Difference between revisions of "North Macedonia Energy Situation"

***** (***** | *****) m |

***** (***** | *****) m |

||

| (23 intermediate revisions by 4 users not shown) | |||

| Line 1: | Line 1: | ||

| − | {{CES | + | {{CES Country2 |

| − | |CES Country Name=Macedonia | + | |CES Country Name=North Macedonia |

|CES Country Capital=Skopje | |CES Country Capital=Skopje | ||

| − | |CES Country Region=Europe & Central Asia | + | |CES Country Region Europe and Central Asia = Europe & Central Asia |

|CES Country Coordinates=41.6000° N, 21.7000° E | |CES Country Coordinates=41.6000° N, 21.7000° E | ||

}} | }} | ||

| − | = Introduction = | + | == Introduction == |

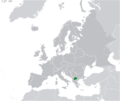

| + | North Macedonia is a landlocked country in Southeast Europe. It is bordered by Greece to the south, Albania to the west, Bulgaria to the east, Kosovo to the northwest and Serbia to the north. Skopje, the capital and largest city, is home to a quarter of the country's population of 1.83 million.<ref>https://en.wikipedia.org/wiki/North_Macedonia</ref> | ||

| − | = Energy Situation = | + | == Energy Situation == |

| + | In the year 2022, the primary source of energy in North-Macedonia, as reflected in the country's total energy supply, was oil, accounting for 45% of the total. This was followed by coal, which constituted 32% of the total energy supply. Coal accounted for 47% of electricity generation, followed by hydropower with 23% and natural gas (17%).<ref name=":0">[https://www.iea.org/countries/north-macedonia IEA country overview North-Macedonia], retrieved on 29 October 2024</ref> | ||

| + | In North Macedonia, the proportion of modern renewable energy sources in final energy consumption was close to 20% in 2021. In terms of electricity generation, 27% of the electricity is generated from renewables, predominantly from hydropower.<ref name=":0" /> | ||

| − | + | North Macedonia has shown an increasing interest in renewable energy sources to diversify its energy mix, reduce dependence on fossil fuels, and meet environmental targets. The government has implemented various policies and initiatives to promote the development of renewable energy projects. | |

| + | North Macedonia has historically relied on hydropower for a significant portion of its electricity generation. The country has utilized its rivers to develop hydropower plants. There have been also efforts to harness wind energy, and several wind projects have been proposed or are under development. Solar energy projects, particularly solar photovoltaic (PV) installations, have gained attention. The government has implemented programs to incentivize the adoption of solar technologies.Biomass and biogas have been explored as potential sources of renewable energy. | ||

| − | = | + | === Installed electricity capacity (MW) by Technology, Grid connection and Year === |

| + | <div class="grid stretch-items"> | ||

| + | <div class="width-1-2"> | ||

| + | {| class="wikitable" | ||

| + | |+Total Installed Capacity by the end of year 2022 is 1,925.52 MW | ||

| + | !Technology | ||

| + | !Grid Connection | ||

| + | !Year | ||

| + | !Capacity (MW) | ||

| + | |- | ||

| + | |Solar photovoltaic | ||

| + | |On-grid | ||

| + | |2022 | ||

| + | |84.93 | ||

| + | |- | ||

| + | |Onshore wind energy | ||

| + | |On-grid | ||

| + | |2022 | ||

| + | |37.00 | ||

| + | |- | ||

| + | |Renewable hydropower | ||

| + | |On-grid | ||

| + | |2022 | ||

| + | |689.19 | ||

| + | |- | ||

| + | |Solid biofuels | ||

| + | |On-grid | ||

| + | |2022 | ||

| + | |2.40 | ||

| + | |- | ||

| + | |Biogas | ||

| + | |On-grid | ||

| + | |2022 | ||

| + | |8.00 | ||

| + | |- | ||

| + | |Coal and peat | ||

| + | |On-grid | ||

| + | |2022 | ||

| + | |824.00 | ||

| + | |- | ||

| + | |Oil | ||

| + | |On-grid | ||

| + | |2022 | ||

| + | |29.00 | ||

| + | |- | ||

| + | |Natural gas | ||

| + | |On-grid | ||

| + | |2022 | ||

| + | |251.00 | ||

| + | |} | ||

| + | </div> | ||

| + | <div class="width-1-2"> | ||

| + | [[File:Installed Electricity Capacity in Percentage - Macedonia.png|center|500px|Installed Electricity Capacity in Percentage - Macedonia]]<br/> | ||

| + | <center>Fig 1: Installed Electricity Capacity in Percentage</center> | ||

| + | </div> | ||

| + | </div> | ||

| + | === Energy Generation and Consumption === | ||

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | !Description of data [unit] | ||

| + | !2020 | ||

| + | !2021 | ||

| + | |- | ||

| + | |Electricity production [GWh] | ||

| + | |5.127 | ||

| + | |5.285 | ||

| + | |- | ||

| + | |Gross electricity consumption [GWh] | ||

| + | |7.748 | ||

| + | |8.172 | ||

| + | |- | ||

| + | |Consumption structure [GWh] / industrial, transport, services and other | ||

| + | |3.285 | ||

| + | |3.548 | ||

| + | |- | ||

| + | |Consumption structure [GWh] / households (residential customers) | ||

| + | |3.191 | ||

| + | |3.317 | ||

| + | |} | ||

| − | = | + | === Net Import & Net Export === |

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | !Description of data [unit] | ||

| + | !2020 | ||

| + | !2021 | ||

| + | |- | ||

| + | |Net imports [GWh] | ||

| + | |2.341 | ||

| + | |4.724 | ||

| + | |- | ||

| + | |Net exports [GWh] | ||

| + | |1.011 | ||

| + | |2.134 | ||

| + | |} | ||

| + | === Energy Losses === | ||

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | !Description of data [unit] | ||

| + | !2020 | ||

| + | !2021 | ||

| + | |- | ||

| + | |Losses in transmission [%] | ||

| + | |1.2% | ||

| + | |1.30% | ||

| + | |- | ||

| + | |Losses in distribution [%] | ||

| + | |13,4% | ||

| + | |13,40% | ||

| + | |} | ||

| − | = | + | === Transmission Network === |

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | !Description of data [unit] | ||

| + | !2.367 | ||

| + | !2.35 | ||

| + | |- | ||

| + | |Horizontal transmission network [km] | ||

| + | |2.367 | ||

| + | |2.35 | ||

| + | |- | ||

| + | |Horizontal transmission network [km] / substation capacity [MVA] | ||

| + | |2.7 | ||

| + | |2.7 | ||

| + | |} | ||

| + | === No of Consumers === | ||

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | !Description of data [unit] | ||

| + | !2020 | ||

| + | !2021 | ||

| + | |- | ||

| + | |Electricity customers / total | ||

| + | |876.466 | ||

| + | |888.998 | ||

| + | |- | ||

| + | |Electricity customers / non-households | ||

| + | |101.531 | ||

| + | |101.007 | ||

| + | |- | ||

| + | |Eligible customers under national legislation | ||

| + | |876.466 | ||

| + | |888.998 | ||

| + | |} | ||

| − | = | + | === Internal Market === |

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | !Description of data [unit] | ||

| + | !2020 | ||

| + | !2021 | ||

| + | |- | ||

| + | |Internal market / electricity supplied to active eligible customers [MWh] | ||

| + | |2.913.592 | ||

| + | |3.176.265 | ||

| + | |- | ||

| + | |Horizontal transmission network [km] / substation capacity [MVA] | ||

| + | |45% | ||

| + | |46% | ||

| + | |} | ||

| − | = | + | == Renewable Energy Potential== |

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | ! | ||

| + | !Unit | ||

| + | !Reference Case 2030 | ||

| + | !Remap 2030 | ||

| + | |- | ||

| + | |Total installed power generation capacity | ||

| + | |MW | ||

| + | |2,226.00 | ||

| + | |3,311.00 | ||

| + | |- | ||

| + | |'''Renewable capacity''' | ||

| + | |MW | ||

| + | |1,139.00 | ||

| + | |2,791.00 | ||

| + | |- | ||

| + | | Hydropower | ||

| + | |MW | ||

| + | |824.00 | ||

| + | |824.00 | ||

| + | |- | ||

| + | | Wind - onshoore | ||

| + | |MW | ||

| + | |200.00 | ||

| + | |589.00 | ||

| + | |- | ||

| + | |Biofuels (solid, liquid, gaseous) | ||

| + | |MW | ||

| + | |30.00 | ||

| + | |247.00 | ||

| + | |- | ||

| + | |Solar PV | ||

| + | |MW | ||

| + | |75.00 | ||

| + | |1,121.00 | ||

| + | |- | ||

| + | |Geothermal | ||

| + | |MW | ||

| + | |10.00 | ||

| + | |10.00 | ||

| + | |- | ||

| + | |'''Non-renewable capacity''' | ||

| + | |MW | ||

| + | |1,087.00 | ||

| + | |520.00 | ||

| + | |- | ||

| + | |Coal | ||

| + | |MW | ||

| + | |800.00 | ||

| + | |233.00 | ||

| + | |- | ||

| + | |Gas | ||

| + | |MW | ||

| + | |287.00 | ||

| + | |287.00 | ||

| + | |} | ||

| + | <div class="grid stretch-items"> | ||

| + | <div class="width-1-2"> | ||

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | !Technologies | ||

| + | !Technical Potential MW | ||

| + | |- | ||

| + | |'''Solar PV''' | ||

| + | |1,479.6 | ||

| + | |- | ||

| + | |'''Wind''' | ||

| + | |4,940.4 | ||

| + | |- | ||

| + | |'''Hydro''' | ||

| + | |1,636.0 | ||

| + | |- | ||

| + | |≤ 10 MW | ||

| + | |255.0 | ||

| + | |- | ||

| + | |> 10 MW | ||

| + | |1,381.0 | ||

| + | |- | ||

| + | |Pumping | ||

| + | | | ||

| + | |- | ||

| + | |'''Biomass''' | ||

| + | |50.0 | ||

| + | |- | ||

| + | |Biogas | ||

| + | |20.0 | ||

| + | |- | ||

| + | |Solid Biomass | ||

| + | |20.0 | ||

| + | |- | ||

| + | |Biowaste | ||

| + | |10.0 | ||

| + | |- | ||

| + | |'''Geothermal el.''' | ||

| + | |10.0 | ||

| + | |- | ||

| + | |Total | ||

| + | |8,116.0 | ||

| + | |} | ||

| + | </div> | ||

| + | <div class="width-1-2"> | ||

| + | [[File:Technical Potential Capacity in Percentage - Macedonia.png|center|500px|Technical Potential Capacity in Percentage - Macedonia]] | ||

| + | <center>Fig 2: Technical potential Capacity in Percentage</center> | ||

| + | </div> | ||

| + | </div> | ||

| + | As we can see, if North Macedonia would use its entire technical potential,it would increase the generating power by 321%. | ||

| − | |||

| + | ==Fossil Fuels== | ||

| + | |||

| + | |||

| + | == Greenhouse Gas Emissions == | ||

| + | North Macedonia has calculated a potential emission reduction of 30% by 2030. | ||

| + | |||

| + | <div class="grid stretch-items"> | ||

| + | <div class="width-1-2> | ||

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | ! | ||

| + | !Unit | ||

| + | !Reference Case 2030 | ||

| + | !Remap 2030 | ||

| + | |- | ||

| + | |Energy-related CO2 emissions | ||

| + | |[Mt CO2 /yr] | ||

| + | |9.2 | ||

| + | |6 | ||

| + | |}<br/> | ||

| + | <center>Greenhouse gas emissions in N. Macedonia are in 2016 around 11Mtons of CO2 and in energy sector 7,66Mtons of CO2 equivalent.</center> | ||

| + | </div> | ||

| + | <div class="width-1-2> | ||

| + | [[File:Sources of Greenhouse Gases - Macedonia.png|center|500px|Sources of Greenhouse Gases - Macedonia]] | ||

| + | <center>Fig 3: Sources of GreenHouse gases</center> | ||

| + | </div> | ||

| + | </div> | ||

| + | |||

| + | |||

| + | ==Key Problems of the Energy Sector== | ||

| + | |||

| + | === Challenges on Increasing the RES Share === | ||

| + | While North Macedonia has significant renewable energy potential, there are challenges associated with increasing the share of renewable energy in the country's energy mix. Some of the challenges include: | ||

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | |'''Policy & Regulatory Framework''' | ||

| + | |Inadequate or inconsistent policies and regulations can hinder the development of renewable energy projects. | ||

| + | |- | ||

| + | |'''Investment and Funding:''' | ||

| + | |Insufficient financial resources and investment opportunities may slow down the growth of renewable energy infrastructure. | ||

| + | |- | ||

| + | |'''Grid Integration:''' | ||

| + | |Integrating renewable energy into the existing power grid can be challenging, especially if the grid infrastructure is outdated or incompatible. | ||

| + | |- | ||

| + | |'''Storage Technologies:''' | ||

| + | |Lack of advanced energy storage solutions can make it difficult to store and manage intermittent renewable energy sources like solar and wind. | ||

| + | |- | ||

| + | |'''Technological Innovation:''' | ||

| + | |Limited research and development in renewable energy technologies may impede progress in adopting more efficient and cost-effective solutions. | ||

| + | |- | ||

| + | |'''Public Awareness and Education:''' | ||

| + | |A lack of public awareness and understanding of the benefits of renewable energy can lead to resistance or lack of support. | ||

| + | |- | ||

| + | |'''Land Use and Environmental Concerns:''' | ||

| + | |Balancing the need for renewable energy projects with environmental and land-use concerns can be a delicate issue. | ||

| + | |- | ||

| + | |'''Infrastructure Development:''' | ||

| + | |Inadequate infrastructure, such as transmission lines and transportation, can pose challenges to the development and distribution of renewable energy. | ||

| + | |- | ||

| + | |'''Political Stability:''' | ||

| + | |Political instability and changes in government can impact long-term renewable energy projects and policies. | ||

| + | |- | ||

| + | |'''Capacity Building:''' | ||

| + | |A shortage of skilled professionals in the renewable energy sector may slow down project implementation and maintenance. | ||

| + | |- | ||

| + | |'''Interconnection with Neighboring Countries:''' | ||

| + | |Developing cross-border interconnections for energy exchange can face political, technical, and regulatory challenges. | ||

| + | |- | ||

| + | |'''Energy Market Structure:''' | ||

| + | |The existing energy market structure may not be conducive to the integration of renewable energy, affecting market dynamics. | ||

| + | |- | ||

| + | |'''Social Acceptance:''' | ||

| + | |Local communities may resist renewable energy projects due to concerns about visual impact, noise, or changes in the landscape. | ||

| + | |- | ||

| + | |'''Subsidies and Incentives:''' | ||

| + | |The absence of or changes in subsidies and incentives can affect the economic viability of renewable energy projects. | ||

| + | |} | ||

| + | |||

| + | ==Policy Framework, Laws and Regulations== | ||

| + | |||

| + | The main scheme supporting renewable energy sources in Republic of Macedonia is a feed- in tariff. The public energy supplier is obliged to purchase the total quantity of electricity delivered by the preferential producer and to pay a regulated tariff for the electricity generated from renewable energy sources. | ||

| + | |||

| + | The electricity transmission or distribution system operators shall provide priority access to renewable energy plants, provided that they meet the conditions for connection. | ||

| + | |||

| + | ===Support Schemes=== | ||

| + | The main scheme supporting renewable energy sources in Republic of Macedonia is a feed- in tariff. The electricity market operator is obliged to pay a regulated tariff for the electricity generated from renewable energy sources. | ||

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | |'''Feed-in tariff''' | ||

| + | |The electricity market operator is obliged to pay a regulated tariff for the electricity generated from renewable energy sources. | ||

| + | |} | ||

| + | |||

| + | ==Institutional Set up and Key Actors in the Energy Sector== | ||

| + | |||

| + | These key actors work together within the regulatory framework to ensure the efficient functioning, sustainability, and development of the energy market in North Macedonia. Collaboration among these stakeholders is essential for achieving energy security, promoting renewable energy, and meeting the country's energy goals. | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |+ | ||

| + | |1. Ministry of Economy: | ||

| + | |The Ministry of Economy is responsible for formulating and implementing energy policies in North Macedonia. It plays a key role in shaping the regulatory framework, energy development plans, and strategies for the energy sector. | ||

| + | |- | ||

| + | |2. Energy Regulatory Commission (ERC): | ||

| + | |The Energy Regulatory Commission regulates and oversees the energy sector in North Macedonia. ERC is responsible for ensuring fair competition, consumer protection, and adherence to legal and regulatory standards. | ||

| + | |- | ||

| + | |3. Transmission System Operator (MEPSO - Elektroprenos): | ||

| + | |MEPSO is the Transmission System Operator responsible for managing the high-voltage electricity transmission system in North Macedonia. It operates, maintains, and develops the transmission infrastructure. | ||

| + | |- | ||

| + | |4. Distribution System Operator (EVN Macedonia and ELEM): | ||

| + | |EVN Macedonia and ELEM are the distribution system operators responsible for managing the low and medium-voltage electricity distribution networks in North Macedonia. They distribute electricity to end-users, maintain the distribution infrastructure, and ensure the continuity of electricity supply. | ||

| + | |- | ||

| + | |5. Electric Power Plants (ELEM): | ||

| + | |ELEM is a state-owned company responsible for electricity generation in North Macedonia. It operates power plants, including hydropower and thermal power plants. | ||

| + | |- | ||

| + | |6. Independent Power Producers (IPPs): | ||

| + | |Independent Power Producers are private entities involved in electricity generation. They contribute to the diversification of the generation mix and may operate renewable or conventional power plants. | ||

| + | |- | ||

| + | |7. Investors and Financing Institutions: | ||

| + | |Investors, both domestic and foreign, play a crucial role in funding and developing energy projects in North Macedonia. Financing institutions, such as banks and international financial organizations, provide funding and support for energy infrastructure projects. | ||

| + | |- | ||

| + | |8. Consumers and Industrial Users: | ||

| + | |End-users, including residential, commercial, and industrial consumers, are essential actors in the energy market. Their energy consumption patterns and demand influence market dynamics. | ||

| + | |- | ||

| + | |9. Government Agencies and Local Authorities: | ||

| + | |Various government agencies and local authorities are involved in permitting, land-use planning, and environmental assessments for energy projects. They also play a role in setting policies that impact the energy sector. | ||

| + | |- | ||

| + | |10. International Organizations and Donors: | ||

| + | |International organizations and donor agencies may provide support, technical assistance, and funding for energy sector development projects in North Macedonia, especially those focused on sustainability, renewable energy, and regulatory reforms. | ||

| + | |- | ||

| + | |11. Environmental Agencies: | ||

| + | |Environmental agencies, such as the Ministry of Environment and Physical Planning, play a role in ensuring that energy projects adhere to environmental regulations and standards. | ||

| + | |- | ||

| + | |12. Market Operator: | ||

| + | |The Market Operator facilitates the electricity market by managing market transactions, ensuring fair competition, and promoting market efficiency. It operates in accordance with the regulatory framework and market rules. | ||

| + | |} | ||

| + | |||

| + | ==Further Information== | ||

| + | |||

| + | *https://www.iea.org/countries/north-macedonia | ||

| + | *[https://ndcpartnership.org/country/mkd NDC partnership North-Macedonia] | ||

| + | * | ||

| + | |||

| + | |||

| + | ==References== | ||

| + | |||

| + | *IRENA, Renewables Readiness Assessment: North Macedonia, 2021 | ||

| + | *[https://www.irena.org/Publications/2020/Oct/Renewable-Energy-Prospects-for-Central-and-South-Eastern-Europe-Energy-Connectivity-CESEC IRENA, Renewable Energy Prospects for Central and South-Eastern Europe Energy Connectivity (CESEC), 2020] | ||

| + | *[https://www.irena.org/publications/2017/Jan/Cost-competitive-renewable-power-generation-Potential-across-South-East-Europe IRENA, Cost-competitive renewable power generation: Potential across South East Europe, 2017] | ||

| + | *LEGAL SOURCES ON RENEWABLE ENERGY res-legal.eu | ||

| + | *[https://www.energy-community.org/implementation/report/North_Macedonia.html Energy Community, North Macedonia] | ||

| + | |||

| + | [[Category:Europe and Central Asia]] | ||

[[Category:Macedonia]] | [[Category:Macedonia]] | ||

| − | [[Category: | + | [[Category:Western Balkans]] |

| + | [[Category:North Macedonia]] | ||

| + | |||

| + | <references /> | ||

Latest revision as of 15:43, 29 October 2024

Capital:

Skopje

Region:

Coordinates:

41.6000° N, 21.7000° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

North Macedonia is a landlocked country in Southeast Europe. It is bordered by Greece to the south, Albania to the west, Bulgaria to the east, Kosovo to the northwest and Serbia to the north. Skopje, the capital and largest city, is home to a quarter of the country's population of 1.83 million.[1]

Energy Situation

In the year 2022, the primary source of energy in North-Macedonia, as reflected in the country's total energy supply, was oil, accounting for 45% of the total. This was followed by coal, which constituted 32% of the total energy supply. Coal accounted for 47% of electricity generation, followed by hydropower with 23% and natural gas (17%).[2]

In North Macedonia, the proportion of modern renewable energy sources in final energy consumption was close to 20% in 2021. In terms of electricity generation, 27% of the electricity is generated from renewables, predominantly from hydropower.[2]

North Macedonia has shown an increasing interest in renewable energy sources to diversify its energy mix, reduce dependence on fossil fuels, and meet environmental targets. The government has implemented various policies and initiatives to promote the development of renewable energy projects.

North Macedonia has historically relied on hydropower for a significant portion of its electricity generation. The country has utilized its rivers to develop hydropower plants. There have been also efforts to harness wind energy, and several wind projects have been proposed or are under development. Solar energy projects, particularly solar photovoltaic (PV) installations, have gained attention. The government has implemented programs to incentivize the adoption of solar technologies.Biomass and biogas have been explored as potential sources of renewable energy.

Installed electricity capacity (MW) by Technology, Grid connection and Year

| Technology | Grid Connection | Year | Capacity (MW) |

|---|---|---|---|

| Solar photovoltaic | On-grid | 2022 | 84.93 |

| Onshore wind energy | On-grid | 2022 | 37.00 |

| Renewable hydropower | On-grid | 2022 | 689.19 |

| Solid biofuels | On-grid | 2022 | 2.40 |

| Biogas | On-grid | 2022 | 8.00 |

| Coal and peat | On-grid | 2022 | 824.00 |

| Oil | On-grid | 2022 | 29.00 |

| Natural gas | On-grid | 2022 | 251.00 |

Energy Generation and Consumption

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Electricity production [GWh] | 5.127 | 5.285 |

| Gross electricity consumption [GWh] | 7.748 | 8.172 |

| Consumption structure [GWh] / industrial, transport, services and other | 3.285 | 3.548 |

| Consumption structure [GWh] / households (residential customers) | 3.191 | 3.317 |

Net Import & Net Export

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Net imports [GWh] | 2.341 | 4.724 |

| Net exports [GWh] | 1.011 | 2.134 |

Energy Losses

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Losses in transmission [%] | 1.2% | 1.30% |

| Losses in distribution [%] | 13,4% | 13,40% |

Transmission Network

| Description of data [unit] | 2.367 | 2.35 |

|---|---|---|

| Horizontal transmission network [km] | 2.367 | 2.35 |

| Horizontal transmission network [km] / substation capacity [MVA] | 2.7 | 2.7 |

No of Consumers

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Electricity customers / total | 876.466 | 888.998 |

| Electricity customers / non-households | 101.531 | 101.007 |

| Eligible customers under national legislation | 876.466 | 888.998 |

Internal Market

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Internal market / electricity supplied to active eligible customers [MWh] | 2.913.592 | 3.176.265 |

| Horizontal transmission network [km] / substation capacity [MVA] | 45% | 46% |

Renewable Energy Potential

| Unit | Reference Case 2030 | Remap 2030 | |

|---|---|---|---|

| Total installed power generation capacity | MW | 2,226.00 | 3,311.00 |

| Renewable capacity | MW | 1,139.00 | 2,791.00 |

| Hydropower | MW | 824.00 | 824.00 |

| Wind - onshoore | MW | 200.00 | 589.00 |

| Biofuels (solid, liquid, gaseous) | MW | 30.00 | 247.00 |

| Solar PV | MW | 75.00 | 1,121.00 |

| Geothermal | MW | 10.00 | 10.00 |

| Non-renewable capacity | MW | 1,087.00 | 520.00 |

| Coal | MW | 800.00 | 233.00 |

| Gas | MW | 287.00 | 287.00 |

| Technologies | Technical Potential MW |

|---|---|

| Solar PV | 1,479.6 |

| Wind | 4,940.4 |

| Hydro | 1,636.0 |

| ≤ 10 MW | 255.0 |

| > 10 MW | 1,381.0 |

| Pumping | |

| Biomass | 50.0 |

| Biogas | 20.0 |

| Solid Biomass | 20.0 |

| Biowaste | 10.0 |

| Geothermal el. | 10.0 |

| Total | 8,116.0 |

As we can see, if North Macedonia would use its entire technical potential,it would increase the generating power by 321%.

Fossil Fuels

Greenhouse Gas Emissions

North Macedonia has calculated a potential emission reduction of 30% by 2030.

| Unit | Reference Case 2030 | Remap 2030 | |

|---|---|---|---|

| Energy-related CO2 emissions | [Mt CO2 /yr] | 9.2 | 6 |

Key Problems of the Energy Sector

While North Macedonia has significant renewable energy potential, there are challenges associated with increasing the share of renewable energy in the country's energy mix. Some of the challenges include:

| Policy & Regulatory Framework | Inadequate or inconsistent policies and regulations can hinder the development of renewable energy projects. |

| Investment and Funding: | Insufficient financial resources and investment opportunities may slow down the growth of renewable energy infrastructure. |

| Grid Integration: | Integrating renewable energy into the existing power grid can be challenging, especially if the grid infrastructure is outdated or incompatible. |

| Storage Technologies: | Lack of advanced energy storage solutions can make it difficult to store and manage intermittent renewable energy sources like solar and wind. |

| Technological Innovation: | Limited research and development in renewable energy technologies may impede progress in adopting more efficient and cost-effective solutions. |

| Public Awareness and Education: | A lack of public awareness and understanding of the benefits of renewable energy can lead to resistance or lack of support. |

| Land Use and Environmental Concerns: | Balancing the need for renewable energy projects with environmental and land-use concerns can be a delicate issue. |

| Infrastructure Development: | Inadequate infrastructure, such as transmission lines and transportation, can pose challenges to the development and distribution of renewable energy. |

| Political Stability: | Political instability and changes in government can impact long-term renewable energy projects and policies. |

| Capacity Building: | A shortage of skilled professionals in the renewable energy sector may slow down project implementation and maintenance. |

| Interconnection with Neighboring Countries: | Developing cross-border interconnections for energy exchange can face political, technical, and regulatory challenges. |

| Energy Market Structure: | The existing energy market structure may not be conducive to the integration of renewable energy, affecting market dynamics. |

| Social Acceptance: | Local communities may resist renewable energy projects due to concerns about visual impact, noise, or changes in the landscape. |

| Subsidies and Incentives: | The absence of or changes in subsidies and incentives can affect the economic viability of renewable energy projects. |

Policy Framework, Laws and Regulations

The main scheme supporting renewable energy sources in Republic of Macedonia is a feed- in tariff. The public energy supplier is obliged to purchase the total quantity of electricity delivered by the preferential producer and to pay a regulated tariff for the electricity generated from renewable energy sources.

The electricity transmission or distribution system operators shall provide priority access to renewable energy plants, provided that they meet the conditions for connection.

Support Schemes

The main scheme supporting renewable energy sources in Republic of Macedonia is a feed- in tariff. The electricity market operator is obliged to pay a regulated tariff for the electricity generated from renewable energy sources.

| Feed-in tariff | The electricity market operator is obliged to pay a regulated tariff for the electricity generated from renewable energy sources. |

Institutional Set up and Key Actors in the Energy Sector

These key actors work together within the regulatory framework to ensure the efficient functioning, sustainability, and development of the energy market in North Macedonia. Collaboration among these stakeholders is essential for achieving energy security, promoting renewable energy, and meeting the country's energy goals.

| 1. Ministry of Economy: | The Ministry of Economy is responsible for formulating and implementing energy policies in North Macedonia. It plays a key role in shaping the regulatory framework, energy development plans, and strategies for the energy sector. |

| 2. Energy Regulatory Commission (ERC): | The Energy Regulatory Commission regulates and oversees the energy sector in North Macedonia. ERC is responsible for ensuring fair competition, consumer protection, and adherence to legal and regulatory standards. |

| 3. Transmission System Operator (MEPSO - Elektroprenos): | MEPSO is the Transmission System Operator responsible for managing the high-voltage electricity transmission system in North Macedonia. It operates, maintains, and develops the transmission infrastructure. |

| 4. Distribution System Operator (EVN Macedonia and ELEM): | EVN Macedonia and ELEM are the distribution system operators responsible for managing the low and medium-voltage electricity distribution networks in North Macedonia. They distribute electricity to end-users, maintain the distribution infrastructure, and ensure the continuity of electricity supply. |

| 5. Electric Power Plants (ELEM): | ELEM is a state-owned company responsible for electricity generation in North Macedonia. It operates power plants, including hydropower and thermal power plants. |

| 6. Independent Power Producers (IPPs): | Independent Power Producers are private entities involved in electricity generation. They contribute to the diversification of the generation mix and may operate renewable or conventional power plants. |

| 7. Investors and Financing Institutions: | Investors, both domestic and foreign, play a crucial role in funding and developing energy projects in North Macedonia. Financing institutions, such as banks and international financial organizations, provide funding and support for energy infrastructure projects. |

| 8. Consumers and Industrial Users: | End-users, including residential, commercial, and industrial consumers, are essential actors in the energy market. Their energy consumption patterns and demand influence market dynamics. |

| 9. Government Agencies and Local Authorities: | Various government agencies and local authorities are involved in permitting, land-use planning, and environmental assessments for energy projects. They also play a role in setting policies that impact the energy sector. |

| 10. International Organizations and Donors: | International organizations and donor agencies may provide support, technical assistance, and funding for energy sector development projects in North Macedonia, especially those focused on sustainability, renewable energy, and regulatory reforms. |

| 11. Environmental Agencies: | Environmental agencies, such as the Ministry of Environment and Physical Planning, play a role in ensuring that energy projects adhere to environmental regulations and standards. |

| 12. Market Operator: | The Market Operator facilitates the electricity market by managing market transactions, ensuring fair competition, and promoting market efficiency. It operates in accordance with the regulatory framework and market rules. |

Further Information

References

- IRENA, Renewables Readiness Assessment: North Macedonia, 2021

- IRENA, Renewable Energy Prospects for Central and South-Eastern Europe Energy Connectivity (CESEC), 2020

- IRENA, Cost-competitive renewable power generation: Potential across South East Europe, 2017

- LEGAL SOURCES ON RENEWABLE ENERGY res-legal.eu

- Energy Community, North Macedonia

- ↑ https://en.wikipedia.org/wiki/North_Macedonia

- ↑ 2.0 2.1 IEA country overview North-Macedonia, retrieved on 29 October 2024