Knowledge fuels change - Support energypedia!

For over 10 years, energypedia has been connecting energy experts around the world — helping them share knowledge, learn from each other, and accelerate the global energy transition.

Today, we ask for your support to keep this platform free and accessible to all.

Even a small contribution makes a big difference! If just 10–20% of our 60,000+ monthly visitors donated the equivalent of a cup of coffee — €5 — Energypedia would be fully funded for a whole year.

Is the knowledge you’ve gained through Energypedia this year worth €5 or more?

Your donation keeps the platform running, helps us create new knowledge products, and contributes directly to achieving SDG 7.

Thank you for your support, your donation, big or small, truly matters!

Difference between revisions of "Fuel Prices Nigeria"

***** (***** | *****) m (1 revision) |

***** (***** | *****) m |

||

| (5 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

{{Fuel Price Factsheet | {{Fuel Price Factsheet | ||

|Fuel Price Country=Nigeria | |Fuel Price Country=Nigeria | ||

| + | |Fuel Pricing Policies="Pricing policy: Gasoline prices are uniform, controlled by government, and infrequently adjusted. The gasoline price was ₦65/liter between Aug 2005 (US$0.50) and Dec 2011 (US$0.41), except in 2007 and 2008 when it was raised to ₦75/liter for a month and then lowered to ₦70/liter. Diesel prices have been deregulated for several years. Government removed the gasoline subsidy on Jan 1, 2012 and allowed the retail price to rise above ₦140 (US$0.88)/liter or higher, but following widespread protests lowered it within two weeks to ₦97 (US$0.61), still representing a 49% increase from the price in 2011. A Jun 2009 presidential directive deregulated the price of kerosene for household use, but Nigerian National Petroleum Corporation (NNPC) continues to sell kerosene at a heavily subsidized price of ₦50 (US$0.32)/liter and receive reimbursement from government. The kerosene price is about one third of the market price and the subsidy is intended to help poor households with lighting and cooking. | ||

| + | |||

| + | Regulatory agencies: Petroleum Products Pricing Regulatory Agency (PPPRA) manages Petroleum Support Fund (PSF), which was established in Jan 2006 to stabilize domestic fuel prices. With the Central Bank of Nigeria as the custodian of the fund, PSF follows the principle of under-recoveries to be reimbursed and over-recoveries to be paid into the fund, based on international costs, charges, and controlled profit margins using a pricing template. Petroleum Equalization Fund Management Board equalizes transportation costs for pan-territorial pricing. PPPRA approves import quotas for gasoline and eligibility for subsidy reimbursement. | ||

| + | |||

| + | Social protection: Leading up to the removal of the gasoline subsidy in Jan 2012, government developed a Subsidy Reinvestment and Empowerment (SURE) program. The objective of the SURE program is three-fold: to mitigate the immediate impact of subsidy removal, accelerate economic transformation through investing in critical infrastructure, and lay a foundation for a national safety net program. Social protection mechanisms under SURE include maternal and child health services, public works for women and youth, urban transport development, and vocational training. However, the full document was not issued until Nov 2011, less than two months before the subsidy removal, giving inadequate time for communication and preparation of the mitigation measures. The 2013 budget allocates ₦273.5 billion (US$1.7 billion) for the SURE program. | ||

| + | |||

| + | Protests: Gasoline pricing has been highly politicized in Nigeria and labor unions strongly oppose deregulation. Immediately after the price increase in Jan 2012, the unions staged an eight-day strike, estimated to have cost the economy more than US$1 billion. | ||

| + | |||

| + | Consequences of subsidies: Fuel subsidies (implicit and explicit) increased six-fold in local currency between 2006 and 2011 and surpassed US$11 billion in 2011, constituting 4.7% of GDP. A market with deregulated diesel and regulated gasoline prices is unusual, leading to much greater apparent consumption of gasoline than diesel. According to IEA data, the gasoline-to-diesel consumption ratio increased from 2 in 2000 to 7 in 2010, nearly triple the second highest ratio in the world (United States) and possibly suggesting increasing smuggling of subsidized gasoline. Five illegal alternative markets for subsidized kerosene have been reported in the media: (1) much higher prices of kerosene on black markets, (2) adulteration of diesel with kerosene, (3) diversion of subsidized kerosene for household use to the aviation fuel sector, (4) out-smuggling to neighboring countries, and (5) presenting subsidized kerosene as having just been imported to claim the subsidy reimbursement for the second time. In Dec 2011, Major Oil Marketers Association of Nigeria warned that selling household kerosene as jet aviation fuel posed a serious safety threat. The scale of corruption also discredits government’s argument that savings from subsidy removal can be used more productively and equitably. A former secretary general of a workers’ union captured this sentiment as follows: “Until they stop corruption, all these ideas will not work… Nigeria is rich, we have money." | ||

| + | |||

| + | |||

| + | Investigations into subsidy abuse: | ||

| + | Protests against the gasoline subsidy removal in Jan 2012 and criticisms of the poor governance in the sector led to establishment of several government committees and task forces in 2012: | ||

| + | • In Jan, the House of Representatives named an eight-member ad hoc committee led by Hon. Farouk Lawan to probe the subsidy regime between 2009 and 2011”to verify and determine the actual subsidy requirements and monitor the implementation of the subsidy regime in Nigeria.” The committee’s report, submitted in Apr, pointed to abuses on an enormous scale and massive overpayments in 2011. Against the appropriated sum of ₦245 billion (US$1.6 billion), the committee found effective subsidy payments amounting to ₦2,587 billion (US$16.7 billion). The number of eligible importers increased sharply from six in 2006 to 140 by 2011. Many transactions appeared suspect. However, a bribery allegation against Hon. Lawan led the executive branch to establish its own committee. | ||

| + | • Federal Ministry of Finance set up a committee in May to scrutinize the fuel subsidy payments in 2011. Headed by Aigboje Aig-Imoukhuede, a member of the Economic Management Team, the committee submitted a report in July, claiming that marketers and importers had committed 17 infractions at a cost of ₦423 billion (US$2.7 billion) in overpayments. | ||

| + | • Protests by marketers that they had not been invited by the technical committee to challenge the allegations prompted establishment in July of a Presidential Committee on Verification and Reconciliation of Subsidy Payments, also headed by Aig-Imoukhuede. This committee lowered the estimates of the overpayments to ₦382 billion (US$2.5 billion), indicting 25 companies. One of the committee’s recommendations was to verify shore tank certificates and records of sales proceeds. | ||

| + | • President Jonathan directed the committee to implement the above recommendation. The report submitted in Nov indicated that transactions of 50 companies, amounting to ₦232 billion (US$1.5 billion), had not been legitimate. | ||

| + | |||

| + | Information: PPPRA’s Web site posts the pricing template for gasoline and kerosene, indicating the magnitude of under-recoveries. The status of PSF after 2008 is difficult to find on PPPRA’s Web site, although it is available through Oct 2011. | ||

| + | |||

| + | (Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.) | ||

|Fuel Currency=NGN | |Fuel Currency=NGN | ||

|Fuel Price Exchange Rate=148.6 | |Fuel Price Exchange Rate=148.6 | ||

|Fuel Price Exchange Rate Date=2010/11/17 | |Fuel Price Exchange Rate Date=2010/11/17 | ||

| − | |||

|Fuel Price Composition=GIZ_IFP2012_Nigeria1.png | |Fuel Price Composition=GIZ_IFP2012_Nigeria1.png | ||

|Fuel Price Composition Fuel Type=Gasoline 95 Octane | |Fuel Price Composition Fuel Type=Gasoline 95 Octane | ||

|Fuel Price Composition Date=2011/02/01 | |Fuel Price Composition Date=2011/02/01 | ||

| − | |Fuel Price Composition Annotation= | + | |Fuel Price Composition Annotation=(1 US$=151.28 NGN) |

| − | |||

| − | |||

| − | There is currently no taxation on diesel and gasoline. | + | *„Vessel Transport/Depot“ costs include vessel financing costs (2.25NGN/litre), lightering costs (3.56 NGN/litre), a Nigerian Ports Authority duty (0,6 NGN/litre), the main depot („Jetty depot“) throughput charge (0,8 NGN/litre) and a main depot storage charge (3,00 NGN/litre). |

| + | *Diesel (referred to as „AGO“) is not subsidized. Therefore, expected diesel pump prices are about twice the price of gasoline. | ||

| + | *There is currently no taxation on diesel and gasoline. | ||

Source: http://www.pppra-nigeria.org/pricingtemplate.asp | Source: http://www.pppra-nigeria.org/pricingtemplate.asp | ||

|Fuel Price Composition 2=GIZ_IFP2012_Nigeria2.png | |Fuel Price Composition 2=GIZ_IFP2012_Nigeria2.png | ||

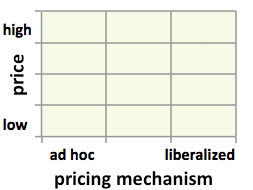

| − | |Fuel Pricing | + | |Fuel Matrix Pricing Mechanism=2 |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|Fuel Matrix Price Level=2 | |Fuel Matrix Price Level=2 | ||

| − | |||

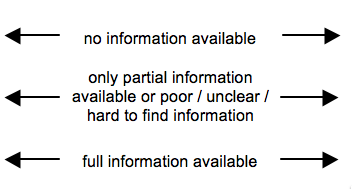

|Fuel Transparency Price Composition=3 | |Fuel Transparency Price Composition=3 | ||

|Fuel Transparency Pricing Mechanism=3 | |Fuel Transparency Pricing Mechanism=3 | ||

| Line 46: | Line 57: | ||

|Fuel Price Factsheet Source Link=http://www.pppra-nigeria.org/index.asp | |Fuel Price Factsheet Source Link=http://www.pppra-nigeria.org/index.asp | ||

}} | }} | ||

| + | |||

| + | [[Category:Nigeria]] | ||

Latest revision as of 13:01, 23 September 2014

Part of: GIZ International Fuel Price database

Also see: Nigeria Energy Situation

Fuel Pricing Policies

| Local Currency: | NGN |

| Exchange Rate: | 148.6

|

| Last Update: |

"Pricing policy: Gasoline prices are uniform, controlled by government, and infrequently adjusted. The gasoline price was ₦65/liter between Aug 2005 (US$0.50) and Dec 2011 (US$0.41), except in 2007 and 2008 when it was raised to ₦75/liter for a month and then lowered to ₦70/liter. Diesel prices have been deregulated for several years. Government removed the gasoline subsidy on Jan 1, 2012 and allowed the retail price to rise above ₦140 (US$0.88)/liter or higher, but following widespread protests lowered it within two weeks to ₦97 (US$0.61), still representing a 49% increase from the price in 2011. A Jun 2009 presidential directive deregulated the price of kerosene for household use, but Nigerian National Petroleum Corporation (NNPC) continues to sell kerosene at a heavily subsidized price of ₦50 (US$0.32)/liter and receive reimbursement from government. The kerosene price is about one third of the market price and the subsidy is intended to help poor households with lighting and cooking.

Regulatory agencies: Petroleum Products Pricing Regulatory Agency (PPPRA) manages Petroleum Support Fund (PSF), which was established in Jan 2006 to stabilize domestic fuel prices. With the Central Bank of Nigeria as the custodian of the fund, PSF follows the principle of under-recoveries to be reimbursed and over-recoveries to be paid into the fund, based on international costs, charges, and controlled profit margins using a pricing template. Petroleum Equalization Fund Management Board equalizes transportation costs for pan-territorial pricing. PPPRA approves import quotas for gasoline and eligibility for subsidy reimbursement.

Social protection: Leading up to the removal of the gasoline subsidy in Jan 2012, government developed a Subsidy Reinvestment and Empowerment (SURE) program. The objective of the SURE program is three-fold: to mitigate the immediate impact of subsidy removal, accelerate economic transformation through investing in critical infrastructure, and lay a foundation for a national safety net program. Social protection mechanisms under SURE include maternal and child health services, public works for women and youth, urban transport development, and vocational training. However, the full document was not issued until Nov 2011, less than two months before the subsidy removal, giving inadequate time for communication and preparation of the mitigation measures. The 2013 budget allocates ₦273.5 billion (US$1.7 billion) for the SURE program.

Protests: Gasoline pricing has been highly politicized in Nigeria and labor unions strongly oppose deregulation. Immediately after the price increase in Jan 2012, the unions staged an eight-day strike, estimated to have cost the economy more than US$1 billion.

Consequences of subsidies: Fuel subsidies (implicit and explicit) increased six-fold in local currency between 2006 and 2011 and surpassed US$11 billion in 2011, constituting 4.7% of GDP. A market with deregulated diesel and regulated gasoline prices is unusual, leading to much greater apparent consumption of gasoline than diesel. According to IEA data, the gasoline-to-diesel consumption ratio increased from 2 in 2000 to 7 in 2010, nearly triple the second highest ratio in the world (United States) and possibly suggesting increasing smuggling of subsidized gasoline. Five illegal alternative markets for subsidized kerosene have been reported in the media: (1) much higher prices of kerosene on black markets, (2) adulteration of diesel with kerosene, (3) diversion of subsidized kerosene for household use to the aviation fuel sector, (4) out-smuggling to neighboring countries, and (5) presenting subsidized kerosene as having just been imported to claim the subsidy reimbursement for the second time. In Dec 2011, Major Oil Marketers Association of Nigeria warned that selling household kerosene as jet aviation fuel posed a serious safety threat. The scale of corruption also discredits government’s argument that savings from subsidy removal can be used more productively and equitably. A former secretary general of a workers’ union captured this sentiment as follows: “Until they stop corruption, all these ideas will not work… Nigeria is rich, we have money."

Investigations into subsidy abuse:

Protests against the gasoline subsidy removal in Jan 2012 and criticisms of the poor governance in the sector led to establishment of several government committees and task forces in 2012:

• In Jan, the House of Representatives named an eight-member ad hoc committee led by Hon. Farouk Lawan to probe the subsidy regime between 2009 and 2011”to verify and determine the actual subsidy requirements and monitor the implementation of the subsidy regime in Nigeria.” The committee’s report, submitted in Apr, pointed to abuses on an enormous scale and massive overpayments in 2011. Against the appropriated sum of ₦245 billion (US$1.6 billion), the committee found effective subsidy payments amounting to ₦2,587 billion (US$16.7 billion). The number of eligible importers increased sharply from six in 2006 to 140 by 2011. Many transactions appeared suspect. However, a bribery allegation against Hon. Lawan led the executive branch to establish its own committee.

• Federal Ministry of Finance set up a committee in May to scrutinize the fuel subsidy payments in 2011. Headed by Aigboje Aig-Imoukhuede, a member of the Economic Management Team, the committee submitted a report in July, claiming that marketers and importers had committed 17 infractions at a cost of ₦423 billion (US$2.7 billion) in overpayments.

• Protests by marketers that they had not been invited by the technical committee to challenge the allegations prompted establishment in July of a Presidential Committee on Verification and Reconciliation of Subsidy Payments, also headed by Aig-Imoukhuede. This committee lowered the estimates of the overpayments to ₦382 billion (US$2.5 billion), indicting 25 companies. One of the committee’s recommendations was to verify shore tank certificates and records of sales proceeds.

• President Jonathan directed the committee to implement the above recommendation. The report submitted in Nov indicated that transactions of 50 companies, amounting to ₦232 billion (US$1.5 billion), had not been legitimate.

Information: PPPRA’s Web site posts the pricing template for gasoline and kerosene, indicating the magnitude of under-recoveries. The status of PSF after 2008 is difficult to find on PPPRA’s Web site, although it is available through Oct 2011.

(Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.)

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

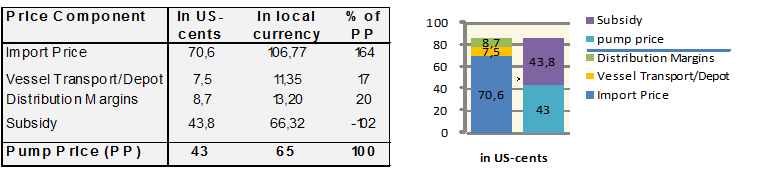

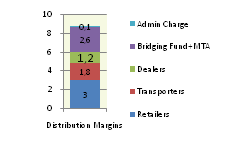

Fuel Price Composition

Price composition for one litre of Gasoline 95 Octane as of 2011/02/01.

(1 US$=151.28 NGN)

- „Vessel Transport/Depot“ costs include vessel financing costs (2.25NGN/litre), lightering costs (3.56 NGN/litre), a Nigerian Ports Authority duty (0,6 NGN/litre), the main depot („Jetty depot“) throughput charge (0,8 NGN/litre) and a main depot storage charge (3,00 NGN/litre).

- Diesel (referred to as „AGO“) is not subsidized. Therefore, expected diesel pump prices are about twice the price of gasoline.

- There is currently no taxation on diesel and gasoline.

Source: http://www.pppra-nigeria.org/pricingtemplate.asp

At a Glance

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Other Information | http://www.pppra-nigeria.org/index.asp |

| Price Composition | http://www.pppra-nigeria.org/pricingtemplate.asp |

| Pump prices and margins | http://www.pppra-nigeria.org/marketfundamentals.asp |

| Wholesale Prices | http://www.pppra-nigeria.org/marketfundamentals.asp |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices

The following coordinate was not recognized: {{#geocode: Nigeria|google }}.