Difference between revisions of "Debt Finance"

***** (***** | *****) (Created page with " <span style="background-color: rgb(255, 255, 255);">► Back to Financing & Funding Portal</span> = Overview = Debt financing comes in the ...") |

***** (***** | *****) m |

||

| (14 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| + | <span style="background-color: rgb(255, 255, 255)">[[Portal:Financing and Funding|► Back to Financing & Funding Portal]]</span> | ||

| − | |||

= Overview = | = Overview = | ||

| + | [[File:Capital structure pyramid.png|thumb|right|400pxpx|Capital structure pyramid]] | ||

| + | Debt financing comes in the form of loans and requires the repayment of both the principal sum borrowed and interest charged on that principal. Generally financial institutions will only provide debt finance to projects and project developers once the market is mature and therefore often need encouragement to enter the market. Debt finance can be provided to local finance institutions to allow them to on-lend to consumers, to project developers, or debt can be provided directly to a project developer. The debt must be repaid whatever the outcome of the project. <ref name="Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.">Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.</ref> | ||

| − | + | International funds dedicated to development projects such as are provided by '''Multilateral Development Banks (MDBs)''' will often create loans with generous repayment terms, low interest rates and flexible time-frames, such loans are called "soft-loans"<ref name="Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.">Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.</ref>.<br/>Investment and commercial banks can lend money against the assets of the project. In the event of defaulting on the loan the bank can have no other claims other than the assets of the project. This type of financing is based on long-term commercial loan contracts<ref name="Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.">Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.</ref>. However, if the project becomes insolvent then the existing assests is sold to generate cash and debt (bank and other lenders) have precedent over equity. This is because, banks and other lenders provide money for a fixed return (margin) and have no claim on further "upside" (profits) while equity takes greater risks (as payments are received only after all debt claims have been met) and thus there is an assumption that equity investors also receive the additional <span style="font-size: 13.6px; line-height: 20.4px; background-color: rgb(255, 255, 255)">"upside" (profits) if the project exceeds the expectation.<ref>Finace guide for policymakers (pg 16):fckLRhttp://www.bbhub.io/bnef/sites/4/2016/08/Finance-Guide-for-Policymakers-RE-GreenInfra-August-2016.pdf </ref></span> | |

| − | |||

| − | + | = Senior Debt = | |

| − | + | Senior debt provided from public sources, takes its place among the first creditors to be repaid from a project. It is primarily used to reduce the costs of the project, by providing concessionary funds that may be blended with more expensive commercial funding, and to offer longer-term debt than may be available in local financial markets. Long-term loans from public sources can also help establish credibility among private financiers for longer-term lending to RE projects. A wide variety of debt amortization and repayment schedules can be used, allowing tailoring of debt service costs to project cash flows. For example, a bullet (one-off) repayment of the loan principal may be made at the end of the loan term, reducing debt service costs in the initial years of the project<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.</ref>. | |

| − | + | A distinction can be made between direct loans to project companies and the provision of credit lines extended through '''commercial financing in- stitutions (CFIs)''' or other intermediaries. Credit lines can create incentives for intermediaries to extend their own loans to RET projects along- side that funded from the credit line as well as allowing blending of commercial and conces- sionary loans to reduce overall costs. The choice of intermediaries is discussed in chapter<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.</ref>. | |

<br/> | <br/> | ||

| − | {| | + | {| cellspacing="1" cellpadding="5" border="0" style="font-size: 13.63636302947998px; width: 100%" |

|- | |- | ||

| − | | colspan="3" style="text-align: center; background-color: rgb(79, 129, 189) | + | | colspan="3" style="text-align: center; background-color: rgb(79, 129, 189)" | <font color="#ffffff"><span style="line-height: 20.39583396911621px">'''Senior Debt'''</span></font> |

|- | |- | ||

| − | | style="background-color: rgb(219, 229, 241); text-align: center | + | | style="background-color: rgb(219, 229, 241); text-align: center" | '''Uses''' |

| − | | style="background-color: rgb(219, 229, 241); text-align: center | + | | style="background-color: rgb(219, 229, 241); text-align: center" | '''Advantages''' |

| − | | style="background-color: rgb(219, 229, 241); text-align: center | + | | style="background-color: rgb(219, 229, 241); text-align: center" | '''Disadvantages''' |

|- | |- | ||

| <div class="page" title="Page 36"><div class="layoutArea"><div class="column"><div class="page" title="Page 25"><div class="layoutArea"> | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"><div class="page" title="Page 25"><div class="layoutArea"> | ||

| Line 30: | Line 31: | ||

| <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | ||

*Obligation to repay creates incentives for project viability.<br/> | *Obligation to repay creates incentives for project viability.<br/> | ||

| − | *<span style="line-height: 1.5em | + | *<span style="line-height: 1.5em">Repayment of principal frees funds for further support to RET projects.</span><br/> |

| − | *<span style="line-height: 1.5em | + | *<span style="line-height: 1.5em"></span>Used as a means to increase CFI involve- ment in RET projects (through provision as credit lines). |

</div></div></div> | </div></div></div> | ||

| <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | ||

*Need for due diligence to verify ability of project to repay loan increases transaction costs.<br/> | *Need for due diligence to verify ability of project to repay loan increases transaction costs.<br/> | ||

| − | *<span style="line-height: 1.5em | + | *<span style="line-height: 1.5em">Leverage is limited and may crowd out potential private providers of debt.</span> |

</div></div></div> | </div></div></div> | ||

|- | |- | ||

| colspan="3" | | | colspan="3" | | ||

| − | ''<span style="font-size: 10.909090995788574px; line-height: 20.39583396911621px | + | ''<span style="font-size: 10.909090995788574px; line-height: 20.39583396911621px">Source: </span><span style="font-size: 10.909090995788574px; line-height: 18px">Adapted from The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds</span>''<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.</ref> |

|} | |} | ||

<div><br/></div><div><br/></div><div> | <div><br/></div><div><br/></div><div> | ||

| − | + | = Subordinated Debt / Mezzanine Finance = | |

| − | This type of lending sits between the top level of senior bank debt and the equity ownership of a project or company. Mezzanine loans take more risk than senior debt because regular repayments of the mezzanine loan are made after those for senior debt, however, the risk is less than equity ownership in the company. Mezzanine loans are usually of shorter duration and more expensive for borrowers, but pays a greater return to the lender (mezzanine debt may be provided by a bank or other financial institution). A RE project can seek mezzanine finance if the amount of bank debt it can access is insufficient: the mezzanine loan may be a cheaper way of replacing some of the additional equity that would be needed in that situation, and therefore can improve the cost of overall finance (and thus the rate of return for owners) <ref name="Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009.">Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. </ref>. | + | This type of lending sits between the top level of senior bank debt and the equity ownership of a project or company. Mezzanine loans take more risk than senior debt as because regular repayments of the mezzanine loan are made after those for senior debt, however, the risk is less than equity ownership in the company. Mezzanine loans are usually of shorter duration and more expensive for borrowers, but pays a greater return to the lender (mezzanine debt may be provided by a bank or other financial institution). A RE project can seek mezzanine finance if the amount of bank debt it can access is insufficient: the mezzanine loan may be a cheaper way of replacing some of the additional equity that would be needed in that situation, and therefore can improve the cost of overall finance (and thus the rate of return for owners)<ref name="Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009.">Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009. </ref><span style="line-height: 1.5em; font-size: 0.85em;">.</span> |

<br/> | <br/> | ||

<div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | ||

| − | {| | + | {| cellspacing="1" cellpadding="5" border="0" style="font-size: 13.63636302947998px; width: 100%" |

|- | |- | ||

| − | | colspan="3" style="text-align: center; background-color: rgb(79, 129, 189) | + | | colspan="3" style="text-align: center; background-color: rgb(79, 129, 189)" | <font color="#ffffff"><span style="line-height: 20.39583396911621px">'''Subordinated Debt / Mezzanine Finance'''</span></font> |

|- | |- | ||

| − | | style="background-color: rgb(219, 229, 241); text-align: center | + | | style="background-color: rgb(219, 229, 241); text-align: center" | '''Uses''' |

| − | | style="background-color: rgb(219, 229, 241); text-align: center | + | | style="background-color: rgb(219, 229, 241); text-align: center" | '''Advantages''' |

| − | | style="background-color: rgb(219, 229, 241); text-align: center | + | | style="background-color: rgb(219, 229, 241); text-align: center" | '''Disadvantages''' |

|- | |- | ||

| <div class="page" title="Page 36"><div class="layoutArea"><div class="column"><div class="page" title="Page 25"><div class="layoutArea"> | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"><div class="page" title="Page 25"><div class="layoutArea"> | ||

| − | * | + | *Provides intermediate funding between equity and senior debt, which helps reduce risks to senior lenders while not taking control away from project sponsors.<br/> |

| − | * | + | *By doing so, can extend the term and reduce costs of senior debt.<br/> |

</div></div></div></div></div> | </div></div></div></div></div> | ||

| <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | ||

*High level of leverage.<br/> | *High level of leverage.<br/> | ||

| − | *<span style="line-height: 1.5em | + | *<span style="line-height: 1.5em">Crowds in senior debt by allowing projects to meet acceptable risk criteria for lenders.</span> |

</div></div></div> | </div></div></div> | ||

| <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | | <div class="page" title="Page 36"><div class="layoutArea"><div class="column"> | ||

*It is generally custom designed for each project, implying high transaction costs.<br/> | *It is generally custom designed for each project, implying high transaction costs.<br/> | ||

| − | *<span style="line-height: 1.5em | + | *<span style="line-height: 1.5em">Significant risk transferred to public financ- ing agencies, but with only limited ability to control these risks.</span> |

</div></div></div> | </div></div></div> | ||

|- | |- | ||

| colspan="3" | | | colspan="3" | | ||

| − | ''<span style="font-size: 10.909090995788574px; line-height: 20.39583396911621px | + | ''<span style="font-size: 10.909090995788574px; line-height: 20.39583396911621px">Source: </span><span style="font-size: 10.909090995788574px; line-height: 18px">Adapted from The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds</span>''<ref name="The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.">The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.</ref><br/> |

|} | |} | ||

| Line 77: | Line 78: | ||

<br/> | <br/> | ||

<div><div class="page" title="Page 36"><div class="layoutArea"></div></div></div></div> | <div><div class="page" title="Page 36"><div class="layoutArea"></div></div></div></div> | ||

| + | |||

| + | |||

| + | |||

| + | = Equity = | ||

| + | |||

| + | Companies usually use debt to fund working capital and need equity throughout the lifecycle. | ||

| + | |||

| + | There are three equity based financing options for the off-grid sector: common stock, preferred stock and equity crowdfunding. | ||

| + | |||

| + | #Common stock: it is usually issued to founders and key employees during the early stages of the company to incentize performance, compensate for low earning and retain key staffs. | ||

| + | #Preferred stock: it is usually issued to later stage equity investors such as angels, venture captial firms and impact investment funds. They receive proceeds before common stakeholdres and have rights such as boad seats, voting rights and right to information. | ||

| + | #Equity crowdfunding: allows the sale of registered securities of usually early-stage firms<ref name="The The World Bank, 2020.Funding the Sun : New Paradigms for Financing Off-Grid Solar Companies- https://energypedia.info/wiki/Publication_-_Funding_the_Sun_:_New_Paradigms_for_Financing_Off-Grid_Solar_Companies_(English)">The World Bank, 2020. Funding the Sun : New Paradigms for Financing Off-Grid Solar Companies- https://energypedia.info/wiki/Publication_-_Funding_the_Sun_:_New_Paradigms_for_Financing_Off-Grid_Solar_Companies_(English)</ref>. | ||

| + | |||

| + | |||

= Further Information = | = Further Information = | ||

| − | *<br/> | + | *[[Debt Instruments|Debt Instruments]] |

| + | *[[Portal:Financing and Funding|Financing and Funding Portal on energypedia]] | ||

| + | *[[An Overview on Micro Hydro Debt Fund|An Overview on Micro Hydro Debt Fund - Nepal]] | ||

| + | *[[Financial Instruments & Support for Renewable Energy|Financial Instruments & Support for Renewable Energy]]<br/> | ||

<div><br/></div> | <div><br/></div> | ||

| + | |||

| + | |||

= References = | = References = | ||

<div><references /><br/></div> | <div><references /><br/></div> | ||

[[Category:Financing_and_Funding]] | [[Category:Financing_and_Funding]] | ||

Latest revision as of 08:24, 11 May 2020

► Back to Financing & Funding Portal

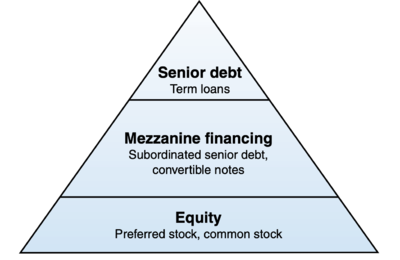

Overview

Debt financing comes in the form of loans and requires the repayment of both the principal sum borrowed and interest charged on that principal. Generally financial institutions will only provide debt finance to projects and project developers once the market is mature and therefore often need encouragement to enter the market. Debt finance can be provided to local finance institutions to allow them to on-lend to consumers, to project developers, or debt can be provided directly to a project developer. The debt must be repaid whatever the outcome of the project. [1]

International funds dedicated to development projects such as are provided by Multilateral Development Banks (MDBs) will often create loans with generous repayment terms, low interest rates and flexible time-frames, such loans are called "soft-loans"[1].

Investment and commercial banks can lend money against the assets of the project. In the event of defaulting on the loan the bank can have no other claims other than the assets of the project. This type of financing is based on long-term commercial loan contracts[1]. However, if the project becomes insolvent then the existing assests is sold to generate cash and debt (bank and other lenders) have precedent over equity. This is because, banks and other lenders provide money for a fixed return (margin) and have no claim on further "upside" (profits) while equity takes greater risks (as payments are received only after all debt claims have been met) and thus there is an assumption that equity investors also receive the additional "upside" (profits) if the project exceeds the expectation.[2]

Senior Debt

Senior debt provided from public sources, takes its place among the first creditors to be repaid from a project. It is primarily used to reduce the costs of the project, by providing concessionary funds that may be blended with more expensive commercial funding, and to offer longer-term debt than may be available in local financial markets. Long-term loans from public sources can also help establish credibility among private financiers for longer-term lending to RE projects. A wide variety of debt amortization and repayment schedules can be used, allowing tailoring of debt service costs to project cash flows. For example, a bullet (one-off) repayment of the loan principal may be made at the end of the loan term, reducing debt service costs in the initial years of the project[3].

A distinction can be made between direct loans to project companies and the provision of credit lines extended through commercial financing in- stitutions (CFIs) or other intermediaries. Credit lines can create incentives for intermediaries to extend their own loans to RET projects along- side that funded from the credit line as well as allowing blending of commercial and conces- sionary loans to reduce overall costs. The choice of intermediaries is discussed in chapter[3].

| Senior Debt | ||

| Uses | Advantages | Disadvantages |

|

|

|

|

Source: Adapted from The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds[3] | ||

Subordinated Debt / Mezzanine Finance

This type of lending sits between the top level of senior bank debt and the equity ownership of a project or company. Mezzanine loans take more risk than senior debt as because regular repayments of the mezzanine loan are made after those for senior debt, however, the risk is less than equity ownership in the company. Mezzanine loans are usually of shorter duration and more expensive for borrowers, but pays a greater return to the lender (mezzanine debt may be provided by a bank or other financial institution). A RE project can seek mezzanine finance if the amount of bank debt it can access is insufficient: the mezzanine loan may be a cheaper way of replacing some of the additional equity that would be needed in that situation, and therefore can improve the cost of overall finance (and thus the rate of return for owners)[4].

| Subordinated Debt / Mezzanine Finance | ||

| Uses | Advantages | Disadvantages |

|

|

|

|

Source: Adapted from The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds[3] | ||

Equity

Companies usually use debt to fund working capital and need equity throughout the lifecycle.

There are three equity based financing options for the off-grid sector: common stock, preferred stock and equity crowdfunding.

- Common stock: it is usually issued to founders and key employees during the early stages of the company to incentize performance, compensate for low earning and retain key staffs.

- Preferred stock: it is usually issued to later stage equity investors such as angels, venture captial firms and impact investment funds. They receive proceeds before common stakeholdres and have rights such as boad seats, voting rights and right to information.

- Equity crowdfunding: allows the sale of registered securities of usually early-stage firms[5].

Further Information

- Debt Instruments

- Financing and Funding Portal on energypedia

- An Overview on Micro Hydro Debt Fund - Nepal

- Financial Instruments & Support for Renewable Energy

References

- ↑ 1.0 1.1 1.2 Wade, H. (2005). Financing Mechanisms for Renewable Energy Development in the Pacific Islands.

- ↑ Finace guide for policymakers (pg 16):fckLRhttp://www.bbhub.io/bnef/sites/4/2016/08/Finance-Guide-for-Policymakers-RE-GreenInfra-August-2016.pdf

- ↑ 3.0 3.1 3.2 3.3 The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.

- ↑ Justice, S., Hamilton, K., Sonntag-O’Brien, V., UNEP Sustainable Energy Finance Initiative., Liebreich, M., Greenwood, C., & Bloomberg New Energy Finance. Private Financing of Renewable Energy - A Guide for Policymakers. 2009.

- ↑ The World Bank, 2020. Funding the Sun : New Paradigms for Financing Off-Grid Solar Companies- https://energypedia.info/wiki/Publication_-_Funding_the_Sun_:_New_Paradigms_for_Financing_Off-Grid_Solar_Companies_(English)