Difference between revisions of "Risks in Energy Access Projects"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 128: | Line 128: | ||

<br/> | <br/> | ||

| − | = Probable | + | = Probable Risks and Suggestions for Mitigation & Control = |

There is a wide range of risks that could threaten the development, implementation and operation of energy projects. Some of the risks may ‘only being seen’ by investors, while developers and owner-operators are aware of other risks. Nevertheless it is important to address them holistically, ideally from the early phase on. The following table summarizes some of the risks identified in the literature review based on existing projects and lessons learned. It also includes suggestions on how risks can be minimized, mitigated or controlled during the life cycle of a project and by different actors.<br/>Many of the listed risks might be context specific therefore do not refer to any specific technological solution per se; the listing provides a synopsis of common risks across, mainly, renewable technology, without analysing the interdependencies and relationships among risks. Moreover, some risks may correspond to more than one category, though the information has been arranged in this order (within six categories) to facilitate a better overview.<br/>In addition, this article is open for further contributions. | There is a wide range of risks that could threaten the development, implementation and operation of energy projects. Some of the risks may ‘only being seen’ by investors, while developers and owner-operators are aware of other risks. Nevertheless it is important to address them holistically, ideally from the early phase on. The following table summarizes some of the risks identified in the literature review based on existing projects and lessons learned. It also includes suggestions on how risks can be minimized, mitigated or controlled during the life cycle of a project and by different actors.<br/>Many of the listed risks might be context specific therefore do not refer to any specific technological solution per se; the listing provides a synopsis of common risks across, mainly, renewable technology, without analysing the interdependencies and relationships among risks. Moreover, some risks may correspond to more than one category, though the information has been arranged in this order (within six categories) to facilitate a better overview.<br/>In addition, this article is open for further contributions. | ||

| Line 548: | Line 548: | ||

<br/> | <br/> | ||

| − | = Risk | + | = Risk Management = |

<div> | <div> | ||

The optimum for a project is to reach a level of risk consciousness that can lead to elaborate effective and efficient mitigation strategies. Therefore risk management needs to be understood as a dynamic process, which should strive to include the ideas and insights from the different the different stakeholders involved in a project (investors, operators, users, etc.), especially during the risk identification.<br/> | The optimum for a project is to reach a level of risk consciousness that can lead to elaborate effective and efficient mitigation strategies. Therefore risk management needs to be understood as a dynamic process, which should strive to include the ideas and insights from the different the different stakeholders involved in a project (investors, operators, users, etc.), especially during the risk identification.<br/> | ||

Revision as of 13:35, 8 March 2017

Overview

Mini-grids and stand-alone systems play an important role when facilitating energy access in developing countries. However, despite the financing scheme and the type of technology applied, there are potential risks to be considered.

Painuly (2001)[1] in Hazelton et al. (2015)[2] states that unawareness and misinterpretation of risks (and benefits) are a major barrier for technology adoption.

Therefore a de-risking approach along the entire life cycle of a project is necessary in order to ensure its success and sustainability.

This article includes:

- An example of activities that can be carried out during a projects’ preparation as guidance on how to be aware of risks.

- An extensive list of risks organized in six sub-categories based on literature review and field experience in monitoring. For most of the risks there are suggestions on how to minimize, mitigate or controll them during the life cycle of a project.

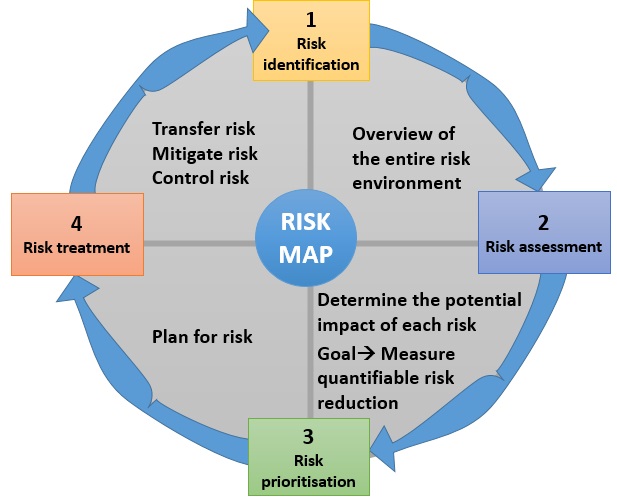

- The four main steps of risk management are presented in a graph that encapsulates the essentials of this iterative process. In addition, there is an explanation on how to prioritize risks according to the dimensions of their probability to occur and their impact potential.

- At the end the reader can consider revising some experiences applying de-risking approaches for rural electrification projects (mini-grids and hydro), as well as further reading about risks management for renewable energy systems.

De-risking Approach During Project Preparation

Not well-prepared projects reduce their chances of receiving funding and miss important opportunities. For example, governments usually do not invest in project preparation except if there is a chance of attracting funding. A report about scaling-up finance for sustainable energy investments of SE4All identifies as key factors that challenge project preparation:

- Lack of adequate project preparation funding for all phases of preparation.

- Lack of capacity to prepare good quality projects.

- Absence of institutional vehicle for project preparation.

In this sense, for a successful project preparation it is important to list all possible risks associated to the project. During any project preparation it is required a sound project structure to reduce uncertainties and allocate risks. However, often the focus is on some phases of the project cycle, rather than on all, often neglecting the earlier stages. This could later lead to an inadequate risk oversight and consequently to an unsuccessful and unsustainable project. Applying a de-risking approach consists of a series of activities to reduce the occurrence of risks or their influence at any point in a project's life. This is also known as 'Risk-management', and its fundamentals are the process of identifying risks, analysing them, determining the degree of tolerance and consequently accepting or designating mitigation or control actions.

An appropriate project preparation should include a range of activities and outputs across the entire project cycle, an example of a governmental project preparation is presented in the SE4All report:

Project cycle phases |

Processes |

Detailed activities |

Examples of required outputs |

|

Early stage Concept development |

Project identification and concept development |

Sector planning, project identification and screening |

Sector policy papers Project concept notes Prefeasibility reports |

|

Establishing the enabling environment |

Identifying legal/ regulatory/ institutional and other impediments and rectifying them |

Laws Regulations Allocation of responsibilities | |

|

Mid to late stage Feasibility, structuring and transacting |

Due diligence |

Detailed financial, legal, engineering, environmental and social appraisals |

Reports that validate and develop concept further |

|

Project structuring |

Detailed financial and legal structuring |

Financial models Legal documentation | |

|

Marketing |

Promotion of the project and assessment of private sector interest |

Detailed project description/ information memorandum Road shows/ conferences | |

|

Transacting |

Procuring and negotiating project documentation |

Bid documentation Signed, negotiated project documentation |

Source: Infrastructure Consortium for Africa, Assessment of Project Preparation Facilities for Africa (2012) in SE4All, Scaling Up Finance for Sustainable Energy Investments (2015)

Probable Risks and Suggestions for Mitigation & Control

There is a wide range of risks that could threaten the development, implementation and operation of energy projects. Some of the risks may ‘only being seen’ by investors, while developers and owner-operators are aware of other risks. Nevertheless it is important to address them holistically, ideally from the early phase on. The following table summarizes some of the risks identified in the literature review based on existing projects and lessons learned. It also includes suggestions on how risks can be minimized, mitigated or controlled during the life cycle of a project and by different actors.

Many of the listed risks might be context specific therefore do not refer to any specific technological solution per se; the listing provides a synopsis of common risks across, mainly, renewable technology, without analysing the interdependencies and relationships among risks. Moreover, some risks may correspond to more than one category, though the information has been arranged in this order (within six categories) to facilitate a better overview.

In addition, this article is open for further contributions.

Table 2: Probable risks and suggestions for mitigation and control

Technical risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Poor estimation of load size, growth and schedule, could derive in under- or oversized systems. This can lead to increased investment/running cost, lower efficiency, and unreliable supply. Overestimated efficiency. |

| |

|

Power quality[2] |

Integrating PV and batteries, in retrofits on existing systems, may affect the stability of the grid due to incompatibilities and an ineffective control system. |

|

|

Equipment failure/ Downtime[2] |

Premature failure of hardware can not only cause service interruption but damage the entire system. In addition, despite existing warranties, these can be hard to fulfil due to the remoteness where they system is located. |

|

|

Hardware compatibility issues[2] |

Proprietary protocols could provoke incompatibility between components. |

|

|

Limitation for continuous supply/storage[2] |

Batteries have a limited life-span and are vulnerable to be misused, this impacts on the energy balance and supply affecting the operation of generators (specific for hybrid systems). |

|

|

Familiarity with the technology[2] |

Difficulty to operate and maintain, complexity of maintenance, limited knowledge on maintenance issues. |

|

|

Future connectivity[2] |

Interim solutions, such as mini-grids, would ideally be connected to the main grid if it becomes available, otherwise it becomes obsolete. |

|

|

Incorrect installation and operation of hardware, combined with the remoteness where the technology is installed. |

| |

|

Building and testing[5] |

Property damage or third-party liability arising from mishaps during building or testing. |

|

Institutional/ Organizational risks | ||

| Risk |

Risk description | Risk mitigation/ control mechanism |

|

Stakeholder management[2] |

Multiple parties involved whose activities, incentives, will not align between parties, causing negative outcomes. |

|

|

Operational[4] |

Administration errors or fraud. |

|

|

Geographical isolation[2] |

Difficulties to acquire spare parts and/or repair due to long distances, transportation challenges and lack of skilled personnel in the area. |

|

Geo-political risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Change in public policy[4] |

Increase in taxes levied on technology or import and export duties. Subsidies affecting operation and/or profitability. |

|

|

Political instability |

Unrest, social conflicts, war. |

|

|

Delays in approvals |

Arbitrary actions of public authorities can affect the development of any energy access project. |

|

|

Arrival of the national grid |

Investment’s payback and further cash flows could be in danger or threatened. |

|

Financial and economic risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Commitment, competence and credit worthiness of investors[6] |

Large level of investment/ long tenor of return, may require additional equity later after project has begun. |

|

|

Inadequate business models[2] |

Effective business models are key for deployment and may need to be continuously revised to scale up. |

|

|

Diesel and cost supply[2] |

Although the use is reduced (hybrid systems), prices and availability impact the operation of the system. |

|

|

Exchange rates/ Inflation[6] |

Foreign exchange rate changes due to devaluation, convertibility or transfer restrictions. |

|

|

Credit[6] |

Risk of default of counterparties or default on specific payments. |

|

|

Liquidity and refinancing[7] |

Liquidity risks arising from revenue shortfalls or mismatches between the timing of cash receipts and payments. At the same time borrowers might be unable to refinance an outstanding loan due to inadequate loan terms or the maturity of the loan is mismatched with the lifetime of the project. |

|

Social risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Public resistance[4] |

Resistance of interest groups because of visual aesthetics, water supply, smell (biogas), etc. |

|

|

Community/ social integration[2] |

Over-consumption from one or few users can cause a black-out. Theft or users connecting loads beyond their quota. |

|

|

Rural customers usually have low incomes which is challenging when setting a price that is both sufficiently high to give returns and low enough to make it affordable. |

| |

|

Operators and end users’ safety[2] |

Risks of harm due to higher voltages and extensive wiring. |

|

|

Theft and vandalism[4] |

Components or other valuable materials, for which there is a secondary market, are in danger of being stolen. |

|

Environmental risks | ||

| Risk | Risk description | Risk mitigation/ control mechanism |

|

Environmental |

Harm to the environment caused by operating the technology may affect planning & permitting. |

|

|

Weather-related /availability[4] |

Risk of fall in volume of electricity produced owing to lack of wind, sunshine, water flow/low rainfall, biomass availability.

|

|

|

Force majeure[4] |

Environmental disaster like severe storms, typhoons, sandstorms, volcanic eruption, earth quakes, mud slides, etc. |

|

Source: Own elaboration based on literature review

Once projects are aware of the different risks they could face, it is important to consider that addressing all risks might be too expensive in terms of time and resources. For this reason it is important to prioritize risks, this can be done effectively using risk-management tools, which can later lead to decide appropriate measures.

Risk Management

The optimum for a project is to reach a level of risk consciousness that can lead to elaborate effective and efficient mitigation strategies. Therefore risk management needs to be understood as a dynamic process, which should strive to include the ideas and insights from the different the different stakeholders involved in a project (investors, operators, users, etc.), especially during the risk identification.

Figure 1: Risk management main steps

Source: Own elaboration based on FEMA (2017)[8] and Manetsgruber et al. (2015)[4]

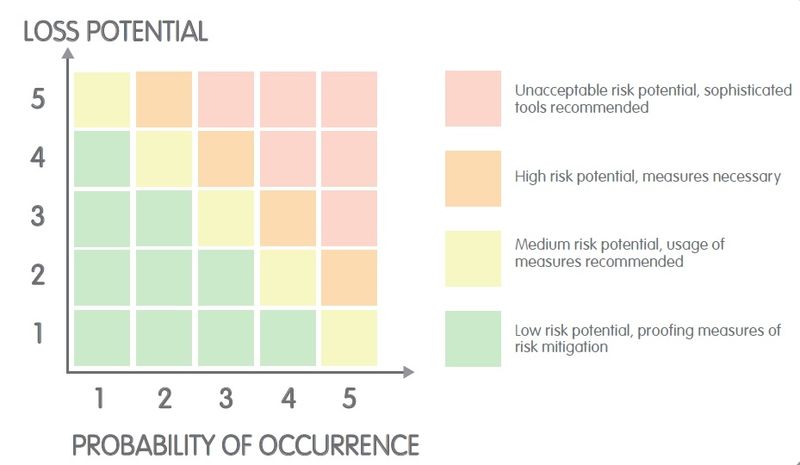

The first step of risk management will result in an overview of all risks associated to different aspects in a project (i.e. the categories considered in Table 2). Every risk should be assessed according to the magnitude of its impact potential and the probability of it to happen. A common and widely used risk management tool to visualise the impact of individual risks is a risk map as shown in Figure 2.

Figure 2: Risk map with different colors indicating levels of importance

Source: Manetsgruber et al. (2015)[4]

The colour differentiation in a risk map indicates the level of importance of each risk. As mentioned, risk management is an iterative process and a risk map can be used to better understand the current risk situation at a particular moment in time, it also represents the outcome or risk mitigation interventions. Being aware of the risks does not necessarily mean to address each of them. Prioritization can be done effectively using the map (chart) in which risks are assessed in two dimensions:

- Probability - to probability of a risk to occur.

- Impact (Loss potential) - the size of the impact varies in terms of different factors (i.e. costs).

Considering both dimensions, there are four possible levels where risks can be placed[9]:

- Low impact/ Low probability - risks at the bottom left corner are low level, these can be often ignored.

- Low impact/ High probability - risks in the bottom right corner are of moderate importance, the project should reduce the likelihood of these to occur.

- High impact/ low probability - risks in the top left corner are of high importance, but they are unlikely to happen. Contingency plans should be in place.

- High impact/ high probability - risks located at the top right corner are critical and should be a top priority for the project.

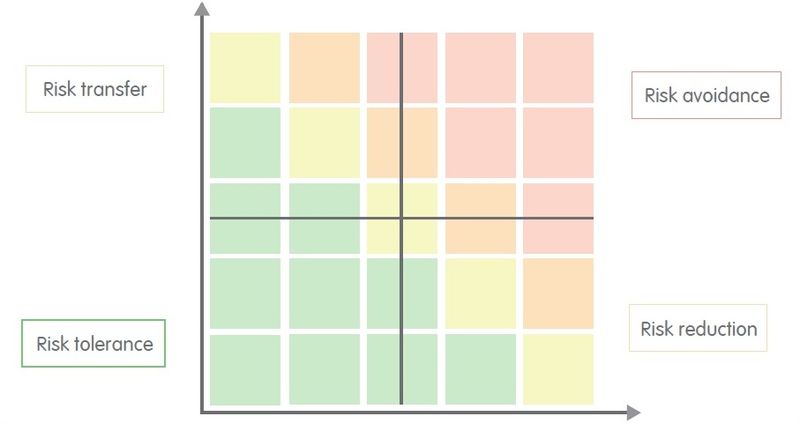

Based on these four leveles and according to the Risk Management Approach Guide (Manetsgruber et al., 2015)[4] there are four general risk management levels that can be developed after analysing the data contained in a risk map (Figure 3). This serves to identify primary strategies to address each risk, and could be adjusted or replaced if necessary over the life cycle of a project. The different strategies can derive from the risk map itself in relation to the impact magnitude and probability, according to levels of:

- Risk tolerance: these type of risks occur rarely and have a low negative impact, the project should be aware of them but there is no need of further action, though these need to be observed and re-assessed if necessary.

- Risk transfer: these risks have a high impact potential and low probability of occurrence, therefore these should be transferred to or covered by a willing third party as they can cause significant harm to the project.

- Risk reduction: risks have a high probability of occurrence and low impact, resource buffers or emergency measures con be applied to reduce the possibility of it to occur. Likewise, measures like for example specific operation practices, training and technology upgrades, among others, can deflect or prevent the threats of these risks.

- Risk avoidance: these risks require actions to mitigate them to decrease the probability of occurrence.

Figure 3: Risk map with four generic strategic risk zones

Source: Manetsgruber et al. (2015)[4]

Rural energy access displays a high degree of complexity and it is required to think about developing a specific risk management approach, tailor-made for the type and scale of the projects[4].

Best Practices

Risk management for mini grids (Risk Management Approach Guide) - Case-based analysis on the economics of mini-grids based on different projects with different: power generation techniques, Business models approaches and integration to given circumstances (page 41- 48) and recommendations (page 50).

Uganda: Solar Kirchner uses an anchor business customer

- The payment risk, including the lack of willingness or ability to pay, is reduced by ensuring stable loads and cash flows by an anchor business, a telecommunication tower. Nearby villages profit from electrification.[4]

Laos: Sunlabob applies risk management by asset splitting

- Negotiation with the national utility to ensure steady incomes for the mini-grid operators after national grid arrives will reduced the payment risk. As does supporting local micro-entrepreneurship.

- Diversifying the power-generating sources (hydro, PV, and a diesel) reduces the technology and performance risk, as well as the resource availability risk.

- Splitting the assets into three categories reduces the total loss of investment risk: public owned infrastructural assets (grid), private owned movable assets, and productive use assets are owned by local entrepreneurs.[4]

Large scale projects

Risk mitigation instruments for renewable energy in developing countries: a case study on hydropower in Africa – from the project finance perspective of a large scale project finance applying risk mitigation instruments provided by the World Bank Group.

Further Reading

- Addressing some issues relating to hybrid mini grid failures in Fiji - Literature review and consultations about technical and non-technical aspects hindering the success and sustainability of hybrid mini-grids in Fiji. This scientific paper also includes guidelines to overcome risks.

- Risk Coverage – Hydropower Development– List of common and interface risks in hydropower development.

- Risk quantification and risk management in renewable energy projects – Risk management methodology for renewable energy systems developed by the International Energy Agency – Renewable Technology Development Programme (IEA-RETD).

References

- ↑ Painuly, Jyoti Prasad, ‘Barriers to renewable energy penetration; a framework for analysis’, Renewable Energy 24, 2001. http://www1.upme.gov.co/SGIC/sites/default/files/Barriers%20to%20renewable%20energy%20penetration.pdf

- ↑ 2.00 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.10 2.11 2.12 2.13 2.14 2.15 Hazelton, James; Bruce, Anna; MacGill Iain, ‘A review of the potential benefits and risks of photovoltaic hybrid mini-grid systems’, Renewable Energy 67, 2013. https://www.researchgate.net/publication/259298363_A_review_of_the_potential_benefits_and_risks_of_photovoltaic_hybrid_mini-grid_systems Cite error: Invalid

<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Hazelton (2013)" defined multiple times with different content - ↑ SE4All Advisory Board's Finance Committee, 'Scaling Up FInance for Sustainable Energy Investments, 2015. http://www.se4all.org/sites/default/files/SE4All-Advisory-Board-Finance-Committee-Report.pdf

- ↑ 4.00 4.01 4.02 4.03 4.04 4.05 4.06 4.07 4.08 4.09 4.10 4.11 4.12 4.13 4.14 4.15 Manetsgruber, David; Wagemann, Bernanrd; Kondev, Bozhil; Dziergwa, Katrin. Risk Management for Mini-Grids: A new approach to guide mini-grid development. 2015. https://www.ruralelec.org/sites/default/files/risk_management_for_mini-grids_2015_final_web_0.pdf Cite error: Invalid

<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Manetsgruber (2015)" defined multiple times with different content - ↑ The Economist, ‘Managing the risk in renewable energy’, 2011 https://www.altran.de/fileadmin/medias/DE.altran.de/documents/Fachartikel/Managing-The-Risk-In-Renewable-Energy.pdf

- ↑ 6.0 6.1 6.2 Green Rhino Energy, ‘Project Risk Matrix’, 2013, http://www.greenrhinoenergy.com/finance/renewable/risks.php Cite error: Invalid

<ref>tag; name "Green (2013)" defined multiple times with different content Cite error: Invalid<ref>tag; name "Green (2013)" defined multiple times with different content - ↑ IRENA, ‘Unlocking renewable energy investment: the role of risk mitigation and structured finance’, 2016, https://www.irena.org/DocumentDownloads/Publications/IRENA_Risk_Mitigation_and_Structured_Finance_2016.pdf

- ↑ FEMA, Risk Mapping, Assessment and Planning (Risk Map), Department of Homeland Security US, 2017,https://www.fema.gov/risk-mapping-assessment-and-planning-risk-map

- ↑ Mind Tools, 'Risk Impact/ Probability Chart', 2017. https://www.mindtools.com/pages/article/newPPM_78.htm