Difference between revisions of "Risks in Energy Access Projects"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 407: | Line 407: | ||

| style="width:268px; height:17px" | | | style="width:268px; height:17px" | | ||

*Internal liquidity facilities to advance or support payments to bridge short-term cash flow problems (i.e.: debt service reserve accounts, excess spread accounts, over-collateralisation, contingent equity). | *Internal liquidity facilities to advance or support payments to bridge short-term cash flow problems (i.e.: debt service reserve accounts, excess spread accounts, over-collateralisation, contingent equity). | ||

| − | *External liquidity facilities provide a short-term letter of credit or credit line without additional cash requirements (i.e. Regional Liquidity Support Facility (RLSF) established in partnership between KfW, Africa Trade | + | *External liquidity facilities provide a short-term letter of credit or credit line without additional cash requirements (i.e. Regional Liquidity Support Facility (RLSF) established in partnership between KfW, Africa Trade Insurance Agency and IRENA in sub-Saharan Africa). |

*Liquidity guarantee to lenghten loans.<br/> | *Liquidity guarantee to lenghten loans.<br/> | ||

*Put options to refinance ensuring long-term lending for borrowers. | *Put options to refinance ensuring long-term lending for borrowers. | ||

| Line 569: | Line 569: | ||

According to the [https://www.ruralelec.org/sites/default/files/risk_management_for_mini-grids_2015_final_web_0.pdf Risk Management Approach Guide] developed by Manetsgruber et al. (2015)<ref>Menetsgruber</ref><ref>Manetsgruber et al. (2015)</ref>, there are four general risk management levels that can be developed after analysing the data contained in a risk map which can serve to identify primary strategies to address each risk. These primary strategies can be considered as a first solution that could be adjusted or replaced if necessary over the life cycle of a project. The different strategies can derive from the risk map itself in relation to the impact magnitude and probability, according to these levels: | According to the [https://www.ruralelec.org/sites/default/files/risk_management_for_mini-grids_2015_final_web_0.pdf Risk Management Approach Guide] developed by Manetsgruber et al. (2015)<ref>Menetsgruber</ref><ref>Manetsgruber et al. (2015)</ref>, there are four general risk management levels that can be developed after analysing the data contained in a risk map which can serve to identify primary strategies to address each risk. These primary strategies can be considered as a first solution that could be adjusted or replaced if necessary over the life cycle of a project. The different strategies can derive from the risk map itself in relation to the impact magnitude and probability, according to these levels: | ||

| − | '''Risk tolerance:''' these type of risks occur rarely and have a low negative impact, the project should be aware of them but there is no need of further action, though these need to be observed and re-assessed if necessary. | + | *'''Risk tolerance:''' these type of risks occur rarely and have a low negative impact, the project should be aware of them but there is no need of further action, though these need to be observed and re-assessed if necessary. |

| − | + | *'''Risk transfer:''' these risks have a high impact potential and low probability of occurrence, therefore these should be transferred to or covered by a willing third party as they can cause significant harm to the project. | |

| − | '''Risk transfer:''' these risks have a high impact potential and low probability of occurrence, therefore these should be transferred to or covered by a willing third party as they can cause significant harm to the project. | + | *'''Risk reduction:''' risks have a high probability of occurrence and low impact, resource buffers or emergency measures con be applied to reduce the possibility of it to occur. Likewise, measures like specific operation practices, training and technology upgrades to deflect or prevent the threats of the risks. |

| − | + | *'''Risk avoidance:''' these risks require actions to mitigate them to decrease the probability of occurrence. | |

| − | '''Risk reduction:''' risks have a high probability of occurrence and low impact, resource buffers or emergency measures con be applied to reduce the possibility of it to occur. Likewise, measures like specific operation practices, training and technology upgrades to deflect or prevent the threats of the risks. | ||

| − | |||

| − | '''Risk avoidance:''' these risks require actions to mitigate them to decrease the probability of occurrence. | ||

</div> | </div> | ||

<br/> | <br/> | ||

Revision as of 12:45, 2 March 2017

Overview

Mini-grids and stand-alone systems play an important role when facilitating energy access in developing countries with improved technology. However there are potential risks to be considered in spite of the financing scheme applied and the type of technology. Painuly (2001)[1] in Hazelton et al. (2015)[2] states that unawareness and misinterpretation of risks (and benefits) are a major barrier for technology adoption.

De-risking approach during project preparation

Not well-prepared projects reduce their chances of receiving funding and miss important opportunities. For instance, governments usually do not invest in project preparation except if there is a chance of attracting funding. A SE4All report about scaling-up finance for sustainable energy investments of SE4All identifies among the key factors challenging proper project preparation:

- Lack of adequate project preparation funding for all phases of preparation.

- Lack of capacity to prepare good quality projects.

- Absence of institutional vehicle for project preparation.

A de-risking approach consists of a series of activities to reduce the occurrence of risks or their influence at any point in a project's life. This is also known as 'Risk-management', and its fundamentals are the process of identifying risks, analysing them, determining the degree of tolerance and consequently accepting or designating mitigation or control actions. During the project preparation it is required a sound project structure to reduce uncertainties and allocate risks. However in many instances during the preparation, the focus is on some phases of the project cycle, rather than on all, neglecting the earlier stages. This could lead to an inadequate risk management and consequently to an unsuccessful and unsustainable project.

An appropriate project preparation should include a range of activities and outputs across the entire project cycle, an example of a governmental project preparation is presented in the SE4All report:

Project cycle phases |

Processes |

Detailed activities |

Examples of required outputs |

|

Early stage Concept development |

Project identification and concept development |

Sector planning, project identification and screening |

Sector policy papers Project concept notes Prefeasibility reports |

|

Establishing the enabling environment |

Identifying legal/ regulatory/ institutional and other impediments and rectifying them |

Laws Regulations Allocation of responsibilities | |

|

Mid to late stage Feasibility, structuring and transacting |

Due diligence |

Detailed financial, legal, engineering, environmental and social appraisals |

Reports that validate and develop concept further |

|

Project structuring |

Detailed financial and legal structuring |

Financial models Legal documentation | |

|

Marketing |

Promotion of the project and assessment of private sector interest |

Detailed project description/ information memorandum Road shows/ conferences | |

|

Transacting |

Procuring and negotiating project documentation |

Bid documentation Signed, negotiated project documentation |

Source: Infrastructure Consortium for Africa, Assessment of Project Preparation Facilities for Africa (2012) in SE4All, Scaling Up Finance for Sustainable Energy Investments (2015) p.44

Probable risks and suggestions for mitigation & control

There is a wide range of risks that could threaten the development, implementation and operation of energy projects. Some of the risks may ‘only being seen’ by investors while developers and owner-operators are aware of other risks, nevertheless it is important to address them holistically, ideally from the early phase of a project and on. The following table summarizes some of the risks identified based on existing projects and lessons learned from the literature review. It also includes suggestions on how risks can be minimized, mitigated or controlled during the life cycle of a project and by different actors.

Many of the listed risks might be context specific therefore do not refer to any specific technological solution per se, as the listing provides a synopsis of common risks across, mainly, renewable technology, withoutanalysing the interdependencies and relationships among risks.Moreover, some risks may correspond to more than one categories, though the information has been arranged in this order within six categories to facilitate a better overview. In addition, this article is open for further contributions.

Table 2: Probable risks and suggestions for mitigation & control

Technical risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Poor estimation of load size, growth and schedule, could derive in under- or oversized systems. This can lead to increased investment/running cost, lower efficiency, and unreliable supply. Overestimated efficiency. |

| |

|

Power quality[2] |

Integrating PV and batteries, in retrofits on existing systems, may affect the stability of the grid due to incompatibilities and an ineffective control system. |

|

|

Equipment failure/ Downtime[2] |

Premature failure of hardware can not only cause service interruption but damage the entire system. In addition, despite existing warranties, these can be hard to fulfil due to the remoteness where they system is located. |

|

|

Hardware compatibility issues[2] |

Proprietary protocols could provoke incompatibility between components. |

|

|

Limitation for continuous supply/storage[2] |

Batteries have a limited life-span and are vulnerable to be misused, this impacts on the energy balance and supply affecting the operation of generators (specific for hybrid systems). |

|

|

Familiarity with the technology[2] |

Difficulty to operate and maintain, complexity of maintenance, limited knowledge on maintenance issues. |

|

|

Future connectivity[2] |

Interim solutions, such as mini-grids, would ideally be connected to the main grid if it becomes available, otherwise it becomes obsolete. |

|

|

Incorrect installation and operation of hardware, combined with the remoteness where the technology is installed. |

| |

|

Building and testing[5] |

Property damage or third-party liability arising from mishaps during building or testing. |

|

Institutional/ Organizational risks | ||

| Risk |

Risk description | Risk mitigation/ control mechanism |

|

Stakeholder management[2] |

Multiple parties involved whose activities, incentives, will not align between parties, causing negative outcomes. |

|

|

Operational[4] |

Administration errors or fraud. |

|

|

Geographical isolation[2] |

Difficulties to acquire spare parts and/or repair due to long distances, transportation challenges and lack of skilled personnel in the area. |

|

Geo-political risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Change in public policy[4] |

Increase in taxes levied on technology or import and export duties. Subsidies affecting operation and/or profitability. |

|

|

Political instability |

Unrest, social conflicts, war. |

|

|

Delays in approvals |

Arbitrary actions of public authorities can affect the development of any energy access project. |

|

|

Arrival of the national grid |

Investment’s payback and further cash flows could be in danger or threatened. |

|

Financial and economic risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Commitment, competence and credit worthiness of investors[6] |

Large level of investment/ long tenor of return, may require additional equity later after project has begun. |

|

|

Inadequate business models[2] |

Effective business models are key for deployment and may need to be continuously revised to scale up. |

|

|

Diesel and cost supply[2] |

Although the use is reduced (hybrid systems), prices and availability impact the operation of the system. |

|

|

Exchange rates/ Inflation[6] |

Foreign exchange rate changes due to devaluation, convertibility or transfer restrictions. |

|

|

Credit[6] |

Risk of default of counterparties or default on specific payments. |

|

|

Liquidity and refinancing[7] |

Liquidity risks arising from revenue shortfalls or mismatches between the timing of cash receipts and payments. At the same time borrowers might be unable to refinance an outstanding loan due to inadequate loan terms or the maturity of the loan is mismatched with the lifetime of the project. |

|

Social risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Public resistance[4] |

Resistance of interest groups because statics, water supply, smell (biogas), etc. |

|

|

Community/social integration[2] |

Over-consumption from one or few users can cause a black-out. Theft or users connecting loads beyond their quota. |

|

|

Rural customers usually have low incomes which is challenging when setting a price that is both sufficiently high to give returns and low enough to make it affordable. |

| |

|

Operators and end users’ safety[2] |

Risks of harm due to higher voltages and extensive wiring. |

|

|

Theft and vandalism[4] |

Components or other valuable materials for which there is a secondary market, are in danger of being stolen. |

|

Environmental risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Environmental |

Harm to the environment caused by operating the technology may affect planning & permitting. |

|

|

Weather-related /availability[4] |

Risk of fall in volume of electricity produced owing to lack of wind, sunshine, water flow/low rainfall, biomass availability.

|

|

|

Force majeure[4] |

Environmental disaster like severe storms, typhoons, sandstorms, volcanic eruption, earth quakes, mud slides, etc. |

|

Source: Own elaboration based on literature review

Once projects are aware of the different risks they could face, it is important to consider that to address all risks might be too expensive in terms of time and resource. For this reason it is important to prioritize risks, this can be done effectively using risk-management tools, which can later lead to decide appropriate measures.

Risk management

The optimum for a project is to reach a level of risk consciousness that can lead to elaborate effective and efficient mitigation strategies. Therefore risk management needs to be understood as a dynamic process, in which it should try to include the ideas and insights from different perspectives (investors, operators, users, etc.), especially during the risk identification.

Figure 1: Risk management main steps

Source: Own elaboration based on FEMA (2017)[8] and Manetsgruber (2015)[9]

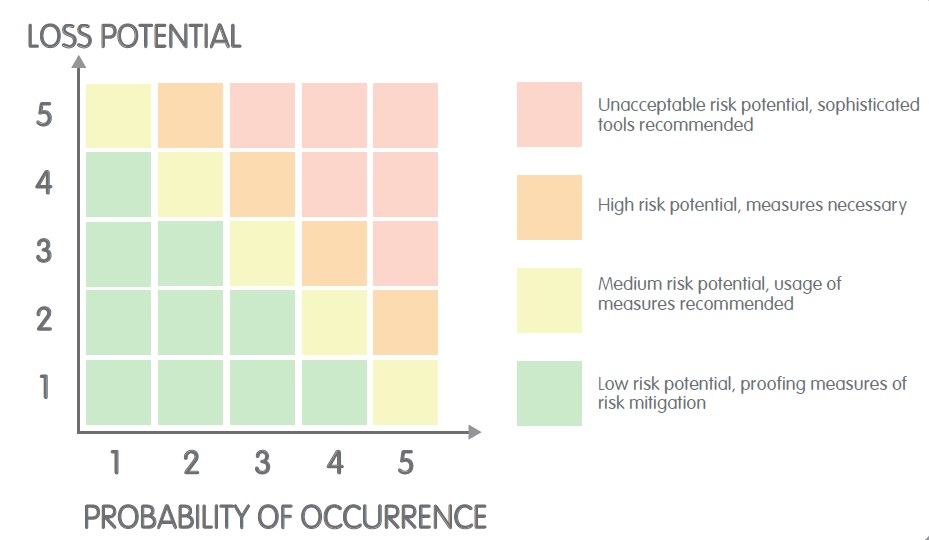

This first step will result in an overview of all risks associated to different aspects in a project (i.e. the categories considered in Table 2). Every risk should be assessed according to the magnitude of its impact potential and the probability of it to happen. A common and widely used risk management tool to visualise the impact of individual risks is a risk map as shown in Figure 2.

Figure 2: Risk map with different colors indicating levels of importance

Source: Manetsgruber et al. (2015)

The colour differentiation in a risk map indicates the level of importance of each risk. As mentioned, the risk management is an iterative process and a risk map can be used to better understand the current risk situation at a particular moment in time, it also represents the outcome or risk mitigation interventions. Being aware of the risks does not necessarily mean to address each of the risks. Prioritization of risks can be done effectively using this risk impact/ probability chart in which the risks are assessed in two dimensions:

- Probability - to probability of a risk to occur

- Impact (Loss potential) - the size of the impact varies in terms of differnt factors (i.e. costs)

Considering both dimensions, there are four possible levels where the risks can be placed[10]:

- Low impact/ Low probability - risks at the bottom left corner are low level, these can be often ignored.

- Low impact/ High probability - risks in the top left corner are of moderate importance, the project should reduce the likelihood of these to occur.

- High impact/ low probability - risks in the bottom right corner are of high importance, but they are unlikely to happen.Contingency plans should be in place.

- High impact/ high probability - risks located at the top right corner are critical and should be a top priority for the project.

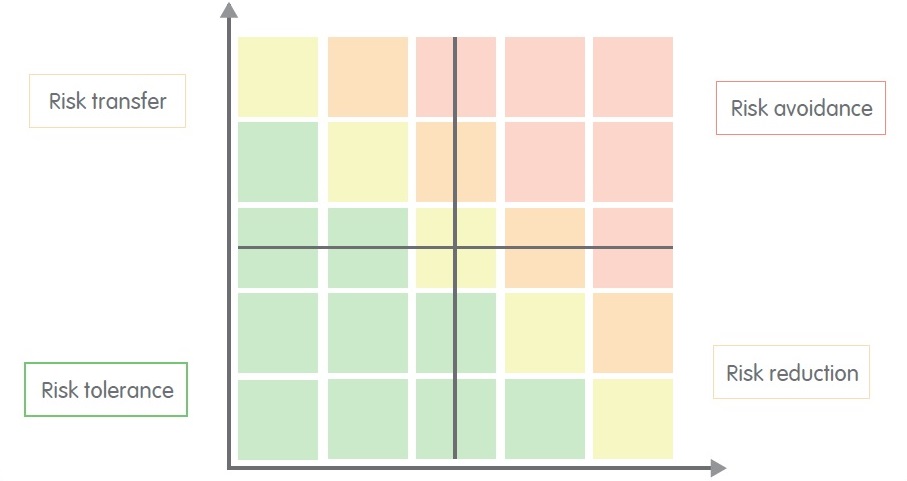

According to the Risk Management Approach Guide developed by Manetsgruber et al. (2015)[11][12], there are four general risk management levels that can be developed after analysing the data contained in a risk map which can serve to identify primary strategies to address each risk. These primary strategies can be considered as a first solution that could be adjusted or replaced if necessary over the life cycle of a project. The different strategies can derive from the risk map itself in relation to the impact magnitude and probability, according to these levels:

- Risk tolerance: these type of risks occur rarely and have a low negative impact, the project should be aware of them but there is no need of further action, though these need to be observed and re-assessed if necessary.

- Risk transfer: these risks have a high impact potential and low probability of occurrence, therefore these should be transferred to or covered by a willing third party as they can cause significant harm to the project.

- Risk reduction: risks have a high probability of occurrence and low impact, resource buffers or emergency measures con be applied to reduce the possibility of it to occur. Likewise, measures like specific operation practices, training and technology upgrades to deflect or prevent the threats of the risks.

- Risk avoidance: these risks require actions to mitigate them to decrease the probability of occurrence.

Source: Manetsgruber et al. (2015)

Best practices

References

- ↑ Painuly, Jyoti Prasad, ‘Barriers to renewable energy penetration; a framework for analysis’, Renewable Energy 24, 2001. http://www1.upme.gov.co/SGIC/sites/default/files/Barriers%20to%20renewable%20energy%20penetration.pdf

- ↑ 2.00 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.10 2.11 2.12 2.13 2.14 2.15 Hazelton, James; Bruce, Anna; MacGill Iain, ‘A review of the potential benefits and risks of photovoltaic hybrid mini-grid systems’, Renewable Energy 67, 2013. https://www.researchgate.net/publication/259298363_A_review_of_the_potential_benefits_and_risks_of_photovoltaic_hybrid_mini-grid_systems Cite error: Invalid

<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content - ↑ SE4All Advisory Board's Finance Committee, 'Scaling Up FInance for Sustainable Energy Investments, 2015. http://www.se4all.org/sites/default/files/SE4All-Advisory-Board-Finance-Committee-Report.pdf

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 4.6 4.7 4.8 Manetsgruber, David; Wagemann, Bernanrd; Kondev, Bozhil; Dziergwa, Katrin. Risk Management for Mini-Grids: A new approach to guide mini-grid development. 2015. https://www.ruralelec.org/sites/default/files/risk_management_for_mini-grids_2015_final_web_0.pdf Cite error: Invalid

<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content - ↑ The Economist, ‘Managing the risk in renewable energy’, 2011 https://www.altran.de/fileadmin/medias/DE.altran.de/documents/Fachartikel/Managing-The-Risk-In-Renewable-Energy.pdf

- ↑ 6.0 6.1 6.2 Green Rhino Energy, ‘Project Risk Matrix’, 2013, http://www.greenrhinoenergy.com/finance/renewable/risks.php Cite error: Invalid

<ref>tag; name "Green (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Green (2013)" defined multiple times with different content - ↑ IRENA, ‘Unlocking renewable energy investment: the role of risk mitigation and structured finance’, 2016, https://www.irena.org/DocumentDownloads/Publications/IRENA_Risk_Mitigation_and_Structured_Finance_2016.pdf

- ↑ FEMA

- ↑ Manetsgruber (2015)

- ↑ Mind Tools, 'Risk Impact/ Probability Chart', 2017. https://www.mindtools.com/pages/article/newPPM_78.htm

- ↑ Menetsgruber

- ↑ Manetsgruber et al. (2015)