Difference between revisions of "Off-grid Energy Companies and Financial Institutions - Need and Options for Collaboration"

***** (***** | *****) m |

***** (***** | *****) |

||

| Line 17: | Line 17: | ||

<br/> | <br/> | ||

| + | |||

= Finance for Off-grid Energy Companies = | = Finance for Off-grid Energy Companies = | ||

| + | |||

| + | The financing requirement of the companies in different stages<ref name="Funding the Sun : New Paradigms for Financing Off-Grid Solar Companies- https://energypedia.info/wiki/Publication_-_Funding_the_Sun_:_New_Paradigms_for_Financing_Off-Grid_Solar_Companies_(English)">Funding the Sun : New Paradigms for Financing Off-Grid Solar Companies- https://energypedia.info/wiki/Publication_-_Funding_the_Sun_:_New_Paradigms_for_Financing_Off-Grid_Solar_Companies_(English)</ref>: [[File:Off-grid Financing.png|thumb|left|700pxpx|alt=Off-grid Financing.png]]<br/> | ||

== Off-grid Energy Companies - <span style="font-size: 19.04px; line-height: 23.8px; background-color: initial">Shift to Consumer Finance?</span> == | == Off-grid Energy Companies - <span style="font-size: 19.04px; line-height: 23.8px; background-color: initial">Shift to Consumer Finance?</span> == | ||

| Line 82: | Line 85: | ||

<br/> | <br/> | ||

| + | |||

= Benefits of Working Together = | = Benefits of Working Together = | ||

Revision as of 20:33, 7 May 2020

Overview

Off-grid energy companies are characterized by small loan delivery channels with highly automated cashless payment processes, agent distribution network, cloud-based monitoring and significant leverage over the borrower [1]. They are also assest heavy and are service oriented with high dependence on consumer financing[2].

These companies have enjoyed a rapid growth due to their ability to tap into the low-income communities in a profitable manner using PAYG method. However, despite their proven benefits and profitability, the scale up and diversification of these companies are constrained by the lack of access to commercial debt. Therefore, there is a huge potential for OECs to collaborate with financial institutions to diversify their product range and to get commercial funding from financial institutions[1]. The off-grid sector is expected to need USD 26 billion in financing to meet the SDG7 goals by 2030[2].

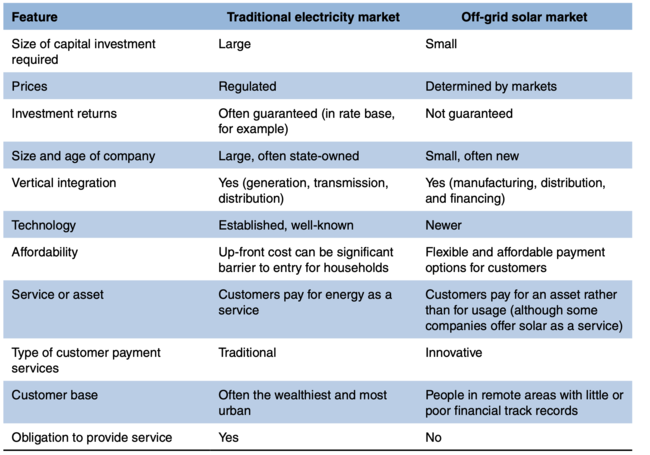

Difference between the off-grid and the traditional electricity market is shown below[2]:

Finance for Off-grid Energy Companies

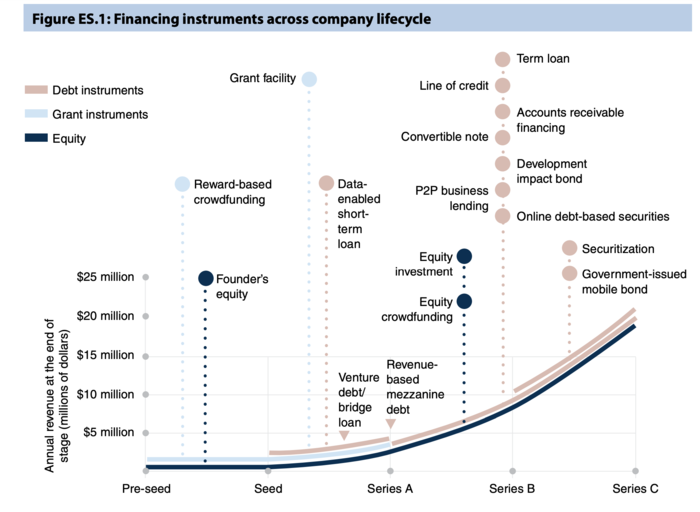

The financing requirement of the companies in different stages[2]:

Off-grid Energy Companies - Shift to Consumer Finance?

Off-grid energy companies (OECs) in this article refer to those companies in Africa that sell solar energy systems to customers based on the PAYG model i.e the total cost for the energy system is broken down into weekly/monthly payments. The customers usually make a small down payment in the beginning and small weekly/monthly payment for using the system, until they finally own the system. In case of failure to pay, the OECs remotely switch off the energy system or repossess them.

To increase their revenue and to keep ahead of competitors, there is a natural tendency for OECs to provide secondary loans to their existing customers. The secondary loan is provided along with the energy systems (initially provided under the PAYG model) for activities such as buying a motorbike or other appliances. For the secondary loans, the energy system continue to act as a control point for loan repayment. In case of failure to pay, the energy system is switched off and the secondary assets might be repossessed.

OECs are not financial institutions and in many countries they are not allowed to offer secondary loans (except for energy systems). Therefore, there is a need as well as opportunity for successful collaboration between OECs and financial institutions to get additional funding and expand its product range.

Financial Institutions - Potential Source of Finance

Financial institutions in Sub-Saharan Africa are classified by large loan size, high margin and low business volume which is the opposite of financial services provided to low-income customers. Low-income customers are mostly assets-led, low balance and high-volume business.

Entry-level accounts for low-income clients are likely to have low balances, make few transactions and use of fixed physical infrastructure such as bank branches and automated teller machines (ATMs) which in end might result in loss rather than profit, for the bank. Similarly, issues like high-collateral requirement, time-consuming applications and inefficient cash management also force financial institutions to mostly focus on the salaried and relatively better-off customers.

Therefore, financial institutions are not able to establish a commercially viable channel to reach out to the bulk of the African market consisting of low-income clients and the OECs present a unique opportunity for financial institutions to tap into its already existing low-income customer base.

Resources of Off-grid Energy Companies and Financial Institutions

The table below shows the simplified analysis of the resources of off-grid energy companies and financial institutions:

| Off-grid Energy Companies | Financial Institution | |

| Assets | agent network | branch network |

| IT system for account management | ||

| customer relationship | ||

| cloud-based customer relation management (CRM) systems | banking expertise | |

| leverage over customers | credit assessment | |

| banking license | ||

| Financial products | Loans | |

| saving accounts | ||

| money transfer services | ||

| Key strengths | ability to reach lower-income populations at scale, profitably with financial services | banking license and know -how |

| Key weakness | banking license and know-how | ability to reach lower-income populations at scale, profitably, with financial services |

Benefits of Working Together

Large Portfolio of Loans

Most of the OECs started out as energy system retailers but with progress over time, have amassed a large portfolio of loans. Managing these large portfolio of loans is outside their core competence and requires skilled financial capabilities. The loan also has to be refinanced. For example, if an installed system costs on average USD 150, then to reach 1 million consumers, OECs will have to raise around USD 150 million in consumer loans. As the sector expands the consumer loans will also increase.

Because of the possibility to remotely switch off the energy systems (cloud-management) in cases of no payments, OECs loan have higher repayment rate than their borrower's profile might suggest. Also, OECs have the infrastructure in place to manage small loans offered to relatively unknown customers.

On the other hand, financial institutions have the competence and infrastructure to manage consumer credit risk and to provide loans. Working togehter, the Financial institutions can help OECs to manage their loan portfolio and the OECs can offer access to their already existing user database.

Access to Low-cost Finance

Financial institutions can also fund a portfolio at a lower cost than that of OECs using long term deposits (of customers) as compared to a commercial debt.

A study among Mircro Finance Institution ( MFI) accounts in Sub-Saharan Africa showed that the MFI accounts are mostly used for saving rather than borrowing. In 2015, the aggregate amount of MFI deposits in Sub-saharan Africa was USD 5 billion. Should this amount be available to OECs, then this amount would be enough to finance consumer loans for 33 million TIER 2 solar home systems with a value of USD 150 each.

For financial institutions, the energy portfolio has a good rate of return.

Foreign Exchange Risk

Most of the capital for OECs is raised in hard currency such as USD or Euro from international equity investors while the consumer loans are given out in the local currency. This exposes OECs to risks associated with currency exchange and in case, the local currency is devalued, it will impose additional cost on the OECs which is unrelated to its business and operations.

On the other hand, the consumer deposits (savings) in financial instituions are made in the local currency. If there is a collaboration between the financial insitutions and the OECs then the OECs can borrow the consumer deposits for scaling up instead of a commercial debt from international investors. This will mitigate the risks associated with currency exchange as both the consumer loans given to customers and the capital raised by OECs will be in local currency.

Options to Work Together

There are several options for how OECs and financial institutions can work together:

Through a close partnership: OECs and financial institutions can forge a close partnership where both the parties focus on their core competencies i.e. the OECs focuses on retail sale of energy services and the financial institutions take care of consumer finance. Considering both the parties are ready to form a partnership, the following points will have to be considered:

- Who signs the loan and which regulations are followed?

- Criteria for identifying the consumers as well as opening an account for them

- Integrating the payment technologies of OECs and financial systems

- Criteria for managing customer relations eg. what brand to promote and how to communicate

OECs obtain a banking license: OECs could apply for a banking license and build the banking business from the base.

Pros: Eventually, this will give OECs access to the stable and cheap source of funding (via their customers' saving deposits) and to capture the entire value chain, resulting in higher profits.

Cons: Having a financial arm would mean more management time and resources put into its developing which might result in less focus on selling energy systems. Also the OECs would need time to accumulate the capital as well as fulfill the rules for becoming a deposit-taking institutions.

Financial institutions obtain/set-up an OEC business: Financial institution can obtain/set-up an OEC business in two ways:

- buy PAYGO-enabled Solar Home Systems and then offer these systems via an affiliate business or wholly owned subsidiary.

- acquire an OEC and integrate the OEC's technology and operations within the financial institutions.

Further Information

Reference

- This article is based on the following publication:Muench, D. Waldron, D.(2016).Access to Energy and Finance: An Integrated Approach to Capture High-Growth Opportunity in Africa.http://www.cgap.org/publications/access-energy-and-finance-integrated-approach