Difference between revisions of "Impact of Taxes on Solar Photovoltaic in India"

***** (***** | *****) m (→Reference) |

***** (***** | *****) m |

||

| Line 1: | Line 1: | ||

| + | |||

= Overview = | = Overview = | ||

| − | This articles is based on the publication, "[https://www.iisd.org/sites/default/files/publications/indias-energy-transition-goods-services-tax-coal-solar.pdf India's Energy Transition: The Impact of the Goods and Services Tax on Solar Photovoltaic and Coal Power Costs]", by the Global Subsidies Initiative (GSI) of the International Institute for Sustainable Development (IISD) and the Council on Energy, Environment and Water (CEEW). <br/> | + | This articles is based on the publication, "[https://www.iisd.org/sites/default/files/publications/indias-energy-transition-goods-services-tax-coal-solar.pdf India's Energy Transition: The Impact of the Goods and Services Tax on Solar Photovoltaic and Coal Power Costs]", by the Global Subsidies Initiative (GSI) of the International Institute for Sustainable Development (IISD) and the Council on Energy, Environment and Water (CEEW).<br/> |

'''It summarizes the impact on Solar Photovoltaic (PV') power plants after the newly implemented Goods and Service Tax (GST).''' | '''It summarizes the impact on Solar Photovoltaic (PV') power plants after the newly implemented Goods and Service Tax (GST).''' | ||

| Line 25: | Line 26: | ||

LCOE is a metric for measuring the cost of electricity generation during the lifetime of an energy source. For calculating LCOE, the lifetime cost of the energy source (includes capital costs, O&M, performance and fuel costs) is divided by the energy produced. It helps to compare between different technologies. <ref>https://www.nrel.gov/analysis/tech-lcoe-documentation.html</ref> | LCOE is a metric for measuring the cost of electricity generation during the lifetime of an energy source. For calculating LCOE, the lifetime cost of the energy source (includes capital costs, O&M, performance and fuel costs) is divided by the energy produced. It helps to compare between different technologies. <ref>https://www.nrel.gov/analysis/tech-lcoe-documentation.html</ref> | ||

| − | The author calculated that the impact of LCOE on a 200 MW plant solar park project and found that a'''fter GST the LCOE increased by 5.8 as compared to pre-GST. '''<br/> | + | The author calculated that the impact of LCOE on a 200 MW plant solar park project and found that a'''fter GST the LCOE increased by 5.8 as compared to pre-GST. '''<br/>[[File:GST on solar pv.png|border|700px|alt=GST on solar pv.png|link=]] |

| − | [[File:GST on solar pv.png|border|700px|alt=GST on solar pv.png|link=]] | ||

| − | = Other Taxes and Compensation= | + | = Other Taxes and Compensation = |

Along with the GST, two other taxes and compensations were introduced in India in 2018. | Along with the GST, two other taxes and compensations were introduced in India in 2018. | ||

== Safeguard Duty<br/> == | == Safeguard Duty<br/> == | ||

| + | |||

Since July 2018, there is a safeguard duty on all solar PV cells and modules. They have to pay a duty of 25% in the first year and 20 percent in the following six months and 15 percent for the last six months. | Since July 2018, there is a safeguard duty on all solar PV cells and modules. They have to pay a duty of 25% in the first year and 20 percent in the following six months and 15 percent for the last six months. | ||

== Compensation from distribution companies (discoms) == | == Compensation from distribution companies (discoms) == | ||

| − | Discoms are required to pay a one-time payment to projects as many solar contracts were awarded before the GST was implemented. This one-time payment is supposed to off-set the cost. | + | |

| + | Discoms are required to pay a one-time payment to projects as many solar contracts were awarded before the GST was implemented. This one-time payment is supposed to off-set the cost. | ||

= Conclusion = | = Conclusion = | ||

| − | There is a lot of uncertainty concerning how GST will be applied in the solar sector. This has resulted in deployment of solar PV and also raised hte cost for those projects awarded before GST. | + | |

| + | There is a lot of uncertainty concerning how GST will be applied in the solar sector. This has resulted in deployment of solar PV and also raised hte cost for those projects awarded before GST. Therefore, the report provides the following suggestations: | ||

| + | |||

*Further clarity on how GST is applied for solar PV technologies | *Further clarity on how GST is applied for solar PV technologies | ||

| − | * Readjust tax rates for those technologies that have matured and those which are under mature | + | *Readjust tax rates for those technologies that have matured and those which are under mature |

| − | * Reinstate support for clean energy research | + | *Reinstate support for clean energy research |

| + | |||

| + | <br/> | ||

| + | |||

| + | = Further Readings = | ||

| + | |||

| + | *[[India_Energy_Situation|India Energy Situation]]<br/> | ||

| + | *[[:Portal:Financing_and_Funding|Financing and Funding portal on energypedia]]<br/> | ||

= Reference = | = Reference = | ||

| − | |||

| − | |||

| + | *[https://www.iisd.org/sites/default/files/publications/indias-energy-transition-goods-services-tax-coal-solar.pdf https://www.iisd.org/sites/default/files/publications/indias-energy-transition-goods-services-tax-coal-solar.pdf] | ||

| + | |||

| + | <references /> | ||

| + | |||

| + | [[Category:Solar]] | ||

| + | [[Category:India]] | ||

[[Category:Financing_and_Funding]] | [[Category:Financing_and_Funding]] | ||

| − | |||

| − | |||

Latest revision as of 08:14, 27 March 2019

Overview

This articles is based on the publication, "India's Energy Transition: The Impact of the Goods and Services Tax on Solar Photovoltaic and Coal Power Costs", by the Global Subsidies Initiative (GSI) of the International Institute for Sustainable Development (IISD) and the Council on Energy, Environment and Water (CEEW).

It summarizes the impact on Solar Photovoltaic (PV') power plants after the newly implemented Goods and Service Tax (GST).

Goods and Service Tax (GST)

On July 1, 2017, India implemented the Goods and Service Tax on all products including the energy sector. GST simplified the Indian tax system by superseding the three core taxes :the Central Goods & Services Tax (CGST), the State Goods & Services Tax (SGST) and the Integrated Goods & Services IGST (IGST).

For applying GST on solar PV, 70 percent of the gross value of the contract will be considered as supply of good and have a GST of 5% while the remaining 30% will be considered as supply of service and will attract 18 percent GST.

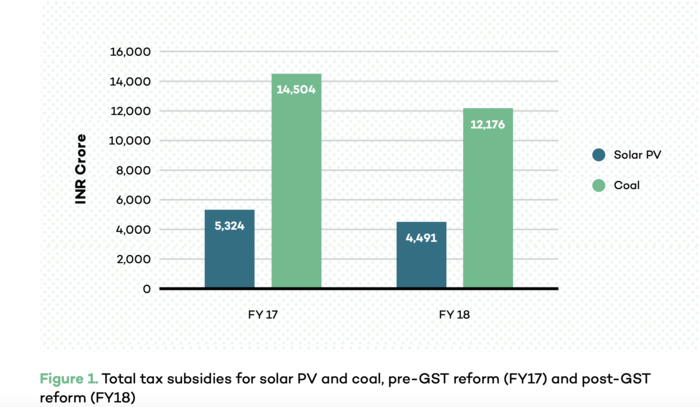

Impact of GST on Subsidy for Solar PV

According to the publication, GST will result in a decrease of 15.6 per cent and 16 per cent in the total tax subsidy for solar PV and coal thermal power. Although the decrease is relatively similar for both the technologies, solar currently receives half the subsidies that coal receives.

Impact on Levelized Cost of Electricity (LCOE) for Solar PV

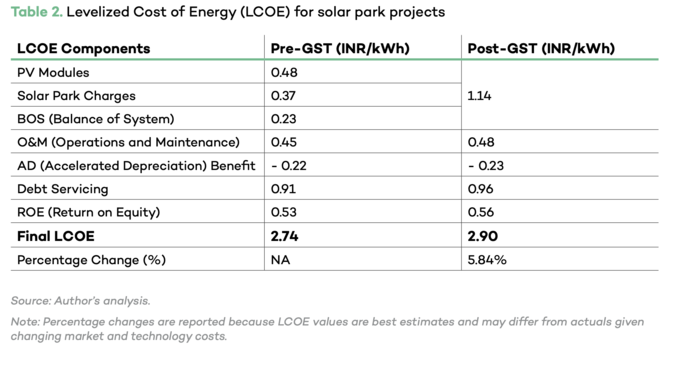

LCOE is a metric for measuring the cost of electricity generation during the lifetime of an energy source. For calculating LCOE, the lifetime cost of the energy source (includes capital costs, O&M, performance and fuel costs) is divided by the energy produced. It helps to compare between different technologies. [1]

The author calculated that the impact of LCOE on a 200 MW plant solar park project and found that after GST the LCOE increased by 5.8 as compared to pre-GST.

Other Taxes and Compensation

Along with the GST, two other taxes and compensations were introduced in India in 2018.

Safeguard Duty

Since July 2018, there is a safeguard duty on all solar PV cells and modules. They have to pay a duty of 25% in the first year and 20 percent in the following six months and 15 percent for the last six months.

Compensation from distribution companies (discoms)

Discoms are required to pay a one-time payment to projects as many solar contracts were awarded before the GST was implemented. This one-time payment is supposed to off-set the cost.

Conclusion

There is a lot of uncertainty concerning how GST will be applied in the solar sector. This has resulted in deployment of solar PV and also raised hte cost for those projects awarded before GST. Therefore, the report provides the following suggestations:

- Further clarity on how GST is applied for solar PV technologies

- Readjust tax rates for those technologies that have matured and those which are under mature

- Reinstate support for clean energy research