Difference between revisions of "Financing Aspects - Wind Energy"

***** (***** | *****) |

***** (***** | *****) m |

||

| (8 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| − | |||

| − | + | [[Portal:Wind|► Back to Wind Portal]] | |

| − | + | = Overview = | |

| − | |||

| − | |||

| − | |||

| − | + | A financial analysis is intended to clarify whether or not the wind farm project is financially feasible for the chosen site and types of wind turbines and several other parameters. A financial efficiency threshold is often set by the project developers. The financial analysis can reaveal, which technical or non-technical modifications can be conducted to reach and surpass the set efficiency threshold. For this purpose a complete cost-benefit analysis under consideration of all relevant project parameters (according to site conditions, choice of technology and financing conditions) must be conducted<ref>The contents of this article have been prepared by the project team of the feasibility study of the Ethiopian wind park Ashegoda, conducted by the Deutsche Gesellschaft für internationale Zusammenarbeit (GIZ) in cooperation with the Austrian development agency and Lahmeyer international. Originally the contents have been published as: GTZ (2006) Feasibility Study for Wind Park DevelopmentfckLRin Ethiopia and Capacity Building - Ashegoda Wind Park Site), retrieved 27.7.2011 [[http://www.gtz.de/de/dokumente/en-feasibility-study-wind-park-ashegoda-2006.pdf]]</ref>.<br/> | |

| − | + | <u>There are several major indicators that can be used to evaluate the financial feasibility of a project based on a complete description of benefits and costs. Common examples are:</u><br/> | |

| + | *the financial internal rate of return (FIRR), | ||

| + | *the Debt Service Coverage Ratio (DSCR),<br/> | ||

| + | *the Return on Equity (ROE) and<br/> | ||

| + | *the levelized generation costs of the wind park.<br/> | ||

| − | + | These indicators and their significance are described at the end of the article.<br/> | |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | = Costs Included in Financial Analysis<br/> = | |

| − | + | <u>The analysis of costs include:</u><br/> | |

| + | *Investment Costs<br/> | ||

| + | *Operation and Maintenance Costs<br/> | ||

| + | *Land Lease Costs<br/> | ||

| + | *Costs for Mitigation Measures<br/> | ||

| + | *Project Financing Structure<br/> | ||

| + | *Equity Finance<br/> | ||

| + | *Debt Finance<br/> | ||

| + | *Up-Front + Administrative Costs for '''[[Clean Development Mechanism (CDM) and Baseline-Assessments for Wind Energy Projects|Clean Development Mechanism]] (CDM)'''<br/> | ||

| − | The | + | The different types of costs are explained briefly in the following. Certainly the type and number of costs that come up in a project depend on project size and site conditions.<br/> |

| − | *Turbines incl. Erection <br> | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] |

| − | *Sea transport and inland transport <br> | + | |

| − | *Crane, if necessary incl. sea transport<br> | + | === Investment costs<br/> === |

| − | *Crane works<br> | + | |

| − | *Installation <br> | + | <u>The total investment costs consist of the following items:</u><br/> |

| − | *Civil works<br> | + | *Turbines incl. Erection<br/> |

| − | *Road access<br> | + | *Sea transport and inland transport<br/> |

| − | *Crane pads <br> | + | *Crane, if necessary incl. sea transport<br/> |

| − | *Foundations / basements <br> | + | *Crane works<br/> |

| − | *Cable trenches<br> | + | *Installation<br/> |

| − | *Control building <br> | + | *Civil works<br/> |

| − | *Required electrical equipment<br> | + | *Road access<br/> |

| − | *Extension of substation <br> | + | *Crane pads<br/> |

| − | *Civil works for new substation<br> | + | *Foundations / basements<br/> |

| − | *Transformer (132kV / 33kV) <br> | + | *Cable trenches<br/> |

| − | *Auxiliary equipment of substation <br> | + | *Control building<br/> |

| − | *132 kV components <br> | + | *Required electrical equipment<br/> |

| − | *Overhead lines (OHL) <br> | + | *Extension of substation<br/> |

| − | *Wind park cabling, earthing, Scada <br> | + | *Civil works for new substation<br/> |

| − | *distribution stations on site <br> | + | *Transformer (132kV / 33kV)<br/> |

| − | *Electrical equipment inside control building <br> | + | *Auxiliary equipment of substation<br/> |

| − | *Auxiliary transformer at control building <br> | + | *132 kV components<br/> |

| − | *Equipment for maintainance team (e.g. tools, cars)<br> | + | *Overhead lines (OHL)<br/> |

| − | *Engineering (international and local)<br> | + | *Wind park cabling, earthing, Scada<br/> |

| + | *distribution stations on site<br/> | ||

| + | *Electrical equipment inside control building<br/> | ||

| + | *Auxiliary transformer at control building<br/> | ||

| + | *Equipment for maintainance team (e.g. tools, cars)<br/> | ||

| + | *Engineering (international and local)<br/> | ||

*Mitigation measures | *Mitigation measures | ||

| − | If the project has an international character, investment costs should be divided into the costs borne by local investors and the part of costs borne by foreign investors.<br> | + | If the project has an international character, investment costs should be divided into the costs borne by local investors and the part of costs borne by foreign investors.<br/> |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | + | === Operation and Maintenance Costs === | |

| − | *repairs<br> | + | The O&M costs include:<br/> |

| − | *maintenance<br> | + | *repairs<br/> |

| − | *spare parts<br> | + | *maintenance<br/> |

| − | *insurance costs<br> | + | *spare parts<br/> |

| − | *personnel costs for wind park management and maintenance <br> | + | *insurance costs<br/> |

| + | *personnel costs for wind park management and maintenance<br/> | ||

*electricity consumption | *electricity consumption | ||

| − | The range of the costs is determined by the changing lifetime of the components and their prices which can not be predicted exactly. Furthermore the way of operating the wind parks can have an influence on the expected costs which can also be only estimated for future times. In addition, the size of the machines and the operating time under full load is expected to have an influence on the maintenance costs.<br> | + | The range of the costs is determined by the changing lifetime of the components and their prices which can not be predicted exactly. Furthermore the way of operating the wind parks can have an influence on the expected costs which can also be only estimated for future times. In addition, the size of the machines and the operating time under full load is expected to have an influence on the maintenance costs.<br/> |

| + | |||

| + | According to Consultant s experience, manufactures have to guarantee that in wind parks with an installed capacity of approximately 50 MW, two experts (usually, one electrical engineer and one mechanical engineer) will be constantly present at the wind park. Additionally, a team of four local experts has to be established for maintenance tasks and a crane has to be available, at least once per year, to realise operation revisions. Further, condition monitoring should be realised by independent engineers in order to plan the repairs. The O&M costs have taken insurance costs into consideration in the form of an insurance following commissioning (Business Interruption Insurance). This has been calculated as an annual 12.0 % of the wind turbine price<br/> | ||

| + | |||

| + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | ||

| + | |||

| + | === Land Lease Costs === | ||

| + | |||

| + | The agreed land lease costs (with regional authority or private owner of the site) have to be considered.<br/> | ||

| − | + | <br/> | |

| − | === | + | === Costs for Mitigation Measures === |

| − | + | If the analysis of the environmental impacts of the wind park revealed significant problems resulting from erection and operation of the wind park, reasonable mitigation measures have to be planned. | |

| − | + | <u>Common environmental problems concern:</u><br/> | |

| + | *protection of birds and bats<br/> | ||

| + | *protection of other species disturbed by building and operation of the wind park<br/> | ||

| + | *protection of nearby domestic dwellings from noise of the wind park<br/> | ||

| + | *technical resolution measures to prevent adverse effect on telecommunication systems in the area<br/> | ||

| + | *...<br/> | ||

| − | + | The planning of application of mitigation measures is normally controlled during the approval of the planning application of the wind park.<br/> | |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | === Project Financing Structure === | |

| − | + | Depending of the availability of investors and funding, the project developer creates a financing structure: He decides, which part of investments has to be provided as equity and which share is finance based on dept.<br/> | |

| + | *''Equity Finance'': It has to be considered, which components and working procedures should be financed by equity. Additionaly it should be decided whether equity should be used for the first investments.<br/> | ||

| + | *''Debt Finance'': The ultimate financing conditions at which debt can be raised will depend upon several factors, including for example the general environment in the debt markets, local political conditions as well as the Lender s interpretation of the projects risk profile. It has to be decided, whether the debt can be provided by foreign or domestic financial institutions, while local activities will be covered by local loans.<br/> | ||

| − | + | <br/> | |

| − | + | <u>The dept structure describes conditions of repayment and interest by the following parameters:</u><br/> | |

| − | * | + | *Availability period of the credit<br/> |

| + | *final maturity - time period after which repayment should be finalized<br/> | ||

| + | *repayment profile - frequency number of repayment rates is determined<br/> | ||

| + | *base rate in % per annum<br/> | ||

| + | *grace period - a starting period without repayments is often arranged for the first years of project operation<br/> | ||

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | + | === CDM Up-Front & Administrative Costs<br/> === | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | In order to register a project as a CDM activity, the project participants have to incur mainly in CDM up-front and CDM monitoring costs. CDM-Upfront costs for a large scale project are usually estimated at USD 100,000. Additionally ongoing CDM administrative costs have to be accounted. GTZ assumed USD 5,000 / per annum for a large wind park project in Ethiopia. CDM administrative Costs are applicable only in years determined as CDM credit periods.<br/> | |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | + | = Expected Benefits of a Wind Project<br/> = | |

| − | In case a project has been approved for CDM support, the financial benefits result from electricity sales and sales of Certified Emission Reduction Credits (CERs) of the CDM.<br> | + | In case a project has been approved for CDM support, the financial benefits result from electricity sales and sales of '''Certified Emission Reduction Credits (CERs)''' of the CDM.<br/> |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | + | ==== Electricity Sales<br/> ==== | |

| − | + | The returns for generated electricity depend on the political framework conditions (and the related support mechanisms) applied in the country. In several countries feed-in tariffs are paid for the delivery of each kWh to support the development of renewable energy technology. If there is no support mechanism, returns of electricity generation are calculated using the prevailing tariffs for electricity sale as well as forecasts of the development of these tariffs.<br/> | |

| − | + | Electricity sales per annum are defined as the net amount of electricity generated and connected to the grid multiplied by the electricity price (as per USDct/kWh) as indicated in the following formula:<br/> | |

| − | + | ==== [[File:Calculation returns electricity sale .jpg|frame|center|180px|Calculation returns electricity sale]]<br/>CDM Revenues ==== | |

| − | + | The CDM scenario includes the additional '''Certified Emission Reduction (CER)''' revenues as cash inflows, as well as the CDM Up-<br/>Front Costs and Administrative Costs as cash outflows. To calculate the revenues from CER sales, the amount of ''CO<sub>2</sub>'' ''avoided ''must be determined. This is done by [[Clean Development Mechanism (CDM) and Baseline-Assessments for Wind Energy Projects|CDM baseline-assessment]]. The expected amount of CERs, which can be saled is multiplied by the assumed price of CERs for the crediting period.<br/> | |

| − | + | <br/> | |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | = | + | = Results of a Financial Analysis - Major Financial Indicators<br/> = |

| − | + | If costs and benefits of the project are determined, major financial indicators may be calculate. | |

| − | The | + | <u>To take into account financial process like depreciation and inflation several additional country-specific values must be determined:</u><br/> |

| + | *''Inflation Rate'' | ||

| + | *''Rate of Exchange'' (if foreign investment and project support is part of the project)<br/> | ||

| + | *''Depreciation Rates'' | ||

| + | *''Dividend Distribution'': The mode of dividend calculation for investors have to be determined. As an example dividends can be geared to internal funds available for distribution (cash after debt service, taxes, and reserve account payments) and net income. Dividend distribution may be limited to the case that the Debt Service Coverage Ration (DSCR) exceeds a certain factor (e.g. 1,2x) and net income is positive.<br/> | ||

| + | *''Corporate Taxes: ''Country-specific information about corporate taxes has to be collected to define the fees, which have to be paid by the wind park operator.<br/> | ||

| + | *''Import Taxes'': Country-specific import taxes for the wind park components have to be found out<br/> | ||

| + | *''Discount Rate (Weighted average cost of capital (WACC))''<br/> | ||

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | |||

| − | + | ==== Discount Rate (Weighted average cost of capital (WACC))<br/> ==== | |

| − | + | The discount rate to be normally used in financial benefit-cost analyses is the WACC. The WACC represents the cost incurred by the entity in raising the capital necessary to implement the project. Since most projects use several sources to raise capital and each of these sources may seek a different return, the WACC represents a weighted average of the different returns paid to these sources.<br/> | |

| − | |||

| − | |||

| − | |||

| − | + | <u>The methodology used to calculate the WACC is as follows:</u><br/> | |

| + | *''Step 1'': A categorisation of financing components according to the Project Financing Plan is done. These components can be divided into domestic and foreign components. The two types of components often have different loan conditions (e.g. local loan at an interest rate of 7 % p.a. and local equity share / foreign loan at an interest rate of 5 % and international equity). | ||

| + | *''Step 2'': The cost of funds are estimated. Since government funds are not costless they might be applied to purposes other than the project, such as debt repayment or to alternative investments. For simplicity, the average cost of government funds can be calculated by dividing total government debt servicing by total public debt.<br/>In order to estimate the cost of equity capital, the capital asset pricing model (CAPM) can be used. CAPM describes the relationship between risk and expected return and that is used in the pricing of risky securities.<br/> | ||

| − | + | [[File:Capital asset pricing model.jpg|frame|center|180px|Capital asset pricing model]]The general idea of CAPM is that investors need to be compensated in two ways: time value of money and risk. The time value of money is represented by the risk-free (Rf) rate in the formula and compensates the investors for placing money in any investment over a period of time. The other half of the formula represents risk and calculates the amount of compensation the investor needs for taking on additional risk. This is calculated by taking a risk measure (<math>\beta</math>) that compares the returns of the asset to the market over a period of time and to the market premium (Km-rf).<br/> | |

| + | *''Step 3'': Adjustment for Taxation. If interest payments are deductible for taxation, applicable tax rates have to be adjusted to each component.<br/> | ||

| + | *''Step 4'': Adjustment for Domestic Inflation. The estimated costs of borrowing and equity capital have been adjusted for inflation to obtain the WACC in real terms. Domestic inflation rate (of 2 %) has been used for domestic loans and equity. Shadow Price Adjustment does not apply in the financial analysis and hence, the standard conversion factor (SCF) of 1 has been considered for local currency expenditure, without reducing local costs.<br/> | ||

| + | *''Step 5'': Application of the Minimum Rate Test, i.e. to review the real cost of capital for each component. The rate for each component should be at least 4 %. | ||

| + | *''Step 6'': The determination of the WACC has been done by applying the weighting percentage<br/>to each component. | ||

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | === | + | === Major Financial Indicators === |

| − | + | After all necessary parameters are defined, the Financial Internal Rate of Revenue can be calculated using the feed-in tariff or selling price for energy to forecast returns of the wind project. All values are integrated into a financial model, which calculates the FIRR for the assumed scenarios. However it is possible as well to calculate the necessary selling price (or feed-in tariff) to reach a certain amount of revenue on equity.<br/> | |

| − | + | Financial indicators are used to evaluate projects and to allow comparison between different sites and conditions. Major financial indicators are described in the following.<br/> | |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | + | ==== Net Present Value<br/> ==== | |

| − | + | The net present value (NPV) of an investment has been defined as the present (discounted) value of future cash inflows minus the present value of the investment and any associated future cash outflows. A positive NPV indicates that the projects are justified in an economic sense and vice verse for a negative NPV.<br/> | |

| − | |||

| − | |||

| − | |||

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | + | ==== Financial IRR (FIRR)<br/> ==== | |

| − | + | The Financial Internal Rate of Return (FIRR) is an indicator to measure the financial return on investment of an income generation project and is used to make the investment decision. The FIRR is obtained by equating the present value of investment costs (as cash outflows) and the present value of net incomes (as cash in-flows) as shown below.<br/> | |

| − | + | [[File:FIRR ROE calculation.jpg|frame|center|180px|FIRR ROE calculation]]with:<br/> | |

| + | *I<sub>x</sub> = Initial Investment<br/> | ||

| + | *B<sub>x </sub>= Benefits<br/> | ||

| + | *r = discount rate<br/> | ||

| + | *m = period<br/> | ||

| − | + | <br/> | |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | == | + | ==== Return on Equity (ROE)<br/> ==== |

| − | The | + | The ROE measures the profitability of a project, calculated as net income divided by Shareholders Equity. Essentially, ROE reveals how much profit a project generates for the capital shareholders, which have invested in it. At least it turns out that a project revenue cannot grow faster than its current ROE without raising additional cash.<br/> |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | + | ==== Debt Service Coverage Ratio (DSCR)<br/> ==== | |

| − | *''SI'': represents the percentage change in project NPV as a result of a 1 | + | The Debt Service Coverage Ratio (DSCR) defines the capability of the Wind Farm operating company to repay principal and interest payments on debt. It is stated as the ratio between cash available to service debt and total debt service. Conventionally, the lender will require that a minimum DSCR of 1.20x be upheld during the amortization period, to ensure that the project can meet its upcoming debt commitments with sufficient buffer.<br/> |

| + | |||

| + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | ||

| + | |||

| + | ==== Levelised Costs ==== | ||

| + | |||

| + | Similar to the internal rate of return calculation, the levelised costs of energy are calculated by searching for a tariff for electricity, with which the net present value turns out as zero and the internal rate of return equals the applied discount rate. In this calculation only the annual project costs such as operation and maintenance and debt service are included, whereas the inflation rate is set to zero.<br/> | ||

| + | |||

| + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | ||

| + | |||

| + | = Sensitivity Analysis<br/> = | ||

| + | |||

| + | The purpose of the sensitivity testing is to establish which project parameters have the potential to alter the financial feasibility of the project by the greatest amount. By systematically altering individual parameters and recording the influence on the project evaluation criteria, those parameters with the greatest potential to cause the economics of the project to deviate from its expected value can be isolated. This provides a transparent overview of the projects risk profile, assists project planning, and helps prepare risk mitigation strategies. | ||

| + | |||

| + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | ||

| + | |||

| + | === Methodology<br/> === | ||

| + | |||

| + | Where applicable, expected values of parameters of the financial analysis are (as used in the Base Case with CDM calculations) increased and decreased by +5 %, -5 %, and +10 %, -10 % respectively. This is done for one parameter at a time, so as to isolate the impact of that variable on project feasibility. Complimentary to this, the respective Sensitivity Indicators (SI) and Switching Values (SV) can be derived.<br/><u>The definitions of the SI and SV are as follows:</u><br/> | ||

| + | *''SI'': represents the percentage change in project NPV as a result of a 1 % increase in the parameter; and | ||

*''SV'': represents the percentage change in the parameter value necessary to drive project NPV down to zero. | *''SV'': represents the percentage change in the parameter value necessary to drive project NPV down to zero. | ||

| − | ''Sensitivity Variables ''can be for e.g.: | + | <u>''Sensitivity Variables ''can be for e.g.:</u> |

| + | *Investment costs | ||

| + | *Energy generation | ||

| + | *Routine O&M | ||

| + | *Sales Tariff | ||

| + | *CO<sub>2</sub> Contract Price | ||

| + | |||

| + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | ||

| + | |||

| + | = Further Information = | ||

| − | * | + | *[[Economic Analyses of Wind Energy Projects|Economic Analyses of Wind Energy Projects]]<br/> |

| − | *Energy | + | *[[Economical Feasibility of Wind Energy Projects|Economical Feasibility of Wind Energy Projects]]<br/> |

| − | |||

| − | |||

| − | |||

| − | + | <br/> | |

| − | + | [[Financing_Aspects_-_Wind_Energy#toc|►Go to Top]] | |

| − | + | = References<br/> = | |

| − | < | + | <references /> |

[[Category:Wind]] | [[Category:Wind]] | ||

| + | [[Category:Financing_and_Funding]] | ||

| + | [[Category:Financing_Wind]] | ||

Latest revision as of 12:42, 29 August 2014

Overview

A financial analysis is intended to clarify whether or not the wind farm project is financially feasible for the chosen site and types of wind turbines and several other parameters. A financial efficiency threshold is often set by the project developers. The financial analysis can reaveal, which technical or non-technical modifications can be conducted to reach and surpass the set efficiency threshold. For this purpose a complete cost-benefit analysis under consideration of all relevant project parameters (according to site conditions, choice of technology and financing conditions) must be conducted[1].

There are several major indicators that can be used to evaluate the financial feasibility of a project based on a complete description of benefits and costs. Common examples are:

- the financial internal rate of return (FIRR),

- the Debt Service Coverage Ratio (DSCR),

- the Return on Equity (ROE) and

- the levelized generation costs of the wind park.

These indicators and their significance are described at the end of the article.

Costs Included in Financial Analysis

The analysis of costs include:

- Investment Costs

- Operation and Maintenance Costs

- Land Lease Costs

- Costs for Mitigation Measures

- Project Financing Structure

- Equity Finance

- Debt Finance

- Up-Front + Administrative Costs for Clean Development Mechanism (CDM)

The different types of costs are explained briefly in the following. Certainly the type and number of costs that come up in a project depend on project size and site conditions.

Investment costs

The total investment costs consist of the following items:

- Turbines incl. Erection

- Sea transport and inland transport

- Crane, if necessary incl. sea transport

- Crane works

- Installation

- Civil works

- Road access

- Crane pads

- Foundations / basements

- Cable trenches

- Control building

- Required electrical equipment

- Extension of substation

- Civil works for new substation

- Transformer (132kV / 33kV)

- Auxiliary equipment of substation

- 132 kV components

- Overhead lines (OHL)

- Wind park cabling, earthing, Scada

- distribution stations on site

- Electrical equipment inside control building

- Auxiliary transformer at control building

- Equipment for maintainance team (e.g. tools, cars)

- Engineering (international and local)

- Mitigation measures

If the project has an international character, investment costs should be divided into the costs borne by local investors and the part of costs borne by foreign investors.

Operation and Maintenance Costs

The O&M costs include:

- repairs

- maintenance

- spare parts

- insurance costs

- personnel costs for wind park management and maintenance

- electricity consumption

The range of the costs is determined by the changing lifetime of the components and their prices which can not be predicted exactly. Furthermore the way of operating the wind parks can have an influence on the expected costs which can also be only estimated for future times. In addition, the size of the machines and the operating time under full load is expected to have an influence on the maintenance costs.

According to Consultant s experience, manufactures have to guarantee that in wind parks with an installed capacity of approximately 50 MW, two experts (usually, one electrical engineer and one mechanical engineer) will be constantly present at the wind park. Additionally, a team of four local experts has to be established for maintenance tasks and a crane has to be available, at least once per year, to realise operation revisions. Further, condition monitoring should be realised by independent engineers in order to plan the repairs. The O&M costs have taken insurance costs into consideration in the form of an insurance following commissioning (Business Interruption Insurance). This has been calculated as an annual 12.0 % of the wind turbine price

Land Lease Costs

The agreed land lease costs (with regional authority or private owner of the site) have to be considered.

Costs for Mitigation Measures

If the analysis of the environmental impacts of the wind park revealed significant problems resulting from erection and operation of the wind park, reasonable mitigation measures have to be planned.

Common environmental problems concern:

- protection of birds and bats

- protection of other species disturbed by building and operation of the wind park

- protection of nearby domestic dwellings from noise of the wind park

- technical resolution measures to prevent adverse effect on telecommunication systems in the area

- ...

The planning of application of mitigation measures is normally controlled during the approval of the planning application of the wind park.

Project Financing Structure

Depending of the availability of investors and funding, the project developer creates a financing structure: He decides, which part of investments has to be provided as equity and which share is finance based on dept.

- Equity Finance: It has to be considered, which components and working procedures should be financed by equity. Additionaly it should be decided whether equity should be used for the first investments.

- Debt Finance: The ultimate financing conditions at which debt can be raised will depend upon several factors, including for example the general environment in the debt markets, local political conditions as well as the Lender s interpretation of the projects risk profile. It has to be decided, whether the debt can be provided by foreign or domestic financial institutions, while local activities will be covered by local loans.

The dept structure describes conditions of repayment and interest by the following parameters:

- Availability period of the credit

- final maturity - time period after which repayment should be finalized

- repayment profile - frequency number of repayment rates is determined

- base rate in % per annum

- grace period - a starting period without repayments is often arranged for the first years of project operation

CDM Up-Front & Administrative Costs

In order to register a project as a CDM activity, the project participants have to incur mainly in CDM up-front and CDM monitoring costs. CDM-Upfront costs for a large scale project are usually estimated at USD 100,000. Additionally ongoing CDM administrative costs have to be accounted. GTZ assumed USD 5,000 / per annum for a large wind park project in Ethiopia. CDM administrative Costs are applicable only in years determined as CDM credit periods.

Expected Benefits of a Wind Project

In case a project has been approved for CDM support, the financial benefits result from electricity sales and sales of Certified Emission Reduction Credits (CERs) of the CDM.

Electricity Sales

The returns for generated electricity depend on the political framework conditions (and the related support mechanisms) applied in the country. In several countries feed-in tariffs are paid for the delivery of each kWh to support the development of renewable energy technology. If there is no support mechanism, returns of electricity generation are calculated using the prevailing tariffs for electricity sale as well as forecasts of the development of these tariffs.

Electricity sales per annum are defined as the net amount of electricity generated and connected to the grid multiplied by the electricity price (as per USDct/kWh) as indicated in the following formula:

CDM Revenues

The CDM scenario includes the additional Certified Emission Reduction (CER) revenues as cash inflows, as well as the CDM Up-

Front Costs and Administrative Costs as cash outflows. To calculate the revenues from CER sales, the amount of CO2 avoided must be determined. This is done by CDM baseline-assessment. The expected amount of CERs, which can be saled is multiplied by the assumed price of CERs for the crediting period.

Results of a Financial Analysis - Major Financial Indicators

If costs and benefits of the project are determined, major financial indicators may be calculate.

To take into account financial process like depreciation and inflation several additional country-specific values must be determined:

- Inflation Rate

- Rate of Exchange (if foreign investment and project support is part of the project)

- Depreciation Rates

- Dividend Distribution: The mode of dividend calculation for investors have to be determined. As an example dividends can be geared to internal funds available for distribution (cash after debt service, taxes, and reserve account payments) and net income. Dividend distribution may be limited to the case that the Debt Service Coverage Ration (DSCR) exceeds a certain factor (e.g. 1,2x) and net income is positive.

- Corporate Taxes: Country-specific information about corporate taxes has to be collected to define the fees, which have to be paid by the wind park operator.

- Import Taxes: Country-specific import taxes for the wind park components have to be found out

- Discount Rate (Weighted average cost of capital (WACC))

Discount Rate (Weighted average cost of capital (WACC))

The discount rate to be normally used in financial benefit-cost analyses is the WACC. The WACC represents the cost incurred by the entity in raising the capital necessary to implement the project. Since most projects use several sources to raise capital and each of these sources may seek a different return, the WACC represents a weighted average of the different returns paid to these sources.

The methodology used to calculate the WACC is as follows:

- Step 1: A categorisation of financing components according to the Project Financing Plan is done. These components can be divided into domestic and foreign components. The two types of components often have different loan conditions (e.g. local loan at an interest rate of 7 % p.a. and local equity share / foreign loan at an interest rate of 5 % and international equity).

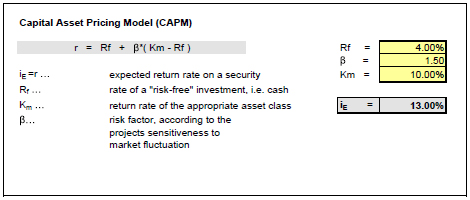

- Step 2: The cost of funds are estimated. Since government funds are not costless they might be applied to purposes other than the project, such as debt repayment or to alternative investments. For simplicity, the average cost of government funds can be calculated by dividing total government debt servicing by total public debt.

In order to estimate the cost of equity capital, the capital asset pricing model (CAPM) can be used. CAPM describes the relationship between risk and expected return and that is used in the pricing of risky securities.

The general idea of CAPM is that investors need to be compensated in two ways: time value of money and risk. The time value of money is represented by the risk-free (Rf) rate in the formula and compensates the investors for placing money in any investment over a period of time. The other half of the formula represents risk and calculates the amount of compensation the investor needs for taking on additional risk. This is calculated by taking a risk measure () that compares the returns of the asset to the market over a period of time and to the market premium (Km-rf).

- Step 3: Adjustment for Taxation. If interest payments are deductible for taxation, applicable tax rates have to be adjusted to each component.

- Step 4: Adjustment for Domestic Inflation. The estimated costs of borrowing and equity capital have been adjusted for inflation to obtain the WACC in real terms. Domestic inflation rate (of 2 %) has been used for domestic loans and equity. Shadow Price Adjustment does not apply in the financial analysis and hence, the standard conversion factor (SCF) of 1 has been considered for local currency expenditure, without reducing local costs.

- Step 5: Application of the Minimum Rate Test, i.e. to review the real cost of capital for each component. The rate for each component should be at least 4 %.

- Step 6: The determination of the WACC has been done by applying the weighting percentage

to each component.

Major Financial Indicators

After all necessary parameters are defined, the Financial Internal Rate of Revenue can be calculated using the feed-in tariff or selling price for energy to forecast returns of the wind project. All values are integrated into a financial model, which calculates the FIRR for the assumed scenarios. However it is possible as well to calculate the necessary selling price (or feed-in tariff) to reach a certain amount of revenue on equity.

Financial indicators are used to evaluate projects and to allow comparison between different sites and conditions. Major financial indicators are described in the following.

Net Present Value

The net present value (NPV) of an investment has been defined as the present (discounted) value of future cash inflows minus the present value of the investment and any associated future cash outflows. A positive NPV indicates that the projects are justified in an economic sense and vice verse for a negative NPV.

Financial IRR (FIRR)

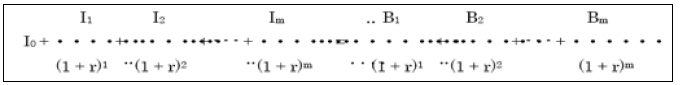

The Financial Internal Rate of Return (FIRR) is an indicator to measure the financial return on investment of an income generation project and is used to make the investment decision. The FIRR is obtained by equating the present value of investment costs (as cash outflows) and the present value of net incomes (as cash in-flows) as shown below.

with:

- Ix = Initial Investment

- Bx = Benefits

- r = discount rate

- m = period

Return on Equity (ROE)

The ROE measures the profitability of a project, calculated as net income divided by Shareholders Equity. Essentially, ROE reveals how much profit a project generates for the capital shareholders, which have invested in it. At least it turns out that a project revenue cannot grow faster than its current ROE without raising additional cash.

Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio (DSCR) defines the capability of the Wind Farm operating company to repay principal and interest payments on debt. It is stated as the ratio between cash available to service debt and total debt service. Conventionally, the lender will require that a minimum DSCR of 1.20x be upheld during the amortization period, to ensure that the project can meet its upcoming debt commitments with sufficient buffer.

Levelised Costs

Similar to the internal rate of return calculation, the levelised costs of energy are calculated by searching for a tariff for electricity, with which the net present value turns out as zero and the internal rate of return equals the applied discount rate. In this calculation only the annual project costs such as operation and maintenance and debt service are included, whereas the inflation rate is set to zero.

Sensitivity Analysis

The purpose of the sensitivity testing is to establish which project parameters have the potential to alter the financial feasibility of the project by the greatest amount. By systematically altering individual parameters and recording the influence on the project evaluation criteria, those parameters with the greatest potential to cause the economics of the project to deviate from its expected value can be isolated. This provides a transparent overview of the projects risk profile, assists project planning, and helps prepare risk mitigation strategies.

Methodology

Where applicable, expected values of parameters of the financial analysis are (as used in the Base Case with CDM calculations) increased and decreased by +5 %, -5 %, and +10 %, -10 % respectively. This is done for one parameter at a time, so as to isolate the impact of that variable on project feasibility. Complimentary to this, the respective Sensitivity Indicators (SI) and Switching Values (SV) can be derived.

The definitions of the SI and SV are as follows:

- SI: represents the percentage change in project NPV as a result of a 1 % increase in the parameter; and

- SV: represents the percentage change in the parameter value necessary to drive project NPV down to zero.

Sensitivity Variables can be for e.g.:

- Investment costs

- Energy generation

- Routine O&M

- Sales Tariff

- CO2 Contract Price

Further Information

References

- ↑ The contents of this article have been prepared by the project team of the feasibility study of the Ethiopian wind park Ashegoda, conducted by the Deutsche Gesellschaft für internationale Zusammenarbeit (GIZ) in cooperation with the Austrian development agency and Lahmeyer international. Originally the contents have been published as: GTZ (2006) Feasibility Study for Wind Park DevelopmentfckLRin Ethiopia and Capacity Building - Ashegoda Wind Park Site), retrieved 27.7.2011 [[1]]