Difference between revisions of "Mini-Grid Financing"

***** (***** | *****) m (→Overview) |

***** (***** | *****) m |

||

| Line 1: | Line 1: | ||

= Overview = | = Overview = | ||

| − | Mini-grids are cost intensive investments which can achieve economies of scale with good regulatory environment, concessional investments and increased portfolio of the developers. This | + | Mini-grids are cost intensive investments which can achieve economies of scale with good regulatory environment, concessional investments and increased portfolio of the developers. As of June 2020, USD 1.6 billion has been pledged for supporting the sector, however only 13% of this proposed amount i.e USD 208 million has been mobilized so far to support mini-grids projects in de-risking, connecting new consumers and closing the price gap. According to AMDA, concessional funding (via grants, subsidies or concessional loans) is key for supporting the sector, especially in post-covid world where the entire economy is recovering. |

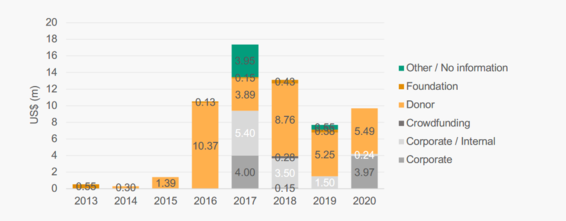

| + | The chart below shows the types of funding available to mini-grids developers from 2013 to 2020. This is based on the AMDA's report from 2022 where they interviewed 35 mini-grid developers across 12 countries in SSA. | ||

| + | [[File:Funding type for mini-grids.png|center|thumb|566x566px|Source: AMDA and ECA (2022). Benchmarking Africa's Mini-grids Report. https://africamda.org/wp-content/uploads/2022/06/Benchmarking-Africa-Minigrids-Report-2022-Key-Findings.pdf]] | ||

| + | This article outlines the major costs that are associated with mini-grids development and also lists publication/resources that can guide practitioners on how they could secure the different types of funding resources. | ||

| + | |||

| + | '''Table: Costs related to mini-grid development'''.<ref>AMDA and ECA (2020). Benchmarking Africa's Mini-grids. https://africamda.org/wp-content/uploads/2021/08/AMDA-Benchmarking-2020-.pdf</ref> | ||

{| class="wikitable" | {| class="wikitable" | ||

!CAPEX | !CAPEX | ||

Revision as of 09:28, 4 July 2022

Overview

Mini-grids are cost intensive investments which can achieve economies of scale with good regulatory environment, concessional investments and increased portfolio of the developers. As of June 2020, USD 1.6 billion has been pledged for supporting the sector, however only 13% of this proposed amount i.e USD 208 million has been mobilized so far to support mini-grids projects in de-risking, connecting new consumers and closing the price gap. According to AMDA, concessional funding (via grants, subsidies or concessional loans) is key for supporting the sector, especially in post-covid world where the entire economy is recovering. The chart below shows the types of funding available to mini-grids developers from 2013 to 2020. This is based on the AMDA's report from 2022 where they interviewed 35 mini-grid developers across 12 countries in SSA.

This article outlines the major costs that are associated with mini-grids development and also lists publication/resources that can guide practitioners on how they could secure the different types of funding resources.

Table: Costs related to mini-grid development.[1]

| CAPEX |

|---|

Generation assets: Includes the assets needed for electricity generation and supply and accounts for the largest proportion of total installed costs for mini-grid development. In sub-Saharan Africa, generation cost account for more than 45% for solar mini-grids.

|

| Distribution assets: Includes assets related to distributing of electricity to end-users. E.g wiring, poles insulators, safety equipment etc |

| Logistics costs: Refers to costs incurred during transport, storage and logistics of the mini-grid assets for planning as well as construction phase |

| Site development costs: Costs for obtaining all relevant permits and preparing the sites, including community consultation and all other meetings with the community. |

| End-user costs: Costs for adding meters and other connection devices, internal wiring, droplines to the home etc. |

| VAT and Duties: All VAT and duties paid on the generation and distribution assets while importing. |

| OPEX |

|---|

| O&M expenses : Day-to-day expenses for maintaining the mini-grids such as fuel costs, repair and replacement of components, customer service etc. This accounts for the largest proportional of total operational expenditure. |

| Fixed operational costs: Include billing and payment collection expenses, expenses related to IoT such as software platform and mobile money infrastructure cost and land leasing. |

| Labour costs: Staff costs , training and travel expenses etc. |

Guidebook on How to Finance Mini-grids

This financing guidebook for mini-grid businesses was developed to provide guidelines and basic recommendations for securing various forms of financing for the most relevant types of mini-grid businesses and projects in Kenya. It serves to provide an overview of mini-grids and the key financing concepts and procedures that developers should consider when developing mini-grid projects. The handbook eases the understanding of the most relevant aspects of financing mini-grids and sheds light on the financing process, options and timings for project developers. It presents an overview of typical (simplified) investment cases, giving corresponding illustrations of tariff structures and key considerations for financing methods for each case.The guidebook is targeting (prospective) mini-grid developers who seek to get a general understanding of financing a mini-grid in Kenya but can also serve as a reference to other stakeholders. It, therefore, offers a general introduction to mini-grid financing in Kenya and is not targeting mini-grid financing experts and companies already engaged with financing mini-grids.While this handbook intends to display the required knowledge for mini-grid financing, mini-grid projects are very site specific. The authors of this handbook, therefore, do not accept any liability for commercial or investment decisions taken on the grounds of the knowledge presented within.

The handbook is the most recent addition to a series of publications by ProSolar for mini-grid practitioners, coming after a practical guide to mini-grid site selection, licensing and sizing.

Kenya Mini-Grid Market Overview: Market Size and relevant actors

The National Rural Electric Cooperative Association (NRECA) estimates the off-grid market in Kenya to consist of around 1 million households, many of which can best be served by solar home systems. Around 280 clusters of more than 50 structures, which are suitable for mini-grids, have been identified through a satellite mapping in the off-grid area. Considering smaller communities will result in a significantly larger amount of communities that can be served by micro-grids. Furthermore, mini-grids in grid-proximity can be a viable option in case the potential future grid integration is part of the business model.

There are currently 21 mini-grids in operation under a public model, of which 19 are owned by the Rural Electrification Authority (REA) and operated by KPLC and 2 are owned and operated by the Kenya Electricity Generating Company (KenGen). These mini-grids are predominantly diesel fuelled, some of which have smaller solar or wind components. There are plans to retrofit and hybridize all existing systems with renewable energy components. The isolated mini-grids operated by KPLC currently have about 20,000 connections in total (less than 0.5% of the Kenyan population). The total installed capacity for these mini-grids is 24.8 MW comprising of 23.7 MW thermal, 0.55 MW wind, and 0.57 MW solar. The stations operated by KenGen are located in Garissa and Lamu. Lamu was recently connected to the national grid, and construction is being undertaken to also connect Garissa to the national grid. Additionally, NGOs, communities, and academia have developed small mini-grids. Also, several private firms in Kenya are developing these mini-grids in small but densely populated areas, sometimes just next to the main grid. These sites differ greatly from the utility scale approach of KPLC in that these mini-grids are based on renewable energy (mostly solar), they are relatively mobile and cover smaller radiuses with low voltage distribution.

- Read more about framework conditions and financing options in Kenya in Chapter 3 of the guidebook.

Further Information

This guidebook has been developed as part of a series of handbooks on mini-grids. You can access the other ones on the following web pages:

- GIZ-ProSolar. What size shall it be? A guide to mini-grid sizing and demand forecasting. August 2016.

- GIZ-ProSolar. How do we license it? Lessons learned from the application for power generation and distribution for the Talek Power Solar Mini-Grid project. July 2015.

- GIZ - ProSolar. Where shall we put it? Solar mini-grid site selection handbook. June 2014.

- ProSolar 2016 fact sheets: ProSolar project, Mini-Grids Result Based Funding (RBF) project.

- AMDA and ECA (2020). Benchmarking Africa's Mini-grids

References

- ↑ AMDA and ECA (2020). Benchmarking Africa's Mini-grids. https://africamda.org/wp-content/uploads/2021/08/AMDA-Benchmarking-2020-.pdf