Difference between revisions of "Semantic Sandbox"

***** (***** | *****) m |

***** (***** | *****) m |

||

| Line 13: | Line 13: | ||

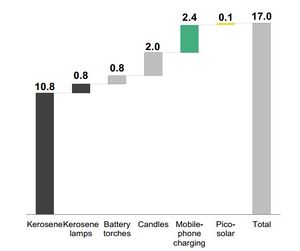

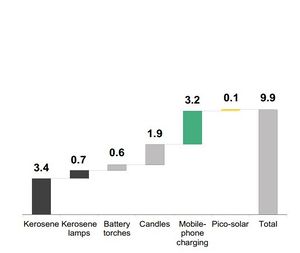

Figure 2 and Figure 3 shows the annual spending on off-grid lighting and phone charging in Africa and Asia respectively. The data shows that kerosene and candles have a huge market presence in African and Asian countries, '''more than 10 billion market in Africa and more than 3 billion market in Asia'''. <ref name="Bloomberg New Energy Finance, Lighting Global, and Global Off-Grid Lighting Association, “Off-Grid Solar Market Trends Report 2016,” 2016, 4, https://www.energynet.co.uk/webfm_send/1690.">Bloomberg New Energy Finance, Lighting Global, and Global Off-Grid Lighting Association, “Off-Grid Solar Market Trends Report 2016,” 2016, 4, https://www.energynet.co.uk/webfm_send/1690.</ref>It is important to note that in many countries such as India and Nepal, the government has even subsidized kerosene to make it affordable for the poorest population. For example, in Nigeria, the amount the government spends on kerosene subsidy is more than that for security, critical infrastructure, human capital human capital development, and land and food security combined.<ref> UNEP DTU Partnership, “The Emerging Market for Pico-Scale Solar PV Systems in Sub-Saharan Africa,” n.d., 8, https://www.gogla.org/sites/default/files/recource_docs/market-pico-solar_web.pdf.</ref>The subsidy on kerosene also creates illegal black market as kerosene is often trafficked from countries where it is subsidised to the neighbouring ones where it is not subsidized.<ref name="Lam et al., “Kerosene: A Review of Household Uses and Their Hazards in Low-and Middle-Income Countries.”">Lam et al., “Kerosene: A Review of Household Uses and Their Hazards in Low-and Middle-Income Countries.”</ref>There is also a disparity between the kerosene price in urban and rural areas. The rural population often buys kerosene in small quantity from the local kerosene vendor and pay a higher price than their urban counterparts. Kerosene itself is not easily available and is also influenced by the world oil prices. <ref name="Lighting Africa, “The True Cost of Kerosene in Rural Africa,” n.d., https://www.gogla.org/sites/default/files/recource_docs/kerosene_pricing_lighting_africa_report.pdf.">Lighting Africa, “The True Cost of Kerosene in Rural Africa,” n.d., https://www.gogla.org/sites/default/files/recource_docs/kerosene_pricing_lighting_africa_report.pdf.</ref> | Figure 2 and Figure 3 shows the annual spending on off-grid lighting and phone charging in Africa and Asia respectively. The data shows that kerosene and candles have a huge market presence in African and Asian countries, '''more than 10 billion market in Africa and more than 3 billion market in Asia'''. <ref name="Bloomberg New Energy Finance, Lighting Global, and Global Off-Grid Lighting Association, “Off-Grid Solar Market Trends Report 2016,” 2016, 4, https://www.energynet.co.uk/webfm_send/1690.">Bloomberg New Energy Finance, Lighting Global, and Global Off-Grid Lighting Association, “Off-Grid Solar Market Trends Report 2016,” 2016, 4, https://www.energynet.co.uk/webfm_send/1690.</ref>It is important to note that in many countries such as India and Nepal, the government has even subsidized kerosene to make it affordable for the poorest population. For example, in Nigeria, the amount the government spends on kerosene subsidy is more than that for security, critical infrastructure, human capital human capital development, and land and food security combined.<ref> UNEP DTU Partnership, “The Emerging Market for Pico-Scale Solar PV Systems in Sub-Saharan Africa,” n.d., 8, https://www.gogla.org/sites/default/files/recource_docs/market-pico-solar_web.pdf.</ref>The subsidy on kerosene also creates illegal black market as kerosene is often trafficked from countries where it is subsidised to the neighbouring ones where it is not subsidized.<ref name="Lam et al., “Kerosene: A Review of Household Uses and Their Hazards in Low-and Middle-Income Countries.”">Lam et al., “Kerosene: A Review of Household Uses and Their Hazards in Low-and Middle-Income Countries.”</ref>There is also a disparity between the kerosene price in urban and rural areas. The rural population often buys kerosene in small quantity from the local kerosene vendor and pay a higher price than their urban counterparts. Kerosene itself is not easily available and is also influenced by the world oil prices. <ref name="Lighting Africa, “The True Cost of Kerosene in Rural Africa,” n.d., https://www.gogla.org/sites/default/files/recource_docs/kerosene_pricing_lighting_africa_report.pdf.">Lighting Africa, “The True Cost of Kerosene in Rural Africa,” n.d., https://www.gogla.org/sites/default/files/recource_docs/kerosene_pricing_lighting_africa_report.pdf.</ref> | ||

| − | Taking all these factors into consideration, picoPV products have an opportunity to replace kerosene as a lighting fuel. | + | Taking all these factors into consideration, picoPV products have an opportunity to replace kerosene as a lighting fuel as they provide cheaper, brighter and healthier lighting. |

{| | {| | ||

|- | |- | ||

Revision as of 07:21, 24 July 2017

Introduction

In recent years, innovative financing schemes like Pay-as-you-go (PAYG) have made picoPV products affordable and easily available to the most remote population of the world. This proliferation of picoPV products have further been supported by the increased awareness about the negative effects of kerosene on health, environment and finances.

This article explores how the recent boom of picoPV market has affected the traditional kerosene and candle market.

Kerosene Market

Since mid 19th century, kerosene has been used for lighting purposes all over the world. This situation changed in developed countries with the introduction of electricity in mid 20th century. However, in developing countries, kerosene is still the dominant fuel used for lighting purposes. [1]

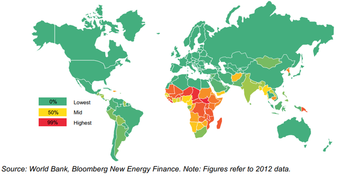

In 2016 1.2 billion people were not connected to the power grid and thus, were dependent on external sources such as candles and kerosene for meeting their lighting needs. Similarly, USD 27 billion is spent annually on lighting and mobile phone charging services using kerosene, candles, battery torches or other fossil fuel-powered technologies. [2]The poor households usually pay for lighting services in the range of USD 100 per kilowatt-hour which is more than a 100 times the amount people in rich countries pay. [3]Households also use approximately 4 to 25 billion liters of kerosene annually for lighting purposes. [4]

Figure 2 and Figure 3 shows the annual spending on off-grid lighting and phone charging in Africa and Asia respectively. The data shows that kerosene and candles have a huge market presence in African and Asian countries, more than 10 billion market in Africa and more than 3 billion market in Asia. [5]It is important to note that in many countries such as India and Nepal, the government has even subsidized kerosene to make it affordable for the poorest population. For example, in Nigeria, the amount the government spends on kerosene subsidy is more than that for security, critical infrastructure, human capital human capital development, and land and food security combined.[6]The subsidy on kerosene also creates illegal black market as kerosene is often trafficked from countries where it is subsidised to the neighbouring ones where it is not subsidized.[7]There is also a disparity between the kerosene price in urban and rural areas. The rural population often buys kerosene in small quantity from the local kerosene vendor and pay a higher price than their urban counterparts. Kerosene itself is not easily available and is also influenced by the world oil prices. [8] Taking all these factors into consideration, picoPV products have an opportunity to replace kerosene as a lighting fuel as they provide cheaper, brighter and healthier lighting.

Transition from Kerosene to LED Lamps using Dry-Cell Batteries

The kerosene and candles market (for lighting) in African context has not only been affected by the penetration of picoPV products but also by the easy availability of low-cost LED lamps using dry-cell batteries. In recent years (after 2008), battery based LED lights have largely penetrated the rural market in many African countries, particularly in West African countries and have replaced kerosene and candles, without any incentives from external government or non-governmental organisations. However, this transition from kerosene and candles to LED lights has largely been unnoticed as the official censuses do not count dry-cell based LED lamps as a lighting option.[9]

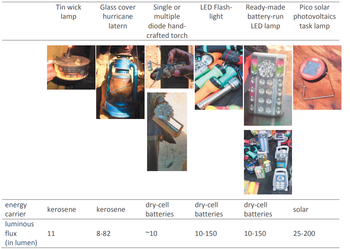

The LED lights have high efficiency and low energy consumption as compared to kerosene or candles. However, the output of the individual LED lamps vary depending on the number of diodes, performance of diodes and dry-cell batteries. Figure 4 shows different types of lighting sources and their performance.[10]

LED lights based on dry-cell batteries are increasingly becoming popular and are replacing the kerosene or candle market. Since both picoPV products and LED lamps deliver comparable services, they can be seen as competitors. Therefore, for picoPV products, it is very important to be cost-effective and easily accessible to compete with LED lamps that have low cost and are low maintenance.

Impact of PicoPV Market Development on the Kerosene Market

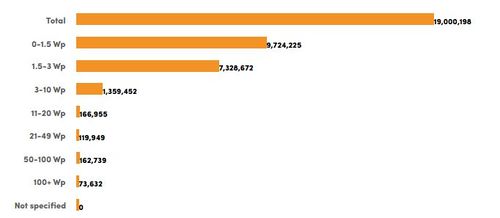

According to the latest solar products’ sales data from GOGLA, in 2016 about 19 million status quo lighting sources ( includes kerosene lamps, candles, battery torches ) have been replaced by solar products.[11]This has been made possible by various factors such as:

- increasing oil and kerosene prices which has created a demand for alternative and lower cost lighting options;

- improvement in the technology and efficiency of the solar panels;

- emergence of new and innovative business models for financings solar products;

- and finally a global certification scheme for ensuring the quality of pico-solar products being sold.

Also, factors such as diffusion of mobile phones and the spread of mobile payment schemes have helped in the proliferation of picoPV products.[12]

Figure 5 shows the number of traditional lighting sources that have been replaced by picoPV products. From the figure, we can see that the picoPV products between the range of 0-1.5 Wp are the most popular alternative to traditional sources followed by the 1.5-3 Wp products.[13]

References

- ↑ Nicholas L. Lam et al., “Kerosene: A Review of Household Uses and Their Hazards in Low-and Middle-Income Countries,” Journal of Toxicology and Environmental Health. Part B, Critical Reviews 15, no. 6 (2012): 396–432, doi:10.1080/10937404.2012.710134.

- ↑ GOGLA, “Global Off-Grid Solar Market Report Semi-Annual Sales and Impact Data July-December 2016,” n.d., 7, https://www.gogla.org/sites/default/files/recource_docs/final_sales-and-impact-report_h22016_full_public.pdf.

- ↑ UNEP/GEF, United Nations Environment Programme and Global Environment Facility, “Developing Effective Off-Grid Lighting Policy,” 2015, 5, http://www.enlighten-initiative.org/portals/0/documents/Resources/publications/Guidance%20note%20OGL_en.lighten_English_2016-01-08.pdf.

- ↑ Elizabeth Tedsen, “Black Carbon Emissions from Kerosene Lamps: Potential for a New CCAC Initiative,” 2013, 2, http://www.ccacoalition.org/sites/default/files/resources/black-carbon-and-kerosene-lamps-study.pdf.

- ↑ Bloomberg New Energy Finance, Lighting Global, and Global Off-Grid Lighting Association, “Off-Grid Solar Market Trends Report 2016,” 2016, 4, https://www.energynet.co.uk/webfm_send/1690.

- ↑ UNEP DTU Partnership, “The Emerging Market for Pico-Scale Solar PV Systems in Sub-Saharan Africa,” n.d., 8, https://www.gogla.org/sites/default/files/recource_docs/market-pico-solar_web.pdf.

- ↑ Lam et al., “Kerosene: A Review of Household Uses and Their Hazards in Low-and Middle-Income Countries.”

- ↑ Lighting Africa, “The True Cost of Kerosene in Rural Africa,” n.d., https://www.gogla.org/sites/default/files/recource_docs/kerosene_pricing_lighting_africa_report.pdf.

- ↑ Gunther Bensch, Jörg Peters, and Maximiliane Sievert, “The Lighting Transition in Africa – From Kerosene to LED and the Emerging Dry-Cell Battery Problem,” n.d., 4, http://en.rwi-essen.de/media/content/pages/publikationen/ruhr-economic-papers/rep_15_579.pdf.

- ↑ Gunther Bensch, Jörg Peters, and Maximiliane Sievert, “The Lighting Transition in Africa – From Kerosene to LED and the Emerging Dry-Cell Battery Problem,” n.d., 10, http://en.rwi-essen.de/media/content/pages/publikationen/ruhr-economic-papers/rep_15_579.pdf.

- ↑ GOGLA, “Global Off-Grid Solar Market Report Semi-Annual Sales and Impact Data July-December 2016,” n.d., 8, https://www.gogla.org/sites/default/files/recource_docs/final_sales-and-impact-report_h22016_full_public.pdf.

- ↑ UNEP DTU Partnership, “The Emerging Market for Pico-Scale Solar PV Systems in Sub-Saharan Africa,” https://www.gogla.org/sites/default/files/recource_docs/market-pico-solar_web.pdf.

- ↑ GOGLA, “Global Off-Grid Solar Market Report Semi-Annual Sales and Impact Data July-December 2016,” n.d., 8, https://www.gogla.org/sites/default/files/recource_docs/final_sales-and-impact-report_h22016_full_public.pdf.