Difference between revisions of "Market Trends in the PicoPV Sector and the Role of Development Cooperation"

***** (***** | *****) m |

***** (***** | *****) m Tag: 2017 source edit |

||

| (19 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| + | [[Portal:Solar|►Back to Solar Portal]] | ||

| + | = The Link Between Energy Access and Poverty<br/> = | ||

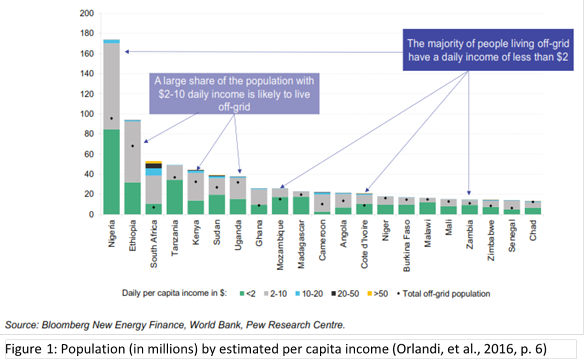

| − | + | According to estimates between 1 and 1.2 billion people have no [[Access to Modern Energy|access to electricity]]<ref name="WEO, 2015. World Energy Outlook 2015– Electricity Access Database. [Online] fckLRAvailable at: http://www.worldenergyoutlook.org/resources/energydevelopment/energyaccessdatabase/ [Accessed 27 July 2016].">WEO, 2015. World Energy Outlook 2015– Electricity Access Database. [Online] fckLRAvailable at: http://www.worldenergyoutlook.org/resources/energydevelopment/energyaccessdatabase/ [Accessed 27 July 2016].</ref>. A further 1 billion people have only access to unreliable and intermittent power supply<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref>. Most of these people live with less than US $ 3.10 a day.<ref name="The World Bank, 2012. Poverty Overview. [Online] Available at: http://www.worldbank.org/en/topic/poverty/overview [Accessed 28 July 2016].">The World Bank, 2012. Poverty Overview. [Online] Available at: http://www.worldbank.org/en/topic/poverty/overview [Accessed 28 July 2016].</ref> The link between lack of energy access and poverty is especially visible in rural areas, where the majority of people living off-grid has a daily income of less than $2”<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref>. Only a few households from higher income classes still remain unconnected from the grid, and those which generally have access to diesel generators. This link between energy access and power is clearly illustrated in Figure 1.<br/> | |

| − | + | [[File:Figure 1 Population (in millions) by estimated per capita income (Orlandi, et al., 2016, p. 6).png|border|left|585px|alt=Figure 1 Population (in millions) by estimated per capita income (Orlandi, et al., 2016, p. 6).png]]<div style="clear: both">Figure 1: Population (in millions) by estimated per capita income<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref><br/></div> | |

| − | + | Poor households often spend a much higher fraction of their income on energy, although the quality of energy services that they receive for this money is much lower than the quality of energy received by richer households, especially in comparison to those connected to the grid. Thus, many rural families in Africa spend an estimated amount of 10% of their household income on kerosene, torches or candles, which will provide them with only a few hours of lighting at night.<ref name="Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action.">Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action, p. 13.</ref><br/><br/> | |

| + | |||

| + | {{Go to Top}}<br/> | ||

| + | |||

| + | = How can PicoPV Products Address this Problem? = | ||

| + | |||

| + | The majority of people without access to the grid live in rural areas. Due to their low income they are not able to make major investments into a self-contained power supply. Instead, they often buy cheap dry cell battery operated LED lanterns that costs less than US $ 10. PicoPV products could provide an alternative by replace dry cell batteries with solar powered accumulators, which are of higher quality. Generally solar power is seen as the most suitable renewable energy technology for delivering wide spread energy access in rural areas. While other technologies, such as hydro power and wind, might be able to deliver more power at lower costs per Watt they have the disadvantage that they require a financially strong investor and that they are not easy to operate. Initial investments for solar technologies on household level are significantly lower. However, even with the current drop in PV prices, purchasing [[Solar Home Systems (SHS)|Solar Home Systems]] (SHSs) of 50 Watt or more, which would provide enough energy for lighting, communication, radio, TV and a fan, is too expensive for the majority of poor people.<ref name="Reiche, K. et al., 2010. What Difference can a PicoPV System Make?, Eschborn: Deutsche Gesellschaft für Technische Zusammenarbeit GmbH (GTZ).">Reiche, K. et al., 2010. What Difference can a PicoPV System Make?, Eschborn: Deutsche Gesellschaft für Technische Zusammenarbeit GmbH (GTZ).</ref>This is especially true for the off-grid population in rural areas as the complex logistics required for the retail of SHSs drive up the prices. Distribution and installation of SHSs is especially costly in areas where households live dispersed.<ref name="Reiche, K. et al., 2010. What Difference can a PicoPV System Make?, Eschborn: Deutsche Gesellschaft für Technische Zusammenarbeit GmbH (GTZ).">Reiche, K. et al., 2010. What Difference can a PicoPV System Make?, Eschborn: Deutsche Gesellschaft für Technische Zusammenarbeit GmbH (GTZ).</ref> In these areas PicoPV products are often a more affordable solution to get reliable access to modern forms of lighting.<br/> | ||

| − | |||

| − | |||

<br/> | <br/> | ||

| − | + | {{Go to Top}} | |

| − | + | ||

| − | + | = The PicoPV Market<br/> = | |

| − | + | The main reasons for a high market potential of PicoPV products are: | |

| − | * | + | *the strong drop in the prices for PicoPV products, which is expected to continue. |

| − | * | + | *the easy handling of Pico PV products which do not require complex installation, operation and maintenance. They can be sold over the counter (OTC) even in remote areas. |

| − | * | + | *the huge gain in welfare (in terms of health, safety, education) for a household which previously relied on torches, kerosene or candles for lighting. |

| − | * | + | *Unlike with [[Solar Home Systems (SHS)|SHSs]] people in remote areas are not worried that owning a PicoPV lamp will lower their chances of someday being connected to the grid.<ref name="Reiche, K. et al., 2010. What Difference can a PicoPV System Make?, Eschborn: Deutsche Gesellschaft für Technische Zusammenarbeit GmbH (GTZ).">Reiche, K. et al., 2010. What Difference can a PicoPV System Make?, Eschborn: Deutsche Gesellschaft für Technische Zusammenarbeit GmbH (GTZ).</ref> |

| − | |||

| − | |||

| + | <br/> | ||

| + | [[File:Figure 2 The theoretically addressable market for different lighting and electricity sources. (IFC, 2012, p. 30).png|border|618px|alt=Figure 2 The theoretically addressable market for different lighting and electricity sources. (IFC, 2012, p. 30).png]]<div style="clear: both"></div> | ||

Figure 2:The theoretically addressable market of different for different lighting and electricity sources. (IFC, 2012, p. 30) | Figure 2:The theoretically addressable market of different for different lighting and electricity sources. (IFC, 2012, p. 30) | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | Figure | + | Figure 3: Pay-back period for a $13 solar light (in months) (Orlandi, et al., 2016, p. 9) |

| − | + | ||

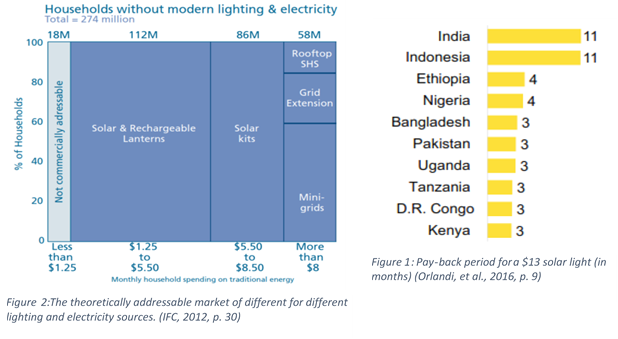

| + | <br/>PicoPV products have an estimated total market of 112 million households. These are people who live in households which currently spent between $1.25 and $5.50 on traditional energy sources a month.<ref name="IFC, 2012. From Gap to Opportunity: Business Models for Scaling up Energy Access, Washington: International Finance Corporation.">IFC, 2012. From Gap to Opportunity: Business Models for Scaling up Energy Access, Washington: International Finance Corporation.</ref> The market for PicoPV products is considered to be significantly larger compared to the markets for solar kits, SHSs, grid extension and mini-grids (Figure 2).<br/>Due to the total savings in fuel or dry cell battery expenditures achieved through PicoPV products they also have a very good payback time. A $13 solar light which replaces kerosene as a fuel is paid off after 3 months in many countries<ref>Calculations are based on the assumption that the solar lights will be replacing a kerosene lamp which runs for 3.85 hours a day and uses 0.03 litres/hours. The latest available kerosene retail prices for each country where used in the calculations.</ref>(Figure 3). Therefore, PicoPV lamps could provide significant savings for poorer households. It is estimated that a solar light could save a family over $60 a year and reduce their expenditure on lighting to just 2% of their household income. According to Lighting Africa (2010) people who currently use kerosene and were to invest into a solar light would receive a return of 15-45 of the initial cost of the light.<ref name="Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action.">Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action.</ref> “The Africa Progress Panel (2015) reported that halving the cost of inefficient lighting sources would save $50 billion for people living below $2.50 per day. It estimated that these monetary saving would be sufficient to reduce poverty by 16-26 million people.”<ref name="Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action.">Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action.</ref> | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | {{Go to Top}} | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | = Recent Market Trends<br/> = | ||

| + | |||

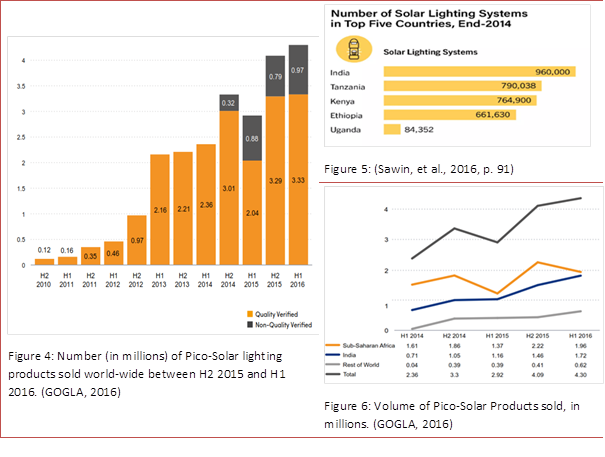

| + | The market for picoPV products has seen a strong increase over recent years. Overall sales in Sub-Saharan Africa and Asia have grown between 2010 and 2016 (Figure 4). By mid-2015, 44 million picoPV products had been sold world-wide (taking into account estimated sales of generic products). This represents a market of $300 million annually.<ref name="Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.">Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.</ref> Figure 5 gives an overview of the five countries with had the highest PicoPV product sales by the end of 2014. India leads the list, with 960,000 sales followed by Tanzania (790,038), Kenya (764,900), Ethiopia (661,630) and Uganda (84,352).<ref name="Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.">Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.</ref> “The largest market for off-grid solar products was sub-Saharan Africa (1.37 million units sold), followed by South Asia (1.28 million units sold).”<ref name="Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.">Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.</ref> In some countries<ref>Countries used for this data are: Mexico, Peru, Kenya, Tanzania, Bangladesh and Nepal.</ref> PicoPV products have already achieved quite high market penetration, with around 15-20% of the households using off-grid solar lighting systems.<ref name="Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.">Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.</ref> However, in Sub-Saharan Africa, branded and certified picoPV products experienced a decline in sales of almost 12% in the period between the second half of 2014 and the first half of 2015 (Figure 6).The drop was partly caused by supply-chain constraints faced by a number of companies. Furthermore, consumers proved to be quite price sensitive. A lot of them consider PicoPV systems still too expensive. On the other hand, incomes typically fluctuate with agricultural seasons, therefore sales figures are lower in the first half of a year in many countries like Ethiopia, Kenya and Tanzania, ergo Sub-Saharan Africa’s core pico-PV market countries.<ref name="GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.">GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.</ref> | ||

| + | |||

| + | <br/> | ||

| + | [[File:Figure 4 Number (in millions) of Pico-Solar lighting products sold world-wide between H2 2015 and H1 2016. (GOGLA, 2016).png|border|605px|alt=Figure 4 Number (in millions) of Pico-Solar lighting products sold world-wide between H2 2015 and H1 2016. (GOGLA, 2016).png]]<div style="clear: both"></div> | ||

| + | Figure 4: Number (in millions) of Pico-Solar lighting products sold world-wide between H2 2015 and H1 2016.<ref name="GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.">GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.</ref><ref name="GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.">GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.</ref> <ref name="GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.">GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.</ref><br/>Figure 5: (Sawin, et al., 2016, p. 91)<br/>Figure 6: Volume of Pico-Solar Products sold, in millions.<ref name="GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.">GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.</ref> | ||

| + | |||

| + | Most of the demand has been of “low cost, small and simple products”<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref>. As a result, an increasing number of PicoPV products on the market are ‘generics’, meaning that they are not produced by known brands and have not been quality controlled according to international standards. Generics could have accounted for over 50% of PicoPV sales in 2015. <ref>Generic sales: seems to be a bot of a gray number. Numbers varry between the ‘Off Grid Solar Market Trends Report (2015) and the new Global Off-Grid Lighting Report (2015). Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref> ‘Generic’ products are generally of lower quality, but they are a lot cheaper in comparison to similar branded products. That is the reason why they have taken over large shares of the market. These products present a risk to the development of PicoPV growth by undermining the market and potentially raising customer suspicions towards solar technologies, due to bad experiences with low quality products.<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref><br/> | ||

| + | |||

| + | {| style="width: 100%" cellspacing="1" cellpadding="1" border="1" | ||

| + | |- | ||

| + | | | ||

| + | [[File:PicoPV in Tanzania Mwanza.JPG|border|right|300px|alt=PicoPV in Tanzania Mwanza.JPG]]Original picoPV products in Mwanza, Tanzania.<br/> | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | | | ||

| + | Generic picoPV products in Mwanza, Tanzania. | ||

| + | |||

| + | [[File:PicoPV in Tanzania Mwanza3.JPG|border|300px|PicoPV_in_Tanzania_Mwanza3|alt=PicoPV_in_Tanzania_Mwanza3]] | ||

| + | |||

| + | |- | ||

| + | | [[File:PicoPV in Tanzania Mwanza2.JPG|border|right|300px|alt=PicoPV in Tanzania Mwanza2.JPG]]Original picoPV products in Mwanza, Tanzania.<br/> | ||

| + | | | ||

| + | Pictures by [[User:Gabriela Gemio|G. Beltrán]]<br/> | ||

| + | |||

| + | |} | ||

| + | |||

| + | {{Go to Top}}<br/> | ||

| + | |||

| + | <br/> | ||

| + | |||

= Distribution Models = | = Distribution Models = | ||

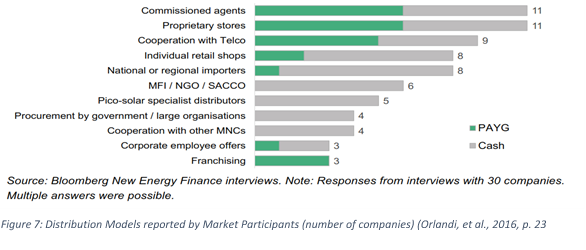

| + | Various different [[Lamp Distribution Models|distribution models]] are being used by companies for PicoPV products. Some companies have set up their own distribution network in developing countries, operating their own stores and training sales agents. Others use the existing network and cooperate with NGOs, companies and credit cooperatives.<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref> “The most successful model for distributing branded products has largely included the market that exists today”<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref>. Since the main target demographic of PicoPV products lives in remote rural areas, the ‘last mile distribution’ of the products is often a major challenge. A report from Kenya found that “an important part of the supply chain are the … ‘energy entrepreneurs’” who sell products in remote areas.<ref name="Delegation of German Industry and Commerce in Kenya, 2013. Target Market Study Kenya - Solar PV and Wind Power, Nairobi: German Energy Desk.">Delegation of German Industry and Commerce in Kenya, 2013. Target Market Study Kenya - Solar PV and Wind Power, Nairobi: German Energy Desk.</ref> Figure 7 gives on overview of the different distribution channels used by 30 companies interviewed worldwide, as well as showing the share of companies which use also the [[Fee-For-Service or Pay-As-You-Go Concepts for Photovoltaic Systems|pay-as-you-go]] (PAYG) approach in each distribution channel.<br/> | ||

| + | [[File:Figure 7 Distribution Models reported by Market Participants (number of companies) (Orlandi, et al., 2016, p. 23).png|border|700px|alt=Figure 7 Distribution Models reported by Market Participants (number of companies) (Orlandi, et al., 2016, p. 23).png]]<div style="clear: both"></div> | ||

Figure 7: Distribution Models reported by Market Participants (number of companies)<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref> | Figure 7: Distribution Models reported by Market Participants (number of companies)<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref> | ||

| − | + | {{Go to Top}} | |

| − | + | ||

| − | + | = Pay-as-you-go as Alternative to PicoPV = | |

| + | |||

| + | About one fifth of companies active in the off grid solar market offer [[Fee-For-Service or Pay-As-You-Go Concepts for Photovoltaic Systems|PAYG]] solar solutions. These allow customers to pay for the solar technologies in instalments, thus overcoming the high up-front cost of the products. In the end the [[Fee-For-Service or Pay-As-You-Go Concepts for Photovoltaic Systems|PAYG]] model will result in higher total cost for the customer compared to purchasing the solar product in cash. However, as payments are made in small instalments PAYG offers financing advantages to the customers as well as giving them a service guarantee and a higher quality of service. The technical risk is shifted towards the retailer. On the other hand the retailer benefits from a higher market uptake. The PAYG model enables customers to use solar products which otherwise would be outside of their financial reach. Therefore, [[Fee-For-Service or Pay-As-You-Go Concepts for Photovoltaic Systems|PAYG services]] are especially relevant for more expensive products such as [[Solar Home Systems (SHS)|SHSs]] or solar kits. In the case of solar kits the weekly fees charged to customers can be as low as 1.5 US $ and thus in a range comparable to the typical energy expenditures of poor households. However, turnovers of 6 US $/month/customer are not interesting for PAYG companies on the medium and long run and often even not profitable as PAYG business are capital intensive. Companies have to make significant initial investments in purchasing and installing of devices and establishing the necessary service infrastructure. The investments only amortize over a long period of time if fees are low. Therefore, PAYG companies tend towards solar systems with higher services levels with monthly fees of 12 to 45 US $ that allow higher profit margins. On the medium and long run the business model of PAYG may lead companies to focus their business on more wealthy households as they are able to pay for more services. | ||

| − | + | {{Go to Top}} | |

| − | + | == Data Collecting with PAYG == | |

| − | |||

| − | |||

| − | + | PAYG companies collect three main types of data: | |

| − | *demographic data points on potential customers which | + | *demographic data points on potential customers which is used to decide whether they will be accepted on a credit check |

*payments data is collected for every transaction using payment technology. | *payments data is collected for every transaction using payment technology. | ||

| − | *Performance and usage data | + | *Performance and usage data is collected and sent to technicians or central databases at large companies.<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref> |

| − | + | ||

| + | Currently this data is mainly being collected along the side, however, it could potentially be very useful for the companies someday. The “value could either be unlocked by selling the database or expanding activities, for instance by extending credit to the best customers for purchases of other appliances such as TVs or clean cooking stoves”. | ||

| + | |||

| + | The database could also be used to give an overview of people’s assets and to establish credit scorings, allowing for more effective financial decisions to be made.<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref> | ||

| + | |||

| + | On the medium and long run this could lead PAYG companies to focus their business on more wealthy households as they are able to pay for more services. In addition, the need for PAYG service providers to collect data raises many concerns about data security and ensuring that the users privacy rights are respected. No matter which technology is being used, there will always be a risk that the data could be hacked.<ref name="Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.">Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.</ref> As the amount of data being collected increases so does the need for advanced security systems. This is an issue which will need to be considered in more detail if the PAYG module is to continue on its current growth trend. | ||

| + | |||

| + | {{Go to Top}} | ||

| + | |||

= Market Trends and the Role of International Cooperation = | = Market Trends and the Role of International Cooperation = | ||

| − | + | ||

| + | Due to falling costs, increasing marketing activities and growing consumer interest the PicoPV market has been growing rapidly in the last years. Small solar lanterns account for 97% of reported sales of solar systems in developing countries. However, [[PicoPV Types|PicoPV brand products]] are exposed to intense competition by generic products of lower [[Quality of PicoPV Systems|quality]] that are significantly cheaper. To push them out of the market PicoPV products must have an obvious benefit compared to these generic products justifying the higher sales price. | ||

| + | |||

| + | It is the task of international cooperation such as the Energising Development (EnDev) programme to enable customers to compare the strengths and weaknesses of generic and brand products through awareness campaigns and consumer information. The goal of development cooperation is to promote a positive welfare impact and a reduction of poverty through a rational acquisition of PicoPV products. On the supply side, it is important to create a value chain in the low price-segment with distributors and retailers offering products with a good price-to-quality-ratio even in remote areas and granting customers a warranty of 1 to 2 years for their products. | ||

| + | |||

| + | A possible alternative to purchasing PicoPV products is offered by [[Fee-For-Service or Pay-As-You-Go Concepts for Photovoltaic Systems|PAYG]] systems. They have become popular but with a tendency towards larger systems with higher service levels. Especially peri-urban areas and villages with higher population densities can expect to see a rise of this approach. In rural areas, where households live dispersed, the PAYG model is often not financially viable. In addition, the fees of [[Fee-For-Service or Pay-As-You-Go Concepts for Photovoltaic Systems|PAYG]] models with more expensive solar systems are generally not affordable for poor households. Therefore, the cash sales model is likely to continue dominating the market for poor households.<br/> | ||

| + | |||

| + | {{Go to Top}} | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | = Further reading = | ||

| + | |||

| + | *2016 [https://www.lightingglobal.org/wp-content/uploads/2016/03/20160301_OffGridSolarTrendsReport.pdf World Bank Group/Bloomberg Off-Grid Solar Market Trends Report] | ||

| + | *2018 [https://www.lightingglobal.org/2018-global-off-grid-solar-market-trends-report/ The 2018 Global Off-Grid Solar Market Trends Report]<br/> | ||

| + | *Sunconnect article: 12.06.2018. , Harald Schützeichel [https://www.sun-connect-news.org/articles/market/details/the-development-of-the-off-grid-industry-stagnates/ The development of the off-grid industry stagnates] | ||

| + | |||

<br/> | <br/> | ||

| − | + | <br/> | |

| + | |||

| + | = References<br/> = | ||

This paper was presented at the OTTI 2016 by [[User:Hellpap|Carsten Hellpap]] on [http://www.energy-access.eu/programme.html#c1493 September 22, 2016.] | This paper was presented at the OTTI 2016 by [[User:Hellpap|Carsten Hellpap]] on [http://www.energy-access.eu/programme.html#c1493 September 22, 2016.] | ||

| Line 59: | Line 132: | ||

<references /><br/> | <references /><br/> | ||

| + | {{Go to Top}} | ||

| + | |||

| + | [[Category:Energy_Access]] | ||

| + | [[Category:Sub-Saharan_Africa]] | ||

| + | [[Category:PicoPV]] | ||

| + | [[Category:Solar]] | ||

[[Category:Financing_Solar]] | [[Category:Financing_Solar]] | ||

| − | |||

| − | |||

| − | |||

| − | |||

Latest revision as of 13:17, 25 March 2022

The Link Between Energy Access and Poverty

According to estimates between 1 and 1.2 billion people have no access to electricity[1]. A further 1 billion people have only access to unreliable and intermittent power supply[2]. Most of these people live with less than US $ 3.10 a day.[3] The link between lack of energy access and poverty is especially visible in rural areas, where the majority of people living off-grid has a daily income of less than $2”[2]. Only a few households from higher income classes still remain unconnected from the grid, and those which generally have access to diesel generators. This link between energy access and power is clearly illustrated in Figure 1.

Poor households often spend a much higher fraction of their income on energy, although the quality of energy services that they receive for this money is much lower than the quality of energy received by richer households, especially in comparison to those connected to the grid. Thus, many rural families in Africa spend an estimated amount of 10% of their household income on kerosene, torches or candles, which will provide them with only a few hours of lighting at night.[4]

How can PicoPV Products Address this Problem?

The majority of people without access to the grid live in rural areas. Due to their low income they are not able to make major investments into a self-contained power supply. Instead, they often buy cheap dry cell battery operated LED lanterns that costs less than US $ 10. PicoPV products could provide an alternative by replace dry cell batteries with solar powered accumulators, which are of higher quality. Generally solar power is seen as the most suitable renewable energy technology for delivering wide spread energy access in rural areas. While other technologies, such as hydro power and wind, might be able to deliver more power at lower costs per Watt they have the disadvantage that they require a financially strong investor and that they are not easy to operate. Initial investments for solar technologies on household level are significantly lower. However, even with the current drop in PV prices, purchasing Solar Home Systems (SHSs) of 50 Watt or more, which would provide enough energy for lighting, communication, radio, TV and a fan, is too expensive for the majority of poor people.[5]This is especially true for the off-grid population in rural areas as the complex logistics required for the retail of SHSs drive up the prices. Distribution and installation of SHSs is especially costly in areas where households live dispersed.[5] In these areas PicoPV products are often a more affordable solution to get reliable access to modern forms of lighting.

The PicoPV Market

The main reasons for a high market potential of PicoPV products are:

- the strong drop in the prices for PicoPV products, which is expected to continue.

- the easy handling of Pico PV products which do not require complex installation, operation and maintenance. They can be sold over the counter (OTC) even in remote areas.

- the huge gain in welfare (in terms of health, safety, education) for a household which previously relied on torches, kerosene or candles for lighting.

- Unlike with SHSs people in remote areas are not worried that owning a PicoPV lamp will lower their chances of someday being connected to the grid.[5]

Figure 2:The theoretically addressable market of different for different lighting and electricity sources. (IFC, 2012, p. 30)

Figure 3: Pay-back period for a $13 solar light (in months) (Orlandi, et al., 2016, p. 9)

PicoPV products have an estimated total market of 112 million households. These are people who live in households which currently spent between $1.25 and $5.50 on traditional energy sources a month.[6] The market for PicoPV products is considered to be significantly larger compared to the markets for solar kits, SHSs, grid extension and mini-grids (Figure 2).

Due to the total savings in fuel or dry cell battery expenditures achieved through PicoPV products they also have a very good payback time. A $13 solar light which replaces kerosene as a fuel is paid off after 3 months in many countries[7](Figure 3). Therefore, PicoPV lamps could provide significant savings for poorer households. It is estimated that a solar light could save a family over $60 a year and reduce their expenditure on lighting to just 2% of their household income. According to Lighting Africa (2010) people who currently use kerosene and were to invest into a solar light would receive a return of 15-45 of the initial cost of the light.[4] “The Africa Progress Panel (2015) reported that halving the cost of inefficient lighting sources would save $50 billion for people living below $2.50 per day. It estimated that these monetary saving would be sufficient to reduce poverty by 16-26 million people.”[4]

Recent Market Trends

The market for picoPV products has seen a strong increase over recent years. Overall sales in Sub-Saharan Africa and Asia have grown between 2010 and 2016 (Figure 4). By mid-2015, 44 million picoPV products had been sold world-wide (taking into account estimated sales of generic products). This represents a market of $300 million annually.[8] Figure 5 gives an overview of the five countries with had the highest PicoPV product sales by the end of 2014. India leads the list, with 960,000 sales followed by Tanzania (790,038), Kenya (764,900), Ethiopia (661,630) and Uganda (84,352).[8] “The largest market for off-grid solar products was sub-Saharan Africa (1.37 million units sold), followed by South Asia (1.28 million units sold).”[8] In some countries[9] PicoPV products have already achieved quite high market penetration, with around 15-20% of the households using off-grid solar lighting systems.[8] However, in Sub-Saharan Africa, branded and certified picoPV products experienced a decline in sales of almost 12% in the period between the second half of 2014 and the first half of 2015 (Figure 6).The drop was partly caused by supply-chain constraints faced by a number of companies. Furthermore, consumers proved to be quite price sensitive. A lot of them consider PicoPV systems still too expensive. On the other hand, incomes typically fluctuate with agricultural seasons, therefore sales figures are lower in the first half of a year in many countries like Ethiopia, Kenya and Tanzania, ergo Sub-Saharan Africa’s core pico-PV market countries.[10]

Figure 4: Number (in millions) of Pico-Solar lighting products sold world-wide between H2 2015 and H1 2016.[10][10] [10]

Figure 5: (Sawin, et al., 2016, p. 91)

Figure 6: Volume of Pico-Solar Products sold, in millions.[10]

Most of the demand has been of “low cost, small and simple products”[2]. As a result, an increasing number of PicoPV products on the market are ‘generics’, meaning that they are not produced by known brands and have not been quality controlled according to international standards. Generics could have accounted for over 50% of PicoPV sales in 2015. [11] ‘Generic’ products are generally of lower quality, but they are a lot cheaper in comparison to similar branded products. That is the reason why they have taken over large shares of the market. These products present a risk to the development of PicoPV growth by undermining the market and potentially raising customer suspicions towards solar technologies, due to bad experiences with low quality products.[2]

|

Original picoPV products in Mwanza, Tanzania.

|

Generic picoPV products in Mwanza, Tanzania. |

| Original picoPV products in Mwanza, Tanzania. |

Pictures by ***** |

Distribution Models

Various different distribution models are being used by companies for PicoPV products. Some companies have set up their own distribution network in developing countries, operating their own stores and training sales agents. Others use the existing network and cooperate with NGOs, companies and credit cooperatives.[2] “The most successful model for distributing branded products has largely included the market that exists today”[2]. Since the main target demographic of PicoPV products lives in remote rural areas, the ‘last mile distribution’ of the products is often a major challenge. A report from Kenya found that “an important part of the supply chain are the … ‘energy entrepreneurs’” who sell products in remote areas.[12] Figure 7 gives on overview of the different distribution channels used by 30 companies interviewed worldwide, as well as showing the share of companies which use also the pay-as-you-go (PAYG) approach in each distribution channel.

Figure 7: Distribution Models reported by Market Participants (number of companies)[2]

Pay-as-you-go as Alternative to PicoPV

About one fifth of companies active in the off grid solar market offer PAYG solar solutions. These allow customers to pay for the solar technologies in instalments, thus overcoming the high up-front cost of the products. In the end the PAYG model will result in higher total cost for the customer compared to purchasing the solar product in cash. However, as payments are made in small instalments PAYG offers financing advantages to the customers as well as giving them a service guarantee and a higher quality of service. The technical risk is shifted towards the retailer. On the other hand the retailer benefits from a higher market uptake. The PAYG model enables customers to use solar products which otherwise would be outside of their financial reach. Therefore, PAYG services are especially relevant for more expensive products such as SHSs or solar kits. In the case of solar kits the weekly fees charged to customers can be as low as 1.5 US $ and thus in a range comparable to the typical energy expenditures of poor households. However, turnovers of 6 US $/month/customer are not interesting for PAYG companies on the medium and long run and often even not profitable as PAYG business are capital intensive. Companies have to make significant initial investments in purchasing and installing of devices and establishing the necessary service infrastructure. The investments only amortize over a long period of time if fees are low. Therefore, PAYG companies tend towards solar systems with higher services levels with monthly fees of 12 to 45 US $ that allow higher profit margins. On the medium and long run the business model of PAYG may lead companies to focus their business on more wealthy households as they are able to pay for more services.

Data Collecting with PAYG

PAYG companies collect three main types of data:

- demographic data points on potential customers which is used to decide whether they will be accepted on a credit check

- payments data is collected for every transaction using payment technology.

- Performance and usage data is collected and sent to technicians or central databases at large companies.[2]

Currently this data is mainly being collected along the side, however, it could potentially be very useful for the companies someday. The “value could either be unlocked by selling the database or expanding activities, for instance by extending credit to the best customers for purchases of other appliances such as TVs or clean cooking stoves”.

The database could also be used to give an overview of people’s assets and to establish credit scorings, allowing for more effective financial decisions to be made.[2]

On the medium and long run this could lead PAYG companies to focus their business on more wealthy households as they are able to pay for more services. In addition, the need for PAYG service providers to collect data raises many concerns about data security and ensuring that the users privacy rights are respected. No matter which technology is being used, there will always be a risk that the data could be hacked.[2] As the amount of data being collected increases so does the need for advanced security systems. This is an issue which will need to be considered in more detail if the PAYG module is to continue on its current growth trend.

Market Trends and the Role of International Cooperation

Due to falling costs, increasing marketing activities and growing consumer interest the PicoPV market has been growing rapidly in the last years. Small solar lanterns account for 97% of reported sales of solar systems in developing countries. However, PicoPV brand products are exposed to intense competition by generic products of lower quality that are significantly cheaper. To push them out of the market PicoPV products must have an obvious benefit compared to these generic products justifying the higher sales price.

It is the task of international cooperation such as the Energising Development (EnDev) programme to enable customers to compare the strengths and weaknesses of generic and brand products through awareness campaigns and consumer information. The goal of development cooperation is to promote a positive welfare impact and a reduction of poverty through a rational acquisition of PicoPV products. On the supply side, it is important to create a value chain in the low price-segment with distributors and retailers offering products with a good price-to-quality-ratio even in remote areas and granting customers a warranty of 1 to 2 years for their products.

A possible alternative to purchasing PicoPV products is offered by PAYG systems. They have become popular but with a tendency towards larger systems with higher service levels. Especially peri-urban areas and villages with higher population densities can expect to see a rise of this approach. In rural areas, where households live dispersed, the PAYG model is often not financially viable. In addition, the fees of PAYG models with more expensive solar systems are generally not affordable for poor households. Therefore, the cash sales model is likely to continue dominating the market for poor households.

Further reading

- 2016 World Bank Group/Bloomberg Off-Grid Solar Market Trends Report

- 2018 The 2018 Global Off-Grid Solar Market Trends Report

- Sunconnect article: 12.06.2018. , Harald Schützeichel The development of the off-grid industry stagnates

References

This paper was presented at the OTTI 2016 by ***** on September 22, 2016.

- ↑ WEO, 2015. World Energy Outlook 2015– Electricity Access Database. [Online] fckLRAvailable at: http://www.worldenergyoutlook.org/resources/energydevelopment/energyaccessdatabase/ [Accessed 27 July 2016].

- ↑ 2.00 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.10 Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.

- ↑ The World Bank, 2012. Poverty Overview. [Online] Available at: http://www.worldbank.org/en/topic/poverty/overview [Accessed 28 July 2016].

- ↑ 4.0 4.1 4.2 Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action, p. 13. Cite error: Invalid

<ref>tag; name "Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action." defined multiple times with different content Cite error: Invalid<ref>tag; name "Scott, A. et al., 2016. Accelerating Access to Electricity in Africa with Off-Grid Solar - Executive Summary, London: Practical Action." defined multiple times with different content - ↑ 5.0 5.1 5.2 Reiche, K. et al., 2010. What Difference can a PicoPV System Make?, Eschborn: Deutsche Gesellschaft für Technische Zusammenarbeit GmbH (GTZ).

- ↑ IFC, 2012. From Gap to Opportunity: Business Models for Scaling up Energy Access, Washington: International Finance Corporation.

- ↑ Calculations are based on the assumption that the solar lights will be replacing a kerosene lamp which runs for 3.85 hours a day and uses 0.03 litres/hours. The latest available kerosene retail prices for each country where used in the calculations.

- ↑ 8.0 8.1 8.2 8.3 Sawin, J. L., Seyboth , K. & Sverrisson, F., 2016. Renewables 2016: Global Status Report, s.l.: REN21.

- ↑ Countries used for this data are: Mexico, Peru, Kenya, Tanzania, Bangladesh and Nepal.

- ↑ 10.0 10.1 10.2 10.3 10.4 GOGLA, 2016. Global Off-Grid Solar Market Report: Semi-Anual Sales and Impact Data, January - June 2016, s.l.: Global Off-Grid Lighting Association.

- ↑ Generic sales: seems to be a bot of a gray number. Numbers varry between the ‘Off Grid Solar Market Trends Report (2015) and the new Global Off-Grid Lighting Report (2015). Orlandi, I., Tyabji , N. & Chase , J., 2016. Off-Grid Solar Markets Trend Report 2016, s.l.: Bloomberg New Energy Finance and Lighting Global.

- ↑ Delegation of German Industry and Commerce in Kenya, 2013. Target Market Study Kenya - Solar PV and Wind Power, Nairobi: German Energy Desk.