Knowledge fuels change

For over a decade, Energypedia has shared free, reliable energy expertise with the world.

We’re now facing a serious funding gap.

Help keep this platform alive — your donation, big or small, truly matters!

Thank you for your support

Difference between revisions of "Wind Energy Country Analyses Mexico"

***** (***** | *****) |

***** (***** | *****) |

||

| (39 intermediate revisions by 4 users not shown) | |||

| Line 1: | Line 1: | ||

| − | + | = Framework Conditions for Wind Energy<ref>GTZ (2009) Energy-policy Framework Conditions for Electricity Markets and Renewable Energies, German Technical Cooperation [[http://www.gtz.de/de/dokumente/gtz2009-en-terna-analysis-complete.pdf]]</ref> = | |

| − | Support for wind energy is project specific. For example the Project for Large Scale Development of Renewable Energy (PERGE) provides a specific mechanism to support wind energy in Mexico. This project receives financial contribution from the Global Environmental Facility (GEF) and the World Bank of 20 million €, which allows the state-owned utility | + | Support for wind energy is project specific. For example the [http://web.worldbank.org/external/projects/main?pagePK=64283627&piPK=73230&theSitePK=40941&menuPK=228424&Projectid=P077717 Project for Large Scale Development of Renewable Energy (PERGE)] provides a specific mechanism to support wind energy in Mexico. This project receives financial contribution from the [http://www.thegef.org Global Environmental Facility (GEF)] and the World Bank of 20 million €, which allows the state-owned utility [http://www.cfe.gob.mx Comisión Federal de Electricidad (CFE)] to provide an incentive for the development of the project La Venta III. The incentive consists of 0.73 €-cent per kWh delivered to the grid in a 5-year period counting from the start of the project. CFE will buy electricity for 25 years at a price of 0.03 €/kWh. In addition, a national wind resource map will be developed. |

| − | + | <br/> | |

| − | + | Under the PERGE scheme CFE awarded the Spanish enterprise [http://www.iberdrolarenovables.es Iberdrola Renovables] the construction contract for La Venta III wind farm in March 2009, following an international public tender. Iberdrola will supply energy to the CFE for the next 20 years. La Venta III wind farm is going to be situated in the municipality of [http://en.wikipedia.org/wiki/Santo_Domingo_Ingenio Santo Domingo Ingenio] in [http://en.wikipedia.org/wiki/Oaxaca Oaxaca State] and will have an installed capacity of 102.85 MW. The construction started in 2009; the project was expected to be operational in May 2011<ref>Iberdrola ingenieria y construcción (2011) Mexico P.E. La Venta 102,85 MW, Retrieved 7.6.2011 [[http://www.iberdrolaingenieria.com/ibding/proyectos.do?op=det&despliega=3]]</ref>. Currently no other projects are expected to receive financial incentive under the PERGE scheme.<br/> | |

| − | + | <br/> | |

| − | + | Another possible framework for wind energy projects is the Independent Power Producer (IPP) scheme: Under this scheme private producers with plants over 30 MW (regardless of the technology) must sell their power to the CFE through long-term [http://en.wikipedia.org/wiki/Power_Purchase_Agreement Power Purchase Agreements (PPA)], which are awarded through competitive bidding. Usually these contracts last for 20 years and the project should be included in the planning programmes of CFE (currently small power producers (<30 MW) do not need to be considered in the expansion plans). A similar scheme for small power producers (< 30 MW) is planned to be established.<br/> | |

| − | + | <br/> | |

| − | + | Under the IPP scheme, CFE plans to tender 600 MW of wind projects during 2008 to 2014 in 100 MW increments. The Power Purchase Agreements (PPA) includes a fixed capacity charge, a fixed operation and maintenance charge and a variable energy charge based on fuel prices.<br/> | |

| − | + | <br/> | |

| − | + | Within the IPP scheme and without extra financial incentive, CFE also signed a 150 million € contract with the local consortium Energias Ambientales de Oaxaca for the construction of the 101 MW Oaxaca I wind farm which is expected to be operational in 2011.<ref>http://saladeprensa.cfe.gob.mx/boletin/index.alia?docID=8327&secID=2</ref><br/> | |

| − | *Tehuantepec Isthmus, located in the state of Oaxaca, | + | <br/> |

| − | *La Rumorosa in Baja California as well as | + | |

| + | To facilitate the connection of wind parks to the national grid, México started the implementation of the "Open Season" project (Temporada Abierta) in 2006. The project consists of an agreement between CFE and the private developers to distribute the costs between CFE and private developers that occurred due to the new transmission infrastructure built in the state of Oaxaca (20 % CFE and 80 % private developers). The Open Season was organized in three steps according to the required specifications of the grid to connect the wind parks. | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | The First Season (mini season) reinforced an existing 115 kV grid by adding a second circuit. Two wind parks that started operations in 2009 are served by this scheme ([http://www.parqueseolicosonline.com/ Parques Ecológicos de México] and [http://www.eurus-energy.com Eurus]). The Second Season consists of four wind parks that were to start operation by 2009 and 2010 and are connected to a new 115 kV transmission line. The Third Season consists of the construction of a new transmission line of 400 kV by CFE with involvement and guarantees of the project developers. It should facilitate the access of six new projects and will increase the connection capacity for two existing projects. It was expected that the new transmission line would be be in operation by September 2010. Besides the 590 km circuit of new or reinforced transmission lines, the plan includes the construction of a new power substation and the upgrade of three existing ones. For new wind parks, a New Season project is going to be the instrument to expand the transmission grid in the future. | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | = Wind Energy Potential = | ||

| + | |||

| + | <u>According to the 2009 Programme for the Use of Renewable Energy, the Mexican zones with potential for wind power generation are:</u> | ||

| + | *Tehuantepec Isthmus, located in the state of Oaxaca, | ||

| + | *La Rumorosa in Baja California as well as | ||

*certain areas in the states of Zacatecas, Hidalgo, Veracruz, Sinaloa and in the Yucatán Peninsula. | *certain areas in the states of Zacatecas, Hidalgo, Veracruz, Sinaloa and in the Yucatán Peninsula. | ||

| − | Based on estimations of the Mexican Wind Energy Association (AMDEE) there is a feasible potential to install 10 GW of wind capacity. However the US National Renewable Energy Laboratory (NREL) estimated that just in Oaxaca there is potential for 33 GW that can be installed in an area of 6 637 km<sup>2</sup>. The potential can differ depending on the selection of wind locations, the accessibility to transmission capacity and the type of wind resource considered. | + | Based on estimations of the [http://www.amdee.org/ Mexican Wind Energy Association (AMDEE)]there is a feasible potential to install 10 GW of wind capacity. However the [http://www.nrel.gov US National Renewable Energy Laboratory (NREL)] estimated that just in Oaxaca there is potential for 33 GW that can be installed in an area of 6 637 km<sup>2</sup>. The potential can differ depending on the selection of wind locations, the accessibility to transmission capacity and the type of wind resource considered. |

| − | The Oaxaca Wind Resource Atlas<ref>Elliott D., Schwartz M., Scott G., Haymes S., Heimiller D. and George R. (2003) Wind energy resource atlas of Oaxaca, National Renewable Energy Laboratory, USA [[http://pdf.usaid.gov/pdf_docs/PNADE741.pdf]]</ref>, produced in 2003 by the NREL wind resource group, is the most extensive mapping study for Mexico. The detailed wind resource maps (at 30 and 50 m height) and other information contained in the atlas facilitate the identification of prospective areas for use of wind energy technologies, both for utility-scale power generation and off-grid wind energy applications. | + | The Oaxaca Wind Resource Atlas<ref>Elliott D., Schwartz M., Scott G., Haymes S., Heimiller D. and George R. (2003) Wind energy resource atlas of Oaxaca, National Renewable Energy Laboratory, USA [[http://pdf.usaid.gov/pdf_docs/PNADE741.pdf]]</ref>, produced in 2003 by the NREL wind resource group, is the most extensive mapping study for Mexico.[[File:Windmap Oaxaca Kopie.jpg|right|600px|Oaxaca - Wind Resource Map|alt=Oaxaca - Wind Resource Map]] The detailed wind resource maps (at 30 and 50 m height) and other information contained in the atlas facilitate the identification of prospective areas for use of wind energy technologies, both for utility-scale power generation and off-grid wind energy applications. |

| − | According to NREL, the wind-mapping results for Oaxaca show many areas that are estimated to have good-to excellent wind resources (wind power Classes 4 to 7, with 7 being the highest). Wind power class 4 correspond to wind speeds between 6.7 – 7.3 m/s and wind power density between 400-500 W/m<sup>2</sup>. Wind power class 7 correspond to wind speeds bigger than 8.5 m/s and power densities bigger than 800 W/m<sup>2</sup>. | + | According to NREL, the wind-mapping results for Oaxaca show many areas that are estimated to have good-to excellent wind resources (wind power Classes 4 to 7, with 7 being the highest). Wind power class 4 correspond to wind speeds between 6.7 – 7.3 m/s and wind power density between 400-500 W/m<sup>2</sup>. Wind power class 7 correspond to wind speeds bigger than 8.5 m/s and power densities bigger than 800 W/m<sup>2</sup>. |

| − | In addition to NREL’s atlas, available maps for other regions of Mexico have been produced by private companies like TrueWind SL (high resolution wind resource atlas for Jalisco State) and 3tierGroup, which unfortunately can't be accessed for free.<br> | + | In addition to NREL’s atlas, available maps for other regions of Mexico have been produced by private companies like TrueWind SL (high resolution wind resource atlas for Jalisco State) and 3tierGroup, which unfortunately can't be accessed for free.<br/> |

| − | + | [[Wind Energy Country Analyses Mexico#Framework Conditions for Wind Energy.5B1.5D|►Go to Top]]<br/> | |

| − | + | = Current Use of Wind Energy and Project Pipeline = | |

| − | {| cellspacing="1" cellpadding="1" border=" | + | By end 2010 projects in operation amounted to 519 MW<ref>GWEC (2011) Global Wind Report 2010, Global Wind Energy Council [[http://www.gwec.net/fileadmin/documents/Publications/Global_Wind_2007_report/GWEC%20Global%20Wind%20Report%202010%20low%20res.pdf]]</ref><ref>http://amdee.org/Proyectos/AMDEE%20Presentacin%20en%20Espaol%202011.pdf</ref>. The project pipeline in Mexico is expected to reach around 4 000 MW before 2012<ref>GTZ (2009) Energy-policy Framework Conditions for Electricity Markets and Renewable Energies, German Society for International Cooperation [[http://www.gtz.de/de/dokumente/gtz2009-en-terna-analysis-complete.pdf]]</ref>. Out of this, 2 564 MW correspond to already committed projects, which are presented in the following table.<br/> |

| − | |+ | + | |

| + | <br/> | ||

| + | |||

| + | {| cellspacing="1" cellpadding="1" border="1" align="left" style="width: 768px; height: 559px" | ||

| + | |+ Table 1: Operational and committed wind energy projects in Mexico | ||

|- | |- | ||

| − | ! scope="col" | Project<br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Project<br/> |

| − | ! scope="col" | | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | |

| − | Project developer<br> | + | Project developer<br/> |

| − | ! scope="col" | Region <br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Region<br/> |

| − | ! scope="col" | Modality<br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Modality<br/> |

| − | ! scope="col" | Capacity [MW] <br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Capacity [MW]<br/> |

| − | ! scope="col" | Approval date<br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Approval date<br/> |

|- | |- | ||

| − | | La Venta<br> | + | | La Venta<br/> |

| − | | CFE<br> | + | | CFE<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Public Service | + | | Public Service |

| − | | 1,35<br> | + | | 1,35<br/> |

| − | | Nov. 1994<br> | + | | Nov. 1994<br/> |

|- | |- | ||

| − | | Guerrero Negro<br> | + | | Guerrero Negro<br/> |

| − | | CFE<br> | + | | CFE<br/> |

| − | | Baja California Sur<br> | + | | Baja California Sur<br/> |

| − | | Public Service <br> | + | | Public Service<br/> |

| − | | 0,6<br> | + | | 0,6<br/> |

| − | | Mar. 1999<br> | + | | Mar. 1999<br/> |

|- | |- | ||

| − | | La Venta II<br> | + | | La Venta II<br/> |

| − | | CFE<br> | + | | CFE<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Public Service<br> | + | | Public Service<br/> |

| − | | 83,3<br> | + | | 83,3<br/> |

| − | | Jan. 2007<br> | + | | Jan. 2007<br/> |

|- | |- | ||

| − | | Eurus <br> | + | | Eurus<br/> |

| − | | Acciona<br> | + | | Acciona<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 250<br> | + | | 250<br/> |

| − | | Dec. 2009<br> | + | | Dec. 2009<br/> |

|- | |- | ||

| − | | Parques Ecologicos de Mexico<br> | + | | Parques Ecologicos de Mexico<br/> |

| − | | Iberdrola<br> | + | | Iberdrola<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 79,9<br> | + | | 79,9<br/> |

| − | | Jan. 2009<br> | + | | Jan. 2009<br/> |

|- | |- | ||

| − | | Fuerza Eolica del Istmo<br> | + | | Fuerza Eolica del Istmo<br/> |

| − | | Fuerza Eólica-Peñoles<br> | + | | Fuerza Eólica-Peñoles<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 30<br> | + | | 30<br/> |

| − | | 2010<br> | + | | 2010<br/> |

|- | |- | ||

| − | | Eléctrica del Valle de México<br> | + | | Eléctrica del Valle de México<br/> |

| − | | EdF Energies Nouvelles-Mitsui<br> | + | | EdF Energies Nouvelles-Mitsui<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 67,5<br> | + | | 67,5<br/> |

| − | | 2009<br> | + | | 2009<br/> |

|- | |- | ||

| − | | Bii Nee Stipa Energia Eólica<br> | + | | Bii Nee Stipa Energia Eólica<br/> |

| − | | Cisa-Gamesa<br> | + | | Cisa-Gamesa<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 26,3<br> | + | | 26,3<br/> |

| − | | 2009<br> | + | | 2009<br/> |

|- | |- | ||

| − | | Eoliatec del Istmo<br> | + | | Eoliatec del Istmo<br/> |

| − | | Eoliatec<br> | + | | Eoliatec<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 22<br> | + | | 22<br/> |

| − | | 2010<br> | + | | 2010<br/> |

|- | |- | ||

| − | | La Venta III<br> | + | | La Venta III<br/> |

| − | | CFE<br> | + | | CFE<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | IPP<br> | + | | IPP<br/> |

| − | | 101,4<br> | + | | 101,4<br/> |

| − | | | + | | 2011<br/> |

|- | |- | ||

| − | | Oaxaca I<br> | + | | Oaxaca I<br/> |

| − | | CFE<br> | + | | CFE<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | IPP<br> | + | | IPP<br/> |

| − | | 101,4<br> | + | | 101,4<br/> |

| − | | 2010<br> | + | | 2010<br/> |

|- | |- | ||

| − | | Centro Regional de Tecnologia Eólica <br> | + | | Centro Regional de Tecnologia Eólica<br/> |

| − | | Instituto de Investigaciones Electricas (IIE)<br> | + | | Instituto de Investigaciones Electricas (IIE)<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Small producer<br> | + | | Small producer<br/> |

| − | | 5<br> | + | | 5<br/> |

| − | | ND<br> | + | | ND<br/> |

|- | |- | ||

| − | | Desarollos Eólicos Mexicanos<br> | + | | Desarollos Eólicos Mexicanos<br/> |

| − | | Demex<br> | + | | Demex<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 227,5<br> | + | | 227,5<br/> |

| − | | 2011<br> | + | | 2011<br/> |

|- | |- | ||

| − | | Eoliatec del Pacifico<br> | + | | Eoliatec del Pacifico<br/> |

| − | | Eoliatec<br> | + | | Eoliatec<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 160,5<br> | + | | 160,5<br/> |

| − | | 2011<br> | + | | 2011<br/> |

|- | |- | ||

| − | | Eoliatec del Istmo (2nd phase)<br> | + | | Eoliatec del Istmo (2nd phase)<br/> |

| − | | Eoliatec<br> | + | | Eoliatec<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 142,2<br> | + | | 142,2<br/> |

| − | | 2011<br> | + | | 2011<br/> |

|- | |- | ||

| − | | Gamesa Energia<br> | + | | Gamesa Energia<br/> |

| − | | Gamesa<br> | + | | Gamesa<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 288<br> | + | | 288<br/> |

| − | | 2011<br> | + | | 2011<br/> |

|- | |- | ||

| − | | Vientos del Istmo<br> | + | | Vientos del Istmo<br/> |

| − | | Preneal<br> | + | | Preneal<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 180<br> | + | | 180<br/> |

| − | | 2012<br> | + | | 2012<br/> |

|- | |- | ||

| − | | Energia Alterna Istmeña<br> | + | | Energia Alterna Istmeña<br/> |

| − | | Preneal<br> | + | | Preneal<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 215,9<br> | + | | 215,9<br/> |

| − | | 2012<br> | + | | 2012<br/> |

|- | |- | ||

| − | | Unión Fenosa Generación México<br> | + | | Unión Fenosa Generación México<br/> |

| − | | Unión Fenosa<br> | + | | Unión Fenosa<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 227,5<br> | + | | 227,5<br/> |

| − | | 2010<br> | + | | 2010<br/> |

|- | |- | ||

| − | | Fuerza Eolica del Istmo (2nd phase)<br> | + | | Fuerza Eolica del Istmo (2nd phase)<br/> |

| − | | Fuerza Eólica<br> | + | | Fuerza Eólica<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 50<br> | + | | 50<br/> |

| − | | 2011<br> | + | | 2011<br/> |

|- | |- | ||

| − | | Oaxaca II-IV<br> | + | | Oaxaca II-IV<br/> |

| − | | CFE<br> | + | | CFE<br/> |

| − | | Oaxaca<br> | + | | Oaxaca<br/> |

| − | | IPP<br> | + | | IPP<br/> |

| − | | 304,2<br> | + | | 304,2<br/> |

| − | | Nov. 2011<br> | + | | Nov. 2011<br/> |

|} | |} | ||

| − | <br> | + | <br/> |

| − | <br> | + | <br/> |

| − | <br> | + | <br/> |

| − | <br> | + | <br/> |

| − | <br> | + | <br/> |

| − | <br> | + | <br/> |

| − | + | <br/> | |

| − | {| cellspacing="1" cellpadding="1" border=" | + | <br/> |

| − | |+ | + | |

| + | <br/> | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | Finally, most of the projects will be commissioned under the self-supply modality. This modality is attractive to project developers because of the high electricity prices for large users charged by CFE. In addition to the projects committed for construction, a number of potential projects with a combined installed capacity of 1,450 MW is presented in table 7. These projects will be developed mainly for export to the US market. | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | {| cellspacing="1" cellpadding="1" border="1" align="left" style="width: 768px" | ||

| + | |+ Table 2: Pipeline of potential wind projects in Mexico | ||

|- | |- | ||

| − | ! scope="col" | Project<br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Project<br/> |

| − | ! scope="col" | Project developer<br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Project developer<br/> |

| − | ! scope="col" | Region<br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Region<br/> |

| − | ! scope="col" | Modality<br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Modality<br/> |

| − | ! scope="col" | Capacity [MW]<br> | + | ! scope="col" style="background-color: rgb(204, 204, 204)" | Capacity [MW]<br/> |

|- | |- | ||

| − | | Fuerza Eólica de Baja<br>California<br> | + | | Fuerza Eólica de Baja<br/>California<br/> |

| − | | Fuerza Eólica<br> | + | | Fuerza Eólica<br/> |

| − | | Baja California<br> | + | | Baja California<br/> |

| − | | Export<br> | + | | Export<br/> |

| − | | 300<br> | + | | 300<br/> |

|- | |- | ||

| − | | Mexico Wind<br> | + | | Mexico Wind<br/> |

| − | | Union Fenosa/Geobat<br> | + | | Union Fenosa/Geobat<br/> |

| − | | Baja California<br> | + | | Baja California<br/> |

| − | | Export<br> | + | | Export<br/> |

| − | | 500<br> | + | | 500<br/> |

|- | |- | ||

| − | | ND<br> | + | | ND<br/> |

| − | | Cannon Power<br> | + | | Cannon Power<br/> |

| − | | Baja California<br> | + | | Baja California<br/> |

| − | | Export<br> | + | | Export<br/> |

| − | | 200<br> | + | | 200<br/> |

|- | |- | ||

| − | | Baja Wind<br> | + | | Baja Wind<br/> |

| − | | Sempra Energy<br> | + | | Sempra Energy<br/> |

| − | | Baja California<br> | + | | Baja California<br/> |

| − | | Export<br> | + | | Export<br/> |

| − | | 250<br> | + | | 250<br/> |

|- | |- | ||

| − | | Baja California<br> | + | | Baja California<br/> |

| − | | Fuerza Eólica<br> | + | | Fuerza Eólica<br/> |

| − | | Baja California<br> | + | | Baja California<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 10<br> | + | | 10<br/> |

|- | |- | ||

| − | | ND<br> | + | | ND<br/> |

| − | | Gobierno del Estado<br> | + | | Gobierno del Estado<br/> |

| − | | Baja California<br> | + | | Baja California<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 10<br> | + | | 10<br/> |

|- | |- | ||

| − | | Los Vergeles<br> | + | | Los Vergeles<br/> |

| − | | SEER<br> | + | | SEER<br/> |

| − | | Tamaulipas<br> | + | | Tamaulipas<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 160<br> | + | | 160<br/> |

|- | |- | ||

| − | | Eólica Santa Catarina<br> | + | | Eólica Santa Catarina<br/> |

| − | | Econergy<br> | + | | Econergy<br/> |

| − | | Nuevo Leon<br> | + | | Nuevo Leon<br/> |

| − | | Self supply<br> | + | | Self-supply<br/> |

| − | | 20<br> | + | | 20<br/> |

|} | |} | ||

| − | <br> | + | <br/> |

| + | |||

| + | <br/>[[Wind Energy Country Analyses Mexico#Framework Conditions for Wind Energy.5B1.5D|►Go to Top]] | ||

| + | |||

| + | = Business Climate = | ||

| + | |||

| + | Mexico is open to '''foreign direct investment (FDI)'''n most economic sectors and has consistently been one of the largest recipients of FDI among emerging markets. In addition, Mexico has signed 12 free trade agreements covering 44 countries. This is a good indicator for a favourable investment climate providing legal security for the investors. | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | Intellectual property rights are guaranteed by a variety of international agreements that Mexico has signed. For example, Mexico is a signatory of the Paris Convention, the Patent Cooperation Treaty and the International Union for the Protection of New Varieties of Plants (UPOV). The authority in charge of enforcing the law and the treaties is the Mexican Institute for Industrial Property (IMPI). Mexico is strategically located next to the growing wind market of the US. Because of the proximity to this big market, companies based in Mexico are starting to offer products and services for the wind industry. High skilled local workforce in the electricity, automotive, aeronautic and civil engineering sectors can be easily trained in the manufacturing of wind power equipment. Regarding research and development, the Instituto de'''Investigaciones Electricas (IIE)''' has established the Centro Regional de Tecnologica – CERTE (Regional Centre for Wind Technology). The Centre will focus on further investigating the wind power potential in Mexico. The Centre will also certify wind turbines. In addition, the CERTE will design and test a locally produced wind turbine that is expected to be produced at industrial scale in the country. Furthermore, the Engineering Institute of UNAM (Mexico National University) is carrying out research on the use of wind technologies for water desalination. | ||

| + | |||

| + | <br/> | ||

| − | + | However, the wind power sector in Mexico faces some challenges. It is acknowledged that despite the big potential, wind development in Mexico has been slow. This is based on the fact that the first permit for wind projects was issued by CRE in 1998 but it was only in 2007 when the first large scale project became operational. Reasons for this delay are the lack of financial incentives from the government and the slow process to expand the grid to areas with wind potential. It is expected that the recent reforms of the regulatory framework (2008) encourage sustained development of the wind industry. Furthermore, there is a limited supply and availability of equipment and services (both at the international and local level). Despite the Open Season scheme, restrictions persist due to the fact that there are long distances between the potential wind projects sites and the connection points to the transmission grid. Communities living next to the projects have complained that the project developers are not fulfilling their commitments on payments and compensations related to the rental of their lands, which is partially caused by delays in the project implementation. Finally, the global financial crisis has dried up commercial bank financing for private wind deals and the Mexican projects have had problems securing financing to be completed.<br/> | |

| − | Mexico | + | [[Wind Energy Country Analyses Mexico#Framework Conditions for Wind Energy.5B1.5D|►Go to Top]] |

| − | |||

| − | + | = Further Information = | |

| − | + | *Barnés, Francisco J. (2009) An Open Season Scheme to develop Transmission Interconnection Investments for large wind farms in Mexico, Comision Reguladora de Energia, Retrieved 7.6.2011 [[http://siteresources.worldbank.org/INTENERGY/Resources/335544-1232567547944/5755469-1239633250635/Francisco_J_Barnes.pdf [1]]] | |

| + | *Gobierno Federal de México/SENER/GTZ (2009) Energías Renovables para el Desarrollo Sustentable en México, Secretario de Energia, German Technical Cooperation (GTZ), Retrieved 9.6.2011 [[http://www.energia.gob.mx/webSener/res/0/ER_para_Desarrollo_Sustentable_Mx_2009.pdf [2]]]<br/> | ||

| + | *[[:File:Elementos para la Promoción de la Energía Eólica en México.pdf |Estudio del Potencial de Exportación de Energía Eólica de México a los Estados Unidos]], Retrieved 8.8.2011 | ||

| + | *[http://www.amdee.org/_literature_44032/Análisis_Comparativo_Sectores_Eólicos_de_EEUU_y_México USAID (2009) Análisis comparativo del Marco Eléctrico legal y Regulatorio de EE.UU. y México para la promoción de la Energía Eólica Marzo 2009], Retrieved 8.8.2011 | ||

| + | *[http://www.amdee.org/_literature_44031/Elementos_de_Promoción_para_la_Energía_Eólicoa USAID (2009) Elementos para la Promoción de Energía Eólica en México, Marzo 2009], Retrieved 8.8.2011 | ||

| + | *[[Country-specific Wind Energy Facts|Wind Energy Map (country-specific wind energy facts)]] | ||

| + | *[[Wind_Energy_Fact_Sheet_Mexico|Wind_Energy_Fact_Sheet_Mexico]]<br/> | ||

| + | *[[Portal:Wind|Wind Portal on energypedia]]<br/> | ||

| − | + | [[Wind Energy Country Analyses Mexico#Framework Conditions for Wind Energy.5B1.5D|►Go to Top]] | |

| − | |||

| − | + | = References<br/> = | |

| − | |||

| − | <br> | + | <references /><br/> |

| − | [[Category: | + | [[Category:Mexico]] |

| + | [[Category:Wind]] | ||

Latest revision as of 13:43, 22 July 2019

Framework Conditions for Wind Energy[1]

Support for wind energy is project specific. For example the Project for Large Scale Development of Renewable Energy (PERGE) provides a specific mechanism to support wind energy in Mexico. This project receives financial contribution from the Global Environmental Facility (GEF) and the World Bank of 20 million €, which allows the state-owned utility Comisión Federal de Electricidad (CFE) to provide an incentive for the development of the project La Venta III. The incentive consists of 0.73 €-cent per kWh delivered to the grid in a 5-year period counting from the start of the project. CFE will buy electricity for 25 years at a price of 0.03 €/kWh. In addition, a national wind resource map will be developed.

Under the PERGE scheme CFE awarded the Spanish enterprise Iberdrola Renovables the construction contract for La Venta III wind farm in March 2009, following an international public tender. Iberdrola will supply energy to the CFE for the next 20 years. La Venta III wind farm is going to be situated in the municipality of Santo Domingo Ingenio in Oaxaca State and will have an installed capacity of 102.85 MW. The construction started in 2009; the project was expected to be operational in May 2011[2]. Currently no other projects are expected to receive financial incentive under the PERGE scheme.

Another possible framework for wind energy projects is the Independent Power Producer (IPP) scheme: Under this scheme private producers with plants over 30 MW (regardless of the technology) must sell their power to the CFE through long-term Power Purchase Agreements (PPA), which are awarded through competitive bidding. Usually these contracts last for 20 years and the project should be included in the planning programmes of CFE (currently small power producers (<30 MW) do not need to be considered in the expansion plans). A similar scheme for small power producers (< 30 MW) is planned to be established.

Under the IPP scheme, CFE plans to tender 600 MW of wind projects during 2008 to 2014 in 100 MW increments. The Power Purchase Agreements (PPA) includes a fixed capacity charge, a fixed operation and maintenance charge and a variable energy charge based on fuel prices.

Within the IPP scheme and without extra financial incentive, CFE also signed a 150 million € contract with the local consortium Energias Ambientales de Oaxaca for the construction of the 101 MW Oaxaca I wind farm which is expected to be operational in 2011.[3]

To facilitate the connection of wind parks to the national grid, México started the implementation of the "Open Season" project (Temporada Abierta) in 2006. The project consists of an agreement between CFE and the private developers to distribute the costs between CFE and private developers that occurred due to the new transmission infrastructure built in the state of Oaxaca (20 % CFE and 80 % private developers). The Open Season was organized in three steps according to the required specifications of the grid to connect the wind parks.

The First Season (mini season) reinforced an existing 115 kV grid by adding a second circuit. Two wind parks that started operations in 2009 are served by this scheme (Parques Ecológicos de México and Eurus). The Second Season consists of four wind parks that were to start operation by 2009 and 2010 and are connected to a new 115 kV transmission line. The Third Season consists of the construction of a new transmission line of 400 kV by CFE with involvement and guarantees of the project developers. It should facilitate the access of six new projects and will increase the connection capacity for two existing projects. It was expected that the new transmission line would be be in operation by September 2010. Besides the 590 km circuit of new or reinforced transmission lines, the plan includes the construction of a new power substation and the upgrade of three existing ones. For new wind parks, a New Season project is going to be the instrument to expand the transmission grid in the future.

Wind Energy Potential

According to the 2009 Programme for the Use of Renewable Energy, the Mexican zones with potential for wind power generation are:

- Tehuantepec Isthmus, located in the state of Oaxaca,

- La Rumorosa in Baja California as well as

- certain areas in the states of Zacatecas, Hidalgo, Veracruz, Sinaloa and in the Yucatán Peninsula.

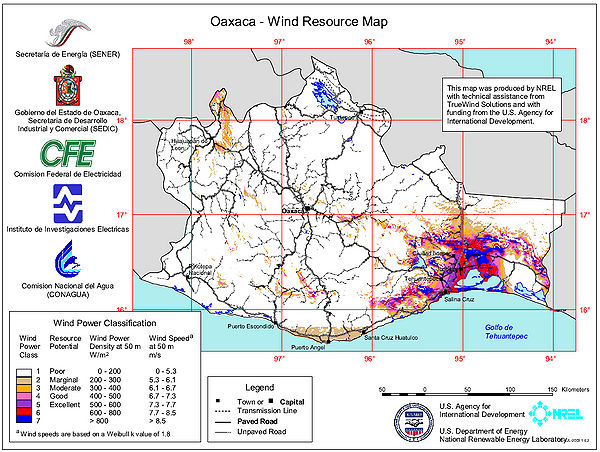

Based on estimations of the Mexican Wind Energy Association (AMDEE)there is a feasible potential to install 10 GW of wind capacity. However the US National Renewable Energy Laboratory (NREL) estimated that just in Oaxaca there is potential for 33 GW that can be installed in an area of 6 637 km2. The potential can differ depending on the selection of wind locations, the accessibility to transmission capacity and the type of wind resource considered.

The Oaxaca Wind Resource Atlas[4], produced in 2003 by the NREL wind resource group, is the most extensive mapping study for Mexico.

The detailed wind resource maps (at 30 and 50 m height) and other information contained in the atlas facilitate the identification of prospective areas for use of wind energy technologies, both for utility-scale power generation and off-grid wind energy applications.

According to NREL, the wind-mapping results for Oaxaca show many areas that are estimated to have good-to excellent wind resources (wind power Classes 4 to 7, with 7 being the highest). Wind power class 4 correspond to wind speeds between 6.7 – 7.3 m/s and wind power density between 400-500 W/m2. Wind power class 7 correspond to wind speeds bigger than 8.5 m/s and power densities bigger than 800 W/m2.

In addition to NREL’s atlas, available maps for other regions of Mexico have been produced by private companies like TrueWind SL (high resolution wind resource atlas for Jalisco State) and 3tierGroup, which unfortunately can't be accessed for free.

Current Use of Wind Energy and Project Pipeline

By end 2010 projects in operation amounted to 519 MW[5][6]. The project pipeline in Mexico is expected to reach around 4 000 MW before 2012[7]. Out of this, 2 564 MW correspond to already committed projects, which are presented in the following table.

| Project |

Project developer |

Region |

Modality |

Capacity [MW] |

Approval date |

|---|---|---|---|---|---|

| La Venta |

CFE |

Oaxaca |

Public Service | 1,35 |

Nov. 1994 |

| Guerrero Negro |

CFE |

Baja California Sur |

Public Service |

0,6 |

Mar. 1999 |

| La Venta II |

CFE |

Oaxaca |

Public Service |

83,3 |

Jan. 2007 |

| Eurus |

Acciona |

Oaxaca |

Self-supply |

250 |

Dec. 2009 |

| Parques Ecologicos de Mexico |

Iberdrola |

Oaxaca |

Self-supply |

79,9 |

Jan. 2009 |

| Fuerza Eolica del Istmo |

Fuerza Eólica-Peñoles |

Oaxaca |

Self-supply |

30 |

2010 |

| Eléctrica del Valle de México |

EdF Energies Nouvelles-Mitsui |

Oaxaca |

Self-supply |

67,5 |

2009 |

| Bii Nee Stipa Energia Eólica |

Cisa-Gamesa |

Oaxaca |

Self-supply |

26,3 |

2009 |

| Eoliatec del Istmo |

Eoliatec |

Oaxaca |

Self-supply |

22 |

2010 |

| La Venta III |

CFE |

Oaxaca |

IPP |

101,4 |

2011 |

| Oaxaca I |

CFE |

Oaxaca |

IPP |

101,4 |

2010 |

| Centro Regional de Tecnologia Eólica |

Instituto de Investigaciones Electricas (IIE) |

Oaxaca |

Small producer |

5 |

ND |

| Desarollos Eólicos Mexicanos |

Demex |

Oaxaca |

Self-supply |

227,5 |

2011 |

| Eoliatec del Pacifico |

Eoliatec |

Oaxaca |

Self-supply |

160,5 |

2011 |

| Eoliatec del Istmo (2nd phase) |

Eoliatec |

Oaxaca |

Self-supply |

142,2 |

2011 |

| Gamesa Energia |

Gamesa |

Oaxaca |

Self-supply |

288 |

2011 |

| Vientos del Istmo |

Preneal |

Oaxaca |

Self-supply |

180 |

2012 |

| Energia Alterna Istmeña |

Preneal |

Oaxaca |

Self-supply |

215,9 |

2012 |

| Unión Fenosa Generación México |

Unión Fenosa |

Oaxaca |

Self-supply |

227,5 |

2010 |

| Fuerza Eolica del Istmo (2nd phase) |

Fuerza Eólica |

Oaxaca |

Self-supply |

50 |

2011 |

| Oaxaca II-IV |

CFE |

Oaxaca |

IPP |

304,2 |

Nov. 2011 |

Finally, most of the projects will be commissioned under the self-supply modality. This modality is attractive to project developers because of the high electricity prices for large users charged by CFE. In addition to the projects committed for construction, a number of potential projects with a combined installed capacity of 1,450 MW is presented in table 7. These projects will be developed mainly for export to the US market.

| Project |

Project developer |

Region |

Modality |

Capacity [MW] |

|---|---|---|---|---|

| Fuerza Eólica de Baja California |

Fuerza Eólica |

Baja California |

Export |

300 |

| Mexico Wind |

Union Fenosa/Geobat |

Baja California |

Export |

500 |

| ND |

Cannon Power |

Baja California |

Export |

200 |

| Baja Wind |

Sempra Energy |

Baja California |

Export |

250 |

| Baja California |

Fuerza Eólica |

Baja California |

Self-supply |

10 |

| ND |

Gobierno del Estado |

Baja California |

Self-supply |

10 |

| Los Vergeles |

SEER |

Tamaulipas |

Self-supply |

160 |

| Eólica Santa Catarina |

Econergy |

Nuevo Leon |

Self-supply |

20 |

Business Climate

Mexico is open to foreign direct investment (FDI)n most economic sectors and has consistently been one of the largest recipients of FDI among emerging markets. In addition, Mexico has signed 12 free trade agreements covering 44 countries. This is a good indicator for a favourable investment climate providing legal security for the investors.

Intellectual property rights are guaranteed by a variety of international agreements that Mexico has signed. For example, Mexico is a signatory of the Paris Convention, the Patent Cooperation Treaty and the International Union for the Protection of New Varieties of Plants (UPOV). The authority in charge of enforcing the law and the treaties is the Mexican Institute for Industrial Property (IMPI). Mexico is strategically located next to the growing wind market of the US. Because of the proximity to this big market, companies based in Mexico are starting to offer products and services for the wind industry. High skilled local workforce in the electricity, automotive, aeronautic and civil engineering sectors can be easily trained in the manufacturing of wind power equipment. Regarding research and development, the Instituto deInvestigaciones Electricas (IIE) has established the Centro Regional de Tecnologica – CERTE (Regional Centre for Wind Technology). The Centre will focus on further investigating the wind power potential in Mexico. The Centre will also certify wind turbines. In addition, the CERTE will design and test a locally produced wind turbine that is expected to be produced at industrial scale in the country. Furthermore, the Engineering Institute of UNAM (Mexico National University) is carrying out research on the use of wind technologies for water desalination.

However, the wind power sector in Mexico faces some challenges. It is acknowledged that despite the big potential, wind development in Mexico has been slow. This is based on the fact that the first permit for wind projects was issued by CRE in 1998 but it was only in 2007 when the first large scale project became operational. Reasons for this delay are the lack of financial incentives from the government and the slow process to expand the grid to areas with wind potential. It is expected that the recent reforms of the regulatory framework (2008) encourage sustained development of the wind industry. Furthermore, there is a limited supply and availability of equipment and services (both at the international and local level). Despite the Open Season scheme, restrictions persist due to the fact that there are long distances between the potential wind projects sites and the connection points to the transmission grid. Communities living next to the projects have complained that the project developers are not fulfilling their commitments on payments and compensations related to the rental of their lands, which is partially caused by delays in the project implementation. Finally, the global financial crisis has dried up commercial bank financing for private wind deals and the Mexican projects have had problems securing financing to be completed.

Further Information

- Barnés, Francisco J. (2009) An Open Season Scheme to develop Transmission Interconnection Investments for large wind farms in Mexico, Comision Reguladora de Energia, Retrieved 7.6.2011 [[1]]

- Gobierno Federal de México/SENER/GTZ (2009) Energías Renovables para el Desarrollo Sustentable en México, Secretario de Energia, German Technical Cooperation (GTZ), Retrieved 9.6.2011 [[2]]

- Estudio del Potencial de Exportación de Energía Eólica de México a los Estados Unidos, Retrieved 8.8.2011

- USAID (2009) Análisis comparativo del Marco Eléctrico legal y Regulatorio de EE.UU. y México para la promoción de la Energía Eólica Marzo 2009, Retrieved 8.8.2011

- USAID (2009) Elementos para la Promoción de Energía Eólica en México, Marzo 2009, Retrieved 8.8.2011

- Wind Energy Map (country-specific wind energy facts)

- Wind_Energy_Fact_Sheet_Mexico

- Wind Portal on energypedia

References

- ↑ GTZ (2009) Energy-policy Framework Conditions for Electricity Markets and Renewable Energies, German Technical Cooperation [[1]]

- ↑ Iberdrola ingenieria y construcción (2011) Mexico P.E. La Venta 102,85 MW, Retrieved 7.6.2011 [[2]]

- ↑ http://saladeprensa.cfe.gob.mx/boletin/index.alia?docID=8327&secID=2

- ↑ Elliott D., Schwartz M., Scott G., Haymes S., Heimiller D. and George R. (2003) Wind energy resource atlas of Oaxaca, National Renewable Energy Laboratory, USA [[3]]

- ↑ GWEC (2011) Global Wind Report 2010, Global Wind Energy Council [[4]]

- ↑ http://amdee.org/Proyectos/AMDEE%20Presentacin%20en%20Espaol%202011.pdf

- ↑ GTZ (2009) Energy-policy Framework Conditions for Electricity Markets and Renewable Energies, German Society for International Cooperation [[5]]