Liquefied Petroleum Gas (LPG)

What is LPG

Liquefied Petroleum Gas (LPG) is a blend of light hydrocarbon compounds. It mainly consists of butane (C4H10) or propane (C3H8) or a mixture of both. At room temperature, both gases are colourless and odourless. Propane has its boiling point at -42°C and butane at -0.5 °C. Under modest pressure or in cooler conditions, LPG transforms into a liquid state. LPG in domestic cylinders used for cooking generally comprises more butane than propane, because the fuel value per kilogram of butane is higher than propane and it liquefies under much lower pressure than propane and thus the handling is safer. National and international standards specify the minimum content of butane and a maximum LPG vapor pressure. When liquefied under pressure, the volume of butane and propane is reduced to around 1/260 of the gaseous aggregate state. The specific calorific value of LPG is around 46 MJ/kg or 12.78 kWh/kg depending on the composition of LPG. In comparison, wood has an energy content in the range of 14-18 MJ/kg or 3.89 - 5 kWh/kg (depending of the type of wood and the moisture content) and charcoal in the range of 27 - 33 MJ/kg or 7.5 - 8.34 kWh/kg (depending on the type of charcoal). If made available as a cooking energy fuel it could help to reduce the use of wood and biomass in households in developing countries.

Liquefied Gas is heavier than air and can therefore accumulate above the ground. This may lead to LPG-'lakes'. It is common practice to add a foul smelling odorant to the gas in order to detect leaks and reduce the risk of explosions.

LPG is non toxic but highly flammable. Therefore, LPG has to be handled with care and all equipment and appliances used to store or transport the gas must comply with high safety standards. They have to be maintained and regularly inspected. Trading with LPG is normaly subject to government safety regulations and corresponding enforcement do prevent fire and explosion accidents.

Further Information:

- Multiple Household Cooking Fuels (These factsheets present different characteristics of different cooking fuels)

- What’s the difference between CNG, LNG, LPG and Hydrogen? (An article about the differences between Compressed Natural Gas (CNG), Liquefied Natural Gas (LNG) and hydrogen.)

- Deutscher Verband Flüssiggas e.V. (This website (German) of the German Association of Liquid Gas communicates news information and events.)

Supply and Demand

LPG Supply

1. How is LPG produced?

LPG is a byproduct of natural gas and oil extraction and crude oil refining. Around 60% of LPG stocks in the last years have been separated from raw gas and raw oil during the extraction of natural gas and oil from the earth, and the remaining 40% have been a byproduct when crude oil is refined.[1]

a. LPG from petroleum gas and oil extraction

Natural gas is made up of gases and liquids to varying degrees. In most cases the gas has to be processed to remove impurities such as ethane, propane, butane and water, to meet the specifications of commercial natural gas. A detailed description of natural gas processing can be found in Wikipedia.[2] The separated propane and butane are used as LPG. Thus, 1 - 10% of the total 'raw petroleum gas' will become LPG[3].

LPG also appears as an accompanying gas during oil extraction. Each ton of raw oil contains 25 - 800 m³ accompanying gas. This is immedialely extracted in order to stabilise the raw oil. The accompanying gases are then either processed or burnt on the spot. As part of the latter process - known as flaring - approximately 140 billion m³ of potential LPG are burnt every. This is equal to approx. 70 million tons (or 5 % of the global gas consumption) or 30 - 35 billion USD[4].

b. LPG from the refining process

LPG is separated from other derivatives in oil and gas refineries. 4 - 5 % of the total raw oil can usually be extracted as LPG. This can decrease to as little as 1 % depending on the quality of the raw oil, the technical standard of a refinery and current market prices for propane and butane in comparison to other oil products.

2. How much LPG is produced?

In the last 15 years, LPG productions has been growing continuously and has always exceeded consumption. This growth can largely be attributed to the gas extraction sector- whose LPG production capacities grew substantially. This especially includes the US-led expansion of shale gas extraction called 'fracking', which provides LPG as by product [5]. Since 2011, LPG production has always been above 270 million tons per year, Thus, it reached 284 million tons/year in 2014[6]. Excess of LPG is partly vented or burned off by the oil and gas companies.

3. Where is LPG produced?

LPG is currently produced in all continents. North America and the Middle East are the largest LPG producer followed by some Asian regions. Africa is producing less than 10% of the world production. Thus in 2014, only 16 million tons of LPG came from Africa, most of it from Algeria.

North American production capacities are expected to grow further due to the expansion in the shale gas sector[7]. It is also expected that LPG production will increase in West Africa, Australia, Russia and China[8]. This increase is mainly possible through the development of refineries which allow the extraction of LPG.

4. How much LPG will be available in the future?

As byproduct of the oil and gas industry the supply of LPG is directly dependent on the extraction of fossil fuels. When fossil fuel extraction increases, more LPG becomes available. When it falls, LPG availability will also fall. While larger production capacities may open up from the development of new fossil fuel sources, it has to be highlighted that most conventional fossil fuel fields are already being exploited. Additional fossil fuel sources may be harnessed from unconventional sources. However, these are mostly linked to significant environmental risks.

More LPG may also be made available from accompanying gases that are currently being flared. This ressource offers 70 million tons of gas. First attempts to power villages by converting such accompanying gases to electricity are prepared as part of a specific High Impact Opportunities (HIO) under the UN Initiative "Sustainable Energy for All" (see SE4All).

LPG Demand

1. How much LPG is consumed where?

According to estimates, around 2 billion people worldwide use LPG for heating, cooking and other purposes. Global LPG consumption in 2008 stood at 230 million tons. By 2012, consumption rose to 265 million tons.

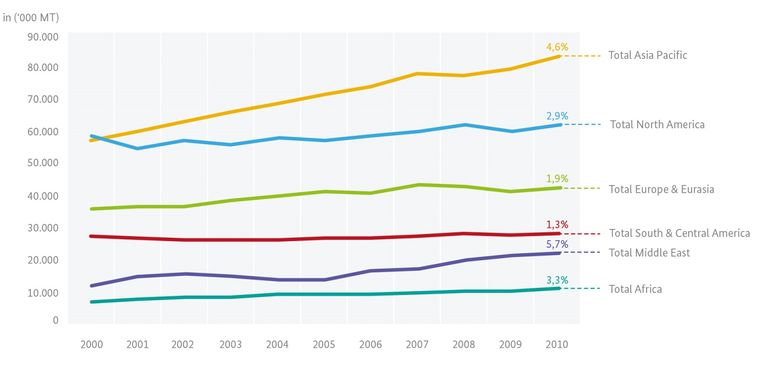

The largest proportion of the increase can be attributed to the Asian-Pacific region. Consumption there rose from 58,000 million tons to 80,000 million tons between 2000 and 2010. In 2011 the Asia-Pacific region made up 35 % of global consumption. Annual growth rates of 4.8 % in demand are anticipated until 2018[9].

Fig. 1. Global LPG consumption from 2002-2012 (adapted from Argus, 2013)

Regarding individual countries, China is the leading LPG consumer with 13.3 million tons p.a., followed by India consuming 9.9 million tons. USA, Mexico and Brazil consume 7.5, 6.3 and 5 million tons of LPG per year.

2. What is LPG used for?

Most consumption of LPG occurs at the household level (49 %), followed by the use of LPG as feedstock in the petrochemical industry (21.6 %) and other industrial uses (11.8 %). Direct consumption in refineries and finally the agricultural sector make up 2 % of global consumption. Other sectors (e.g. Autogas) add up to an aggregated 9.3 % of total consumption[10].

LPG is used for the following purposes:

- Heating and Cooking - especially in locations that are not connected to local gas distribution systems.

- Auto gas - Consumption of auto gas is enhanced through low taxes. In 2008, more that 13 million cars ran on LPG globally. Industries are currently promoting the spread of car gas.

- Furthermore, LPG is used for cooling and in the Petrochemical industry. The petrochemical industry uses LPG mainly as feedstock for instance in the production of plastic[11].

In poor developing countries LPG is almost exclusively used as a cooking fuel. The users are predominately middle- to high-income households in regions with a supply network (mostly urban and peri-urban areas).

Relationship between Demand and Supply

Since 2007, the global production capacity of LPG is growing faster than demand: In 2012, there were 9.7 million tons of LPG availalbe in excess. This gap is currently widening. In 2012, for example, consumption rose by 2 % whereas production rose by 3 %.

Despite excess capacities, LPG remains scarce in many regions - especially in the rural areas of developing countries (see e.g. Chandra, 2010). This is mainly due to lacking supply networks, which are not able to supply households with the excess LPG. Furthermore, the target group 'poor households' which is a large potential customer group often targeted in international initiatives tends to dispose of too little income to afford LPG. This will be discussed further below.

The excess amount of LPG is thus often processed. LPG is used in petrochemical industries or in the production of Liquid Natural Gas[12].

Further Information:

- Paper/Statistical Review of Global LP Gas2013.pdf Statistical Review of LP Gas (Short overview of results of statistical research of Argus and WLPGA concerning the production and consumption of LPG.)

- Indian LPG Market Prospects (A PowerPoint presentation on plans of the Indian government concerning LPG consumption and development.)

- Residential Market for LPG: A Review of Experience of 20 Developing Countries (A World Bank sponsored study of LPG markets in 20 different countries.)

- Global Liquefied Petroleum Gas (LPG) Market is Expected to Reach USD 266.41 Billion in 2018: Transparency Market Research (Short overview of results of a market survey by Transparency Market Research about the future development of LPG markets.)

- Gas Flaring - Warum Ölkonzerne auf Klimaschutz pfeifen (Documentary (in German) about gas flaring and technical solutions to extract accompanying gases.)

- List of Publications of the World LPG Associations

LPG Supply

Value Chain and Supply Route

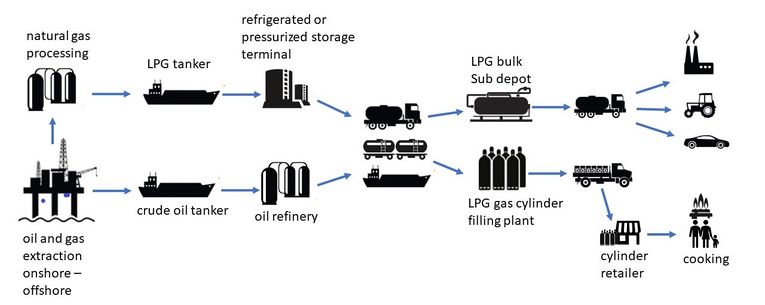

A number of different steps are necessary between the raw form of LPG up to the final consumer. A sophisticated infrastructure is required for the distribution. LPG either comes directly from gas wells or is a by-product of crude oil refining. Subsequently, it is delivered from supply points in a liquefied form to primary bulk storage facilities, where it is stored under refrigeration or pressurisation. The owners/operators of bulk storage facilities may also be the importers and have the necessary transport facilities. LPG for cooking is brought to cylinder filling plants. The cylinders are either owned by the bottling company or by distributers or by the consumers (see below the different distribution systems). The filled cylinders are distributed to a network of intermediaries, who operate depots and the necessary transportation facilities. The cylinders are supplied to retail points, where they are sold to customers. Empty cylinders are either returned along the chain to the filling plant or directly brought to a filling station by the customer.

Figure 2. Route of LPG from production to the end-consumer (adapted from graphic on WLPGA website)

Cylinder Distribution Systems

There are two main systems for distributing LPG cylinders to consumers: the Consumer Controlled Cylinder Model (CCCM) and the Branded Cylinder Recirculation Model (BCRM).

In CCCM the consumer owns the cylinder and is fully responsible for maintaining the cylinder. The consumer can refill it at any refilling station. Main disadvantag of the CCCM is a possible decline in cylinder safety, leading to an increased risk of fire and explosion accidents. In addition, the CCCM is susceptible for black market LPG activities by unlicensed and uncertified refilling businesses disregarding safety.

In BCRM the LPG marketing company owns the cylinder and hence, is fully responsible for maintaning the cylinder. Consumers can refill the cylinder only at authorized stations of the marketing company. The consumer generally pays a deposit to obtain the first cylinder from authorized distributers, which is typically set below the cost of the cylinder, plus the purchase price of the LPG it contains. Empty cylinders are exchanged for a full cylinder of the same brand for the refill price. Main disadvantages of BCRM are the often higher end consumer cost of the cylinder and the refilling and the exclusion of small enterprises from the LPG business.

LPG as a Cooking Fuel for Low-Income Households

General Factors Concerning the Choice of Cooking Fuels

The selection of the type of fuel during cooking is contingent of several factors. Factors influencing the decision are availability, affordability, habits and the usability of the fuel. The prevailing use of fire food in many developing countries is primarily because it is cheap (often free) and widely available. In the future wood will remain the primary cooking fuel for rural households[13].

An increase in LPG use could reduce the total amount of wood, coal and kerosene consumed. This is the case in some cities where LPG is available. But households do not tend to fully replace one fuel by another. Instead, they use a mix of fuels and a specifif fuel is chosen according to availability, affordability and convenience.

LPG Cooking Systems

A typical cooking system which uses LPG is made up of a steel cylinder filled with LPG, a pressure controller, a tube connecting the cylinder to the pressure controller and the burner, and finally the burner itself. The burner can consist of one or more cooking tops.

The size of the system depends on the size of the cylinder. Cylinders exist in various sizes e.g.: 2.7 kg, 6 kg, 12 kg, 14,5 or 16 kg. A survey in 20 countries showed that low-income countries households mainly use cylinders smaller than 6 kg[14]. Nevertheless, the majority of currently available LPG cylinders are larger (up to 47.5 kg). This proves problematic for low-income households both in the acquisition as well as the recharge of LPG.

Advantages & Disadvantages of LPG as a Cooking Fuel for Low-income Households

Advantages of LPG

The main advantages of LPG provision of low-income households in comparison to conventional fuels (wood, wood charcoal) are:

- Health-related: The use of LPG reduces the interior air pollution by 90% in comparison to traditional ways of burning biomass e.g.: three-stone fire[15][16]). As LPG burns almost completely, the proportion of pollutants is reduced.

- Environmental impacts-related: CO2 emissions are relatively low. Greenhouse gases are reduced by 5-16 times per prepared meal compared to coal[17]. If LPG was used, the wood consumption can be substantially reduced - 45 kg of LPG is sufficient to produce the thermic energy of about half a ton of wood. In regions with low biomass availability, or in regions where more than the sustainably available amount of biomass is burnt, LPG could lead to a significant relief of biomass resources.

- Further advantages: LPG stoves quickly supply heat and work more efficient than stoves which burn biomass. The simple and precise regulation simplifies the cooking process and can save time.Due to its high energy density, LPG is easily transportable.

Disadvantages of LPG

The disadvantages of LPG as a cooking fuel are the following:

1. Availability: A UNDP study found that 120 billion tons of LPG are necessary to supply 2 billion people with cooking energy[18]. This equates to 60 kg of LPG per capita and is equivalent to half of the current global production. These quantities are currently not available.

A mix of the following strategies would therefore be required if 2 billion people were to be supplied with LPG as a cooking fuel:

- New fossil fuel sources would have to be developed

- Current extraction processes would have to become more efficient

- The use of LPG in other sectors would have to be reduced

2. Costs: The LPG market is underdeveloped in most regions where LPG would be an addition to current cooking fuels. Significant sums would have to be invested to develop these markets.

Costs entail:

a. Market Development Costs include:

- LPG production capacities if a country has access to fossil fuel ressources

- Import facilities if a country does not have access to fossil fuel ressources

- A distribution network with storage and filling stations

No reports are known that explore the necessary investment costs of developing an LPG market in-depth. Further research is needed in this field.

b. Costs for Households

Households require capital to buy hardware such as the LPG stove and the cylinder. Again, limited data exists that compares regional prices. A typical 14 kg LPG cylinder system usually costs between 60 - 70 US$. This is a barrier for many households. A competitive kerosene-based cooking systems is 83 % cheaper[19]. Improved wood or wood charcoal stoves can be obtained for as little 2 US$.

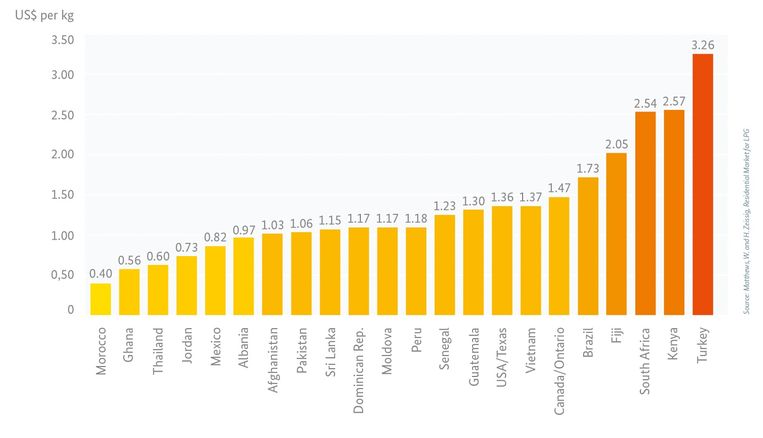

Furthermore, households need to be able to pay the running costs for LPG. A survey that explored the costs to the consumer in 20 countries found that large discrepancies exist. One kg of LPG costs between 0.40 US$ in Morocco and 3.26 US$ in Turkey.

Figure 3. LPG prices for the end-consumer in December 2010 (adapted from Matthews and Zeissig, 2011)

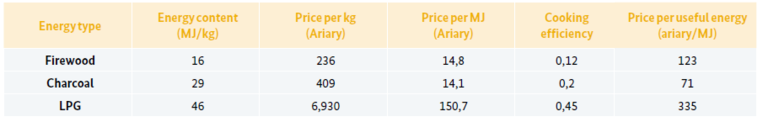

The price of LPG is affected by taxes, subsidies and market distribution costs. LPG becomes cheaper when distribution routes are short or bought in bulk. Low-income households mostly live in remote rural areas and buy small amounts. This is a disadvantage in comparison to wood, which can be collected free of charge. A survey in a medium-sized city in northern Madagascar provided some data on comparable prices for different cooking fuels. It shows that a kg of LPG costs approx. 2.80 US$. This is 17 times higher than the price for a kg of charcoal and 30 times higher than the price for wood (see figure 4).

Figure 4. Urban consumer prices in Diego, Madagascar in 2013 (GIZ HERA, 2014 )

In terms of useful energy delivered, LPG costs 0.13 US$ / MJ. Firewood costs 0.05 US$ / MJ and charcoal costs 0.03 US$ / MJ.

More recent data from 2019 are available from refugee camps in Bangladesh. A 12 kg cylinder and a simple gas stove cost around 45 USD. Refilling the cylinder cost 12 US$ or 1 US$/kg. According to the data from UNHCR around 82g of LPG is consumed per person and day. For a 5 household with 5 persons it would mean around 12 kg per month.[20]

Tabular Overview of Advantages & Disadvantages

The following table summarises the most important advantages and disadvantages of LPG as a cooking fuel for low income households:

| Advantages | Disadvantages | |

| Overall |

|

|

| Economic | Macro

Micro

|

Macro

Micro

|

| Social |

|

|

| Environment |

|

|

Table 1. Overview of advantages and disadvantages of LPG as a cooking fuel

Further Information:

- Multiple Household Cooking Fuels (Fuel Factsheets show different cooking fuels.)

- Residential Market for LPG: A Review of Experience of 20 Developing Countries (A study sponsored by the World Bank reviewing 20 countries)

The Interventionist Perspective

Challenges to an improved LPG supply

The challenges that arise when working towards an improved supply of LPG as a cooking fuel in low-income households can be divided into five areas:

1. Administration

A centrepiece of a LPG market is its effective administration. This includes the regulation of market actors, subsidies, authorising retailers and ensuring a safe and correct procedure e.g. when cylinders are being refilled. This is vital both for functional market structures and the security of consumers. A strong and functioning market administration may also help to attract foreign investments.

A report from the World LPG Association reviews the most important aspects to be considered in the regulation of LPG markets. The report contains different sales models, ways to handle cylinders and outlines the definition and regulation of safety standards (see WLPGA, 2013).

2. Availability

In many countries the private sector already supplies LPG to high-income households in urban areas. However, many countries and rural areas in particular still lack supply infrastructure. These regions are unlikely to be covered by the private sector alone. Therefore, interest groups such as the World LPG Association (WLPGA) lobby for increased public sector investments. The private sector can be partially involved in these costs, if a supply strategy is in development[21].

Next to the provision of decentralised distribution networks, filling stations are important for the supply of rural areas. LPG should always be disposable, as a secure supply would increase people's acceptance of LPG. Acceptance is likely to fall if supply is unstable.

3. Affordability

As soon as supply is assured, affordability becomes the largest barrier to an increased use of LPG. Subsidies are necessary both for initial and running costs if LPG is to be made available for low-income households.

a. Subsidies for upfront and running costs

Subsidising the initial costs allows access to LPG usage. Nevertheless, subsidies of the equipment without subsidies of running costs could lead to a situation in which families cannot afford to actually use LPG. This would lead to 'dead' investments[22].

Subsidising the fuel makes sense when LPG is to be made availabe for low-income households.Different precautions measures have to be taken. For instance, the amount of low-priced LPG could be limited through coupons that are distributed to the poor households. Subsidised cylinders can be marked with colours to prevent subsidised LPG being sold-on to other households[22]. The grading of subsidies according to usage ensures that households with low consumption pay a comparitively low price. According to this model, large-scale consumers can be made to pay a progressively rising tariff that cross-subsidises poor users with limited consumption[22].

b. Who pays for the subsidies?

LPG subsidies would require large investment sums. The financing of hardware costs could stem from various sources. Microcredit institutions could distribute credits. Alternatively, LPG entrepreneurs could remain owners of the cylinders and demand rent or a deposit from the customers. The distribution of smaller cylinders would decrease the overall amount of capital or subsidies required.

Regarding the running costs, there are various possibilities to keep the costs of LPG subsidies low. Subsidies of kerosene could be shifted to the LPG sector which would encourage a 'fuel switch' without increased costs for the public sector. In Indonesia such a switch from kerosene to LPG subsidies saved the government 6.9 million US$ p.a.. It has to be ensured that low-income consumers to not carry the burden of potential price increases as this is the target group most likely to become incapable of paying for the running costs.

c. Guidelines for subsidies

Badly defined subsidies can decrease incentives to invest, decrease efficiency, encourage wasteful behaviour and burden public finances[23]. As consumers quickly grow accustomed to subsidies, reducing subsidies is difficult realise once they were introduced.

The following points should therefore be considered in the design of different subsidy programs of LPG for low-income households:

- Subsidies for system components can be more cost-efficient and requires less monitoring than investments in fuel

- Subsidies for rural households must be targeted and transparent as without necessary restrictions subsidy regulations are often ignored

- Time-bound subsidies reduce costs but can cause to market collapse once subsidies are withdrawn

- The price structure in relation to other fuels should be aligned with the energy supply strategy of a given country

The private sector should be involved in all financing plans, for instance by taking responsibility for the distribution of small cylinders.

4. Awareness

LPG is considered as a modern, clean and easy-to-use fuel. Nevertheless, educational campaigns are sometimes useful. Especially health and environmental benefits should be underlined to target groups. The correct utilisation should be advocated in order to avoid accidents. Also, consumer confidence regarding the correct filling of cylinders needs to be raised. In underdeveloped LPG markets consumers sometimes obtain less LPG than what they have paid for.

Technical solutions to this problem such as see-through cylinders have been developed by Ragasco. Such cylinders allow the consumer to check the filling level him/herself. Yet, such cylinders are not established on the market.

5. Security of Supply

Current production surpluses of 9.7 million tons allow for the increased distribution of LPG to low-income households. Nevertheless, it should be considered that prices will rise as soon as demand exceeds production. At this point, the distribution of the limited LPG ressource will be determined by the purchasing power of the customers. As prices rise, low-income households will be the first to be excluded from an adequate LPG supply. This is important to consider as many low-income households are already excluded due to the LPG price level as they are today.

a. Short and mid-term security of supply

The demand for LPG of the petrochemical industry rose markedly in the US and the Middle East. It is expected that petrochemical industries will absorb current supply surpluses as long as prices remain low[7]. Increased demand is also expected in the autogas sector. Overall LPG consumption is expected to rise by 4.4 % p.a. between 2012 and 2018.

In can nonetheless be anticipated that LPG will be available for consumption by low-income households. This is due to anticipated increases in LPG production raising quicker than consumption levels.

Furthermore, unused accompanying gases can be used to supply low-income households. In Nigeria, where large parts of the population use traditional cooking fuels and LPG-consumption remains low despite available oil resources, the usage of accompanying gases would be viable.

Whilst accompanying gases are used for electrification programs through SE4All-Initatives, there are no known programs which specialise in LPG supply through using accompanying gases. This is the case despite the existence of the technological know-how.

b. Long-term security of supply

Since LPG supply is directly related to the availability of finite oil and gas deposits, supply for low-income households cannot be guaranteed in the long-term. To the contrary; as demand increases and availability decreases, prices will rise and thus increase the costs for low-income households.

Thus to ensure the long-term supply of LPG for low-income households, the development of supply strategies should be agreed with representatives of both politics and industry. As described above, demand is state-aided in various sectors (autogas, petrochemical industries etc.); this already threatens supply of low-income households in the middle-term.

To realistically ensure the goal of ' universal access to clean cooking fuels by 2030' stated by the IEA through 50% use of LPG, the following conflicts should be consciously avoided:

- Conflicts between producing and importing countries

- Conflicts between consumers on a household level, car gas and petrochemical industries

- Conflicts between demand centres in the city and rural areas

Tabular Overview of Challenges

| Barrier | Characteristics |

| 1. Regulation |

|

| 2. Availability |

|

| 3. Affordability |

|

| 4. Awareness |

|

| 5. Supply security |

|

Table 2. Overview of the most important challenges in the use of LPG as a cooking fuel

Further Information:

- Kerosene to LP Gas Conversion Programme in Indonesia (This case study from Indonesia presents the experiences from shifting from Kerosene to LPG.)

- GACC Reports and Research (This website contains publications of 'Global Alliance on Clean Cook stoves.)

- Senegal: Best Practice Case Studies (This case study documents the experiences of a programme which aimed to increase LPG-usage in Senegal.)

Activities of International Organisations

United Nations Development Programme (UNDP)

UNDP is developing a regional project as part of the SE4All-Initiative. It mainly targets Asia and aims to enable access to modern cooking fuels for 500,000 households. UNDP cooperates with the private sector and local NGOs to reduce existing barriers that inhibit the improved supply of LPG. Potential activities to improve the LPG supply are identified and action plans are established through multi-stakeholder meetings and market surveys. Strategies to enable market developments are devised through dialogue and facilitation of cooperation with the relevant actors. The initiative is presented in a Vimeo video: 500.000 Smoke Free Households

World LPG Association (WLPGA)

WLPGA is an interest group of the global LPG industry. Its goal is to increase the demand of LPG and establish good business practice and safety standards. Through lobbying, knowledge management and consulting, the group increases LPG consumption and enhances market development.

In 2012, WLPGA started the 'Cooking for Life' campaign. Its goal is to enable one billion people access to LPG as a cooking fuel by 2030. The campaign involves government representatives, representatives from the health sector, energy industry and NGOs. Next to the prevention of 500,000 deaths per year due to 'indoor air pollution', the campaign states that it protects 2.65 million hectares of forest (this equals 51% of global annual deforestation).

To this end different resources and approaches are made available. Experiences of successful programmes should be made accessible and communicated. More information is available on the website of the campaign: Cooking for Life

Global LPG Partnership (GLPGP)

The Global LPG Partnership (GLPGP) was set up as a High Impact Initiative (HII) under the SE4All High Impact Opportunity (HIO) "Universal Adoption of Clean Cooking Solutions". The HII is led by the Energy Transportation Group (ETG) and aims to accelerate the transition to LPG for cooking by engaging public and private sectors. Other key players of the HIO are the WLPGA, representatives of national governments, local LPG businesses and the health community. The strategy of the Partnership is to implement a multi-phase process in 4-5 countries in Sub-Saharan Africa (SSA).

The implementation of GLPGP will start in Ghana, Cameroon, Kenya, Uganda and Tanzania. A total of 750 million US$ are to be made available through the launch of a commercial equity fund for infrastructure (250 million US$), commercial debt (250 million US$) and a 250 million US$ concessional fund for consumer cost finance and local retail distribution. It is estimated that 70 million people will gain access to LPG for cooking through these measures and that 2 % of Africa's biomass will be offset.

► More information is available on the website of the HII: Global LPG Partnership

Further Information

- Cooking Portal on Energypedia

- BLEENS - Biogas, Liquefied Petroleum Gas, Electricity, Ethanol, Natural Gas, and Solar

- Cooking with Liquefied Petroleum Gas (LPG)

- LPG Stoves

- Cost-Benefit Analysis of LPG Cookstove Intervention

- Access to Modern Energy

- Cooking Fuels

- Cooking with Clean Fuels: Designing Solutions in Kakuma Refugee Camp

- Cooking Energy in Refugee Situations

- Cooking Energy in Refugee Camps- Challenges and Opportunities

- Using Liquid Petroleum Gas in Mozambique Households

- From the 'Energy Ladder' to 'Fuel Stacking'

- PAYG for LPG: https://www.engineeringforchange.org/news/challenges-opportunities-scaling-pay-go-lpg/

- LPG Smart Metering for Kenya: https://www.engineeringforchange.org/news/kenyan-bureau-standards-launched-worlds-first-lpg-smart-metering-standard/

References

- ↑ https://www.wlpga.org/about-lpg/production-distribution/

- ↑ https://en.wikipedia.org/wiki/Natural_gas

- ↑ WLPGA, 2014

- ↑ Roenn, 2013

- ↑ Leija and Gist, 2013 - http://www.ogj.com/articles/print/volume-111/issue-6/processing/shale-gas-development-altering-lpg-demand--trade.html

- ↑ Argus & WLPGA. Statistical review of global LPG 2014. Paris: World LP Gas Association; 2015.

- ↑ 7.0 7.1 PR Newswire, 2013 - http://www.prnewswire.com/news-releases/global-liquefied-petroleum-gas-lpg-market-is-expected-to-reach-usd-26641-billion-in-2018-transparency-market-research-219382641.html

- ↑ Argus, 2013 - http://media.argusmedia.com/~/media/Files/PDFs/White Paper/Statistical Review of Global LP Gas 2013.pdf

- ↑ PR Newswire, 2013: http://www.prnewswire.com/news-releases/global-liquefied-petroleum-gas-lpg-market-is-expected-to-reach-usd-26641-billion-in-2018-transparency-market-research-219382641.html

- ↑ Stealthgas, 2013: http://www.stealthgas.com/images/stories/lpgglobaldemand.png

- ↑ LPGas 2013: http://www.lpgasmagazine.com/propane-a-wanted-commodity-in-petrochemical-sector/

- ↑ Argus, 2013 - http://media.argusmedia.com/~/media/Files/PDFs/White

- ↑ GIZ, 2014 - https://energypedia.info/images/3/32/2014-03_Multiple_Household_Cooking_Fuels_GIZ_HERA_eng.pdf

- ↑ World Bank, 2011 - http://siteresources.worldbank.org/INTOGMC/Resources/LPGReportWeb-Masami.pdf

- ↑ WHO, 2011 - http://www.who.int/hia/green economy/en/

- ↑ Polsky and Ly, 2012 - http://ldihealtheconomist.com/media/The Health Consequences of Indoor Air Pollution.pdf

- ↑ Bailis et al., 2003 - http://rael.berkeley.edu/sites/default/files/very-old-site/OA5.1.pdf

- ↑ UNDP, 2000 - http://www.undp.org/content/undp/en/home/librarypage/environment-energy/sustainable energy/world energy assessmentenergyandthechallengeofsustainability.html

- ↑ TDL, 2013 - http://www.thisdaylive.com/articles/hindering-growth-of-nigeria-s-lpg-market-with-kerosene-subsidy/157397/

- ↑ LPG Distribution at Refugee Camp in Bangladesh, https://energypedia.info/images/d/df/Webinar_Series-_Sustainable_Energy_in_Humanitarian_Settings.pdf

- ↑ IEA, 2011 - http://www.iea.org/publications/worldenergyoutlook/resources/energydevelopment/energyforallfinancingaccessforthepoor/

- ↑ 22.0 22.1 22.2 IEI, 2004 - http://www.iei-asia.org/IEIBLR-LPG-IndianhomesReport.pdf

- ↑ Matthews and Zeissig, 2011 - http://siteresources.worldbank.org/INTOGMC/Resources/Review of LPG market in 20 countries 2011.pdf