Click here to register!

Solar Powered Irrigation in Mozambique : Market Share

Introduction

This article is part of the publication on Solar irrigation market analysis in Mozambique which looks at the feasibility of introducing individual solar-powered irrigation packages at small scale enterprise level in Mozambique.

Main target segment

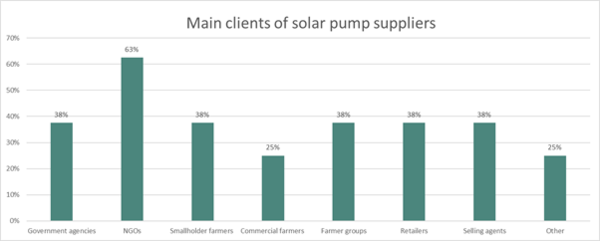

To the question “who is your main client” each respondent in this study gave on average 3 answers.

NGOs are mentioned the most as the main client by pump distributors (63%). Almost all other client categories (government, smallholder farmers, farmer groups, retailers and selling agents) are mentioned as one of their main clients by 38% of the respondents. Commercial farmers are mentioned by only 25% of the suppliers.

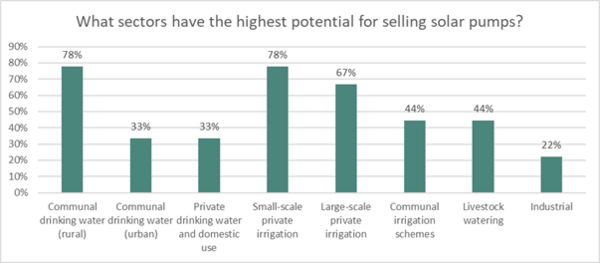

Asked for the sectors with the highest potential for selling solar pumps, most suppliers (78%) indicated that small-scale private irrigation, as well as communal rural drinking water systems have the highest potential, closely followed by large-scale private irrigation (67%).

Four solar pumps available in Mozambique have an output that corresponds to the water requirement of smallholder farmers, i.e. those pumps providing 2 to 2.5 m3/hour, which allows for an irrigated area of 2000 to 4000 m2 depending on the location, season, crop, soil type and irrigation system. These are the Taifu, Futurepump SF2, Grundfos 2.5-2 and Lorentz PS2-100 models. The Solartech SPM600H has a larger flow but the lowest pump price, which also makes it a potential option for smallholder farmers. The Feili pump has a relatively high price, but includes almost all required components. The cost of the Taifu, Solartech, Lorentz and Grundfos pumps will increase considerably since the solar panels are currently not included in the price, see Table 5. It should be noted that there are important differences in capacity and quality of the pumps in the table below. It should be used as an indication of some available products and prices, and not as a tool for comparison.

Table 8 Overview of solar pumps for small-scale irrigation

| Overview of pumps applicable for small-scale irrigation | |||||||

| Supplier in Mozambique | Brand | Model | Price in Meticais | Price in EUR | Total Watt-age | Rated head (m) | Rated flow (m3/h) |

| Metaluz Lda | Taifu (Jiadi and Pumpman) | 4SWN205-0.8N | 32,760 | 449 | 1280 | 57 | 2.2 |

| Sun Power Engineering | Solartech | SPM600H | 20,000 | 274 | 270 | ? | 10 |

| Water Irrigation Solutions Moz, Lda | Futurepump | SF2 | 77,500 | 1062 | 120 | 3-6 | 2 |

| SE1 | ? | 60 or 120 | 3-6 | 1 | |||

| Blue Zone Mozambique Lda | Grundfos | SQF 2.5-2 | 140,000 | 1918 | 1200 | 100 | 2,5 |

| Soelec | Lorentz | PS2-100 | 80,000 | 1096 | 327 | 40 | 2 |

| F&L Lda | Feili | FLD, FLA | 210,000 | 2877 | ? | ? | 60 |

Number of Solar Pumps Sold

Overall the quantity sold by each distributor increases over time.

Table 9 Historic pump sales per company

|

| ||||

| 2020 | 2019 | 2018 | 2017 and before | |

| Company A | 30 | 20 | 15 | 0 |

| Company B | 450 | 420 | 435 | 320 |

| Company C | 10 | 15 | 9 | 5 |

| Company D | 100 | 100 | 100 | 0 |

| Company E | 200 | 180 | 150 | (150) |

| Company F | 2 | 3 | 0 | 0 |

| Company G | 25 | 6 | 2 | 1 |

| Company H | 3 | 0 | 0 | 0 |

| TOTAL | 820 | 744 | 711 | 476 |

| Increase rate | +10% | +5% | ||

Local Representation

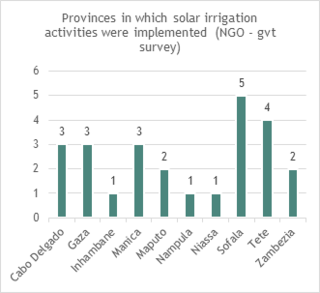

50% of the respondents have a representation in Maputo, the second location mentioned is Beira (37%). There is a clear relation between the towns with a local representation and the main provinces where the solar pumps are sold. However, there is no clear link between the location of local branches and the provinces where NGOs and government have distributed pumps.

| Main provinces where solar pumps are used (per supplier) | In which towns do you have a representation |

| Maputo | Maputo, Nampula and Beira |

| Nampula, Sofala, Gaza | Maputo |

| Gaza, Zambezia |

|

| Sofala, Cabo delgado, Zambezia, Tete | Matola and Beira |

| All over the country | Tete, Manica, Beira, Nampula |

| Inhambane | Maputo |

| Maputo | Maputo |

| Manica, Sofala | Chimoio |

After Sale Services

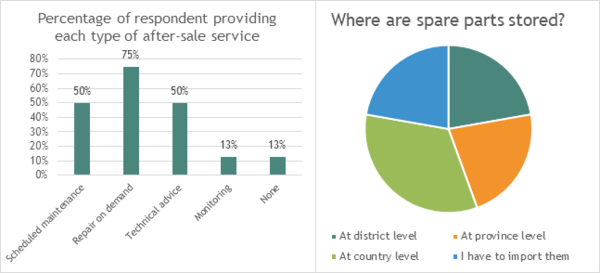

Asked for the after-sales services offered, 75% of the suppliers provide repairs on demand. Half of the suppliers also provide scheduled maintenance services or technical advice to their clients. The companies have between 1 and 6 technicians available for after-services, yet the largest one (SunPower) stands out with 15 available technicians throughout the country. The availability of technicians seems to have a direct effect on the average downtime, or the time between a reported pump failure and reparation, which is 2 days according to SunPower, while the average downtime amongst all suppliers is 9 days. It should be noted that a downtime of 9 days could lead to a lost harvest in case the farmer cannot find an alternative pump in the meanwhile.

There is also a relation between the downtime and the level where spare parts are stored, with those suppliers storing spare parts at district level being able to fix failures in 2-3 days, while the two companies who need to import the spares both indicate a period of 15 days before a pump failure can be solved.

Finance Solutions

Only two respondents indicated that they offer solar pumps with a credit or lease arrangement. One large distributor does so to known and trusted customers only, mainly because the interest rates at the banks are too high for their clients. The other supplier, a retailer, mentions that they provide credit only to clients with a monthly salary of more than 10,000 meticais. The money is subsequently collected through home visits and bank transfers. No company makes use of a central collection point, mobile money or other methods to collect instalments. The main reason for not providing finance solutions to their customers is that the companies do not have enough cash flow to pre finance the pumps (60%). One supplier mentioned the delayed payments by customers as a reason to not engage in credit provision.

The open question on what kind of support would be needed to offer (more) products on credit was answered in two ways. Half of the responses indicated that a bank facility with low credit rates should become accessible for farmers that are interested to buy a pump. The other half mentioned that a project or subsidy would be needed to make up for the deficit.

Success Formula

Finally, each company was asked for their success formula in the solar pumps sector. As shown in the word cloud, three major types of strategies could be extracted from this, highlighting either the quality of the products, the importance of a country-wide network, and a close relationship with the clients.