Click here to register!

Difference between revisions of "Fuel Prices Ghana"

***** (***** | *****) m (Protected "Fuel Prices Ghana" ([edit=sysop] (indefinite) [move=sysop] (indefinite)) [cascading]) |

***** (***** | *****) |

||

| Line 1: | Line 1: | ||

{{Fuel Price Factsheet | {{Fuel Price Factsheet | ||

|Fuel Price Country=Ghana | |Fuel Price Country=Ghana | ||

| + | |Fuel Pricing Policies=Ghana liberalized fuel prices in Feb 2005 and began setting price ceilings in line with world prices. A price smoothing scheme called the ex-refinery differential, which operates like a price stabilization fund, was introduced in the last quarter of 2006 to pay fuel marketers for under-recovery of costs for selling kerosene, LPG, and premix (a heavily subsidized fuel for fishing boats). Government began reviewing prices twice a month in Oct 2007, but suspended price adjustments between May and Nov 2008. The frequency of price adjustments fell sharply beginning in 2009. There were no price adjustments in 2010, two price increases in 2011, and one downward price adjustment in 2012, with several of these adjustments tending to be large. A price increase of 30% for gasoline and diesel in Jan 2011 sparked street protests in Accra. Kerosene prices have been frozen since the end of Oct 2009. In addition, the controlled ex-refinery price of LPG has been markedly lower than the import-parity cost. In Nov 2011, the ex-refinery price differential was declared illegal, and the stay of execution was denied in Jan 2012. National Petroleum Authority (NPA) said in Feb 2012 that the fuel subsidy in 2011 was in excess of 450 million cedis (US$276 million). Ghana’s cabinet in Mar 2010 approved a Commodity Price Risk Management Policy, paving the way for hedging petroleum products and crude oil. Ghana hedged half of its crude oil requirements in 2010−11. In Jun 2011, the finance minister announced that government would hedge 100% of crude output and about half of crude purchase. IMF reported in Feb 2012 that sizable hedging gains in the first half of 2011 allowed fuel subsidies to be covered through July. In Jan 2012, government announced that it was hedging crude on a quarterly basis. The NPA posts detailed information on historical prices and price structures on its Web site. (Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.) | ||

|Fuel Currency=GHS | |Fuel Currency=GHS | ||

|Fuel Price Exchange Rate=1.4183 | |Fuel Price Exchange Rate=1.4183 | ||

|Fuel Price Exchange Rate Date=2010/11/17 | |Fuel Price Exchange Rate Date=2010/11/17 | ||

| − | |||

|Fuel Price Composition=GIZ_IFP2012_Ghana1.png | |Fuel Price Composition=GIZ_IFP2012_Ghana1.png | ||

|Fuel Price Composition Fuel Type=Gasoline 95 Octane | |Fuel Price Composition Fuel Type=Gasoline 95 Octane | ||

| Line 14: | Line 14: | ||

(** Subsidy across fuels: This value is only positive for gasoline and negative for all other fuels, i.e., the consumption of all other fuels is subsidized by the consumption of gasoline (the idea is to subsidize fuels mainly consumed by the poor)) | (** Subsidy across fuels: This value is only positive for gasoline and negative for all other fuels, i.e., the consumption of all other fuels is subsidized by the consumption of gasoline (the idea is to subsidize fuels mainly consumed by the poor)) | ||

|Fuel Price Composition 2=GIZ_IFP2012_Ghana2.png | |Fuel Price Composition 2=GIZ_IFP2012_Ghana2.png | ||

| − | |Fuel Pricing | + | |Fuel Matrix Pricing Mechanism=2 |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|Fuel Matrix Price Level=2 | |Fuel Matrix Price Level=2 | ||

| − | |||

|Fuel Matrix Annotation=ad-hoc-style pricing in 2010/Jan. 2011? | |Fuel Matrix Annotation=ad-hoc-style pricing in 2010/Jan. 2011? | ||

Revision as of 15:05, 15 February 2013

Part of: GIZ International Fuel Price database

Also see: Ghana Energy Situation

Fuel Pricing Policies

| Local Currency: | GHS |

| Exchange Rate: | 1.4183

|

| Last Update: |

Ghana liberalized fuel prices in Feb 2005 and began setting price ceilings in line with world prices. A price smoothing scheme called the ex-refinery differential, which operates like a price stabilization fund, was introduced in the last quarter of 2006 to pay fuel marketers for under-recovery of costs for selling kerosene, LPG, and premix (a heavily subsidized fuel for fishing boats). Government began reviewing prices twice a month in Oct 2007, but suspended price adjustments between May and Nov 2008. The frequency of price adjustments fell sharply beginning in 2009. There were no price adjustments in 2010, two price increases in 2011, and one downward price adjustment in 2012, with several of these adjustments tending to be large. A price increase of 30% for gasoline and diesel in Jan 2011 sparked street protests in Accra. Kerosene prices have been frozen since the end of Oct 2009. In addition, the controlled ex-refinery price of LPG has been markedly lower than the import-parity cost. In Nov 2011, the ex-refinery price differential was declared illegal, and the stay of execution was denied in Jan 2012. National Petroleum Authority (NPA) said in Feb 2012 that the fuel subsidy in 2011 was in excess of 450 million cedis (US$276 million). Ghana’s cabinet in Mar 2010 approved a Commodity Price Risk Management Policy, paving the way for hedging petroleum products and crude oil. Ghana hedged half of its crude oil requirements in 2010−11. In Jun 2011, the finance minister announced that government would hedge 100% of crude output and about half of crude purchase. IMF reported in Feb 2012 that sizable hedging gains in the first half of 2011 allowed fuel subsidies to be covered through July. In Jan 2012, government announced that it was hedging crude on a quarterly basis. The NPA posts detailed information on historical prices and price structures on its Web site. (Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.)

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

Fuel Price Composition

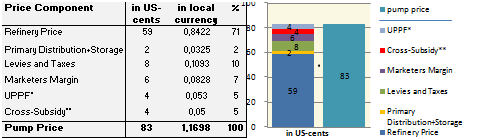

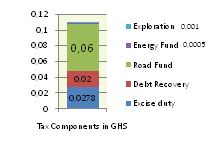

Price composition for one litre of Gasoline 95 Octane as of 2010/10/01.

Source: http://www.npa.gov.gh/petroleum-prices/ ; (see → Annex A2 for October 2010 values)

(* Unified Petroleum Price Fund: Supports fuel transportation to rural regions while maintaining a countrywide uniform pump price; the goal is to ensure the supply in all regions.)

(** Subsidy across fuels: This value is only positive for gasoline and negative for all other fuels, i.e., the consumption of all other fuels is subsidized by the consumption of gasoline (the idea is to subsidize fuels mainly consumed by the poor))

At a Glance

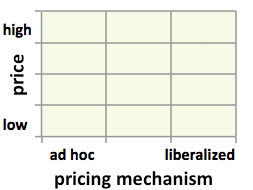

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

ad-hoc-style pricing in 2010/Jan. 2011?

Statements are missing, when and why prices are re-calculated (why frozen prices for 14 months, followed by a 30% price hike?)

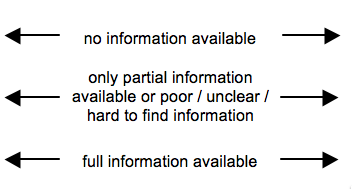

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Price Composition | http://www.npa.gov.gh/petroleum-prices/ |

| Pump prices and margins | http://www.npa.gov.gh/petroleum-prices/ |

| Pump prices and margins | http://www.npa.gov.gh/ |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices