Click here to register!

Difference between revisions of "Market for Solar Home Systems (SHS) in East Africa"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 21: | Line 21: | ||

| | ||

| − | [[Image: | + | [[Image:Solar PV Offgrid Potential Ethiopia.JPG|495x339px|Solar PV Offgrid Potential Ethiopia.JPG]]<br> |

| | ||

| Line 59: | Line 59: | ||

As the table below shows, market potentials for Kenya are promising. | As the table below shows, market potentials for Kenya are promising. | ||

| − | [[Image: | + | [[Image:SHS Potential Market Kenya.JPG|530x162px|SHS Potential Market Kenya.JPG]]<br> |

*PV sales have been growing at a sustained rate of over 10 % per year for the last ten years. | *PV sales have been growing at a sustained rate of over 10 % per year for the last ten years. | ||

| Line 94: | Line 94: | ||

Demand by private sector for solar products remains limited, but may become an important niche market. Growth in the SHS sector is slow but encouraging with at least three companies actively marketing their products. | Demand by private sector for solar products remains limited, but may become an important niche market. Growth in the SHS sector is slow but encouraging with at least three companies actively marketing their products. | ||

| − | The future outlook however seems promising | + | The future outlook however seems promising: High electricity prices, combined with some favourable policy indicate future opportunities in the grid-connected solar PV market towards 2015. <br> |

| − | <br> | + | <br> |

| + | |||

| + | [[Image:Marketanalysis_SHS_Rwanda.jpg|597x196px]] | ||

<br> | <br> | ||

| + | |||

| + | An overview of key solar market players and the market analysis in detail can be read up here. | ||

| + | |||

| + | |||

<references /> | <references /> | ||

[[Category:Solar]] | [[Category:Solar]] | ||

Revision as of 12:07, 2 December 2010

East Africa is an market of the future when it comes to renewable energies: In Ethiopia, Kenya, Rwanda, Tanzania and Uganda was a great economical growth the recent years. A consequence of population and economic growth is an increasing need for energy.

Networks and power plants are outdated and lacking in efficiency. In many rural areas, people have no access at all to electricity.

In view of the acute energy crisis, demand for alternative and innovative supply options is growing. Enormous natural potentials exist for photovoltaics, wind, water and bioenergy as well as for solar and geothermal energy.

Almost all countries in the region have launched promotion programmes for renewable energies, and competitive bidding offers interesting business opportunities within ongoing development programmes. The private sector is also showing increasing interest in renewable alternatives, especially after the oil price shock in 2008.

With regard to this developing market, the following part presents potentials of East Africa.

Target Market Analysis for Ethiopia

Even if Ethiopia has abundant solar energy resources (national annual average irradiance is estimated to be 5.2 kWh/m2/day), the Ethiopian solar market is still at an early development stage with an estimated installed capacity of 5 MWp. Growth during the 1990s was under 5 % but has reached 15-20 % during the last few years, primarily driven by the telecom market that constitutes 70 % of installed capacity. Five or six companies supply 90 % of the market and some lack a specialist focus on solar PV.

SHS has the greatest annual growth rate of 20 % with few suppliers and driven by the extension of low-cost housing and real estate developments.

Additionally, the political environment already turned into positive: Since 14th December 2009 the Ministry of Finance and Economic Development (MoFED) lifted the import duty fees on PV modules and balance of system (BOS).

Local Capacities

Availability of qualified solar technicians in Ethiopia is limited. Training is mainly given by companies to their technicians. Whenever there is a training session it is sporadic, non-modular and project specific. As a result a cadre of highly skilled technician with technical capacities to design, size and install larger and more complex PV systems is lacking. Including in-house technicians of local PV dealers, all of whom are based in Addis Ababa, a total of about 50 technicians are believed to exist nationwide.

Outlook: Market Potentials

The market potential is estimated at 52 MW, the majority within the solar home systems (SHS) market and continued expansion in telecom sector.

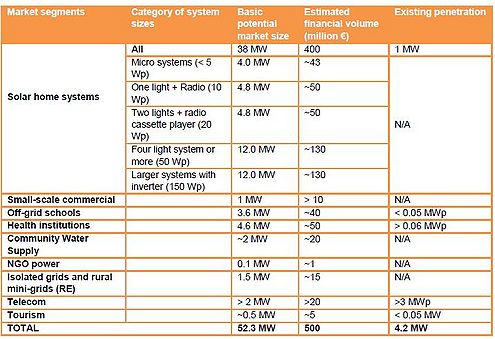

Table below shows the Solar PV Off-Grid Market Potential in Ethiopia[1].

Important conclusions:

- The total potential market for solar PV in Ethiopia is estimated to be about 52 MW. Currently, the estimated market penetration rate is about 8 % of the potential.

- Over three-quarters of the total demand comes from the household sector distantly followed by the health institutions, rural schools and the telecom industry.

- At present, institutional PV markets (health institutions and schools) are financed almost entirely by donors. Out of an estimated potential market of about 10 MW in community and institutional PV market, only a small fraction (about 1 %) is currently served. Since the bulk of the market is yet to be tapped and financing is most likely to come from donors, demand in these sectors will continue to provide much needed incentives to the commercial PV market growth.

For futher information about market analysis for Solar PV in Ethiopia see the full report.

Target Market Analysis for Kenya

Kenya boasts a solar market that is one of the most mature and well-established in Africa. At over 1.2 MW in sales per year, the PV market offers opportunities in solar home systems, institutional systems and government procurement. Growth has been constant at over 10 % per year over the past ten years.

By African standards, Kenya’s market is well-developed, though largely based on over-the-counter sales of PV components and solar home systems (SHS). In general there is a good availability of PV modules, batteries, inverters, charge regulators and appliances. The value chain has reached into rural areas where there is a relatively strong foundation of experienced (if uncertified) basic level installers.

Local Capacities

Outside of the solar companies themselves, Kenya has no organised solar energy training programmes for artisans or engineers. It does have some University-level courses in alternative energy, but these are fairly basic and do not prepare “solar engineers” per se.

When it comes to design and installation of more complex systems (above 1 kWp), there is a lack of significant engineering capacity at all levels. Installation of small systems is accomplished by agents or specialist installers (who often market systems on their behalf) or systems are simply self-installed (>30 %). Concerning installation or design of large systems, international supply companies are often called to bring in expertise.

For the size of the market, there is a sufficient pool (> 50) of experienced solar technicians in Kenya who can handle the installation of “medium” sized systems.

Even improvements in training programmes are necessary, a base of capacity in Kenya for the installation of SHS, institutional systems, inverter-battery backup and pumping systems exists - even though most installers do not have formal training.

Outlook: Market Potentials

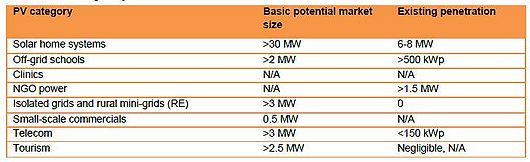

As the table below shows, market potentials for Kenya are promising.

- PV sales have been growing at a sustained rate of over 10 % per year for the last ten years.

- Furthermore, costs for off-grid solutions increased rapidly in 2008. In addition, 70 % of the country is far from the grid, and this means that commercial, NGO and households that had previously relied on generator power are reconsidering use of generators and switching to hybrid solar.[2]

For further information seethe full report.

Target Market Analysis for Rwanda

Rwanda has a net deficit of power with a national electrification rate of 8 % and a rural electrification rate of 1 %. The current installed capacity of Rwanda’s energy sector amounts more than 85 MW, however, the country needs a total of at least 100 MW to meet present demand and sustain its economic growth.

A combination of high electricity and fuel prices, and a growing economy, as well as export opportunities into the Democratic Republic of the Congo (DRC), should increase the overall demand for solar PV equipment in Rwanda. However, due to the small size of the country, the medium to long- term off-grid opportunities will gradually decrease as the grid network is enlarged and coverage made denser.

The Rwandan solar PV market is an early-stage market of small players that is poorly integrated into the global and regional solar energy industry. But the Rwandan Government is working with partners such as the European Union, the World Bank and the Belgium Government to install solar PV in public health centres, schools and government administration facilities in the rural areas. Their total installation target is approximately 200 kWp in solar PV installations commencing in 2009.

Only one company called Modern Technology Services (MTS) is aggressively exploiting this market at present.

Local Capacities

There are five to six players active in the Rwandan solar energy sector, and they are the primary repositories of solar energy skills (as well as a number of independent contractors). There is also some regional expertise in solar energy in smaller towns. Rwandan solar energy companies are just beginning to build up capacities. Their products are rather expensive (over USD 20/Wp), and there is limited capacity to design and deliver sophisticated PV systems and battery backups.

Capacity building services have been conducted sporadically by a variety of players in the past ten years. Unfortunately, there is no coordinated repository of trained PV technicians, and as yet there is no accepted code of practice or curriculum for PV in the country in university or among technician practitioners.

There is a task force in the Ministry of Infrastructure to establish some basic standards for solar PV equipment and installation.

An international NGO is set to start producing PV modules from second quality silicon wafers and to sell them in the local market at discounted prices.

Outlook: Market Potentials

Government and donor projects will continue to dominate the market in the short and medium term. The government plans to increase grid connection to 16 % by 2012 at a cost of USD 400 million. This will require a combination of expanded grid extension and new power generation. By the year 2020, the grid coverage is projected to reach 35 %.

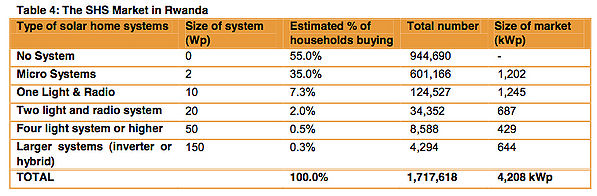

Demand by private sector for solar products remains limited, but may become an important niche market. Growth in the SHS sector is slow but encouraging with at least three companies actively marketing their products.

The future outlook however seems promising: High electricity prices, combined with some favourable policy indicate future opportunities in the grid-connected solar PV market towards 2015.

An overview of key solar market players and the market analysis in detail can be read up here.