Fee-For-Service or Pay-As-You-Go Concepts for Photovoltaic Systems

Overview

Fee-For-Service (FFS) or Pay-As-You-Go (PAYG) concepts for photovoltaic systems are enjoying increasing popularity in Africa, Asia and Lain America. The companies active in this business are often called Distributed Energy Service Companies (DESCOs).[1]The following overview describes different technologies and different companies as well as on the strengths and weaknesses of the different concepts.

Introduction

In recent years, several energy service companies have appeared on the market, combining Fee-For-Service or Pay-As-You-Go concepts with the sale of photovoltaic systems or electricity produced by these devices. The idea for this development goes back to the mobile industry and the introduction of pre-paid deals in developing countries.

The idea is simple: Through the pre-paid model, more people can afford these services and become potential or actual customers. For solar power, the idea is similar. Despite significantly lower prices, small photovoltaic systems currently still are too expensive for the broad mass of people in developing countries. Fee-For-Service or Pay-As-You-Go approaches can overcome this hurdle.

Basic concepts of fee-for-service or pay-as-you-go DESCOs

In principle, two approaches can be distinguished. Firstly, there are companies that do not sell the system itself, but only the power generated by the systems, and furthermore ensure the correct operation and maintenance of the systems. This results usually in one-time installation costs as well as weekly/ monthly payments. On the other hand, companies selling the systems using PAYG-concepts have increasingly appeared on the market (rent to own models). Again, a purchase price usually has to be paid in the beginning and a customizable monthly/weekly/daily fee is applied if the user wants to use the system. In both cases, the system is blocked automatically if the weekly/monthly/daily fee is not provided and cannot be used again until credit has been purchased. In the ownership model, at a given amount of payments, the systems unlocks automatically and for an unlimited time, therefore the user becomes owner of the system and does not have to pay fees anymore. In general, the payment of the time-related deposits is done using scratch cards or mobile payment services. As a result, transaction costs can be saved.

Financial aspects

FFS and PAYG business are capitel intensive as the companies have to make significant initial investments in purchasing and installing of devices and establishing the necessary service infrastructure. The investments only amortise over a longer period of time through the revenues of the services.

Mayor FFS and PAYG companies

Currently the following companies have already established or are still establishing PAYG-concepts and are going to be discussed in the following:

| Table 1: Companies providing solar systems using the PAYG concept | ||

|

Company |

Countries |

Type |

|

Africa | ||

|

Angaza Design |

Rent-to-own* | |

|

Azuri Technologies |

Ghana,Kenya,Malawi,Rwanda, South Africa,South Sudan, Tanzania, Uganda |

Rent-to-own |

| BBOXX |

Rent-to-own | |

|

Equinox |

Rent-to-own | |

|

FRES |

Service** | |

|

M-Kopa |

Rent-to-own | |

|

Mobisol |

Rent-to-own | |

|

Off Grid Electric |

Service | |

|

PEG Ghana |

Rent-to-own | |

|

Fenix |

Rent-to-own | |

|

Waka Waka |

Rent-to-own | |

|

Asia | ||

|

Simpa Networks |

Rent-to-own | |

Latin America | ||

|

Quetsol |

Guatemala |

Rent-to-own |

| ||

Africa

Angaza Design

General Information

Angaza Design is a Palo Alto (San Francisco) based company, which has introduced the PAYG concept for picoPV systems in Tanzania, Kenya, Uganda and Zambia. Anganza was founded in 2010 by Lesley Marincola and supported with a 100.000 USD funding by USID for a field research in Tanzania in cooperation with SunnyMoney. The heart of their business is the so called PAYG platform, which enables distributors and manufactures of energy products to offer the PAYG concept in their portfolio. A product then is acquired over time through continuous payments by the customer, until he is the owner of the product. So far, PAYG is offered as part of the "SoLite3 lantern" picoPV lamp, although products of other manufacturers will follow (product such as water filtration)[2][3].

Details

Besides the SoLite3 lantern, Angaza also sells the possibility of using the developed system architecture "Angaza Energy Hub" (both software and hardware side) for other products. The SoLite3 package consists of a 3W solar panel, a LED lamp, a cellphone charger (universal connectors), tips on proper use of cellphone charger and operating instructions[4]. The running time is specified up to 4 h in bright light, 8 h with medium brightness and 20+ hours on the lowest level. The energy is stored in a comprehensive 3000 mAh lithium iron phosphate battery, which has a lifespan of five years and is replaceable. The dimensions of the lamp are 22cmx12cmx6cm and the weight is about 0.7 kg. Warranty is given for one year. The embedded PAYG hardware includes a GSM modem and allows users to unlock the required energy. On the other hand, SoLite3 automatically records usage and diagnostic data of the system, which is stored into the Angaza Energy Hub, a cloud based software, where customer payments, information, communication and management is provided. The SoLite3 lantern also comes with an LCD display, which allows viewing the detailed payment information (and remaining energy credit).

Figure 1: Angaza: SoLite3

The Angaza concept uses the rent-to-own model. This way the user becomes owner at the end of the payments. At the beginning an upfront fee of 10 USD has to be paid for SoLite3, the remaining energy payments are made in accordance to the usage and customer financial capabilities. In general, fees are between 1 USD and 2 USD a week and the system should be paid off in less than 12 months. Therefore the user buys credit and the system gets unlocked for the proportional energy. The pre-pay for energy is done using mobile-money (such as M-PESA of Safricom). Customers send micro-payments to Angaza on a flexible schedule and immediately after receiving the payment, Angaza uses the cellular network to activate the customer’s solar device for the proportional amount of energy. The customer receives an automatic phone call from Angaza and has to place the cell phone close to the SoLite3 device. Using the audio channel, Angaza communicates with the device (the communication is encoded) and the proportional energy is released.[5] Internally, a meter records the energy use and the device deactivates when the prepaid amount has been exhausted.

Conclusion

| Table 2: Angaza: Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

Azuri Technologies

General Information

Azuri Technologies was founded in August 2012, and goes back to the Cambridge spin-out Eight19. Azuri sells their so-called Indigo product that combines solar and mobile technology and is characterized as a PAYG concept. Indigo was introduced in 2011 by Eight19, which is currently researching and developing organic solar cells for the offgrid market. In order to achieve a greater number of units and market penetration, Azuri Technologies was founded as a spin-out.

In July 2013 Azuri in collaboration with GVEP was given a grant of $ 1 million provided by USAID in order to establish the PAYG solar concept in Rwanda with around 40.000 systems.

Azuri’s HQ is in Cambridge, United Kingdom, with staff based in Uganda, Ghana and Ethiopia and is currently presence in 10 countries across sub Saharan Africa. In Ghana the rollout for 100.000 households in a first phase started in July 2015.[6]

Details

Azuri distributes their product indigo, using the PAYG rent-to-own concept. There are different service levels, Azuri talks of the so-called "energy escalator". In essence, a solar panel is installed, which is connected to the core, the indigo box. The box contains the battery, connectors for LED lamps, mobile phone etc., as well as the electronics, which controls the payment and the locking/unlocking of the device.

Within the Energy Escalator, four different classes of service levels are available:

- Light - 3 W: 2 LED lamps, mobile phone charging capability

- Home - 10 W: 4 LED lights, mobile charging capability and radio

- Media - 40 W: 4 LED lamps, mobile phone charging capability, radio and TV

- Work - 80 W: 4 LED lamps, mobile phone charging capability, radio, TV, sewing machine etc.

The smallest of these service classes uses a 3.3 Ah lithium iron phosphate battery, which has a lifespan of about 5 years and can be replaced. The lamps provide light for about 8-9 hours.

Figure 2: Azuri Technologies - Indigo:

Indigo users pay (for the smallest version) an upfront fee of 10 USD for the installation of the system by Azuri technicians and from this point have to buy scratch cards with credit, in order to keep the system unlocked. These scratch cards are sold by local distributors and resellers. About 1.5 USD per week are necessary to keep the system running. After about 18 months (80 payments) and a final fee of 5 USD, the device is permanently unlocked. On the other hand there is the possibility to upgrade and move up to a higher service class and therefore obtain more energy.

The scratch cards themselves contain a code. This code and the serial number of the indigo system have to be sent to local a Azuri gateway by the user via SMS. The customer will then receive an SMS with the appropriate code to unlock the Indigo system for the booked period (1 week, 4 weeks). This code is entered directly using the input pad to the indigo box. In addition to physical scratch cards, there is also the opportunity to earn credit through mobile money.

Within the warranty period (1 year), the dealer is obligated to provide support and repair services. Therefore, it is also in his sense that the systems are be installed by trained Azuri technicians to ensure that panel, box, lamps and cables are properly installed (e.g. shading). In addition, the customer is shown the necessary know-how. Customer information and relevant details of the device are stored in the cloud-based Azuri database. After buying credit new information regarding the period of time booked is recorded by the dealer (each sold scratch card is registered) as well as in the database so that problems can be identified quickly.

Conclusion

| Table 3: Azuri: Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

BBOXX

General Information

BBOXX Ltd. was registered in the United Kingdom in 2010 and its headquarters are based in London. More than 41,000 BBOXX products have been sold in more than 35 countries and 30 local BBOXX shops are operating in Kenya, Rwanda and Uganda. BBOXX systems can be paid by customers in monthly instalments from 1 to 3 years which includes the price of the product as well as maintenance costs. A remote monitoring and management system called SMART Solar is being used. This provides the company with data about the installed systems and also includes a remote shut-down option, which helps to de-risk payment plans and provides an incentive for customers to make their monthly payments.[7]

Details

Conclusion

| Table : BBOXX Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

|

E.quinox

General Information

E.quinox is a student-led, non-profit humanitarian project that hopes to bring cost-effective, sustainable renewable energy to developing countries. It was founded by students of the Imperial College London in 2009 and operates in Rwanda and Tanzania. In a first approach, a total of 5 Energy Kiosk were introduced in Rwanda and Tanzania, where solar energy is used to charge portable batteries, which can be rented by residents (discharged batteries are then returned in the kiosk). In summer 2012, the stand-alone solution Izuba Box (SHS system) was introduced, which is based on the PAYG concept. In the initial pilot phase, a total of 74 systems were installed.

Details

The stand-alone model (Izuba Box) consists of a PAYG solar kit, which is installed in the customer´s home. A solar panel is connected to the box and provides lighting and the possibility to charge small appliances, such as cell phones and radios. For lighting, 2W LED bulbs are included in the package. Inside the box, there is a battery, a circuit board and a charge controller. The circuit board includes the locking/unlocking mechanism. Outside, a LCD monitor allows customers to unlock the system, check battery level and time before next payment is required. The box itself, is supposed to be placed in the center of the house, with the the lights wired up to rooms and the solar panel on the roof. During the pilot phase, two different types of systems were used: the “Home” system (65 systems installed) and the “Pro” system (9 systems installed). The Pro system is targeted to customers, who require more power and energy such as in the case of a barber shop for example. Therefore it has a larger solar panel and battery and is equipped with a conventional AC output.

Figure 3: First Generation of e.quinox Stand Alone boxes:

Feedback from the pilot phase has led to some renovations in the 2013er model. E.quinox will introduce the following three different models.

| Table 4: e.quinox Izuba Box 2013 | ||

|

Standalone MINI |

Standalone Home |

Standalone Pro |

|

Battery: 1Ah Lead-Acid Power: 1 W Solar Panel Outputs: 1 x USB 5V 1 x DC Jack 10V Interface: 6 x LEDs 1x Keypad |

Battery: 7Ah Lead-Acid Power: 7 W Solar Panel Outputs: 2 x USB 5V 3 x DC Jack 10V Interface: 1 x LCD 1x Keypad |

Battery: 26 Ah Lead-Acid Power: 30 W Solar Outputs: 4 x USB 5V 5 x DC Jack 10V 1 x 150W AC Interface: 1 x LCD 1x Keypad |

For the Izuba box, e.quinox uses the rent-to-own model. The 2012er home system purchase costs were approximately 65 GBP (for the pro version 170 GBP), with a battery life of 2 years, although, a spare battery was included in the calculation. These acquisition costs were more or less the costs that had to be paid by the users during the pilot phase. In order to purchase a device, a down payment of 10-15% was required, including a 5 days "free code". Once the credit is exhausted, the system unlocks and the customer has to purchase credit, using mobile money by the providers MTN or TIGO or buy pay directly at an Energy Kiosk. Different types of unlock codes with can be purchased, ranging from 2 days to 8 weeks of electricity. The code then has to be entered using the keypad and the device again unlocks. The algorithm running on the device is also available in the online portal, where customer contact information and product history are stored as well. Once all payments have been made, the device remains unlocked. For the new devices, automatic unlocking mechanisms through mobile apps or integrated GSM modems are being investigated.

Conclusion

| Table 5: E.quinox: Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

Fres

General Information

FRES (Foundation Rural Energy Services) is a Dutch foundation which acts in the field of rural electrification and and provides electricity through the use of solar energy to households and small business`s. A main focus is on the creation of small local companies, which implement the concept of fee-for service in the field of SHS or mini grids.

Through the establishment of independent companies, sustainability of the projects is ensured. Fres currently operates in five countries with five different companies. Besides Mali, South Africa, Burkina Faso, Uganda and Guinea Bissau new companies might be added in Cameroon or Benin in the coming years[8].

Details

The different companies offer different products. Besides SHS, solar mini grids and diesel mini grids can be found in the portfolio. In general, the fee-for-service without ownership concept is carried out; therefore customers pay only for the electricity they use without becoming owner of the devices. They do have to pay a monthly fee in order to have access to lighting and electricity, while Fres (actually local companies) remain owner of the devices and have to guarantee their functionality and carry out required maintenance, repairs or replacements. Different service levels are offered.

- S1: 2 lamps or 1 socket outlet

- S2: 2 lamps and 1 socket outlet or 3 lamps

- S3: 3 lamps and 1 socket outlet

The monthly fee amounts more or less what people usually would have to pay for candles or kerosene and is usually paid at local energy shops (where also customer service is provided)[9].

| Table 6: Fres companies | |

|

Mali | |

|

Company |

Yelen Kura |

|

Since |

2001 |

|

Customers (SHS) |

1.269 (mini grids: approx. 2.600) |

|

Employees |

51 |

|

Energy Shops |

15 |

|

Product & Service Rate |

5,81 EUR – 13,75 EUR |

|

South Africa | |

|

Company |

NuRa |

|

Since |

2001 |

|

Customers (SHS) |

16.500 |

|

Employees |

88 |

|

Energy Shops |

9 |

|

Product & Service Rate |

5,44 EUR - 32,22 EUR per month |

|

Burkina Faso | |

|

Company |

Yelen Ba |

|

Since |

2008 |

|

Customers (SHS) |

1.372 |

|

Employees |

23 |

|

Energy Shops |

7 |

|

Product & Service Rate |

9,22 EUR – 21,15 EUR per month |

|

Uganda | |

|

Company |

Fres Uganda |

|

Since |

2010 |

|

Customers (SHS) |

1.019 |

|

Employees |

44 |

|

Energy Shops |

4 |

|

Product & Service Rate |

6,67 EUR – 16,83 EUR per month |

|

Guiné-Bissau | |

|

Company |

Fres Guiné-Bissau |

|

Since |

2011 |

|

Customers (SHS) |

299 |

|

Employees |

5 |

|

Energy Shops |

4 |

|

Product & Service Rate |

5,80 EUR – 13,68 EUR per month |

Since Fres had experienced difficulties because of payment arrears in some countries, a test with prepaid meters has been carried out in Mali increasing payment rate from 82 % to 99 %. These types of prepaid meters are supposed to get used more frequently in future. It should be mentioned that companies operate financially independently after an initial period. However, companies still have not reached yet their breakeven point.

Conclusion

| Table 7: Fres: Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

M-Kopa

General Information

M-Kopa was founded in 2011 in Kenya, after initial field trials in 2010 were successful. M-Kopa is based on the pay-as-you-go and rent-to-own concept for SHS and distributes products of various performance classes. As of October 2013, M-Kopa has over 30.000 customers, adding weekly 1.000 more. The number of employees has grown to nearly 200, and the products are sold in over 750 retail stores. M-Kopa was founded among others by Nick Hughes, who was responsible also for the launch of the mobile payment service M-Pesa in 2004. The same service is also used in the context of M-Kopa as a payment method[10]. In 2015, the company started its operations in Tanzania. M-Kopa celebrated reaching 250,000 homes across Kenya, Uganda and Tanzania in September 2015 and the company claims to be the 'world’s leading ‘pay-as-you-go’ energy provider to off grid homes'[11].

Details

M-Kopa currently sells two different solar power systems and more will follow in the future (including products such as solar pumps, refrigerators for shop owners, sewing machines, etc.).

Both products are manufactured by d.light. Available are:

- d.light d10g solar home system

- d.light d20g solar home system

The systems vary in performance and scale. The minor system consists of a 4 W solar panel, which is permanently installed and connected to the control box, which contains a GSM modem for automated communication purposes. In addition to three LED lamps, which are firmly fixed and adjustable in terms of different levels of brightness, it is possible to charge mobile phones. Suitable adapters are integrated. The larger system consists of a 5 W solar panel, three LED lamps, one of which can be used mobile, cell phone charger and a small radio.

The smaller of the two systems costs about 2500 Kenyan shillings (about 28 USD) as an upfront fee and 40 shillings per day of use (approx. 0.45 USD), whereas the larger system has an one-time costs of 2999 shillings (about 34 USD) and daily costs in the range of 50 shillings (about 0.55 USD). The systems differ not only in price but also in the length of the warranty - 1 year for the d.light d10g and 2 years for the d.light d20g[10].

The considerable high up-front payment was chosen to create a sense of ownership. The daily instalments on the other hand are based on the ability to pay of the customers and equal roughly the average expenses for kerosene per day. Although the total amount has to be paid within one year, the flexible allows choosing payment frequency individually.[12]

Figure 4: M-KOPA: d.lightd 10g and d.light d20g:

After the user has purchased (corresponding initial price) and installed the system, credit can be paid via M- PESA. Therefore, the user has to purchase credit for his M- PESA account and can then send the desired amount by phone to M- KOPA. Automatically, the device gets unlocked for the paid period (days, weeks), so network coverage of the device is necessary. The respective IMAI number of the SIM card of the solar system is stored as well as the customer ID in the centralized system, which also allows to store and analyze customer data in order to ensure customer service[10]. This way for example, low energy yield due to shading or other technical problems are registered by M- Kopa and a quick solution can be found.

Just before the credit runs out, a reminder SMS automatically is sent to the customer and finally the system locks after the credit is exhausted. Two days later another SMS is sent as a reminder to reactivate the system. After a few days without reactivation, the customer receives calls by M-KOPA in which the return of the system on one hand, and the refund of money already paid to the customer on the other hand, are proposed (the customer also can ask for more time regarding the reactivation)[13] .

Conclusion

| Table 8: M-KOPA Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

Mobisol

General Information

Mobisol is a Berlin based company, which was founded in 2010 and uses the pay-as-you-go and rent-to-own approach in the field of SHS. After foundation, pilot projects in Kenya and Tanzania were successfully performed. At the beginning of 2013 the market launch in Tanzania was carried out and later on operations were expanded to Rwanda, where the company just recently connected its 10,000 customer.

In November 2014, the European Union, the Government of Rwanda and Mobisol launched a project that will provide solar systems to 49,000 households and 1,000 schools in Eastern Rwanda.[14]

According to a press statement in Februar 2016[15], Mobisol has 185 permanent employees.. The company has installed 35,000 solar systems in Africa and is now the largest provider of micro-financed solar home and business systems in terms of Watt-peak installed (3.5 MW). [16].

Details

Mobisol SHS sells four different service levels: 20 W (phased out in 2015 in Tanzania), 60 W, 120 W and 200 W. A solar panel is fixed on the roof and connected to the solar controller. In such a GSM modem is integrated, which transfers and monitors the technical parameters of the battery and solar panel for example to a web-based database of Mobisol, and on the other hand serves as the control unit which manages the credit and causes corresponding locking/unlocking.

In general, the systems are equipped with several LED lamps (including a mobile flashlight), there are cell phone chargers, cables and switches, as well as an inverter, which allows to connect AC consumers [16]. In this approach, lead-acid batteries are used.

| Table 9: Mobisol Service Levels | |||

|

Mobile 20 W |

Basic 60 W |

Premium 120 W |

Premium 200 W |

|

Basic energy needs (lighting, mobile phone charging, radio) |

Basic energy needs and TV |

Energy needs of larger households (TV, laptop, etc.) |

Energy needs of small business (bar / restaurant, commercial cell phone charging etc.) |

In addition to the actual product, a comprehensive after-sales service is offered, which includes free repair and maintenance work during the three-year warranty period. This warranty is given to system components (solar panel 20 years)[16]. The prices vary depending on the performance of the systems between approximately 310 and $ 1000 USD[17], where the upfront fee is of about 10% of the system costs and the monthly fees vary between 12 USD and 45 USD and are paid during 36 months[18], considerable long pay-back time compared to usual rates for businesses of MFIs[12]. Afterwards the system is owned by the customer[19][20].

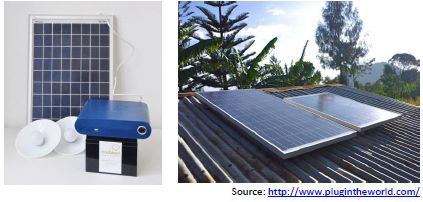

Figure 5: Mobisol Device:

The systems are installed by Mobisol technicians. Actually, Mobisol puts an emphasis on training and utilizing local technicians and marketing teams in order to guaranty success. Payment processing of monthly fees is ensured by M-PESA. Therefore the client sends the corresponding amount by mobile phone using the M-PESA services to Mobisol. Since the solar controller is equipped with a GSM modem, the activation is automated. Besides, the modem also allows passing the automated monitoring data of the systems and in case of failure, such is quickly identified. Customers can call the free of charge hotline and on the other hand can receive advices and instructions by Mobisol, which are sent via SMS to the customer[18] [20].

Conclusion

| Table 10: Mobisol Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

Off-Grid-Electric

General Information

Off-grid Electric is a California and Tanzania based company, which was founded by F. Xavier Helgesen, Joshua Pierce and Erica Mackey in 2011. The company does not sell a product in the traditional sense, but rather provides an energy service under the designation M-POWER. Villages and their residents are given the opportunity to achieve individual electrification using solar energy. A pay-as-you-go approach is used, although in this case it is only service orientated and not rent-to-own. In 2012, a first pilot phase in the region around Arusha was carried out[21].

In February 2015, Off Grid Electric and (now former) Tanzania President Jakaya Kikwete launched the "One Million Solar Homes" initiative, a goal of providing one million Tanzanian households with reliable solar electricity by 2017[22]

Details

Unlike other providers of SHS or picoPV systems, which use the PAYG approach to sale the product by initial and continuous payments, Off-Grid Electric pursues a different path. Through PAYG electric power is offered as a service, which enables customers to conveniently use solar energy. These plug-and-play home systems are installed in the homes of the customers. Off-Grid Electric takes care of installation, maintenance and repair, the customer pays only for the service including the different electrical appliances, such as provided LED lamps and mobile phone charging adapter. Therefore the customers take no risks. There are different classes of service levels, the cheapest costs $ 1.2 per week. In addition, a one-time installation fee of 6 USD has to be paid. This fee in a way also serves as a commission for the sales agents. Besides the basic service level, which includes lighting and mobile phone charging, upgrades can be booked (at higher prices), which allow radio, TV or other additional lamps. Thereby Fosera products are used [23] [24] [25] [26].

For continuous payments, M- PESA is used. Again, the user sends an SMS with the amount to be paid as pre-pay credit to Off-Grid Electric (where credit can be deposited for different time periods). Through an unlock code then the system get unlocked for the paid period. The system automatically turns off when no credit is left. To ensure that systems do not remain long periods unused, these can be confiscated by local agents of Off-Grid Electric. Currently, about 80 % of systems are constantly used [25]. Meanwhile, the demand for M POWER is so great that many orders are open and the company could grow much faster. The opportunity to enter Nigeria market is currently being investigated[25].

Figure 6: Off-Grid-Electric: M-POWER:

Conclusion

| Table 11: Off-Grid-Electric: Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

PEG-Ghana

- Homepage: PEG Ghana

General Information

PEG Ghana Ltd. is an asset financing company currently selling PAYG solar energy products to off-grid customers, currently only in Ghana. They are planning to reach 500,000 households in West Africa by 2018, and 1 million households by 2020.

PEG Ghana’s experience is based on the former company “Impact Energies” that had been a leader in selling and leasing solar home systems through microfinance banks in West Africa since 2011, having reached 30,000 poor customers in slightly over 2 years. In 2013, Impact Energies became PEG Ghana. PEG Ghana has shifted to a PAYG approach and completed a 12 month pilot with two PAYG solar and mini-grid technologies. In September 2014, PEG became the first licensee of M-KOPA Solar, the global leader of PAYG energy for off-grid customers.

Details

PEG is currently selling the M-KOPA III solar home system, an 8 watt system powering 3 lights, a radio, and a mobile phone charger. PEG offers customers one-year financing on the M-KOPA III, following an initial deposit. They also include a 2 year warranty, a no-risk money-back guarantee, and 24/7 customer care support.

Their village Direct Sales Representative programme also creates jobs in the target communities.

Conclusion

Fenix

- Homepage: Fenix intl

General Information

Founded in 2009 by Mike Lin and Brian Warshawsky, Fenix International is a venture-funded next-generation energy company with offices in East Africa and Silicon Valley. Core expertise is in renewable energy, mobile finance, and last-mile sales, marketing, distribution and customer service. Fenix International partners with global telecom companies such as MTN, Orange and Vodafone to supply mobile-enabled solar systems to off-grid African communities. They offer designs, manufactures and distributes ReadyPay Solar, a mobile payment-enabled solar panel and smart battery in Uganda.

In January 2015, Fenix International announced that it has over 12 million in working capital financing including grants from the Africa Enterprise Challenge Fund and from the GSMA Mobile for Development Foundation, Inc. (GSMA Foundation), funded by the UK Government.[27]

Details

Fenix started with extending credits for the ReadySets to customers through corporate employee lending programs and savings and credit cooperatives (SACCOs) with very strong repayment rates. But then introduced the ReadyPay Solar Power System - a lease-to-own energy product that enables people to purchase power with their cell phones. Piloting ReadyPay in Uganda since December 2013, delivering through a partnership with MTN, meaning that customers can find the solar products for sale alongside mobile phones in MTN’s telecom retail shops. They offer ReadyPay Solar home and business kits that include lights, phone charging cables, radios, and even an LCD TV. Customers just need to apply and pay a small upfront deposit at the shop, and receive a secure code via SMS to unlock 7 days of power. Pay for power in increments that fit their budget (daily, weekly or monthly to lease-to-own a ReadyPay kit in 18 months or less). After having completed all installment payments (usually after 18 months), a code will permanently unlock the ReadyPay Solar Power System.

Conclusion

Waka Waka

General Information

WakaWaka ("shine bright" in Swahili) is a social venture founded in 2010 after the founders Maurits Groen and Camille van Gestel won a competition to green the 2010 FIFA World Cup soccer championship, starting with selling a solar-powered LED lamp “WakaWaka light”. In 2013 WakaWaka launched the “WakaWaka Power” that combines the original lamp with the ability to charge phones and other handheld devices. Crowdfunding campains raised the funds for donations of 12.000 lamps in Haiti and also for Syrian refugees. Cross-subsidising system: proceeds selling WakaWaka products at competitive prices are used to make them available to off-grid communities around the world at an affordable rate.

In the fourth quarter of 2014, WakaWaka entered the Rwandan solar market to pilot a pay-as-you-go energy service, called the Virtual Grid (VG). The PAYG technology replaces the usual high upfront costs of solar-powered energy weekly payments (equal to the current average spend on kerosene and mobile phone charging). The Dutch development bank FMO invested EUR 600,000 in the Virtual Grid Pilot providing 9000 off-grid households with access to affordable solar light and power and will also support a nationwide rollout in Rwanda and later other African countries.[28]

Details

Users pay an initial fee for the device and after having bought pre-pay cards (RWF 40.000), it is paid off. Pre-pay cards allow to receive the activation code to enter into the keypad and are valid for seven days of light and power and cost 500 Rwandan Francs – slightly less than people would be spending on kerosene.

Conclusion

Asia

Simpia Networks

General Information

Simpa Networks was founded in 2010 by Paul Needham, Jacob Winiecki, and Michael MacHarg and operations in India are based out of Bengaluru in Karnataka. Simpa Networks provides SHS using the PAYG concept and is based on the rent-to-own idea. In January 2013, Asian Development Bank signed a 2 million USD investment in Simpa Networks allowing the company to expend and by 2015 more than 60.000 households are supposed to have better access to electricity[29]. At the moment, Simpa partners with Selco India and has agreements to sell more than 5.000 systems in 2013.

On one hand, Simpa sells on the basis of the PAYG concept SHS, on the other hand also receives revenues through the sale or licensing of their developed payment platform "Progressive Payment" to microgrid operators and other energy supplier[30].

Details

Simpa offers different SHS, between 25 W to 50 W at an overall price of between 150 USD and 400 USD. These systems include the solar panel, the battery, charge controller and three or four led lights, a mobile phone charger and also a possibility of using direct current devices. Besides power electronics and battery, the control box - Simpa Regulator - contains a system integrated microcontroller with user interface which regulates the device and controls the payments and locks or unlocks the system. A centralized software – Revenue Management System – is accessible via SMS gateway and over the internet and is used for payment processing and account settlement.

Simpa does not make or install the systems themselves; their partner Selco India installs the systems at the customer’s houses. The panel typically is installed on the roof of the house. Customers have to pay an upfront fee of between 10%-30% of the systems price and afterwards have to purchase credit using their mobile phones and its short messaging service. Therefore scratch-cards with credit have to be purchased. The lowest energy credit to purchase is about 0.88 USD (50 rupees), although different pricings are available (50-500 rupees). An activation code has to be sent then to Simpa in order to receive an activation code (afterwards Simpa has checked if the code has been used so far). The activation code then has to be typed into the keypad of the box and the device gets unlocked for the paid time. On a liquid crystal display the energy credit balance available for use is shown.

A part of this payment goes towards the repayment of the system; the other part belongs to Simpa as profit. It should be noted, that the higher the recharge amount is, the higher the relative (and absolute) amount for repayment. Once the entire amount has been paid, the device unlocks permanently. Usually this should happen after two or three years of usage. Afterwards, the system is supposed to work for a total of 10 years. In order to make sure that the sellers take care of the maintenance of the sold devices; an adapted remuneration model has been introduced by Simpa.

Figure 7: Simpa Networks: Device:

Conclusion

| Table 12: Simpa Networks: Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

Latin America

Quetsol

General Information

Quetsol is a solar company in Guatemala which was founded in 2010 by Juan Rodríguez and Manuel Aguilar and currently employs a staff of 20 people. The company sells powerful grid and off-grid solar systems ("Energía Avanzanda" - advanced energy) as well as various performance classes of SHS for rural electrification ("Energía básica" - basic energy). So far, SHS were mainly sold to rural population by microfinance of the Guatemalan bank BANRURAL. By 2013, more than 3,500 SHS have been sold. In a pilot phase, the PAYG concept (rent-to-own) is being tested in Guatemala since Abril 2013. Quetsol expects to reach 100.000 homes in the next five years with the new PAYG concept, which was supposed to start nationwide by November 2013 [31][32][33].

Details

Regarding rural electrificaction, Quetsol provides two different solar kits (Q1, Q3), a third middle powered kit will follow (Q2).

Figure 8: Quetsol: Solar KITS Q1 and Q3:

So far, the sytems were usually paid via microfinance by the users. For the smaller KIT Q1 a monthly payment of approximately 100 Quetzal (12.6 USD) and for KIT Q3 a monthly payment of approximately 280 Quetzal (35 USD) has to be paid. The smaller of the systems is supposed to provide for lighting and mobile phone charging, whereas the larger system allows the connection of DC appliances such as TV, radio, laptop etc [34].

| Table 13: Quetsol: Specifications | ||

|

KIT Q1 |

KIT Q2 |

KIT Q3 |

|

|

|

The amount of the monthly payments does not change when considering the PAYG pilot project, which currently is being carried out in San Pedro Carchá, Alta Verapaz. Customers have the possibility to unlock their devices for different periods of time (daily, weekly or monthly amounts of electricity) and therefore can consume energy according to their financial flexibility. During the pilot, Quetsol has recruited local leaders, teachers and store owners as franchisees, who have been supplied with smartphones. The PAYG concept then is based on their cooperation with Quetsol. Via smartphone, the local franchisees distribute unlock codes to costumers, who have to enter the codes on the dial pad of the control box of their solar kit to unlock the system. Once the credit is exhausted, the system locks and the customer needs to buy credit and obtain a new code by the local franchisee. The corresponding monthly expenses for the smaller kit are about 12.6 USD.

Conclusion

| Table 14: Quetsol: Advantages and Disadvantages | |

|

Advantages |

Disadvantages |

|

|

Analysis

The different companies, discussed in this article, have tried to establish the PAYG concept in the field of solar home systems or picoPV with different approaches. First of all, one can distinguish between the simple services providing electricity or the rent- to-own concept, which ultimately makes the customer the owner of the device. Both options have advantages and disadvantages. Furthermore, different approaches with regard to the design of systems can be distinguished. There are companies, which rely on picoPV and thus, in principle distribute solar lanterns (including cell phone charger), while other companies operate in the low power range of SHS and finally, there are also providers, which distribute more powerful systems and thus appeal to a wider customer base, especially of course regarding to the small business sector. Before the details are analyzed, a general overview about the strengths and weaknesses of the PAYG concepts for both, companies and end-users, is provided. Afterwards, this is extended to some details.

|

Table 15: SWOT Analysis: For Companies | |

|

Strenghts |

Weaknesses |

|

|

|

Opportunities |

Threats |

|

|

|

Table 16: SWOT Analysis: For End-users | |

|

Strenghts |

Weaknesses |

|

|

|

Opportunities |

Threats |

|

|

Rent-To-Own vs. Service Concepts

In general, two concepts have been introduced in this report. There are companies offering only the pure energy service and others, following the rent-to-own concept and therefore their business concepts differ somehow. Obviously a company selling the electricity (and not the system) only makes money when customers pay for energy, which they only will in case the systems work. Therefore in these cases, maintenance of the systems and their correct functionality as well as a good service are the clue for a working business. On the other hand, for companies following the rent-to-own concept, this only applies for the warranty period, which in general is between 1 und 3 years. Afterwards at first glance, no obligations are given, although in order to keep business running and perform in a sustainable way, after sale service somehow should be offered. A major difference between both concepts exists regarding the ownership of the devices and the impact this might cause on people`s behavior. It is plausible to think, that people tend to be less careful with the systems, when repair and maintenance costs are covered by the company. On the other hand, it’s just the opposite when people own or will own the system. Generally, a good end-user behavior should be noted, although it is clear that people rely on the availability of spare parts and a well thought out maintenance plan in order to keep satisfaction high.

Another interesting aspect to consider is the question whether midterm affordability of people is better off in one of the cases. Usually, periodical service fees (for both concepts) are comparable to those expenses, people usually would have in order to satisfy their need for light (candles or kerosene) and electricity (especially cell phone charging) and therefore do not make big difference regarding an increase in the affordability (this might not be true, when considering increased productivity due to better light in the evening and therefore higher income generation through productive activities). However, once all the payments in the case of the rent-to-own concept have been accomplished, no regular expenses on energy have to be made. Therefore, affordability increments considerably in a first consideration (since people tend to spend a high share of their income on lighting and cell phone charging). However there is a lot of uncertainty regarding the durability of the systems and costs for necessary repairs. Actually, people finally being owner of the device would have to save some money whenever possible in order to be able to pay for reinvestments and keep systems running for several years.

In this context obviously some more aspects need to be mentioned: on one hand it is import to emphasize the relevance of a well working after sales services with skilled and trained technicians as well as a high availability of spare parts. As in case of the rent-to-own concept, afterwards warranty has expired repairs have to be paid by the customers and their will and options for regular savings are limited, a financial model for replacements might an important consideration. PAYG concepts for these events could be a solution. In case the user does not own enough money for a necessary replacement of the battery for example, the company could again turn on the initial algorithm and implement once more the PAYG concept, making the user to pay regularly for the system to unlock until the costs of the battery are covered and the system unlocks permanently again.

Another important issue deals with the possibility to upgrade the service level. This applies to both, service and rent-to-own concept. Obviously, energy needs will increment during the time, especially when higher incomes or affordability due to the implementation of PAYG are achieved. Therefore, the possibility to adapt the local energy production to incrementing energy needs seems extremely important and upgrade of systems should be an important feature. Some rent-to-own companies include such models in their portfolio, although details have to be investigated. Here again, the principal issue might be the financing of new devices (very similar to the problem of spare parts) and the question whether PAYG mechanism is used also for upgrades. Obviously in case of the service-concept this is no major issue, since periodical fees will simply adapt to higher service levels and customers do not have to pay for the devices themselves (except a connection fee).

Implementation of the Pay-As-You-Go Concept as part of EnDev activities

In general, it is hard to draw a conclusion about PAYG concepts since so far, little experiences have been gained regarding these particular concepts. On the other hand, fee-for-service is not a totally new and innovative business model and therefore some conclusion of former projects exist. A major problem always has been the need to collect service fees, and the risk to be unable to obtain the total amount, since some projects experienced important non-payment problems. Often, the expenses for the collection of service fees were disproportionate and therefore often break-even of the project could not be reached, as in the case of Shell/Eskom or some FRES projects [25]. However, this issue with the implementation of the new PAYG concepts somehow is being solved or at least reduced. Mobile payment and automated locking/unlocking of the devices reduce considerably efforts and facilitates operation and processes. On the other hand, important issues remain and have to be considered. The use of PAYG concepts within EnDev activities therefore should cover following concerns:

Recommendations

General Issues

Rent-to-own or service-concept

Both concepts have some pros and cons. In the medium term, rent-to-own concept could have a stronger influence on increasing affordability (if it is carried out the correct way). Also, prospect to own the system might be an interesting and preferred feature for people. In any case, it seems essential to guarantee a good and reliable system including fast maintenance and repair service to ensure sustainability and to guarantee customer satisfaction and therefore payments and enough cash flow.

Existing structures

If available and possible, existing structures should be used. In particular, the use of existing retail networks could be a major benefit in order to be able to provide an extensive network of product purchasing points and customer service (maintenance and repair).

In order to reach the mass market, companies have to include and to pay particular attention to the distribution channels and marketing activities within their business models. It requires a lot of time and work to establish such a distribution network and it is to be expected that sales will only pick up slowly in the beginning. If the company is already selling similar products (e.g. mobile phones), they can rely on an existing distribution network.[35]

Different service levels

It seems crucial to provide different service levels. On one hand, upgrade possibilities should be provided in order to respond to different energy demands of different customers but also to the progress of a single customer. On the other hand, service levels for small businesses with high electricity demand should be available.

Limited time period

For both customers and companies, an extensive time period comes along with higher risk. The company might get into trouble in terms of cash flow calculations because of uncertainty of payments, whereas the customer enters a long term contractual relationship, which might have a discouraging effect.

Equity finance and working capital of companies

Buying in bulk to be able to deliver the technology according to demand companies face the difficulty to bridge the time between purchasing the product and selling it to the end-costumers, receiving the money even within a larger period of time.[12]

Solution for spare parts

In any case spare parts have to be available rapidly. In case of rent-to-own: financing after expiration of warranty has to be offered (possibly resumption of PAYG).

Payment

The easiest way of payments is the use of mobile money services like M-PESA, since this would again imply to use existing structures. Semi and fully automated payment and payment processing are possible; this depends mainly on the control box of the device and its hard and software. Scratch cards are also a possible option. Both alternatives definitely reduce transaction costs (if compared to traditional fee collecting), although it should be mentioned that some approaches are easier and more straightforward than others.

From the consumers' point of view, the possibility to check the remaining balance regularly helps to keep them on track with the payment schedule.Similarly, the possibility to transfer a half payed solar system to another user will increase the flexibility of the system and make it more attractive for cash-constrained consumers. [36]

Governmental laws and regulations

In many countries, uncertainty about the future is caused by political instability. Duty taxes for solar products are excluded in some countries (e.g. Kenya), but threatened to be re-introduced. Also mobile money transactions might be taxed as it is the case in Uganda.[12]

Technological Issues

Control Box

GSM modem in general, control boxes including a GSM modem have some advantages but also disadvantages.

Advantages:

- Possibility of real-time analysis of operational data of relevant parameters

- Automated detection of problems

- Automated unlocking after payment

Disadvantages:

- Network coverage is always needed

Therefore: A well-carried out analysis of the network coverage in the area is fundamental, since only working systems will have success. If it turns out, that good coverage is given, a system including a GSM modem is highly recommended.

Battery

Different technologies exist and are used in the different approaches. It should be noted, that the battery usually is one of the crucial elements, which has a major influence on the total reliability of a system. A system, whose battery has to be replaced after one year of usage, is not desirable. Therefore systems using new lithium technologies such as lithium iron phosphate are highly recommended.

Annex, Questionnaire for Additional Analysis

1. Distribution and after-sale service of the systems

- a. How common are a retail stores?

2. Costs

- a. Upfront costs

- b. Periodical costs (daily, weekly, monthly)

3. Rent-to-own or service approach?

4. Who installs the system?

- a. Customer

- b. Technician

5. What happens if no recharge is done?

6. Who pays transaction costs?

7. What happens in case of damage or incorrect use, what is the after-sale-service like?

- a. Is there a Warranty – how long?

- i. How long?

- i. How long?

- ii. Which elements (module , power electronics , battery, lamp)

- ii. Which elements (module , power electronics , battery, lamp)

- iii. Cost for spare parts after warranty period?

- iii. Cost for spare parts after warranty period?

- iv. Which form of financing? (New battery e.g. very expensive, again PAYG?)

- b.How long do repairs take?

- c. Who pays for the repairs?

- d. Automated detection of correct functionality, problems and damages

- e. What happens during the failure phase with purchased credit?

- f. How reliable is the customer service?

8. What happens during upgrade (e.g. Azuri Energy Esacalator) with the already paid system?

- a. Will it be accepted as payment?

9. How does the recharging, locking and unlocking (technically) work?

- a. Scratch cards

- b. Mobile money

- c. Cell phone

- d. GSM modem inside the device

- i. Enough network coverage?

10. Is the payment system secure?

11. How well the system is protected against abuse (technically)?

12. Financial structure and possibilities of the company

Further Information

References

- ↑ Financing DESCOs - a Framework. Dirk Muench, Chris Aidun, Persistent Energy Capital, March 2015

- ↑ Angaza Design: SoLite 3 Product Info.URL: http://www.angazadesign.com/wp-content/uploads/2013/02/Angaza-Design_SoLite3_ProductInfo.pdf

- ↑ USAID: Electrifying the base of the pyramid through innovative micropayment technology,URL: http://www.usaid.gov/div/portfolio/angaza

- ↑ Angaza Design: SoLite 3 Product Info.URL: http://www.angazadesign.com/wp-content/uploads/2013/02/Angaza-Design_SoLite3_ProductInfo.pdf

- ↑ Similar to conventional modems, data is sent as audio data over the mobile phone network. The technology provides the possibility to filter ambient noise and in the case of a failure, automatic recovery of the connection is supported. Furthermore, in principle, all kind mobile phones are supported

- ↑ News: Ghana Launches PayGo Home Solar. July 2015 See: http://ae-africa.com/read_article.php?NID=6508

- ↑ BBOXX Company brochure. URL: http://www.bboxx.co.uk/wp-content/uploads/2014/10/NEW-COMPANY-BROCHURE-website.pdf

- ↑ Fres: About Fres.URL:http://www.fres.nl/en/about/about-fres.html

- ↑ Fres: Annual Report 2012.URL: http://www.fres.nl/en/component/docman/doc_download/85-annual-report-2012.html

- ↑ 10.0 10.1 10.2 M-KOPA: M-KOPA makes high-quality solar affordable.URL: http://www.m-kopa.com/

- ↑ A quarter of a million homes now on M-Kopa. URL: http://www.m-kopa.com/press-release/a-quarter-of-a-million-homes-now-on-m-kopa/

- ↑ 12.0 12.1 12.2 12.3 See: Rolffs, P., Byrne, R. and Ockwell, D. (2014) Financing Sustainable Energy for All: Pay-as-you-go vs. traditional solar finance approaches in Kenya, STEPS Working Paper 59, Brighton: STEPSfckLRCentre (http://steps-centre.org/wp-content/uploads/Financing-Energy-online.pdf) Cite error: Invalid

<ref>tag; name "STEPS working paper 59" defined multiple times with different content Cite error: Invalid<ref>tag; name "STEPS working paper 59" defined multiple times with different content Cite error: Invalid<ref>tag; name "STEPS working paper 59" defined multiple times with different content - ↑ Sullivan, N.; Omwansa, T.: Prepaid & Pay-as-you-go Models for Asset Financing – Analysis of Mobile-Money Business Models for Kickstart (irrigation pumps) and M-KOPA (solar panels) in Kenya. URL: http://bit.ly/1bk9Xvp

- ↑ EU Backs Affordable and Sustainable Energy for Rural Homes in Rwanda (13/11/2014). URL: http://eeas.europa.eu/delegations/rwanda/press_corner/all_news/news/2014/20141113_1_en.htm

- ↑ http://ae-africa.com/read_article.php?NID=6972

- ↑ 16.0 16.1 16.2 Mobisol: Mobisol empowers people.URL: http://www.plugintheworld.com/

- ↑ Allafrica.com: Tanzania: Voda, Mobisol Partner in Lighting Villages.URL: http://allafrica.com/stories/201309230248.html

- ↑ 18.0 18.1 Lindner, C.: Mobisol - a green inclusive business. CSR conference Berlin 2012.URL: http://prezi.com/cyrhpc3tmi10/mobisol-a-green-inclusive-business/

- ↑ Reset: RESET Partner Project: Mobisol - Solar Energy via SMS.URL: http://in.reset.org/project/mobisol

- ↑ 20.0 20.1 REPIC: Mobisol Project Affordable Solar Home Systems. URL: http://www.repic.ch/files/9213/7664/6468/1_DT_Power_GmbH_Final_Report_light.pdf

- ↑ GSMA: Offgrid-Electric.URL:http://www.gsma.com/mobilefordevelopment/wpontent/uploads/2012/06/Off_Grid_Electric.pdf

- ↑ One Million Solar Homes initiative. URL: http://www.sierraclub.org/compass/2015/02/tanzanias-president-kikwete-promises-one-million-solar-homes

- ↑ GSMA: Offgrid-Electric.URL:http://www.gsma.com/mobilefordevelopment/wpontent/uploads/2012/06/Off_Grid_Electric.pdf

- ↑ 100 % Solutions: How To Power 10 Million Off-Grid African Homes In 10 Years.URL: http://100pct.us/story/africa/how-to-power-10-million-offgrid-african-/664d6f377a717970585047756d4a506f776757326c413d3d

- ↑ 25.0 25.1 25.2 25.3 Interview with Prof. Adelmann in Frankfurt, 11.10.2013.

- ↑ The Borgen Project: 10 Million lit in 10 years.URL: http://borgenproject.org/10-millions-homes-lit-in-10-years/

- ↑ Fenix International Raises $12.6 Million in Financing See: http://www.fenixintl.com/2015/01/26/fenix-international-raises-12-6-million-financing/

- ↑ Launching the Virtual Grid, 2014: http://waka-waka.com/news/2014/08/launching-the-VG/

- ↑ ADB: Affordable Pay-As-You-Go Solar Power for India Energy-Poor Homes. URL: http://www.adb.org/sites/default/files/pub/2013/affordable-solar-power-india-energy-poor-homes.pdf

- ↑ Jewel, Catherine: Pay as you go solar power. Wipo Magazine. URL: http://www.wipo.int/wipo_magazine/en/2012/04/article_0006.html

- ↑ Gonzáles, A.: Un futuro limpio. URL: http://www.prensalibre.com/revista_d/FUTURO_0_851315242.html

- ↑ Indiegogo: Quetsol-Turn Lives ON across Guatemala.URL: http://www.indiegogo.com/projects/quetsol-turn-lives-on-across-guatemala

- ↑ Pastorek, W.: Bringing Solar To Impoverished Towns, With A Model Straight From The Corporate World.URL: http://www.fastcoexist.com/3016109/change-generation/bringing-solar-to-impoverished-towns-with-a-model-straight-from-the-corpor#1

- ↑ Quetsol: Energía básica.URL: http://quetsol.com/productos/energia-basica/

- ↑ See: p. 26 in International Energy Agency (IEA), developed by Task 9, (Author: Dr. Thomas Meier) “Innovative Business Models and Financing Mechanisms for PV Deployment in Emerging Regions” (Report IEA-PVPS T9-14: 2014) http://www.iea-pvps.org/index.php?id=311fckLRThe report addresses the problem of high upfront costs of PV technology which remains one of the key challenges that needs to be overcome to achieve a faster and greater deployment of PV technology, particularly in emerging regions. A number of selected case studies of innovative business models and financing mechanisms are presented, with the intention to provide the reader with ideas about how the issue could be addressed. It is an attempt to systematically collect and analyze a range of experiences with business models and financing mechanisms. For PAYG business models see chapter 2 “Pay-As-You-Go Business Model to make PV Affordable for Low-Income Households” with a case study on Azuri Technologies. See chapter 4 “Achieving PV Sales by Using Existing Distribution Networks”including a case study on Chloride Exide, that make best use of existing infrastructure from their battery business, in particular their vast distribution system as well as their reputation for quality products.

- ↑ Off-Grid Power and Connectivity: Pay-as-you-go Financing and Digital Supply Chains for Pico-Solar (2015)