Difference between revisions of "Market Development of PAYGO"

***** (***** | *****) m |

***** (***** | *****) m |

||

| Line 39: | Line 39: | ||

Geographical spreading of PAYGO companies:<ref name="François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.">François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.</ref><br/> | Geographical spreading of PAYGO companies:<ref name="François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.">François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.</ref><br/> | ||

| − | *African growth is highly concentrated in Kenya, Tanzania and Ethiopia, with 78% of sales in those three countries.<ref name="Scott | + | *African growth is highly concentrated in Kenya, Tanzania and Ethiopia, with 78% of sales in those three countries.<ref name="Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.">Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.</ref> |

*East Africa has seen the emergence of the first market leaders: (e.g. M-KOPA in Kenya, Fenix in Uganda, Mobisol in Tanzania)<br/> | *East Africa has seen the emergence of the first market leaders: (e.g. M-KOPA in Kenya, Fenix in Uganda, Mobisol in Tanzania)<br/> | ||

*Rapid expansion of those players towards West Africa, and new players started in the region (e.g. Baobab+ in Senegal).<br/> | *Rapid expansion of those players towards West Africa, and new players started in the region (e.g. Baobab+ in Senegal).<br/> | ||

| Line 87: | Line 87: | ||

'''Figure: Global PAYGO Companies: Sales volume and age of company. Including the average size of the SHS product offered. Lepicard, Hystra, 2017.'''<br/> | '''Figure: Global PAYGO Companies: Sales volume and age of company. Including the average size of the SHS product offered. Lepicard, Hystra, 2017.'''<br/> | ||

| − | + | [[File:GOGLA 2017 PAYGO companies and sales volume.PNG|center|700pxpx|PAYGO companies and sales volume]]Source: Lepicard et al. 2017<ref name="François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.">François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.</ref><br/> | |

| − | |||

| − | Source: Lepicard et al. 2017<ref name="François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.">François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.</ref><br/> | ||

| − | This is, however, only a small glance in time. The market changes dynamically: new players emerge, others disappear, and others change their approaches.<ref name="Scott | + | This is, however, only a small glance in time. The market changes dynamically: new players emerge, others disappear, and others change their approaches.<ref name="Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.">Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.</ref> |

*Find an overview of players involved in 2015 in [https://rael.berkeley.edu/wp-content/uploads/2015/05/LG-2015-PAYG-Report-Alstone-etal.pdf Lighting Global 2015] (Peter Alstone).<br/> | *Find an overview of players involved in 2015 in [https://rael.berkeley.edu/wp-content/uploads/2015/05/LG-2015-PAYG-Report-Alstone-etal.pdf Lighting Global 2015] (Peter Alstone).<br/> | ||

| Line 99: | Line 97: | ||

== Scenario 2030: Outlook<br/> == | == Scenario 2030: Outlook<br/> == | ||

| − | A simple model by Scott/Miller, 2016, predicts that total sales in sub-Saharan Africa of quality-certified SHS could grow from the 3.3 million sold in 2014 to 17 million in 2030. “The total value of the sales under these scenarios would rise from around $ 111 million in 2015 to $ 943 million by 2030 under Business as Usual, and $ 1.5 billion in 2030 under Sustainable Energy for All scenario. Under the Power for All scenario annual sales of about $ 1.9 billion would be reached by 2026.”<ref name="Scott | + | A simple model by Scott/Miller, 2016, predicts that total sales in sub-Saharan Africa of quality-certified SHS could grow from the 3.3 million sold in 2014 to 17 million in 2030. “The total value of the sales under these scenarios would rise from around $ 111 million in 2015 to $ 943 million by 2030 under Business as Usual, and $ 1.5 billion in 2030 under Sustainable Energy for All scenario. Under the Power for All scenario annual sales of about $ 1.9 billion would be reached by 2026.”<ref name="Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.">Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.</ref> They make, however, no assumption how large the share of sales with PAYGO will be, which currently is quite small –even in Kenya. |

PAYGO has the potential to unlock demand on an unprecedented scale. Of all the unbankable households in Senegal, that are not able to pay the upfront costs of a micro credit, and were not served by MFI therefore, around half could be addressed with PAYGO solutions.<ref name="François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.">François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.</ref><br/> | PAYGO has the potential to unlock demand on an unprecedented scale. Of all the unbankable households in Senegal, that are not able to pay the upfront costs of a micro credit, and were not served by MFI therefore, around half could be addressed with PAYGO solutions.<ref name="François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.">François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.</ref><br/> | ||

Revision as of 12:55, 17 August 2017

Overview

This article looks at the market development of pay-as-you-go (PAYGO) from 2010 until 2017 (today).

In recent years, many PAYGO companies appeared in many countries. Find an overview of relevant companies and their approaches here.

PAYGO companies started operations less than 5 years ago. What started as trial-and-error, turned out to evolve into different, rapid growing business models. However, even market leaders are still testing the core of their business models. So far, the PAYGO industry has only a limited track record.[1]

- E.g. d.light has over 65 million customers worldwide. d.light’s Pay-Go systems are selling faster than those offered by its competitors, making scaling up “even faster than we imagined”[2]. Mobisol launched in Kenya in 2016 and services over 70,000 households in Rwanda and Tanzania.[3]

One of the key success factors of PAYGO is mobile money and payments service. [2]

PAYGO Market Development

History

PAYGO has its roots in Sub-Saharan Africa (in Kenya [4]) with ambitious young start-ups received support from the Power Africa initiative.[5]

- 2010: First PAYGO approaches are tested in Eastern Africa.[1]

- 2015: around 30 companies operate in at least 32 countries.[6]

Financing need– steady increase over time:

- 2010 – 2013: steady increase of financing from around USD 9 million to USD 22 million.[7]

- 2014: “an unprecedented influx of capital into the sector” of around USD 100 million. This is still only a third of their reported investment needs of USD 300 million in 2014.

- 2015: similar to 2014 [7]

Type of financing – changing over time:[7]

- in 2010, about 80% of funding was equity.

- In 2014, mix of equity investments and debt financing; with about 10% continues to come from grants.

- Since 2015: need of debt financing grows.

Only the largest companies are able to raise significant amounts of investment, with many smaller players continuing to struggle.

Current Market Stage of PAYGO

Geographical spreading of PAYGO companies:[1]

- African growth is highly concentrated in Kenya, Tanzania and Ethiopia, with 78% of sales in those three countries.[7]

- East Africa has seen the emergence of the first market leaders: (e.g. M-KOPA in Kenya, Fenix in Uganda, Mobisol in Tanzania)

- Rapid expansion of those players towards West Africa, and new players started in the region (e.g. Baobab+ in Senegal).

- In Latin and Central America some PAYGO companies are present: (e.g. Kingo in Guatemala, Honduras, Nicaragua, El Salvador)

- South East Asia (e.g. Kamworks in Cambodia, Sunlabob in Laos)

- Little development in South Asia: o In India, Government subsidies pushed rural bank financing to finance SHS until 2014.

According to the Global Off-Grid Lighting Association (GOGLA), the total revenue reported was at least USD 41.5 million in 2016. This figure underestimates total PAYGO revenues, because not all PAYGO companies reported. (GOGLA only includes data from its 55 member companies and products qualified by the Lighting Global platform.) Since past reports did not entail data on PAYGO separately, we cannot compare the data from previous years and detect an exact growth pattern. However, continued increase is expected. “In this context, revenues are defined as all cash collected per product, including deposits, top-up fees, service fees, and any other fees paid by customers. This includes payments made by customers who were added in the reporting period, as well as customers who were added prior to the reporting period.”[8]

Table: Percentage of PAYGO revenues of three product categories. GOGLA 2017[8]

|

Product category |

% of the total reported PAYG revenues |

USD |

|---|---|---|

3-10 Wp |

68% |

28 million |

11-20 Wp |

12% |

Below 5 million |

50-100+Wp |

20% |

8.2 million |

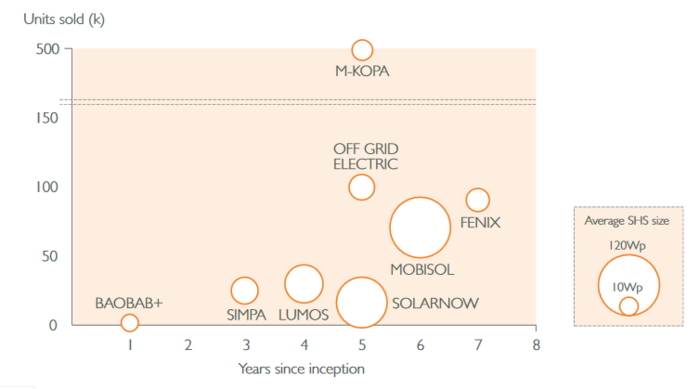

The table shows that most of the products sold in 2016 were still very small solar products. The PAYGO companies differ in size and sales volume. The largest company in terms of scale is M-KOPA, which reached 500,000 SHS in April 2017. Find detailed case studies in the Hystra report.[1]

Figure: Global PAYGO Companies: Sales volume and age of company. Including the average size of the SHS product offered. Lepicard, Hystra, 2017.

Source: Lepicard et al. 2017[1]

This is, however, only a small glance in time. The market changes dynamically: new players emerge, others disappear, and others change their approaches.[7]

- Find an overview of players involved in 2015 in Lighting Global 2015 (Peter Alstone).

Market Outlook for PAYGO

Scenario 2030: Outlook

A simple model by Scott/Miller, 2016, predicts that total sales in sub-Saharan Africa of quality-certified SHS could grow from the 3.3 million sold in 2014 to 17 million in 2030. “The total value of the sales under these scenarios would rise from around $ 111 million in 2015 to $ 943 million by 2030 under Business as Usual, and $ 1.5 billion in 2030 under Sustainable Energy for All scenario. Under the Power for All scenario annual sales of about $ 1.9 billion would be reached by 2026.”[7] They make, however, no assumption how large the share of sales with PAYGO will be, which currently is quite small –even in Kenya.

PAYGO has the potential to unlock demand on an unprecedented scale. Of all the unbankable households in Senegal, that are not able to pay the upfront costs of a micro credit, and were not served by MFI therefore, around half could be addressed with PAYGO solutions.[1]

Entry barriers will fall

Technological barriers to the PAYGO business are falling, and the sector is likely to see the entry of a larger number of PAYGO companies. Hopefully, also creating local employment among more locally managed companies. Entry barriers are likely to fall because of three outsourcing developments in the PAYGO sector:[9]

- TECHNOLOGY: Companies can implement PAYGO without investing in technology development. Service providers: Angaza Designs (San Francisco, Nairobi), Lumeter Networks (California).

- MOBILE INTERFACE: Companies can integrate with mobile and mobile money networks without building the necessary interfaces themselves. Service providers: KopoKopo (Seattle, Nairobi), Maxcom (Dar es Salaam).

- CREDIT SCORE: Companies can outsource customer credit-risk scoring to third parties. Service providers: InVenture (Santa Monica, with office in Kenya), First Access (New York).

Disaggregating the PAYGO value chain

PAYGO companies diversify their product range / business model

PAYGO companies offer (often for the first time) credits for solar products to households. After those are paid off, customers may be interested in other products. PAYGO companies may start to sell upgrades, appliances, devices, and services to those who successfully complete their payment cycles; or selling the collected customer data and payment history to other financial institutions to identify credit ratings of potential customers.[1]

A growing number of Microfinance institutions (MFIs) in the PAYGO business

For years, PAYGO companies used to be vertical integrated, excluding financial intermediaries. This changes now, with synergistic partnerships that disaggregate the value chain (e.g. Companies like Angaza provide PAYGO hardware and portfolio management software to potential financiers). So far, MFI mostly stayed out of PAYGO. However, they are better equipped to finance PAYGO business models: they have more local currency and less foreign exchange risk. They also have an existing customer base and loan distribution network that they could use to sell PAYGO products (and other financial products). Specialisation might bring down costs along the value chain.[10]

Less Government structures

PAYGO companies can perform a similar, critical role as public players used to in the past. For example, the government owned company Infrastructure Development Company Limited (IDCOL) in Bangladesh: with their one-stop-shop role, they managed successfully to channel financing for SHS.[9] As PAYGO companies are able to occupy this one-stop-shop role, they might be able to increase the financing for SHS even further. If more private PAYGO companies take over such roles, the efficiency and effectiveness of the funding process will increase.

Hampering Factors of PAYGO market development

Lack of data

Because the PAYGO sector is relatively new, information on market size, effective policy incentives, business model dynamics or financial and operational performance of PAYGO companies is limited.[11] The lack of this industry data is keeping investors from entering the sector that is growing and therefore in need of higher commercial investments.[12]

Lack of Reporting Standards

Without proper data collection and reporting on major facts of the PAYGO sector, investors have no chance to get a transparent picture to calculate their risks. They probably perceive the risks to invest in PAYGO companies as higher; or do not invest at all. Investors need standardized process and information with relevant market data. According to GOGLA, companies are willing to provide the data.[12] Lighting Global suggests a KPI framework to standardise the data reporting and trainings to enhance capacity to collect the data.[11]

- Find here the Technical Guide for the KPI Framework

Conclusion

This article depicts the market overview with quickly summarising the history and the current market stage of PAYGO. The Market Outlook section looks at the future of PAYGO. The predictions of scenarios for 2030 do not take PAYGO separately into account. Nonetheless, market size is likely to grow. Entry barriers will fall. The PAYGO value chain is in the process of being disaggregated: vertically integrated PAYGO companies get competition by partnerships of companies that each stick to their competence (including microfinance institutions). Hampering factors for PAYGO are the lack of data and the lack of reporting standards.

Further Information

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 François Lepicard et al., ‘REACHING SCALE IN ACCESS TO ENERGY: Lessons from Best Practitioners’ (Hystra, 2017), https://www.gogla.org/sites/default/files/recource_docs/hystra_energy_report.pdf.

- ↑ 2.0 2.1 Andrew Burger, ‘Competition Heats Up in Kenya’s Off-Grid, Mobile Pay-Go Solar Market’, Microgrid Media, 21 March 2017, http://microgridmedia.com/competition-heats-kenyas-off-grid-mobile-pay-go-solar-market/.

- ↑ Kennedy Kangethe, ‘Solar Solutions Provider to Open 20 Stores in Kenya’, Capital Business, 17 March 2017, https://www.capitalfm.co.ke/business/2017/03/solar-solutions-provider-open-20-stores-kenya/.

- ↑ Sanjoy Sanyal et al., ‘Stimulating Pay-As-You-Go Energy Access in Kenya and Tanzania: The Role of Development Finance’ (World Resources Institute, 2016), http://www.wri.org/sites/default/files/Stimulating_Pay-As-You-Go_Energy_Access_in_Kenya_and_Tanzania_The_Role_of_Development_Finance.pdf.

- ↑ Andrew Burger, ‘Off-Grid Solar Start-Ups Pierce the ¨Heart of Darkness¨’, Microgrid Media, 8 December 2016, http://microgridmedia.com/off-grid-solar-start-ups-pierce-%c2%a8heart-darkness%c2%a8/.

- ↑ Peter Michael Alstone, Connections beyond the Margins of the Power Grid Information Technology and the Evolution of Off-Grid Solar Electricity in the Developing World (University of California, Berkeley, 2015), https://rael.berkeley.edu/wp-content/uploads/2015/05/LG-2015-PAYG-Report-Alstone-etal.pdf.

- ↑ 7.0 7.1 7.2 7.3 7.4 7.5 Andrew Scott and Charlie Miller, ‘Accelerating Access to Electricity in Africa with Off-Grid Solar - - Research Reports and Studies - 10230.Pdf’ (Overseas Development Institute, 2016), https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/10230.pdf.

- ↑ 8.0 8.1 Laura Sundblad, Johanna Diecker, and Petros Theodorou, ‘Global Off-Grid Solar Market Report Semi-Annual Sales and Impact Data JULY-DECEMBER 2016, PUBLIC REPORT’ (GOGLA, 2017), https://www.gogla.org/sites/default/files/recource_docs/final_sales-and-impact-report_h22016_full_public.pdf.

- ↑ 9.0 9.1 Sanyal, Sanjoy, Ariel C. Pinchot, Jeffrey Prins, and Feli Visco. ‘Stimulating Pay-As-You-Go Energy Access in Kenya and Tanzania: The Role of Development Finance’. World Resources Institute, 2016. http://www.wri.org/sites/default/files/Stimulating_Pay-As-You-Go_Energy_Access_in_Kenya_and_Tanzania_The_Role_of_Development_Finance.pdf.

- ↑ Daniel Waldron, ‘Solar Energy: A New Frontier for Microfinance’, CGAP, 17 April 2017, http://www.cgap.org/blog/solar-energy-new-frontier-microfinance.

- ↑ 11.0 11.1 Lighting Global, ‘Overview: PAYG KPI Framework | Lighting Global’, accessed 21 July 2017, https://www.lightingglobal.org/payg-kpi/.

- ↑ 12.0 12.1 GOGLA, ‘Announcing the First-Ever Key Performance Indicator Framework for the Off Grid Solar Pay-As-You-Go Sector | GOGLA’, 31 May 2017, https://www.gogla.org/news/announcing-the-first-ever-key-performance-indicator-framework-for-the-off-grid-solar-pay-as-you.