Difference between revisions of "Small-scale Cold Storage For Fruit and Vegetables in India"

***** (***** | *****) () |

***** (***** | *****) m |

||

| (22 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | |||

= Overview = | = Overview = | ||

[[India Energy Situation|India’s]] agricultural sector, employing 52% of the nation’s population<ref name="IBEF, 2014">IBEF (2014) Indian Food Industry. [Online] Available from: http://www.ibef.org/industry/indian-food-industry.aspx [accessed: 5th August 2014]</ref>, accounts for 17.4% of GDP<ref name="CIA Factbook, 2014">CIA Factbook (2014) India.[Online] Available from:https://www.cia.gov/library/publications/the-world-factbook/geos/in.html [accessed 12th August 2014]</ref> . It has the potential to enable [[India Energy Situation|India]] – which today is the world’s biggest producer of milk, spices and pulses, and the second largest producer of fruits and vegetables worldwide<ref name="Worldbank, 2011">Worldbank (2011) Case study: Waste to Wealth by Incubating Mini Cold Storage Technology Ventures in India [Online] Available from: http://siteresources.worldbank.org/INTARD/Resources/335807-1338987609349/IndiaCaseStudy.pdf [accessed: 17th August 2014]</ref> – to become a self-sufficient food producer as well as a major food exporter. Currently, however, Indian production merely contributes 1.7% of total international trade of fruits and vegetables<ref name="TechSci Research, 2013">TechSci Research (2013, February 6th) Global Cold Chain Logistics Market. [Powerpoint Slides]. Presented at the National Cold Chain Summit in Hyderabad. Available from: http://www.assocham.org/events/recent/showevent.php?id=822</ref>. Also, prevailing poverty, rapid population growth and below average productivity levels have kept problems of mal and undernourishment that call for an improvement in India’s food supply <ref name="Worldbank, 2011">Worldbank (2011) Case study: Waste to Wealth by Incubating Mini Cold Storage Technology Ventures in India [Online] Available from: http://siteresources.worldbank.org/INTARD/Resources/335807-1338987609349/IndiaCaseStudy.pdf [accessed: 17th August 2014]</ref>. | [[India Energy Situation|India’s]] agricultural sector, employing 52% of the nation’s population<ref name="IBEF, 2014">IBEF (2014) Indian Food Industry. [Online] Available from: http://www.ibef.org/industry/indian-food-industry.aspx [accessed: 5th August 2014]</ref>, accounts for 17.4% of GDP<ref name="CIA Factbook, 2014">CIA Factbook (2014) India.[Online] Available from:https://www.cia.gov/library/publications/the-world-factbook/geos/in.html [accessed 12th August 2014]</ref> . It has the potential to enable [[India Energy Situation|India]] – which today is the world’s biggest producer of milk, spices and pulses, and the second largest producer of fruits and vegetables worldwide<ref name="Worldbank, 2011">Worldbank (2011) Case study: Waste to Wealth by Incubating Mini Cold Storage Technology Ventures in India [Online] Available from: http://siteresources.worldbank.org/INTARD/Resources/335807-1338987609349/IndiaCaseStudy.pdf [accessed: 17th August 2014]</ref> – to become a self-sufficient food producer as well as a major food exporter. Currently, however, Indian production merely contributes 1.7% of total international trade of fruits and vegetables<ref name="TechSci Research, 2013">TechSci Research (2013, February 6th) Global Cold Chain Logistics Market. [Powerpoint Slides]. Presented at the National Cold Chain Summit in Hyderabad. Available from: http://www.assocham.org/events/recent/showevent.php?id=822</ref>. Also, prevailing poverty, rapid population growth and below average productivity levels have kept problems of mal and undernourishment that call for an improvement in India’s food supply <ref name="Worldbank, 2011">Worldbank (2011) Case study: Waste to Wealth by Incubating Mini Cold Storage Technology Ventures in India [Online] Available from: http://siteresources.worldbank.org/INTARD/Resources/335807-1338987609349/IndiaCaseStudy.pdf [accessed: 17th August 2014]</ref>. | ||

| Line 6: | Line 5: | ||

| + | = India's Cold Chain and Cold Storage Sector - The Status Quo<br/> = | ||

| + | A pivotal difference in agricultural supply and value chains in developed and developing nations is, that in the former unbroken cold chains for post harvest production exist, whereas many producers in less developed nations often struggle with limited storage options and even access to basic cold storage structures; access to cold storage, especially for small-scale farmers, is extremely limited. If cold storage is available, poor road conditions, bad electricity supply, inadequate handling of produce post harvest, e.g. during transportation, and a lack of temperature control on markets increase the challenges posed<ref name="Emerson 2013">Emerson Climate Technologies (2013) The Food Wastage and Cold Storage Infrastructure Relationship in India. [Online] Available from: http://www.emerson.com/SiteCollectionDocuments/India%20Cold%20Storage%20Report%202013/Report_layout_Reduced.pdf</ref>. | ||

| − | < | + | In their report on cold storage infrastructure in India, Emerson Climate Technologies<ref name="Emerson 2013">Emerson Climate Technologies (2013) The Food Wastage and Cold Storage Infrastructure Relationship in India. [Online] Available from: http://www.emerson.com/SiteCollectionDocuments/India%20Cold%20Storage%20Report%202013/Report_layout_Reduced.pdf</ref> estimate that in 2012, 6300 cold storage facilities were installed in India with a total space of 30.11 million metric tons. The report further notes that this number is required to double if current levels of food wastages are not to increase further. Also intra-country differences with regards to cold storage capacity stand out: 60%, i.e. 10.187 metric tons, of cold storage space is located in Uttar Pradesh, West Bengal, Gujarat and Punjab alone. Whereas the disparity between supply and demand for cold storage is at 20% in Uttar Pradesh, this gap amounts to staggering 97% in Tamil Nadu, where in 2010 merely 0.0239 million metric tons of cold storage had been installed. The National Horticulture Board<ref name="National Horticulture Board, 2010">National Horticulture Board (2010) Cold Storage for Fresh Horticulture Produce Requiring Pre-cooling before Storage. Haryana: Cold Chain Development Centre National Horticulture Board </ref> estimates that investments in the dimension of about INR 550.74 billion till 2015/16 are required to keep up with growing vegetable and fruit production of vegetables<ref name="Emerson 2013">Emerson Climate Technologies (2013) The Food Wastage and Cold Storage Infrastructure Relationship in India. [Online] Available from: http://www.emerson.com/SiteCollectionDocuments/India%20Cold%20Storage%20Report%202013/Report_layout_Reduced.pdf</ref>. Currently, 95% of total cold storage capacity in India is in the hand of private players<ref name="TechSci Research, 2013">TechSci Research (2013, February 6th) Global Cold Chain Logistics Market. [Powerpoint Slides]. Presented at the National Cold Chain Summit in Hyderabad. Available from: http://www.assocham.org/events/recent/showevent.php?id=822</ref>. |

| + | It is further noteworthy that the majority of cold storage facilities cater to single commodities only – mainly potatoes which are an important staple food in the Indian context requiring special storage conditions. However, whereas single commodities storages are easier to manage, the trend is moving towards multi commodity storages offering higher returns<ref name="TechSci Research, 2013">TechSci Research (2013, February 6th) Global Cold Chain Logistics Market. [Powerpoint Slides]. Presented at the National Cold Chain Summit in Hyderabad. Available from: http://www.assocham.org/events/recent/showevent.php?id=822</ref>. | ||

| − | + | Currently, over 3500 players, which are made up of 85% of cold chain solution providers and 15% transportation service providers, are active in India’s cold storage infrastructure. About 25000 trucks, out of which 80% were solely used to transport milk – leaving merely 5000 trucks for the transportation of fruits and vegetables – are run by 250 reefer transport companies<ref name="Emerson 2013">Emerson Climate Technologies (2013) The Food Wastage and Cold Storage Infrastructure Relationship in India. [Online] Available from: http://www.emerson.com/SiteCollectionDocuments/India%20Cold%20Storage%20Report%202013/Report_layout_Reduced.pdf</ref>. India’s cold chain for fresh produce is very fragmentary and non-existent in many places. Some of the underlying factors limiting and hampering this sector are listed below:<br clear=all> | |

| − | |||

| − | + | [[File:01CSS.png|thumb|500px|Factors limiting cold storage in India|left]]<br clear=all> | |

| − | + | Due to the ubiquitous lack of cold storage, small-scale farmers are eager to sell their produce as close as possible after the time of harvest since the market value of vegetables decreases by 25% to 40% daily<ref name="Worldbank, 2011">Worldbank (2011) Case study: Waste to Wealth by Incubating Mini Cold Storage Technology Ventures in India [Online] Available from: http://siteresources.worldbank.org/INTARD/Resources/335807-1338987609349/IndiaCaseStudy.pdf [accessed: 17th August 2014]</ref>. A report by the Worldbank<ref name="Worldbank, 2011">Worldbank (2011) Case study: Waste to Wealth by Incubating Mini Cold Storage Technology Ventures in India [Online] Available from: http://siteresources.worldbank.org/INTARD/Resources/335807-1338987609349/IndiaCaseStudy.pdf [accessed: 17th August 2014]</ref> states that 10% of this loss occurs in farmer’s markets driving down prices in times of excess supply and in the worst case leads to price crashes resulting in prices that do neither cover production, harvesting or transportation cost<ref name="Kornstein, 2012">Kornstein, S. (2012) India’s Cold Storage Capacity. [Online] January 14th 2012. Available from: Something’s Brewing http://www.somethingsbrewing.com/2012/01/indias-cold-storage-capacity/ [accessed on 22nd July 2014]</ref>. On the other hand, consumers suffer under peaking prices during supply gaps and off-seasons. Storage structures can help to store seasonal produce for which year-round demand exists and to create buffer stocks stabilizing food prices for producers and consumers alike<ref name="GIZ-HERA , 2011">GIZ-HERA (2011) Modern Energy Services for Modern Agriculture – A Review of Smallholder Farming in Developing Countries. Available from: http://www.water-energy-food.org/documents/giz/energy-services-for-modern-agriculture.pdf</ref>. | |

| − | |||

| − | |||

= Further Information = | = Further Information = | ||

| − | *[[Portal: | + | *[[Cold Storage of Agricultural Products|Cold Storage of Agricultural Products]] |

| + | *[[Pre-cooling of Agricultural Products|Pre-cooling of Agricultural Products]] | ||

| + | *[[Portal:Water and Energy for Food|Water and Energy for Food (WE4F) portal on energypedia]] | ||

*[[India Energy Situation|India Energy Situation]] | *[[India Energy Situation|India Energy Situation]] | ||

| − | + | *[[:File:GIZ_(2016)_-_Promoting_Food_Security_and_Safety_via_Cold_Chains.pdf|Promoting Food Security and Safety via Cold Chains]]<br/> | |

| − | |||

| − | <br/> | ||

| Line 36: | Line 35: | ||

[[Category:India]] | [[Category:India]] | ||

[[Category:Powering_Agriculture]] | [[Category:Powering_Agriculture]] | ||

| + | [[Category:Agriculture]] | ||

[[Category:Energy_Efficiency]] | [[Category:Energy_Efficiency]] | ||

Latest revision as of 19:12, 14 July 2020

Overview

India’s agricultural sector, employing 52% of the nation’s population[1], accounts for 17.4% of GDP[2] . It has the potential to enable India – which today is the world’s biggest producer of milk, spices and pulses, and the second largest producer of fruits and vegetables worldwide[3] – to become a self-sufficient food producer as well as a major food exporter. Currently, however, Indian production merely contributes 1.7% of total international trade of fruits and vegetables[4]. Also, prevailing poverty, rapid population growth and below average productivity levels have kept problems of mal and undernourishment that call for an improvement in India’s food supply [3].

Whilst productivity levels are one point of possible intervention, the post-harvest chain of food supply cannot be neglected[5]. As a matter of fact, out of 76.42 million tons of fruits and 156.32 tons of vegetables produced in India, about 40% go to waste creating an annual loss of about $6 billion. The loss is mainly caused by a lack in food processing and cold storage facilities [4][3].Targeting post harvest losses instead of solely focusing on the production site can offer higher internal rates of return, have a significant impact on poverty alleviation, and improvement of health and food security whilst ensuring a more sustainable use of resources[5].

India's Cold Chain and Cold Storage Sector - The Status Quo

A pivotal difference in agricultural supply and value chains in developed and developing nations is, that in the former unbroken cold chains for post harvest production exist, whereas many producers in less developed nations often struggle with limited storage options and even access to basic cold storage structures; access to cold storage, especially for small-scale farmers, is extremely limited. If cold storage is available, poor road conditions, bad electricity supply, inadequate handling of produce post harvest, e.g. during transportation, and a lack of temperature control on markets increase the challenges posed[6].

In their report on cold storage infrastructure in India, Emerson Climate Technologies[6] estimate that in 2012, 6300 cold storage facilities were installed in India with a total space of 30.11 million metric tons. The report further notes that this number is required to double if current levels of food wastages are not to increase further. Also intra-country differences with regards to cold storage capacity stand out: 60%, i.e. 10.187 metric tons, of cold storage space is located in Uttar Pradesh, West Bengal, Gujarat and Punjab alone. Whereas the disparity between supply and demand for cold storage is at 20% in Uttar Pradesh, this gap amounts to staggering 97% in Tamil Nadu, where in 2010 merely 0.0239 million metric tons of cold storage had been installed. The National Horticulture Board[7] estimates that investments in the dimension of about INR 550.74 billion till 2015/16 are required to keep up with growing vegetable and fruit production of vegetables[6]. Currently, 95% of total cold storage capacity in India is in the hand of private players[4].

It is further noteworthy that the majority of cold storage facilities cater to single commodities only – mainly potatoes which are an important staple food in the Indian context requiring special storage conditions. However, whereas single commodities storages are easier to manage, the trend is moving towards multi commodity storages offering higher returns[4].

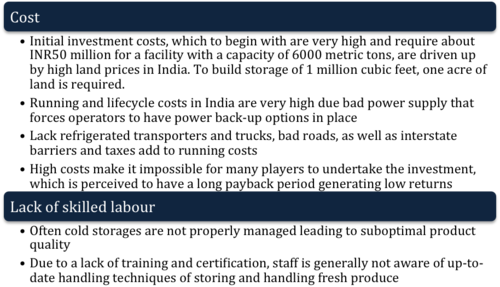

Currently, over 3500 players, which are made up of 85% of cold chain solution providers and 15% transportation service providers, are active in India’s cold storage infrastructure. About 25000 trucks, out of which 80% were solely used to transport milk – leaving merely 5000 trucks for the transportation of fruits and vegetables – are run by 250 reefer transport companies[6]. India’s cold chain for fresh produce is very fragmentary and non-existent in many places. Some of the underlying factors limiting and hampering this sector are listed below:

Due to the ubiquitous lack of cold storage, small-scale farmers are eager to sell their produce as close as possible after the time of harvest since the market value of vegetables decreases by 25% to 40% daily[3]. A report by the Worldbank[3] states that 10% of this loss occurs in farmer’s markets driving down prices in times of excess supply and in the worst case leads to price crashes resulting in prices that do neither cover production, harvesting or transportation cost[8]. On the other hand, consumers suffer under peaking prices during supply gaps and off-seasons. Storage structures can help to store seasonal produce for which year-round demand exists and to create buffer stocks stabilizing food prices for producers and consumers alike[9].

Further Information

- Cold Storage of Agricultural Products

- Pre-cooling of Agricultural Products

- Water and Energy for Food (WE4F) portal on energypedia

- India Energy Situation

- Promoting Food Security and Safety via Cold Chains

References

- ↑ IBEF (2014) Indian Food Industry. [Online] Available from: http://www.ibef.org/industry/indian-food-industry.aspx [accessed: 5th August 2014]

- ↑ CIA Factbook (2014) India.[Online] Available from:https://www.cia.gov/library/publications/the-world-factbook/geos/in.html [accessed 12th August 2014]

- ↑ 3.0 3.1 3.2 3.3 3.4 Worldbank (2011) Case study: Waste to Wealth by Incubating Mini Cold Storage Technology Ventures in India [Online] Available from: http://siteresources.worldbank.org/INTARD/Resources/335807-1338987609349/IndiaCaseStudy.pdf [accessed: 17th August 2014]

- ↑ 4.0 4.1 4.2 4.3 TechSci Research (2013, February 6th) Global Cold Chain Logistics Market. [Powerpoint Slides]. Presented at the National Cold Chain Summit in Hyderabad. Available from: http://www.assocham.org/events/recent/showevent.php?id=822

- ↑ 5.0 5.1 Kader, A.A. (2005) Increasing Food Availability by Reducing Postharvest Losses of Fresh Produce. In: Mencarelli, F. and Tonutti, P. (eds.). International Postharvest Symposium, Verona, Italy

- ↑ 6.0 6.1 6.2 6.3 Emerson Climate Technologies (2013) The Food Wastage and Cold Storage Infrastructure Relationship in India. [Online] Available from: http://www.emerson.com/SiteCollectionDocuments/India%20Cold%20Storage%20Report%202013/Report_layout_Reduced.pdf

- ↑ National Horticulture Board (2010) Cold Storage for Fresh Horticulture Produce Requiring Pre-cooling before Storage. Haryana: Cold Chain Development Centre National Horticulture Board

- ↑ Kornstein, S. (2012) India’s Cold Storage Capacity. [Online] January 14th 2012. Available from: Something’s Brewing http://www.somethingsbrewing.com/2012/01/indias-cold-storage-capacity/ [accessed on 22nd July 2014]

- ↑ GIZ-HERA (2011) Modern Energy Services for Modern Agriculture – A Review of Smallholder Farming in Developing Countries. Available from: http://www.water-energy-food.org/documents/giz/energy-services-for-modern-agriculture.pdf