Difference between revisions of "Fuel Prices Vietnam"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 1: | Line 1: | ||

{{Fuel Price Factsheet | {{Fuel Price Factsheet | ||

|Fuel Price Country=Vietnam | |Fuel Price Country=Vietnam | ||

| − | |Fuel Pricing Policies="Pricing policy: Vietnam has a price stabilization fund and every liter sold contributes to it, with the contribution varying from time to time. The money from or to oil companies goes through the fund and nothing goes to government: suppliers are instructed to either apply an extra levy (and retain it in their accounts) or use part of the imputed value of suppliers’ funds. Until recently, fuel prices were set by government with irregular adjustments. The stabilization fund was D703 billion (US$33 million) in the deficit in early 2011. In Apr 2012, Ministry of Trade and Industry said outflows from the fund exceeded inflows by more than D2.3 trillion (US$110 million), and yet still leaving companies with losses of D5 trillion (US$239 million). Since mid-2012, price adjustments have been more market-based, with wholesalers allowed to adjust prices (although still subject to final government approval). Where price adjustments exceeding 7% are necessary, government is to consider other options to stabilize prices, such as reducing import tariffs and drawing down on the stabilization fund. Government was going to start deregulating prices in May 2007 but stopped because of price volatility. Government abolished subsidies to importers, but they were not allowed to raise retail prices without approval from the trade and finance ministries. With increases in retail prices failing to stay in line with rising international prices, importers suffered from negative margins. | + | |Fuel Pricing Policies="Pricing policy: Vietnam has a price stabilization fund and every liter sold contributes to it, with the contribution varying from time to time. The money from or to oil companies goes through the fund and nothing goes to government: suppliers are instructed to either apply an extra levy (and retain it in their accounts) or use part of the imputed value of suppliers’ funds. Until recently, fuel prices were set by government with irregular adjustments. The stabilization fund was D703 billion (US$33 million) in the deficit in early 2011. In Apr 2012, Ministry of Trade and Industry said outflows from the fund exceeded inflows by more than D2.3 trillion (US$110 million), and yet still leaving companies with losses of D5 trillion (US$239 million). Since mid-2012, price adjustments have been more market-based, with wholesalers allowed to adjust prices (although still subject to final government approval). Where price adjustments exceeding 7% are necessary, government is to consider other options to stabilize prices, such as reducing import tariffs and drawing down on the stabilization fund. Government was going to start deregulating prices in May 2007 but stopped because of price volatility. Government abolished subsidies to importers, but they were not allowed to raise retail prices without approval from the trade and finance ministries. With increases in retail prices failing to stay in line with rising international prices, importers suffered from negative margins. In Jan and Feb 2013, government did not allow prices to rise and instead asked fuel suppliers to draw from the stabilization fund to reduce losses. |

Tax reductions: Import tariffs on gasoline and jet fuel were abolished in Feb 2012 and on diesel and kerosene in Mar 2012. Government has historically adjusted import tariffs frequently to smooth retail prices. | Tax reductions: Import tariffs on gasoline and jet fuel were abolished in Feb 2012 and on diesel and kerosene in Mar 2012. Government has historically adjusted import tariffs frequently to smooth retail prices. | ||

Revision as of 14:45, 15 April 2013

Part of: GIZ International Fuel Price database

Also see: Vietnam Energy Situation

Fuel Pricing Policies

| Local Currency: | VND |

| Exchange Rate: | 19271

|

| Last Update: |

"Pricing policy: Vietnam has a price stabilization fund and every liter sold contributes to it, with the contribution varying from time to time. The money from or to oil companies goes through the fund and nothing goes to government: suppliers are instructed to either apply an extra levy (and retain it in their accounts) or use part of the imputed value of suppliers’ funds. Until recently, fuel prices were set by government with irregular adjustments. The stabilization fund was D703 billion (US$33 million) in the deficit in early 2011. In Apr 2012, Ministry of Trade and Industry said outflows from the fund exceeded inflows by more than D2.3 trillion (US$110 million), and yet still leaving companies with losses of D5 trillion (US$239 million). Since mid-2012, price adjustments have been more market-based, with wholesalers allowed to adjust prices (although still subject to final government approval). Where price adjustments exceeding 7% are necessary, government is to consider other options to stabilize prices, such as reducing import tariffs and drawing down on the stabilization fund. Government was going to start deregulating prices in May 2007 but stopped because of price volatility. Government abolished subsidies to importers, but they were not allowed to raise retail prices without approval from the trade and finance ministries. With increases in retail prices failing to stay in line with rising international prices, importers suffered from negative margins. In Jan and Feb 2013, government did not allow prices to rise and instead asked fuel suppliers to draw from the stabilization fund to reduce losses.

Tax reductions: Import tariffs on gasoline and jet fuel were abolished in Feb 2012 and on diesel and kerosene in Mar 2012. Government has historically adjusted import tariffs frequently to smooth retail prices.

Hedging: After fuel-hedging losses of some US$30 million in 2008, several airline executives were jailed, allegedly for acting irresponsibility and causing losses, and two foreign executives were barred from leaving the country."

(Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.)

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

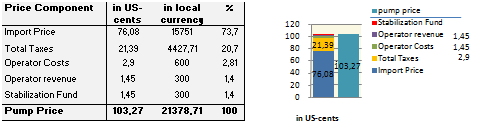

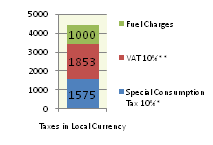

Fuel Price Composition

Price composition for one litre of Gasoline 92 Octane as of 2011/03/29.

(*The Special Consumption Tax is 10% of import price (incl. import tax, which is 0% as of March 2011))

(**VAT is 10% of pump price minus Fuel Charge of 1000 Dong.)

Import Price is the 30-day-average Singapore spot market price.

As of March 2011, there is no „Fuel Charge“ on diesel.

Source: http://www.petrolimex.com.vn/

At a Glance

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

Historical fuel price data missing.

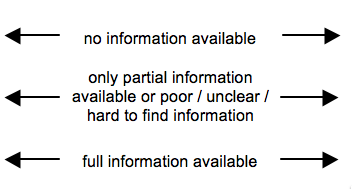

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Other Information | http://www.petrolimex.com.vn/ |

| Price Composition | http://www.petrolimex.com.vn/Desktop.aspx/Trang-Noi-Dung/Gia-co-so/ (In Vietnamese language) |

| Pump prices and margins | http://www.petrolimex.com.vn/Desktop.aspx/Trang-Noi-Dung/Gia-co-so/ (In Vietnamese language) |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices

The following coordinate was not recognized: {{#geocode: Vietnam|google }}.