Difference between revisions of "Recent Market for PicoPV Systems"

***** (***** | *****) m (→Rwanda) |

***** (***** | *****) m (Wiki Gardener moved page Recent Market for PicoPV systems to Recent Market for PicoPV Systems without leaving a redirect) |

(No difference)

| |

Revision as of 14:08, 12 January 2015

Overview

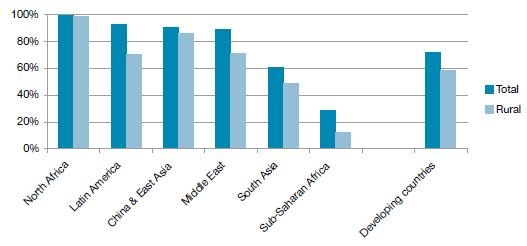

Electrification Situation in General: Every fourth human being is without access to electricity today. Electrification rates are the lowest in Sub-Sahara Africa (SSA), but rural access rates remain surprisingly low even in countries with high GDP and impressive overall access rates. The fact that rural access rates are lagging behind across all countries and regions reflects the fact that costs of traditional grid electrification grow exponentially with falling population rates (and load) density. [1] The figure [1] shows electrification rates for various regions. Obviously, it is important to concentrate on Sub-Saharan Africa and South Asia.

Market for PicoPV

-> see Market for PicoPV article

Outlook

Various reasons indicate a rpaidly growing market of PicoPV system:

- Regarding prospect expectations, producing cost for components of PicoPV systems are falling in the next five years. This will enhance affordability for low-income households.

- Recently, liquid fuels remain the world's largest energy source. [2] Therefore, increasing - and volatile - fossil fuel costs (further enhanced through carbon emission reduction targets)[3], will increase the search of households for alternative options.[1] (for price projection scenarios see International Energy Outlook 2010).

- Another cause for a growing market is a population growth, which is increasing faster than grid growth. Therefore, growing off-grid popluations are expected.

- Recently, already a third (1.6 billion people) of the off-grip population use a mobile phone. Due to the fact, that mobile phones don't need any cross country cables and required broadcast towers are easy to set up, their diffusion over the countries will increase even more. [4] The example of Uganda shows the great spread of mobile phones in comparison to grid connection: Over 90% of people living in rural area have no access to grid, but almost 50% already have broadcast towers.[4] Charging their phone often necessitate an expensive or difficult proceeding. Therefore, cooperations with phone companies as well as an increasing number of PicoPV systems with a mobile charge application could increase this trend and provide a more economic solution.[5] Solar Energy Foundation forecasts, that "solar trade will develop along the route of broadcasting towers."[4] (p.4).

Moreover, Pico PV systems may well be part of a solution, by allowing “pre-electrification”. There are several good reasons to be bullish regarding the potential of this emerging off-grid market segment:

- Pico PV systems are over-the-counter consumer products and don’t need specific know-how for installation or O&M. Therefore, distribution has lower transaction costs than for all other grid or off-grid alternatives.

- The welfare gain from electrification at household level is arguably largest after stepping from flame-based lighting to efficient electric lights.

- Grid electrification is perceived by the vast majority of households as the “gold standard” of electrification. But with PicoPV systems, consumers do not fear that PicoPV lamps will bar them from future grid roll-out, as they often do in the case of SHSs.[1]

Analysis of Certain African Countries

Uganda

Target analysis in Uganda show a potential market expansion:

- Up to 60 % of the rural households can afford micro-solar systems of 2-20 Wp (lanterns, phone chargers, radio systems).

- 10 % of the rural population can potentially afford medium to larger SHS PV systems (50 Wp – 150 Wp).

- 30 % of the rural households would be considered too poor to afford a solar PV system.[6]

Rwanda

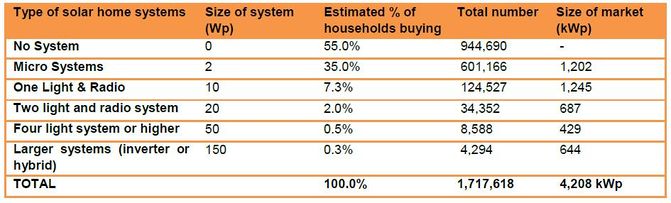

Analysis of market in Rwanda describe an encouraging development: Growth in the SHS sector is slow but encouraging with at least three companies actively marketing their products. Given the low-income level of the country, this report estimates that less than 10 % of the total off-grid rural population (1.7 million un-electrified) would have an interest in a 10-50 Wp PV system and another 30-40 % would be interested in a micro system. The following table provides a basic model for this market:[7]

Tanzania

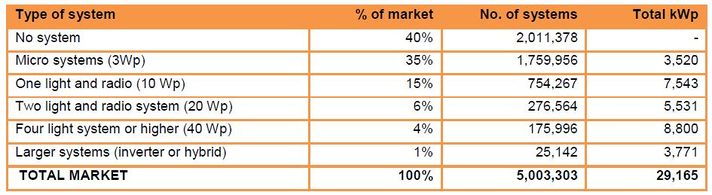

Analysis of market in Tanzaniaclaims, that is growing at a rapid rate. Secondly, it is large, as can be seen in the table below. Thirdly, for qualifying companies, the government will be offering USD 2/Wp per sold system for systems below 100 Wp.[8]

Further Information

References

- ↑ 1.0 1.1 1.2 1.3 GIZ.2010. What difference can a PicoPV system make? Early findings on small Photovoltaic systems - an emerging lowcost energy technology for developing countries: GIZ PicoPV Booklet Cite error: Invalid

<ref>tag; name "Difference" defined multiple times with different content Cite error: Invalid<ref>tag; name "Difference" defined multiple times with different content Cite error: Invalid<ref>tag; name "Difference" defined multiple times with different content - ↑ Energy Information Administration. 2010. International Energy Outlook 2010

- ↑ GTZ Furel Price Index 2000-2009

- ↑ 4.0 4.1 4.2 Solar Energy Foundation. 2010. Sun Connect. Will the demand for mobile phones initiate a solar boom? Cite error: Invalid

<ref>tag; name "SEF" defined multiple times with different content Cite error: Invalid<ref>tag; name "SEF" defined multiple times with different content - ↑ _

- ↑ GTZ. 2009. Uganda’s Solar Energy Market - Target Market Analysis.

- ↑ GTZ. 2009. Rwanda’s Solar Energy Market Target Market Analysis.

- ↑ GTZ. 2009. Tanzania’s Solar Energy Market Target Market Analysis.