Barriers and Risks to Renewable Energy Financing

► Back to Financing & Funding Portal

Overview

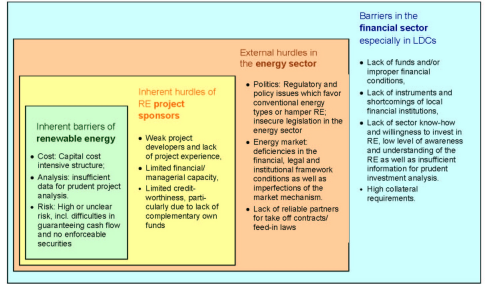

There are a number of key risks and barriers that can threaten investment in renewable energy (RE) projects and thus prevent the uptake of desirable technologies.

Lindlein & Mostert (2005)[1] have suggested that it is appropriate to group these barriers by the market categories supply, demand and framework conditions. From this view the most pervasive barriers to financing renewable energy from demand to supply are categorised as:

- Demand side barriers due to the characteristics of RE projects and internal problems of RE project sponsors.

- On thesupply side of RE finance there are several shortcomings in the financial sector especially in developing countries where there might be no supply at all.

- Framework conditions for projects within the energy sector can include substantial burden and barriers for RE finance[1].

At a broad macro-economic level, barriers to RE investment can be categorised as follows[2]:

- Cognitive Barriers. Theses relate to the low level of awareness, understanding and attention afforded to RE financing and risk management instruments particularly in low income countries.

- Political Barriers. These are associated with regulatory and policy issues and governmental leadership.

- Analytical Barriers: these relate to the quality and availability of information necessary for prudent underwriting, developing quantitative analytical methodologies for risk management instruments and creating useful pricing models for environmental markets such as carbon emissions permits.

- Market Barriers: these are associated with lack of financial, legal and institutional frameworks to support the uptake of RE projects in different jurisdictions.

Technological Differences

Different RE technologies have different degrees of exposure to the various barriers and risks due to their specifics and maturity.

The table below highlights some of the key risk issues affecting different RE technologies. Technology and operational risks are the principal deterrents to attracting appropriate commercial insurance cover[2].

Key Risks & Barriers Associated with RE Projects | ||

RET Type |

Key Risk Issues |

Risk Management Considerations |

|

Geothermal

|

|

|

|

Large PV

|

|

|

|

Solar thermal

|

|

|

|

Small hydropower

|

|

|

|

Wind power

|

|

|

|

Biomass power

|

|

|

|

Biogas power

|

|

|

|

Tidal/wave power |

|

|

|

Notes: * The probability of success in achieving (economically acceptable) minimum levels in thermal water production (minimum flow rates) and reservoir temperatures. **Stimulation technology attempts to improve natural productivity or to recover lost productivity from geothermal wells through various techniques including chemical and explosive stimulation. | ||

Source:[2]

Generally all large RET projects will require access to long term funding on a project finance basis, but their exposure to their barriers and risks will differ. Thus the need to obtain pre-investment financing and other project development processes will be more significant for hydro projects and less so for other technologies that do not have the same impacts on land use and on downstream communities[3].

Thus project sizes and transaction cost barriers are generally lower for wind and geothermal projects that can be developed on a greater scale than other technologies.

Geothermal and small hydro can be competitive with conventional technologies, and wind energy is also approaching competitiveness in some countries. However, solar technologies remain a long way from achieving cost competitiveness; therefore its affordability remains a key risk[3].

Resource uncertainties are also a problem for all technologies, though in differing ways:

- Geothermal projects have the greatest risk at the time of resource appraisal, when the expensive drilling of exploratory wells is needed.

- Biomass projects have a significant problem with the continuing availability of affordable and adequate resources.

- Technologies dependent on carbon financing are likely to be more vulnerable to the resource uncertainty problem.

Off-Grid Projects:

- These projects face different problems from those on non-grid RET projects. Off-grid projects are generally reliant on sales of individual household or small scale systems to rural communities. Technical challenges may be limited but affordability and financeability are key.

- The very small scale of such projects, down to the individual household level, means transaction costs can become an overwhelming barrier.

- The lack of long term project financing is less of a barrier to such projects, due to their very small size, they typically rely on corporate finance or on customer purchases[3].

The figure below shows the significance of barriers and risks to different technologies, providing an indication of which barriers and risk are likely to pose the greatest challenges to developing RETs.

| Technologies & Barriers and Risks | |||||||||||

|

|

Financing Barriers |

Project Risks | |||||||||

|

|

Lack of Long-term Financing |

Lack of Project Financing |

High & Uncertain Project Development Costs |

Lack of Equity Finance |

Small Scale of Projects |

High Financial Cost |

High Exposure to Regulatory Risk |

Uncertainty Over Carbon Financing |

High Costs of Resource Assessments |

Uncertainty over Resource Adequacy | |

|

On-Grid |

| ||||||||||

|

Wind |

Hi |

Med |

Lo |

Lo |

Lo |

Med |

Med |

Med |

Lo |

Med | |

|

Solar |

Hi |

Med |

Lo |

Med |

Med |

Hi |

Med |

Med |

Lo |

Med | |

|

Small Hydro |

Hi |

Med |

Med |

Med |

Lo |

Lo |

Med |

Lo |

Med |

Hi | |

|

Biomass |

Hi |

Med |

Lo |

Lo |

Med |

Med |

Med |

Med |

Lo |

Hi | |

|

Geothermal |

Med |

Med |

Hi |

Med |

Lo |

Lo |

Med |

Lo |

Hi |

Med | |

|

Off-grid |

| ||||||||||

|

Solar/Micro-hydro |

Med |

Lo |

Med |

Hi |

Hi |

Med |

Lo |

Lo |

Lo |

Med | |

|

Source: Adapted from The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds[3]. Note – Lo = Small/no impact (mitigation of risks is desirable.) Med = Moderate impact (mitigation of risks is less likely to be required.) Hi = Significant impact (mitigation of risks is generally necessary if the project is to proceed. | |||||||||||

Financing Barriers

a) Lack of Long-Term Financing

RE technologies tend to have high up-front costs and low ongoing operating costs, making access to long term funding for such projects a necessity. Without long-term financing, investment decisions are biased toward conventional technologies that can be financially viable with shorter-term loans. In many developing countries long-term financing is difficult and sometimes impossible to get. This is in part due to regulatory or other restrictions on long-term bank lending. A lack of experience with RE technologies also means that potential financiers may feel unable to assess the risks involved, and there may also be a lack of matching funding sources.

Long-term financing also depends on investors who are looking for long-term assets to match the profile of their liabilities such as pension funds. In developing countries, such funds either don’t exist or limit investment activities largely to the purchase of government debt owing to its low risk.

file://localhost/Users/Fungi/Library/Caches/TemporaryItems/msoclip/0clip_image002.png

b) Lack of Project Financing

As well as long-term financing, RET projects will also be looking to access funds on a project finance basis—where the security for the loan comes from future project cash flows and where little or no up-front collateral is required, although there will still be a need for a share of the project to be funded from equity. Non- or limited-recourse funding of this type allows RET projects to spread their costs over the project lifetime, funding the high up-front cost from the positive cash flows generated during operations. The alternative is to rely heavily on equity funding, payments to which can be delayed until the later years of the project.

RETprojects are more exposed to the limited availability of project financing than most conventional technologies, as the share of capital costs in their total cost is much greater. Conventional technologies will also generally find it easier to attract equity financing and, potentially, corporate financing of investment costs as a whole. This is in part due to the lower capital investment required by these technologies, and also the much greater familiarity of most potential project sponsors with conventional technologies.

file://localhost/Users/Fungi/Library/Caches/TemporaryItems/msoclip/0clip_image004.png

c) High and Uncertain Project Development Costs

While all major infrastructure projects will tend to suffer from slow, costly, and uncertain project development and approval processes, particularly in LICs, these are again likely to be exacerbated for RET projects for multiple reasons. Such projects are often located in environmentally and socially sensitive areas. Land-use requirements for larger solar and wind projects, in particular, can be very significant. Renewable energy sources are frequently most abundant in areas at considerable distances from existing transmission and distribution grids, resulting in lengthy negotiations over grid extensions and the funding of these. A lack of experience with RETs will slow the approval process as the concerned agencies will find it harder to assess applications. The need to conduct assessments of potential renewable energy resources will further lengthen the process (wind projects, for example, need at least one year of reliable site-specific data on wind resources to be able to assess their viability).

All this makes it vital that RET project sponsors have access to significant amounts of funds to cover the costs of project development prior to reaching financial close. Such funds will generally need to come from their own resources or from sources of risk capital3 such as venture capital funds. The small size of most potential RET project sponsors in LICs means that funding from this route is limited. And there is generally little availability of risk capital in LIC financial markets.

d) Lack of Equity Finance

Linked to both the need for long-term project financing and limited access to preinvestment financing is the challenge posed by the lack of equity finance available for many if not most RET projects. While large numbers of

3 Risk capital is considered to be funds that are seeking high returns and are willing to assume high levels of risk to achieve these. RET project developers exist, there are only limited numbers of large-scale project sponsors, particularly among those operating in LICs, with the ability and willingness to fund RET projects on a corporate finance basis. RET projects are generally smaller than conventional generation projects, and this is reflected in the size of developers. The high risks of investment in many LICs, whether inside or outside the energy sector, will also tend to deter many larger energy companies based in more developed economies.

This lack of equity capital means that project sponsors are often unable to cover the costs of development activities without external assistance. But, as highlighted above, access to risk capital of the type required is limited in LICs. The lack of equity capital also increases the dependence on project financing, as sponsors are unable to provide collateral for loans or to put up large amounts of equity. As a result, loans have to be secured against future cash flows, given the absence of alternatives.

In this vein

e) Small Scale of Projects

The small scale of many RET projects creates significant problems in obtaining private financing. Economies of scale in due diligence are significant, and many larger financial institutions will be unwilling to consider small projects. Typical due diligence costs for larger projects can be in the range of $0.5 million to $1 million. International commercial banks are generally not interested in projects below $10 million, while projects up to $20 million will find it difficult to obtain interest.4 But lower limits may apply for domestic and regional banks operating in smaller economies, particularly where these lack the resources themselves to make large-scale loans.

4 Scaling-up Renewable Energy in Developing Countries: Finance and investment perspectives, K Hamilton (April 2010). Chatham House: Energy, Environment & Resource Governance Program Paper 02/10. (http://www.chathamhouse.org.uk/research/eedp/papers/view/-/id/874/).

While household, micro, and mini systems are obviously far below these limits, even larger grid-connected RET projects are generally smaller than their conventional counterparts. As a result, they often struggle to attract funding from larger financiers. These very small systems also face the problem of lack of local demand in rural areas, leading to underutilized assets and worsening financial returns and attractiveness to financiers.

Risks of Renewable Energy Projects

Further Information

References

- ↑ 1.0 1.1 Lindlein, P. & Mostert, W., 2005. Financing Renewable Energies - Instruments, Strategies, Practice Approaches, KfW.

- ↑ 2.0 2.1 2.2 United Nations Environment Programme (UNEP), 2004. Financial Risk Management Instruments for Renewable Energy Projects - Summary Document, UNEP, Division of Technology, Industry and Economics.

- ↑ 3.0 3.1 3.2 3.3 The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds.