Difference between revisions of "Financing Opportunities for Energy Access Companies in Mozambique"

***** (***** | *****) m |

***** (***** | *****) m (→References) |

||

| Line 47: | Line 47: | ||

=== Micro Finance === | === Micro Finance === | ||

The '''microfinance sector''' is still small and concentrates predominantly on Maputo city and Maputo province. High interest rates make credit from Micro Finance Institutions (MFI) very expensive. | The '''microfinance sector''' is still small and concentrates predominantly on Maputo city and Maputo province. High interest rates make credit from Micro Finance Institutions (MFI) very expensive. | ||

| − | Given the difficulties in accessing local credit, most off-grid solar companies either depend on their own finances or are raising international capital.<ref name=":0">ECA/Green Light (2018): Off-Grid Solar Market Assessment in Mozambique <nowiki>https://www.lightingafrica.org/wp-content/uploads/2019/07/Mozambique_off-grid-assessment.pdf</nowiki> </ref> | + | Given the difficulties in accessing local credit, most off-grid solar companies either depend on their own finances or are raising international capital.<ref name=":0">ECA/Green Light (2018): Off-Grid Solar Market Assessment in Mozambique <nowiki>https://www.lightingafrica.org/wp-content/uploads/2019/07/Mozambique_off-grid-assessment.pdf</nowiki> </ref> |

| + | |||

The lack of affordable loans limits the ability of energy access enterprises to manage their inventory levels, give credit to dealers, expand their distribution networks and invest in the marketing of their products. It also limits the ability of SMEs to import larger quantities of stock and thereby secure better price offers from their suppliers. This in turn leads to higher prices that are often unaffordable for low-income groups.<ref name=":0" /> | The lack of affordable loans limits the ability of energy access enterprises to manage their inventory levels, give credit to dealers, expand their distribution networks and invest in the marketing of their products. It also limits the ability of SMEs to import larger quantities of stock and thereby secure better price offers from their suppliers. This in turn leads to higher prices that are often unaffordable for low-income groups.<ref name=":0" /> | ||

== References == | == References == | ||

<references /> | <references /> | ||

Revision as of 15:54, 28 September 2021

Access to Financial Services and Products

Access to finance is difficult for renewable energy companies in Mozambique due to sectoral and legal framework conditions, high interest rates, required collateral and lack of information.

According to World Bank’s Doing Business report, Mozambique scores 25 with regard to getting credit (with 0 being the lowest and 100 the highest score). The degree to which collateral and bankruptcy laws protect the rights of borrowers and lenders, and thus facilitate lending, is especially low with an index of 1 (out of 12). Furthermore, only 7.6% of individuals and firms are listed in a credit registry.[1]

Commercial banks have high lending rates[2], making it difficult for small retailers and micro- or medium entrepreneurs to get access to working capital, e.g. for stocking products. According to the findings of the FinScope MSME Survey Mozambique 2012, about 75% of micro enterprises and 50% of small enterprises lack access to financial services and products in the country.[3]

However, the lack of access to finance is not only hampered by high interest and required collateral, but also due to the mere fact that banking institutions are not easy to reach in rural areas nor do all provinces have the same coverage of bank branches.

For an overview about the accessibility of financial services for individuals, read the article about end-user finance.

Mozambique’s financial sector is comprised by the following Credit institutions and financial companies:

| 2019[4] | |

| Commercial banks | 19 |

| Micro-banks | 9 |

| Credit unions | 9 |

| Electronic money institutions | 3 |

| Savings and loan organisations | 12 |

| Representations of Savings and Credit Unions, Micro-credit operators | 529 |

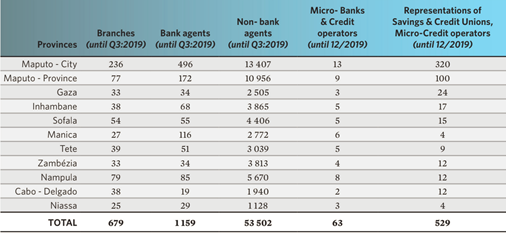

Provincial distribution of bank branches as of 2019[5]

Micro Finance

The microfinance sector is still small and concentrates predominantly on Maputo city and Maputo province. High interest rates make credit from Micro Finance Institutions (MFI) very expensive. Given the difficulties in accessing local credit, most off-grid solar companies either depend on their own finances or are raising international capital.[6]

The lack of affordable loans limits the ability of energy access enterprises to manage their inventory levels, give credit to dealers, expand their distribution networks and invest in the marketing of their products. It also limits the ability of SMEs to import larger quantities of stock and thereby secure better price offers from their suppliers. This in turn leads to higher prices that are often unaffordable for low-income groups.[6]

References

- ↑ World Bank (2020): Ease of Doing Business in Mozambique https://www.doingbusiness.org/en/data/exploreeconomies/mozambique#

- ↑ U.S. International Trade Administration, “Mozambique -Country Commercial Guide.”

- ↑ Republic of Mozambique (2016): National Financial Inclusion Strategy 2016-2022 https://thedocs.worldbank.org/en/doc/469371468274738363-0010022016/original/MozambiqueNationalFinancialInclusionStrategy20162022.pdf

- ↑ FinScope Report Mozambique 2019 https://drive.google.com/file/d/1TYp_gAuemR2rUVUNWeYyA2N9hG5U7qUS/view

- ↑ FinScope Report Mozambique 2019 https://drive.google.com/file/d/1TYp_gAuemR2rUVUNWeYyA2N9hG5U7qUS/view

- ↑ 6.0 6.1 ECA/Green Light (2018): Off-Grid Solar Market Assessment in Mozambique https://www.lightingafrica.org/wp-content/uploads/2019/07/Mozambique_off-grid-assessment.pdf