Difference between revisions of "Market for PicoPV"

***** (***** | *****) (Created page with "== Electrification situation in general == Every fourth human being is without access to electricity today. Electrification rates are the lowest in Sub-Sahara Afric...") |

***** (***** | *****) |

||

| Line 1: | Line 1: | ||

| − | == Electrification situation in general == | + | == Electrification situation in general == |

| + | Every fourth human being is without access to electricity today. Electrification rates are the lowest in Sub-Sahara Africa<br>(SSA), but rural access rates remain surprisingly low even in countries with high GDP and impressive overall access rates. The fact that rural access rates are lagging behind across all countries and regions reflects the fact that costs of traditional grid electrification grow exponentially with falling population rates (and load) density. <ref name="Primer">2010. GTZ. What difference can a PicoPV system make? Early findings on small Photovoltaic systems - an emerging lowcost energy technology for developing countries</ref> | ||

| + | | ||

| − | + | [[Image:Electrification Rates.JPG]] | |

| − | | + | <ref name="Primer" /> |

| − | + | | |

| − | |||

| − | |||

| − | |||

| − | | ||

The figure below show the most off-grid Arican households. | The figure below show the most off-grid Arican households. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | | |

| − | + | == Detail analysis of certain African Countries: == | |

| − | |||

| − | |||

| − | + | Targetanalysis in '''Uganda '''show a potential market expansion: | |

| − | + | *Up to 60 % of the rural households can afford micro-solar systems of 2-20 Wp (lanterns, phone chargers, radio systems). | |

| + | *10 % of the rural population can potentially afford medium to larger SHS PV systems (50 Wp – 150 Wp). | ||

| + | *30 % of the rural households would be considered too poor to afford a solar PV system.<ref>2009. GTZ. Uganda’s Solar Energy Market - Target Market Analysis.</ref> | ||

| + | | ||

| + | Analysis of market in '''Rwanda '''describe an encouraging development: Growth in the SHS sector is slow but encouraging with at least three companies actively marketing their products. Given the low-income level of the country, this report estimates that less than 10 % of the total off-grid rural population (1.7 million un-electrified) would have an interest in a 10-50 Wp PV system and another 30-40 % would be interested in a micro system. The following table provides a basic model for this market:<ref>2009. GTZ. Rwanda’s Solar Energy Market Target Market Analysis.</ref> | ||

| − | + | <br> | |

| − | | + | [[Image:SHS Market in Rwanda.JPG|612x185px|SHS Market in Rwanda.JPG]] |

| − | + | | |

| + | ..to be continued | ||

| + | <br> | ||

<references /> | <references /> | ||

| − | | + | |

| − | [[Category:Solar]][[Category:PicoPV]] | + | [[Category:Solar]] [[Category:PicoPV]] |

Revision as of 15:28, 16 November 2010

Electrification situation in general

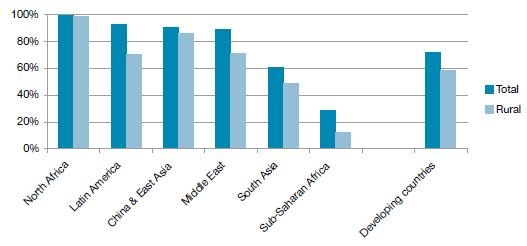

Every fourth human being is without access to electricity today. Electrification rates are the lowest in Sub-Sahara Africa

(SSA), but rural access rates remain surprisingly low even in countries with high GDP and impressive overall access rates. The fact that rural access rates are lagging behind across all countries and regions reflects the fact that costs of traditional grid electrification grow exponentially with falling population rates (and load) density. [1]

The figure below show the most off-grid Arican households.

Detail analysis of certain African Countries:

Targetanalysis in Uganda show a potential market expansion:

- Up to 60 % of the rural households can afford micro-solar systems of 2-20 Wp (lanterns, phone chargers, radio systems).

- 10 % of the rural population can potentially afford medium to larger SHS PV systems (50 Wp – 150 Wp).

- 30 % of the rural households would be considered too poor to afford a solar PV system.[2]

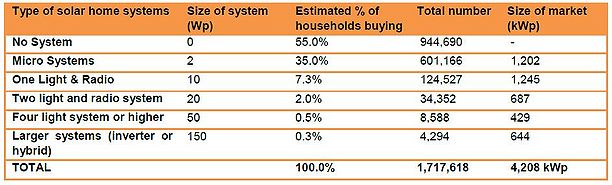

Analysis of market in Rwanda describe an encouraging development: Growth in the SHS sector is slow but encouraging with at least three companies actively marketing their products. Given the low-income level of the country, this report estimates that less than 10 % of the total off-grid rural population (1.7 million un-electrified) would have an interest in a 10-50 Wp PV system and another 30-40 % would be interested in a micro system. The following table provides a basic model for this market:[3]

..to be continued

- ↑ 1.0 1.1 2010. GTZ. What difference can a PicoPV system make? Early findings on small Photovoltaic systems - an emerging lowcost energy technology for developing countries

- ↑ 2009. GTZ. Uganda’s Solar Energy Market - Target Market Analysis.

- ↑ 2009. GTZ. Rwanda’s Solar Energy Market Target Market Analysis.