Loans for Financing Hydropower

Overview

There is still considerable sensitivity in government circles to the opening-up of strategically and economically important public services - not only in the electricity sector - to non-governmental participation, even if carefully regulated and controlled. At the same time, there is also some nervousness in the private sector over entering into long-term commitments in a government dominated field, particularly in view of the risks to which the private party may be exposed.

Both parties may therefore aim initially at only an "arm's length" relationship with minimal mutual involvement and strictly limited risks. This can be achieved through subscription to loan capital - bonds or debentures - issued by governments or government controlled and quasi-governmental utilities. The private sector can thus contribute through arm's length financing to the capital needs for power system expansion without being in any way involved in the management and operation of any part of the utility service or being dependent on its financial success. Bonds and debentures, backed by the government or by governmental agencies, national or international, offer a fixed and guaranteed yield and have a firm redemption life (often termed loan life). The lender is thus shielded from a variable and, to some extent, unpredictable performance of the utility. The governmental utility service is free to develop and run its system as it considers appropriate. Marginal electricity supply development can be financially supported in this way provided the utility has the capacity to take on the necessary development effort and cope with subsequent exploitation. One of the causes of marginalisation is, however, that this capacity has been fully absorbed by the effort devoted to the central areas and that no significant spare capacity can be mobilized for local electrification.

Loan Financing

Participation of private capital by way of loans may be more attractive in cases where a small scheme is promoted from the outset as a non-governmental venture by particular interest groups or NGOs. The developer or promoter may then actively canvass for private support and attempt to manage the risk of failing to meet loan redemption commitments. The private investor will remain shielded from the commercial performance of the enterprise and yet have the satisfaction of contributing to a socially and economically important activity, if only in a strictly local context. This role may be particularly attractive for charitable bodies.

Private sector contributions to loan financing can also be secured indirectly through the provision of funds to aid and financing agencies which in turn support or invest in electrification projects. There are many possibilities, from donations to charitable or non profit-making bodies to the purchase of loan stock or bonds issued by multi-lateral agencies - the World Bank and Regional Investment Banks, for example. The funds solicited by multi-lateral agencies are not normally earmarked for a specific purpose but regular statements on the disposition of such funds are published; a fixed return is guaranteed by the governments supporting the agencies in question.

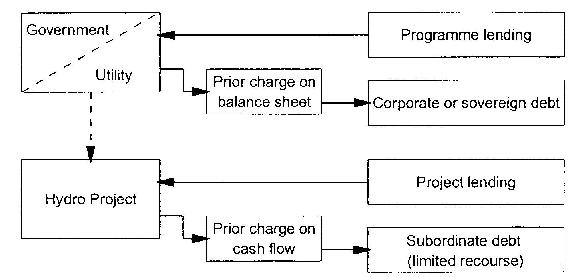

A clear distinction has to be made between:

- lending to government or utility. The disbursement of funds for a specific project remains the responsibility of one of these bodies. The lender stays at "arm's length" although he may wish to scrutinize the development programme for which finance is sought; this is certainly done by the financing agencies. Programme loans (which are not tied to a specific project) form a corporate or sovereign debt and a prior charge on the balance sheet of the undertaking concerned; the loan charges incurred by the undertaking have to be met before any other of its borrowings are paid off. Debt management can be difficult where there is scarcity of development capital and defaulting on sovereign debt is not uncommon. Programme lending can therefore be risky in spite of its priority status.

- lending for a particular project (sometimes termed "direct lending"). The organization responsible for project implementation - which may well be government or utility - has to form a separate and financially independent entity to manage this project. With such Project Loans, loan sums are redeemed from the cash flow generated by the project. The borrower's debt is subordinate to indebtedness incurred directly by government or utility. The lender has recourse only to the assets created out of his loan; hence he is lending with "limited recourse". The value of the assets created is his security or collateral but he will naturally look for more far-reaching guarantees from governments - his own and the borrower's and from national and international agencies.

The two alternative loan arrangements are presented in the diagram. Programme lending at government or utility level is still widely practised by public and private financing institutions, especially also in connection with the structural adjustment of economic resources. The focus is however moving more towards project lending and hence towards closer involvement of the lender in the disbursement of the funds and in the objectives of the development proposal. Private-sector inputs, particularly for small schemes, tend now to concentrate on the funding of specific projects, even in the face of opposition to the proposed development on social or environmental grounds.

Soft Loan

A soft loan is:

1. A loan with a below-market rate of interest.

2. Loans made by multinational development banks and the World Bank to developing countries. Typically, soft loans have extended grace periods in which only interest or service charges are due. They also offer longer amortization schedules and lower interest rates than conventional bank loans[1].

Example - India

Promoting small hydropower projects is one of the policy instruments in the National Policy for Hydropower Development of India to accelerate the pace of hydropower development. The Ministry of Non-Conventional Energy Sources (MNES) deals with all matters related to Small Hydel Projects (up to 3 MW capacity). These projects are being provided with the following incentives:

- incentives for detailed survey & investigation and preparation of DPR.

- Incentives during the execution of the project in the form of capital/ interest subsidy.

- Special incentives for execution of small hydro projects in the North Eastern Region by the Government departments/SEBs/State agencies.

- Financial support for renovation, modernisation and upgrading of old small hydro power stations.

The Small Hydel Projects are site specific and depending on the hydrology, typically the plant load factor varies from 40 to 60%. The Small Hydel Projects upto 25 MW will also be transferred to MNES in order to provide greater thrust for its development. Government of India proposes to provide soft loans to these projects (up to 25 MW) through IREDA / PFC/ REC and other financial institutions and MNES would announce a suitable package of financial incentives for the accelerated development of Small Hydel Projects upto 25 MW station capacity. The State Government and Central and State Hydro Corporations like NHPC / NEEPCO etc. would be encouraged to take up a cluster of small/mini hydel schemes on Build, Operate and Transfer basis, and other suitable arrangements.

Related Links:

Micro-hydro revolving fund in Peru (see also Chapter 4 in The provision of access through the expansion of micro hydro and mini-grids)

International support for renewables in China

Commercial Loan

A commercial loan is a debt-based funding arrangement that a business can set up with a financial institution. The proceeds of commercial loans may be used to fund large capital expenditures and/or operations that a business may otherwise be unable to afford[1].

Further Information

- Further types of financing for MHP can be found here.

- Micro-hydro revolving fund in Peru Micro-hydro revolving fund in Peru (see also Chapter 4 in The provision of access through the expansion of micro hydro and mini-grids

- International support for renewables in China

- Costs of Micro-Hydro Power Sites

- Micro-Hydro Power - Analysis of Costs

- Micro-hydro Power - Institutional Set-up