Click here to register!

Sustainability Assessment of Improved Cookstoves in Kenya

Overview

This article gives an overview of the Study: "Improved Cookstoves in Kenya: To what extend has a sustainable market been established?" carried out in Kenya in 2012/13.

Idea

The Energising Development (EnDev) Partnership is a joint impact-oriented global sector programme of Germany, the Netherlands, Norway, Australia, United Kingdom and Switzerland, with additional co-funding from Ireland and the European Union. Its aim is to provide sustainable access to modern energy.

Since 2006, EnDev Kenya has been promoting improved cookstoves in Kenya. As of June 2012, this project had already reached 3.352.000 people. Its focus and main aim has been to establish sustainable markets, allowing EnDev to eventually phase out activities and nonetheless ensure sustainable access to improved cookstoves (ICS). Against this background, this sustainability study aims to evaluate to what extent a sustainable market has really been created in zones where EnDev has phased out activities.

Methodology

The paper uses GIZ-HERAs sustainability framework, a framework developed in order to evaluate the sustainability of cookstove markets. It includes four quantitatively measureable criteria (penetration rate, usage rate, maintenance rate and replacement rate) and several sustainability factors which influence these criteria.

The factors can be categorized into those that:

- encourage the continued supply of ICS

- encourage demand

- directly encourage the usage, maintenance and replacement rates

- enhance the political framework for ICS markets

- reduce market volatility

For a holistic approach that covers sustainability criteria and factors, interviews were conducted with households, stove producers, and related organizations. For an insight into the demand side as well as usage and maintenance rates, a total of 1193 household interviews were conducted in 55 villages in 11 divisions of 3 clusters. Random sampling was used to identify locations, sub-locations and eventually villages that would be used for the surveys. These were conducted by trained enumerators, without exterior influences from the project or village elders, and based on a previously field-tested questionnaire.

A total of 83 stove dealers in those 3 clusters were also interviewed by trained enumerators with the help of a different questionnaire, in order to give an insight into the supply side of the market. Due to different share of dealers per division (partly due to availability of materials), the number of interviews with different stove dealers varies across divisions, an effort was made to interview producers outside the given divisions where it was needed.

Lastly, 5 qualitative in-depth interviews were conducted with relevant actors in the cooking energy sector, so that the general environment and political framework could be analyzed.

These were representatives from the following organisations:

- Kenyan Tea Development Foundation

- APHIA Plus

- Improved Cookstove Association Kenya

- Kenyan Ministry of Energy

- SNV

In order to answer the research question as to what extent a sustainable market has been established, those project divisions where EnDev has either been active for at least 3 years, or where it has been active 3 years ago and pulled out were identified. Results were then compared to active areas.

General Results

A wide range of information was found out through household interviews. The target group, and thus main interviewee were women above the age of 18, and most households interviewed were either of average wealth or well off. Firewood was the predominant fuel, with 99% using it, about 48% of interviewees also use charcoal.

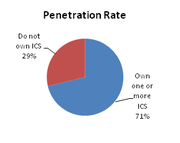

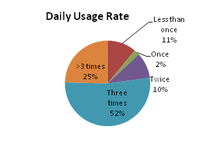

As for the sustainability criteria, the penetration rate and usage rate are very high: about 71.2% of interviewed households own one or more ICS, and 89% of households that own an ICS use it on a daily basis, more than three quarters even use it three times a day or more often. Overall, the satisfaction with their ICS is very high, with 95.3% of interviewees being either “satisfied” or “very satisfied”.

|

|

The maintenance and replacement rates, however, paint a more ambiguous picture. 52% of respondents have not maintained or repaired their stoves, although it is questionable as to whether all interviewees understood what is meant by stove maintenance. Only 23.4% of households claim to have had the stove repaired, usually by the household itself or a family member. The reason not to maintain or repair the stove was usually, in 83.1% of cases, that it was still in good condition.

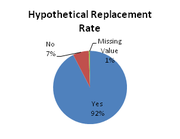

The replacement rate was also very low. Reasons not to replace a stove are similar: the rationale is that it is still in good condition. 92.5% of ICS owners state they would replace the stove if necessary. However, a total of about 90 stoves were found to be in poor condition and a total of 40 households had replaced an ICS, making the calculated replacement rate around 44.4%. However, this calculation is based on a low number of observations and may not be accurate.

The stove dealer questionnaire also allowed for a large variety of information and aspects of supply to be gathered.

Most stove dealers (91.6%) were trained by GIZ, about 13.3% by another stove dealer. Competition is stated by 74.4% to have increased over the last three years.

A bit more than half of stove dealers are members of the Improved Stove Association Kenya (ISAK), a part of the project’s exit strategy; although 40% of interviewed members state ISAK does nothing for their business.

All dealers state to inform households about maintenance activities and 80% have been asked for repair services. In addition, 89.2% of dealers state households usually replace a broken stove.This is compatible with the hypothetical replacement rate from household questionnaires, but not with the observed one.

Pull-Out Analysis

When comparing active divisions to pull-out divisions, the following picture for sustainability criteria emerges: all criteria have a higher rate in pull-out areas, the usage and maintenance rate are almost unchanged. There are, however significant differences in the clusters, and rates have fallen in some divisions. This is something that may need to be analyzed more thoroughly.

|

Sustainability Criteria |

Active |

Pull-Out |

|

Penetration Rate |

67.4% |

76.3% |

|

Usage Rate |

88.8% |

89.3% |

|

Maintenance Rate |

47.7% |

49.2% |

|

Replacement Rate |

34.5% |

49.2% |

As for the supply side, stove dealers are seen to take better records of their sales in pull-out areas, but also to modify the stove design a bit more according to their user’s wishes rather than just focusing on technical performance. More stove dealers in pull-out areas are expanding their business. Overall, however, results between active and pull-out areas do not differ much, and differences between clusters are more significant.

All in all, the conclusion is that the market has seen a steady development since EnDev Kenya first started its activities. The development tends towards a sustainable market, but the development of the replacement rate will be a huge factor towards whether or not a sustainable market will exist.

Recommendations and Outlook

Using the data collected from household and dealer surveys, as well as the in-depth interviews with relevant actors in the cookstove environment, a few recommendations are given. These include analyzing replacement and maintenance rates in more detail, and trying to increase these. More research is also needed for explaining the differences between rates in clusters, and different tendencies upon the project pulling out.

Other recommendations include an extension of entrepreneur training into more managerial and financial aspects, as well as a concentration on after-sales service. Quality control also needs to be ensured. Lastly, in order to strengthen the institutional environment for a sustainable market, the ISAK needs to be re-assessed and evaluated.

Further Information

References

Author: Katja Diembeck

Supervisor: Lisa Feldmann, energypedia consult