 million USD. However, because this is still an unproven industry and PAYGO customers do not have a proven track record due to informality, it is difficult to convince banks to lend PAYGO companies those amounts of debt capital.

Local banks often have limited understanding of the sector and an exaggerated sense of the risks of lending to companies in the sector and are also hesitant to provide financing to PAYGO customers: they perceive PAYGO companies as early-stage, risky businesses and are unfamiliar with the technology as well as the creditworthiness of rural consumers.[22]

Furthermore, many risks are perceived higher than for other conventional industries.

- Correlation risks (customer clustering) and tenor expectations (anticipated period of the payback times).[25]

- Foreign currency debt has two major risks: 1.) Complex structures with high transaction costs (involving legal and tax advisory services). 2.) Currency risks: depreciation of local currency limits their assets.[22]

Two sample deals for debt funding before 2017: both are still limited amounts and demonstrate the high perceived risk within the PAYGO sector:

- In 2015, BBOXX and Oikocredit financed a pilot in East Africa for 2,500 customers (0.5 million USD). Local currency with 21% interest rate and a timeline of 30 month (equivalent to the households’ contracts) and 30% over-collateralisation reduced the investors’ risks.[26][25]

- In May 2016, SunFunder launched its Structured Asset Finance Instrument (SAFI). Solar Now in Uganda got a credit of 2 million USD to reach new customers. This approach is replicable with other PAYGO companies and other investors may join SunFunder. [25]

The following table shows the funding needs of PAYGO companies over time. In the seeding stage, PAYGO companies depend on grants and equity lending below 1 million USD. As more companies reach the expansion and scaling up stage, more debt money is needed.

In 2017, a few companies are now in the search for more than 50 million USD, and a first cohort is likely to approach even the scaling up stage of several 100 million USD soon to be able to finance customer purchases. Since this is outside of impact investors’ interest, they need to get the debt financing in other facilities.[25]

Table: Risks are lower for smaller amounts of funding.[25]

|

High risks |

|

|

|

|

Low risk |

|---|---|---|---|---|---|

|

|

Seed stage |

Early stage |

Expansion stage |

Scaling-up stage |

|

|

|

0.25-1 million |

3-5 million |

10-20 million |

50-100 million |

|

|

|

Grants, equity |

equity |

equity |

debt |

|

However, even for companies in the early stages, little capital is available and with a high risk attached to build up businesses, testing and piloting.[25]

It is expected that the scale-up will be fast: in the US residential solar securitisation increased from 50 to 800 million USD in 2 years after the portfolio performance metrics were harmonised.[25]

- Find more about how to measure and mitigate risk in PAYGO solar refinancing.

C Affordability

PAYGO Is Expensive: High Interest Rates

Interest rates for micro loans are usually pretty high. They range from around 50% to an Annualised Percentage Rate of over 600%.[27] The high effective interest rate is partly explained by the need for the PAYGO companies to recover initial investment in product development and distribution infrastructure.[22]

Flexibility Of Payments Is Conditional

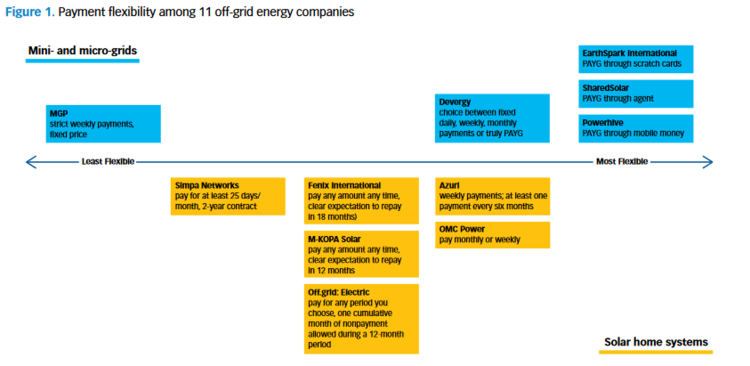

Not all companies offer the same flexibility to their customers. Some companies have restrictions on timing and level of amount of payments. All impose at least some conditions on flexible payments. “Most plans are considerably more constrained than those offered to mobile telephone customers.”[28] Mobile phones still can be used, even if customers do not buy minutes (via mobile money or scratch cards). Most PAYGO companies expect customers to spend a certain amount during 12-24 month.

Find an overview of 5 mini-grid providers and 6 solar companies and their level of flexibility:

Only mini-grid companies that use smart meters, can implement a pay-as-you-go approach. Only solar companies that have record keeping score of the payments, can implement a flexible PAYGO approach.[28]

Interrupted Electricity Supply

In Rwanda, round 1/3 of households is sometimes out of power because instalments are too high. “Seventy-six percent of Indigo customers said a monthly payment of RWF 3,000 would be convenient for them (slightly less than the current RWF 3,500 per month). Thirty-two percent of customers had been out of credit at least once because they did not have money to pay for the top up.”[13] PAYGO makes solar products affordable for some customer groups, while two thirds of the would prefer lower instalments and report to still have challenges to pay over USD 4.

D Households’ Expenses For Lighting

Households Using PAYGO Have Higher Expenses For Lighting

People using PAYGO tend to spend more for their lighting services than people without a solar lamp. “It proved difficult to establish the real amount spent per week by Indigo users and non- users on lighting, but it seems that the Indigo users pay more than the control group of non-users for lighting purposes.”[13] This is probably because they continue to use and buy other sources of lighting fuel. Furthermore, around 40% with a solar product charge their phones out of the house, and spend money and time for charging.[13]

E Psychology: Decision Making

Psychological Discord Associated With PAYGO Models

PAYGO companies offer their target customers to pay money in small instalments. Some difficulties to make those payments might be associated with psychological discord. Dan Ariely calls it the “pain of paying”.[29]

- Every time someone parts with his or her money, it inflicts psychological “pain.”

- This “pain” happens no matter how big or small the amount of money someone is paying.

- This “pain” is increased if someone pays in cash (instead of credit card or an automatic payment)

Even if it just a small amount, pay-as-you-go customers feel this pain every time they make a deposit on their solar home system.

Some PAYGO companies follow some of the recommendations to overcome this disadvantage:

- Use mobile payments or automatic deductions to reduce the pain of paying: Dan’s research suggests that the more abstract the money, the less pain you experience.

- However, the payment structure should also align with the cash flow of the customers[30]: maybe a steady monthly payment plan is not how they income is generated.

Furthermore, borrowing through a mobile phone feels different than borrowing through more traditional, in-person avenues, and is more tempting. For people, who make complex financial decisions under conditions of extreme scarcity on a daily basis, mental accounting is a hard thing to measure.[31] Mental accounting plays a role especially in “push-loans” via SMS because, after being offered a loan, potential customers feel they “loose” something that they in reality do not need.[32]

F Financial Inclusion

Only/Mostly Wealthy People Use PAYGO

Households that use PAYGO systems to pay for their energy services are among the wealthier segments of the rural population in Rwanda. It is more challenging for poorer households to afford solar energy even with PAYGO.[13]

Some suggest that PAYGO solar companies are not primarily serving the most remote, isolated communities and are therefore not delivering on the imperative of the energy access sector to bring energy services to the most vulnerable people.[20]

PAYGO Is Tricky (And Expensive)

The question is whether there really is a need for PAYGO approaches: Why do people need PAYGO and credits to purchase energy products? They have money to buy mobile phones…why do they not decide to buy efficient lighting products as well?

- Salvatore Chester “Based on my local experience in rural Ethiopia, PAYG is a tricky and expensive solution for the majority at the BOP. More burden is added by extremely expensive MFI's credits, guarantees and now... "free" insurance. I do hope that poorest are provided with affordable and competitive products delivered where they are, for their cash, instead. Yes , as simple as that. https://www.facebook.com/groups/TEA.ethiopia/”

- Salvatore Chester Further to my earlier comment, please consider that most of same solar-customers had the opportunity to buy cash their nice mobile phones by the hundred of millions (NB. mobile phones market penetration is over 80% in Africa) without these tricky / expensive payg and credit systems. Where were they, then?

From the customer’s point of view, the financial offerings of the PAYGO companies are expensive. PAYGO have to calculate that they offer financial products to unbanked customers. In many countries, a lack of general manufacturing infrastructure and the high transaction costs of raising exclusively international capital raise the costs.[22]

Consumer Understanding Of Loans

Unclear disclosure of interest rates, fees and other terms means customers often may not understand what they are agreeing to. Without an internet connection, they are often not able to access terms and other documents.[32]

Data Usage

Consumers might not understand exactly what type of data is collected and used by the lender or seller through the mobile device. Since most people are not used to have the product to produce mobile data, “it is unlikely they will read the full terms and conditions”. [32]

Multi-Borrowing; Unregulated Credit Markets

As most digital lenders (e.g. PAYGO companies) are nonbanks they are not required to report data at all. Nobody can check how many micro-loans somebody already has.[32] Because it is highly unregulated and therefore easy to obtain loans, multiple loans might set the consumer out to fail and be included in a black list for outstanding loans.[27]

G Policy And Commitmentpolicy Focus To Overcome Market Barriers Depend On Governmental Commitment

</div> Creation of the environment to allow for a rapid market growth through huge investment will not come over night. Governments need to focus their policies on PAYGO and other energy access topics and need to commit to long-term plans to foster scaling up of PAYGO approaches. Furthermore, policies that identify other issues like quality should be included and replicated in many countries.[14]

Comparison of Advantages and Disadvantages of PAYGO Approaches

The following table lists some of the relevant positive and negative experiences with PAYGO models. For each bullet point, you find more details in the rest of the article above.

|

Category |

Positive experiences |

Negative experiences |

|---|---|---|

|

Impact on energy access |

|

|

|

Financing possibilities |

|

|

|

Affordability |

|

|

|

Households’ expenses for lighting |

|

|

|

Psychology |

|

|

|

Financial inclusion |

|

|

|

Policy & Commitment |

|

|

Conclusion

PAYGO has been hyped since its appearance a few years ago. The advantages identified in this article are that PAYGO is considered as the key driver for energy access, that PAYGO fosters a commercial, demand-driven approach of energy access and that therefore private investment for energy access increases because private sector is able to step in. Furthermore, the small instalments of PAYGO overcome the affordability hurdle and people spend less money for phone charging and for lighting because PAYGO is less expensive than kerosene. In addition, PAYGO offers financial inclusion of new segments of the population. PAYGO lowers the credit risks for households, and they are more likely to be financially included.

There are also some negative experiences or potential disadvantages of PAYGO.

Some actors fear that the increase in investment is only a hype and that is grows too fast. They also fear that PAYGO companies can never reach profitability in rural areas. Furthermore, PAYGO is still in its early stages as a technology: there are only a handful of companies (32 in 2016) and competition is limited. Furthermore, many companies and/ or projects involved face difficulties. One of those (among others) is the difficulty to acquire the relevant funding in the stages of business development. Most of the funding depends on public funding, while private financing has its limitations due to many risks and lack of access to commercial funding institutions.

PAYGO products are relatively expensive for the customers: payments include high interest rates to pay for product development of the PAYGO companies. Flexibility of payments is conditional, mostly wealthy people use PAYGO. Some studies revealed that households using PAYGO have higher expenses for lighting, others face interrupted electricity supply because they cannot pay the instalments in time. From a psychological perspective, there are also difficulties associated with paying multiple times. This might be one reason why some users consider PAYGO as tricky and expensive. Furthermore, high interest rates, little understanding of terms and data use, and the ease of compiling multiple loans makes it difficult to judge for a potential PAYGO customer the real costs of the arrangement. Some studies show that the rather wealthier segment of the population profits from PAYGO approaches and therefore the poorer are still financially excluded.

How the market situation for PAYGO companies will develop in the future, depends also highly on the policy focus to overcome market barriers and on the respective Governmental commitment.

While there are many stories and webpages talking highly about PAYGO possibilities, there is little research on how PAYGO approaches might have a negative effect on the affordability and market outreach of energy access services and products. “It is not easy for most investors to publicly acknowledge concerns about sectors where they have made financial commitments.”[33] This is why this article tried to focus rather on the critique and the possible negative implications of PAYGO than the positive outcomes.

If you have experienced similar or other negative experiences, please contact us or edit this article to provide others with your experiences! Thank you.

Further Information

- Financing and Funding Portal

- PAYGO: Definition and How It Works

- Fee-For-Service or PAYGO for PV systems

- Market Development of PAYGO

- PAYGO Approaches: Overhyped or Justified

- Role of Supporting Environment in Fostering Pay-as-you-go Approaches (PAYGO)

- Moreno, Alejandro, Asta Bareisaite, and others. ‘Scaling up Access to Electricity: Pay-as-You-Go Plans in off-Grid Energy Services’. The World Bank, 2015. Link.

- Lepicard, François, et Al. ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’. Hystra, 2017. Link.

- Winiecki, Jacob, and Kabir Kumar. ‘Access to Energy via Digital Finance: Overview of Models and Prospects for Innovation’. Consultative Group to Assist the Poor (CGAP), Washington, DC, USA, 2014. Link.

- A list of relevant PAYGO companies and an in-depth explanation about PAYGO approaches: Bennu Solar Ltd. ‘PAYG Solar. Information on PAYG Enabled Solar Solutions |Bennu Solar’, 2017. Link.

References

- ↑ Davinia Cogan and Simon Collings, ‘Mapping the Market for Energy Access An Overview of the Crowdfunding for Energy Access Market to Date’ (GVEP International, 2016), https://assets.publishing.service.gov.uk/media/58da0abbe5274a06b300002a/Crowd_Power_-_Mapping_the_market_for_energy_access.pdf.

- ↑ Andrew Burger, ‘Competition Heats Up in Kenya’s Off-Grid, Mobile Pay-Go Solar Market’, Microgrid Media, 21 March 2017, http://microgridmedia.com/competition-heats-kenyas-off-grid-mobile-pay-go-solar-market/.

- ↑ Andrew Burger, ‘Easy Energy with Mobile Pay’, accessed 21 July 2017, https://www.eniday.com/en/technology_en/pay-as-you-go-energy-with-mobile-payments/.

- ↑ 4.0 4.1 John Keane and Laura Sundblad, ‘Dear Critics: Here’s Why the Off-Grid Energy Industry Needs Impact Investment | NextBillion’, 6 April 2017, https://nextbillion.net/dear-critics-heres-why-the-off-grid-energy-industry-needs-impact-investment/.

- ↑ Chris Aidun, Dirk Muench, and Rodrigo Weiss, ‘Hype in the Energy Access Sector (Finally!) | NextBillion’, 6 April 2017, https://nextbillion.net/hype-in-the-energy-access-sector-finally/.

- ↑ Ivan Nygaard, Ulrich Elmer Hansen, and Thomas Hebo Larsen, ‘The Emerging Market for Pico-Scale Solar PV Systems in Sub-Saharan Africa: From Donor-Supported Niches toward Market-Based Rural Electrification’, Report (UNEP DTU Partnership, 2016).

- ↑ 7.0 7.1 François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.

- ↑ Cogan, Davinia, and Simon Collings. ‘Mapping the Market for Energy Access An Overview of the Crowdfunding for Energy Access Market to Date’. GVEP International, 2016. https://assets.publishing.service.gov.uk/media/58da0abbe5274a06b300002a/Crowd_Power_-_Mapping_the_market_for_energy_access.pdf.

- ↑ 9.0 9.1 9.2 9.3 Orlandi, Itamar. ‘Q1-2017-Off-Grid-and-Mini-Grid-Market-Outlook’. Bloomberg Finance L.P., 2017. https://data.bloomberglp.com/bnef/sites/14/2017/01/BNEF-2017-01-05-Q1-2017-Off-grid-and-Mini-grid-Market-Outlook.pdf.

- ↑ Energiewende team, ‘Pay-as-You-Go Solar and Microgrids Considered New Class of Infrastructure Investment’, Energy Transition, 27 February 2017, https://energytransition.org/2017/02/pay-as-you-go-solar-and-microgrids-considered-new-class-of-infrastructure-investment/.

- ↑ SunFunder. ‘Unlocking Capital for Emerging Market Solar’, 12 October 2016. http://blog.sunfunder.com/?og=1.

- ↑ Sanjoy Sanyal et al., ‘Stimulating Pay-As-You-Go Energy Access in Kenya and Tanzania: The Role of Development Finance’ (World Resources Institute, 2016), http://www.wri.org/sites/default/files/Stimulating_Pay-As-You-Go_Energy_Access_in_Kenya_and_Tanzania_The_Role_of_Development_Finance.pdf.

- ↑ 13.0 13.1 13.2 13.3 13.4 13.5 13.6 J-C. Berthélemy and V. Béguerie, ‘Field Actions Science Reports. Decentralized Electrification and Development’ (Veolia Insitute, 2016), 92, http://www.energy4impact.org/file/1783/download?token=TA1nhUl9.

- ↑ 14.0 14.1 Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.

- ↑ Lepicard, François, Simon Brossard, Jessica Graf, Lucie Klarsfel, and Adrien Darodes de Tailly. ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’. Hystra, 2017. https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.

- ↑ 16.0 16.1 Berthélemy, J-C., and V. Béguerie. ‘Field Actions Science Reports. Decentralized Electrification and Development’. Veolia Insitute, 2016. http://www.energy4impact.org/file/1783/download?token=TA1nhUl9.

- ↑ Andrew Burger. ‘Easy Energy with Mobile Pay’. Accessed 21 July 2017. https://www.eniday.com/en/technology_en/pay-as-you-go-energy-with-mobile-payments/.

- ↑ Powermundo, ‘Livelihoods | Powermundo’, 2016, http://www.powermundo.com/our-impact/livelihoods/.

- ↑ Aidun, Chris, Dirk Muench, and Rodrigo Weiss. ‘Hype in the Energy Access Sector (Finally!) | NextBillion’, 6 April 2017. https://nextbillion.net/hype-in-the-energy-access-sector-finally/.

- ↑ 20.0 20.1 20.2 20.3 Greg Neichin, Diane Isenberg, and Mary Roach, ‘An Impact Investor Urges Caution on the “Energy Access Hype Cycle” | NextBillion’, 17 March 2017, https://nextbillion.net/an-impact-investor-urges-caution-on-the-energy-access-hype-cycle/.

- ↑ Sanjoy Sanyal, ‘“Pay-As-You-Go” Solar Could Electrify Rural Africa | World Resources Institute’, 8 February 2017, http://www.wri.org/blog/2017/02/pay-you-go-solar-could-electrify-rural-africa.

- ↑ 22.0 22.1 22.2 22.3 22.4 Sanyal, Sanjoy, Ariel C. Pinchot, Jeffrey Prins, and Feli Visco. ‘Stimulating Pay-As-You-Go Energy Access in Kenya and Tanzania: The Role of Development Finance’. World Resources Institute, 2016. http://www.wri.org/sites/default/files/Stimulating_Pay-As-You-Go_Energy_Access_in_Kenya_and_Tanzania_The_Role_of_Development_Finance.pdf.

- ↑ Energiewende team. ‘Pay-as-You-Go Solar and Microgrids Considered New Class of Infrastructure Investment’. Energy Transition, 27 February 2017.

- ↑ Andrew Burger, ‘Nigeria Bank of Industry Pumps Up Mobile Pay-Go, Solar Microgrid Financing’, Microgrid Media, 21 January 2017, http://microgridmedia.com/nigeria-bank-industry-pumps-mobile-pay-go-solar-microgrid-financing/.

- ↑ 25.0 25.1 25.2 25.3 25.4 25.5 25.6 Bloomberg New Energy Finance, ‘How Can Pay-as-You-Go Solar Be Financed?’, Bloomberg New Energy Finance, 7 October 2016, https://about.bnef.com/blog/can-pay-go-solar-financed/.

- ↑ Justin Guay, ‘The World’s First Securitization of Off-Grid Solar Assets | Greentech Media’, 17 December 2015, https://www.greentechmedia.com/articles/read/the-worlds-first-securitization-of-off-grid-solar-assets.

- ↑ 27.0 27.1 Graham Wright, ‘Are We Really Financially Excluding 2.7 Million With Digital Credit in Kenya?’, LinkedIn Pulse, 17 January 2017, https://www.linkedin.com/pulse/we-really-financially-excluding-27-million-digital-credit-wright.

- ↑ 28.0 28.1 Alejandro Moreno, Asta Bareisaite, and others, ‘Scaling up Access to Electricity: Pay-as-You-Go Plans in off-Grid Energy Services’ (The World Bank, 2015), http://bit.ly/2wkwf4f.

- ↑ Dan Ariely, ‘The Pain of Paying’, Dan Ariely, 5 February 2013, http://danariely.com/2013/02/05/the-pain-of-paying/.

- ↑ Amy Ahearn, ‘The Pain of Paying. Pitfalls of the “Pay-as-You-Go” Model | +Acumen’, 10 April 2017, http://www.plusacumen.org/journal/pain-paying.

- ↑ Alicia Brindisi, ‘In Conversation with FAI: David McKenzie on Mental Accounting in Development Research’, Financial Access Initiative, accessed 31 July 2017, http://www.financialaccess.org/blog/2015/7/31/in-conversation-with-fai-david-mckenzie-on-mental-accounting-in-development-research.

- ↑ 32.0 32.1 32.2 32.3 Michelle Kaffenberger and Patrick Chege, ‘Digital Credit in Kenya: Time for Celebration or Concern?’, CGAP, 3 October 2016, http://www.cgap.org/blog/digital-credit-kenya-time-celebration-or-concern.

- ↑ Keane, John, and Laura Sundblad. ‘Dear Critics: Here’s Why the Off-Grid Energy Industry Needs Impact Investment | NextBillion’, 6 April 2017. https://nextbillion.net/dear-critics-heres-why-the-off-grid-energy-industry-needs-impact-investment/.