Knowledge fuels change - Support energypedia!

For over 10 years, energypedia has been connecting energy experts around the world — helping them share knowledge, learn from each other, and accelerate the global energy transition.

Today, we ask for your support to keep this platform free and accessible to all.

Even a small contribution makes a big difference! If just 10–20% of our 60,000+ monthly visitors donated the equivalent of a cup of coffee — €5 — Energypedia would be fully funded for a whole year.

Is the knowledge you’ve gained through Energypedia this year worth €5 or more?

Your donation keeps the platform running, helps us create new knowledge products, and contributes directly to achieving SDG 7.

Thank you for your support, your donation, big or small, truly matters!

Difference between revisions of "Fuel Prices Korea, South"

***** (***** | *****) |

***** (***** | *****) m |

||

| Line 54: | Line 54: | ||

|Fuel Price Factsheet Source Annotation=A4 | |Fuel Price Factsheet Source Annotation=A4 | ||

}} | }} | ||

| + | |||

| + | [[Category:South Korea]] | ||

Latest revision as of 16:57, 9 December 2015

Part of: GIZ International Fuel Price database

Fuel Pricing Policies

| Local Currency: | KRW |

| Exchange Rate: | 1130.56

|

| Last Update: | 2011/05/01 |

South Korea imposes high taxes on fuels, reaching the European level of fuel taxes.

In April 2011, the South Korean government published plans to lower fuel taxes, as soon as the crude price exceeds 130 US$/barrel (this price reached 116 US$ in April 2011). Also, the government tries to bring more retailers into the downstream sector, to increase market pressure on the four main refining companies, to which most retailers are affiliated (→App. A2).

President Lee gave a statement in January 2011, by which he somehow blamed the major refinery companies for the high prices. Comparing the crude and retail prices in 2008 and early 2011 led to the assumption, that major refinery companies should lower their disproportionate high revenues (see →App. A3). However, the idea of installing fixed, regulated fuel prices is rejected by the government.

The official website http://www.kesis.net (Korea Energy Statistics Information System) offers comprehensive fuel price monitoring. Official information regarding the fuel price composition / fuel taxation is not available online, hints welcome!

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

Source: http://www.kesis.net

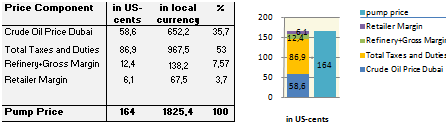

Fuel Price Composition

Price composition for one litre of Gasoline 95 Octane as of 2011/01/01.

Approx. values

Total Taxes and Duties includes: 3% import duty on crude imports, 10% VAT on crude imports, further VAT on refined oil products, environmental protection tax, education tax (→App. A1; shares unknown, hints welcome).

Source: own calculations based on http://www.kesis.net, internet articles (see →App.A3) and http://www.eia.doe.gov (for crude oil price on Dubai spot market).

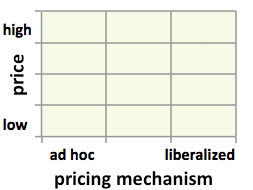

At a Glance

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

Official and detailed information on fuel taxation missing, hints welcome!

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Other Information | http://english.yonhapnews.co.kr/business/2011/04/12/30/0501000000AEN20110412011000320F.HTML (A2) |

| Other Information | http://www.koreatimes.co.kr/www/common/printpreview.asp?categoryCode=202&newsIdx=79765 (A3) |

| Other Information | http://online.wsj.com/article/SB10001424052748703806304576245832442095892.html (A4) |

| Other Information | http://www.mb.com.ph/articles/309281/s-koreas-oilrelated-tax-revenues-top-27-trillion-won (A1) |

| Pump prices and margins | http://www.kesis.net/flexapp/KesisFlexApp.jsp |

| Pump prices and margins | http://www.knoc.co.kr/ |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices

The following coordinate was not recognized: {{#geocode: Korea, South|google }}.