Knowledge fuels change - Support energypedia!

For over 10 years, energypedia has been connecting energy experts around the world — helping them share knowledge, learn from each other, and accelerate the global energy transition.

Today, we ask for your support to keep this platform free and accessible to all.

Even a small contribution makes a big difference! If just 10–20% of our 60,000+ monthly visitors donated the equivalent of a cup of coffee — €5 — Energypedia would be fully funded for a whole year.

Is the knowledge you’ve gained through Energypedia this year worth €5 or more?

Your donation keeps the platform running, helps us create new knowledge products, and contributes directly to achieving SDG 7.

Thank you for your support, your donation, big or small, truly matters!

Difference between revisions of "Country Project South Africa"

***** (***** | *****) (Created page with "'''<big>Introduction</big>''' This article was written by South Africa Group 3 members - Thabo Moyo, Nkosinathi Madushele, Olanike Olajide, Samson Faboye, Zenzile Rasmeni and...") Tag: 2017 source edit |

***** (***** | *****) |

||

| (18 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | ''' | + | '''Introduction''' |

| − | This article was written by South Africa Group 3 members - Thabo Moyo, Nkosinathi Madushele, Olanike Olajide, Samson Faboye, Zenzile Rasmeni and Oyetola Ogunkunle as part of the requirements of the Open Africa Power Programme 2021 | + | This article was written by South Africa Group 3 members - [https://www.linkedin.com/in/thabomoyo/ Thabo Moyo], [https://www.linkedin.com/in/nkosinathi-madushele-3288b233/ Nkosinathi Madushele], [https://www.linkedin.com/in/olanike-grace-olajide-7ab8531b8/ Olanike Olajide], [https://www.linkedin.com/in/samsonfaboye/ Samson Faboye], [https://www.linkedin.com/in/zenzile-zelda-rasmeni-83717a6b/ Zenzile Rasmeni] and [https://www.linkedin.com/in/oyetola-ogunkunle-phd-8b306b146/ Oyetola Ogunkunle] as part of the requirements for the Open Africa Power Fellowship Programme 2021. Click [[:File:South Africa Group 3 OAP.pdf|'''here''']] to download the pdf version of this article. |

| + | |||

| + | = 1. Introduction/overview of the country = | ||

| + | '''Context and Significance''' | ||

| + | |||

| + | [[South Africa Energy Situation|South Africa]], adjudged as Africa's most industrialised (Monyei & Adewumi, 2017), developed and second-largest economy (World Bank, 2021a), is located on the continent's southernmost part. The country is bordered (as depicted in Figure 1) to the North by Botswana and Zimbabwe; Mozambique and Eswatini to the Northeast; and Namibia to the Northwest. Lesotho, an independent country, is entirely bounded as an enclave within the Eastern part of the country. The entire Eastern, Western and Southern bounds of the country are coastlines. To the East is the Indian Ocean, while the Atlantic Ocean borders the Western coast. However, both Oceans meet at the Cape Agulhas, which is noted as the Southernmost tip of the African continent. | ||

| + | |||

| + | '''Table 1: Highlights of South Africa's National Overview''' | ||

| + | {| class="wikitable" | ||

| + | |+'''South Africa Fact File''' | ||

| + | |- | ||

| + | | colspan="3" |'''National Component''' | ||

| + | | colspan="4" |'''Indicators ''' | ||

| + | | colspan="5" |'''Data ''' | ||

| + | |- | ||

| + | | colspan="3" rowspan="3" |'''Population''' | ||

| + | | colspan="4" |Total | ||

| + | | colspan="5" |56.5 million (July 2020 est) | ||

| + | |- | ||

| + | | colspan="4" |Rural vs Urban | ||

| + | | colspan="5" |67.4% urban Vs 32.6% Rural | ||

| + | |- | ||

| + | | colspan="4" |Annual Growth Rate | ||

| + | | colspan="5" |1.40% | ||

| + | |- | ||

| + | | colspan="3" rowspan="2" |'''Official Languages (11)/Ethnicity''' | ||

| + | | colspan="4" |English, Afrikaans, isiXhosa, Sepedi, Setswana, Sesotho, Xitsonga, siSwati, Tshivenda, isiNdebele, Southern Sotho | ||

| + | | colspan="5" |isiZulu (24.7%), isiXhosa (15.6%), Afrikaans (12.1%), Sepedi (9.8%), Setswana (8.9%), Sesotho (8%), Xitsonga (4%), siSwati (2.6%), Tshivenda (2.5%), isiNdebele (1.6%), Others (1.9%), English (8.4%) | ||

| + | |- | ||

| + | | colspan="9" |Black African (80.9%), Coloured (8.8%) *persons with mixed-race heritage, White (7.8%), Indian/Asian (2.5%) | ||

| + | |- | ||

| + | | colspan="3" |'''Administrative Divisions''' | ||

| + | | colspan="4" |9 Provinces | ||

| + | | colspan="5" |Gauteng, Mpumalanga, Northwest, Eastern Cape, Western Cape, Free State, Kwa Zulu Natal, Limpopo, Northern Cape | ||

| + | |- | ||

| + | | colspan="3" |'''Capital''' | ||

| + | | colspan="9" |Pretoria (Executive), Cape Town (Parliamentary), Bloemfontein (Judiciary) | ||

| + | |- | ||

| + | | colspan="12" |'''Labour Force:''' 14.687million (2020 est.) | ||

| + | |- | ||

| + | | colspan="5" |Agricultural sector | ||

| + | | colspan="4" |Industry | ||

| + | | colspan="3" |Services | ||

| + | |- | ||

| + | | colspan="5" |4.60% | ||

| + | | colspan="4" |23.50% | ||

| + | | colspan="3" |79.10% | ||

| + | |- | ||

| + | | colspan="3" |'''Natural Resources''' | ||

| + | | colspan="9" |Gold, Chromium, Antimony, Coal, Iron ore, Manganese, Nickel, Phosphates, Tin, Rare earth elements, Uranium, Gem Diamonds, Platinum, Copper, Vanadium, Salt, Natural Gas | ||

| + | |- | ||

| + | | colspan="3" |'''Currency''' | ||

| + | | colspan="4" |Rand (ZAR) | ||

| + | | colspan="5" |US$1=13.98ZAR | ||

| + | |- | ||

| + | | colspan="3" |'''Industries''' | ||

| + | | colspan="9" |Automobile assembly, metalworking, machinery, textiles, iron and steel, chemicals, fertiliser, foodstuff, commercial ship repairs. World's largest producer of platinum, chromium and gold | ||

| + | |- | ||

| + | | colspan="3" |'''GDP (US$)''' | ||

| + | | colspan="9" |351.432 Billion (World Bank, 2018) | ||

| + | |- | ||

| + | | colspan="3" |'''GDP Per Capita, PPP ($)''' | ||

| + | | colspan="9" |12,628 | ||

| + | |- | ||

| + | | colspan="3" |'''Annual GDP Growth %''' | ||

| + | | colspan="9" |0.2% (2019), -7% (2020), 3.5% (2021) | ||

| + | |- | ||

| + | | colspan="3" rowspan="3" |'''Air Pollutants''' | ||

| + | | colspan="4" |Particulate matter emissions | ||

| + | | colspan="5" |23.58 micrograms per cubic metre (2016 est.) | ||

| + | |- | ||

| + | | colspan="4" |Methane emissions | ||

| + | | colspan="5" |476.64 megatons (2016 est.) | ||

| + | |- | ||

| + | | colspan="4" |CO2 emissions | ||

| + | | colspan="5" |476.64 megatons (2016 est.) | ||

| + | |- | ||

| + | | colspan="3" |'''Energy use (kg of oil equivalent per capita)''' | ||

| + | | colspan="9" |2,768 | ||

| + | |- | ||

| + | | colspan="3" |'''Electric power consumption (kWh per capita)''' | ||

| + | | colspan="9" |4,543 | ||

| + | |- | ||

| + | | colspan="3" |'''Inflation, GDP deflator (annual %)''' | ||

| + | | colspan="9" |3.9 | ||

| + | |- | ||

| + | | colspan="3" rowspan="4" |'''Electricity Access''' | ||

| + | | colspan="4" |Total | ||

| + | | colspan="5" |94% (2019) | ||

| + | |- | ||

| + | | colspan="4" |Urban vs Rural Areas | ||

| + | | colspan="5" |95% Urban vs 92% Rural | ||

| + | |- | ||

| + | | colspan="4" |Consumption | ||

| + | | colspan="5" |16.55 billion kWh (2016 est.) | ||

| + | |- | ||

| + | | colspan="4" |Imports | ||

| + | | colspan="5" |50.02 million kW (2016 est.) | ||

| + | |- | ||

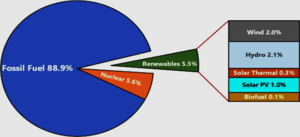

| + | | colspan="12" |'''Energy Mix''' | ||

| + | |- | ||

| + | | colspan="2" |Fossil Fuels | ||

| + | | colspan="2" |Nuclear fuels | ||

| + | | colspan="2" |Solar PV | ||

| + | | colspan="2" |Solar Thermal | ||

| + | | colspan="2" |Biofuel | ||

| + | |Wind | ||

| + | |Hydroelectric plants | ||

| + | |- | ||

| + | | colspan="2" |88.90% | ||

| + | | colspan="2" |5.60% | ||

| + | | colspan="2" |1.00% | ||

| + | | colspan="2" |0.30% | ||

| + | | colspan="2" |0.10% | ||

| + | |2.00% | ||

| + | |2.10% | ||

| + | |} | ||

| + | Sources:(CIA World Fact Book, 2021; World Bank, 2021b; World Bank, 2021c). | ||

| + | |||

| + | = 2. Evolution and present situation of power system = | ||

| + | Upon the discovery of gold in the Rand area, a number of energy generators emerged to complement mining operations, and in 1923 parliament of the then Union of South Africa established Eskom (a state-owned company) through the reconciliation of the aforementioned energy generators (Maharaj, 2011). The company’s primary objective was to provide cheap electricity to promote industrialisation (Eskom, A Proud Heritage, 2013). A consequence of developing a state-owned company resulted in Eskom becoming a monopoly in the generation, transmission, as well as in distribution of electricity. The coal belt in Mpumalanga was an ideal place for the construction of baseload thermal power plants, and to this day, more than 80% of the country’s power is generated from coal (GreenCape, 2020). On Thursday, the 10<sup>th</sup> of June 2021, President Cyril Ramaphosa announced the license-exemption cap on self- or distributed-generation plants, revising it from 1 megawatt to 100 megawatts (Creamer, 2021). It is anticipated that this announcement would aid in post-pandemic economic growth and address issues posed by load shedding. The amendment to the Electricity Act of 2006 is yet to be gazetted. However, it should be noted that there are Independent Power Producers that feature in the country’s energy electricity mix, as would be outlined in later sections of the current report. | ||

| + | |||

| + | = 3. Review of current components and activities of the power system = | ||

| + | |||

| + | '''Access to Electricity''' | ||

| + | |||

| + | Figure 2 indicates access to electricity by population as extracted from the World Bank database (WorldBank, 2021). It can be observed that in 2020, 85% of the South African population had access to electricity. However, a primary driver in access is geospatial location; by implication, rural areas struggle to connect to the National Grid. The sharp increase in electricity can be attributed to rapid economic growth and the social inclusion of people who were not connected to the grid (pre-democracy). | ||

| + | [[File:South Africa’s Access to Electricity. .png|thumb|524x524px|alt=|none|Figure 1: South Africa’s Access to Electricity. (Source: World Bank, 2021).]] | ||

| + | |||

| + | [[File:Annual Electricity in TWH.png|thumb|457x457px|alt=|none|Figure 2: Annual Electricity in TWH. '' ''(Source: Calitz & Wright, 2021).]] | ||

| + | |||

| + | The installed generation capacity and electricity generation mix is illustrated in Figure 3. | ||

| + | |||

| + | '''Generation''' | ||

| + | |||

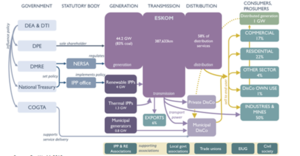

| + | Power generation in South Africa is compartmentalised into nine categories, as indicated in Figure 2[TM1] . Eskom SOC produces more than 80% of the energy generated. The primary baseload of the energy generated is derived from thermal power plants (81.6%). Moreover, South Africa is a net exporter of electricity. It imports around 9,000 kWh annually from the Cahora Bassa Hydraulic generation station in Mozambique while exporting around 16,000 kWh to the SADAC region (Carruthers, 2019). | ||

| + | |||

| + | '''Transmission''' | ||

| + | |||

| + | Electricity is transmitted from generation plants by the Transmission wing of Eskom SOC. Energy generation sites produce electricity at 20 kV[TM2] , and step-up transformers are then utilised to ensure that there are minimal electricity losses prior to reaching the distribution network. There is approximately 28 000 km of high voltage transmission lines (Eskom, Electricity Technologies, 2021). The transmission infrastructure is serviced and maintained by the Transmission wing of Eskom SOC. | ||

| + | |||

| + | '''Distribution''' | ||

| + | |||

| + | The distribution of electricity to clients is carried out by Eskom as well as municipalities. There are approximately 300 electricity distributors in South Africa, with the primary intention of distributing the requisite electricity to the end-users. The distribution network is approximately 350 000km (Eskom, Electricity Technologies, 2021). With the eminent revision of the Electricity Act (yet to be gazetted), it is anticipated that there will be a number of Independent Power Producers that will provide embedded electricity supply, and this is expected to increase electricity availability and reduce reliance on Eskom SOC as well as municipalities. | ||

| + | |||

| + | '''System Operation''' | ||

| + | |||

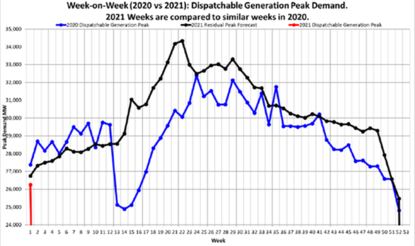

| + | [[File:South Africa's Peak Energy Demand and 2021 Projections. .png|thumb|415x415px|alt=|Figure 3: South Africa's Peak Energy Demand and 2021 Projections. '' ''(Source: Calitz & Wright, 2021).]]South Africa’s National Control Centre is located in Germiston (Gauteng). Electricity transmission primarily operates on the principle of supply and demand. With our current technology, it is not feasible to store large quantities of electricity; consequently, generation plants produce the requisite energy as and when required. However, the power generated must be controlled at a frequency of 50Hz to ensure grid stability. It should be noted that there are a number of residential customers that do not pay their electricity bills while adding illegal connections to their distribution boards. This has resulted in a number of local transformers exploding, and subsequently, the electricity distributors have imposed what is now known as load reduction to protect the electricity infrastructure. Load reduction is different from load shedding in that the distributors are rationing electricity (load reduction) to protect the infrastructure, as opposed to load shedding, wherein the national Control Centre removes electricity from the grid to ensure that the frequency of the supply is maintained at 50Hz. | ||

| + | |||

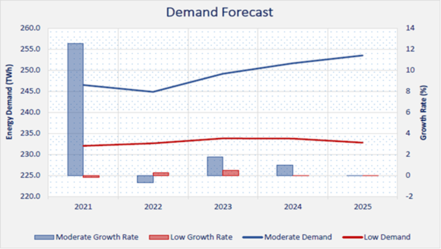

| + | The country’s peak demand is approximately 35 GW, with annual energy consumption and future demand approximated as indicated in Figure 4.[[File:South Africa’s Five Year Energy Demand Forecast.png|thumb|441x441px|alt=|none|Figure 4: South Africa’s Five Year Energy Demand Forecast]] | ||

| + | |||

| + | |||

| + | Moreover, the future energy demand projections are indicated in Figure 5. | ||

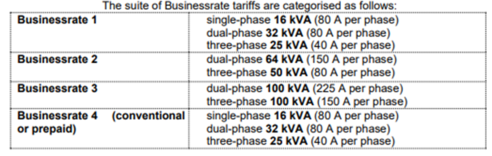

| + | [[File:South Africa’s Business Rates Tariffs per Business Class.png|thumb|492x492px|alt=|none|Figure 5(a): South Africa’s Business Rates Tariffs per Business Class]] | ||

| + | |||

| + | [[File:South Africa’s Energy Charge per Business Class.png|thumb|515x515px|alt=|none|Figure 5(b): South Africa’s Energy Charge per Business Class]] | ||

| + | |||

| + | Business and residential tariffs are given in Figures 6 to 7. | ||

| + | [[File:South Africa’s Residential Tariffs.png|thumb|462x462px|alt=|none|Figure 6: South Africa’s Residential Tariffs]] | ||

| + | |||

| + | The targeted Energy Availability Factor (EAF) is 80% of the nominal capacity of 44 GW. However, due to ageing infrastructure (amongst others), the EAF is projected to be 68% in 2021 and would increase to 70% to 72% in 2022 and 2023, respectively (Oberholzer, 2020). | ||

| + | |||

| + | The following chronicles the major power outages in recent history: | ||

| + | |||

| + | 2008: This marked the first time in recent history where South Africans were introduced to load shedding. The Outages were attributed to the slow rate of introducing new power to the grid, compared to the country's growth rate (Myburgh, 2008). | ||

| + | |||

| + | 2015: At the time, this was the longest load shedding the country had experienced, running for 99 days. This was attributed to the ageing power plants (Montalto, 2015) | ||

| + | |||

| + | 2019: This is considered to be the most expensive load shedding that the country experienced with the Council for Scientific Innovation and Research (CSIR), citing a total economic cost of between R60-120 billion (Wright & Calitz, 2020) | ||

| + | |||

| + | = 4. Institutional Set up = | ||

| + | '''Ministry of Energy''' | ||

| + | |||

| + | The institutional setup of South Africa's energy sector is domiciled under the Department of Mineral Resources and Energy (DMRE). The institutional arrangement is a merger between the defunct energy and mineral resources departments (DoE and DMR) in June 2019. Intriguingly, mines and energy have always been under one department – the Department of Minerals and Energy (DME) until 2009 when the departments were separated under the then Jacob Zuma administration. Therefore, in the years between 2009 and 2019, the institutional domiciliary of energy was the Department of Energy. Tyler (2009) unpacks the organogram of the DoE as having two arms – electricity and nuclear. It also has departments for hydrocarbon, clean energy and energy planning. Furthermore, the DoE has directorates for energy efficiency and renewable energy (''ibid''). But these have consistently suffered from a lack of capacity and resources. | ||

| + | |||

| + | The strategic mandate of the DMRE is to lead the path of South Africa's quest for sustainable development and economic growth in the mining and energy sector (DMRE, 2021). The department is reported to by 11 entities, namely: | ||

| + | |||

| + | * Central Energy Fund SOC Ltd (CEF) | ||

| + | * Council for Geoscience (CGS) | ||

| + | * Mine Health and Safety Council (MHSC) | ||

| + | * Minetek | ||

| + | * National Energy Regulator of South Africa (NERSA) | ||

| + | * National Nuclear Regulator (NNR) | ||

| + | * Petroleum, Oil and Gas Corporation of South Africa (PetroSA) | ||

| + | * South African Diamond and Precious Metals Regulator (SADPMR) | ||

| + | * South African National Energy Development Institute (SANEDI) | ||

| + | * South African Nuclear Energy Corporation (NECSA) | ||

| + | * Tate Diamond Trader | ||

| + | |||

| + | '''Power Sector Regulatory bodies''' | ||

| + | |||

| + | The power sector regulation is vested in the National Energy Regulator of South Africa (NERSA). This regulatory mandate is bestowed by the National Electricity Regulatory Act of 2004. This Act mandates NERSA as the licencing authority for generation, transmission and power distribution. The Act also grants NERSA the mandate to regulate energy prices and tariffs and arbitrate disputes amongst energy sector players. Above all, The Act mandates NERSA as the leading arbitrator to disputes amongst players within the energy sector and the pilot to guide the government's electricity policies (Republic of South Africa, 2005). Accordingly, NERSA regulates the electricity, gas and liquid sectors. However, in terms of power generation, South Africa has a sole provider in Eskom. This is a 100% government share owned corporation with a monopoly on power generation and transmission, accounting for 96% of national electricity. The Department of Public Enterprises is tasked with the oversight of Eskom. | ||

| + | |||

| + | '''Rural Electrification Bodies''' | ||

| + | |||

| + | A conscious effort towards achieving complete rural electrification has been at the heart of the post-apartheid energy policy pursuit since 1994. At the inception of South Africa's democratic governance in 1994, national electricity access stood at 60%, with rural access at 30%. At present rural electrification, access stands at 92%, up from 26.4% in 1990 (Rathi & Vermaak, 2018). Accordingly, to achieve this rural electrification success, the South African government since 1994 had launched three programmes as enumerated in Table 2 below: | ||

| + | |||

| + | Table 2: South Africa's Electrification Programmes | ||

| + | {| class="wikitable" | ||

| + | |'''Programme''' | ||

| + | |'''Target''' | ||

| + | |- | ||

| + | |National Electrification Programme(NEP) | ||

| + | |Aimed to provide electricity access to households that had not had access during apartheid | ||

| + | |- | ||

| + | |Integrated National Electrification Programme (INEP) | ||

| + | |Focused on rural electrification, as urban electrification had dominated the previous NEP | ||

| + | |- | ||

| + | |Integrated Resource Plan (IRP) | ||

| + | |Emphasises the use of more renewable energy sources, especially in areas that are not grid-accessible | ||

| + | |} | ||

| + | Source: (Rathi & Vermaak, 2018 p. 347) | ||

| + | |||

| + | = 5. Policy, Legal, and Regulatory Framework = | ||

| + | [[File:Structure of South Africa’s Power Sector .png|thumb|Figure 7: Structure of South Africa’s Power Sector (Source: Dyson, 2020, p. 4)|alt=]] | ||

| + | '''Structure and ownership of the power sector''' | ||

| + | |||

| + | The control of South Africa's power sector is under the purview of the National government. However, the provision of power is a concurrent duty of national and municipal governments (Baker and Phillips, 2019). The operational and legal framework of the power sector was shrouded in government secrecy during apartheid. Beset with sanctions, the apartheid government invested in alternative energy sources in liquid fuels to power the industrial sector, crucial for economic survival (Mondliwa and Roberts, 2019). | ||

| + | |||

| + | Post-apartheid governance saw reforms in the power sector, with the 1998 White Paper on Energy Policy proposing an end to a government monopoly on power generation transmission and distribution. This proposal defined by further cabinet deliberations would mean that the government monopoly on power provision would be cut to 70% while the remaining 30% would be allotted to Independent Power Producers (DME, 1998). Eskom Holdings SOC Limited is a government entity with the mandate to provide the country with generation and provision. Established as a statutory government entity in 1923 by the Electricity Act of 1922, it became a public company from 1st July 2002 by the enactment of the Eskom Conversion Act 13 of 2001. The government, however, holds all the share capital of the corporation (Eskom, 2021). | ||

| + | |||

| + | The Minister of Public Enterprises serves as the Eskom government representative, the supervisory government department of Eskom. The Companies Act, 71 of 2008 of and Public Finance Management Act, 1 of 1999 amended by the Act 29 guides the statutory duties and responsibilities of Eskom (ibid). | ||

| + | |||

| + | Further reforms approved by the Cabinet in 2001 on the government monopoly were the 'managed liberalisation' initiative. This saw the vertical unbundling of Eskom with the establishment of a government-owned dedicated Transmission company. Primary energy sources were also diversified to make operational spaces for IPPs. | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | '''Electricity Act, Energy policies, Secondary Regulations.''' | ||

| + | |||

| + | The legal framework for operationalising electricity in South Africa is guided by the Electricity Regulation Act (ERA) of 2006. This Act is based on amendments of the Electricity Act 41 of 1987, KwaZulu and Natal Joint Services Act 84 of 1990 and the National Energy Regulator Act 40 of 2004. | ||

| + | |||

| + | The Electricity Act so enacted is aimed to: | ||

| + | |||

| + | "establish a national regulatory framework for the electricity supply industry; to make the National Energy Regulator the custodian and enforcer of the national electricity regulatory framework; to provide for licences and registration as the manner in which generation, transmission, distribution, trading and the import and export of electricity are regulated; and to provide for matters connected therewith" (Presidency, 2006). | ||

| + | |||

| + | The Electricity Regulation Amendment Act 28 of 2007 was the first to the ERA of 2006. The amendment inserted specific definitions, a new chapter to deal with municipalities' electricity reticulation, and extended the Minister's powers to make regulations (Presidency, 2008). Further amendments to the ERA of 2006 were carried out in 2020 with amendments to Schedule 2. This was effected by the publication of a Licencing Exemption and Registration Notice (GN 402 in GG 43151) which elaborates the new amendments. This section, as amended, provides for licencing exemptions for specified parties either in obligation to apply or hold a licence from the National Energy Regulator of South Africa (NERSA). | ||

| + | |||

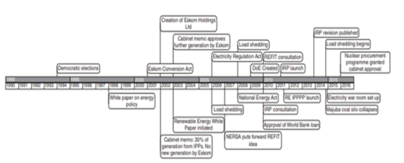

| + | '''Energy policies, Secondary regulations and Electrification Plans:'''[[File:Timeline of South Africa’s Energy policy, 1990 -2016. .png|thumb|404x404px|alt=|Figure 8: Timeline of South Africa’s Energy policy, 1990 -2016. Source (Baker, 2017, p. 377)]]From the 1960s, the nexus of South Africa's energy policy was built around the 'minerals for energy complex' in which energy generation relied heavily on coal production – an abundant mineral from the country's extractive industry (Davidson & Winkler, 2006). This helped keep energy prices low while driving investment in the extractive industry. While this policy helped boost excess power generative capacity, it also accounted for increased carbon emissions- over three and half times the average of developing countries and higher than most European countries (Dyson, 2020). At the same time, South Africa's high carbon emissions can be attributed to its coal power plants, the energy-intensive activity required for mining and production of steel, aluminium, chromium and the heavy manufacturing industry. | ||

| + | |||

| + | The White Paper on the Energy Policy of 1998 was the first post-apartheid national energy policy and regulatory framework. The document's object was set in five themes, namely: "increased access to affordable energy services, improving energy governance, stimulating economic development, managing energy-related environmental impacts, and securing energy supply through diversity" (Spalding-Fecher, 2002 pp. 6). This policy was launched to strengthen the governing ANC's Reconstruction Development Programme (RDP) launched in 1994 and the Growth Employment and Redistribution (GEAR) strategy launched in 1996. These post-apartheid national development policies were geared at economic redistribution and poverty alleviation. By seeking to increase energy access, the government embarked on rural electrification on a massive scale such that electricity increased from 35% in 1990 to 66% by 2001 (NER, 2001). | ||

| + | |||

| + | As a strategy for increased electrification access, the White Paper on Energy policy of 1998 opened up off-grid electrification and instituted subsidised energy access. Energy subsidies were impacted by removing Value Added Tax (VAT) on paraffin oil, a primary source of cooking energy for low-income households (Spalding-Fecher, 2002). While increased energy access increased carbon emissions, the 1998 White Paper on Energy Policy nevertheless makes efficient energy usage in the domestic, extractive, industrial, and commercial sectors (Du Plessis, 2015). This led to the launch of another energy policy in 2004 – the White Paper on Renewable Energy which sought to correlate energy efficiency with renewable energy (DME, 2004). In this, the Renewable Energy White Paper of 2004 differed from that of the Energy Policy of 1998 as it provided a framework for sustainable development transition as guided by international agendas cutting carbon emissions set by the Kyoto Protocol and the United Nations Framework Convention on Climate Change (UNFCC) (Murombo, 2015). | ||

| + | |||

| + | The Free Basic Electricity (FBE) Policy of 2003 is a brainchild of the ANC manifesto during the 2000 municipal elections. It was targeted at providing free electricity to typically poor households at 50 kWh per month. As determined by the Department of Mines and Energy (DME), this unit of electricity is estimated to be sufficient to cover basic household needs – lighting, limited heating, cooking, and powering electronics (Makonese ''et al.,'' 2012). In the same vein, the Integrated National Electrification Programme (INEP) set up in 2002 facilitates the delivery of the FBE policy. This works through the investment of public sector finance into the provision of electricity infrastructure (Bohlmann & Inglesi-Lotz, 2018). Therefore, while the INEP ensures broader electricity coverage, the FBE policy affords inclusive energy access. | ||

| + | |||

| + | In 2007, Cabinet approved the Biofuels Industrial Strategy (BIS). This Strategy is heavily induced by the Black Economic Empowerment (BEE) programme, and it created a value chain in the agricultural sector. The Strategy targeted the rural areas (former Bantustans) characterised by lacking market access for agricultural produce and had suffered historic neglect from the apartheid period. Their farm produces such as soybeans, sunflower and sugar cane served as raw materials for the biofuels industry. | ||

| + | |||

| + | The National Energy Act, 34 of 2008, shaped the legal framework for the energy provision within tackling the nexus poverty alleviation, environmental management and economic growth. This Act also provides for energy efficiency measurement through institutional management and research into energy demand, generation, consumption and supply. | ||

| + | |||

| + | The Nuclear Energy Policy of 2008 laid out the South African government's vision for exploration and the use of radioactive minerals such as uranium. The policy also iterates South Africa's nuclear energy programme to be used for peaceful purposes only. | ||

| + | |||

| + | The Integrated Resource Plan (IRP) 2010 - 2030 is a long term strategic energy plan covering 2010 and 2030. The implementation of the IRP is effected by ministerial determination as regulated by electricity regulations. The IRP outlines strategies for doubling power generation capacity through the admixture of renewable and non-renewable energy sources. | ||

| + | |||

| + | The Nation Development Plan (NDP) Vision 2030 is the extant overarching strategic plan of South Africa from which all sectoral policies are based. It was laid out in 2012 and iterated a proposal for investment in the energy sector, particularly in renewable sources, to support economic growth, competitive and affordable power tariffs. The NDP proposes renewable to supply 20,000 MW of the projected 29,000MW expansion in the power sector by 2030 (NPC, 2011). The national electrification laid out in the NDP incorporates the framework of the National Electrification Programme. This is a bid to extend more comprehensive access to electricity across the socio-economic cadres. Under this plan, 590,000 households are expected to be connected to the national grid over the medium term. At the same time, 20,000 households annually are targeted to be connected to non-grid electric sources (mainly solar) (ibid). Ultimately, the NDP looks to divestment from coal as the energy source to much cleaner energy sources, thereby cutting significantly South Africa's carbon emissions. | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | = 6. Clean cooking = | ||

| + | '''Introduction''' | ||

| + | |||

| + | Cooking is part of our everyday life and for Africans, cooking is more of a culture than of a necessity. While there is significant increase in the embrace of modern energy sources for cooking in cities, metropolises, conurbations, it is not the case in under-served communities. The United Nations has for example, identified universal access to modern energy as a major goal and sustainable energy as a significant pillar of the post-2015 development agenda (United Nations Foundation, 2015). In developing countries, access to modern energy sources often signifies a shift away from traditional solid fuels (such as wood) due to the significant health and environmental impacts of solid biomass, compared to modern energy sources, such as electricity (preferably from renewable sources) and liquefied petroleum gas (LPG). This paradigm shift in cooking has led to the clean coking initiative. | ||

| + | |||

| + | The South African case study significantly provides an interesting trend of clean cooking integration into the under-served communities and policies and regulations supporting this is worth investigating. This section focuses on analyzing and understanding the South African residential sector's clean energy characteristics considering their energy-use profile, and further presents how well the clean cooking concept has gone in South Africa. | ||

| + | |||

| + | '''The advent of Clean Cooking''' | ||

| + | |||

| + | To address Africa's long-standing energy challenge and build on new opportunities for transforming the cooking sector, the World Bank, under implementation by the Africa Energy Group (AFTEG), launched the Africa Clean Cooking Energy Solutions (ACCES) initiative to promote enterprise-based, large-scale dissemination and adoption of clean cooking solutions in Sub-Saharan Africa (SSA). By increasing access to modern technologies and cleaner fuel, the initiative seeks to alleviate the adverse health, environment, and socio-economic impacts of traditional cooking practices in SSA. This initiative could be regarded as the beginning of clean cooking in Africa. | ||

| + | |||

| + | '''Cooking in South Africa''' | ||

| + | |||

| + | South Africa is a large country at the southern tip of the African continent with an abundance of cheap and accessible coal resulting in the energy sector being largely coal-driven; with 71% of the country’s primary power generation lead by coal, followed by oil (including diesel) at 22% Adedeji ''et al.'' (2019). Total primary energy consumption was 5,087 PJ in 2018, which was more than a quarter of the total primary consumption of the entire African continent and the rate of urbanization and increase in population in South Africa reveals a prospective increase in consumption in the future. The problems related to cookstoves are unique to different geographic regions in South Africa and require unique interventions. Dirty, inefficient cookstoves and open fires cause major issues in South Africa, particularly around shack fires and energy poverty. Inadequate cookstoves still cause major health and environmental issues in South Africa, particularly through shack fires and energy poverty associated with the high cost of fuel. Open fires are used outdoors or in semi-enclosed annexes. Cooking is more traditional, so firewood use is deeply engrained in culture. In townships, the high density of the population forces many to cook indoors with paraffin cookstoves. Households often cook for the extended family, so large pots are common, especially during funerals which are community events. Wood is the popular choice for cooking large quantities of food. A vast majority of people in South Africa rely on gathering biomass for cooking in rural areas, which dramatically damages health and impairs productivity improvements (Global Alliance for Clean Cook Stoves). | ||

| + | |||

| + | Table 3. Level of access to Clean Cookstoves and Fuels in South Africa | ||

| + | {| class="wikitable" | ||

| + | |'''Region''' | ||

| + | |'''Sub-Saharan Africa''' | ||

| + | |- | ||

| + | |Country | ||

| + | |South Africa | ||

| + | |- | ||

| + | |Population | ||

| + | |51,189,307 | ||

| + | |- | ||

| + | |Percentage of population using solid fuels for cooking | ||

| + | |13% | ||

| + | |- | ||

| + | |Number of people who primarily use fuels such as wood, charcoal, coal, and kerosene for cooking | ||

| + | |no data | ||

| + | |- | ||

| + | |Percentage of wood fuel harvest that is unsustainable | ||

| + | |no data | ||

| + | |- | ||

| + | |Number of people affected by HAP | ||

| + | |6,654,610 | ||

| + | |- | ||

| + | |Number of households affected by HAP | ||

| + | |1,411,761 | ||

| + | |- | ||

| + | |Number of deaths per year attributable to HAP | ||

| + | |7,623 | ||

| + | |- | ||

| + | |Number of child deaths per year attributable to HAP | ||

| + | |1,283 | ||

| + | |- | ||

| + | |Urban population using solid fuels | ||

| + | |6.9% | ||

| + | |- | ||

| + | |Rural population using solid fuels | ||

| + | |41.2% | ||

| + | |- | ||

| + | |Population using wood for cooking | ||

| + | |15.2% | ||

| + | |- | ||

| + | |Population using dung for cooking | ||

| + | |0.2% | ||

| + | |- | ||

| + | |Population using charcoal for cooking | ||

| + | |0.0% | ||

| + | |- | ||

| + | |Population using coal for cooking | ||

| + | |1.2% | ||

| + | |- | ||

| + | |Population using kerosene for cooking | ||

| + | |14.8% | ||

| + | |- | ||

| + | |Population using gas for cooking | ||

| + | |2.0% | ||

| + | |- | ||

| + | |Population using electricity for cooking | ||

| + | |66.4% | ||

| + | |- | ||

| + | |Population using other fuels for cooking | ||

| + | |0.2% | ||

| + | |} | ||

| + | Source: Global Alliance for Clean Cook Stoves. | ||

| + | |||

| + | '''Prevalent Techniques in the Country''' | ||

| + | |||

| + | There is a renewed interest in clean cooking fuels and cookstoves in recent years through the dissemination of clean cookstoves, an agenda strongly pushed by the GACC. This interest is accompanied by increased efforts to understand the complexities influencing the uptake and sustained use of cleaner cooking alternatives. | ||

| + | |||

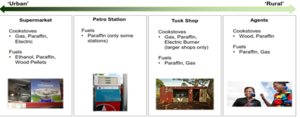

| + | As in Figure 10, existing markets for cookstoves and fuels in different geographic regions already have market-based channels for clean cookstoves and fuels. | ||

| + | |||

| + | Figure 9. Existing Markets for Cookstoves and fuels in different geographic regions | ||

| + | [[File:Existing Markets for Cookstoves and fuels in different geographic regions.png|left|thumb|Source: Global Alliance for Clean Cook Stoves.]] | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | '''Setbacks and Challenges''' | ||

| + | |||

| + | In the sub-Saharan Africa alone, including South Africa, a static access rate combined with rapid growth in population have led to a rise in the number of people without access to clean cooking from some 750m in 2010 to 890m in 2018, according to ''Tracking SDG 7: The Energy Progress Report'', published in May 2020 by a group of organizations including the IEA, the W.H.O and the World Bank Group (Africa Business, 2020). The flexibility, ease of use, and low cost of open fires will be a challenge to the adoption of clean cookstoves and fuels. Many households still use non-compliant paraffin cookstoves, and even approved paraffin cookstoves still present a risk of fire. | ||

| + | |||

| + | '''Investigation of clean cooking in South Africa.''' | ||

| + | |||

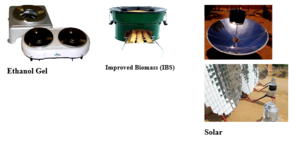

| + | There is a renewed interest in clean cooking fuels and cookstoves in recent years through the dissemination of clean cookstoves, an agenda strongly pushed by the GACC. Among South African households, electric stoves and traditional three-s tone stoves are used. In a study by Whitney ''et al''. (2018), the authors found that in South Africa, the 5 Star, Rocket and Isitofu stoves were used, using biomass briquettes, charcoal and wood pellets respectively in the study area. Interestingly, these traditional cookstoves were used in urban and peri-urban settlements in springs, Gauteng (26.2607° S, 28.4630° E). | ||

| + | [[File:Typologies of cookstoves over open fires01.png|thumb|Figure 10a: Typologies of cookstoves over open fires]] | ||

| + | |||

| + | |||

| + | |||

| + | [[File:Samples of Clean Cooking devices.png|thumb|Figure 10b: Samples of Clean Cooking devices. Source: Accenture.com.]] | ||

| + | |||

| + | |||

| + | |||

| + | '''Limitations of Cook Stove Penetration''' | ||

| + | |||

| + | Factors that may affect the choice of a cooking system are economic factors, socio-demographics; fuel availability; attitude toward technology; awareness of the risks of traditional cooking stoves and the benefits of ICS; location, and social and cultural influence across South Africa generally. Economic factors represent a major element influencing ICS adoption. Since energy poverty and limited clean cooking are largely a concern of developing and emerging countries (Lee, 2018), income plays a major role in consumer behaviour. The price of clean technologies is often a prohibitive factor and a primary reason for non-adoption. The household composition also emerged as a factor affecting the use of ICS. Household size (i.e., the number of family members living in the same house) has sometimes been found to influence whether to adopt sustainable cooking options. Family size can vary greatly in developing and emerging countries, including South Africa. | ||

| + | |||

| + | A study by Van der Kroon ''et al.'' (2014) also showed that a larger number of adults means abundant labour available for the fuel collection necessary for traditional stoves, thus reducing the intention to adopt ICS. | ||

| + | |||

| + | '''Prospects of Clean Cooking in South Africa''' | ||

| + | |||

| + | In South Africa, clean cooking is part of the basic services necessary to lead a healthy and productive life and saves households time and money. The SDG-2 Zero Hunger. Affordable and convenient cooking reduces the time and money needed to cook, thus increasing the likelihood that families will fit in cooking amongst their many other daily priorities if vigorously pursued. SDG 3 Good Health and Well-being. If smoke emissions from cooking are reduced, it decreases the burden of disease associated with household air pollution and improves well-being, especially for women and children. When implemented would improve the prospect of achieving clean cooking in South Africa. Energy access enables enhanced productivity and inclusive economic growth. The clean cooking sector offers many job opportunities that would promote decent work and economic growth. | ||

| + | |||

| + | |||

| + | '''Several other clean cooking products are available, but have not been widely adopted.''' | ||

| + | [[File:Clean cooking alternatives yet to be widely adopted.png|thumb|Figure 11: Clean cooking alternatives yet to be widely adopted. Source: Global Alliance for Clean Cook Stoves.]] | ||

| + | |||

| + | Clean cooking can address household and ambient air pollution, resource efficiency and climate vulnerability and bring about sustainable cities and communities. Clean cooking solutions will help address the most basic needs of the township dwellers while also delivering climate benefits—up to 25% of black carbon emissions come from burning solid fuels for household energy needs (USAID). Cooking with electricity could present a disruptive and transformative value proposition for households, allowing for more efficient and faster cooking times, adjustable heat levels, safer cooking, and absence of dangerous indoor emissions, as well as a visibly cleaner cooking environment (Leach ''et al''., 2018; Leary ''et al''., 2019; Myint ''et al''. 2019 and Scott ''et al''., 2019). | ||

| + | |||

| + | '''Framework for 100% Clean Cooking in South Africa.''' | ||

| + | |||

| + | The South African government in collaboration with Eskom, the sole national utility, to implement an LPG cookstove distribution program. A two-burner gas stove with a 5 kg LPG cylinder and three vouchers for fuel refills were distributed free to households in a kit (Kimemia and Annegarn, 2016). The government also financially supported Eskom’s project to utilize the utility’s preexisting network and distribution facilities. A pilot test of 100,000 households in Cape Town found that 89% of families still used LPG as their primary fuel one year later (Mohlakoana & Annecke, 2009). Seven years after the program’s implementation in 2006, Kimemia and Annegarn (2016) found that over 60% of households continued to use LPG as their primary cooking fuel source. Those interviewed cited the initial free handout of an LPG cookstove kit and the time-saving benefits as reasons for continuing sustained use of the fuel, and cited electricity tariffs as reasons for not switching back to electric stoves. However, those who had switched back to electricity cited the lack of a fuel subsidy, the volatility of LPG pricing, and lack of infrastructure and supply as reasons for discontinuing use. According to Kimemia and Annegarn (2016), if the fuel itself were subsidized in a manner similar to the current subsidy for electricity use – which gives free electricity to households for the first 50 kWh – then LPG use could increase even more. This framework has helped to increase the use of clean cooking stoves in South Africa. | ||

| + | |||

| + | = 7. Specific regulation and business models for each electrification mode, cooking and other energy access related activities. = | ||

| + | '''Introduction''' | ||

| + | |||

| + | At the heart of human development and economic growth lies access to energy. Providing access to affordable energy is essential for increasing human welfare and improving living standards (Türkoğlu and Kardoğan, 2018). For such reasons, access to energy is part of the United Nations (UN) sustainable development goals (SDGs). According to the UN (2018), access to energy enhances economic opportunities and creates jobs, provides better education and healthcare, women and youth empowerment, and creates inclusive, equitable, and sustainable communities. Statistics revealed that global access to electricity increased to approximately 89% in 2017 (IEA ''et al.,'' 2019). | ||

| + | |||

| + | The number of people who lacked access to electricity stood at 940 million in 2016, which decreased to 840 million in 2018 (IEA ''et al.,'' 2019; Ritchie and Rosa, 2019). The IEA ''et al.'' (2019) stated that access to clean cooking and related technologies increased from 57% to 61% between 2010 and 2017. Low and middle-income economies have primarily driven the increase in access to electricity and clean cooking (Ritchie and Rosa, 2019). Despite this increase, most people in Sub-Saharan Africa (SSA) still lack access to both electricity and clean cooking (IEA et al., 2019; IEA, 2019; Ritchie and Rosa, 2019). In 2016 statistics revealed that out of the 940 million people who lacked access to electricity, 939.53 million were located in SSA (Ritchie and Rosa, 2019). | ||

| + | |||

| + | The IEA (2019) stated that the rate at which people gain access to electricity in Africa outpaced the population growth. It doubled from 9 million a year between 2000 and 2013 to 20 million between 2014 and 2018. SSA’s electrification rate remains significantly low compared to other parts of the world, with an electrification rate of 45% per annum (IEA, 2019). According to the IEA (2019), access to energy in African countries is dominated by grid expansion at 45%. It is the least costly option, followed by mini-grids at 30% and stand-alone systems accounting for about a quarter. | ||

| + | |||

| + | Ritchie and Rosa (2019) stated that SSA ranked the lowest for access to clean fuels, where only 14% of households in 2016 had access. The IEA (2019) stated that only seven million people had gained access to clean cooking in SSA since 2015. Since population growth outpaced provision efforts, people without access to clean cooking increased to over 900 million in 2018. | ||

| + | |||

| + | The EIA (2019) further states that South Africa’s (SA) energy access is different from other Sub Saharan countries. This is attributed to the country's economy as it ranks amongst the most matured economy in the continent. The following paper will review access to energy in SA as well as the electrification modes that can help increase access to energy in SSA. | ||

| + | |||

| + | '''Energy in South Africa''' | ||

| + | |||

| + | Access to energy in SA is significantly high compared to other countries in the SSA region. The electrification rate in SA for the year 2014, as stated by Sarkodie and Adams (2020) was 86%, with 85% and 87% for rural and urban areas, respectively. Jamal (2015) stated that the government made the electrification of residential areas a priority. In 2019 the number of households that had access to electricity stood at 85%, which shows a decline from 2014 attributed to population growth in the country, especially in the Gauteng province (Stats SA, 2019). The state-owned entity Eskom provides 92.8% of the country’s electricity demand, while the remaining 7.2% is provided by independent power producers from renewable energy sources (Ismael and Khembo, 2015). | ||

| + | |||

| + | Access to electricity for households in 2019 ranking from highest to lowest was as follows: Free State (93,4%), Limpopo (92,7%), Northern Cape (91,7%), Mpumalanga (90.1%), Eastern Cape (89.3%), Western Cape (88.4%), KwaZulu-Natal (86.7%), North-West (81,6%), Gauteng (76,6%) (StatsSA, 2019). Access to clean cooking in 2019 stood at 79.3% (75.1% for cooking through electricity and 4.2 for gas), meaning close to 21% of households used wood, coal, paraffin, and other sources (StatsSA, 2019). Clean cooking through electricity was highest in Freestate (86.3%), Northern Cape (84,2%), while through gas was highest in Western Cape (13.2%), Northern Cape (7,1%), Eastern Cape (4,8%) (StatsSA, 2019). While the use of paraffin was most common in Gauteng (7,3%), that of wood in Limpopo (32,1%), Mpumalanga (16,7%), Eastern Cape (10,5%) and KwaZulu-Natal (8,4%) (StatsSA, 2019). | ||

| + | |||

| + | '''IRP Report''' | ||

| + | |||

| + | South Africa aims at achieving an energy sector that promotes economic growth and development, social equity, and environmental sustainability through the 2030 national development plan (NPC, 2011). The NDP developed the integrated resource plan (IRP) to achieve the vision it set for the energy sector. The IRP is defined as an electricity infrastructure development plan based on the least-cost electricity supply and demand balance, considering the security of supply and the environment. One of the country's aims is to continue to pursue diversity in the energy mix to reduce reliance on single or limited primary energy sources. The introduction of renewable energy through Independent Power Producers (IPP) is also one of the plans by the 2019 IRP. | ||

| + | |||

| + | The 2019 IRP report revealed that coal will continue to be the largest supplier of electricity generation as it is abundant in the country, with new coal power stations that will generate 1 500 MW acquired by the year 2030. However, Eskom will have to adhere to emissions standards by ensuring that investments are made into technologies that produce high efficiency and low emissions as well as through the decommissioning of coal power plants. This will also be achieved through investing in other cleaner options for power generation. | ||

| + | |||

| + | Nuclear power is regarded as one of the options that is clean for power generation; it has little emissions compared to coal. The IRP report stated that one nuclear power plant will be obtained by 2024, generating 1 860 MW. This will be done by 2024 because the existing nuclear power plant (Koeberg Power Station) will be reaching its end of life. However, the rate of the decommissioning of coal power stations will highly influence the rate at which the nuclear power plant will be procured. | ||

| + | |||

| + | The IRP also reported that new solar photovoltaic and wind power plants with 6 000 MW and 1 4400MW respectively will be commissioned by 2030 and provide off-grid electricity. Biomass from waste, sugar industries, paper and pulp was viewed as an option that can be used in co-generation and provide electricity without using a lot of transmission and infrastructure. | ||

| + | |||

| + | In its effort to reduce emissions and opt for clean energy sources, Eskom is said to be working on a 5 000MW utility-scale battery storage that will be commissioned by 2030. Eskom also intends to convert all their diesel-fired power plants into gas power plants. By 2023 and 2027, the country hopes to have commissioned 1 000 MW and 2 000 MW new gas power plants, respectively. With such changes in place, it is expected for energy tariffs to rise to encourage households and industries to transition to cleaner options such as solar PV and liquid petroleum gas (LPG) that will be cost-efficient. | ||

| + | |||

| + | Through the regional power projects, South Africa has entered into a treaty that will provide hydropower via the Grand Inga hydropower project that will provide 2 500 MW to the country from the Democratic Republic of Congo (DRC). The power will be transmitted to SA from DRC across Zambia, Zimbabwe and/or Botswana. This project is estimated to be completed by 2030 and will provide electricity for the country for 2030 and beyond. | ||

| + | |||

| + | Access to grid electricity is still not available for three million South African households. However, effort has been made to provide electrification through off-grid option; the drawback is that they are only good for lighting and small power that is not for heating and cooking purposes. The provision of grid electricity for most areas is not feasible due to the associated cost and geographic location. Such efforts need to be placed on quantifying off-grid and micro-grid opportunities and place a framework to accelerate this development. | ||

| + | |||

| + | '''Roadmap to Energy Access Improvement''' | ||

| + | |||

| + | According to the IRENA (2015) load shedding and electricity outages have become a norm for approximately 30 countries in Africa. IRENA (2015) further states that the only way to solve such is by investing in mixed energies instead of relying on one energy source. South Africa is no exception to this as the country experiences load shedding and electricity, particularly during the winter months as demand for electricity reaches its peak. The blackouts in the country are as a result of the lack of capacity by Eskom to produce enough energy for the country as a number of their power stations are reaching their end of life and no new power station have been built to replace the ones that have ceased to operate (Nowakowska and Tubis, 2015). | ||

| + | |||

| + | As stated by IRENA (2015), Renewables can play a significant role in transforming the energy mix in Africa and solving the issue of blackouts and load shedding. As indicated by the DoE (2019), South Africa aims at achieving energy mix by 2030. This change is driven by economics, emerging technologies, environmental concerns and changing customer sensibilities, and the need for energy security (IRENA, 2015; DPE, 2019). Africa has an abundance of renewable energy sources and fossil fuels; policymakers are the ones that influence which route the country takes to meet its energy needs (Kerekezi and Kithyoma, 2003; IRENA, 2015). The energy policy in SA is shifting in favour of renewable and clean energy options. The NDP (2011) indicated that in the next 20 years, coal's contribution will be lower compared to that of solar, wind, and imported hydro-energy. | ||

| + | |||

| + | The DPE (2019) released a report on the roadmap Eskom is implementing to achieve the goal of renewable energy in the country and reducing the use of coal. The roadmap states that Eskom should transition from a vertically integrated monopoly to an entity with separate legal and functionality structures for generation, transmission, and distribution (DPE, 2019). This transition will allow Eskom to provide reliable, affordable, economically competitive, and environmentally sustainable electricity to drive inclusive economic growth (DPE, 2019). This, together with the efforts by Eskom to include renewable energy in the provision of electricity, will lead the country to the goal of achieving 40% of renewable energy in the energy mix by 2030 (IRP, 2019). | ||

| + | |||

| + | The implementation of clean and renewable energy has socioeconomic benefits as it allows for electrification in rural areas as they are usually not electrified (IRENA, 2015; IRP, 2019). The following section will discuss modes of electrification and how they can improve access to energy in areas without electricity especially remote areas. | ||

| + | |||

| + | '''Electrification Modes''' | ||

| + | |||

| + | According to the US-EIA (2021), fossil fuels (coal, natural gas, and petroleum), nuclear energy, and renewable energy sources (wind, geothermal, hydro, solar, and biomass) are the three major sources of energy for electricity generation. The US-EIA (2021) further states that most of the electricity is generated using steam turbines powered by fossil fuels, nuclear, biomass, geothermal, and solar thermal energy, followed by gas turbines, hydro turbines, wind turbines, and solar photovoltaics technologies (US-EIA, 2021). Yahyaoui (2017) stated that fossil fuels are the most favourable option for electricity generation due to their cost effectiveness, while nuclear power receives little to no acceptance because of the significant risks is poses and costly waste storage. These energy sources can be used to supply electricity into two discrete components: the grid extension and the low-voltage distribution system (NRECA, 2000). The energy sources and supply modes listed above highlight the possible options for the electrification of areas that lack access to energy. The options for electrification using these sources and modes will be discussed in the following sections to determine the best one for remote areas. | ||

| + | |||

| + | '''Grid Extension''' | ||

| + | |||

| + | Couture et al. (2019, p. 314) defined grid extension as “the extension of the medium voltage (MV) and low voltage (LV) distribution grid to connect households or other customers to the central energy supply system”. According to Malaya ''et al.'' (2014), extending the national grid is often the most obvious and desirable option for the electrification of remote areas. The energy source for generating electricity on a national grid is often powered by fossil fuels, particularly coal and natural gas (Duffy et al., 2018). | ||

| + | |||

| + | Grid extension for countries such as China and South Africa is the most preferred option as non-grid alternatives are a temporary solution (Niez, 2010). The regulations for grid extension, as stated by Niez (2010), include the regular maintenance of power lines and transformers, reduce losses due to theft by implementing policies that state that stealing cables and tempering with meters is illegal as well as have campaigns against such activities, use low-cost technologies to control the costs of electrification such as using single-wire earth return (SWER) as currently used in South Africa. | ||

| + | |||

| + | As stated by Attia and Shirley (2018), the business models for grid extension includes: | ||

| + | |||

| + | (a). Utility concessions which are public-private agreements that permit private firms to secure rights to offer services under the supervision of the government. | ||

| + | |||

| + | (b). Distribution franchising that creates public-private partnerships for electricity distribution networks and revenue collection at the end of the grid. | ||

| + | |||

| + | (c). Rural electricity cooperatives that are composed of an isolated generation and distribution infrastructure systems connected to the national grid upon its arrival, owned by the rural customers that take power from the system. These are usually financed by affordable credit that is given by government agency. | ||

| + | |||

| + | (d). Regulatory frameworks for micro-utilities and distributed energy service companies (DESCOs) these models are in place when a gid is extended to a place that has mini/micro-grids in place, they clarify how the national utility defines a mini-grid, reorganise the permitting process, and predetermine outcomes and tariffs. | ||

| + | |||

| + | '''Stand-alone systems''' | ||

| + | |||

| + | Rodríguez Gómez (2013) defined a stand-alone system as an energy power system that normally supplies electricity to a home, a school, a clinic, or any other form of low off-grid load a daily power requirement of less than 3-5 kWh. These systems range from low power stand alone which are usually called off-grid systems that power households using diesel generators and solar PV, and micro-grid powered by renewables that supply several households or even a village (Dufo-López and Bernal-Agustín, 2019). | ||

| + | |||

| + | As stated by Borhanazad et al. (2014), business models for stand-alone systems include: | ||

| + | |||

| + | '''(a). Market-based business models''' | ||

| + | |||

| + | (i). Cash sales model- the customers/end-users that is usually a household or a facility purchases the power models system outright and becomes the owner of the system, | ||

| + | |||

| + | (ii) Fee for service model-, An energy service company (ESCO) invests in and owns the off-grid power generating system and supplies electricity to customers that pay for the electricity regularly, | ||

| + | |||

| + | (iii). Dealer credit- The supplier/dealer sells the system to a customer that signs a credit arrangement with the dealer and becomes the owner of the system, | ||

| + | |||

| + | (iv). End-user credit- this is similar to Dealer credit. However, the customer is responsible for getting credit directly from a third party, and | ||

| + | |||

| + | (v). Lease hire purchase- the supplier leases system to the customer, that becomes the owner during the lease period and is responsible for its maintenance and repair; | ||

| + | |||

| + | '''(b) government-induced community-based business models''' | ||

| + | |||

| + | (i). Grant-based models- The system is financed usually by the government, and the responsibility of maintaining it falls on a community-based entity, | ||

| + | |||

| + | (ii) partially grant-based models- the project system is executed under a partially based grant that is financed by a combination of local contributors and loans; and | ||

| + | |||

| + | (c) public-private partnership models, | ||

| + | |||

| + | (i) operation management PPP- a public entity or partner that owns the model contracts a private partner to operate and maintain the system, | ||

| + | |||

| + | (ii) Operation-maintenance management PPP- same as operation management PPP, where the private partner may invest capital in the system, but the public partner remains the owner of the system. | ||

| + | |||

| + | '''Microgrid''' | ||

| + | |||

| + | A microgrid is an LV electricity distribution system, with its own distributed energy resources, with storage devices that are capable of functioning separately as a small-scale electricity grid if disconnected from the main grid or in a non-autonomous way if interconnected to the main grid (Schwaegerl and Tao, 2014; Hayes, 2017). | ||

| + | |||

| + | The proposed business models for microgrids include as stated by Schwaegerl and Tao (2014): (a). Distribution system operators (DSOs) Monopoly Model: in this model, the DSOs owns and operates the distribution of the grid, as well as sells the electricity. | ||

| + | |||

| + | (b). Liberalised Market Model: in this model, the microgrid is owned by various stakeholders such as suppliers, DSO, and consumers, the daily operations and management of the grid are done by a microgrid operator or central controller (MGCC). | ||

| + | |||

| + | (c). Prosumer Consortium Model: in this model, single or multiple consumers own and operate micro-sources to reduce electricity costs or increase sales revenue from energy export to the upstream network. | ||

| + | |||

| + | A study by Emmanouil ''et al.'' (2021) in Egypt revealed that microgrids that are not connected to the main grid could provide for the needs of communities such as lighting, baking/cooking, television, radio, and irrigation purposes. This study concluded that microgrids are a solution for the electrification of remote areas, such as rural areas, as they meet the needs of communities (Emmanouij et al., 2021). | ||

| + | |||

| + | According to Akinyele ''et al.'' (2018), the shortcomings of microgrids can be categorised into (a). Social aspects: the lack of knowledge by users, the question of ownership, lack of experience/qualification by the installers, little to no engagement with the community on the pre-design phase. | ||

| + | |||

| + | (b) technical aspects: inappropriate and poor design coupled with the lack of standard maintenance procedures and lack of conformity to international standard codes and the use of sub-standard materials, and inadequate knowledge of renewable energy. | ||

| + | |||

| + | (c). lack of financial support by the government and financial framework, as well as the lack of revenue generation and the cost of replacing components of the grid. | ||

| + | |||

| + | (d) environmental: lack of planned Environmental Assessment (EA) and weak environmental awareness. | ||

| + | |||

| + | (e) policy: lack of political will for widespread application, ineffective policy initiatives and framework for including the private sector, and quality control policies. | ||

| + | |||

| + | Energy efficiency and Renewable energy | ||

| + | |||

| + | Patterson (1996) defined energy efficiency as using less energy to produce the same number of services or useful output. While renewable energy, as stated by Shinn (2018), often referred to as clean energy, is derived from natural sources or processes that are infinite and constantly replenished. | ||

| + | |||

| + | Business models for energy efficiency and renewable energy, as stated by Odels (2015), includes: | ||

| + | |||

| + | (a). Ownership business models such as Public-private partnerships (PPPs) that involves a contract between a government agency and a private company in which the private company performs a public service. Common PPP models include build–own–operate–transfer (BOOT) model, build–own–operate (BOO) model, and build–own–transfer (BOT) model. | ||

| + | |||

| + | (b). Service business models such a user cooperative business models, that, requires the formation of a non-profit community organisation that is owned and managed by its members. The members of the organisation are the ones that make contributions that fund projects with or without outside private or public funding. | ||

| + | |||

| + | (c). An ESCO is a service business model that is used mostly for energy efficiency; the ESCO is compensated depending on its performance, which is calculated as a fixed percentage of energy savings compared to the consumer's baseline energy use. | ||

| + | |||

| + | (d) Customer-side renewable business model that places renewable energy systems on the property of the customer. | ||

| + | |||

| + | (e). Utility-side renewable business model that has projects that are larger than customer-side projects and range from one to some hundred megawatts. | ||

| + | |||

| + | = 8. Existing Major Energy Projects = | ||

| + | '''Large energy project''' | ||

| + | |||

| + | Over the last ten years, starting in 2011, the South African government has procured just over 4GW of renewable energy from renewable energy independent power producers. The table below shows a breakdown of the technology types and corresponding capacities as taken from (Mkhize ''et al.,'' 2020). | ||

| + | |||

| + | Table 4. Energy Technology Typologies adopted in South Africa | ||

| + | {| class="wikitable" | ||

| + | |'''Technology ''' | ||

| + | |'''Capacity (MW)''' | ||

| + | |- | ||

| + | |Wind | ||

| + | |1363 | ||

| + | |- | ||

| + | |Solar PV | ||

| + | |2287 | ||

| + | |- | ||

| + | |Solar CSP | ||

| + | |600 | ||

| + | |- | ||

| + | |Landfill gas | ||

| + | |13 | ||

| + | |- | ||

| + | |Small hydro | ||

| + | |19 | ||

| + | |- | ||

| + | |Biomass | ||

| + | |42 | ||

| + | |} | ||

| + | Source: Mkhize et al., (2020) | ||

| + | |||

| + | Other major energy projects are the two coal mega-projects being implemented by the state utility Eskom, Medupi and Kusile, which are expected to produce 4764MW and 4800MW, respectively (Eskom, n.d.). | ||

| + | |||

| + | '''Case example of the provision of modern energy access''' | ||

| + | |||

| + | At the advent of democracy in 1994, South Africa’s access to electricity stood at 36%. In a bid to better coordinate the expansion of access to electricity to those groups of society previously excluded, in 1999, the government launched the Integrated National Electrification Programme (INEP), which saw electrification rates rise to 88% (Department of Energy, n.d.). | ||

| + | |||

| + | '''Rural electrification projects''' | ||

| + | |||

| + | The INEP was initially aimed at providing access to poor off-grid communities through Solar Home Systems (SHSs). The initial target was 300 000 households over five years, but by the early 2000s, under 100 000 installations had been carried out in rural communities (Practical Action, 2018 pp. 39). | ||

| + | |||

| + | = 9. Key Challenges in the Energy Sector = | ||

| + | South Africa is again experiencing serious energy constraints in 2021, which impedes economic growth and is a major inconvenience to everyone (IEA, 2019). Sustained power cuts, caused by under-investment and a shortage of generating capacity, have damaged the South African economy. The government is doing everything within its power to deal with the problem of energy shortage in the country. Currently, there are approximately 4 million households in South Africa without electricity. According to Power Africa, the following are the biggest challenges that meet South Africa's energy sector include macroeconomic forces, outdated Integrated Resource Plan (IRP), and local content requirements (Power Africa, 2018). | ||

| + | |||

| + | '''Macroeconomic Forces''' | ||

| + | |||

| + | Sustained power cuts, caused by under-investment and a shortage of generating capacity, have damaged the South African economy. Fixing South Africa’s energy crisis is not just about generating more electricity, however. More focus is also needed on the transmission and distribution of electricity (Voss et al., 2017). It doesn’t make sense to invest heavily in generation capacity without also rethinking transmission and distribution. To date, however, the key element of how energy moves from generation to consumption has mostly been overlooked. Another challenge leading to the prevalent power cuts has to do with Eskom’s precarious financial position. Eskom has tried to avoid or reduce power cuts caused by failures of its main power plants by using expensive options like gas turbines, but Eskom has effectively borrowed a colossal amount of money on behalf of citizens, so any financial gaps will have to be plugged through electricity tariffs, higher taxes or painful cuts to public spending (Jabulani Sikhakhane, 2020). Most of the coal power stations are more than 40 years old and are prone to breakdowns. In addition, much of the necessary maintenance on these plants were neglected for many years. Eskom estimates that breakdowns consume as much as a fifth of our electricity capacity (SA News, 2021). The country is still paying huge debts and might be willing to go on with the present predictable power cuts until the backlogs of maintenance is completely offset. | ||

| + | |||

| + | '''Outdated Integrated Resource Plan''' | ||

| + | |||

| + | The Integrated Resource Plan for Electricity 2010–2030 (IRP), adopted in March 2011, did not address the grid at all (Pratibha Vuppuluri, 2020). Grid planning can’t be an afterthought. It has to be built into the planning process from the start. In South Africa’s case, Eskom produces electricity at coal-fired power plants in Mpumalanga, the largest nett supplier, and delivering most of it to the economic heartland of Gauteng, the largest nett consumer. The contribution of small-scale residential generation is being delayed by an absence of clear policies and regulations (Steve Hedden, 2015). Generation from solar panels could account for 30 GW capacity in South Africa by 2050. The forecast in the 2013 IRP assumes an average residential installation size of 5 kilowatts (kW). This means the 30 GW of energy in 2050 would come from six million citizens. Instead of a small number of power stations owned and operated by one utility, South Africa may have millions of producers, each with unique production and consumption patterns, buying and selling electricity at changing prices throughout the day. Without clear policies, only those wealthy enough to install their own capacity will benefit from this power. Energy planning must include assumptions about changing capacity, flexibility to adapt, and clear policies to unlock the potential of small-scale residential power generation potential. Incorporating grid planning into energy planning allows IPPs to be integrated more rapidly and reduces potential delays between the construction of generating capacity and transmission lines. A more flexible grid, and more flexible capacity, would complement rather than hinder intermittent renewable energy. Lack of integrated planning could also constrain the integration of IPPs. South Africa’s planned IPPs could contribute as much as 20 GW of capacity. That is nearly 45% of South Africa’s power-generating capacity from all sources in 2013. Eskom has already connected 32 projects totalling 1.6 GW, but it could become increasingly difficult and expensive to integrate IPPs. Grid planners will struggle to connect IPPs to the grid if energy planning continues along the same lines of the 2010 IRP and the 2013 update, without planning for the impact of decentralised capacity from the beginning. Part of the problem is that the IRP is written by the Department of Energy while grid planning is done by Eskom (Department of Energy, 2010). | ||

| + | |||

| + | '''Local Content Requirements''' | ||

| + | |||

| + | South Africa relies on low-grade coals for generating electricity. The use of low-quality coals is the main contributor to GHG emissions. Eskom is thus vulnerable to impacts of international response measures that may be taken to reduce GHG emissions (Davidson et al., 2002), for which South Africa has no commitments. The economy exhibits high carbon intensity due to the energy-intensive economy and heavy use of coal (Department of Energy, 2018). Plentiful supplies of inexpensive coal have supported the development of large-scale coal-fired power stations. Emissions per unit of economic output are high because the specific energy efficiencies of many sectors are lower than average, making emissions control very difficult. Energy efficiency standards are generally lacking. Even given the benefits of energy efficiency, most of the standards have not been implemented because of low-cost energy supply in coal, lack of public awareness, the unaffordability of appliances, and the inadequate long-term policies and absence of codes and standards. Energy pricing, particularly electricity pricing, is lacking. Electricity is generated from coal of low quality, and its price does not account for the environmental externality of this resource (Nkomo, 2005). The full cost of producing electricity is higher than that borne by Eskom, and the external costs are borne by society. Even though low prices benefit the poor and give South Africa a comparative advantage, the low price of coal has not promoted incentives for investments in both energy-efficient technologies and renewable energy. | ||

| + | |||

| + | = 10. References = | ||

| + | |||

| + | Akinyele, D., Belikov, J. and Levron, Y. Challenges of microgrids in remote communities: A STEEP model application. ''Energies'', 11(432). doi: <nowiki>https://doi.org/10.3390/en11020432</nowiki> | ||

| + | |||

| + | Attia, B. and Shirley, R. (2018, June 13). Distributed models for grid extension could save African utilities billions of dollars: Sub-Saharan Africa utilities run big deficits [online]. Available from: <nowiki>https://www.greentechmedia.com/</nowiki> | ||

| + | |||

| + | Borhanazad, H., Foroogh, S., Hazelton, J., and Mekhilef, S. (2014). Stand Alone Renewable Energy Systems for Rural Development. In Energy Science & Technology: 197-219. Edited by Sharma, U.C. and Kumar, S. Houston, Texas: Studium Press LLC. | ||

| + | |||

| + | Baker, L. (2017). Post-apartheid electricity policy and the emergence of South Africa’s renewable energy sector. In D. Arent, C. Arndt, M. Miller, F. Tarp, & O. Zinaman (Eds.), ''The Political Economy of Clean Energy Transitions'' (First, pp. 371–390). Oxford University Press. | ||

| + | |||

| + | Baker, L., & Phillips, J. (2019). Article Politics and Space Tensions in the transition: The politics of electricity distribution in South Africa. ''Politics and Space'', ''37''(1), 177–196. <nowiki>https://doi.org/10.1177/2399654418778590</nowiki> | ||