Distributed Renewables for Energy Access in SADC Countries

Introduction

The SADC Renewable Energy and Energy Efficiency Status Report was published in 2018 by the REN21 Secretariat. This article displays chapter 3 of that report. Other chapters include an regional overview, a renewable energy market and industry overview, energy efficiency, policy landscape and investment flows.[1]

Distributed renewables for energy access in SADC countries

Distributed renewables for energy access (DREA) refers to any renewable energy supply system or technology that operates independent of the national grid. The term may include both rural off-grid systems and systems providing energy to urban populations in grid-connected areas where supply is unreliable or where consumers cannot afford high upfront costs to access grid electricity. Distributed renewable energy (DRE) systems are increasingly used to improve energy access to populations and communities in low-income and peri-urban as well as rural areas. While DRE systems also can be connected to the grid, they are typically small-scale. The most common units are 1-100 kW power plants located at or near electricity end-users, but DRE systems may also include systems for cooking, heating and cooling that generate and distribute services independently of any centralised system. They are sometimes found in urban areas but are most commonly found in rural areas. The technologies used in DRE systems include solar PV, small-scale hydropower, small wind turbines, methane digesters and direct biomass combustion devices (including clean cook stoves). [2]

Access To Electricity And National Energy Targets

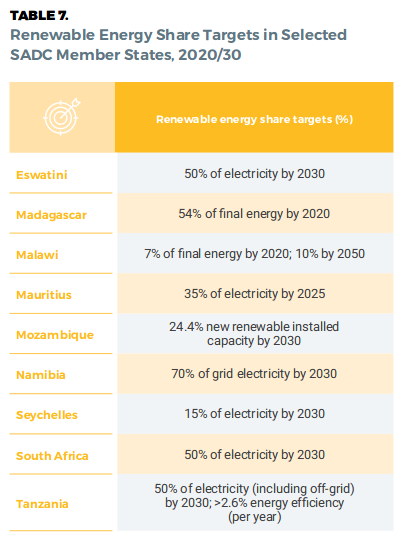

Most SADC Member States have developed national energy access and renewable energy policies, which include targets for implementation. Improved access is typically linked to electrification – that is, the percent of the population that is able to access electricity through either the main grid or mini-grids. Table 7 shows Member State targets for the share of renewables in the energy mix and table 8 describes electrification/energy access targets.[3]

Table 7: Renewable Energy Share Targets in Selected SADC Member States, 2020/30[3]

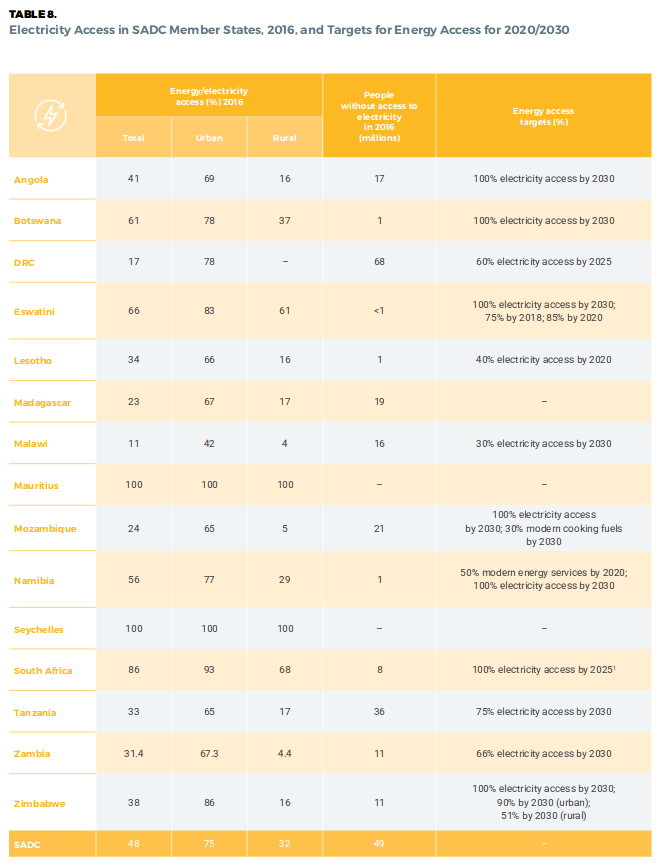

As shown in table 8, the national targets are not uniform across Member States and are set for different time frames, with some Member States not having specific targets. Overall, average electricity access in the region in 2016 was 48%.[3]>

Table 8: Electricity Access in SADC Member States, 2016, and Targets for Energy Access for 2020/2030[3]

To increase energy access, Member States are employing a wide range of strategies, including setting up or continuing their support for dedicated institutions with the mandate to improve electrification and energy access, with a particular focus on rural areas far from the electricity grid.

Rural Electrification And The Role Of Renewable Energy

Rural electrification is a major focus of programme development in the region, and Member States increasingly consider the option of distributed generation and mini-grids as part of their rural electrification programmes. Several SADC Member States have met this challenge by developing specialised agencies to implement these policies. Typically, rural electrification agencies or authorities are based within, or closely associated with, the major national utility. Examples of such agencies are described briefly below.

Eswatini has a Rural Electrification Unit within the Department of Energy that aims to electrify a minimum of 10,000 households annually to achieve universal electricity access by 2030.[4] This is subject to the availability of funds on an annual basis.

Malawi has developed a slightly different approach, creating a Rural Electrification Fund that is administered by the Malawi Energy Regulatory Authority and funded by a levy on the tariff. Mauritius’ new Renewable Energy Agency (MARENA) is responsible for “creating an enabling environment” for renewable energy in the country.[5] As the population is nearly 100% grid-connected, there is no requirement for an agency promoting grid extension.

Mozambique’s Fundo de Energia (FUNAE)i was set up as a financially and administratively autonomous agency to develop renewable energy projects, mostly off-grid. Namibia has a Rural Electrification Programme that is administered by the Electricity Division of the Ministry of Mines and Energy and funded by NamPower and regional electricity distributors ii . In 2017, as part of the Implementation of the Renewable Energy Policy, a proposal was made for the formation of a Rural Energy Agency, but it was rejected by the Cabinet, suggesting that the stakeholders should instead use existing institutions to implement rural electrification, for example the national utility through a special fund maintained by a tariff levy.[6] Tanzania’s Rural Energy Agency, which administers the Rural Energy Fund, is independent of the national utility TANESCO and is supported by a 5% levy on commercial energy sales. Zambia’s Rural Electrification Authority is tasked with carrying out the country’s Rural Electrification Master Plan. Zimbabwe’s Rural Electrification Agency operates through a fund derived from an electricity tariff levy of 6% and is administered by a board that reports to the Minister of Energy and Power Development. The use of special tariff levies for funding rural electrification is widespread, and all of the specialised agencies or authorities mentioned above are dependent on a levy of some kind.

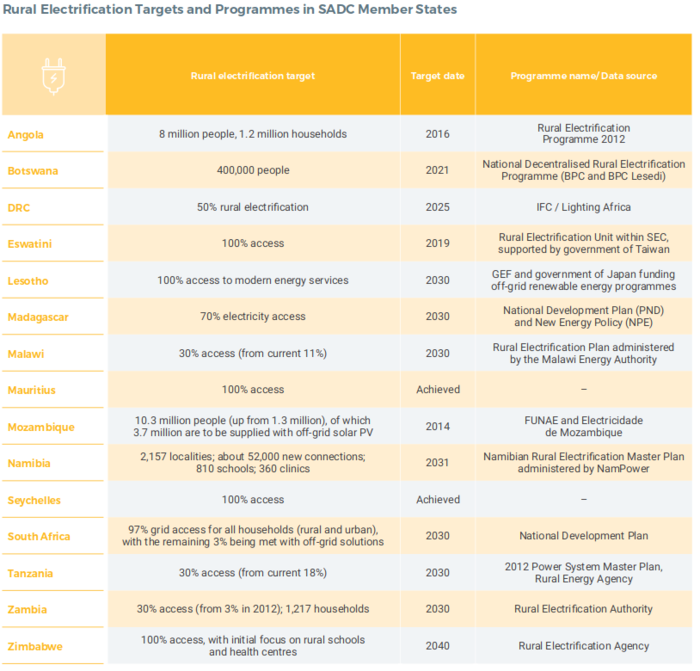

Table 9 summarises trends in rural electrification in the SADC region and indicates which countries have appointed specialised agencies to address it, and what targets have been established to expand it.[7]

Table 9: Rural Electrification Targets and Programmes in SADC Member States[7]

Countries with specific rural electrification targets include Angola, Botswana, the DRC, Madagascar, Mozambique, Namibia, South Africa, Tanzania,Zambia and Zimbabwe. The target date for South Africa’s rural electrification plans has shifted to 2025 considering the universal access date stated in the National Development Plan of 2013.

Many Member States have specifically included renewable energy as part of efforts to meet their targets. For example, Zimbabwe includes solar PV, small-scale hydropower, and bagasse-based and biogas generation, while Zambia includes mini-hydropower, solar PV systems and solar mini-grids. Lesotho has received support from UNDP/GEF for a Renewable Energy-Based Rural Electrification Project and also from Japan for using renewable energy in income-generating activities in off-grid area.

The trend in rural electrification in the SADC region is moving strongly towards the use of mini-grids and/or household solar systems and other mini- and pico-scale technologies, as national utilities face significant financial constraints that have hampered their capacity to meet government targets for energy access and grid extension.

Off-Grid Power Generation

As noted earlier, the trend in rural electrification in the SADC region is moving strongly towards the use of mini-grids and/or household solar systems and other mini- and pico-scale technologies, as national utilities face significant financial constraints that have hampered their capacity to meet government targets for energy access and grid extension. To improve the rate of uptake, most Member States offer subsidies of some kind for the installation of off-grid systems, recognising that rural households will rarely have the financial capacity to pay for the technologies themselves. In Eswatini , the recently reviewed National Energy Policy and update of the implementation strategy that commenced in January 2018 prioritises the use of solar home systems and micro grids, particularly for rural areas deemed too expensive for grid extension. In Lesotho , under the UNDP/GEF-funded Lesotho Renewable Energy-Based Rural Electrification Project, the Lesotho Solar Energy Society was reactivated from dormancy; of the 5,000 households expected to benefit, just over 1,500 had benefited as of mid-2018.[8]

The National University of Lesotho certified 19 solar PV practitioners, and 50% of solar dealers received training.[8] A credit guarantee scheme was provided for off-grid rural areas to enable residents to access loans. Lesotho is implementing an SEforALL project with UNDP/GEF that is aimed at developing cornerstone policies and establishing a financial support scheme to assist in de-risking private sector renewable energy investment and helping the private sector develop bankable projects. Under the project Lesotho plans to increase energy access by developing mini-grids and energy centres. In Malawi , biomass dominates energy consumption, providing 99.4% of energy use in rural areas and 35% in urban centres.[9] (This is followed by liquid fuels at about 6%, electricity at 2.3% and the rest from coal and solar power.[8] ) Households are the main energy market, using up to 83% of the total energy, followed by manufacturing industries at 11.9% and the service industry at less than 2%.[8] Due to the dominance of household uses, there is considerable potential for mini-grids in rural areas of Malawi, where the cost of connecting to the national grid may be prohibitive. With only 30% of the rural population planned to be grid-connected by 2030, the rest will be served through mini-grids and solar PV. [10] By 2016 an estimated 5,000 solar home systems, 2,000 solar water heaters and more than 7 off-grid mini-grids were supplying electricity to about 900 people nationwide. 14 Based on current sales volumes provided by Sunny Money, pico solar products are rapidly becoming an alternative source for lighting in Malawi’s rural areas, replacing the dominant wick paraffin lamps.[8]

Pico solar, if used as a substitute for a paraffin or kerosene lamp, can repay itself in three to four months.[11] The market for electricity appliances and other services lies in lighting, communication technology (phone charging, TV, radio), ventilation, refrigeration, etc. Malawi’s targets for renewable energy technologies by 2030 are: 75,000 solar home systems, 13,500 mini-grids and 4,500,000 pico solar products.[11] This presents an opportunity for a growing market of pico solar products and other solar systems as communities become aware of the advantages of the technology, and also as distribution channels and consumer financing services become better developed. In Mozambique , solar PV home systems are used for off-grid electrification and for mini-grids and stand-alone solutions. FUNAE has supported two such mini-grids, each just under 500 kW. After assessing more than 10,000 villages for their potential for small-scale renewable or hybrid systems (5 kW to 100 kW), FUNAE found that solar hybrid and wind hybrid systems would be the most economical.[12]

Several successful biogas projects have been supported, but no structured process is in place to use the learning from these projects to introduce biogas on a larger scale. The vast majority of households in Mozambique use charcoal and fuelwood for cooking at home; less than 5% of households use a modern form of energy. [8]

In rural areas, where most of the population lives, 97% of households rely on wood for their energy needs.[8]

In urban areas, charcoal has become the fuel of choice, accounting for over 50% of all energy expenditure.[8] The traditional biomass energy sector in Mozambique is vibrant, stimulated in part by FUNAE’s impetus to expand rural electrification in its role as an alternative, off-grid utility. FUNAE has implemented close to 1,000 off-grid projects, including mini- grids. The principal management model has been to oversee the implementation of projects directly and to undertake quality control of installations and equipment. Although this has resulted in speedy installations, it has failed to generate local jobs in the private sector because FUNAE uses internal resources to operate and maintain systems. This model has created the perception that the government will provide energy access at low cost, limiting private sector engagement.[12]

In a bid to improve the local market, FUNAE has established a factory to produce solar panels. But because FUNAE’s services are subsidised, and tariffs are required to conform to national tariffs, FUNAE’s multiple roles are seen as dampening the market for the private sector.[12]SEforALL’s assessment of mini-grid markets in Mozambique, summarised in table 10, provides an overview of the market potential based on the average annual energy expenditure and the potential population.[12]

The potential is most significant for stand-alone systems in terms of area covered and ease of deployment.

Table 10: Estimated Market Sizes in Mozambique for Grid Extension, Mini-grids and Stand-alone Systems[12]

In Namibia, a country with low population density, the challenge is to provide electricity access to the 79% of the rural and sparse population that does not have access by establishing feasible and maintainable off-grid solutions. The Rural Electricity Distribution Masterplan 2010 prioritises 2,879 rural localities to be electrified in the next 20 years and identifies 27 localities for off-grid electrification (including via renewables); however, implementation has been limited.[13]

So far the country has developed several pilot mini-grids, including three off-grid systems: Gobabeb, Tsumkwe Mini Grid and Gam Solar PV Mini Grid. In rural and remote areas where neither the main grid nor mini- grids are available, consumers depend on stand-alone electricity sources, mainly diesel generators. The use of solar technologies has been increasing, and hybrid solar/diesel systems have proved to be technically sound off-grid solutions.[14]

The Solar Revolving Fund under the Ministry of Mines and Energy continues to subsidise stand-alone solar systems for individual household use: between 2015 and 2017, it financed some 1,600 solar systems (water heaters, pumps and solar home systems).[15] EEP Africa supported a very successful biomass energy project that is harvesting invader bush – which covers substantial areas of northern Namibia – for use in a steam boiler. The project, Combating Bush Encroachment for Namibia’s Development, has installed a 250 kW bush-to electricity gasification pilot power plant on a commercial farm in the heavily bush-infested Otavi area. The plant, which was not yet operational as of mid-2018, is considered as a proof-of-concept project to determine the financial feasibility of this approach, assess the robustness of the technology and establish Namibia’s first IPP.[16] Non-electricity off-grid renewable energy projects include the small/ micro wind energy installations used for water pumping, which are very common in Namibia, especially on farms. This technology has been used successfully for decades, with about 30,000 wind- driven water pumps installed in the country as of 2005; however, the current trend is to replace these with solar energy sources.[8]

Seychelles’ solar PV systems are mostly off-grid, especially for outlying islands that are not connected to the national grid. As of mid-2018 an estimated 68 kW of power was being generated from 13 known grid-independent systems, including 25 kW at the Aldabra Atoll Research Station, 7.5 kW in the Aride Nature Reserve, 2 kW in the Curieuse National Marine Park and 5 kW on Cerf Island.[17]

In South Africa , the availability of renewable energy products and technical expertise for off-grid applications is relatively high. Under the New Household Electrification Strategy the government aims to electrify some 300,000 households with non-grid solutions by 2025. [8] Since the early 2000s the country has introduced solar home systems to rural households that were too remote to be connected to the grid. Identification of these villages was done in close collaboration with Eskom and municipal distribution development planning to ensure that only households that would not be grid-connected for at least five years on average would receive solar home systems. These systems were seen at the outset to be a temporary solution, and involved mainly stand-alone systems ranging from 50 watts peak (Wp) to 100 Wp. The 100 Wp systems were introduced starting in 2012 and were provided to both existing and new customers. The non-grid service is offered on a fee-for-service basis: customers pay a one-off connection fee towards the installation, followed by a small monthly service fee that covers lifetime running costs including operation and maintenance, replacement of batteries, fee collection and customer support. The government subsidises about 80% of the capital costs of the systems, and 100% for households classified as indigent, using the government free basic services grant. [18] However, local communities have lacked trust in off-grid solutions, particularly those provided for free, and some residents view this approach as an indication that the government is resigning its responsibilities to provide promised grid connection (which often is perceived to be superior to off-grid supply). Projects such as iShack i have encountered difficulties in obtaining buy-in from peri-urban or rural residents who fear that the government may change its priorities for investment if it sees that communities have found their own solutions. [19]

One way to address the social perception of the inferiority of off-grid supply would be to provide a comparable level of service to grid connection and to establish demonstration projects – for example, in urban areas and in public sector institutions – to increase their credibility. Some non-governmental off-grid schemes exist in South Africa, but scale has not been achieved in biogas, solar home systems, mini- or micro grids, solar kiosks or appliances. A segment of private sector suppliers – for example, Kestrel Renewable Energy Installations – is servicing the energy needs of the household and agricultural sectors, primarily providing small-scale solar PV and solar water pumping services. [20]

Tanzania provides an example of a successful rural electrification programme that has avoided subsidisation by shifting the burden to the private sector, developing a standardised PPA that encourages investment by IPPs using renewable energy. [21] Private entrepreneurs have boosted the country’s renewable energy development by developing innovative solar projects using a pay-as-you-go approach for off-grid projects. [22] The main market growth is in solar home systems, with Off-Grid Electric taking off in the north and Mobisol and BBOXX penetrating the PAYG market. [23] The PAYG leased model increases accessibility by removing the one-off capital cost, and, in some cases, maintenance of the system is taken care of during the contract lifetime. Tanzania’s Rural Energy Agency and the Ministry of Energy and Minerals have placed specific focus on stand-alone and mini- grid systems. Under the Sustainable Solar Market Packages programme, which sought to stimulate the private market to deploy solar equipment, small power producers were encouraged to build local energy networks using results-based financing through local financing institutions.[8]

The programme also facilitated the distribution of solar products by providing a one- stop shop for public institutions to obtain solar PV. However, market confidence in solar products has been shaken due to equipment spoilage related to the entry of inferior goods into the market. Lighting Africa has been working with government officials to address this. [24] Since 2008 the World Bank has implemented the Tanzania Energy Development and Access Expansion Project to address urban electricity access and rural energy access. [25]

The EU, through the ACP-EU Energy Facility, has supported several off-grid IPPs, including the 4 MW Mwenga run-of-river hydropower plant and JUMEME’s solar hybrid mini-grid models. [26]

- EEP Africa has supported companies in developing 12 stand-alone mini-grids. [27]

- Devergy, in partnership with Energy4Impact, is piloting the use of solar micro-grid systems to power larger appliances, such as refrigerators, as well as agricultural equipment. [28]

- E.ON is working with non-governmental organisations to build productive uses, aiming to install 100 new mini-grids in the country in the next few years. [8] In total Tanzania had at least 109 mini-grids as of 2016, with an estimated installed capacity of 157.7 MW and serving about 184,000 customers. [29]

- Sixteen of these plants were connected to the national grid (with the power sold to the national utility, TANESCO), and the remaining 93 operated as isolated mini- grids. [29] Hydropower was the most common technology (49 mini- grids); however, the 19 fossil fuel-based systems accounted for 93% of customer connections and for almost half of total installed capacity. [29]

Tanzania also had 25 biomass mini-grids and 13 solar mini-grids (10 of them small donor-funded, community-owned demonstration projects). [29]

There were no wind power mini-grids in the country as of mid-2018.

Zambia has a growing market for solar home systems and mini-grids, and hydropower mini-grids also are being implemented. The product range includes solar home systems for households (6 Wp to 250 kW) and schools and health centres (100 Wp to 600 Wp), solar lanterns as well as solar pumps for irrigation. Irregular household cash flow, however, has limited people’s ability to pay for these products, even though solar importers and distributors have developed innovative financing models such as fee-for- service and PAYG. The ability of consumers to make informed purchasing decisions is also limited by a lack of awareness about solar power and its possibilities, a lack of information regarding available financing options, and a lack of understanding of the differences between good and poor-quality products (which has resulted in the entry of sub-standard products). All of these factors pose a major constraint to expansion of the Zambian market. Since early 2017 the Energy Regulatory Board (ERB) has collaborated with the Zambian Bureau of Standards (ZABS) and the Zambia Revenue Authority to control the quality of renewable energy products at the point of entry. Only companies licensed by ERB are entitled to import products free of duties and value- added tax (VAT), and licence holders are required to meet quality standards set by ZABS. The tax exemption lowers the costs of these products and encourages consumers to purchase items only from licensed service providers. Some 28 solar companies hold licences from ERB to import household solar products.[8] The Zambian renewables programme offers a 100% subsidy, but because its tariffs are the lowest in the region, the levy has generated insufficient funds to meet the electrification target, and implementation has been limited to 80 small grid-extension projects and 300 small solar PV systems for chiefs’ palaces, schools and clinics. [30]

Among the pilot solar power mini-grids is one with battery storage employing PAYG. [31] Many examples of hydropower mini-grids exist in Zambia. Zengamina, a mini-grid located in the Ikelenge district, is powered by a 750 kW run-of-river hydropower plant. The grid consists mainly of 11 kV distribution lines, but a 15-kilometre- long 33 kV line had to be built to feed a large commercial farm and other households, as well as commercial customers along the way. [32]

Additionally, a 1 MW small-scale hydropower plant at Shiwang’andu in the Chinsali District links reliable energy services with productive use activities to enhance employment opportunities in the rural areas of Zambia. [32] SNV has instigated a revival of the biogas industry in Zambia. [33] For example, the Energy for Agriculture project, implemented during 2015-2018, has supported the construction of 3,375 bio- digesters in the Southern, Lusaka, Western, Central, Northern, Eastern and Copperbelt provinces. Its purpose is to provide farming households with access to clean energy, increased employment and income, and improved living conditions through the productive use of waste products (biogas and bio-slurry). Dairy farmers are expected to be able to use biogas as a fuel for powering milk chillers, and households will be able to use biogas for cooking. The size of the digesters ranges from 4 cubic metres (m 3 ) to 100 m 3 , producing 1 m 3 to 25 m3 of biogas per day at a cost of between USD 600 and USD 7,000, depending on the size and location of the installation. [34]

Zimbabwe offers a 100% subsidy for rural electrification at schools, health centres and chief's homesteads, although in practice a lack of funding has slowed implementation. The Rural Electrification Agency provides for the extension of the national grid to rural communities and also supports off-grid renewable energy solutions, such as solar mini-grids and biomass activities, through the Rural Electrification Fund. The Fund aimed to erect 50 mini-grids during 2018 in areas located at least 20 kilometres from the national grid. Numerous potential micro-hydropower sites exist in Zimbabwe, particularly in the Eastern Highlands and at agricultural dams throughout the country. Practical Action has helped to install at least five schemes that are now operational: Himalaya (75 kW); NyaMWanga (30 kW, with 3,800 beneficiaries); Hlabiso (30 kW, with 3,800 beneficiaries); Ngarura (20 kW, with 5,500 beneficiaries); and Chipendeke (25 kW, with 4,000 beneficiaries and connecting 35 households, 5 businesses, a clinic, a school and a health centre). [35]

However, these community-based schemes often struggle to deliver effective service due to challenges of governance and lack of professionalisation of the service. The role of the private sector is important in such schemes, but the absence of economies of scale makes them unattractive for private companies.

Access To Clean Cooking

To reduce rapid deforestation from the use of fuelwood for cooking, governments, the donor community and non-governmental organisations have heightened efforts to increase the manufacture, use and uptake of more-efficient cook stoves in the SADC region. Several Member States also have explored the use of domestic biogas systems for cooking. Eswatini continues to promote the use of wood-efficient cook stoves in households and public institutions, such as schools. In Lesotho, through collaboration with the EU under the 11th European Development Fund, the government signed a EUR 7 million (USD 8.1 million) financing agreement; a call for proposals for the distribution of energy-efficient appliances was advertised, and companies were identified to undertake the task of distributing improved cook stoves and other energy-efficient appliances. [36] Manufacturers and distributors of improved cook stoves in Lesotho include Fairtrade International (FLO) and atmosfair (the Save80 model).[8]

In 2013 the United Nations Food and Agriculture Organization assessed a project that trained farmers on stove construction using cow dung. Appropriate Technology Services has promoted the Mabotle, Thaba-Tseka and Nkokonono stove models, but uptake has been limited due to the multi-functionality of the traditional three-stone fire, which provides cooking, heating and light. [8] African Clean Energy has developed a stove manufactured in Lesotho that combines efficient cooking with a battery pack for a light and solar phone charging, but it is much more expensive than the simple stoves, at roughly EUR 40 (USD 46).[8]

In Malawi , more than 500,000 improved cook stoves were estimated to be in use in the country as of early 2017. [37] In Mozambique efficient cook stoves have been distributed in Tete province in the vicinity of the bio-coal briquette factory. In Namibia , efficient cook stoves are being promoted annually at platforms such as trade fairs/shows. In South Africa , a Biomass Action Plan is being developed with technical support from the Dutch government, and a newly launched Bioenergy Atlas is available online.[8][38] The technical support facility will support potential project developers in identifying potentials and exploiting them. Businesses are also using various distribution channels and models to market improved cook stoves and other renewable energy systems. For example, Restio Energy has distributed more than 32,000 stoves in addition to 1,700 household energy kits that include a solar light and phone charging capability. [38] A new wood pellet technology was tried in South Africa but failed to take off, indicating the need to potentially subsidise the early stages of wood pellet market development and distribution until the market is large enough to maintain viability. The International Institute for Environment and Development suggests focusing on smaller-scale community-based biomass models, using local communities to establish distribution channels in combination with stove producers. [39]

In Tanzania , a campaign is being carried out to promote alternative energy sources for cooking, including LPG, biogas, briquettes and ethanol. The use of biomass is a major concern in Tanzania, representing 90% of total primary energy consumption in 2010 – primarily for cooking – and contributing to severe environmental (deforestation) impacts. [40] The country’s SEforALL Action Agenda emphasises operationalising the Biomass Energy Strategy (BEST) to better regulate and reduce biomass use. 66 The Tanzania Improved Cook Stove programme, implemented by SNV in collaboration with EnDev, has exceeded its target of reaching more than 60,000 households. [41]

In addition to artisanal clay stoves, various manufactured stove brands are available on the market. To enhance impact, the entire value chain is being addressed, encouraging large-scale production of stoves and improved fuels. [40]

Some businesses are experimenting with the “Nespresso model”, offering the appliance at a low price and then recouping the cost through sales of the fuel required to run it. Another cooking alternative in Tanzania is domestic biogas, which has an estimated potential of 165,000 installations nationwide over a 10-year time frame. [8]

From 2009 to 2014 the Centre for Agricultural Mechanization and Rural Technologies and SNV constructed 11,013 biogas plants under the Tanzania Domestic Biogas Programme, greatly reducing biomass use for cooking. [8] [42] Potential also exists to use biogas to support dairy farmers in pasteurising milk and meeting their energy needs, and also to generate electricity. Efforts to reduce dependence on traditional biomass for cooking will be assisted by the fact that many Member States are now linked to international programmes supporting the promotion of efficient cook stoves and are assisting countries to develop specific policies to achieve this, such as the Global Alliance for Clean Cookstoves (see sidebar 2).[43] As of mid-2018 GACC was supporting one project each in Lesotho, Malawi, Mozambique and Zambia, relying on various financing facilities such as the Pilot Innovation Fund (up to USD 150,000), the Women’s Empowerment Fund, the Catalytic Small Grants programme (up to USD 100,000), the Spark Fund (up to USD 500,000) and the Working Capital Fund in partnership with Deutsche Bank and the Capacity Building Facility.[43]

SIDEBAR: Global Alliance for Clean Cookstoves

Further Information

- REN21, 2018. SADC Renewable Energy and Energy Efficiency Status Report (Paris: REN21 Secretariat) http://www.ren21.net/wp-content/uploads/2018/12/SADC_2018_EN_web.pdf

- Energy Access Portal

- Rural Electrification

- Mini-Grid Portal

- Solar

- Cooking Portal

References

- ↑ REN21, 2018. SADC Renewable Energy and Energy Efficiency Status Report (Paris: REN21 Secretariat) http://www.ren21.net/wp-content/uploads/2018/12/SADC_2018_EN_web.pdf

- ↑ Paul Komor and Timothy Molnar, Background Paper on Distributed Renewable Energy Generation and Integration , prepared for United Nations Climate Change, Technology Executive Committee (Bonn, Germany: 20 February 2015), http://unfccc.int/ttclear/misc_/Static-Files/gnwoerk_static/TEC_TD5/a4fd877135344ead9b22c4ff5e2d-0184/1df38b6a7c2847deb251bdd3b0f75669.pdf . Access To Electricity And National Energy Targets

- ↑ 3.0 3.1 3.2 3.3 Table 7 and table 8 from the following sources: electricity access data from United Nations (UN) Statistics, “Indicator 7.1.1: Proportion of population with access to electricity”, SDG Indicators database, https://unstats.un.org/sdgs/indicators/database ; other data from Member State and third-party sources, including Sustainable Energy for All (SEforALL), United Nations Environment, the European Union, the World Bank and Tracking SDG7: The Energy Progress Report. Cite error: Invalid

<ref>tag; name "Table 7 and table 8 from the following sources: electricity access data from United Nations (UN) Statistics, “Indicator 7.1.1: Proportion of population with access to electricity”, SDG Indicators database, https://unstats.un.org/sdgs/indicators/database ; other data from Member State and third-party sources, including Sustainable Energy for All (SEforALL), United Nations Environment, the European Union, the World Bank and Tracking SDG7: The Energy Progress Report." defined multiple times with different content Cite error: Invalid<ref>tag; name "Table 7 and table 8 from the following sources: electricity access data from United Nations (UN) Statistics, “Indicator 7.1.1: Proportion of population with access to electricity”, SDG Indicators database, https://unstats.un.org/sdgs/indicators/database ; other data from Member State and third-party sources, including Sustainable Energy for All (SEforALL), United Nations Environment, the European Union, the World Bank and Tracking SDG7: The Energy Progress Report." defined multiple times with different content Cite error: Invalid<ref>tag; name "Table 7 and table 8 from the following sources: electricity access data from United Nations (UN) Statistics, “Indicator 7.1.1: Proportion of population with access to electricity”, SDG Indicators database, https://unstats.un.org/sdgs/indicators/database ; other data from Member State and third-party sources, including Sustainable Energy for All (SEforALL), United Nations Environment, the European Union, the World Bank and Tracking SDG7: The Energy Progress Report." defined multiple times with different content - ↑ Swaziland (Eswatini) submission, SADC Questionnair e.

- ↑ Government of the Republic of Mauritius, “The Mauritius Renewable Energy Agency Act No 11 of 2015”, Government Gazette of Mauritius , No. 100 (3 October 2015), http://mauritiusassembly.govmu.org/English/acts/Documents/2015/act1115.pdf

- ↑ Francis Hangome, Government of Namibia, Windhoek, personal communication with Renewable Energy Policy Network for the 21st Century (REN21) and SACREEE, 28 June 2018.

- ↑ 7.0 7.1 from REN21, SADC Renewable Energy and Energy Efficiency Status Report 2015 (Paris: 2015), p. 43, http://www.ren21.net/wp-content/uploads/2015/10/REN21_SADC_Report_web.pdf , and from additional updates from Member States.

- ↑ 8.00 8.01 8.02 8.03 8.04 8.05 8.06 8.07 8.08 8.09 8.10 8.11 8.12 8.13 8.14 8.15 8.16 8.17 8.18 Danish Energy Management & Esbensen, Renewable Energy Market Landscape Study Covering 15 Countries in Southern and East Africa. Volume II. Country Profiles, Stakeholder Maps (August 2017), https://www.entwicklung.at/fileadmin/user_upload/Dokumente/Regionen/Volume_II_Market_Landscape_-Study_-EEP-SEA_CountryProfiles_StakeholderMaps-1.pdf

- ↑ Government of Malawi, Malawi Biomass Energy Strategy (Lilongwe: 2009), http://www.euei-pdf.org/sites/default/files/field_publication_file/EUEI_PDF_BEST_Malawi_Final_report_Jan_2009_EN.pdf.

- ↑ ECONOLER, “Support to SE4ALL country actions processes in Zimbabwe and Malawi”, http://econoler.com/en/projects/support-to-se4all-country-actions-processes-in-zimbabwe-and-malawi/

- ↑ 11.0 11.1 CONREMA, BIF2 Malawi: Pico Solar Products (PSP): Market Analysis and Strategy (Blantyre, Malawi: May 2014), http://conrema.org/.

- ↑ 12.0 12.1 12.2 12.3 12.4 Green Mini-Grid Market Development Programme, Mini Grid Market Opportunity Assessment: Mozambique (April 2017), https://greenminigrid.se4all-africa.org/file/166/download.

- ↑ Ministry of Mines and Energy of the Government of Namibia, Implementation of the Off-Grid Energisation Master Plan (OGEMP) http://www.mme.gov.na/files/publications/541_off-grid-masterplan.pdf

- ↑ European Union Energy Initiative Partnership Dialogue Facility (EUEI PDF) and Regional Electricity Regulators Association of Southern Africa (RERA), Supportive Framework Conditions for Mini-grids Employing Renewable Energy and Hybrid Generation in the SADC Region. Namibia Case Study: Gap Analysis and National Action Plan (Eschborn, Germany: December 2013), http://www.euei-pdf.org/sites/default/files/field_publication_file/SADC_RERA_Case_Studies.zip .

- ↑ Francis Hangome, Government of Namibia, Windhoek, personal communication with REN21 and SACREEE, 28 June 2018.

- ↑ Energy and Environment Partnership (EEP), Southern and East Africa, “Success story NAM7097: Invader Bush to Energy”, https://eepafrica.org/about-us/success-stories/success-story-nam7097 .

- ↑ Tracking SDG7: The Energy Progress Report, Seychelles Country Report, https://trackingsdg7.esmap.org/country/seychelles

- ↑ Government of the Republic of South Africa, State of Renewable Energy in South Africa 2015 (Pretoria: 2015), p. 106, http://www.energy.gov.za/files/media/Pub/State-of-Renewable-Energy-in-South-Africa.pdf .

- ↑ Sustainability Institute, “The iShack Pr oject”, https://www.sustain-abilityinstitute.net/programmes/ishack , viewed 18 April 2018.

- ↑ Kestrel Renewable Energy, “Kestrel Renewable Energy Installations”, http://www.kestrelwind.co.za/installations.asp, viewed 23 April 2018.

- ↑ Babalwa Bungane, “T anzania: rural electrification project excludes few“, ESI Africa, 23 April 2018, https://www.esi-africa.com/tanza-nia-rural-electrification-project-leaves-out-12-villages/

- ↑ Energypedia, “Fee-for-service or pay-as-you-go concepts for pho- tovoltaic systems”, https://energypedia.info/wiki/Fee-For-Service_or_Pay-As-You-Go_Concepts_for_Photovoltaic_Systems , viewed 19 April 2018.

- ↑ Lighting Africa, Off-Grid Solar Market Trends Report 2018 (Washington, DC: 2018), https://www.lightingafrica.org/wp-content/up-loads/2018/02/2018_Off_Grid_Solar_Market_Trends_Report_Full.pdf .

- ↑ Deutsche Gesellschaft für Internationale Zusammenarbeit GmbH, Target Market Analysis: Tanzania’s Solar Energy Market (Eshborn, Germany: November 2009), https://www.giz.de/fachexpertise/downloads/gtz2009-en-targetmarketanalysis-solar-tanzania.pdf

- ↑ World Bank, “TZ-Energy Development & Access Expansion Project”, http://projects.worldbank.org/P101645/tz-energy-development-ac-cess-expansion?lang=en , viewed 20 April 2018.

- ↑ ACP-EU Energy Facility Monitoring, “The success of hydropower”, 30 January 2017, http://energyfacilitymonitoring.eu/the-success-of-hydropower/ . 115 SADC REGIONAL STATUS REPORT 2018

- ↑ EEP , “EEP Project of the Year 2014: Devergy (TAN4019)”, 25 November 2014, https://eepafrica.org/eep-project-of-the-year-2014-devergy-tan4019 .

- ↑ Energy4Impact, “Testing strategies for promoting productive use of energy in micro-grids”, 11 January 2017, https://www.energy4impact.org/news/testing-strategies-promoting-productive-use-energy-micro-grids .

- ↑ 29.0 29.1 29.2 29.3 Lily Odaro et al., Accelerating Mini-Grid Deployment in Sub-Saharan Africa: Lessons from Tanzania (Washington, DC: TaTEDO and World Resources Institute, 2016), http://www.wri.org/publication/tanzania-mini-grids .

- ↑ Africa Electrification Initiative, “Practitioner Workshop in Dakar”, http://siteresources.worldbank.org/EXTAFRREGTOPENERGY/Resources/717305-1327690230600/8397692-1327691245128/ Implementing_REAs_ZAMBIA.pdf .

- ↑ Amanda Lennon, “First Africa pr oject for Baywa is Zambia solar-plus-storage”, Energy Storage News, 7 November 2017, https://www.energy-storage.news/news/first-africa-project-for-baywa-is-zambia-solar-plus-storage-pilot .

- ↑ 32.0 32.1 Luc Payen at al., Developing Mini-grids in Zambia: How to Build Sustainable and Scalable Business Models? prepared for Practical Action by ENEA (Paris: February 2016), www.enea-consulting.com/wp-content/uploads/2016/02/ENEA-Practical-Action-Developing-mini-grids-in-Zambia2.pdf .

- ↑ Jobs In Zambia, “Consultant – Str engthening Investment Climate for Biomass Technology In Zambia”, 16 May 2016, http://www.zambia.jobsportal-career.com/2016/05/19/consultant-strengthen-ing-investment-climate-for-biomass-technology-in-zambia/ .

- ↑ Kabanda Chulu, “Sweden, SNV sign biogas pact”, Zambia Daily Mail , 22 September 2015, https:/ /www.daily-mail.co.zm/sweden-snv- sign-biogas-pact/ .

- ↑ Practical Action , “Micro-hydro for irrigation in Himalaya, Zimbabwe”, https://practicalaction.org/rused-himalaya , viewed 19 June 2018; EUEI PDF and RERA, Supportive Framework Conditions for Mini-grids Employing Renewable Energy and Hybrid Generation in the SADC Region. Zimbabwe Case Study: Gap Analysis and National Action Plan (Eschborn, Germany: December 2013), https://energypedia.info/wiki/Zimbabwe_Case_Study_-_Gap_Analysis_and_National_Action_Plan_-_Supportive_Framework_Conditions_for_Mini-grids_Employing_Renewable_and_Hybrid_Generation_in_the_SADC_Region .

- ↑ European Union, “Lesotho and the EU”, https://eeas.europa.eu/headquarters/headquarters-homepage/1427/lesotho-and-eu_fr .

- ↑ Ingrid Gercama and Nathalie Bertrams, “Illegal logging in Malawi: can clean cooking stoves save its forests? The Guardian (UK), 23 February 2017, https://www.theguardian.com/sustainable-business/2017/feb/23/illegal-logging-in-malawi-can-clean-cooking-stoves-save-its-forests .

- ↑ 38.0 38.1 Bioenergy Atlas for South Africa, http://bea.dirisa.org.

- ↑ International Institute for Envir onment and Development, “South African biomass energy: little heeded but much needed”, Briefing, August 2013, http://pubs.iied.org/pdfs/17165IIED.pdf.

- ↑ 40.0 40.1 Camco Clean Energy (Tanzania) Limited (Camco), Biomass Energy Strategy (BEST) Tanzania (Eschborn, Germany: EUEI PDF, April 2014), p. 69, http://www.euei-pdf.org/sites/default/files/field_publication_file/BEST_Biomass_Energy_Strategy_Tanzania_Final_Version_April_2014.pdf .

- ↑ SNV , “Tanzania Improved Cookstoves (TICS) Programme”, http://www.snv.org/project/tanzania-improved-cookstoves-tics-programme , viewed 22 April 2018.

- ↑ “Tanzania Domestic Biogas Programme”, https://unfccc.int/files/focus/mitigation/application/pdf/poster_tanzania,.pdf

- ↑ 43.0 43.1 43.2 Southern African Power Pool (SAPP), Annual Report 2017 (Harare, Zimbabwe: 2017), http://www.sapp.co.zw/sites/default/files/SAPP.pdf