Difference between revisions of "Renewable Energy Support Mechanisms: Feed-In Tariffs and Auctions"

***** (***** | *****) |

***** (***** | *****) m |

||

| (5 intermediate revisions by 2 users not shown) | |||

| Line 4: | Line 4: | ||

Energy policies set the goals for a country’s energy future. They create stability in the market, increasing the confidence of investors and thereby allow for energy support to be realised. Therefore, policies play an important role in the future development of (renewable) energy technologies. Renewable energy technologies are widely seen as the future. They provide clean energy using non-finite resources, help mitigate climate change, increase countries’ energy independencies and can improve energy security. However, many renewable energy technologies are relatively new and not yet as established as ‘convention’ energy generation technologies which burn fossil fuels. By choosing to shift their support mechanisms away from fossil fuels and towards renewable energy technologies governments can help boost these technologies in their countries. For an overview of all of the different renewable energy support mechanisms and their strengths and weaknesses have a look at the article [[Comparison of various Policy Tools for Promoting Renewable Energies|Comparison of various Policy Tools for Promoting Renewable Energies]]. | Energy policies set the goals for a country’s energy future. They create stability in the market, increasing the confidence of investors and thereby allow for energy support to be realised. Therefore, policies play an important role in the future development of (renewable) energy technologies. Renewable energy technologies are widely seen as the future. They provide clean energy using non-finite resources, help mitigate climate change, increase countries’ energy independencies and can improve energy security. However, many renewable energy technologies are relatively new and not yet as established as ‘convention’ energy generation technologies which burn fossil fuels. By choosing to shift their support mechanisms away from fossil fuels and towards renewable energy technologies governments can help boost these technologies in their countries. For an overview of all of the different renewable energy support mechanisms and their strengths and weaknesses have a look at the article [[Comparison of various Policy Tools for Promoting Renewable Energies|Comparison of various Policy Tools for Promoting Renewable Energies]]. | ||

| − | This article looks in detail at two of the main support mechanism, Feed-In Tariffs (FITs) and auctions. After a short definition and overview of each policy type the article examines how these policies can be implemented and looks at the effectiveness of each policy type at achieving certain objectives. Due to the complexity of renewable energy support mechanism it can often be difficult to judge which policy type might offer the most advantages for a given country. Especially for newly emerging and developing policies there are not yet that many case studies available which show the effects of a certain policy on the development of renewable energy technologies. Therefore, this article aims to provide a short guide on the benefits and disadvantages of FITs and auctions, based on a literature review and selected country examples. | + | This article looks in detail at two of the main support mechanism, Feed-In Tariffs (FITs) and auctions. After a short definition and overview of each policy type the article examines how these policies can be implemented and looks at the effectiveness of each policy type at achieving certain objectives. Due to the complexity of renewable energy support mechanism it can often be difficult to judge which policy type might offer the most advantages for a given country. Especially for newly emerging and developing policies there are not yet that many case studies available which show the effects of a certain policy on the development of renewable energy technologies. Therefore, this article aims to provide a short guide on the benefits and disadvantages of FITs and auctions, based on a literature review and selected country examples. |

{{Go to Top}} | {{Go to Top}} | ||

| + | <br/> | ||

== Background == | == Background == | ||

| Line 23: | Line 24: | ||

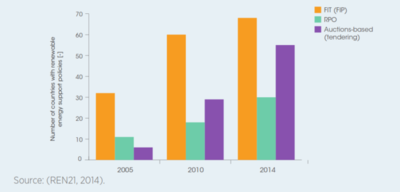

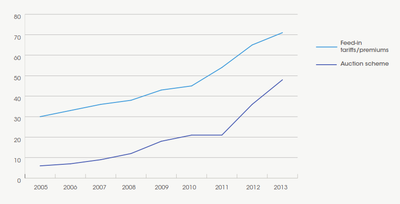

Figure 1 and Figure 2 show the development of different support mechanisms since 2005. As can be seen in 2005, FITs used to be the most popular support mechanism by far, while only 6 countries at the time had implemented auctions. Even today the FIT remains the most common support mechanism, however, auctions have seen a very strong growth and where implemented in over 60 countries by early 2015. (Ferroukhi, et al., 2015)<ref name="Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.">Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.</ref> | Figure 1 and Figure 2 show the development of different support mechanisms since 2005. As can be seen in 2005, FITs used to be the most popular support mechanism by far, while only 6 countries at the time had implemented auctions. Even today the FIT remains the most common support mechanism, however, auctions have seen a very strong growth and where implemented in over 60 countries by early 2015. (Ferroukhi, et al., 2015)<ref name="Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.">Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.</ref> | ||

| − | {| | + | {| style="width: 100%" cellspacing="0" cellpadding="0" border="1" |

|- | |- | ||

| style="width:313px" | | | style="width:313px" | | ||

| Line 33: | Line 34: | ||

|} | |} | ||

| − | + | <br/> | |

{{Go to Top}} | {{Go to Top}} | ||

| Line 53: | Line 54: | ||

<u>Net Metering:</u> The current retail price is paid for all renewable energy which is being exported to the grid. Electricity used on site reduces the electricity bills, which would normally also have to be paid at the retail price. Therefore, this model effectively means that all renewable energy which is being generated gets paid the current retail price. | <u>Net Metering:</u> The current retail price is paid for all renewable energy which is being exported to the grid. Electricity used on site reduces the electricity bills, which would normally also have to be paid at the retail price. Therefore, this model effectively means that all renewable energy which is being generated gets paid the current retail price. | ||

| − | <u>Net Billing:</u> The payments for electricity generated and electricity consumed are netted out over a certain period of time. This can be applied using either the gross FIT or the net FIT model. (Passey, et al., 2014)<ref name="Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.">Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.</ref> | + | <u>Net Billing:</u> The payments for electricity generated and electricity consumed are netted out over a certain period of time. This can be applied using either the gross FIT or the net FIT model. (Passey, et al., 2014)<ref name="Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.">Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.</ref> |

{{Go to Top}} | {{Go to Top}} | ||

| Line 59: | Line 60: | ||

=== Advantages and Disadvantages === | === Advantages and Disadvantages === | ||

| − | {| | + | {| cellspacing="0" cellpadding="0" border="1" style="width: 100%;" |

|- | |- | ||

| style="width:302px" | | | style="width:302px" | | ||

| Line 92: | Line 93: | ||

(Passey, et al., 2014) <ref name="Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.">Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.</ref> (Laumanns, et al., 2015)<ref name="Laumanns, U. et al., 2015. Feed-in Tariffs (FIT). [Online] Available at: https://energypedia.info/wiki/Feed-in_Tariffs_(FIT) [Accessed 25 August 2016].">Laumanns, U. et al., 2015. Feed-in Tariffs (FIT). [Online] Available at: https://energypedia.info/wiki/Feed-in_Tariffs_(FIT) [Accessed 25 August 2016].</ref> | (Passey, et al., 2014) <ref name="Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.">Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.</ref> (Laumanns, et al., 2015)<ref name="Laumanns, U. et al., 2015. Feed-in Tariffs (FIT). [Online] Available at: https://energypedia.info/wiki/Feed-in_Tariffs_(FIT) [Accessed 25 August 2016].">Laumanns, U. et al., 2015. Feed-in Tariffs (FIT). [Online] Available at: https://energypedia.info/wiki/Feed-in_Tariffs_(FIT) [Accessed 25 August 2016].</ref> | ||

| − | + | <br/> | |

{{Go to Top}} | {{Go to Top}} | ||

| Line 107: | Line 108: | ||

*[[Feed-in Tariffs Wind Energy|Feed-In Tariffs Wind Energy]] | *[[Feed-in Tariffs Wind Energy|Feed-In Tariffs Wind Energy]] | ||

| − | + | <br/> | |

{{Go to Top}} | {{Go to Top}} | ||

| Line 117: | Line 118: | ||

Renewable energy auctions, sometimes also called ‘demand auctions’ or ‘procurement auctions’ are a type of support mechanism for renewable energy technologies. In most cases renewable energy auctions are opened by the government of a country. They will specify the capacity (kW) or the electricity generation (kWh) which is up for auction, as well as the generation technology and sometimes the generation location. Project developers can than submit a bid to the auction, outlining their project proposal and stating the price per unit of electricity at which they will be able to realise their project. The government then evaluates the different offers, ranking them based on their price and other criteria. The best candidates are then selected and the government signs a power purchasing agreement with the successful bidders. (Lucas, et al., 2013)<ref name="Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.">Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.</ref> Auctions are very flexible and can be organized in many different ways. In order for an auction to succeed it is important that it is adapted to the countries specific circumstances. These depend on the goals which the country wants to achieve through the auction. | Renewable energy auctions, sometimes also called ‘demand auctions’ or ‘procurement auctions’ are a type of support mechanism for renewable energy technologies. In most cases renewable energy auctions are opened by the government of a country. They will specify the capacity (kW) or the electricity generation (kWh) which is up for auction, as well as the generation technology and sometimes the generation location. Project developers can than submit a bid to the auction, outlining their project proposal and stating the price per unit of electricity at which they will be able to realise their project. The government then evaluates the different offers, ranking them based on their price and other criteria. The best candidates are then selected and the government signs a power purchasing agreement with the successful bidders. (Lucas, et al., 2013)<ref name="Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.">Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.</ref> Auctions are very flexible and can be organized in many different ways. In order for an auction to succeed it is important that it is adapted to the countries specific circumstances. These depend on the goals which the country wants to achieve through the auction. | ||

| − | + | <br/> | |

{{Go to Top}} | {{Go to Top}} | ||

| Line 133: | Line 134: | ||

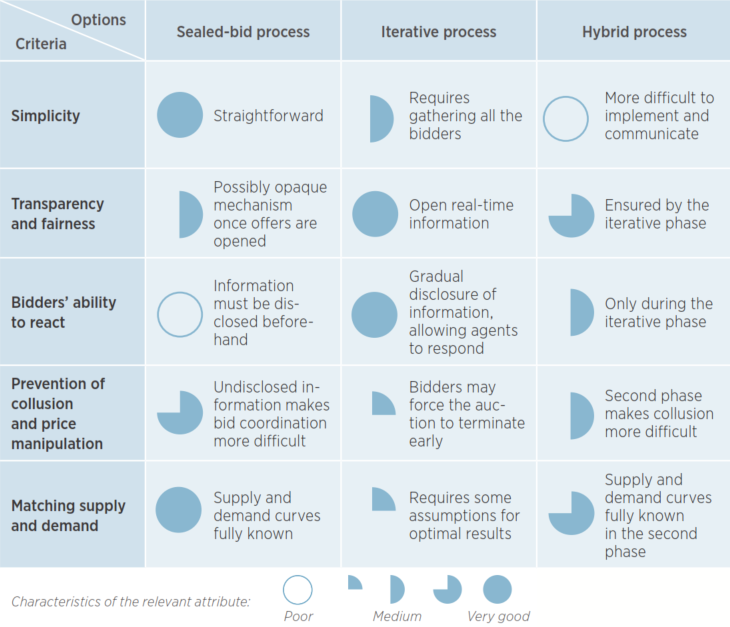

Figure 3: Summary comparison of bidding procedures (Ferroukhi, et al., 2015)<ref name="Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.">Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.</ref> | Figure 3: Summary comparison of bidding procedures (Ferroukhi, et al., 2015)<ref name="Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.">Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.</ref> | ||

| − | + | <br/> | |

{{Go to Top}} | {{Go to Top}} | ||

| Line 139: | Line 140: | ||

=== Advantages and Disadvantages === | === Advantages and Disadvantages === | ||

| − | {| | + | {| cellspacing="0" cellpadding="0" border="1" style="width: 100%;" |

|- | |- | ||

| style="width:302px" | | | style="width:302px" | | ||

| Line 169: | Line 170: | ||

(Lucas, et al., 2013)<ref name="Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.">Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.</ref>, (Laumanns, 2014)<ref name="Laumanns, U., 2014. Renewable Energy Tendering Schemes. [Online] Available at: https://energypedia.info/wiki/Renewable_Energy_Tendering_Schemes [Accessed 11 August 2016].">Laumanns, U., 2014. Renewable Energy Tendering Schemes. [Online] Available at: https://energypedia.info/wiki/Renewable_Energy_Tendering_Schemes [Accessed 11 August 2016].</ref> | (Lucas, et al., 2013)<ref name="Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.">Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.</ref>, (Laumanns, 2014)<ref name="Laumanns, U., 2014. Renewable Energy Tendering Schemes. [Online] Available at: https://energypedia.info/wiki/Renewable_Energy_Tendering_Schemes [Accessed 11 August 2016].">Laumanns, U., 2014. Renewable Energy Tendering Schemes. [Online] Available at: https://energypedia.info/wiki/Renewable_Energy_Tendering_Schemes [Accessed 11 August 2016].</ref> | ||

| + | <br/> | ||

| + | {{Go to Top}} | ||

| − | + | <br/> | |

=== Links To Other Articles About Auctions === | === Links To Other Articles About Auctions === | ||

| Line 178: | Line 181: | ||

*[[Competitive Tendering (Concessions, Auctions)|Competitive Tendering (Concessions, Auctions)]] | *[[Competitive Tendering (Concessions, Auctions)|Competitive Tendering (Concessions, Auctions)]] | ||

*[[Energy Auctions in Brazil|Energy Auction in Brazil]] | *[[Energy Auctions in Brazil|Energy Auction in Brazil]] | ||

| − | *[[:File:Renewable Energy Auctions (GIZ).pdf|Renewable Energy | + | *[[:File:Renewable Energy Auctions (GIZ).pdf|Renewable Energy Auctions (GIZ).]]Goal-oriented policy design (2015) |

*[[:File:Summary of Energy Auctions Felled from Renewable Energy Sources.pdf|Summary of Energy Auctions Felled from Renewable Energy Sources]] | *[[:File:Summary of Energy Auctions Felled from Renewable Energy Sources.pdf|Summary of Energy Auctions Felled from Renewable Energy Sources]] | ||

*[[Bidding Strategies in Brazilian Electricity Auctions|Bidding Strategies in Brazilian Electricity Auctions]] | *[[Bidding Strategies in Brazilian Electricity Auctions|Bidding Strategies in Brazilian Electricity Auctions]] | ||

| − | + | <br/> | |

{{Go to Top}} | {{Go to Top}} | ||

| + | <br/> | ||

| − | + | <br/> | |

== Comparing FIT and Auctions<br/> == | == Comparing FIT and Auctions<br/> == | ||

| Line 193: | Line 197: | ||

The main difference between FIT and auctions is the price discovery mechanism. ‘For FIT the price is fixed by the policy makers, however, in auctions the industry determines the price for the project through competitive bidding between the bidders.’ (Jacobs, 2015)<ref name="Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].">Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].</ref> If the country does not have much experience with setting prices for a certain renewable energy technology and there is not enough cost data available, then auctions are a useful way of discovering the true cost of the technology. However, for auctions to be successful they need to be competitive. This means that there needs to be enough interest amongst project developers in the country to invest in the technology. The auction should be oversubscribed, so that the generation capacity offered by all of the bidders is higher than the demand. In situations where these conditions cannot be met FIT are often a better option. Another point that should be considered is that auctions are open to everyone. If there is a special interest from the government’s point of view for the renewable energy generation to be focused on a certain sector (example farmers, private household, industry etc.) then FIT are often the better policy to target a certain type of production. (Jacobs, 2015)<ref name="Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].">Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].</ref> Usually auctions are better for large scale projects and established technologies. On the other hand, FIT are less risky from the project developers point of view, which is why they help support small scale projects as well as emerging technologies. | The main difference between FIT and auctions is the price discovery mechanism. ‘For FIT the price is fixed by the policy makers, however, in auctions the industry determines the price for the project through competitive bidding between the bidders.’ (Jacobs, 2015)<ref name="Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].">Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].</ref> If the country does not have much experience with setting prices for a certain renewable energy technology and there is not enough cost data available, then auctions are a useful way of discovering the true cost of the technology. However, for auctions to be successful they need to be competitive. This means that there needs to be enough interest amongst project developers in the country to invest in the technology. The auction should be oversubscribed, so that the generation capacity offered by all of the bidders is higher than the demand. In situations where these conditions cannot be met FIT are often a better option. Another point that should be considered is that auctions are open to everyone. If there is a special interest from the government’s point of view for the renewable energy generation to be focused on a certain sector (example farmers, private household, industry etc.) then FIT are often the better policy to target a certain type of production. (Jacobs, 2015)<ref name="Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].">Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].</ref> Usually auctions are better for large scale projects and established technologies. On the other hand, FIT are less risky from the project developers point of view, which is why they help support small scale projects as well as emerging technologies. | ||

| − | '''There is an increasing trend, world-wide, to move away from ridged support mechanisms models.''' As the energy market becomes more and more complex so do the energy policies in many countries. Hybrid support mechanisms are gaining in popularity. Often having two different types of support mechanisms ruining in parallel, or even combining elements from different policies into one can be advantageous. Therefore, FIT and Auctions can well be implemented in one country at the same time. In these cases, the conditions under which the two support mechanisms can be applied need to be well defined. For example, in many countries which have implemented both FIT and Auctions, the FIT are targeted towards small projects while the auctions are limited to large project developers. The country has to carefully choose and define the thresholds for the projects, deciding which project classify as small scale (Grau, 2014)<ref name="Grau, T., 2014. Comparison of Feed-in Tariffs and Tenders to Remunerate Solar Power Generation, Berlin: DIW Berlin.">Grau, T., 2014. Comparison of Feed-in Tariffs and Tenders to Remunerate Solar Power Generation, Berlin: DIW Berlin.</ref>. However, there are also examples of countries which have implemented the policies in exactly the opposite way (example: Uganda: Auctions for small scale, [[ | + | '''There is an increasing trend, world-wide, to move away from ridged support mechanisms models.''' As the energy market becomes more and more complex so do the energy policies in many countries. Hybrid support mechanisms are gaining in popularity. Often having two different types of support mechanisms ruining in parallel, or even combining elements from different policies into one can be advantageous. Therefore, FIT and Auctions can well be implemented in one country at the same time. In these cases, the conditions under which the two support mechanisms can be applied need to be well defined. For example, in many countries which have implemented both FIT and Auctions, the FIT are targeted towards small projects while the auctions are limited to large project developers. The country has to carefully choose and define the thresholds for the projects, deciding which project classify as small scale (Grau, 2014)<ref name="Grau, T., 2014. Comparison of Feed-in Tariffs and Tenders to Remunerate Solar Power Generation, Berlin: DIW Berlin.">Grau, T., 2014. Comparison of Feed-in Tariffs and Tenders to Remunerate Solar Power Generation, Berlin: DIW Berlin.</ref>. However, there are also examples of countries which have implemented the policies in exactly the opposite way (example: [[Renewable Energy Support Mechanisms: Feed-In Tariffs and Auctions#Uganda|Uganda]]: Auctions for small scale, [[Renewable Energy Tendering Schemes#Denmark|Denmark]]: Auctions for emerging tech).<br/> |

Table 1: Comparison of FIT and Auctions | Table 1: Comparison of FIT and Auctions | ||

| − | {| cellspacing="0" cellpadding="0" border="1" | + | {| cellspacing="0" cellpadding="0" border="1" style="width: 100%;" |

|- | |- | ||

| − | | style="width: 47px; | + | | style="width: 47px; background-color: rgb(51, 153, 255)" | |

'''Level''' | '''Level''' | ||

| − | | style="width: 142px; | + | | style="width: 142px; background-color: rgb(51, 153, 255)" | |

'''Category''' | '''Category''' | ||

| − | | style="width: 207px; | + | | style="width: 207px; background-color: rgb(51, 153, 255)" | |

'''FIT''' | '''FIT''' | ||

| − | | style="width: 207px; | + | | style="width: 207px; background-color: rgb(51, 153, 255)" | |

'''Auctions''' | '''Auctions''' | ||

| Line 218: | Line 222: | ||

Risk | Risk | ||

| − | | style="width: 207px; | + | | style="width: 207px; background-color: rgb(255, 102, 102)" | |

Risk is shifted towards the government<br/> | Risk is shifted towards the government<br/> | ||

| − | | style="width: 207px; | + | | style="width: 207px; background-color: rgb(102, 204, 102)" | |

Lower risk for government | Lower risk for government | ||

| Line 228: | Line 232: | ||

Cost | Cost | ||

| − | | style="width: 207px; | + | | style="width: 207px; background-color: rgb(204, 204, 204)" | |

Can be very costly, however, if funded by consumers then there is no burden of the public budget.<br/> | Can be very costly, however, if funded by consumers then there is no burden of the public budget.<br/> | ||

| − | | style="width: 207px; | + | | style="width: 207px; background-color: rgb(204, 204, 204)" | |

Project costs are set far in advance, offering, more control and certainty over the final total cost. However, high transaction costs. | Project costs are set far in advance, offering, more control and certainty over the final total cost. However, high transaction costs. | ||

|- | |- | ||

| − | | style="width:142px; | + | | style="width:142px; height:82px" | |

Setting Target Groups | Setting Target Groups | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 82px; background-color: rgb(102, 204, 102)" | |

Easier to target the policy towards certain groups (ex: farmers, private households, industry).<br/> | Easier to target the policy towards certain groups (ex: farmers, private households, industry).<br/> | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 82px; background-color: rgb(255, 102, 102)" | |

Should be open to all. Difficult to target towards certain groups.<br/> | Should be open to all. Difficult to target towards certain groups.<br/> | ||

|- | |- | ||

| − | | style="width:47px; | + | | style="width:47px; height:50px" rowspan="3" | |

'''Project Developers''' | '''Project Developers''' | ||

| − | | style="width:142px; | + | | style="width:142px; height:50px" | |

Risk | Risk | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 50px; background-color: rgb(102, 204, 102)" | |

Lower risk for project developers | Lower risk for project developers | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 50px; background-color: rgb(255, 102, 102)" | |

Risk is shifted towards project developers. | Risk is shifted towards project developers. | ||

|- | |- | ||

| − | | style="width:142px; | + | | style="width:142px; height:37px" | |

Cost | Cost | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 37px; background-color: rgb(102, 204, 102)" | |

Lower costs for project developers. | Lower costs for project developers. | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 37px; background-color: rgb(255, 102, 102)" | |

High planning and transaction costs due to pre-auction requisites. | High planning and transaction costs due to pre-auction requisites. | ||

|- | |- | ||

| − | | style="width:142px; | + | | style="width:142px; height:90px" | |

Small/New Project Developers | Small/New Project Developers | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 90px; background-color: rgb(102, 204, 102)" | |

FITs make it easy for new companies to enter the market and allow small companies to be competitive. | FITs make it easy for new companies to enter the market and allow small companies to be competitive. | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 90px; background-color: rgb(255, 102, 102)" | |

Difficult for small/new companies due to high risk as well as large planning and transaction costs. | Difficult for small/new companies due to high risk as well as large planning and transaction costs. | ||

|- | |- | ||

| − | | style="width:47px; | + | | style="width:47px; height:83px" | |

'''Innovation''' | '''Innovation''' | ||

| − | | style="width:142px; | + | | style="width:142px; height:83px" | |

Promoting New Technologies | Promoting New Technologies | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 83px; background-color: rgb(102, 204, 102)" | |

Good at providing support for new technologies. | Good at providing support for new technologies. | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 83px; background-color: rgb(255, 102, 102)" | |

Suited for slightly more established technologies | Suited for slightly more established technologies | ||

|- | |- | ||

| − | | style="width:47px; | + | | style="width:47px; height:83px" rowspan="4" | |

'''Market Development'''<br/> | '''Market Development'''<br/> | ||

| − | | style="width:142px; | + | | style="width:142px; height:83px" | |

Discovering True Market Price | Discovering True Market Price | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 83px; background-color: rgb(255, 102, 102)" | |

Especially in fast changing markets the FIT often does not reflect the true market price.<br/> | Especially in fast changing markets the FIT often does not reflect the true market price.<br/> | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 83px; background-color: rgb(102, 204, 102)" | |

If designed well and there is enough competition, then actions are a good way of discovering the true market price<br/> | If designed well and there is enough competition, then actions are a good way of discovering the true market price<br/> | ||

|- | |- | ||

| − | | style="width:142px; | + | | style="width:142px; height:83px" | |

Long-Term Stability | Long-Term Stability | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 83px; background-color: rgb(102, 204, 102)" | |

FITs offers very stable condition during their running time.<br/> | FITs offers very stable condition during their running time.<br/> | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 83px; background-color: rgb(204, 204, 204)" | |

Offers very stable conditions for the phase of the projects, however, time gaps between auctions can lead to discontinuity and start stop market development. | Offers very stable conditions for the phase of the projects, however, time gaps between auctions can lead to discontinuity and start stop market development. | ||

|- | |- | ||

| − | | style="width:142px; | + | | style="width:142px; height:72px" | |

Adaptability | Adaptability | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 72px; background-color: rgb(255, 102, 102)" | |

Changing/Adapting the policy is very complex<br/> | Changing/Adapting the policy is very complex<br/> | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 72px; background-color: rgb(102, 204, 102)" | |

For each new auctions the terms can be adapted to reflect the present circumstances.<br/> | For each new auctions the terms can be adapted to reflect the present circumstances.<br/> | ||

|- | |- | ||

| − | | style="width:142px; | + | | style="width:142px; height:50px" | |

Growth/Achieving RE Targets | Growth/Achieving RE Targets | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 50px; background-color: rgb(102, 204, 102)" | |

Provides incentive for maximising generation. | Provides incentive for maximising generation. | ||

| − | | style="width: 207px; | + | | style="width: 207px; height: 50px; background-color: rgb(102, 204, 102)" | |

More control over new installation capacity. | More control over new installation capacity. | ||

| Line 341: | Line 345: | ||

{{Go to Top}} | {{Go to Top}} | ||

| + | <br/> | ||

| + | <br/> | ||

== Country Examples == | == Country Examples == | ||

| Line 393: | Line 399: | ||

<br/>Table 2: GET FIT Premiums in Uganda (Meyer , et al., 2015)<ref name="Meyer , R., Tenenbaum, B. & Hosier , R., 2015. Promoting Renewable Energy Through Auctions: The Case of Uganda, s.l.: World Bank - Live Wire.">Meyer , R., Tenenbaum, B. & Hosier , R., 2015. Promoting Renewable Energy Through Auctions: The Case of Uganda, s.l.: World Bank - Live Wire.</ref> | <br/>Table 2: GET FIT Premiums in Uganda (Meyer , et al., 2015)<ref name="Meyer , R., Tenenbaum, B. & Hosier , R., 2015. Promoting Renewable Energy Through Auctions: The Case of Uganda, s.l.: World Bank - Live Wire.">Meyer , R., Tenenbaum, B. & Hosier , R., 2015. Promoting Renewable Energy Through Auctions: The Case of Uganda, s.l.: World Bank - Live Wire.</ref> | ||

| − | {| cellspacing="0" cellpadding="0" border="1" | + | {| cellspacing="0" cellpadding="0" border="1" style="width: 100%;" |

|- | |- | ||

| style="width:182px" | | | style="width:182px" | | ||

| Line 500: | Line 506: | ||

{{Go to Top}} | {{Go to Top}} | ||

| + | <br/> | ||

= Further Information = | = Further Information = | ||

| Line 509: | Line 516: | ||

*[http://www.wind-energy-the-facts.org/introduction--types-of-res-e-support-mechanisms.html http://www.wind-energy-the-facts.org/introduction--types-of-res-e-support-mechanisms.html] | *[http://www.wind-energy-the-facts.org/introduction--types-of-res-e-support-mechanisms.html http://www.wind-energy-the-facts.org/introduction--types-of-res-e-support-mechanisms.html] | ||

*[http://leonardo-academy.org/mod/video/view.php?id=8154 Designing RES Auctions Well: International Experience and Lessons Learned] | *[http://leonardo-academy.org/mod/video/view.php?id=8154 Designing RES Auctions Well: International Experience and Lessons Learned] | ||

| + | *European research project: [http://auresproject.eu/publications AURES (Auctions for Renewable Energy Support)] offers publications on auction designs for renewable energy support. | ||

| + | *[http://www.ecofys.com/files/files/aures-wp4-synthesis-report-final.pdf Auctions for Renewable Support: Lessons Learnt from International Experiences]<br/> | ||

| − | + | <br/> | |

{{Go to Top}} | {{Go to Top}} | ||

| Line 516: | Line 525: | ||

= References = | = References = | ||

| − | <references /> | + | <references /> |

{{Go to Top}} | {{Go to Top}} | ||

| + | [[Category:Policies_and_Regulations]] | ||

| + | [[Category:Financing_and_Funding]] | ||

| + | [[Category:Renewable_Energy]] | ||

| + | [[Category:Feed-in_Tariffs]] | ||

| + | [[Category:Germany]] | ||

| + | [[Category:Uganda]] | ||

| + | [[Category:China]] | ||

[[Category:South_Africa]] | [[Category:South_Africa]] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

Latest revision as of 14:08, 22 December 2016

Introduction/Background

Energy policies set the goals for a country’s energy future. They create stability in the market, increasing the confidence of investors and thereby allow for energy support to be realised. Therefore, policies play an important role in the future development of (renewable) energy technologies. Renewable energy technologies are widely seen as the future. They provide clean energy using non-finite resources, help mitigate climate change, increase countries’ energy independencies and can improve energy security. However, many renewable energy technologies are relatively new and not yet as established as ‘convention’ energy generation technologies which burn fossil fuels. By choosing to shift their support mechanisms away from fossil fuels and towards renewable energy technologies governments can help boost these technologies in their countries. For an overview of all of the different renewable energy support mechanisms and their strengths and weaknesses have a look at the article Comparison of various Policy Tools for Promoting Renewable Energies.

This article looks in detail at two of the main support mechanism, Feed-In Tariffs (FITs) and auctions. After a short definition and overview of each policy type the article examines how these policies can be implemented and looks at the effectiveness of each policy type at achieving certain objectives. Due to the complexity of renewable energy support mechanism it can often be difficult to judge which policy type might offer the most advantages for a given country. Especially for newly emerging and developing policies there are not yet that many case studies available which show the effects of a certain policy on the development of renewable energy technologies. Therefore, this article aims to provide a short guide on the benefits and disadvantages of FITs and auctions, based on a literature review and selected country examples.

Background

There are two main categories of regulatory generation focused renewable energy support mechanisms; Tariff-based Instruments and Quantity-based Instruments. Tariff-based instruments provide an economic incentive for generating electricity using renewable energy sources. Usually this takes the form of investment subsidies or payments for energy generated. The Feed-In Tariff (FIT) is an example of a tariff-based instrument. A FIT guarantees a fixed price for renewable energy which is fed in to the grid. (Barroso, et al., 2015a)[1]. On the other hand, Quantity-based instruments work by setting minimum targets for renewable energy in the energy mix and holding certain parties in the energy supply chain responsible for these targets. An example of a quantity-based instrument is a Renewable Purchase Obligation (RPO) which “imposes a minimum quota or a share of renewable energy production on electricity suppliers, and is often supplemented by a renewable energy market allowing for the trading of renewable energy certificates (RECs)“ (Barroso, et al., 2015a)[1] (Wind Energy, The Facts, n.d.)

FIT are the most established renewable energy support mechanism. However, in recent years many countries have started to implement a blend of different policies, allowing them to profit from the benefits offered by a range of different policies. Such a mix of policies can be described as Hybrid Instruments. Hybrid instruments are support mechanisms which combine aspects from tariff and quantity-based instruments. Renewable energy Auctions (sometimes also called tenders) are an example of hybrid instruments. In auctions both the price and the quantity are determined through a price bidding process, before the project start. This allows auctions to provide a “stable revenue guarantee for the project developers (similar to the FIT mechanism), while at the same time ensuring that the renewable generation target will be met precisely (similar to an RPO).” (Barroso, et al., 2015a)[1].

International Trends

The number of countries with at least one type of renewable energy target rose from 43 in 2005 to 164 in 2016. (Wuester, 2016) “By early 2012, 109 countries had some type of policy to support renewable power generation, up from 48 countries in 2005. More than half of these countries are developing countries or emerging economies.” (IRENA, 2012)[2] The joint IEA/IREAN Country Policy Database for Global Renewable Energy currently stores information on 117 countries (status 2016).

Figure 1 and Figure 2 show the development of different support mechanisms since 2005. As can be seen in 2005, FITs used to be the most popular support mechanism by far, while only 6 countries at the time had implemented auctions. Even today the FIT remains the most common support mechanism, however, auctions have seen a very strong growth and where implemented in over 60 countries by early 2015. (Ferroukhi, et al., 2015)[3]

|

Figure 1: Number of countries with renewable energy policies by type (Wuester, 2016) |

Figure 2: Development of FIT and Auctions in the past years (Lucas, et al., 2013)[4] |

Feed-In Tariff

Definition

A Feed-In Tariff (FIT) provides renewable energy generators with a fixed price for the energy which they produce. The FIT is set for each technology individually and is paid for a fixed number of years. This increases the stability and allows for long-term planning, which encourages investment in to renewable energy projects. In some countries the FIT is funded through the electricity utility bills, which means that the costs are passed down to the consumers. However, in other countries, where an increase in consumer bills was deemed unacceptable government budgets have been set aside for the FIT. (Passey, et al., 2014)[5]

Overview of Different FIT models

Gross FIT: The FIT is paid for all of the renewable energy which is being generated, independent of whether this energy is being exported to the grid or used on-site.

Net FIT: The FIT is only paid for the renewable energy which is being exported to the grid. Even though the FIT is not paid for generated electricity which is being used on site, this energy is offsetting the cost of bills which would normally have to be paid. Therefore, in order to determine whether the Gross FIT or the Net FIT model will be more profitable, the price of the FIT and of the grid retail price per unit of electricity has to be compared.

Net Metering: The current retail price is paid for all renewable energy which is being exported to the grid. Electricity used on site reduces the electricity bills, which would normally also have to be paid at the retail price. Therefore, this model effectively means that all renewable energy which is being generated gets paid the current retail price.

Net Billing: The payments for electricity generated and electricity consumed are netted out over a certain period of time. This can be applied using either the gross FIT or the net FIT model. (Passey, et al., 2014)[5]

Advantages and Disadvantages

|

Advantages |

Disadvantages |

|

|

(Passey, et al., 2014) [5] (Laumanns, et al., 2015)[6]

Links to other articles about FET

- Feed-In Tariffs (FIT)

- South Africa Renewable Energy Feed-In Tariff

- Powering the Green Economy: The Feed-In Tariff Handbook

- Feed-In Tariff (FIT) Tool – SADC RERA Mini-Grids

- Feed-In Policies

- Tariffs

- Actual Status of Feed-In Tariffs (FIT) Implementation World Wide

- Feed-In Tariffs Wind Energy

Auctions

Definition

Renewable energy auctions, sometimes also called ‘demand auctions’ or ‘procurement auctions’ are a type of support mechanism for renewable energy technologies. In most cases renewable energy auctions are opened by the government of a country. They will specify the capacity (kW) or the electricity generation (kWh) which is up for auction, as well as the generation technology and sometimes the generation location. Project developers can than submit a bid to the auction, outlining their project proposal and stating the price per unit of electricity at which they will be able to realise their project. The government then evaluates the different offers, ranking them based on their price and other criteria. The best candidates are then selected and the government signs a power purchasing agreement with the successful bidders. (Lucas, et al., 2013)[4] Auctions are very flexible and can be organized in many different ways. In order for an auction to succeed it is important that it is adapted to the countries specific circumstances. These depend on the goals which the country wants to achieve through the auction.

Overview of Different Auction Models

Sealed Bid Auction: All bidders submit their proposal, containing the price and quantity of generation. The individual bidders are not able to see each other’s proposals. All of the submissions are then screened to confirm that they meet the outlined requirements. The bids are ranked from lowest to highest, according to their price and possibly other additional criterial. Then the best ranking projects are selected one by one, until the number of selected projects covers the volume of renewable energy generation which is being auctioned. (Lucas, et al., 2013)[4]

Iterative Process/Descending Clock Auction: In this type of auction the auctioneer (in most cases the government) declares a price for a new renewable energy generation project. The bidders then come forward and announce what quantity of generation they are able to offer for this price. The price is then progressively lowered by the auctioneer, which results in lower generation quantities offered by the bidders. This process is continued until the generation quantity offered matches the volume of new renewable energy which the government wants to invest in. In this auction the bidders know each other’s offers and are therefore able to adapt their own offers based on the competition. (Lucas, et al., 2013)[4]

Hybrid Type Auction: These auctions consist of a combination of different models to select the bidders. As an example, Brazil uses an auction which is divided into two phases. The first phase is a descending clock auction used to discover the price. The second phase consists of a sealed bid auctions which ensures that the bidders cannot collude on the price. (Lucas, et al., 2013)[4]

Figure 3: Summary comparison of bidding procedures (Ferroukhi, et al., 2015)[3]

Advantages and Disadvantages

|

Advantages |

Disadvantages |

|

|

(Lucas, et al., 2013)[4], (Laumanns, 2014)[7]

Links To Other Articles About Auctions

- Renewable Energy Tendering Schemes

- Competitive Tendering (Concessions, Auctions)

- Energy Auction in Brazil

- Renewable Energy Auctions (GIZ).Goal-oriented policy design (2015)

- Summary of Energy Auctions Felled from Renewable Energy Sources

- Bidding Strategies in Brazilian Electricity Auctions

Comparing FIT and Auctions

The main difference between FIT and auctions is the price discovery mechanism. ‘For FIT the price is fixed by the policy makers, however, in auctions the industry determines the price for the project through competitive bidding between the bidders.’ (Jacobs, 2015)[8] If the country does not have much experience with setting prices for a certain renewable energy technology and there is not enough cost data available, then auctions are a useful way of discovering the true cost of the technology. However, for auctions to be successful they need to be competitive. This means that there needs to be enough interest amongst project developers in the country to invest in the technology. The auction should be oversubscribed, so that the generation capacity offered by all of the bidders is higher than the demand. In situations where these conditions cannot be met FIT are often a better option. Another point that should be considered is that auctions are open to everyone. If there is a special interest from the government’s point of view for the renewable energy generation to be focused on a certain sector (example farmers, private household, industry etc.) then FIT are often the better policy to target a certain type of production. (Jacobs, 2015)[8] Usually auctions are better for large scale projects and established technologies. On the other hand, FIT are less risky from the project developers point of view, which is why they help support small scale projects as well as emerging technologies.

There is an increasing trend, world-wide, to move away from ridged support mechanisms models. As the energy market becomes more and more complex so do the energy policies in many countries. Hybrid support mechanisms are gaining in popularity. Often having two different types of support mechanisms ruining in parallel, or even combining elements from different policies into one can be advantageous. Therefore, FIT and Auctions can well be implemented in one country at the same time. In these cases, the conditions under which the two support mechanisms can be applied need to be well defined. For example, in many countries which have implemented both FIT and Auctions, the FIT are targeted towards small projects while the auctions are limited to large project developers. The country has to carefully choose and define the thresholds for the projects, deciding which project classify as small scale (Grau, 2014)[9]. However, there are also examples of countries which have implemented the policies in exactly the opposite way (example: Uganda: Auctions for small scale, Denmark: Auctions for emerging tech).

Table 1: Comparison of FIT and Auctions

|

Level |

Category |

FIT |

Auctions |

|

Government |

Risk |

Risk is shifted towards the government |

Lower risk for government |

|

Cost |

Can be very costly, however, if funded by consumers then there is no burden of the public budget. |

Project costs are set far in advance, offering, more control and certainty over the final total cost. However, high transaction costs. | |

|

Setting Target Groups |

Easier to target the policy towards certain groups (ex: farmers, private households, industry). |

Should be open to all. Difficult to target towards certain groups. | |

|

Project Developers |

Risk |

Lower risk for project developers |

Risk is shifted towards project developers. |

|

Cost |

Lower costs for project developers. |

High planning and transaction costs due to pre-auction requisites. | |

|

Small/New Project Developers |

FITs make it easy for new companies to enter the market and allow small companies to be competitive. |

Difficult for small/new companies due to high risk as well as large planning and transaction costs. | |

|

Innovation |

Promoting New Technologies |

Good at providing support for new technologies. |

Suited for slightly more established technologies |

|

Market Development |

Discovering True Market Price |

Especially in fast changing markets the FIT often does not reflect the true market price. |

If designed well and there is enough competition, then actions are a good way of discovering the true market price |

|

Long-Term Stability |

FITs offers very stable condition during their running time. |

Offers very stable conditions for the phase of the projects, however, time gaps between auctions can lead to discontinuity and start stop market development. | |

|

Adaptability |

Changing/Adapting the policy is very complex |

For each new auctions the terms can be adapted to reflect the present circumstances. | |

|

Growth/Achieving RE Targets |

Provides incentive for maximising generation. |

More control over new installation capacity. |

This table was put together based on information compiled from the following sources: (Wuester, 2016), (Passey, et al., 2014)[5], (Laumanns, 2014)[7], (Laumanns, et al., 2015)[6], (Lucas, et al., 2013)[4].

Country Examples

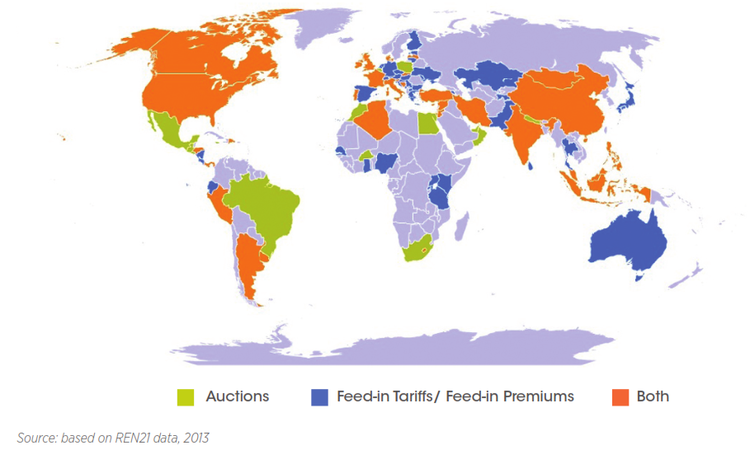

Many countries have implemented both support mechanisms, see Figure 4 in orange.

Figure 4: Auctions, FIT and both in 2013. (Lucas, et al., 2013)[4]

South Africa

In 2009 South Africa introduced a FIT which included a generous fixed price for renewable energy generation for different technologies. However, the FIT was not very successful, possible due to uncertainties within the legal framework which resulted in a lack of trust from investors. In 2011 the FIT tariff was lowered substantially for all technologies. Shortly afterwards the Department of Energy decided to abandon the FIT. In the two years of its existence not a single megawatt of renewable energy power was signed off under the FIT. Instead the Department of Energy decided to switch to auctions as a support mechanism and they launched the Renewable Energy Independent Power Producer Procurement (REIPPP) program in 2011.

The first round of bids was held in November 2011. Before entering the auction all bidders had to fulfil minimum requirements in the areas of environment, land, commercial and legal, economic development, financial, and technical. During the auction the bid price contributed towards 70% of the selection criteria, while the remaining 30% considered the projects job creation, local content, preferential procurement, enterprise development, and socio-economic development. 28 out of 53 bids were able to qualify, resulting in a new installed capacity of 1,416 megawatts. However, the prices were not very competitive and only slightly lower than the maximum cap which had been set. Therefore, in a second bidding round launched in 2012, less capacity (1,257 megawatts) was offered in order to drive up the competition. In this bid only 19 out of 51 qualifies bidders were selected. The increased competition was able to lower the prices, especially for wind and photovoltaics. Also, the percentage of locally sourced content rose in the second bidding round. A third bidding round took place in 2013, with 1,116 megawatts up for auction.

“The South African experience suggests that competitive tenders are a viable alternative to feed-in tariff programs for renewable energy and potentially offer better price outcomes with fewer risks of excessive rents being appropriated by renewable energy suppliers. In developed countries the core rationale for introducing REFITs was to create market certainty and simplify procurement processes in order to stimulate production and innovation in climate-change-mitigating renewable energy technologies and markets, thus bringing prices down over time. But in many developing countries, especially in Africa, the market for renewable energy technologies is much smaller and this rationale does not apply. Indeed, for many smaller developing countries with low carbon footprints, the argument for greater use of more expensive renewable energy technologies needs to be balanced against other development priorities.” (Eberhard, 2013)[10]

China

In China the auction policy scheme was introduced mainly to provide a market based mechanism through which the real price of a technology could be discovered. Before the first auctions prices for renewable energy projects where awarded on a case to case basis by local governments. This resulted in a wide variation of priced throughout the country. For example, prices for wind power projects ranged from USD 75 to USD 197 per MWh among different Chinese regions, with a relatively high average (Barroso, et al., 2015a)[1]. Therefore, in 2003, actions were launched for large scale wind projects of 100MW or more. The results from these auction where recorded and in 2009, after five auction rounds, they were used to determine an official FIT for four geographical regions in the country. Following the success of using auctions to determine a benchmark price for large scale wind projects, additional auction rounds were launched for solar and offshore wind. The first solar auction took place in 2009 and the FIT for solar was fixed in 2011. For offshore wind the first auction took place in 2011 and as a result a FIT was established in 2014. (Barroso, et al., 2015a)[1] (Elizondo et al., 2014).

“The Chinese example indicates that auction results can be used to discover reasonable support tariffs for other support instruments and avoid excessive or slow renewable deployment. However, the whole process takes many years from the introduction of auctions to administratively determined feed-in tariffs, and the regulatory effort is quite demanding. It is also likely that the discovered technology costs are decreasing in the meantime due to technological progress. Moreover, only well-designed auctions serve as a good price discovery process. If strategic behaviour such as underbidding is a major problem, as observed in China auction prices will serve only as a rough indication.” (Tietjen, et al., 2015)[11]

Uganda

Because of threatening power shortages and a lack of private investment into small scale renewable energy projects the government of Uganda decided to launch the Global Energy Transfer FIT (GET FIT) program. The main objectives of the GET Fit Program are to:

- “help enhance the overall enabling environment for private investment in renewable energy through improvements in the Renewable Energy Feed-In Tariff system and its application;

- help stabilize Ugandan power sector finances by adding least-cost generation capacity;

- enable Government of Uganda to pursue its ambitious electrification targets;

- improve the availability of long-term commercial finance for small-scale renewable energy generation projects in Uganda; and

- help decentralize and diversify Uganda’s energy mix, thus enhancing security of supply.” (GET FIT Uganda, n.d.)[12]

In 2013 Uganda launched an auction scheme called the GET FIT premium program, which is part of the national GET FIT policy. The GET FIT premium auctions gives small power producers the opportunity to gain premium payments in addition to the national FIT. The costs for the already existing FIT are passed down to the consumers, however, the costs for the premium payments are taken up by European Donors. Small scale biomass, hydro, bagasse and solar PV plants can apply for the premium payments. For all technologies except solar PV the developers compete through a fixed scoring system which consider their financial and economic performance (35%) environmental and social performance (30%) and technical organisational performance (35%). Bidders need to score at least 70% overall and cannot score less than 50% in any category in order to qualify for the premium payments. For these technologies there is no competition based on price, because the amount of premium payments received are already pre-determined (see Table 1).

However, due to the rapid fall in the price of PV technology it was decided that for PV projects the price should be included in the auction criteria. Therefore, in the PV auctions 70% of the score is determined by the price, while the remaining 30% considers the same non-price factors as for the other technologies. This allows for a better market adaptation, keeping up with the rapid price changes in the PV sector. (Barroso, et al., 2015b)[13]. The GET FIT premium payment for solar PV is calculated by taking the difference between the accepted bid price and the national FIT. For all projects the premium payments are based on a projection of the twenty-year output of the plat. However, the payments are frontloaded into the first five years of operation. In this way the projects will receive more funding during the critical first stage and the donors do not have to make risky long term commitments (Meyer , et al., 2015)[14].

Table 2: GET FIT Premiums in Uganda (Meyer , et al., 2015)[14]

|

Technology |

Current FIT ($/kWh) |

GET FIT premium ($/kWh) |

Maximum Capacity Factor (%) |

|

Solar PV |

0.11 |

0.054 |

0 |

|

Biomass |

0.103 |

0.01 |

40 |

|

Bagasse |

0.095 |

0.005 |

0 |

|

Hydro (9-20 MW) |

0.085 |

0.014 |

60 |

|

Hydro (up to 9MW) |

0.115-0.85 |

0.014 |

60 |

The bidding process for solar PV projects was divided into 3 stages. The first stage started in 2014 and interested bidders had to register as well as declare their experience with solar projects in developing countries and their financial capacity. Nine out of twenty-four developers qualified for the second round in which they had to submit their technical and price bids as well as the predefined financial, environmental, and social parameters within 3 months’ time (Meyer , et al., 2015)[14]. The bids were then evaluated by external consultant who gave a score for the non-price elements (30%) and for the price elements (70%) of the proposals. In December 2014 2 projects were selected as the winners. (Barroso, et al., 2015b)[13] (Meyer , et al., 2015)[14]

While it is unusual to target auctions towards small and medium scale projects there are several reasons why this the GET FIT premium payment model was chosen in Uganda. It was found that the already existing FIT was too low to attract investment into small scale renewable projects. The premium payments offer a way of augmenting the FIT for successful projects. Another reason is that Uganda wanted to bridge its power shortage gap. There were already plans to increase electricity production through large scale hydropower, however, these would take several years to realise. Therefore, small scale renewable energy projects with low deployment times were chosen to address the current power shortage. Therefore, the GET FIT premium payment were specially designed to support these projects. (Electricity Regulatory Authority, 2016b)[15] (Electricity Regulatory Authority, 2016a)[16]

Germany

The strong growth of renewable energy generation in recent years is largely based on favourable policies, outlined in the renewable energy law (EEG), especially the FIT and the priority grid access granted to renewable generation. “The share of renewable electricity generation increased from 3.6 percent in 1990, when the law was enacted, to 30 percent in 2015.” (Appunn, 2016)[17] For more information on the German FIT read the Feed-In Tariffs (FIT)/Germany section.

However, a 2014 reform of the EEG, which will take effect in 2017, includes a switch from FIT to auctions. Under the new EEG the financial support awarded to projects will be determined through auctioning. However, the FIT will remain in place for small scale renewable energy plants under 750kW (150 kW for biomass). (Appunn, 2016)[17] In this way the policy aims to ensure that private households and small community initiatives continue to have favourable installation conditions. By switching to auctions the government will have better control over the new renewable energy capacity installed each year. Specific amounts of generation capacity will be auctioned each year so that the growth of renewable energy follows the 2014 ‘deployment corridor’, which will allow Germany to meet its renewable energy target in 2050. (Appunn, 2016)[17] This controlled growth will also give the country time to build out and improve the national grid allowing it to cope with the increased renewable energy capacity. Furthermore, by switching to auctions the government is hoping to achieve better market integration of renewable energy technologies and lower the costs of the support mechanism. (Bundesministerium für Wirtschaft und Energie, 2016)[18] However, according to the predictions made by Morris the new policy might actually slow down the current growth rate of renewable energy technologies in Germany.

For a graph "Renewable power growth faster than German government’s plan", have a look at the blog entry by Morris, 2016)[19].

The auction model for in the EEG reform is to be based on the lessons learned from a three test auctions, all for 500 MW solar PV, held in 2015. One of the main reasons for the trial auctions was to determine whether the competition would be large enough in order to allow for successful auctions to be held, as well as to see what kind of participants the auction would attract. In the three test auctions the competition was very high, however, this in itself does not necessarily guarantee a long term high competition, as this also depends on the future land availability for solar PV. (Bundesministerium für Wirtschaft und Energie, 2016)[18] In terms of participants it was found that while large scale project developers did pay an important role, it was still possible for small project developers and individual people to participate successfully in the auction. The pilot auctions showed that small project developers where at less of a disadvantage when the auction specification already included many of the planning specifications, because it meant that they had less financial risk due to lower pre-auction investments. (Bundesministerium für Wirtschaft und Energie, 2016)[18]

The pilot auctions were also used to determine which auction model would work best. In the first auction the ‘pay-as-bid’ model was test, while the second and third auction where held according the ‘uniform-pricing’ model. Due to the experiences gathered with these two models it was decided to use the ‘pay-as-bid’ model for future auctions. This was because in the ‘uniform-pricing’ “strategic “behaviour was observed. However, due to the price regulation advantages of the ‘uniform-pricing’ model the suggestion was made that it might be advantageous to switch the model from time to time. (Bundesministerium für Wirtschaft und Energie, 2016)[18] Due to the high competition and the fact that the auctions manager to lower the price consecutively in each round the auctions where deemed successful and Germany has decided to proceed with this support mechanism in the future.

Further Information

- Comparison_of_various_Policy_Tools_for_Promoting_Renewable_Energies

- Renewable_Energy_Quota_and_Certificate_Schemes

- Clean_Development_Mechanism_(CDM)_and_Wind_Energy_Projects_in_Brazil

- Video from the Clean Energy Solution Centre: Lessons Learned from Auction Design for Renewable Electricity

- http://www.wind-energy-the-facts.org/introduction--types-of-res-e-support-mechanisms.html

- Designing RES Auctions Well: International Experience and Lessons Learned

- European research project: AURES (Auctions for Renewable Energy Support) offers publications on auction designs for renewable energy support.

- Auctions for Renewable Support: Lessons Learnt from International Experiences

References

- ↑ 1.0 1.1 1.2 1.3 1.4 Barroso, L. A. et al., 2015a. Renewable Energy Auctions: A Guide to Design 2 (Renewable Energy Auctions and Policies), Abu Dhabi: IRENA.

- ↑ IRENA, 2012. Evaluating Policies in Support of the Development of Renewable Energy Power, Abu Dabi: IRENA.

- ↑ 3.0 3.1 Ferroukhi, R., Hawila, D. & Vinci, S., 2015. Renewable Energy Auctions: A Guide to Design 1 (Summary for Policy Makers), Abu Dabi: IRENA.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 4.6 4.7 Lucas, H., Ferroukhi, R. & Hawila , D., 2013. Renewable Energy Auctions in Developing Contries, Abu Dabi: IRENA.

- ↑ 5.0 5.1 5.2 5.3 Passey, R., Watt, M. & Woldring, O., 2014. Review of International Renewable Energy Support Mechanisms, Turner: IT Power.

- ↑ 6.0 6.1 Laumanns, U. et al., 2015. Feed-in Tariffs (FIT). [Online] Available at: https://energypedia.info/wiki/Feed-in_Tariffs_(FIT) [Accessed 25 August 2016].

- ↑ 7.0 7.1 Laumanns, U., 2014. Renewable Energy Tendering Schemes. [Online] Available at: https://energypedia.info/wiki/Renewable_Energy_Tendering_Schemes [Accessed 11 August 2016].

- ↑ 8.0 8.1 Jacobs, D., 2015. Auctioning RE projects: Lessons learned from auction design for renewable electricity. [Online] Available at: Auctioning RE projects: Lessons learned from auction design for renewable electricity [Accessed 25 August 2016].

- ↑ Grau, T., 2014. Comparison of Feed-in Tariffs and Tenders to Remunerate Solar Power Generation, Berlin: DIW Berlin.

- ↑ Eberhard, A., 2013. Feed-In Tariffs or Auctions, Cape Town: The World Bank Group.

- ↑ Tietjen, O., Amazo Blanco, A. L. & Pfeffe, T., 2015. Renewable Energy Auctions - Goal Orientated Policy Design, Eschborn: Gemeinschaft für Internationale Zusamenarbeit.

- ↑ GET FIT Uganda, n.d. About GET FIT. [Online] Available at: http://www.getfit-uganda.org/about-get-fit/ [Accessed 29 August 2016].

- ↑ 13.0 13.1 Barroso, L. A. et al., 2015b. Renewable Energy Auctions: A Guide to Designe 5 (Winner Selection Process), Abu Dabi: IRENE.

- ↑ 14.0 14.1 14.2 14.3 Meyer , R., Tenenbaum, B. & Hosier , R., 2015. Promoting Renewable Energy Through Auctions: The Case of Uganda, s.l.: World Bank - Live Wire.

- ↑ Electricity Regulatory Authority, 2016b. Get Fit Uganda final. [Online] Available at: https://www.youtube.com/watch?v=N-5xS2WP3-Y&feature=youtu.be [Accessed 29 August 2016].

- ↑ Electricity Regulatory Authority, 2016a. GET FIT Documentary HD. [Online] Available at: https://www.youtube.com/watch?v=G50oabpqV4w [Accessed 29 August 2016].

- ↑ 17.0 17.1 17.2 Appunn, K., 2016. EEG reform 2016 – switching to auctions for renewables. [Online] Available at: https://www.cleanenergywire.org/factsheets/eeg-reform-2016-switching-auctions-renewables [Accessed 15 September 2016].

- ↑ 18.0 18.1 18.2 18.3 Bundesministerium für Wirtschaft und Energie, 2016. Ausschreibungsbericht nach § 99 Erneuerbare-Energien-Gesetz (EEG 2014), Berlin: Bundesministerium für Wirtschaft und Energie.

- ↑ Morris, C., 2016. EEG: Umstieg von Einspeisevergütung auf Ausschreibungen verdrängt Bürgerenergie. [Online] Available at: http://blog.iass-potsdam.de/de/2016/06/eeg-umstieg-von-einspeiseverguetung-auf-ausschreibungen-verdraengt-buergerenergie/ [Accessed 25 August 2016].