Difference between revisions of "Micro Hydropower Debt Fund Component - EnDev Nepal"

***** (***** | *****) (Created page with "= Overview<br/> = Despite vast hydropower resources in Nepal the majority of the rural population has currently no access to electricity. Whereas up to 90 % of the urban popul...") |

***** (***** | *****) |

||

| Line 30: | Line 30: | ||

[[File:GIZ EnDev Nepal Debt Found Scheme.png|left|GIZ EnDev Nepal Debt Found Scheme.png]] | [[File:GIZ EnDev Nepal Debt Found Scheme.png|left|GIZ EnDev Nepal Debt Found Scheme.png]] | ||

| + | |||

| + | == <br/> == | ||

== Capacity Building for Rural Communities<br/> == | == Capacity Building for Rural Communities<br/> == | ||

Revision as of 14:46, 12 November 2012

Overview

Despite vast hydropower resources in Nepal the majority of the rural population has currently no access to electricity. Whereas up to 90 % of the urban population is connected to the grid, only a minority (estimated 35 %) of the rural population has access to electricity.

Micro-Hydropower (MHP) has been promoted in Nepal for decades to supply remote rural areas with power. The typical size of MHP ranges from 5- 100 kW, however, most installed schemes have a capacity between 15 and 30 kW. Up to 2011, about 1977 MHP schemes were implemented, accounting for a total installed capacity of about 13.9 MW.

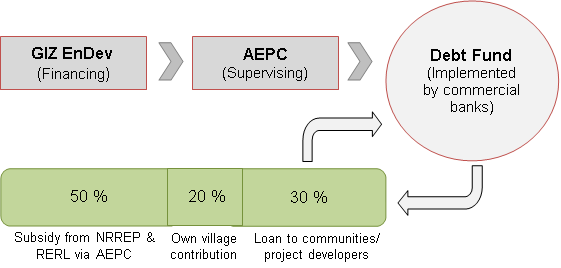

Micro Hydropower Subsidy Schemes

The government agency Alternative Energy Promotion Centre (AEPC) has promoted the off-grid electrification of rural areas in Nepal for many years and implements two major support programmes for MHP. Both the UNDP/World Bank funded Renewable Energy for Rural Livelihood Programme (RERL) and the newly established multi donor funded National Rural and Renewable Energy Programme (NRREP) provide subsidies for MHP which cover between 33 – 50 % of the total investments (average of 45%). The project developer, either a local community or a private developer, consequently faces high own contributions. Including equity and subsidy there is still a fund gap of approximately 30% of total costs and external funding is required. In particular, poor and remote communities (that face high transport costs) fail in providing sufficient own resources.

Status Quo of Green Finance

Commercial banks could be in a position to fill this gap. However, due to insufficient experiences in dealing with renewable energy projects and lending to rural areas, there is a high perceived risk and commercial banks either reject any involvement or ask for high securities and interest rates which project developers cannot provide. Consequently, many viable MHP projects are not implemented.

Energising Development Nepal

A solution is to build partnerships between commercial banks and local micro finance institutions (MFIs) in a way that they act as the banks’ local agent. These financial institutions have the local knowledge and willingness to invest but do not have sufficient funds for lending. Following this model banks can become familiar with lending to renewable energy projects and experience that it can be a profitable business. A debt fund which is supported by GIZ can provide the initial capital for gaining first experiences. If successful, banks will use their own funds to continue lending. In addition, it will improve the access to credit for electrifying the rural population of Nepal which otherwise would never receive electricity. In the long-term this can also contribute to a viable MHP sector lending whereby projects are implemented only on a commercial basis without the involvement of subsidies. The intervention of Energising Development (EnDev) in Nepal aims to provide access to energy for rural areas and bring the private sector into financing of MHP schemes. Therefore, the linkages between AEPC as leading rural electrification agency, commercial banks, project developers and MFIs have to be strengthened.

Micro Hydropower Debt Fund

The Micro Hydropower Debt Fund (MHDF) is set up under the supervision of the Alternative Energy Promotion Centre (AEPC) and placed at two competitively selected banks for administration. Besides providing financial support to local communities which would like to setup and operate their own MHP plants, the fund administering banks are expected to experience ways of financing MHP projects. MFIs will be involved as a partner and administer the loan in the field on behalf of the selected partner bank. Once the loans have been repaid by the communities it will be used for financing further MHP schemes.

Support of AEPC

AEPC as the main implementation partner and supervisor of the fund has currently limited experience in cooperating with the private financial sector. EnDev provides support to develop modalities and mechanisms of the fund in order to finance rural Renewable Energy projects in cooperation with commercial banks. It will support AEPC to establish similar funds for various renewable energy technologies in the future.

Capacity Building for Partner Banks and MFIs

One major bottleneck for private finance in the MHP sector is the banks’ limited ability to assess the viability of loan requests by communities intending to build and operate MHP schemes. Therefore, AEPC in cooperation with EnDev supports the commercial partner banks to develop appraisal processes for concerned loans. In addition, the MFIs will be strengthened to facilitate the loan administration in the field. The partner banks will be informed on potential project sites that have qualified for AEPC subsidies and are financially as well as technically viable. Furthermore, it proposes suitable local financial institutions (MFIs) that are close to the project site and could act as a local agent.

Capacity Building for Rural Communities

Alongside the existing support from both programmes (NRREP & RERL) rural communities, which receive a loan from one of the two partner banks, are strengthened in order to operate the MHP scheme in an economic sustainable manner. Besides operational training the promotion of productive end-use of electricity will be addressed.

Expected Outcome

- Installation of approx. 920 kW of additional generation capacity.

- Providing 5,700 households with electricity (approx. 31,000 persons).

- partner banks and MFIs have the knowledge and practically proven that they can assess MHP projects in rural areas and select those which are viable for financing.

- Communities are trained on the promotion of productive end-use of electricity.

- Strengthening the cooperation between AEPC, project developers and national as well as local micro financial institutions (MFIs).

- Demonstration that lending to the rural micro hydro sector can be profitable and a commercially viable business.