Clean Development Mechanism (CDM) and Baseline-Assessments for Wind Energy Projects

The Clean Development Mechanism (CDM)[1]

In the Kyoto Protocol the industrialised countries committed themselves to binding reduction targets for greenhouse gases (GHG). In order to enable these countries to fulfil their commitment in a cost-efficient way, three flexible mechanisms - Emissions Trading (ET), Joint Implementation (JI) and Clean Development Mechanism (CDM) - were developed. ET is a trade-based mechanism allowing states to buy or sell emissions rights, JI and CDM are project-based mechanisms allowing the generation of emission reductions, which are attributable to the domestic target, by investing in projects abroad.

Under the CDM, an Annex I country[2] invests in an emission-reducing project in a Non-Annex I country. These countries are also referred to as „investor country“ and „host country“. The emission reductions - the so-called certified emission reductions (CERs) - can be gained from 2000 onwards, and will be issued retrospectively as soon as the rules have been fixed and the Kyoto Protocol has come into force.

Clean Development Mechanism (CDM) Requirements

For the CDM two sets of requirements exist: requirements for the participation in the mechanism in general (relating to states) and requirements for the projects (relating to the design of projects).

Regarding participation, host countries have to have ratified the Kyoto Protocol. Apart from the ratification, the investor countries have to fulfil a set of requirements relating to the estimation and reporting of domestic emissions and the booking of emission rights and certificates into a national registry.

Regarding the requirements of projects, as a technological restriction the CDM does not allow the usage of nuclear facilities.

But CDM projects also have to fulfil additional requirements:

- Existing official development assistance resources must not be diverted for project financing; other public funding used for this purpose is to be separated from and not counted towards the financial obligations of the industrialised countries.

- Sustainable development: projects shall promote sustainable development in the host country. The respective requirements are specified and applied by the host country. In case of approval, the project participants are provided with a so called „letter of approval“ by the host country.

- Additionality: the emission reductions resulting from the project are to be additional to reductions which would have occurred otherwise. This requirement is checked by comparing the project emissions with the emissions of a hypothetical reference case (the "baseline") – this reference case is used to simulate the situation without the project. So determining the additionality of a project mainly depends on the choice and calculation of the baseline.

Clean Development Mechanism (CDM) Project Cycle

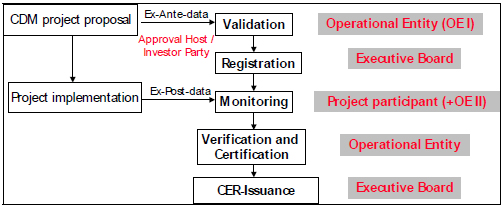

Projects wanting to qualify as CDM projects have to undergo the following project cycle:

A) Project Design

The project participants (the investor and the organisation carrying out the project) draw up a so-called project design document (PDD). An outline for such a document has already been developed by the United Nations Framework Convention on Climate Change (UNFCCC)[3].

The Project Design Document (PDD) contains:

- a general as well as a technical description of the project

- the construction of the baseline and calculation of baseline emissions

- the information needed to assess the fulfilment of the CDM project requirements

- a plan for the monitoring of the project emissions

- the calculation of the project emissions.

- In order to gain information about the sustainability of the project, the following activities have to be conducted:

- analysis of the environmental impacts of the project

- invitation of stakeholders’ comments. Based on the PDD, the project participants apply for the "letter of approval", to have the project recognised as a CDM project by the government of the host country. The host countries may then give their approval that the activity satisfies their sustainable development requirements.

B) Validation

The next step is the validation of the project by an appointed "Operational Entity“ (OE), which evaluates the project using the project design document with regard to the CDM criteria. OE are independent bodies which have been accredited by the "Executive Board" (EB). The EB is the central authority for the CDM, it is responsible for monitoring the CDM. It consists of 10 members (6 non-Annex I: 4 Annex-I parties) from parties to the Kyoto Protocol.

C) Registration After a project has been validated, the documents are passed on to the EB for registration - i.e. formal acceptance as a CDM project.

D) Monitoring:

Subsequently, monitoring takes place. This is a task for the project participants. The verification, which takes place at regular intervals, is also conducted by an OE (different from the OE which conducted validation) which checks the accuracy of the estimated CERs ex-post. The certification involves the written assurance of the OE that the project has resulted in the verified emission reductions within a certain period. The certification report actually represents an application for the issuing of emission credits to the amount of the verified emission reductions. The EB issues the CERs, unless there is an application submitted by a third party within a certain time to re-examine the CDM project. When issued, the CERs are individually marked with a serial number, the Share of Proceeds[4] is deducted and the remaining CERs credited to the account/s of the project participants. The CERs rewarded for a project can then be used to fulfill an emission reduction commitment or can be sold to other countries with a commitment. The flow chart shows the described steps in CDM-project application and the institutional entities of the CDM involved in the progress.

Calculation of Emission Reductions

The assumption of a baseline - the amount of anthropogenic emissions which would occur if the project did not take place - is of crucial significance for the amount of credits a CDM project can generate. The amount of CERs issued for a project equals the difference between the actual emissions and the baseline. Three basic approaches are eligible for the construction of the baseline.

The most appropriate approach is to be chosen and this choice has to be explained and justified. The following approaches were developed:

- current or historical emissions,

- emissions of a technology which represents an economically attractive course of action, taking barriers to investment into account,

- average emissions of similar project activities undertaken in the previous five years, in similar social, economic, environmental and technological circumstances, and whose performance is among the top 20 percent of their category.

More detailed methodologies for the construction of the baseline are to be developed by the Executive Board in the future.

Projects can generate CERs only for a specified period, the crediting period. Participants can choose between two approaches for the crediting period:

- either a maximum of seven years which may be renewed twice at most. For each renewal an operational entity has to determine whether the baseline is still valid

- or a maximum of ten years with no option of renewal.

In order to promote small projects, simplified regulations regarding baseline construction and monitoring are applied for the following project categories:

- renewable energy project activities with a maximum output capacity of up to 15 MW,

- energy efficiency improvement project activities which reduce energy consumption, on the supply and / or demand side by up to 15 GWh per year,

- other project activities that both reduce anthropogenic emissions by sources and that directly emit less than 15 kilotonnes of carbon dioxide equivalent annually.

The simplified regulations will be worked out by the Executive Board.

When calculating the project emissions, a project boundary has to be defined, which encompasses all GHG emissions which are significant and reasonably attributable to the project and are under the control of the project participants.

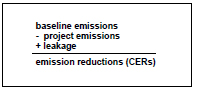

If projects lead to a net change of emissions occurring outside the project boundary, this is referred to as leakage. The calculation of emission reductions incurred by the project has to be adjusted accordingly. The emission reductions attributed to a project are then calculated as follows:

Project example: Preliminary CDM and Baseline-Study for the Jordan – Wind Park "Shawbak”

The CDM and Baseline study for the Shawbak wind project has been prepared by S. C. Wartmann of the German Fraunhofer Institute for Systems and Innovations Research (ISI) for the Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ).

Description of the Project

- Project purpose: Construction of a privately owned 25 MW wind park at Shawbak, Jordan, to satisfy the country’s rising energy demand with a technology independent of fossil fuels.

- Project developers: The project is being developed by the GTZ on behalf of the German Federal Ministry for Economic Cooperation and Development, which was asked for assistance in developing wind power projects in Jordan by the Jordanian Ministry of Energy and Mineral Resources.

- Background: Electricity demand in Jordan rose at an average rate of 6.9 % p.a. from 1994-1999 and peak demand is expected to rise annually by around 4 % (with the morning demand growing stronger than the peak evening demand) between 2000-2015, with the overall demand being expected to double in this period (peak demand 1999: 1,173 MW, 2015: 2,207 MW). At present 1,540 MW are available with 66 % of this coming from steam turbine plants fired with heavy fuel oil, 30 % from gas turbines fired with diesel and natural gas, 3 % from diesel engines and 1 % from hydro and wind power. As there are currently no overcapacities in the Jordan electricity sector, generating capacities have to be expanded in order to avoid shortages in the future. The expansion plans include a 300-450 MW combined cycle power plant at Samara starting operation in 2003 at the earliest, and a 100 MW gas turbine at Rehab Power station which will be run on diesel at first and then be changed to a combined cycle plant together with an existing 100 MW gas turbine at Rehab as soon as natural gas becomes available.

- Jordan is heavily dependent on fuel imports as only small resources of natural gas (5.5 billion cubic feet p.a., wells in the Risha district) and oil (600 barrels per day, Hamzeh) are available. At present, only one fourth of the existing gas turbine capacity is fired with natural gas, the rest is fired with diesel. Heavy fuel oil is imported from Iran, it is planned to import natural gas from Egypt from 2003 at the earliest. A 30-year agreement was signed in 2001, but financing for the necessary pipeline is still pending, so the start of the gas imports might be delayed. Wind power could help to decrease Jordan’s dependence on fuel imports.

- Technical description of the project: The project site is located on a plateau close to King’s Highway, Shawbak. It has not been defined exactly, which part of the plateau will be designated as wind park area. On the site it is planned to erect 32-42 wind energy converters (WEC) with a capacity ranging between 600 - 800 kW[5] each, with a hub height of 50 m. Thus a capacity of approx. 25 MW will be reached. The wind park will be connected to the Jordanian grid via an 132 kV line through the substation in Rhashadiya. Due to very specific wind patterns in the eastern part of the area, electricity production for this area could not be estimated. The estimates made for the western part of the wind park area underlie uncertainties in wind behaviour patterns: the yearly electricity production (including losses, uncertainty and climatic variation) is estimated between 35,000 MWh/a (pessimistic) and 76,000 MWh/a (optimistic) with the average ranging between 51,000 and 58,000 MWh/a (this range as well depending on the types of turbines chosen).[6] The technical equipment will be imported, so the project does not aim at technology transfer. The construction period is planned to be 1 year, the operation period 20 years.

- Project boundary: The project boundary will encompass the electricity produced by the wind park excluding transmission and distribution losses. As the electricity is fed directly into the Jordanian grid, the losses suffered will be the same as for all other power plants.

- Crediting period: CDM projects can receive CERs only for a defined period, the so called crediting period. A crediting period of 10 years without renewal or a crediting period of 7 years which can be renewed up to two times with a baseline review before each renewal can be chosen.

As the operational lifetime of the project will be 20 years, a renewable crediting period of 7 years – with the second crediting period also lasting 7 years and the third lasting only 6 years – is suggested. So at best CERs could be rewarded for the whole operational lifetime of the project. As the baseline will be checked and, if necessary, revised before each renewal of the crediting period, the amounts of rewarded CERs may be lower for the crediting periods 2 and 3.

Proposed Baseline Methodology

As mentioned before, the baseline is the level of GHG emissions against which the emission reduction incurred by the project activity is measured. Project participants have to construct the baseline according to a baseline methodology approved by the Executive Board, the supervisory authority for the Clean Development Mechanism. The simplified methodologies for small projects cannot be applied for the Aqaba wind park project, as the project capacity of 25 MW exceeds the threshold for renewable energy project activities of 15 MW. As no methodologies have been approved so far, a simple methodology was developed for this study.

Basic Assumptions

The first question in baseline construction is, what would have happened without the project in question? For projects concerned with power generation this means: how would the demand satisfied by the project plants haven been met otherwise? So the question is, which power plants will the wind park replace and to which extent? These may be existing generating capacities or capacities which are considered as an alternative to the project in question. For baseline construction the following three basic baseline approaches exist:

Existing actual or historical emissions:

- Emissions from a technology that represents an economically attractive course of action, taking into account barriers to investment

- the average emissions of similar project activities undertaken in the previous five years in similar social, economic, environmental and technological circumstances, and whose performance is among the top 20 per cent of their category there.

The approach deemed most appropriate has to be selected for baseline construction. The first approach is selected for the Shawbak wind park project. As the wind park output is highly dependent on the wind regime, wind independent excess capacities are needed which can substitute the capacity of the wind park in order to avoid shortages in power supply, if the wind conditions are not favourable. So as long as wind power is available, the electricity output of the conventional power plants will be decreased by the amount of electricity produced by the wind park.

In view of the dependency on wind patterns, economically more attractive wind independent plants can hardly be considered an equal alternative to the wind park, which has to be assumed when the second approach is applied. So only other wind park projects could be considered as an alternative. As wind power is an emission-free technology, baseline and project emissions would both amount to zero emissions – leading to the conclusion that wind power does not lead to emission reductions.

The third approach is based on the assumption that more advanced technologies provide for lower emissions. So this approach is only suitable for projects which actually lead to emissions – comparing the Shawbak project to another wind park (which is suitable according to the third approach)) again means comparing an emissions-free project to a zero emissions baseline.

When applying the first approach, the Shawbak project will be compared to existing generating capacities in Jordan. As the baseline will have to be estimated for up to 20 years, planned changes in the existing generating capacity have to be considered. So the baseline construction for the three crediting periods will not be based on the same assumptions.

In general, the following assumptions are made for the substitution of power from fossil fueled power plants with wind power: the electricity produced by the Shawbak wind park will replace electricity produced by other Jordanian power plants, i.e. these plants will produce less electricity. As the wind park production is dependent on the wind regime, the power plants chosen for substitution will not be shut down completely, as they have to function as back-up in case of unfavourable wind conditions. The plants preferably replaced by wind power are the ones showing comparably lower efficiency and higher fuel costs.

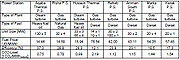

Table 1 shows the degrees of efficiency (MWh sent out/MWh fuel input) and other characteristics of several Jordanian power stations[7]:

Crediting period 1

For the first crediting period the following assumptions are made:

- no changes are made to the existing generating capacities as displayed in table 1

- the imports of natural gas from Egypt have not started yet.

As mentioned before, the diesel-fired gas turbines show the highest fuel costs and the lowest efficiency. According to the load duration curve for 1999 shown in Figure 4-2 of the DECON/NERC study[8], these plants as well as the existing diesel engines are used to cover the peak load demand. Coverage of the base load can be attributed to the 130 MW thermal units at Shawbak, of the mid-merit load to the 33/66 MW thermal units at the Hussein P.S. and the gas-fired gas turbines at Risha P.S.

For the diesel engines, efficiencies and fuel costs per output are not available, but as the specific price (JD/GJfuel input) for diesel oil is approximately twice as high as for heavy fuel oil and more than twice that for natural gas according to the DECON/NERC study,[9] it is assumed that the fuel costs per output are also quite high for the diesel engines. With regard to the low efficiency and the high fuel costs of the diesel-fired plants (diesel engines as well as gas turbines), these should preferably be replaced by wind power.

As the availability of wind power is dependent on the wind regime, the correlation between the hourly system loads of the diesel-fired plants and the wind regime at Shawbak is of great significance. The generating capacity of a wind park can only substitute for the generating capacity of other plants being used at the same point of time, i.e. during the same operating hours. Between the annual load distribution of the diesel-fired plants and the potential output of the wind farm, a positive correlation is found. The DECON/NERC study finds that 84 % of the wind park output would substitute for the electricity produced from diesel-fired plants.[10] The remainder would replace plants with higher efficiency and lower fuel prices.

For the construction of the baseline in crediting period 1 this share will be applied. So 84 % of the average annual wind park output14 will be compared to output from diesel-fueled plants. For the remaining 16 %, electricity from the Risha P.S. gas turbines or the 33/66 MW units at Hussein thermal power station could be replaced. These plants show similar efficiency degrees and only a small difference in fuel costs.

When choosing the power plant 16 % of the wind power are to substitute for, it has to be considered that on the one hand, gas turbine stations in general allow for an easier and faster load adjustment than steam power stations, which is important in case the wind power output changes rapidly because of unfavourable weather conditions. On the other hand, the fuel costs for the Hussein P.S. as well as the amount of CO2-load are both higher compared to the Risha P.S.

So two scenarios are constructed: each with 84 % of the wind power output replacing energy from diesel-fired plants, but in Scenario I the remainder replaces energy from the gas turbines in Risha P.S. and in Scenario II it replaces the thermal units in Hussein P.S.

Crediting period 2 and 3

As only little information is available about future changes in the Jordanian capacity mix aswell as fuel availability and prices the crediting periods 2 and 3 will rely on the same assumptions:

- fuel imports from Egypt have started and natural gas is available, so all gas turbines can be fired with the appropriate fuel;

- the price for the imported gas is comparable to the world market price, thus being approximately double the gas price in 2001;[11]

- the newly built combined cycle power plants at Samara and the Rehab Power Station as well as other newly built power plants (for which it is assumed that planning only started after the DECON/NERC study had been conducted) show higher efficiencies and thus lower fuel costs per MWhoutput than the existing power plants;

- as data about the lifetimes of the existing power plants are not available, it is assumed that all plants existing in 2001 will still be in operation in order to avoid shortages in power supply;

- the gas turbines which were formerly fired with diesel show an average efficiency of 20 % as they are fired with gas.

As the diesel-fired plants still show the lowest efficiency and highest fuel prices (with diesel having been substituted by natural gas for the gas turbines, but the price for natural gas having doubled) the wind power electricity is still compared to the remaining gas turbines and diesel engines. Due to the higher gas price, the Risha P.S. will also be included for substitution by wind power, so only one scenario for the crediting period 2 and 3 is constructed.

The diesel engines are not included in the baseline for the second and third crediting period as no information about the efficiency is available in the DECON/NERC study or with NEPCON. Thus only the gas-fired gas turbines existing in 2001 are included.[12] With an average efficiency of 20 %, the CO2-load per MWh output amounts to 1 t CO2/MWh[13]. In order to calculate an average CO2-load per MWhoutput for all the gas turbines without knowing the share of electricity production among the various plants, it is assumed that the share of electricity produced by the Risha P.S. and the other gas turbine plants is the same as in 1999[14]Then 881 GWh were produced by gas turbines, with 734 GWh (corresponding to 83 %) coming from Risha P.S. and 147 GWh (17 %) from the diesel-fired gas turbines. These shares will be applied when calculating the baseline for crediting periods 2 and 3.

It has to be kept in mind that only little information about the capacity mix, efficiencies, energy prices and distribution of electricity production in Jordan was available for crediting period 2 and 3, and many assumptions had to be made, so the constructed baseline contains some uncertainties.

As soon as more accurate data is available, e.g. about the CO2-loads of the diesel engines, the baselines should be modified accordingly.

Construction of the Baseline

The baseline is the average amount of CO2 accruing for the production of one MWh of electricity derived from fossil fuels which has been replaced by electricity from the wind farm.

Crediting Period 1

For the first crediting period the baseline is calculated as follows:

with:

- CO2-loadDFU as the average CO2-load of the Jordanian diesel-fueled plants (gas turbines and diesel engines). Loads for the diesel engines were not available in either the DECON/NERC study or the NEPCO. The NEPCO provided information about the amount of diesel oil used for energy generation and the amount of energy generated by dieselfired gas turbines and diesel engines.[15] These figures show an average load of 1.00 tCO2/KWhoutput which is much lower than the average load of the diesel-fired gas turbines in Table 1, between 1.15-2.19 t CO2/kWhoutput. As long as consistent data is not available, an average CO2-load of 1.30 t CO2/kWhoutput is applied, as suggested in the DECON/NERC study.[16] In order to calculate this baseline accurately, the missing loads for the diesel engines have to be provided.

- CO2-loadGas as the CO2-load of the Risha P.S. gas turbine plant (0.70 t CO2/MWhoutput).

- CO2-loadsteam as to the CO2-load of the Hussein P.S. gas turbine plant (1.00 t CO2/MWhoutput).

- The CO2-loads were calculated with heating values and efficiency degrees given in table 4-8 of the DECON/NERC study[17] and IPCC factors[18] for the fuel carbon content.

Crediting Period 2 and 3

For the second and third crediting period the baseline is:

with:

- CO2-loadRisha as the CO2-load of the Risha P.S. gas turbine plant. (0.70 t CO2/MWhoutput)

- CO2-loadGT as the CO2-load of the other gas turbines listed in Table 1. (1.00 t CO2/MWhoutput) c)

Projection of Baseline Emissions

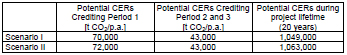

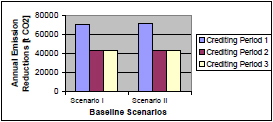

For the detailed calculations, see the sheets “Scenario I” and “Scenario II” in the Excel file “Shawbak-PDD-calculations.xls”. Table 2 shows the annual emission reductions for the two scenarios and the crediting periods.

The two scenarios were only constructed for the first crediting period, so the annual emissions are the same for crediting periods 2 and 3. In the first crediting period as well as for the crediting periods 1-3, Scenario II shows less than 1 % higher emission reductions than Scenario I. The average reduction per MWhouput equals 0.91 t CO2 in Scenario I and 0.93 t CO2 in Scenario II.

Leakage

Emissions which are attributable to the project activity but occur outside the project boundary are referred to as leakage and have to be included in the calculation of project emissions. The DECON/NERC study does not indicate that any leakage occurs for the Shawbak wind park project.

CDM Project Requirements

Due to the fact that the Shawbak wind park project was not specifically designed as a CDM project, no information regarding the project requirements has been gathered and the necessary activities have not been conducted yet (e.g. the invitation of stakeholders comments). With the information available in the DECON/NERC study only a rough estimate about the fulfilment of the project requirements is possible.

Additionality

In general the requirement of additionality is considered fulfilled as soon as the project activity leads to emission reductions. The baseline calculations showed that this is the case for the Shawbak wind park project. But the basic idea of additionality is to determine whether the project would have been carried out even without being viable as a CDM project – in this case the baseline being identical to project emissions, and no reductions being achieved.

For the Shawbak wind park project the economic viability is a strong argument for additionality: for the financing scheme chosen in the DECON/NERC study a levelized tariff of at least 43.26 JD/MWh[19] is needed in order to render the project attractive for private investors. In the preliminary tariff arrangements between the Central Electricity Generating Company (CEGCO) and the National Electric Power Company (NEPCO) for another Jordanian wind park (Hofa Wind Farm, 1.10 MW) a tariff of only 22.30 JD/MWh has been established.[20] Furthermore a comparison with the load distribution in the Jordanian Power Sector shows that only 84 % of the wind power could substitute for electricity from plants fired with expensive fuel (diesel engines and gas turbines fired with diesel, with fuel costs of 42.91 JD/MWh), the remainder of 16 % would substitute for lower cost fueled thermal plants (heavy fuel oil, 14.46 - 18.94 JD/MWh) and gas turbines (gas, 14.59 JD/MWh). These figures indicate that the necessary feed-in price will not be reached, and without other sources of income (e.g. the value of the rewarded CERs in case the project qualifies as CDM project) the project will not be attractive for private investors and will not be carried out. The project can thus be regarded as additional.

Environmental Impacts

An Environmental Impact Assessment (EIA) has not been conducted yet, but is requested by the Ministry of Energy and Mineral Resources (MEMR) and will be approved by the General Corporation for Environment Protection (GCEP)[21]. So far no major environmental concerns have been encountered, if this will be the case in the EIA, the project will have to be modified accordingly. No settlements exist In the wind park area, so noise and shadow flicker will not lead to problems. It may be necessary to move the site at least 1 km east of the King’s Highway, as the area in question is used by local communities for cereal farming and as rangeland and is furthermore highly important for both migratory and resident bird populations.[22]

Public Funding

The project is intended to be privately financed, no sources of public funding are included in the financing process at present, so no diversion of Overseas Development Assistance (ODA) for project financing will take place.

Approval of Voluntary Participation by the Host Party

A set of quality criteria relating to sustainable development which can be applied for CDM projects has not yet been defined by the Jordanian Government. In the Jordan National Energy Strategy, the government stated that it is in favour of developing wind power resources,[23] furthermore the MEMR asked the German Federal Ministry for Economic Cooperation and Development for assistance regarding the development of wind power projects. So it can be assumed that the letter of approval for the project will be granted.

Before the project can be implemented, several national regulations have to be fulfilled, e.g. conducting an Environmental Impact Assessment. In order to receive a generation licence from the National Regulation Commission which is necessary for wind farms, the project will have to undergo a competitive bidding process.

Conclusions

The study showed that the Shawbak wind park projects might produce between 70,000 – 72,000 t CO2-reductions annually as an average in the first crediting period and 43,000 t CO2-reductions annually in the second and third crediting period, amounting to approx. 1,000,000 t CO2-reductions for the three crediting periods (20 years).

It has to be kept in mind that the baseline contains some uncertainty because not enough information about the future developments in the Jordanian power sector was available and that this information should be gathered and included in the baseline in order to increase the reliability of the baseline, especially for the crediting periods 2 and 3.

Regarding the CDM project requirements, the information given indicates that all the requirements will be fulfilled. Again, more information is needed in order to make a thorough and reliable assessment. The project may then have to be modified according to the requirements.

Taking the maximum price[24] of 5.50 Euro/t CO2-equivalent (equaling 3.52 JD/t CO2-equivalent) granted for emission reductions in the CERUPT scheme,[25] an initiative of the Netherlands, as a value for the CERs issued for the project, the average reduction of 0.91 – 0.93 t CO2/MWhoutput for the two baseline scenarios equals a value of 3.20 – 3.30 JD/MWhoutput. For the crediting periods 1-3 the value of emission reductions then roughly amounts to 3,200,000 – 3,300,000 JD.

The DECON/NERC study finds that a levelized tariff of 43.26 JD/MWh is needed to render the project attractive for private investors, i.e. financially viable. In case the NEPCO is willing to grant a higher feed-in tariff of 39 JD/MWh - as the wind park substitutes for expensive thermal generation - as indicated in the DECON/NERC study[26], the value of the emission reduction certificates stated above may nearly be sufficient to ensure financial viability.

In sum it can be concluded, that the Shawbak wind park project seems viable as a CDM project. But even with the CERs issued for the wind park emission reductions, financial viability may not be reached if a higher feed-in tariff cannot be negotiated, the project does not prove more productive or the CERs will not have a much higher value than assumed here.

As the project will help to increase Jordan’s indenpendence from fuel imports and to establish wind power technology further as well as to reduce CO2 emissions, project developers should seek a way to ensure that the project is carried out despite the problems concerning financial viability.

Further Information

- The Clean Development Mechanism

- Clean Development Mechanism (CDM) and Wind Energy Projects in Brazil

- Wind Portal on energypedia

References

- ↑ The contents of this article has been created by S.C. Wartmann of the Fraunhofer Institute Systems and Innovation Research (ISI) for the Deutsche Gesellschaft für Technische Zusammenheit (GTZ). Originally the contents has been published as a GTZ-study concerning CDM supported wind projects in Jordan: GTZ (2002) Preliminary CDM and Baseline-StudyfckLRfor the “TERNA Wind Energy Project, Jordan – Wind Park Shawbak”, commissioned by the Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ), retrieved 11.7.2011 [[1]]

- ↑ The countries with an emission reduction target are listed in Annex I of the Protocol and are thus referred to asfckLR„Annex I countries”, the countries without a target, the developing countries, are referred to as “Non-Annex IfckLRcountries”.

- ↑ UNFCCC (2006) Clean development mechanism design document form (CDM-PDD), retrieved 11.7.2011 [[2]]

- ↑ The Share of Proceeds is a levy on the amount of CERs issued for a CDM project activity. The resources fromfckLRthis levy are to be used for two purposes: to cover the administrative costs of the CDM and to provide fundingfckLRfor the Adaptation Fund, used to finance adaptation measures for countries most affected by climate change.fckLRFor the Adaptation Fund, the levy is 2 % of the issued CERs; for the coverage of the administrative costs, afckLRpercentage still has to be fixed which will be proposed by the Executive Board.

- ↑ The calculations were conducted for four types of turbines: Enercon E40 (600 kW), Vestas V47fckLR(660 kW), Neg Micon NM 48 (750 kW), Nordex N50 (800 W).

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p.27.

- ↑ The efficiency was calculated by applying the standardised heating values for heavy fuel oil, diesel and naturalfckLRgas to the specific fuel consumption of the power stations which were given in the DECON/NERC study, seefckLRMEMR (2001), p.14. For the conversion factors mass/volume see J.W. Rose; J.R. Cooper (1977): TechnicalfckLRData on Fuel, Istanbul; Shell; http://www.shell.ch/gas/de/fg_01.htm. For the calculations see the filefckLR“Shawbak-PDD-calculations”.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p.14.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p. 8.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p. 16.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p. 8.

- ↑ These are: Hussein Thermal P.S. (33 MW), Rehab Power Station (60 MW), Marka P.S. (80 MW), Amman South P.S. (60 MW), Karak P. S. (20 MW). The capacities given are the sum of the single units of each plant. In 2001 the Rehab P.S. had 160 MW, of which the 100 MW unit is planned to be included in a combined heat and power plant. See MEMR (2001), p. 10-11.

- ↑ Calculation: specific emissions of electricity output [t CO2/MWhoutput] = (Specific emissions of fuel input [t CO2/MWhfuel input])/efficiency. For the specific emissions of the fuel input see “Shawbak Wind Park Calculations.xls”

- ↑ See NEPCO (2001): Significant Figures, URL: www.nepco.com.jo/e_two.htm.

- ↑ See www.nepco.com.jo/e_two.htm.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p. 36.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p.14.

- ↑ See IPPC(1996): Revised 1996 IPCC Guidelines for National Greenhouse Gas Inventories. Reference Manual (Volume 3), Cambridge.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p.36.

- ↑ This price is preliminary as the price arrangements between NEPCO and CEGCO are currently being investigated by the Fichtner Consulting Engineers. See MEMR (2001), p. 9.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p. 7.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p. 24-25.

- ↑ See: Jordan National Energy Strategy: http://www.nic.gov.jo/memr/startegy.html.

- ↑ Another initiative, the World Bank’s, Prototype Carbon Fund (PCF) has not defined a maximum price, but has declared 5-6 US$ per t CO2 as target price for the average of the project portfolio. reductions of project activities an average price of 5-6 US$ per t CO2- shall be achieved. See www.prototypecarbonfund.org

- ↑ See www.senter.nl.

- ↑ Ministry of Energy and Mineral Resources (MEMR) (2001): Terna Wind Energy Project, Jordan.fckLRFeasibility Study for Wind Park Shawbak, Amman-Jordan, p. 36.