Cambodia Energy Situation

Capital:

Phnom Penh

Region:

Coordinates:

11.5500° N, 104.9167° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

181,040

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

16,767,842 (2022)

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

75 (2022)

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

29,504,829,319 (2022)

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

1,759.61 (2022)

Access to Electricity (% of population): It is the percentage of population with access to electricity.

82.50 (2021)

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

33.12 (2014)

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

30.63 (2014)

Introduction

The Kingdom of Cambodia is located in the tropical region of Southeast Asia in the Lower Mekong region. The physical landscape is dominated by the lowland plains around the Mekong River and the Tonle Sap Lake. Of the country area 181,040 Km2, approximately 49% remains covered by forest. There are about 2.5 million hectares of arable land and over 0.5 million hectares of pasture land. The climate in Cambodia is tropical and subject to both southeast and northwest monsoons. Cambodia has a population of around 15.1 million people, with a growth rate of about 1.8 % and an average age of the population of 19 years. [1]

Years of war has severely damaged Cambodia’s power sector. After restoration of order in the country the Government has followed a program focused on rehabilitation and development of the basic infrastructure, with the aim of improving the socio - economic conditions. Cambodia is an agricultural country, where over 85% of the population live in rural areas with agriculture as the main profession. Their livelihood depends mainly on agriculture: farming, fishing, livestock, forest and non-forest products.

For heating, the majority of population use fuel-wood, charcoal, agricultural residues collected mostly from forest areas close to their villages. [1] For lighting and small electrical appliances (e.g. mobile phone chagrining), about 1.6 million of 2.3 million rural households rely on car batteries and kerosene lighting.[2]

Major Energy Challenges

- high electricity prices - dependent on imported fossil fuels

- low energy access

- great dependence on traditional biomass for cooking

- rising demand, persisting shortages

- inefficiency in old generating equipment

- in-competitive market structure

- lacking marketable RE technologies/business models

- RE usage negligible in energy mix

- lacking financing, legal framework, policies and incentives for energy efficiency and renewable energy investment

- lacking institutional and educational capacities

- lacking public awareness for energy efficiency and renewable energies

Energy Situation

Key Energy Figures for Cambodia (Source: IEA 2008[3])

| Energy Production | 3.64 | Mtoe |

| Net Imports | 1.61 | Mtoe |

| TPES | 5.22 | Mtoe |

| TPES per Capita | 0.36 | toe/capita |

| Electricity Consumption | 1.64 | TWh |

| Electricity Consumption per Capita | 112 | kWh/capita |

Energy Access in Cambodia

| Access to modern cooking fuels | 7.9 |

| urban % HH, 2008 | 37.3 |

| rural % HH, 2008 | 1.5 |

| Electricity Access, national % HH, 2010 | 29.7 |

| urban % HH, 2008 | 87 |

| rural % HH, 2008 | 13 |

| No. of people w/o access to electricity (2009) (mil.) | 11.3 |

| Population served by off-grid sources (minigrids, HH systems) % | 4 |

| Electricity access target | 70% of HH in 2030 (100% of villages) |

Fossil Fuels

At the moment, all commercial fossil fuels available in Cambodia (2008: 1.549 ktoe) are imported in the form of LPG(liquidified petroleum gas), gasoline, diesel and other petroleum products.[4]

Oil and Gas [5]

Oil reserves have been found off the shore of Cambodia. The size of the oil fields are unknown, however, estimated at around 2 billion barrels of oil, which could contribute $2 billion in annual revenues, and about 11 trillion cubic feet of natural gas. Exploitation was underway when, neighbouring Thailand contested the maritime area claimed by Cambodia based on a 1973 Thai claim on the eastern boundary line of the Gulf in an area known as the Overlapping Claims Area (OCA). In an effort to ease tensions, both countries signed a Memorandum of Understanding in 2001 in which an agreement outlines a framework to solve the maritime dispute. It was however scrapped by the Thai cabinet in 2009 when the Cambodian government appointed ousted prime minister Thaksin Shinawatra as special adviser to Prime Minister Hun Sen. Foreign investors are expected to be strongly involved in the exploitation process. This, together with high corruption rate in Cambodia, contributes to the assumptions of many that the broader population will not profit from these natural resources.

With the new Thai government in place from August 2011 an, Cambodia (as well as Thailand due to its growing energy demand) is eager to start negotiations again soon. Chevron was expected to develop the site. Chevron Overseas Petroleum (Cambodia) Ltd. is believed to start drilling in offshore Bloc A soon, even though it is quite small. There is some time pressure as work has been delayed, yet not all remaining issues are solved so far. Extraction is to start in 2012. Before this, a possible joint production with Thailand will have to be agreed on. South Korea is also said to be interested in the oil and gas sector in Cambodia. Japanese JOGMEC (Japan Oil Gas Metals Coporation) has signed an MoU with the Cambodian Petroleum Authority on all 17 inland blocs (K. Thim, Siem Reap and Peah Vihear) to investigate data on oil resources. [6]

Coal

During the period 1958-61, China’s countrywide mineral survey mission reported indication of coal in Kampot, Kampong Thom, Kratie, Stung Treng and Battanbang provinces. One deposit in Phum Talat in Stung Treng province has also been identified and the reserve has been estimated to be around 7 million tons, the exploitation might be feasible for application in cement production and for domestic fuel. The inventory and feasibility study of coal deposits in Cambodia are needed.[1]

A new coal fired power plant is planned to be built in Sihanoukville: 135 MW. With a PPA agreement, the government is obliged to have a guarantee i.e. the Cambodia International Investment Development Group, which is owned by ruling party senator Lao Meng Khin, in case the state-owned Electrucite du Cambodge, fails to pay for the power.[7] Another coal fired power plant (1,800 MW) is planned to be built in Koh Kong by Cambodian tycoon Ly Yong Phat (Cambodia People's Party senator, stakes in hotels, entertainment, utilities, plantations etc in Koh Kong) under a US$3 billion joint-venture agreement with Thai energy firm Ratchaburi Electricity Generating Plc. The ownership structure is unknown and would be Cambodia's largest power station. However, under 90 % of the power (1,600 MW), would be sold to Thailand. Tariffs are currently being negotiated. Also 30 Million USD are going to be invested in power lines between the coal plant and the Tata Hydropower plant in Koh Kong.From the Thai side, this project is attractive as in Thailand the company has received very strong criticism from environmentalists on projects like this - now this problem is being outsourced to Cambodia. The Cambodian government should conduct a proper environmental impact assessment for the plant. Marketing the power domestically could drop power prices to $0.04, down from the current $0.17, one of the highest rates in the region. Yet the plant would far exceed the country’s current demand for power.[8]

3 coal operated power plants are planned, with several extension/construction phases - further details not available:

- plant 1 of 200 MW: 100 MW (phase 1 in 2012), 100 MW (phase 2 in 2013)

- plant 2 of 700 MW: 100 MW each year from 2014-2018, 200 MW in 2019

- plant 3 of 400 MW: in 2020, either coal or gas-fired.

Renewable Energy[9]

Cambodia has abundant RE resources such as mini/micro/pico hydropower, solar, biomass and other. At present, the development of RE sources in Cambodia is very slow in comparison with its neighboring countries, because of the lack of experiences and funds, and inadequate data. Hence the utilization of these sources is also insignificant in the contribution to the total energy supply mix, which is mainly based on imported fuel oil for power generation. In order to promote RE development, Cambodia (in late 2011/ early 2012) is working on a RE strategy which lays down the policy intention, objectives and guidelines for developing the requisite infrastructure for providing renewable electricity services in rural areas.

Biomass

Biomass is the main source of energy for Cambodia, mainly in the form of the wood and charcoal. Wood-fuel serves about 85% of the total energy demand and is used for domestic cooking and also extensively by industries, but currently is not used for power generation.

The New Energy and Industrial Technology Development Organization (NEDO) has conducted an assessment of the potential for using biomass as a source of renewable energy in Cambodia.Based on existing crop and livestock residues and if assumes 35% conversion efficiency, the preliminary assessment of biomass generation potential estimate at around 18.852 GWh/yr with 2 MW already exploited.

Biomass gasification is currently being further looked into:more and more rice mills (rice husk), ice factories (wood) and garment factories (wood) are using gasifiers. Also, rural electricity enterprises (REE) which supply rural villages with basic electricity services are increasingly evaluating biomass gasifiers due to increasing diesel prices. Currently roughly 150 biomass gasifiers have been installed throughout Cambodia, mostly using dual-fuel mode thus replacing up to 80% of diesel. In some cases, gas engines have been installed. Estimates see a market of up to 600 more medium sized gasifiers (100-300kW), and maybe 50 larger gasifiers (uo to 1MW).

The first biomass (mostly rice husk is used by rice mills and fire wood by ice plants and REE) were introduced in 2006 by SME Renewable Energywhi imported Ankur gasifiers from India. Soon, local companies started copying these gasifiers - with varying quality. Especially ice plants which run 24/7 can achieve huge savings with gasifiers, as do big rice mills due to the available fuel.Due to the huge amount of rice husk available - if all risk husk resources from mills were used in gasifiers to generate electricity, up to 30% of Cambodia's current electricity demand could be met (1.3 mio. metric tons of rice husk generating 650.000 MWh - 750 MW capacity). Additionally,Cambodia should also focus on improving quality and safety of gasifiers, as well as only using sustainable biomass/ bio waste, such as cut off from rubber or cashew plantations, to avoid contributing to deforestation. In many rice mills, only 25% of rice husk is needed to generated the power needed. Therefore, abundant husks could be sold on to other gasifier operators. The logistics in this and in harnessing the vast potential of rice husk through out the country where smaller (e.g. houshold) mills operate are further challenges to overcome.Rice mills do not operate throughout the year, therefore easier access to licenses to sell electricity and act as an REE or to feed into the grid would make this business more profitable for them and would make use of the installed capacity.

Main challenges for implementing these gasifiers are lacking know how of the workforce/operators, careless handling of waste tar and waste water which is often dumped in nearby rivers or fields with great harmful impacts, low work safety and lacking quality, waste and environmental standards.

There is also great potential for other biomass waste applications such as sustainable charcoal briquettes, rice husk briquettes, gasification of corn cobs, etc.

Biogas

For biogas implementation on household level see National Biodigester Programme, Industrial and community application not very common. Single pig farms use biodigesters. Potential for upscaling.

Biofuel

Jatropha – 200 ha (Fencing), around 10 companies - 1.000ha, Palm Oil – 4,000 ha (recently) (potential up to 10, 000 ha) and sugar cane 20,000 ha.

One Korean company is producing ethanol from cassava: production capacity of ethanol 36,000 t/year from 100,000 tons of cassava.

Solar

Based on insolation of 5.10 kWh/sq.m on 0.02% of Cambodia's land area, the preliminary solar power generation potential estimate is about 7,665 GWh/yr and solar hot water potential is estimated at 17,995 GWh/yr.

In Cambodia, the use of solar photovoltaic technology has started since 1997 for lighting, radio, TV and telecommunication in the rural areas. The total installation is about 1,150 kWp and primarily has been installed on telecommunication repeater station in remote areas. Most of the solar systems resulted from donor projects supported by SIDA, NEDO and other donors. All the equipment is imported from other countries.

A World Bank programme carried out via the REF and Sunlabob/Kamworks is to install 12,000 solar home systems (SHS) throughout seven of Cambodia’s provinces from Mid 2011 till January 2012. The project is implemented by Lao-based company Sunlabob. Sunlabob is also said to be in talks with the government to continue developing solar energy beyond household units, possibly expanding to the construction of centralised systems in remote areas that households could connect to. It allegedly is also looking at a larger-scale solar plant that would allow Sunlabob to sell energy to the state power company, Electricite du Cambodge.[10]

The main obstacles for solar industry are accessibility, awareness and affordability.[2]

Wind

The potential of wind energy is small in account of average wind speed of 3m/s and less. The estimated wind generation potential is 3,666 GWh/yr. However, the southern coastal area (Sihanouk Ville, Kampot, Kep, Koh Kong) and mountainous areas in the southwest and northeast of the country, as well as on the southern part of the reat lake Tonle Sap, have favorable wind condition for wind power generation because of average wind speed of around 5m/s. (5% of country surface). Still, wind energy is subject to great seasonal variations.

Wind energy has been utilized for water pumping in central part of Cambodia (Prey Veng province) which is supported by the NGO with installed capacity of 700 kW.

Hydro

In theory, the hydro potential is said to be 10.000 MW, but current contribution is far less (20 MW, with many more under construction).

In 2010, hydro contributed 3% to Cambodia's total electricity supply.

Large-scale Hydro power

The potential for large hydro has only been explored. 29 locations with a potential greater than 10 MW have been identified and are at different stages of development. A huge issue is the mitigation of social and environmental impacts of large dams, especially on the Mekong and its tributaries (e.g. fisheries, resettlement, land issues, changes in flood patterns, less sediments, GHG emissions from reservoirs in (sub-)tropical countries, etc.). Lacking transparency, great involvement of foreign investment, lacking environmental and social impact assessment and community consultations make large scale hydro highly controversial.Critics say that these plants infringe on indigenous customs of tribal people (e.g. Koh Kong plant, Se San 2). [11] Grass-root level community protests, such as the one against the planned Hydro Dam Lower Se San 2 are becoming more common and heard.[12]

Besides the already existing large scale hydro power generation plant, a serious of new plants is being planned. Especially Vietnamese (EVNI) and Chinese companies are investing in Cambodia in the large-scale hydro field:

Five hydroelectric dams with a total capacity of 915 MW are currently (2011) under construction by Chinese investors with the total investments of 1.6 billion U.S. dollars[13]:

| # | Name/Location | Capacity (MW) | Comment | Developer/Country |

| 1 | Kamchay (Kampot province) | 193.2 | China | |

| 2 | Kirirum 3 | 18 | (securing electricity supply for the capital Phnom Penh) | China |

| 3 | Stung Atai | 120 | China | |

| 4 | Russey Chrum Krom | 338 | China | |

| 5 | Stung Tatai (Koh Kong) | 246 | (securing electricity supply for the capital Phnom Penh) | China |

| Total | 915 |

Planned projects where MoUs for studies have been signed:

| # | Name/Location | Capacity (MW) | Comment | Country/Developer |

| 1 | Sambo | 2,600 | Mekong | China |

| 2 | Stung Chhay Areng | 108 | China | |

| 3 | Lower Sesan 1 | 90 | Vietnam | |

| 4 | Lower Sesan 2 | 400 | 2012-2015, 50% of power for Cambodia, 50% export to Vietnam[14] | Vietnam |

| 5 | Stung Treng | 900 | Mekong | Vietnam |

| 6 | Sekong | 190 | Vietnam | |

| 7 | Lower Sre Pok 3 | 368 | ||

| 8 | Lower Sre Pok 4 | 48 | ||

| 9 | Prek Chhlong | 25 |

Permitted projects:

| # | Name/Location | Capacity (MW) | Comment | Country/Developer |

| 1 | Prek Laeng 1 | 70 | Korea | |

| 2 | Prek Laeng 2 | 50 | Korea | |

| 3 | Stung Sen | 40 | Cambodia | |

| 4 | Stung Posat | 40 | Korea |

Mini/Micro/Pico Hydro power

Cambodia has an enormous water resource for hydropower development and in some parts of the country, mini/micro/pico hydropower may provide opportunities for rural electrification. The assessment of theoretical potential of mini, micro, pico hydropower is about 300 MW with present installed capacity of 1.87 MW. At present, there is one mini hydropower plant with 1 MW installed capacity and 2 micro hydropower plants with total installed capacity of 370 kW which are in operation under the responsibility of Provincial Electricity Unit of Electricite Du Cambodge (EDC). There are also privatly owned micro and pico hydropower plants with the installed capacity ranged from 1 kW to 30 kW in the northern provinces and the units are imported from Vietnam or China.

Often, these hydropower stations are located in mountainous areas and the cost for establishing distribution networks is very high, making small -hydropower in many cases unaffordable.

Other RE sources

Geothermal: no assessments available, some thermal springs, but appear low-grade.

Tidal: no assessments available, low apparent potential.

At present the RE development is still at the beginning stage and needs more support from the Royal Government to overcome serious barriers to promote RE development and to facilitate private sector participation.

Electricity Situation [15]

During the 1970s, the electricity sector was seriously damaged by the civil war from 1970 to 1979. During this time, there was only one transmission line in Cambodia connecting the Kiriom I Hydropower Station to Phnom Penh capital town with a voltage rating of 115 kV and length of 120 km which ceased to operate since 1973 when most electricity related facilities including generation, transmission and distribution facilities were nearly destroyed.

Since 1995, the Cambodian government is making efforts to reestablish the electricity sector. However till today, there is no national electricity network and electricity is supplied via the 24 small isolated electricity systems.

EdC, the government-owned utility, serves Phnom Penh, Sihanoukville, Siem Reap, Kampong Cham, Takeo and Battambang, accounting for nearly 90 percent of total electricity consumption. EdC serves approximately 10 percent of the population with most of its customers located in Phnom Penh.Nearly half of EdC’s installed power supply capacity of 140MW is purchased from 2 IPPs (63 MW). Despite the creation of substantial IPP generation capacity and EdC’s commendable efforts to reduce system losses from nearly 25 percent to 13 percent, the quality and reliability of electricity supply in Phnom Penh continues to be poor.[16]

From 2003 to 2008, the electricity demand rose on an average 22.3% while the electricity supply rose only 21.5%. The electricity production rose from 695 GWh in 2003 to 1,681 GWh in 2008. However, the electricity demand rose from 134 MW in 2003 to 314 MW in 2008. In particular, the highest record of growth rate is being updated year by year and reached 26.7% and 27.5% for electricity supply and electricity demand respectively in 2007. In 2010 the annual electric energy consumption per capita was 160 kWh.

The electricity mix consist of 34% imported electricity (28% Vietnam, 13.6% Thailand, 0.4% Lao), 54% heavy fuel oil, 3% hydropower, 2% coal and others. At the moment Cambodia is eager in increasing electricity generation capacities (hydro and coal plants) to decrease import dependencies. 93% of electricity generated by licensed operators is based on expensive, imported diesel fuel.

In 2008, only 25% of households have access to electricity (rural electrification rate of around 15%). The Phnom Penh capital zone, in particular, shares 80% or more of national total electricity consumption: in 2010 300 MW annual consumption load (of 538 MW nation wide). Yet, power shortages are common and increasing as power supply cannot keep track with demand.[17]

Several private companies are active in the electricity sector in Cambodia, running or investing in power porjects (mostly hydro or coal) or advising the Government on its electrification strategy.[18]

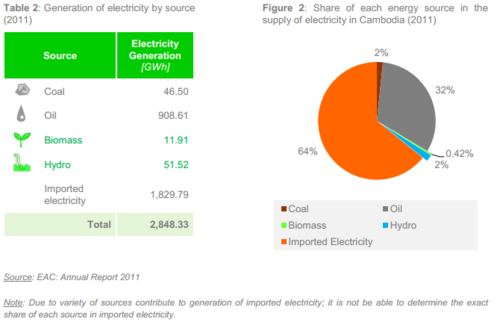

The figure below shows the generation as well as supply of electricity in Cambodia (2011). [19]

Electricity Prices

As a great share of the electricity is imported and are used to produce more than half of locally produced electricity, Cambodian electricity prices are among the highest in the region. With the development of large hydro potentials and more coal fired plants, these tariffs might decline in the future. Yet,the national power grid is still being constructed, so tariffs will also have to fund the extension of the distribution network. In summer 2011, electricity prices were:

- Phnom Penh: 0.18 USD/kWh for households, 0.19 USD/kWh for businesses

- grid-connected towns and urban areas: 0.25 - 0.40 USD/kWh

- rural areas (mostly diesel generators): 0.50 - 1 USD/kWh

- battery (car batteries) charging stations (diesel - to be found in 35% of rural villages): up to 4 USD/kWh

Electricity Demand Forecasts

According to the available electricity demand forecast in Cambodia prepared by the Ministry of Industry, Mines and Energy in 2007 and on the demand forecast by World Bank and KEPCO in 2006, the electricity demand projection in Cambodia in 2024 is 3,045.33 MW and 16,244.61 GWh for capacity and electric energy respectively.

According to Cambodia Power Report 2011 [20], Cambodia's power consumption is forcast to rise from 1.4TWh in 2010 to 3.4TWh by the end of 2020, representing average annual growth of 9.4% in 2011-2020.

Cambodian power generation in 2010 is put at 1.3TWh, having risen around 5.0% from the 2009 level. An average 8.9% annual increase to 2.0TWh between 2011 and 2015 is expected. Thermal generation, comprising coal, gas and oil, is expected to increase by an average 8.9% per annum during the period to 2015, but growth looks set to accelerate later in the decade.

The use of domestic natural gas supply in power generation is dependent on successful development of gas resources currently under investigation, with Chevron's Block A prospects capable of supplying gas from 2013. Oil currently accounts for around 95.7% of total generation, rising to a possible 96.3% by 2015, in spite of greater hydro, coal and gas expansion. Oil will remain a significant part of the Cambodian power generation mix, although its market share should eventually fall thanks to fuel substitution.

Electricity Grid Development

So far, no national grid exists. Cambodia has ambitious plans regarding its grid development plan. Until 2027 roughly 2,100 km electricity grid (230kV and 115kV transfer lines) are to be constructed with interconnections between existing grid systems such as Phnom Penh and surroundings, connections to planned power plants as well as cross-border lines to Lao.

Grid extension works are funded by China[21] , KfW and others.

Policy Framework, Laws and Regulations

Electricity Sector Development Policy[15]

Cambodia faces a major challenge to develop an adequate and reliable source of electricity in the years ahead. Based on intensive studies of the best means for providing a national electricity supply network, the Royal Government of Cambodia (RGC) formulated an electricity sector development policy in October 1994, which aimed at:

- Providing an adequate supply of electricity throughout Cambodia at reasonable and affordable price.

- Ensuring a reliable, secure electricity supply at prices, which facilitate investment in Cambodia and development of the national economy

- Encouraging exploration and environmentally and socially acceptable development of energy resources needed for supplying to all sectors of the Cambodian economy, and

- Encouraging an efficient use of electric energy and minimizing detrimental environmental effects resulting from electricity supply and use.

In order to meet the growing demand for electricity over the next 20 years, the RGC is formulating an electricity sector strategy which consists of:

- Development of generation and transmission

- Power trade with neighboring countries, and

- Provincial and Rural Electrification

It was reported that the major natural resources for power generation available in Cambodia is hydropower with potential of 10,000 MW or more, however, the hydropower capacity already developed in Cambodia is very limited to be only around 13 MW and 10,000 MW is large enough compared with the next 15 years domestic electricity demand of around 3,045.33 MW in 2024.

In summary, the strategic plan of Cambodia is to procure the required electric energy by importing electricity from neighboring countries for the coming years and, after that, to utilize hydropower, which is the major source of domestic renewable energy, as much as possible in parallel with development of coal thermal plants step by step.

Rural Electrification Plan[22]

The Rural Electrification Strategy (RES) of the Royal Government of Cambodia (RGC) aims to substantially scale up access to electricity services for rural area, where about 85% of the Cambodian population lives and only 15% of them have access to electricity services and to improve the standard of living, reduce poverty and foster economic development. By 2020, the objective is for all villages (100%) to have access to electricity in different forms; by the year 2030 - 70% of all rural households should be electrified. The remaining rural households (30%) shall be targeted by a "Renewable Energy Development Program" which will provide quality renewable energy services in remote regions by using mostly solar applications (solar lanterns, SHS). The main components of the Rural Electrification Strategy are as follows:

- Grid expansion from the existing grids

- Upscaling of power generation (hydro, oil, coal) and cross border power supply from neighbouring countries (Thailand, Vietnam and Lao PDR) and

- Mini grids (diesel, biomass (especially gasification), micro hydro)

- Battery lighting (solar, locally wind).

Renewable Energy (solar, wind, mini/micro hydro power, biomass, biogas, etc.) - renewable energy target of 15% of electricity generation by 2015 (excluding large hydro).

According to the "Master Plan Study Rural Electrification by Renewable Energy in the Kingdom of Cambodia (June 2006, JICA), the maximum use of renewable energy including micro hydropower was proposed to secure sustainability for source of electricity. This study recommended the off-grid electrification with micro hydropower scheme for such mountainous or hilly areas where hydropower potential is bigger than village size demand and village exists within an economic distance for transmission from the potential site as the most promising electricity source for such areas. The 145 number of micro to mini hydro power potential sites in the capacity range from 1 kW to 2,585 kW were identified in this Master Plan Study. Micro hydropower stations, which generate about 300 W to 1 kW are quite common and require little capital. They will be ideal for small rural communities.

In order to facilitate access to electricity supply at reasonable and affordable price in rural areas, the Government of Cambodia has established "Rural Electrification Fund" for enabling the development of electricity supply facilities in such areas. The objective of the fund is to promote and encourage the private sector to participate in providing the sustainable rural electrification services.Also, the objective of Rural Electrification Fund for the next five years term includes the provision of grant for development of 850 kW of micro hydropower and 6,000 kW of mini hydropower plants as well as 12,000 solar home systems.

Wood and Biomass Energy Strategy

In early 2012, in a haste, a wood and biomass energy strategy was commissioned by MIME. Even though biomass remains a very important energy source for the Cambodian people, it has widely been ignored. The strategy is a combination of different projects: efficient charcoal production, efficient fuel wood/biomass use in industries (brick kilns, garment factories, ice plants), up-scaling of the improved cook stove project to rural areas, analysing wood flows, managing forest resources sustainably, using agricultural waste (rice husk), etc. Funding is outstanding. Coordination between MIME and the Forestry Administration is lacking. A inter-ministerial working group has been suspended. The supply and demand side do not coordinate their actions.

Rural Energy Strategy Program

Recently, an effort has been started to come up with an entire energy sector strategy. This approach is new to the energy topic in Cambodia but leaves room for hope for the future development of the energy situation, especially for rural areas. Aspects from the Masterplan are also used for this programme.

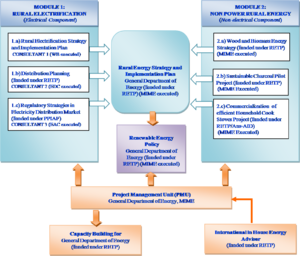

Under the Worldbank's Rural Electrification and Transmission Project (RETP) the Rural Energy Strategy Program is carried out. The General Department of Energy at MIME is in charge of the programm which is divided into two modules:

- Module 1: Rural Electrification - 3 Consultants (WB, EdC, EAC) for the Rural Electrification Strategy and Implementation Plan, Distribution Planning and Regulatory Strategies in Electricity Distribution Market respectively

- Module 2: Non Power Rural Energy - Wood and Biomass Energy Strategy, Sustainable Charcoal Pilot Project, Commercialization of efficient Household Cook Stoves Project. (Cambodia is one of the national partners of the Global Alliance for Clean Cook Stoves).

In 2011, as part of the above mentioned Rural Energy Strategy Program, the French Consultancy Innovation Energie Développement (IED) developed the Sustainable Rural Electrification Plan for Cambodia (Executive Summary) (www.srep-cambodia.com) which shall be executed in order to reach the rural electrification targets set out by the government. Around USD 1 billion will be needed in three stages to reach these targets. The extension of the national grid plays a vital role, but so do mini-grids based on biomass, hydro and solar applications:

Stage 1 of SREP 2011- 2015: $ 418. 5 million

National Grid Extension $ 327,4 million

Total Off-Grid $ 91.1 million, of which

- Off Grid:

- Hydro mini-grid $ 31.5 million

- Biomass mini-grid $ 16.4 million

- Diesel mini-grid $ 23.9 million

- Solar Home Systems $ 6.7 million

- Community PV $ 2.2 million

- Solar Battery Charging $ 0.4 million

Stage 2: 2016 – 2020, 301.8 million

Stage 3: 2021 – 2030, 287.6 million

Means of Facilitation

There are basically two means of facilitation used for the improvement of rural energy supply:

Rural Electrification Fund (REF)

The REF is part of the REAP with the goal of achieving Cambodia's electrification targets. Renewable energy plays a certain role in its programme. Mini hydro plants and solar home systems are eligible to receive subsidies up to 25% of total investment costs. The International Development Association (IDA) and the Global Environmental Facility (GEF) provide the money for the REF.

The project period of the fund is 2004 to 01/2012. From 2012 onwards, the fund has to find new means of funding.

Activities include:

- Rural Electricity Enterprises (REE): an Association of REE has been established (2011), funded by REF, to collect info from REE (improvements, challenges, etc.) and to spread technical knowledge and training information. REF grants assistance to REE for increasing household connections (45 USD/connection) - target of 50,000 additional connections nearly reached. Certain eligibility criteria (location, likely reach of the national grid, license, price/kWh, etc.) is taken into consideration.

- Solar Home Systems (SHS): initially 100 USD grant was given to solar companies for encouraging sales of SHS > 40 Wp to rural households. The target was to reach 12.000 disseminated SHS through this programm. As the mid-term review showed, progress was too slow. Hence, the approach was restructured: interest free installment sales with bi-annual or monthly installments (cash sales also possible) with a pay-back period of max. 4 years. Sunlabob (German-Lao) won the tender and will work on this project together with the local solar social enterprise Kamworks (Dutch-Khmer). Due to the deadline of the project in 01/2012, 8.000 SHS will have to be installed by then, the remaining 4.000 SHS will be installed later.

- Mini/Micro Hydro and other renewable energy technologies: REF granted assistance of 400 USD/kWh for any mini/micro hydro project and 300 USD/kWh for other renewable energy technologies. This approach failed as well, capacity and investment from project developers' side was missing. The funds were then reused for hydro power projects in 5 locations.

- Future project idea:"Power to the poor" - From the experiences by EdC and its grid expansion, the very poor are not connected by the grid as the connection costs (wiring, fee, etc.) of 50-100 USD (depending on location) are too high for them. Hence, REF wants to provide interest free loans to them which are to be paid back within 3 years. Funding is still not secured for this project.

- Rural Income Generation Promotion: the productive use of electricity will be especially promoted until the end of 2011.

Fiscal Incentives

Several fiscal and investment incentives have been agreed upon for project developers active in renewable energies in a law from 2003. Yet, it is not clear, in which degree companies can use these incentives and up to which amount they can be granted. Also, information on reduced custom duties on renewable energy equipment varies greatly.

Policies Beyond Electrification

While the policy framework for rural electrification is quite comprehensive, there is a policy gap with respect to other types of energy that are essential for the rural population. In other words, cooking energy that is supplied by biomass, or fuels such as LPG is not yet covered by a specific policy.[23]

Yet, a wood and biomass energy strategy is currently under development by MIME, funded by the WB RETP. First results are expected in late 2011. Under the same programme, a sustainable charcoal pilot project is being carried out (GERES). The third component of the non-power sector activities currently deals with the commercialization of efficient household cook stoves (funded by RETP/Aus-AID) (also GERES).

Climate Change

On activities, policies, actors etc on on Climate Change see Climate Change Situation Cambodia.

Institutional Set-up

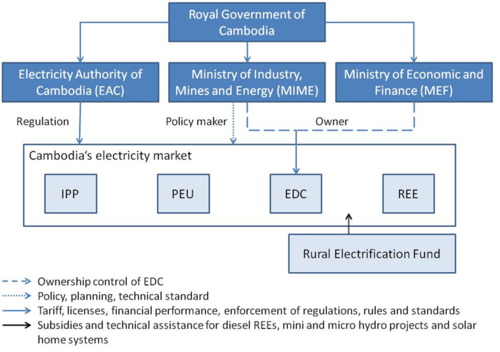

The Ministry of Industry, Mines and Energy (MIME) is in charge of the energy issues in Cambodia. It develops energy policies, strategic plans and with partners develops standards (technical, safety, environment).

However, the oil and gas sector is handled by the Cambodian National Petroleum Authority (CNPA).

General Directorate of Energy (MIME): The Department of Energy Development is the principal government agency responsible for energy sector planning as well as consumption and data collection, and has to work closely with other governmental departments. For the sustainable development of energy, emphasis is given to hydropower and renewable energy sources. Therefore, to better ensure an adequate supply of fuel-wood throughout the country, it should coordinate with the Department of Forestry and Ministry of environment, through a broader energy plan, encompassing the fuel mix of possible energy sources.

The Electricity Authority of Cambodia (EAC) is responsible for regulating the electricity industry and has the following duties:

- licensing, tariff setting,

- solving the disputes between producers/suppliers and consumers,

- setting up the uniform accounting standards,

- enforcing the regulation,

- review of planning and financing performance.

Its website offers great reports on Cambodia's power sector.

Electricity du Cambodge (EdC) is a government owned power utility responsible for the generation, transmission and distribution of power in nine areas of the country (provincial towns and Phnom Penh). EdC sells 90% of the electricity used in Cambodia. EdC is co-owned by MIME and the Ministry of Economy and Finance (MEF).

Independent Power Producers (IPPs) provide 89% of the electricity produced in Cambodia, and sells it to the EdC.

The Public Electricity Utility (PEU) is the owner and operator of state-owned power plants.

Rural Electricity Enterprises (REEs) are privately-owned, licensed electricity providers (mainly using diesel generators, few using biomass gasifiers), mainly in areas not coveres by EdC. Sizes very between 50 and 5,000 customers - around 40 have more than 1,000 customers. Most REEs are rather small, providing rural villages with electricity - on average the installed capacity is 232 kW (minimum 20 kW, maximum 1,43 MW). Of the 249 REEs (estimate), approx. 226 are engaged in distribution and retailing, the remaining ones are only distributors. 50% of REEs offer 24h service, the rest operates only 4-12 hours per day.

Other figueres mention: Some REEs (31) are only distributors, bying power from EdC and selling it on to the customers, 178 are consolidated companies which generate and distribute electricity.

226 (estimate) are unlicensed REEs. REEs are extremely important for the electricity sector in Cambodia.

Overview of the institutional set-up of Cambodia's electricity sector.

The Department of Forestry and Wildlife under the jurisdiction of the Ministry of Agriculture Forestry and Fisheries (MAFF) is currently responsible for implementing a government policy, in cooperation with other government departments to ensure the management and protection of the nation’s forests, for the sustainable future and stability of forest biodiversity, through:

- Management of fuel-wood

- Management of concession areas

- Reforestation in the concession forestry as well in the community forestry

Donor Activities in the Energy Sector

► ESMAP Report (2012) on examples of pro-poor decentralized energy projects in Cambodia

GTZ /GIZ Activities

- Under the GTZ/GIZ Private Sector Promotion (PSP)(2008-2011) rural electrification based on renewable energies was part of two local PPP:

- Solar Lanterns: One PPP dealt with building up a sustainable business model for solar shops with Kamworks, a social enterprise working with solar energy products. The PSP Program was able to initiate a project establishing a network of solar shop operators providing low-cost solar energy solutions to rural populations. Through this initiative, Kamworks was able to select, recruit and train a number of solar shop operators; thus, creating a network of entrepreneurially-minded solar energy providers throughout Phnom Penh and various rural areas.

- Jatropha:GTZ-PSP has introduced a pilot project to make electricity available to rural locations through renewable energy sources, decreasing the dependence of fossil fuels. The project implementation started in Paoy Cha commune in June 2008 in collaboration with the Rural Electrification Enterprise (REE) of a local entrepreneur. The business model is based upon bio-fuel production, using oil from the seeds of the Jatropha cura – a common shrub usually grown in rural Cambodia, which is used as a natural fencing material to prevent livestock from foraging through local crops. Locally produced Jatropha oil hence replaces part of the diesel needed. Moreover, the project extended the household and business connections of the REE grid.

- GIZ Renewable Energies ( 07/2010 till 06/2012): The project will focus on innovative pilot projects in corporation with the private sector to establish sustainability beyond the project phase: Pilots in the field of solar and wind pumps (for irrigation and water supply), bio-gasification (rise husk, etc.) and further business models regarding Jatropha are under discussion. Furthermore, the project supports SNV and the National Biodigester Programme in order to upscale the sales of household biogesters and to add new provinces to the project's field of activity.

Other Donors and Organisations

So far, no formal working group on renewable energies has been established to foster communication and coordination between donors and between donors and governmental institutions.

The World Bank, the Asian Development Bank and the Japanese development corporation JICA are the most important donors in the energy sector in Cambodia. They are mainly working in the field of grid extension, and power generation.

World Bank - the world bank is currently active in the Rural Energy Strategy Program, with consultants working directly in MIME on this. Furthermore the World Bank funds the REF and its activities.

Asian Development Bank (ADB)[24]

- New Country Partnership Strategy for 2011-2013: The Asian Development Bank (ADB) announced a soft-loan package of USD 488 million for 2011-2013. Natural resources and energy are amongst the focus areas of this investment plan in the Greater Mekong Subregion. Of the soft-loan package, USD 127 million is allocated for 2011, and USD 209 million and USD 152 million for 2012 and 2013 respectively.

- Biomass[25]: ADB together with the governments of Cambodia (and Vietnam and Laos) are starting an initiative to boost biomass waste (rice husk and animal manure) use for energy and fertilizer. The ADB is starting a project with a 4 million dollar grant from the Nordic Development Fund (Denmark, Finland, Iceland, Norway and Sweden) and 600,000 dollars from Cambodia, Vietnam and Laos governments to start pilot projects in biogas systems, biochar kilns and improved cooking stoves. This project will conduct studies, build human and institutional capacity on biomass investment, and promote regional exchange among the Greater Mekong area countries and harmonize biomass and bio energy standards. The project is part of ADB’s Energy for All Initiative and will run from July 2011 to December 2014.

- Rural energy Pilot Project: extension of multi-voltage line, improved cooking solution, 5.3 Mio USD, Australian Grant [26]

- In conjunction with the above mentioned EdC grid extension, together with AusAid a pilot project on Output based Aid (OBA) for Rural electrification (based on Lao experiences) will be carried out (mid 2012 till September 2013) in Svay Rieng. Aim is a OBA Pool Fund for RE open to different kinds of donors. REE or utilities get paid for each connection, subsidies and microfinance for the connection to the grid for poor rural households (to overcome the high up front cost, and high investment costs for utilities, overcoming lack of access to finance).

JICA and KOICA are also conducting capacity development, training and vocational training programmes in the field of energy.

The French (through the Ministry of Economy, Industry and Labour DGTPE) are also active in rural electrification and grid extension (assessment of potential, stragy development, potential future loan for the implementation of these strategies and plans). AfD is interested in financing mechanisms (non sovereign financing for banks) in the rural electrification sector - wants to implement a credtif facility for REE and microfinance institutions. Green microfinance for the National Miodigester Program or SHS programs are also looked into.

NEDO signed an MoU in late 2011 with MIME to build a rice husk gasifier for a rice mill in Takeo provice to set an example in high quality gasification.[27]

UNIDO has conducted studies related to small hydro power and biofuels and was active in productive use of energy.

Cambodia is part of the Netherlands' Asian Sustainable and Alternative Energy Programme (ASTAE). The mandate is to scale up the use of sustainable energy options in Asia to reduce energy poverty and protect the environment. Achieving this objective rest on promoting ASTEA's three pillars for sustainable development: renewable energy, energy efficiency and access to energy.[28]

The Dutch SNV,which is also being financially supported by GIZ/BMZ (June 2010 - July 2012) has been working in the dissemination of household sized biodigesters for cooking and illumination based on biogas. Since 2006, SNV has supported the National Biodigester Programme which is active in 8 provinces and has so far disseminated more than 10,000 biodigesters. Currently, this is the only broad activity in the field of renewable energy.

The french NRO GERES, supported by UNDP, EU and others, has been working in the field of efficient cook stoves. So far, GERES has disseminated over 1 million improved charcoal stoves for urban households. Only recently, activities have been expanded to target rural households as well, marketing an improved fuel wood stove. Furthermore, Geres' activities include sustainable forest management, biochar production from organic and agricultural waste , improved palm sugar stoves for SME, efficient charcoal production and production of charcoal bricketts from coconut shells (joint venture with french NGO PSE).

REEEP (Renewable Energy and Efficiency Partnership) is going to support two mini-grids that will be upgraded to hybrid diesel and renewable energy systems with funding from the OPEC Fund for International Development (OFID). In the village of Chamback, a hybrid solar photovoltaic (PV) and diesel system will provide 24-hour service to 1000 households who currently only have 10-14 hours of electricity per day, and bring service to an additional 600 households without any access. In the village of Charchuck, a biomass gasifier will be added to the local mini-grid, powering 500 households, a local hospital and four phone relay stations. Currently only 400 households have 8 hours of electricity a day. The clean energy pilots are being implemented by Innovation Energie Développement (IED) in close collaboration with Cambodian Ministry of Mining Industry and Energy (MIME) and the Electricity Authority of Cambodia (EAC).[29] [30]

Finland will double its support for green energy projects in Thailand, Laos, Vietnam and Cambodia from 4.9 mil. Euro to 9.1 mil. Euro for the 2013 - 2016 extension. The Energy and Environment Partnership Programme for clean technologies was launched in 2009 by the Ministry for Foreign Affairs of Finland with support from the Nordic Development Fund, also sponsored by Denmark, Iceland, Norway, and Sweden. During the first phase of the programme that runs till this year the donors have allocated a budget of Euro 7,9 million. To date, more than thirty projects in Thailand, Laos, Cambodia and Vietnam have benefited from the funds.[31]

Private Equity Renewable Energy Funds

- The Overseas Private Investment Corporation (OPIC) (U.S. Government Finance Institution) has launched the Mekong Renewable Resources Fund (MRRF) with a contribution of USD 50 million (total target capitalization USD 150 Mio) (July 2011). The MRRF will be managed by Indochina Capital Corporation, a Vietnam-based asset management firm.[32] The fund will be invested in renewable energy across lower Mekong counties of Vietnam, Laos and Cambodia. The fund will specifically target environmental services and infrastructure; renewable energy; and energy efficiency sectors specifically investing in carbon reduction or emission neutral projects.The MRRF will primarily invest in SMEs. Renewable energy investments may include wind, small hydro, solar, and biomass, while energy efficiency investments may include renovations to existing power plants, agricultural processing, and industrial facilities. OPIC specifies that the funds will invest in deployment of "mature" renewable energy technologies, naming wind, solar, hydro and small hydro, in an attempt to increase electricity supply in under-served markets. It is not yet clear how much of the money will flow to Cambodia. Morover, OPIC will provide the first political risk insurance contract for the Reduced Emissions and Deforestation and Degradation (REDD) project in Cambodia to protect forest that sequesters 8.7 million metric tons of CO2.[33]

- Maybank Investment will start a $500 million private equity renewables fund with a focus on wind, solar, geothermal, small hydroelectric, biomass, biofuels and energy efficiency projects in Asia. Part of the funds are also going to go to Cambodia.[34]

Challenges Regarding Energy, Renewable Energy and Rural Energy in Cambodia[35]

Institutional Structure

- Poor institutional synergies

- absence of provincial energy service delivery planning

- lacking coordination capacity at institutional level

Policy and Regulatory Framework

- energy policies have long focused on electricity supply (this is slowly changing)

- regulatory frameworks for rural energies such as battery charging stations, cooking, lighting, small REE still missing or underdeveloped

- lacking renewable energy development policy and law

- missing leading institution for applied research on renewable energy technologies (RET)

Programme Concerns

- only recently has a rural energy programme been started with focus on rural energy such as biomass energy

- old programmes did not include cooking energy, now changing but still still small compared to electricity issues (mainly grid extension)

Access Issues

- higher prices for energy services in rural areas

- Cambodia has among the highest electricity prices in the world, especially in rural areas (up to US $ 1 per kWh)

- REE often not viable due to high diesel costs, few customers and low demand

- rural households and SME have no information about RET and their advantages

Financing Concerns

- unfavorable investment environment for energy - high import tax on RET (35%), no public support or investment incentives

- lacking access to loans for energy providers or SME wanting to invest

- due to small scale of many projects, carbon markets have not been targeted widely by Cambodian projects but potential is there

Gender Concerns

- women (and children) are strongly affected by indoor air pollution due to prevalent use of traditional cooking techniques

- women are also more intensely involved in fuel wood collection

Monitoring and Evaluation Framework

- lacking analysis of data on rural cooking and lighting

- lacking data and statistics on biomass energy (usage, availability, possible usages, etc.)

Further Reading

- IEA: Data and graphs on energy figures for Cambodia

- The World Bank on Cambodia

- UN Cambodia Energy Sector Strategy

- UNDP Energy and Poverty Challenges Cambodia

- Open Development Cambodia webpage on energy

References

- ↑ 1.0 1.1 1.2 http://www.un.org/esa/agenda21/natlinfo/countr/cambodia/energy.pdf

- ↑ 2.0 2.1 http://www.phnompenhpost.com/index.php/2011071550395/Business/cambodias-energy-dilemma.html

- ↑ http://www.iea.org/stats/indicators.asp?COUNTRY_CODE=KH

- ↑ http://www.iea.org/stats/balancetable.asp?COUNTRY_CODE=KH

- ↑ http://english.alarabiya.net/articles/2011/07/14/157542.html

- ↑ http://oilprice.com/Energy/Energy-General/Cambodia-Next-Oil-and-Natural-Gas-Frontier.html

- ↑ http://www.bernama.com/bernama/v6/newsbusiness.php?id=659796

- ↑ http://www.phnompenhpost.com/index.php/2012032955308/Business/koh-kong-power-to-go-to-thais.html

- ↑ http://agmhp.aseanenergy.org/focus-countries/2009/09/30/renewable-energy-in-the-kingdom-of-cambodia

- ↑ http://www.phnompenhpost.com/index.php/2012011853987/Business/largest-ever-cambodian-solar-project-launched.html

- ↑ http://www.rfa.org/english/news/cambodia/dam-04062012184436.html

- ↑ http://www.rfa.org/english/news/cambodia/dam-02282012135535.html

- ↑ http://english.peopledaily.com.cn/90001/90776/90883/7431947.html

- ↑ http://english.vovnews.vn/Home/EVNI-speeds-up-power-projects-in-Cambodia-Laos/20117/128001.vov

- ↑ 15.0 15.1 http://agmhp.aseanenergy.org/focus-countries/2009/10/30/current-status-of-electricity-sector-of-kingdom-of-cambodia

- ↑ http://www.worldbank.org/en/country/cambodia/overview

- ↑ http://www.opendevelopmentcambodia.net/power/electricity/in-need-of-power-phnom-penh-blacks-out/

- ↑ http://www.awrlloyd.com/news-and-publications/view/awr-lloyd-contributing-to-cambodia-energy-master-plan/

- ↑ http://aseanrenewables.info/wp-content/uploads/2013/05/KH-Combodia_Rev02.pdf

- ↑ http://news.wooeb.com/779997/cambodia-power-report-q3-2011-new-market-research-report

- ↑ http://www.chinadaily.com.cn/bizchina/2012-04/06/content_14992134.htm

- ↑ http://agmhp.aseanenergy.org/focus-countries/2009/09/30/rural-electrification-plan-in-kingdom-of-cambodia

- ↑ http://www.un.org.kh/undp/media/files/rural_energy.pdf

- ↑ http://english.cri.cn/6826/2011/07/07/2741s647072.htm

- ↑ http://www.lankabusinessonline.com/indochina/fullstory.php?nid=1666004579 ,

- ↑ http://pid.adb.org/pid/LoanView.htm?projNo=45303

- ↑ http://www.nedo.go.jp/content/100399132.pdf

- ↑ http://www.faststartfinance.org/programme/asian-sustainable-and-alternative-energy-programme-astae

- ↑ http://www.reeep.org/58.22291/reeep-to-fund-rural-energy-access-in-cambodia-ethiopia-and-tanzania.htm

- ↑ http://www.renewableenergyfocus.com/view/24157/reeep-funds-clean-energy-in-rural-cambodia-ethiopia-and-tanzania/

- ↑ http://www.scandasia.com/viewNews.php?coun_code=fi&news_id=10072

- ↑ http://www.opic.gov/news/press-releases/2009/pr062811, http://www.indochinacapital.com/ ,

- ↑ http://www.earthtechling.com/2011/12/opic-pumps-1-1-billion-into-clean-energy/

- ↑ http://www.renewableenergyworld.com/rea/news/article/2011/11/asia-report-solar-dispute-is-just-part-of-the-friction

- ↑ http://www.scribd.com/doc/59159097/UNDP-Energy-and-Poverty-Challenges-and-the-Way-Forward-Cambodia