Difference between revisions of "Fuel Prices India"

***** (***** | *****) m (Protected "Fuel Prices India" ([edit=sysop] (indefinite) [move=sysop] (indefinite)) [cascading]) |

***** (***** | *****) |

||

| Line 1: | Line 1: | ||

{{Fuel Price Factsheet | {{Fuel Price Factsheet | ||

|Fuel Price Country=India | |Fuel Price Country=India | ||

| + | |Fuel Pricing Policies=The Ministry of Petroleum and Natural Gas supervises both the upstream and downstream fuel sectors in India (http://petroleum.nic.in/). While there is plenty of legal information on the ministries website, clear and easy-to-understand information regarding fuel price breakdowns and further pricing policies is missing. Annual reports offer detailed top-level-statistics and also fuel price timelines. | ||

| + | |||

| + | The downstream market is open to private companies. The fuel price is regulated via maximum prices, which are set by the government / the ministry several times a year (depending on the degree of volatility of international crude oil prices). Prices are changed on an ad-hoc basis and in times of high crude oil prices OMCs are forced to sell at prices levels that do not cover the overall costs. This leads to temporary huge losses for oil companies that need to be outbalanced by the government. Thus, in fact fuels (especially diesel) are subsidized in India (→App. A1). Taxes on diesel are much lower than on gasoline. | ||

| + | |||

| + | Indian states impose different taxes on fuels. Also, every state imposes VAT independently. | ||

| + | |||

| + | "Government heavily subsidizes the prices of LPG and kerosene for household use. Subsidized kerosene is rationed and distributed through the Public Distribution System, which also delivers subsidized food. Two separate government committees in 2006 and 2008 recommended moving away from subsidizing the kerosene price to cash transfer to the poor. In 2011, another proposal was made, shifting from a price subsidy to a monthly cash transfer of Rs. 300 (about US$6.50) delivered to women. As of 2010, there were 120 million LPG customers and 850 million cylinders in circulation. Government’s vision of covering 100% of population with gas has led to a target of adding another 50 million customers to increase coverage from 50% to 75%. The prices of non-branded diesel and at times non-branded gasoline have also been kept below market levels. Compensation for losses suffered by the three state-owned oil companies marketing subsidized fuels was Rs. 120,000 million (actual, US$2.5 billion) in fiscal 2009/10 (Apr–Mar), Rs. 350,000 million (actual, US$7.7 billion) in fiscal 2010/11, Rs. 650,000 million (revised budget, US$13.6 billion, up from Rs. 200,000 million originally budgeted) in fiscal 2011/12, and Rs. 400,000 million (original budget, US$7.7 billion as of Apr 2012) in fiscal 2012/13, apart from an additional US$0.6 billion set aside for LPG and kerosene in each fiscal year. In the first quarter of fiscal 2012/13, the three companies posted combined losses of Rs. 405 billion (US$7.5 billion) on fuel sales. Lack of timely reimbursement forces oil companies to borrow heavily. The petroleum ministry is piloting a biometric scheme for distribution of subsidized LPG. The 2012/13 budget looks to expand pilot programs, allowing eligible consumers to recoup LPG and kerosene subsidies via the Aadhaar platform (a 12-digit number which the Unique Identification Authority of India will issue for all residents in India). Government in Sep 2012 increased the price of diesel by Rs. 5 (US$0.09) a liter, steepest-ever once-time increase, and limited the number of subsidized LPG refills to six a year per household. The price of LPG outside the quota can be as high as triple the subsidized price." | ||

| + | |||

| + | (Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.) | ||

|Fuel Currency=INR | |Fuel Currency=INR | ||

|Fuel Price Exchange Rate=45.479 | |Fuel Price Exchange Rate=45.479 | ||

| Line 7: | Line 16: | ||

|Fuel Price Composition=GIZ_IFP2012_India.png | |Fuel Price Composition=GIZ_IFP2012_India.png | ||

|Fuel Price Composition Fuel Type=Gasoline 95 Octane | |Fuel Price Composition Fuel Type=Gasoline 95 Octane | ||

| − | |||

|Fuel Price Composition Annotation=For an assumed price of 58.90 INR. | |Fuel Price Composition Annotation=For an assumed price of 58.90 INR. | ||

| Line 17: | Line 25: | ||

Source: http://www.kokkada.com/calculations-of-petrol-prices-in-india/ (→App. A3). Taxation on Diesel is considerably lower, resulting to overall lower pump prices. | Source: http://www.kokkada.com/calculations-of-petrol-prices-in-india/ (→App. A3). Taxation on Diesel is considerably lower, resulting to overall lower pump prices. | ||

| − | |Fuel Pricing | + | |Fuel Matrix Pricing Mechanism=2 |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|Fuel Matrix Price Level=2.5 | |Fuel Matrix Price Level=2.5 | ||

| − | |||

|Fuel Matrix Annotation=Clear information on fuel price breakdown and pricing formula missing. | |Fuel Matrix Annotation=Clear information on fuel price breakdown and pricing formula missing. | ||

|Fuel Transparency Price Composition=2 | |Fuel Transparency Price Composition=2 | ||

| Line 43: | Line 44: | ||

|Fuel Price Factsheet Source Type=Other Information | |Fuel Price Factsheet Source Type=Other Information | ||

|Fuel Price Factsheet Source Link=http://petroleum.nic.in/ | |Fuel Price Factsheet Source Link=http://petroleum.nic.in/ | ||

| − | |Fuel Price Factsheet Source Annotation=GSI: Lessons Learned from Attempts to Reform India's Kerosene Subsidy | + | |Fuel Price Factsheet Source Annotation=GSI: Lessons Learned from Attempts to Reform India's Kerosene Subsidy |

}} | }} | ||

{{Fuel Price Factsheet Source | {{Fuel Price Factsheet Source | ||

Revision as of 10:53, 18 February 2013

Part of: GIZ International Fuel Price database

Also see: India Energy Situation

Fuel Pricing Policies

| Local Currency: | INR |

| Exchange Rate: | 45.479

|

| Last Update: | 2011/05/01 |

The Ministry of Petroleum and Natural Gas supervises both the upstream and downstream fuel sectors in India (http://petroleum.nic.in/). While there is plenty of legal information on the ministries website, clear and easy-to-understand information regarding fuel price breakdowns and further pricing policies is missing. Annual reports offer detailed top-level-statistics and also fuel price timelines.

The downstream market is open to private companies. The fuel price is regulated via maximum prices, which are set by the government / the ministry several times a year (depending on the degree of volatility of international crude oil prices). Prices are changed on an ad-hoc basis and in times of high crude oil prices OMCs are forced to sell at prices levels that do not cover the overall costs. This leads to temporary huge losses for oil companies that need to be outbalanced by the government. Thus, in fact fuels (especially diesel) are subsidized in India (→App. A1). Taxes on diesel are much lower than on gasoline.

Indian states impose different taxes on fuels. Also, every state imposes VAT independently.

"Government heavily subsidizes the prices of LPG and kerosene for household use. Subsidized kerosene is rationed and distributed through the Public Distribution System, which also delivers subsidized food. Two separate government committees in 2006 and 2008 recommended moving away from subsidizing the kerosene price to cash transfer to the poor. In 2011, another proposal was made, shifting from a price subsidy to a monthly cash transfer of Rs. 300 (about US$6.50) delivered to women. As of 2010, there were 120 million LPG customers and 850 million cylinders in circulation. Government’s vision of covering 100% of population with gas has led to a target of adding another 50 million customers to increase coverage from 50% to 75%. The prices of non-branded diesel and at times non-branded gasoline have also been kept below market levels. Compensation for losses suffered by the three state-owned oil companies marketing subsidized fuels was Rs. 120,000 million (actual, US$2.5 billion) in fiscal 2009/10 (Apr–Mar), Rs. 350,000 million (actual, US$7.7 billion) in fiscal 2010/11, Rs. 650,000 million (revised budget, US$13.6 billion, up from Rs. 200,000 million originally budgeted) in fiscal 2011/12, and Rs. 400,000 million (original budget, US$7.7 billion as of Apr 2012) in fiscal 2012/13, apart from an additional US$0.6 billion set aside for LPG and kerosene in each fiscal year. In the first quarter of fiscal 2012/13, the three companies posted combined losses of Rs. 405 billion (US$7.5 billion) on fuel sales. Lack of timely reimbursement forces oil companies to borrow heavily. The petroleum ministry is piloting a biometric scheme for distribution of subsidized LPG. The 2012/13 budget looks to expand pilot programs, allowing eligible consumers to recoup LPG and kerosene subsidies via the Aadhaar platform (a 12-digit number which the Unique Identification Authority of India will issue for all residents in India). Government in Sep 2012 increased the price of diesel by Rs. 5 (US$0.09) a liter, steepest-ever once-time increase, and limited the number of subsidized LPG refills to six a year per household. The price of LPG outside the quota can be as high as triple the subsidized price."

(Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.)

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

Fuel Price Composition

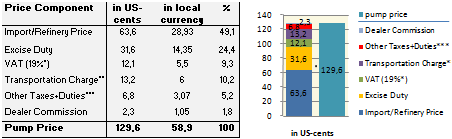

Price composition for one litre of Gasoline 95 Octane.

For an assumed price of 58.90 INR.

(*VAT differ among states and over time; 19% is an usual value; up to 28% for gasoline in some states.)

(**Transportation charge differs depending on actual transportation costs. 6 INR is an average value.)

(***includes: Education Tax (0.43INR), Crude Oil Custom Duty (1.1INR) and Petrol Custom Duty (1.54INR).)

Source: http://www.kokkada.com/calculations-of-petrol-prices-in-india/ (→App. A3). Taxation on Diesel is considerably lower, resulting to overall lower pump prices.

At a Glance

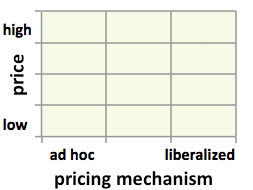

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

Clear information on fuel price breakdown and pricing formula missing.

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Other Information | http://petroleum.nic.in/ (GSI: Lessons Learned from Attempts to Reform India's Kerosene Subsidy) |

| Other Information | http://www.iisd.org/pdf/2010/lessons_india_kerosene_subsidy.pdf |

| Pump prices and margins | http://www.iocl.com (Indian Oil; retailer) |

| Pump prices and margins | http://petroleum.nic.in/petstat.pdf (Ministry report) |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices

The following coordinate was not recognized: {{#geocode: India|google }}.