Impacts of Flat Rate Electricity Tariffs

Overview

Capacity based flat rate tariffs offer a maximum amount of energy consumption (in most cases) for a fixed fee. This type of tariff is widely used across multiple industries: telecoms, internet providers, rental services, etc.[1]. The simplicity of flat-rate tariffs have made it a popular method of charging consumers, however, its impacts on energy usage efficiency and the sector as a whole is limited. This article will attempt to expand this and assess the impacts of flat rate tariffs through comparisons with other tariff structures.[2]

Flat Rates

Flat rate tariff is actually a name used for two different types of tariff structures. The first one being one that charges a flat fixed price for every kWh consumed. This means that variation in costs to the consumer is directly linked to their own consumption[3].

The definition that will be employed in this article refers to a capacity based definition from GIZ. The flat rate tariff is defined as a flat, unchanging charge that allows the user to consume up to a maximum amount[4]. These rates are also sometimes called fixed rates and are an example of a power tariff. Power tariffs charge based on Watts, rather than kWh. These rates demand that a user’s consumption never exceeds a set wattage at any given time, lest they cause a load limiter to cut-off supply until usage goes down again. This usually means the consumer cannot use all their appliances simultaneously, or must group them together such that total power usage does not exceed their given limit[5]. In India, these rates can range from 60 to 200 INR/month (€ 0.81 – € 2.72)which in Bihar account for 7 to 10% of a household’s monthly income. Customers with metered supply however pay lower rates than those charged by the flat rate tariff[6]. In Ethiopia, users consuming less than or equal to 25 kWH are charged at a flat rate of 0.273 ETB/month (€ 0.02). The next rate of 0.34 ETB/month (€ 0.24) is charged for users in the 26-50 kWH range[7].

Because this rate is fixed regardless of the cost of power generation or amount of consumption, flat rates inherently possess a cost for premium. This is called the hedging cost. As flat-rates assume a singular rate for a period of time, consumers are offered a stability in energy cost despite the variance in production costs or energy consumption. This means the monetary risk is with the supplier/utility, hence the tariff comes with a built-in charge for this premium provided[8].

However, flat rate tariffs remain prevalent due to the ease of service on the utility’s part. Where measurement of actual consumer usage is costly[1], as is the case in mini-grids and underdeveloped electricity networks, a flat rate tariff is the most optimal choice[6] due to the increased cost of advance metering technology[9] and the economic efficiency afforded[10]. In distant networks, the system experiences lower demand and a smaller economy of scale. Due to this, profitability is difficult to achieve let alone metering. Where metering is applied, only the most basic technologies can be used due to the cost[11]. The high cost of metering can also be attributed to the need to measure, process or calculate the data. This induces administrative cost and/or parasitic energy costs for automated systems[12], making metering expensive in distributed situations and flat rate tariffs favourable[5].

List of possible impacts

Due to flat rates’ independence from actual usage, it fails to reflect the true costs of energy used. Another possible impact is that flat rate tariffs contribute to inequity between different types of consumption, where one household may use more, and another much less despite the same rate charged.

Much of the information regarding the impacts of flat electricity tariffs are derived from studies that propose new tariff structures (see case studies below). The comparison between flat rate tariffs as a basis, and a new tariff offer insights into the impact of flat rate tariffs themselves.

There are three relevant impacts to expect from flat rates: higher prices for consumers (cost of premium), people consuming less per more for their energy services (cross-subsidisation), and people consume more or less as their optimum because they cannot retrieve this information from their energy bill.

Cost of Premium: People pay more than with consumption based tariffs

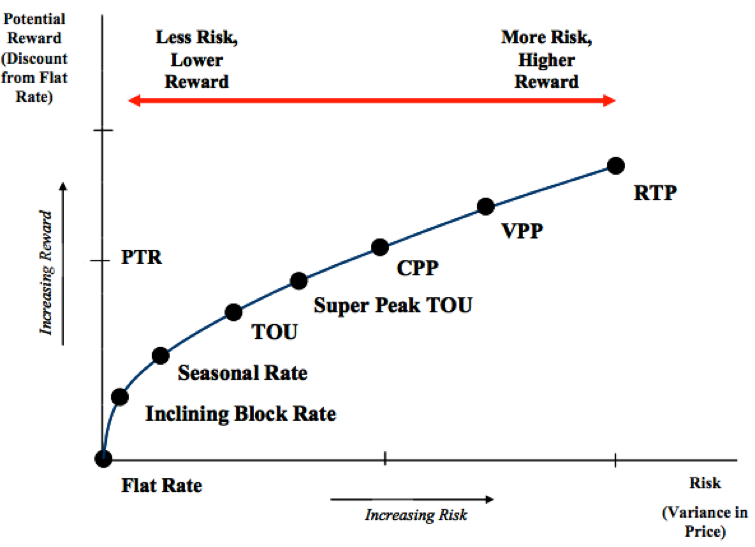

Flat rate tariffs tend to be more expensive for the consumer when compared to a consumption based tariffs. Part of this is because of the hedging cost of premium associated. Figure 1 shows how different tariff structures have embedded risk. Clearly, RTPs (Real Time Pricing) have the highest risk, but also the highest reward. The uncertainty of how much a consumer will have to pay for his/her consumption in the next time period increases risk for the household. However, should the user be able to shift his/her consumption to a ‘cheaper’ time, they also obtain the highest reward. As consumers effectively pass on risk to the utility, the supplier must raise their charge of service to account for this uncertainty. On average, an Australian household is able to save 1-2% of their yearly electricity expenditure by switching to a tariff that employs real time pricing[9].

However, in the bigger scheme of things, RTP is more expensive to the utility and may increase electricity tariffs regardless. In order to accurately apply such a tariff, a smarter grid is necessary, equipped with additional infrastructure. The costs of this currently outweigh the savings offered by real time pricing though[9], hence the persistence of flat rates in countries like India and Nepal.

Figure 1: Risk and Reward Trade-off[13]

Cross-subsidization: People who consume less pay more for their energy services

Another impact of flat rate tariffs is unintended cross-subsidizing. In a consumer base, there are three types of users: average, peaky, and flat. The average middle class urban user has consumption that is neither flat nor peaky, using 25% of their electricity during peak times. The peaky user has large spikes in use during peak load and uses 40% of their electricity during this time. Finally, the flat user has a rather consistent demand curve, only using electricity during peak load 10% of the time[13]. Say all three user types are charged using a flat rate tariff. As the peaky user increases their consumption during peak load, the price of energy they use rises as well, enough that this price sits above the tariff charged. As flat and average users most often do not have peak load usage, they should be able to avoid these costs as well.

The result is that while the peaky user is exceeding the cost of electricity as priced by the flat rate tariff, the flat and average user ends up paying for these raised costs. Effectively a form of cross-subsidizing[14]. This is made worse by the fact that flat users are often those in the lower income levels of society[13]. As such, several studies in North America (2010) and India (2016) by the IEEE & the World Bank recommend that lower income households would save far more, and pay less with per-usage rates in lieu of flat rates. This much is true however, only in cases where households successfully respond to variations in price. This is perhaps the biggest deterrent of RTP at the moment, and a reason for flat rates tariffs’ continued utilization[15].

Hidden Generation charge: People cannot retrieve their consumption pattern from their energy bill

Flat rate tariffs effectively shield consumers from fluctuating generation charges. However as a consequence, the users are unaware of the cost of generation as well. Where /kWh rates are able to reflect this, flat rate tariffs on their own make this comparison impossible. As such, an estimated /kWh rate based on the flat rate tariff is often made to enable this comparison. However, as Greacen et al. puts it, this is an apples-to-oranges comparison as flat rates serve to recover cost in a vastly different grid. This feature is beneficial for private suppliers but must be regulated to ensure flat rate tariffs are set at cost reflective margins[5].

How much energy is wasted or not used in the case of electricity flat rates?

While it is known that some consumers experience under-consumption or over-consumption when charged with a flat rate tariff, specific data to support such claims are hard to come by[10]. This phenomenon manifests in leaving lights on as it is paid for anyway, or simply not turning off an appliance for the same reason. In this manner, flat rates heavily discourage efficient and conscientious use of electricity. One such method of mitigating this is by applying a ‘per device’ price. This allows a saving by ridding the need for a load limiter. However, the saving from not installing a load limiter necessitates that each household’s device inventory is up to date. This means costly spontaneous visits from the utility to ensure there are no additional devices that exceed the agreed upon limit[5].

Flat rates are designed to cover the cost of an average consumer, naturally, some consumer groups will over consume and others, under consume. This behaviour leads to some cross-subsidizing and inequitable pricing. Additionally, due to a lack of metering, it is practically impossible to measure how much energy is unused—relative to the average expected consumption—or used in excess[10].

Unfortunately, no study examined for this article lists an example of how much energy is wasted with flat rates.

What is known from several studies such as those conducted by The Study Group is that flat rates have reason to be avoided. Flat rates have been found to lead to over consumption as well as inhibits energy efficiency (systemically and in terms of usage practice)[16].

Examples of Impacts/Case Studies

On the Inequity of Flat Rate Pricing | Australia, 2014

- Looks at the effects of flat rate pricing on consumer groups

- Compares these effects to those known for smart meter enabled households

- Findings reveal that half of a population effectively cross-subsidizes the other half

- The ones who subsidize are most often households already in financial hardship

- Gains from applying real-time pricing and demand response can accrue to AUS 1.6 Billion per annum for the East Coast grid

Impacts of Small Scale Electricity Systems | Asia, 2016

- Studies the impacts of different tariff structures in India and Nepal

- Finds recommendations to improve affordable energy access:

- There is a preference for a micro-grid compared to extending access to the larger national network

- Though the norm in India is a flat rate, metering is an increasingly growing option among suppliers due to rising consumption

- Metering and per-usage rates provide a viable way of reducing cost to low consumption consumers, and preventing violations for the supplier

- Assesses wholesale and retail electricity pricing

- Compares different tariff structures

- Recognizes the value of economic efficiency due to flat rates

- Recommends a more seasonal form of flat rate tariffs

- Finds that flat rates applied to all classes is inequitable

- Time-based tariffs only work best for the consumer where one is involved and responds to price signals

- Flat rate tariffs

- Net metering

- Financing and Funding Portal

- Raising fixed rate charges and the issues of doing so (ACEEE, 2014)

- The impact of dynamic pricing on low income consumers (ACEEE, 2014)

- See also Chapter 9: Setting tariffs and recommendations on regulation for tariffs in mini-gridsTenenbaum, B., Greacen, C., Siyambalapitiya, T., & Knuckles, J. (2014). From the Bottom Up: How Small Power Producers and Mini-Grids Can Deliver Electrification and Renewable Energy in Africa. The World Bank. Link

- ↑ 1.0 1.1 Herweg, F. & Mierendorff, K., 2011. Uncertain Demand, Consumer Loss, Aversion, and Flat-rate Tariffs. Journal of the European Economic Association ene Available at: http://www.sciencedirect.com/science/article/pii/S092876551100042X, June.fckLR

- ↑ Hobman, E. V., Frederiks, E. R., Stenner, K. & Meikle, S., 2016. Uptake and usage of cost-reflective electricity pricing: Insights from psychology and behavioural economics. Renewable and Sustainable Energy Reviews Available at: http://www.sciencedirect.com/science/article/pii/S1364032115015270, 5 January, Volume 57, pp. 455-467.fckLR

- ↑ National Action Plan for Energy Efficiency, 2009. Customer Incentives for Energy Efficiency Through Electric and Natural Gas Rate Design, s.l.: EPA Available at: https://www.epa.gov/sites/production/files/2015-08/documents/rate_design.pdf.fckLR

- ↑ Philipp, D., 2014. Billing Models for Energy Services in Mini-Grids , s.l.: https://www.giz.de/fachexpertise/downloads/2014-en-philipps-pep-fachworkshop-minigrids.pdf.fckLR

- ↑ 5.0 5.1 5.2 5.3 5.4 Greacen, C., Knuckles, J., Siyambalapitiya, T. & Tenenbaum, B., 2014. From the Bottom Up | How Small Power Producers and Mini-Grids Can Deliver Electrification and Renewable Energy in Africa, Washington D.C.: https://openknowledge.worldbank.org/bitstream/handle/10986/16571/9781464800931.pdf?sequence=1&isAllowed=y.fckLR

- ↑ 6.0 6.1 Agarwal, A., Rao, N. D. & Wood, D., 2015. IMPACTS OF SMALL-SCALE ELECTRICITY SYSTEMS, s.l.: WRI Available at: https://www.wri.org/sites/default/files/Impacts_of_Small-Scale_Electricity_Systems.pdf.fckLR

- ↑ Buchmann, E. et al., 2017. Ehtiopia Energy Situation. [Online] Available at: https://energypedia.info/wiki/Ethiopia_Energy_SituationfckLR[Accessed 2017].fckLR

- ↑ Sioshansi, F. P., 2012. A.3 Estimating the Hedging Cost Premium in Flat Electricity Rates. In: http://app.knovel.com/hotlink/pdf/id:kt00BJUUP1/smart-grid-integrating/estimating-hedging-cost, ed. Smart Grid - Integrating Renewable, Distributed and Efficient Energy. s.l.:Elsevier Available at: http://app.knovel.com/hotlink/pdf/id:kt00BJUUP1/smart-grid-integrating/estimating-hedging-cost.fckLR

- ↑ 9.0 9.1 9.2 Alcott, H., 2011. Rethinking Real Time Pricing. Resource and Energy Economics Available at: http://www.sciencedirect.com/science/article/pii/S092876551100042X, June, 33(4), pp. 830-842.fckLR

- ↑ 10.0 10.1 10.2 Braithwait, S., Hansen, D., O & Sheasy, M., 2007. Retail Electricity Pricing And Rate Design In Evolving Markets, s.l.: EEI Available at: http://eei.org/issuesandpolicy/stateregulation/Documents/Retail_Electricity_Pricing.pdf.fckLR

- ↑ IFC, 2017. OPERATIONAL AND FINANCIAL PERFORMANCE OF MINI-GRID DESCOS, s.l.: World Bank Group, Available at: http://sun-connect-news.org/fileadmin/DATEIEN/Dateien/New/IFC_Minigrids_Benchmarking_Report_Single_Pages_January_2017.pdf.fckLR

- ↑ Levinson, D. & Odlyzko, A., 2007. Too expensive to meter: The influence of transaction costs in transportation and communication, s.l.: http://www.dtc.umn.edu/~odlyzko/doc/metering-expensive.pdf.fckLR

- ↑ 13.0 13.1 13.2 Faruqui, A., Sergici, S. & Palmer, J., 2010. The Impact of Dynamic Pricing on Low Income Customers, s.l.: Edison Foundation Available at: http://www.edisonfoundation.net/IEE/Documents/IEE_LowIncomeDynamicPricing_0910.pdf.fckLR

- ↑ Downer, D. & Simshauser, P., 2014. On the Inequity of Flat-Rate Electricity Tariffs, s.l.: AGLE Available at: http://aglblog.com.au/wp-content/uploads/2014/07/No.41-On-the-inequity-of-tariffs.pdf.fckLR

- ↑ Mohsenian-Rad, A.-H. & Leon-Garica, A., 2010. Optimal Residential Load Control With Price Prediction in Real-Time Electricity Pricing Environments. IEEE Transactions on Smart Grid Available at: http://ieeexplore.ieee.org/document/5540263/, 1(2), pp. 120-133.fckLR

- ↑ World Energy Council, 2001. Pricing Energy In Developing Countries, London: World Energy Council Available at: http://regulationbodyofknowledge.org/wp-content/uploads/2013/03/WorldEnergyCouncil_Pricing_Energy_in.pdf.

- ↑ ESMAP, 2016. Ghana: Mini-Grids for Last-Mile Electrification, s.l.: Energy Sector Management Assistance Program Available at: http://sun-connect-news.org/fileadmin/DATEIEN/Dateien/New/ESMAP_Ghana_Mini_grids_for_last_Mile_Electrification_Optimized.pdf.fckLR

Retail Electricity Pricing and Rate Design in Evolving Markets | North America, 2007

Conclusion

The article revealed that the assumptions made at the start of this article have been proven to be true. Flat rate tariffs, while convenient for both parties do have several downsides that make it unfair for different consumption patterns. Consumers using larger quantities will benefit, while those using less end up cross-subsidizing. This inequity may aggravate the energy and wealth gap and will have to change to serve each consumer equally and fairly. This effect of course is modified by the wealth and consumption distribution of a community, where a community with more uniform and similar usage may benefit from lower tariffs. Flat rate tariffs will continue to be used where metering infrastructure is expensive and comes at a severe cost to the consumers. Especially in mini-grids, maximum load flat rate tariffs help regulate consumption with minimal added cost[17]. The point at which a metered tariff becomes more financially viable than a flat tariff in a mini grid is case-dependent. Factors like size, number of connected users, energy source, and the need to match generation costs in the area, all contribute to this[5].

Further information