Difference between revisions of "Market for PicoPV"

***** (***** | *****) m |

***** (***** | *****) |

||

| Line 2: | Line 2: | ||

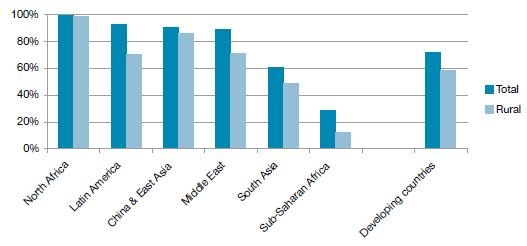

Every fourth human being is without access to electricity today. Electrification rates are the lowest in Sub-Sahara Africa<br>(SSA), but rural access rates remain surprisingly low even in countries with high GDP and impressive overall access rates. The fact that rural access rates are lagging behind across all countries and regions reflects the fact that costs of traditional grid electrification grow exponentially with falling population rates (and load) density. <ref name="Primer">2010. GTZ. What difference can a PicoPV system make? Early findings on small Photovoltaic systems - an emerging lowcost energy technology for developing countries</ref> | Every fourth human being is without access to electricity today. Electrification rates are the lowest in Sub-Sahara Africa<br>(SSA), but rural access rates remain surprisingly low even in countries with high GDP and impressive overall access rates. The fact that rural access rates are lagging behind across all countries and regions reflects the fact that costs of traditional grid electrification grow exponentially with falling population rates (and load) density. <ref name="Primer">2010. GTZ. What difference can a PicoPV system make? Early findings on small Photovoltaic systems - an emerging lowcost energy technology for developing countries</ref> | ||

| + | |||

| + | The figure shows electrification rates for various regions. Clearly, it is necessary to concentrate first on Sub-Saharan Africa and South Asia. | ||

| | ||

| Line 9: | Line 11: | ||

<ref name="Primer" /> | <ref name="Primer" /> | ||

| − | | + | <br> |

| + | |||

| + | == Market for off-grid PV == | ||

| + | |||

| + | In 2000, about 1.3 million households in developing countries used solar home systems<br>(SHSs) or solar lanterns 0.4-0.5 million of which were procured through donor driven projects (Nieuwenhout, 2002).<br>The most mature off-grid PV markets exist in India (450,000 installed SHSs), China (150,000 SHSs), Kenya (120,000 SHSs), Morocco (80,000 SHSs), Mexico (80,000 SHSs), and South Africa (50,000 SHSs). Kenya and China are by far the fastest growing markets, with annual growth rates of 10% – 20% in recent years. | ||

| + | |||

| + | Many of these countries also manufacture components for SHS, such as batteries, controllers, and lights. In 2002, PV module manufacturers existed in India (23 firms), China (7 firms), Thailand (3 firms), and Namibia (1 firm). PV cells are manufactured<br>in India (9 firms) and China (7 firms). In recent years, the manufacturing base in China has grown exponentially. Gabler (2008) and Photon (2008) estimate for 2007 that newly installed off-grid PV capacity in Developing Countries lies at around 50 MWp per year (compared to 150 MWp global annual market volume for off-grid PV – including off-grid PV for recreational uses and industry, such as telecom repeaters, worldwide). | ||

| + | |||

| + | At system prices of about 10 €/Watt, total turnover in Developing Countries can be estimated to account for 0.5 € billion.<ref name="Difference">2010. GTZ.What difference can a PicoPV system make? Early findings on small Photovoltaic systems -an emerging lowcost energy technology for developing countries</ref> | ||

| + | |||

| + | | ||

| + | |||

| + | == Market for PicoPV == | ||

| + | |||

| + | The current market size as well as the future market potential for PicoPV is difficult to predict at this point in time, as<br>data on demand response does not exist. However, a simple “back of the envelope” calculation allows getting a first idea<br>of the potential market size: one could take the roughly 1.5 billion people currently without modern energy and assume that this corresponds to about 300 million households which are currently using traditional low performance lighting at high costs. If we are right in our predictions for cost reduction, all of these would (theoretically!) profit from a fuel swap, and many would be able to afford the US$30 entry level products which will be available soon. Thus the potential theoretical market size is 300 M x 30 US$ or 9 billion US$. <ref name="Difference" /> | ||

| + | |||

| + | Regarding the fact, that statistics of households without access to modern energy are often underestimated (because households living in on-grid areas without legal or functional access are counted as well as households with frequent, long-term breakdowns), market size might be even larger.<ref name="BOP">2010. Lighting Africa. Solar Lighting for the Base of the Pyramid - Overview of an Emerging Market -</ref> | ||

| + | |||

| + | Once early findings on demand response and market penetration rates will become available, realistic market estimates and growth rates can be calculated, which would also factor in households buying more than one lamp and urban customers. | ||

| + | |||

| + | | ||

| + | |||

| + | == Outlook == | ||

| + | |||

| + | Regarding prospect expectations, ''producing cost ''for components of PicoPV systems are falling in the next five years. This will | ||

| + | |||

| + | increase affordability for low-income households. | ||

| + | |||

| + | Furthermore, increasing - and volatile - ''fossil fuel costs ''(further enhanced through carbon emission reduction targets)<ref>GTZ Furel Price Index 200-2009</ref>, will | ||

| + | |||

| + | increase the search of households for alternative options.<ref name="Difference" /> | ||

| − | + | | |

| − | + | Moreover, Pico PV systems may well be part of a solution, by allowing “'''pre-electrification'''”. There are several good reasons to be bullish regarding the potential of this emerging off-grid market segment: | |

| − | & | + | <br>• Pico PV systems are over-the-counter consumer products and don’t need specific know-how for installation or O&M. Therefore, distribution has ''lower transaction costs ''than for all other grid or off-grid alternatives.<br>• The ''welfare gain ''from electrification at household level is arguably largest after stepping from flame-based lighting to efficient electric lights.<br>• Grid electrification is perceived by the vast majority of households as the “gold standard” of electrification. But with PicoPV systems, consumers do not fear that PicoPV lamps will bar them from future grid roll-out, as they often do in the case of SHSs.<ref name="Difference" /> |

== Detail analysis of certain African Countries: == | == Detail analysis of certain African Countries: == | ||

| − | === Uganda === | + | === Uganda === |

Targetanalysis in '''Uganda '''show a potential market expansion: | Targetanalysis in '''Uganda '''show a potential market expansion: | ||

| Line 37: | Line 69: | ||

| | ||

| − | === Tanzania === | + | === Tanzania === |

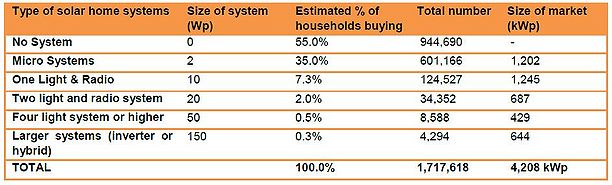

Analysis of market in '''Tanzania '''claims, that is growing at a rapid rate. Secondly, it is large, as can be seen in the table below. Thirdly, for qualifying companies, the government will be offering USD 2/Wp per sold system for systems below 100 Wp.<ref>2009. GTZ. Tanzania’s Solar Energy Market Target Market Analysis.</ref> | Analysis of market in '''Tanzania '''claims, that is growing at a rapid rate. Secondly, it is large, as can be seen in the table below. Thirdly, for qualifying companies, the government will be offering USD 2/Wp per sold system for systems below 100 Wp.<ref>2009. GTZ. Tanzania’s Solar Energy Market Target Market Analysis.</ref> | ||

| Line 48: | Line 80: | ||

<br> | <br> | ||

| − | |||

| − | |||

<br> | <br> | ||

Revision as of 09:10, 23 November 2010

Electrification situation in general

Every fourth human being is without access to electricity today. Electrification rates are the lowest in Sub-Sahara Africa

(SSA), but rural access rates remain surprisingly low even in countries with high GDP and impressive overall access rates. The fact that rural access rates are lagging behind across all countries and regions reflects the fact that costs of traditional grid electrification grow exponentially with falling population rates (and load) density. [1]

The figure shows electrification rates for various regions. Clearly, it is necessary to concentrate first on Sub-Saharan Africa and South Asia.

Market for off-grid PV

In 2000, about 1.3 million households in developing countries used solar home systems

(SHSs) or solar lanterns 0.4-0.5 million of which were procured through donor driven projects (Nieuwenhout, 2002).

The most mature off-grid PV markets exist in India (450,000 installed SHSs), China (150,000 SHSs), Kenya (120,000 SHSs), Morocco (80,000 SHSs), Mexico (80,000 SHSs), and South Africa (50,000 SHSs). Kenya and China are by far the fastest growing markets, with annual growth rates of 10% – 20% in recent years.

Many of these countries also manufacture components for SHS, such as batteries, controllers, and lights. In 2002, PV module manufacturers existed in India (23 firms), China (7 firms), Thailand (3 firms), and Namibia (1 firm). PV cells are manufactured

in India (9 firms) and China (7 firms). In recent years, the manufacturing base in China has grown exponentially. Gabler (2008) and Photon (2008) estimate for 2007 that newly installed off-grid PV capacity in Developing Countries lies at around 50 MWp per year (compared to 150 MWp global annual market volume for off-grid PV – including off-grid PV for recreational uses and industry, such as telecom repeaters, worldwide).

At system prices of about 10 €/Watt, total turnover in Developing Countries can be estimated to account for 0.5 € billion.[2]

Market for PicoPV

The current market size as well as the future market potential for PicoPV is difficult to predict at this point in time, as

data on demand response does not exist. However, a simple “back of the envelope” calculation allows getting a first idea

of the potential market size: one could take the roughly 1.5 billion people currently without modern energy and assume that this corresponds to about 300 million households which are currently using traditional low performance lighting at high costs. If we are right in our predictions for cost reduction, all of these would (theoretically!) profit from a fuel swap, and many would be able to afford the US$30 entry level products which will be available soon. Thus the potential theoretical market size is 300 M x 30 US$ or 9 billion US$. [2]

Regarding the fact, that statistics of households without access to modern energy are often underestimated (because households living in on-grid areas without legal or functional access are counted as well as households with frequent, long-term breakdowns), market size might be even larger.[3]

Once early findings on demand response and market penetration rates will become available, realistic market estimates and growth rates can be calculated, which would also factor in households buying more than one lamp and urban customers.

Outlook

Regarding prospect expectations, producing cost for components of PicoPV systems are falling in the next five years. This will

increase affordability for low-income households.

Furthermore, increasing - and volatile - fossil fuel costs (further enhanced through carbon emission reduction targets)[4], will

increase the search of households for alternative options.[2]

Moreover, Pico PV systems may well be part of a solution, by allowing “pre-electrification”. There are several good reasons to be bullish regarding the potential of this emerging off-grid market segment:

• Pico PV systems are over-the-counter consumer products and don’t need specific know-how for installation or O&M. Therefore, distribution has lower transaction costs than for all other grid or off-grid alternatives.

• The welfare gain from electrification at household level is arguably largest after stepping from flame-based lighting to efficient electric lights.

• Grid electrification is perceived by the vast majority of households as the “gold standard” of electrification. But with PicoPV systems, consumers do not fear that PicoPV lamps will bar them from future grid roll-out, as they often do in the case of SHSs.[2]

Detail analysis of certain African Countries:

Uganda

Targetanalysis in Uganda show a potential market expansion:

- Up to 60 % of the rural households can afford micro-solar systems of 2-20 Wp (lanterns, phone chargers, radio systems).

- 10 % of the rural population can potentially afford medium to larger SHS PV systems (50 Wp – 150 Wp).

- 30 % of the rural households would be considered too poor to afford a solar PV system.[5]

Rwanda

Analysis of market in Rwanda describe an encouraging development: Growth in the SHS sector is slow but encouraging with at least three companies actively marketing their products. Given the low-income level of the country, this report estimates that less than 10 % of the total off-grid rural population (1.7 million un-electrified) would have an interest in a 10-50 Wp PV system and another 30-40 % would be interested in a micro system. The following table provides a basic model for this market:[6]

Tanzania

Analysis of market in Tanzania claims, that is growing at a rapid rate. Secondly, it is large, as can be seen in the table below. Thirdly, for qualifying companies, the government will be offering USD 2/Wp per sold system for systems below 100 Wp.[7]

- ↑ 1.0 1.1 2010. GTZ. What difference can a PicoPV system make? Early findings on small Photovoltaic systems - an emerging lowcost energy technology for developing countries

- ↑ 2.0 2.1 2.2 2.3 2010. GTZ.What difference can a PicoPV system make? Early findings on small Photovoltaic systems -an emerging lowcost energy technology for developing countries

- ↑ 2010. Lighting Africa. Solar Lighting for the Base of the Pyramid - Overview of an Emerging Market -

- ↑ GTZ Furel Price Index 200-2009

- ↑ 2009. GTZ. Uganda’s Solar Energy Market - Target Market Analysis.

- ↑ 2009. GTZ. Rwanda’s Solar Energy Market Target Market Analysis.

- ↑ 2009. GTZ. Tanzania’s Solar Energy Market Target Market Analysis.