An Overview on Micro Hydro Debt Fund

Background

Electricity in Nepal was introduced in 1911 with the establishment of Pharping Powerhouse at Pharping, Kathmandu. The powerhouse second in South Asia was established in cooperation with Britain and has been equipped to generate 500 kilowatt of electricity. In spite of the potential to generate 43,000 MW of hydroelectric power, Nepal has till date generated 972.49 MW [1]. With the generated electricity, only 76% of households in the country have access to electricity (including off-grid solutions)[2]. On the other hand, 24% of households still depend on kerosene and other non-clean sources for lighting. Out of Nepal’s 3,915 village development committees (VDCs - now changed to “Gaun Palika” or Rural Municipalities and “Nagar Palika” or Municipalities under the new Federal Constitutional structure), only 2,900 are connected to the national grid. In contrary, urban areas have better access to electricity relative to rural areas (93% versus 49%)[3] due to easy and accessible geography.

It is apparent that renewable energy development and decentralized solutions are a critical part of the overall strategy to combat the energy crisis in Nepal. This is further explained by the facts that there are relatively low coverage of the national grid, increasing demand for rural electrification and the available alternative energy sources in the country. Renewable energy development is therefore, a high priority for the government as it provides an appropriate solution to remote, sparsely populated areas unviable for grid extension, while being clean, safe and environment friendly. Development of renewable energy technologies (RETs), both on-grid and off-grid, has become crucial to increase energy access (including electricity) for better overall development, poverty reduction and shared prosperity. Isolated RETs such as micro hydropower, solar photovoltaic (SPV) and biogas can substantially improve the rural economy. Specifically, Micro Hydropower Plants (MHPs) have been serving off-grid rural households in the hilly regions of Nepal since they were introduced in 1960s.

The Alternative Energy Promotion Center (AEPC) was established in 1996 as a central body of the Government of Nepal (GoN) to promote alternative energy, especially in rural areas. Due to the efforts by the GoN and development partners since the 5th development plan (1975–1980), rural electricity access through MHPs and the number of stakeholders in this sector have been steadily increasing. MHPs are proven technology for enhancing energy access in Nepal. The primary reasons being - locally available technology eases the operation and management, utilization of local resources, indigenous and renewable technology, and decentralized operation. With support from AEPC, more than 54.2 MW[4] is generated through micro/mini hydropower schemes in various districts of Nepal. These plants have been providing off-grid electricity to more than 400,000 rural households[5]. The far-flung rural areas have typical characteristics of scattered settlement, low energy density and low ability to pay for the services.

The MHPs in the rural areas are being promoted by AEPC through its several programs assisted by its development partners. In order to make these micro hydro plants feasible, subsidy is provided to the micro hydro system as per the subsidy policy approved by the government. The subsidy policy is changed periodically after its evaluations. Recently, the subsidy policy was revised in 2016.

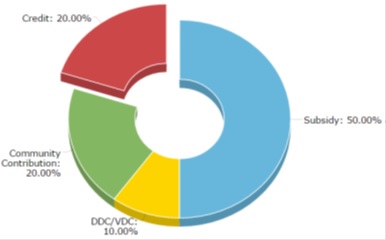

The AEPC is the national focal agency for promoting alternative energy in Nepal. It also works closely with the private sectors and adopts a demand-based approach. AEPC focuses on capacity building, technical and financial assistance, and coordination and quality assurance, whereas the private sector is involved in consulting, manufacturing, supply and installation, and aftersales services. The community is the focal point within the institutional architecture and needs to play an active role to implement MHPs. The financial mixture of the micro hydro generally comprises of subsidy in the range of 40-50%, District Development Committee (DDC) and Village Development Committee (VDC) investment of 10-15% and rest of the community equity is generated through kind contribution and loan. The financial mixture for the construction of a MHP is illustrated in Figure 1.

Figure 1: Credit Support requirement for Micro Hydro Projects

In many cases, the community does not have ability to pay their contribution due to their poor economic status; hence besides having these financing, there remains a fund gap of 20-30% of the total cost of the project. AEPC is engaging financial institutions and commercial banks to provide credit facility to such projects, however there is always issues of collateral for the credit in rural areas. The commercial banks are reluctant to provide credit facility in the rural area. This is due to the limited knowledge on the technology and its associated cash flow to pay back the loan from the community. The commercial banks have limited funds to lend for this sector as they lack sufficient expertise to conduct technical, managerial and operational assessments of the micro hydropower projects.

Concept of Micro Hydro Debt Fund

In 2008, there were several discussions between Deutsche Gesellschaft für lnternationale Zusammenarbeit (GlZ) GmbH (then GTZ) and Alternative Energy Promotion Centre (AEPC) as the need to support the rural financial sector was an important topic. Although many donor agencies were engaged in the renewable energy sector, hardly any focused decision on the topic of Green Finance was made – to bring local banks into the rural sector for financing renewable energy projects. During several meetings, it was recognized that many micro hydro projects are lacking sufficient funds. Including equity and subsidy, there is still a fund gap of around 20% to 30% of total costs of the project. Therefore, the partners came to the conclusion that local financial institutions and commercial banks should fill this financial gap by providing credit support to the micro hydro user groups/communities.

Bringing this idea to commercial banks, their credit departments had several concerns about going into rural areas. In addition, their knowledge in renewable energies was very limited. However, local financial institutions, most of them close to the sites, were willing to invest in micro hydro power but did not have expertise and sufficient funds for lending. The partners agreed on a possible solution to build and support a partnership between local financial institutions and commercial banks. If banks could offer a loan to local financial institutions in a way that they become a partner with the local institution acting as a local agent, sufficient funds would be available to finance the micro hydro sites. As banks had many concerns in financing local financial institutions in rural areas, a possible solution to this scenario was the idea of a Micro Hydro Debt Fund (MHDF). The debt fund mechanism deposited funds in two commercial banks earmarked solely for lending to micro-hydro power projects and channelled through a local financial partner or via direct lending to a project.

Following this model, the partners expected banks to be familiar with the financial lending in rural renewable energy projects. Involvement of as many partners as possible, the whole banking sector will learn that renewable energies can also be profitable business in rural areas. The idea was that the Fund could be used for gaining first experiences. With successfully lending the credit facility of the deposited amount, the banks will continue to use their own funds for lending the micro hydro projects by increasing their overall portfolio. This can help them become competitive, diversified and successful. In addition, it will improve the access to credit for electrifying the rural population of Nepal.

The Micro Hydro Debt Fund was envisaged to provide credit facility to the micro hydro projects, which had already received approval for AEPC subsidy and were facing difficulty in accessing credit facility for its implementation. MHDF was established as a revolving fund, which was deposited in two commercial banks selected through competitive bidding.

Objectives of MHDF

- The overall objective of MHDF is to improve the access to energy of the rural population by providing credit for rural micro hydro projects. In doing so, the rural population of Nepal will be the beneficiaries, as loans will help them to realize their efforts to receive electricity.

- Furthermore, the fund will demonstrate that lending to the rural micro-hydro sector can be profitable, and managed by interested financial institutions as a commercially sustainable business.

- The fund will increase the pace of electrification in the rural areas and stimulate the development of productive agro-processing and other income generating enterprises – thereby improving job opportunity and livelihood creation for the people.

Implementation of MHDF

For the establishment of the fund, AEPC and GIZ signed a Memorandum of Understanding (MOU) on 15th July 2010 and an implementation agreement in 7th June 2011. Initially, goal of this fund was to enable more than 3500 households (more than 19000 people) to the newly connected electricity mini grid based on approximately 416 kW additionally generated by the supported MHPs. To implement this project, GIZ contributed EUR 500,000 for the initial capitalization of the MHDF and an additional fund of EUR 42,000 under technical assistance, and then with its amendment on 2nd October 2012, total financial contribution was amended to EUR 1,150,000 and 92,000 for technical assistance. With this amendment, this fund targets to provide electricity to more than 13,300 households, 45 social institutions, 55 rural businesses newly established though MHP based on 1500 kW, additionally generated by the supported MHP.

Through competitive tendering process and associated guidelines, two partner banks – NMB Bank Limited (before merger it was Clean Energy Development Bank), and Himalayan Bank Limited were selected. On 19th September 2011, AEPC and the Banks entered into agreement for depositing the funds into the bank and its lending criteria to the micro hydro projects. Based on the agreement, the banks paid interest to AEPC for using this fund and lent credit facility to the micro hydro projects at a commercial rate. Under this framework of MHDF, HBL has provided credit support to 8 MHP and NMB Bank has successfully provided credit facility to 18 MHPs. A steering committee that comprises members from AEPC and the partner Banks, GIZ/EnDev was selected to supervise the projects supported under MHDF. GIZ/EnDev provides financing support to AEPC for the establishment of the MHDF fund and carries overall supervision as a part of the steering committee. AEPC provides regular information to the banks about the potential micro hydro sites that require MHDF credit support and also demonstrates sufficient cash flow to cover the interest and principle repayment. AEPC provides capacity development support to the community and partner banks, along with supervision and monitoring of the micro hydro projects under MHDF.

Framework on MHDF loan disbursement

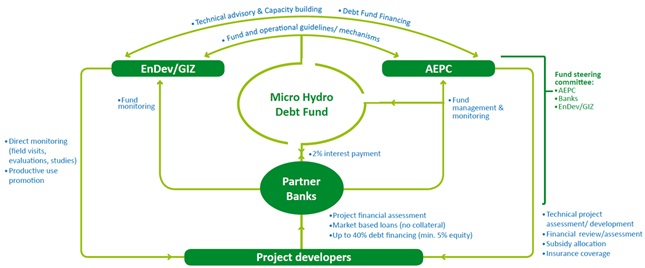

MHPs which have been approved by AEPCs’ Technical Review Committee (TRC) and are unable to complete financial closure can be benefited through this scheme. Such projects can request for support under MHDF. Upon receiving the request from the community, MHDF steering committee does the financial assessment of the project on its ability to pay back the loan. The MHDF provides the credit facility to the micro hydro project of 10-100 kW capacity approved by the TRC of AEPC. The community cash equity must be at least 5% of the project cost and MHDF loan can be provided maximum 40% of the total costs. In case of the default of the MHDF loan, the total outstanding dues should be borne by the bank and AEPC on 50:50 bases. The process cycle flowchart for Micro Hydro Debt Fund is shown in Figure 2.

Figure 2: MHDF Process Flowchart.

The MHDF loan is disbursed to the micro hydro projects after its appraisal following standard procedures of the respective banks. The terms and condition for lending by banks to the MHPs states that the bank shall not ask for personal guarantee of the developers as a security of the loan. Because this loan facility is envisaged to provide credit facility to community owned micro hydro plants in rural areas that are facing difficulty in accessing credit facility for its implementation. A provision of personal guarantee is not relevant for as most of the MHPs are owned by communities. Such provision may lead to unintended hassles during loan processing. Therefore, MHDF is a unique scheme intended to support such communities without requirement of any collateral. Also micro hydro loan is considered as a deprived sector category loan for the Banks. The deprived sector credit policy is directed credit policy of Nepal Rastra Bank, which is designed to meet the credit demand of poor and rural section of the country[6].

The partner banks provide credit facility equivalent to the amount that is deposited by AEPC under the MHDF. All the lending by the bank should be in line with the Renewable Energy (RE) Policy[7] 2006, and corresponding Renewable Energy Subsidy Policy and its delivery mechanism of the government. The RE policy provides emphasis on arrangement to provide concessional loan for community owned micro hydro project for its implementation as well as operation and maintenance of the projects. Renewable Energy Subsidy Policy 2013 envisaged linking the subsidy with the credit in view to replace subsidy gradually in long term and states “In order to encourage financial institutions to invest in renewable energy, efforts will be made in creating an institutional credit mechanism through credit-line and credit guarantee scheme under the Central Renewable Energy Fund, which will supervise and disburse the subsidy”. Recently approved Renewable Energy Subsidy Policy 2016 has endorsed its working policy to strengthen and expansion of Central Renewable Energy Fund (CREF) to ensure credit mobilization into the renewable energy sector. The subsidy is now linked to credit facility for deficit funding for the financial closure of a micro hydro projects stating that 20% credit should be mobilized from the banks for accessing the subsidy.

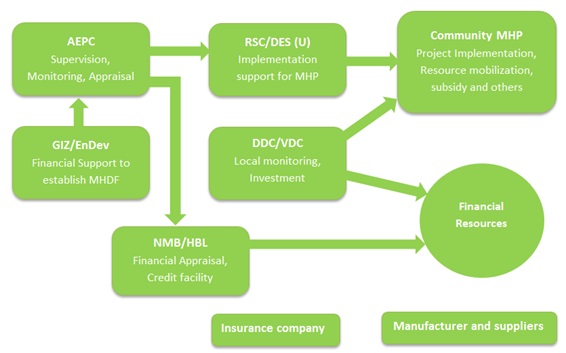

Institutional Support for micro hydro development under MHDF

The micro hydro projects that are supported with credit facility from MHDF are implemented with technical and financial support of AEPC along with its associated programs Rural Energy Development Program (REDP) and Energy Sector Assistant Program (ESAP- NRREP). Regional Service Centre (RSC) and District Energy and Environment Section/Unit (DEES/U) support the projects at the local level for their implementation. Private sector companies work as service provider for supply, delivery and installation of micro hydro plant at the community adhering to the technical standards set by AEPC.

GIZ/EnDev provides financing support to AEPC for the establishment of the MHDF fund and carries overall supervision. AEPC provides regular information to the banks about the potential micro hydro sites that require MHDF credit support and demonstrates sufficient cash flow to cover the interest and principle repayment. AEPC provides capacity development support to the community, partner banks, supervision and monitoring of the micro hydro projects under the MHDF.

Figure 3: Institutional Support for MHDF loan disbursement

At the local level, DDC and VDC provide monitoring and financial support for the implementation of the micro hydro projects. The management of the micro hydro plant at the community is done either through formation of user committee or a cooperative with its beneficiaries as shareholders. The management committee is responsible for operation and management of the plant, and for its tariff setting to cover its expenditures including its Equitable Monthly Instalment (EMI). Selected partner banks receive deposit funds from AEPC to provide credit support to micro hydro projects at the local level and provide interest to this fund at competitive market rates at the time of deposit that is reviewed periodically. The banks carry out the financial appraisal and loan application form from the community as per their norms and standard regulations. The MHDF loan is financed in a way that project financing accepts the project itself as collateral. The business unit is responsible for the disbursement and monitoring whereas, in case of default, the recovery unit is responsible to take necessary action as per the bank regulations including property auction, black-listing the members of the user committee and recovery case filing in Debt Recovery Tribunal (DRT). The banks monitor the projects as a partner of AEPC and provide periodic report to AEPC with progress and issues at the particular time. Banks are providing support to the community for insurance of the micro hydro plant and claim insurance amount in case of damages. The insurance amount is basically against the damages due to natural calamities in order to recover the damages and bring back the project to operational mode. Annual insurance premium is paid by AEPC on behalf of the community.

Status of micro hydropower plants under MHDF

With the financial support from GIZ/EnDev to AEPC, a revolving fund was established; two commercial banks, Himalayan Bank Limited and NMB Bank Limited hold the MHDF funds. This fund is providing financial products with credit support on initial investment cost to rural communities for the establishment of micro hydropower projects in these areas. The steering committee comprises members from AEPC and the partner banks, and GIZ/EnDev supervises the MHDF.

Figure 4: Site map of supported under MHDF.

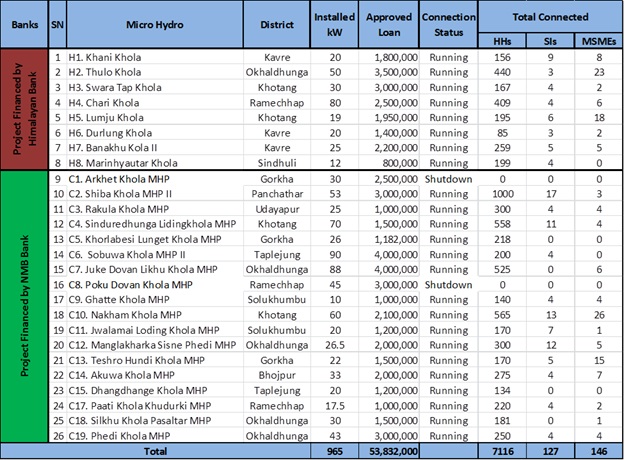

Under the provision of MHDF loan, HBL has provided credit support to 8 MHP and NMB Bank has provided credit facility to 18 MHPs with details provided in Table 1. The 26 MHPs implemented under MHDF scheme are located in Gorkha, Okhaldhunga, Sindhuli, Solukhumbu, Udaypur, Paachthar, Bhojpur, Kathmandu and Taplejung districts. The Figure 4 illustrates the geo location of MHDF supported projects.

MHDF supported 26 micro hydro projects have cumulative capacity of 965 kW and has disbursed NPR 53.8 million as credit facility to these micro hydro projects. These 26 sites are currently supplying electricity services to 7116 rural households (HHs), 127 social institutions (SIs) and 146 Micro, Small and Medium Enterprises (MSMEs). Out of 26 MHPs, 24 MHPs are in operation, whereas 2 MHPs are currently shutdown since being hit by earthquake on April 2015. The comparison between the targeted goal and the achievement is shown in Table 1. The earthquake was the major setback for the MHDF as 18 sites were partially and completely damaged which was escalated by immediate landslides during the monsoon season. Out of 18 sites 9 sites were completely damaged and shut down. With the recent efforts from the partners to foster MHDF, seven MHPs damaged during the earthquake have been rehabilitated.

Table 1: MHPs Supported Under MHDF

Table 2: Target v/s Achievements

| Installed Kilowatts (kW) | Connected Households | Connected Social Institutionss | Connected MSMES | |

|---|---|---|---|---|

| Target | 1500 | 13300 | 45 | 55 |

| Achievement | 965 | 7116 | 127 | 146 |

At present all the MHPs except two are functioning well however, the major breakdown in these projects occurred mainly in civil infrastructures due natural disasters i.e. landslides and floods in the monsoon season. The other breakdown of plants occurred due to the collapse of wooden poles used in the distribution systems. Almost all MHPs use wooden poles in distribution lines, which will eventually decay with time. Minor and frequent break down would arise in fuse system and very rare breakdown of shaft, runner blades, transformers and generator occurred in micro hydro projects.

Most of the micro hydro projects have some social issues that are affecting the projects’ performances. The breakdown in micro hydro projects generally occurs due to damage in civil infrastructures (the reason being earthquake, landslide, flooding) and damage in electromechanical equipment. The frequent interruption of electricity supply during operation has made the users question on quality of electricity, in some cases elongated duration of plant’s shutdown leads to conflicts among users. In some cases, social issues have more prominent negative effect, especially concerning management and tariff collection. Due to social issues, the management (users committee) couldn’t function properly. Timely tariff collection and proper management of the plant is not possible.

GIZ/EnDev along with the partners conducted several field visits and meetings with the community to address the problems. Such meetings were helpful to encourage the community and made them aware about the loan repayment. In addition, rehabilitated MHPs are now progressing with new management and proper tariff system. The partners have learnt that these issues could only be solved on community level with proper cooperation between AEPC, GIZ/EnDev and banks.

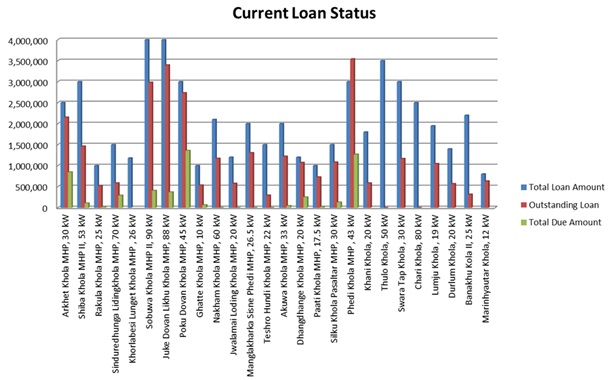

Figure 5: MHDF loan Analysis

Three of the MHP sites Khorlabeshi Luget Khola MHP, Thulo Khola MHP and Chari Khola MHP have paid back the total amount of the loan. For the remaining MHPs, payback done by the communities to the banks is 38 and 41 percent for Himalayan Bank and NMB Bank respectively. Previously, due to the low repayment from the community, the banks were reluctant to provide loans to new projects and to provide additional time to the existing projects. Now, with the continuous dialogue between the partner and regular filed visits being conducted, the banks are more familiar to the reality and conditions in rural areas where the MHP plants have been installed. With this increased exposure to the MHP projects, banks are gradually changing their perspective on the micro hydro portfolio. With the combined efforts from all partners, the sites are reviving themselves and the beneficiaries have started to pay back loan. The following graphs in Figure 5 represent the total payment done at by MHPs.

MHDF Challenges

In general, the major issues and challenges being faced by MHDF are listed below:

- Lack of Managerial Skills

It has been observed that community managed micro hydro plants exhibit several issues in their management skills. In most of the cases, local village leaders are engaged during its construction, resource mobilization and implementation, so such people are leading the management committee. Even though the management is done by the user committee, it is observed that few individuals with sufficient information are making most of the decision and other members are unaware what is going on in the project. These people are mainly communicating with the banks about MHDF loan and its resettlement. Along with the operational cost, the management has the additional obligation of the loan. It seems due to economic condition of the people, they could not impose decisions mainly to cover the financial obligations.

- Insufficient tariff collection and decision on its utilization

When it is functional, the income of the micro hydro plant comes from the tariff collected from its users. The management along with users (usually in a mass meeting) determines the tariff of the plant so that it could cover its operational and other expenditures. In general, the tariff collection is not conducted regularly or the collected tariff is high enough to cover the operation cost. The tariff is not sufficient to pay the bank EMI. Also due to the frequent breakdown, the community could not pay regular EMI from its any income sources.

- Lack of sound Technical Knowledge

Recent sites visits and assessment of micro hydropower under Micro Hydro Debt Fund revealed that most of the micro hydro has regular interruption and significant outage during their services period causing serious impact upon the quality and reliability of the services provided by the micro hydro to its users. It has been observed that during the monsoon season, the projects are facing several problems mainly in its water conveyance structures due to the damages caused by floods and landslides. There are 18 micro hydro plants out of 26, which were been either fully or partially damaged by the earthquake, which has forced the plants to shut down completely or function partially. This has caused unreliability it its services, hence these disruptions create problem in the tariff collection and revenue generation.

- Lack of Capacity Development Skills

Most of the micro hydro projects supported through MHDF funds are being managed with the formation of user committee registered under district water resource committee or in some cases with the formation of cooperative of the users. It has been observed that these micro hydro plants do not have sufficient management capacity to run the system properly. It reflects their decision making ability, records on utilization of financial resources and development of strategies for the sustainable operation of the micro hydro plant. These plants were supported during its installation from AEPC, DEECCU/S and its partner NGO working as RSC in that particular area. The main focus of their assistance during its implementation was provided for installation and resource mobilization. However, capacity development on management aspects seems to be ignored. The community lacked support for tariff fixation. It is observed in most of the cases that tariff could not cover incurring expenditures, not even the EMI. The community lacked capacity development support, awareness on tariff fixation to cover MHDF loans, alternative arrangements or strategies on repayment of bank loan and enhancing load factor of the plants with promoting end-use activities to increase the tariff collection mechanism. Operators and managers were included in the regular technical plant operation training and financial accounting training conducted by AEPC. Besides, there was not any particular targeted support involving the management of the MHDF supported projects.

Conclusion and Recommendation

Micro hydro plants supported with MHDF were intended to provide electricity services to its users in meeting their demand for better lighting facility, electricity to run appliances, reduce drudgery and generate income with various productive end-uses. This framework has been able to provide credit-financing support to 26 MHPs so far. Besides other challenges, the major setback for the MHDF was due to the April 2015 earthquake, disrupting operation of 18 sites. With the collaborative efforts from AEPC, GIZ/EnDev, banks and communities, it has been possible to rehabilitate these sites. After rehabilitation process, the damaged sites are in a better technical condition to provide quality services.

Through several rounds of meetings/discussions organized with the communities pointed out needs of good management practice and also on regular tariff collection. Communities have limited capacity to manage and operate such big infrastructure. As the civil components are constructed by the community with the local resources with limited technical knowledge of the needed structures and lack of proper standards, civil structures are often damaged during monsoon and landslides resulting in frequent disruption in supply. Therefore, it is essential to develop their capacities both technical and managerial aspects of the project. Providing access to loan only is not enough to create sustainable market for such projects. This issue of the civil structure can be resolved by proper supervision of the construction standards during the construction phase. Besides providing various capacities building trainings there is also need for continuous supervisory support to the new projects during the initial phases to establish a proper functioning body.

The communities on the other hand should also provide dedicated staffs to support the management of their MHP projects. At present, the tariff collected are not enough, the management should increase tariff rates so as to cover the bank EMI. The management should also promote end-use application as these contribute significantly on entire tariff of the micro hydro plant. At present, there are limited end-use activities with little contribution in entire tariff collection and is affecting the revenue collection.

In some cases, it is observed that the outstanding dues are high and alternative arrangements should be made to bring them on a good track. In response to this situation, banks have also shown willingness to reschedule the loan in case the community is willing to pay back the loan and express their commitment to support rural sector in providing electricity. Recent field visits and follow-ups for banks indicate their increasing involvement in MHDF.

Finally, AEPC, Banks and GIZ/EnDev should continue periodic interaction to discuss challenges and issues on loan repayment and measures for its settlement. In the absence of such meeting, the community people might ignore the repayment issue thinking that it could be later resolved with government intervention. An experience sharing with the projects that are paying regular EMI to these defaulted projects will motivate them to repay the loan. To prevent loan default in future due to the occurrence of some technical problems as outages to the plant can affect its tariff collection. A separate emergency fund can be established to cover few months EMI to update the loan. After the plan comes into operation, community will pay back to the emergency fund.

For the future projects which will be supported under MHDF, the steering committee should put emphasis on the challenges encountered, and proper assessment of technical and financial aspects should be made before project appraisal. AEPC emphasizes their support to community for proper management, tariff collection practices, financial management during its operation and any irregularities needs to be timely flagged.

References

- A Year in Review Fiscal Year 2016/17

- AEPC Annual Progress Report, FY 2009-10

- Nepal Labor Force Survey 2008, Central Bureau of Statistics

- Baseline of Renewable Energy Technology Installation in Nepal, 2013

- Nepal - Scaling up electricity access through mini and micro hydropower applications : a strategic stock-taking and developing a future roadmap, 2015

- NRB unified Directive 2016

- Rural Energy Policy 2006