Indonesia Energy Situation

Capital:

Jakarta

Region:

Coordinates:

6.1750° S, 106.8283° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

The primary energy supply in Indonesia is mainly based on fossil fuels like oil, gas and carbon. In 2015, 41% of Indonesian energy consumption was based on oil, 24% on natural gas and, 29% on coal. Renewable energy, particularly hydro and geothermal have a share of 6%, but statistics do not cover the traditional use of biomass as energy for cooking, lighting and process heat in rural areas, which is estimated to comprise 21% up to 29% of the total energy demand. In the past, the prolonged price subsidies and availability of oil , resulted in low oil prices in Indonesia. Currently, the gasoline market has been opened for private players and gasoline price for transportation is fluctuates adapting to changes in oil prices. Additionally, Indonesia has a hard time to produce 1 million barrel/month. Indonesia, the founding member of OPEC has left the organisation in 2009 and is now importing larger quantities of oil. However, on the other hand, Indonesia is still a net exporter of natural gas. That is why the national utility PLN is switching power generation from expensive oil to gas and coal of which Indonesia has large reserves.

Energy Situation

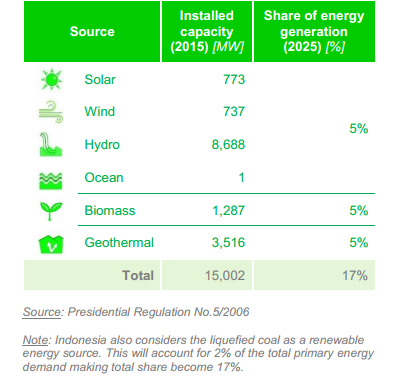

The total power generation in Indonesia is around 55 GW. Around 30 GW has been installed by the utility PLN. The remaining consists largely of captive power for the manufacturing industry. Diesel generators account for approximately 60 % of captive power capacity, while cogeneration plants provide approximately 25%. The share of 80% from the 30GW are coming from oil, gas, and coal, 18% from hydropower, and 2% from geothermal. However, hydro and geothermal power plants generate a higher share of the electricity as the capacity of the other plants is not fully used. Electricity makes around 10% of of the total energy consumption. About 80% of the electricity is consumed on Java and Bali alone. In recent years consumption of electricity has increased by 7 per cent annually. It is calculated that for every 1 percent increase in GDP the energy demand increases by 1.6 percent until year of 2020. Indonesia has failed to meet this demand growth with adequate system investments which has resulted in increased frequency and duration of power outages which prove costly to local industries. These factors have sharply put the need for diversification of supplies into focus and Indonesia has an ambitious plan for renewable energy and in parallel are advancing plans for the use of nuclear energy. The figure below shows the renewable energy targets according to Presidential Regulation No.5/2006:[1]

Subsides to the energy sector are one of the biggest items on the national budget. The combined fuel and electricity subsidies accounted for IDR 111.9 trillion in 2010. In the same year the government allocated IDR 57.46 trillion ($6.37 billion) for the fuel subsidy and the rest went to the state utility - PLN - as an operating subsidy in compensation for being compelled to sell electricity at below cost. Average generation cost in Indonesia are around 1200 IDR/kWh and reach up to 3000 IDR/kWh for diesel generated power in remote areas. Average selling price is around 700 IDR/kWh.

In spite of abundant hydropower resources hydropower is only used to a small extent. According to a Hydro Power Potential Study conducted by PLN in 1982, the total potential capacity of hydropower resources in Indonesia is 75 GW. Yet, in 2008 the country had installed a total of 3,504 MW hydropower capacity, which represents a mere 4.7% of the technical potential and only 7.2% of the total Indonesian electricity generation capacity. The development of new hydropower plants for electricity generation remained slow. The contribution of hydropower towards the Indonesian energy mix has been falling steadily in the last years; from 13% in 1998 to 7.2% in 2008.

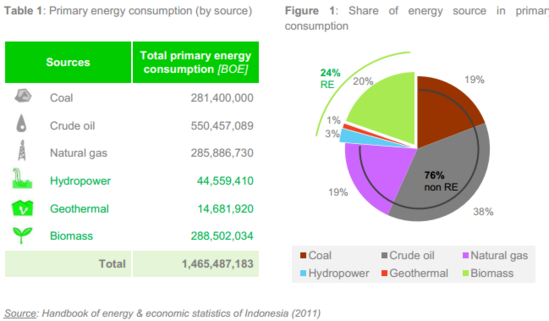

The figure below shows the primary energy consumption in Indonesia in 2011. [1]

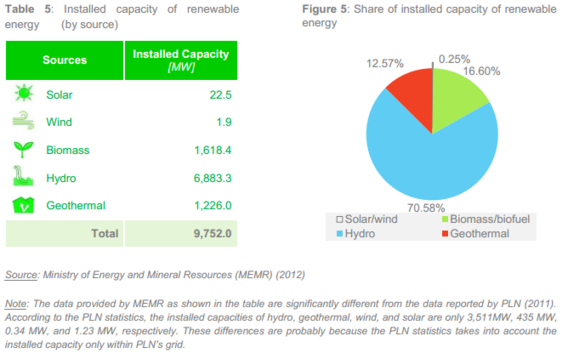

Similarly, the figure below shows the installed capacity of renewable energy in Indonesia. [1]

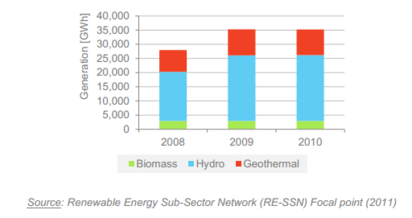

The figure below shows the energy generation from renewable energy sources from 2008 to 2010. [1]

Electricity Situation

Indonesia has a comparatively low overall rate of electrification for a middle-income country. Figures and interpretations diverge, but as much as 20% of the population representing 50 million people does not have access to electricity. Around 50% of un-electrified people in Indonesia are actually living in (already) electrified areas and would need grid densification programmes. The costs are estimated to be US$ 290 per connection. The other half is living in non-electrified villages, which are mostly found in remote rural areas. Such areas can either be targeted through grid extension or dedicated off-grid solutions. The World Bank Regional Electrification Master Plan for Indonesia made some estimation about least cost options coming to the following conclusions:

- Grid expansion is the least-cost means of electrification up to distances of around 7 km where good micro-hydro resources are available (assuming that sufficient grid-connected generation capacity is available)

- Where this is not the case, grid expansion is least-cost up to distances of around 16 km, where biomass isolated grids become lower-cost

- In cases where good micro-hydro, biomass (and geothermal) resources are not available, then grid expansion remains least-cost at distances up to 28 km, where diesel isolated grids are to be preferred

- Household level solutions are only to be preferred where practical constraints on access prevent the use of isolated grids or for smaller villages where it is not economic to install isolated grids.

Villagers in non-electrified areas rely on candles, kerosene lamps, dry cells and car batteries to satisfy part of their energy needs. Rural households typically spend a significant share of their income on these energy sources – despite the inconvenience and the environmental and health hazards associated with them.

Whilst the application of MHP technology is not new to Indonesia, only a small proportion of the country’s huge mini and micro-hydro power (MHP) potential has been exploited so far. Unfavourable framework conditions for stand-alone systems and on-grid schemes, lack of specialist know-how and a basic lack of awareness of the available potential have been the main reasons for this sluggish progress in the past. However, in remote rural areas, hydro power is now becoming increasingly competitive compared to fossil fuel-powered alternatives, due to the high energy prices (which can be trice as high as in the centres) that neutralise the still existing fuel subsidies by the Indonesian Government.

Other renewable energy technologies like Solar Home Systems, small wind turbines or biogas plants and other bioenergies are spread to a different extend in rural areas, but lack for the technical maturity or sustainable operation and service models that are necessary for large scale dissemination.

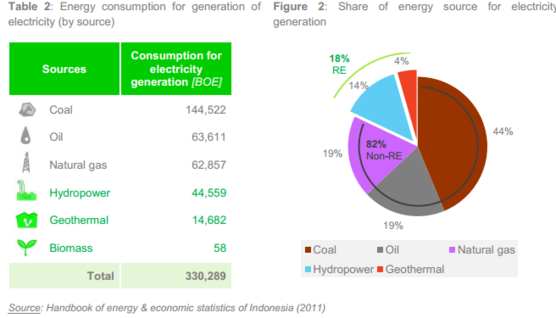

The figure below shows the energy consumption for generation of electricity. [1]

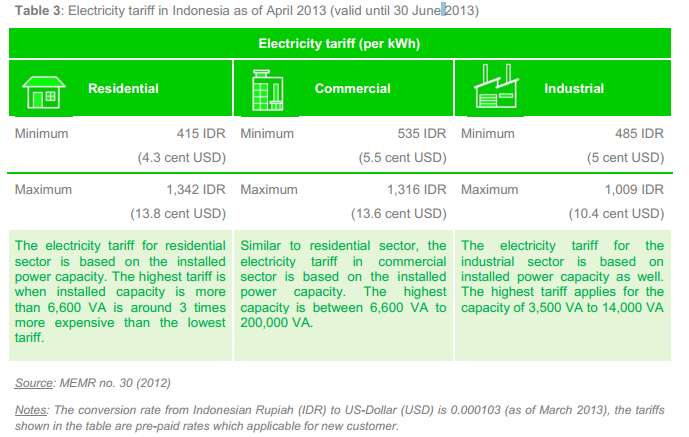

The figure below summarize the electricity tariff in Indonesia (April,2011). [1]

►Go to Top

Policy Framework, Laws and Regulations

The energy sector in Indonesia is dominated by key policies and objectives related to the following:

- Diversification: A key objective of the GOI is to reduce dependence on oil by expanding the use of coal, gas and renewable energy sources. Specific targets are set for each energy source in 2025. The Ministerial Decree on Renewable Energy Resources and Conservation (Ministerial Decree No. 002/2004) has set the target for new and renewable energies to increase to 25% (18% renewable and 7% other new energies) by 2025.

- Energy conservation

- Energy Sector Reform: more transparency, more coordination; among other things it was planned to make the utility PLN a fully independent and financially viable company but due to legal disputes such a decision has not been taken.

- Rural electrification: The current National Energy Management Blueprint identifies ambitious short- and long-term developmental objectives for the electricity sector including the increase of the electrification level to 90% of all households by 2020 and to 100% of all villages by 2010.

The Coordinating Ministry of People’s Welfare is responsible for the development and administration over poverty reduction policies and programs in Indonesia. In the last years government programs have been consolidated in 3 major clusters focussing on

(1) individual assistance and social protection (subsidised staple food and scholarships for the poorest),

(2) national program for community empowerment (PNPM) and

(3) strengthening of small and medium enterprises (mainly by providing cheap credits).

As a core element of the national poverty reduction strategy PNPM has been up-scaled in 2009 covering the whole country with a budget over 2 billion US$. The PNPM follows the philosophy of community driven development (CDD), providing institutional training and support to communities, who then can apply for funding for self-defined community development projects. The core PNPM cycle is foreseen to be implemented for three consecutive years building the institutional base in the villages for later intervention of other sector programs. As communities are free to define their priorities they can also opt for local energy infrastructure projects like hydro powered mini grids.

Energy policy for rural electrification is developed by the Directorate General for Electricity and Energy Utilisation (DGEEU) of the Ministry for Energy and Mineral Resources (MEMR). A rural electrification program is jointly implemented by the DGEEU and the Indonesian electricity utility PLN.

Updated 2017 : Now nomenclature for DGEEU is Directorate General for Electricity (DGE) since President Decree No. 24/2010 (link: Nomor 24 Tahun 2010.pdf https://www.kemenkopmk.go.id/sites/default/files/produkhukum/Perpres Nomor 24 Tahun 2010.pdf ) Update 2017 : under same decree - Perpres No. 24/2010, Indonesia renewable energy policy is handled by Directorate General of New Renewable Energy and Energy conservation (EBTKE), and with President decree No. 68/2015 (link esdm 2015.pdf https://www.minerba.esdm.go.id/library/sijh/pepres esdm 2015.pdf ) explain the duty of EBTKE which include plan, formulae and implementation of state policies and control and supervision of the activities of any form of renewable energy include Geothermal, bio energy, other form of new and renewable energy, and energy conservation. For progress of EBTKE action plan to campaign and develop the renewable energy in Indonesia please visit link http://ebtke.esdm.go.id/profile/5/capaian.rencana.kerja (in bahasa).</pre></div> PLN Strategies for renewable energy development

The strategy pursued by PLN for the future electrification of rural areas is based on the following principles of

- empowerment of the rural population to secure electricity according to their own conceptions,

- utilisation of local energy resources, in particular renewable, and

- increasing the involvement of the private sector and of rural cooperatives.

Part of that strategy is the “community-based rural energy development” concept, according to which cooperatives, municipal institutions, non-governmental organisations and/or private actors, with the technical assistance of PLN, serve as power providers in rural areas. PLN provides assistance at two different levels: either for establishing a stand-alone (isolated) grid including power generation, or for establishing a village network for connection to the PLN-operated central power grid. However, the program has been criticised as inefficient and too bureaucratic.

Rural electrification is generally not financially attractive to PLN because Indonesia’s off-grid areas are sparsely populated, have very low load factor, and are dominated by low-end household consumers who are charged a heavily subsidized tariff (average revenue for household consumers was about IDR 628 kWh in 2006. Most off-grid regions are supplied by diesel power plants that consume high priced diesel oil. This increases PLN’s cost of production far above IDR 2000 kWh.

In 2002, MEMR issued a new regulation for small renewable energy projects interested in selling power to PLN known as PSK Tersebar. The regulation requires PLN to purchase electricity generated from RE sources by non-PLN producers for projects of up to 1 MW capacity. Institutions eligible to participate are cooperatives, private companies and government-owned companies. Purchase tariffs are calculated at 80% for medium voltage and 60% for low voltage of PLN’s announced Electricity Base Price, which is supposed to be its marginal production cost at the location, where the plant is to be built. The ministry also introduced some benchmark tariffs on the cost of power production by area subsystems.

An additional program to foster rural energy supply is the Energy Self-sufficient Villages program (DME), set-up by Indonesia’s president in 2005. All rural energy related activities by Indonesian ministries are considered under this program if they result in a village’s energy self-sufficiency of at least 60%. Because the ministries do not receive extra funding, ongoing activities are integrated into the DME program. Pilot projects under the DME mainly focus on biofuels based on Cassava, Nyamblung and Jatropha. The implementation of the DME is significantly delayed and the target for 2009 was not reached. The DME program was supported by a small project of the Environment and Climate Protection Program financed by the German Ministry for Environment (BMU).

On January 31st 2012 the Government of Indonesia (GoI) issued a Renewable Energy Feed-in Tariff (FiT) for biomass, biogas and municipal solid waste. The FiT guarantees access to the grid for renewable energy generators and obligation for national state utility company (PT. PLN) to purchase the renewable energy generated until capacity 10 MW. This policy expected to boost-up renewable energy development and further private sector involvement in renewable energy sector in Indonesia. However, the new FiT not clearly mentioning time period of standard Power Purchase Agreement (PPA). Currently, almost all of the time period of the power purchase based on B to B negotiation with state utility company. This will undermine some potential investors because of un-clear certainty regarding the time period of the contract purchase power. Based on previous FiT which were issued in 2009, incentive for all renewable energy varied between ¢€ 5.5 - ¢€ 8.2 /kWh. Current issued FiT, additional incentives are applied for biomass/biogas and municipal solid waste which are at range ¢€ 8.13 – ¢€ 10.6 / kWh and applicable if the electricity feed into medium voltage (20 kV) transmission line. Further incentives are available for some islands with lack access to electricity and infrastructure with maximum factor of 1.3.

FiT for other renewable energy technologies, such as solar and wind are also planned but have not been issued yet by the regulator. The new issued FiT expected to support bio-energy development in Indonesia and maximize utilization of bio-energy potential which distribute among the archipelago[2].

Detailed information on the new FiT’s in Indonesia can be found here:

The Government of Indonesia has made a voluntary commitment to reduce the GHGs and pledges to reduce around 26 percent of Business as Usual emission in year 2020 by unilateral finance and it could be increased to 41 percent with international finance supports. To reach this target, the energy sector must play a role at least by reducing greenhouse gasses emission by 6% of the total emission reduction target.

Since recently the GOI has also established a new allocation fund for rural electrification called Dana alokasi khusus DAK. The DAK was approved by the ministry of finance. The technical guidelines have been worked out by the DGEEU and have still to be approved by the MEMR. The current budget of DAK is 15 Mio US$. It will increase to 100 Mio US$ per year. DAK is providing 200,000 to 800,000 € to local governments. These governments can use the money to construct new MHPPs, rehabilitate MHPPs, extend the grid of MHPPs or install solar systems. The districts have to contribute at least 10% of the costs. Funds can only be used for hardware. The local governments have to design and construct the plant. Consultant activities are not included, but can partly be financed by the MEMR.

The Indonesian Ministry of Energy and Mineral Resources has published a ESDM No. 38 Tahun 2016.pdf rural electrification regulation. This regulation includes information on how a business can provide electricity to currently un-electrified regions through business area concessions and how it can receive electricity subsidies from the government. It however, does not define how one can become an electricity provider.

link to the regulation: ESDM No. 38 Tahun 2016.pdf http://jdih.esdm.go.id/peraturan/Permen ESDM No. 38 Tahun 2016.pdf

Furthermore about the Renewable energy power generation tariff, there are next MEMR decree No. 19/2015 (issued in July 2015), which set the FIT tariff for renewable energy from mini hydro power generation (<10 MW) by 12 c USD / kWh, and MEMR decree No. 19/2016 for Solar PV power generation with USD 14.5 c / kWh, while Tariff for other renewable energy such as geothermal power generation was already regulated as per MEMR decree No. 17/2014 to 12 USD to 28 USD c / kWh (depend on the location). Those tariffs had a negative reaction from PLN as the off taker since those exceeding their electricity basic production costs (BPP). The PLN rejection to the tariff continued which affect to the progress of renewable energy development in Indonesia. Then the GOI issued a new decree in January 2017 - MEMR decree No. 12/2017 to replace those previous decree, on this decree the tariff for new and renewable energy is not in the FIT form but based on 85 percent of the BPP (issued by PLN verified by MEMR), the new tariffs applied for electricity generated from solar energy, wind, hydropower, biomass, biogas, waste and geothermal energy. Seem that with the new tariff still there are rejection but now arise from the private sector and investors who consider it as unattractive tariff. While instead, the GoI via MEMR believe that the new tariff still be attractive to renewable energy investors, particularly in the 13 priority areas which having localBPP higher than the national's. GoI mentioned that the potential of renewable energy in those priority areas was very large, about 210 gigawatts will attract investment. Those areas namely, Aceh, North Sumatra, Riau, Bangka Belitung, West Kalimantan, South Kalimantan, East Kalimantan, North Sulawesi, South Sulawesi, West Nusa Tenggara, East Nusa Tenggara, Maluku, and Papua. The main challenge in those area actually most sites are remote and have underdeveloped PLN grid which rise additional project risk.

GOI optimism that with the role and participation of the private sector / investors the targets of 23% energy mix in 2025 will be realistically achieved, this is the very ambitious renewable energy targets.

Stories about the renewable energy tariff in Indonesia will continue as GOI must balance the condition between one side of the energy supply prices affordable by the people of Indonesia and the other side to encourage the private sector to participate dominantly in providing the renewable energy generation with incentives.

Link for MEMR decree:

MEMR decree No. 19/2015 - ESDM 19 Th 2015).pdf http://jdih.esdm.go.id/peraturan/(Permen ESDM 19 Th 2015).pdf

MEMR decree No. 19/2016 – ESDM No. 19 Tahun 2016.pdf http://jdih.esdm.go.id/peraturan/Permen ESDM No. 19 Tahun 2016.pdf

MEMR decree No. 17/2014 – ESDM 17 2014.pdf http://prokum.esdm.go.id/permen/2014/Permen ESDM 17 2014.pdf

Institutional Set-up in the Energy Sector

Ministry of Energy and Mineral Resources (MEMR):

- The MEMR is responsible for the national energy policy and is supervising state-owned utilities and energy service companies. Important aspects of implementation have been transferred to the provincial and district level in the course of the ongoing decentralisation process.

Ministry of Finance:

- The Ministry of Finance has taken over a leading role in responding to climate change issues. MoF leads an inter-ministerial working group on climate change and low carbon issues. It is leading GOI collaboration with the World Bank on the development of low carbon development options. The MOF has initiated the establishment of an Indonesia Clean Technology Fund, a US$ 250 million equity enhancement fund for clean technology projects in Indonesia. MoF takes the lead in preparing project proposals for the World Bank’s Clean Technology Fund.

Director General of Electricity and Energy Utilisation of the MEMR (DGGEU):

- DGEEU is responsible for the electricity sector policy and its regulation DGEEU also chairs the Rural Electrification Steering Committee, which is responsible of ensuring inter-agency coordination and cooperation in matters related to the government’s rural electrification program. In addition, DGEEU co-ordinates and supports small power purchase agreement project developments. DGEEU is also the central governmental actor for mini and micro hydro power. The DGEEU sees its role in guiding facilitation for the hydro power sector development by providing regulation and standards. Recently a separate Directorate General for New and Renewable Energies and Energy conservation (DG NREEC) has been founded that started to work in February 2011. The new DG NREEC takes over the role of the central governmental institution for mini and micro hydro power.

The Directorate General for New and Renewable Energies and Energy Conservation (NREEC):

- The Directorate General for New and Renewable Energies and Energy Conservation (NREEC) started up in February 2011. NREEC was set up as a focal point for renewable energy in Indonesia. As the central governmental institution for renewable energies including hydro power it is also the central counterpart on the policy level for the ongoing ENDEV measure.

BAPPENAS (National Development Planning Agency-Bureau for Electricity, Energy Development and Mining):

- Prioritizes renewable energy projects, special rural electrification projects, determines level of government support, and appoints Government project partners. BAPPENAS is the agency responsible for preparing long- and medium-term (five-year) national development plans.

National Energy Council (DEN):

- It is chaired by the president, with the objective to define procedures to elaborate a National Energy Master Plan and Regional Energy Master Plans and to clarify the authorities of the central and local governments.

Directorate General for Community and Village Empowerment (PMD) within the Ministry for Home Affairs (MOHA):

- PMD implements the Rural PNPM and it is supporting the Green PNPM program, a new grant facility established under the country-wide PNPM. For this special fund the World Bank acts as trustee via the PNPM Support Facility (PSF). The objective of this facility is to provide additional funding to the existing block grants provided under PNPM for activities contributing to the sustainable management of natural resources (NRM). The Green PNPM is jointly financed by Australia, Canada, Denmark, and the Netherlands and provides for MHP earmarked grants of approx. 26 Mio US$ for about 250-350 schemes until 2012.

Ministry of Public Works (MPW):

- responsible for hydro power resource surveys. In a few cases, the operation of hydro plants and building codes.

Ministry of Cooperatives and Small Enterprise Development (MOC):

- responsible for enhancing the role of cooperatives in rural electrification and in some cases initiator of electrification projects.

Unfortunately, there is no effective coordination among the different governmental institutions. In fact, the different ministries partly compete with each other and the programs they implement have varying procedures and diverse financing sources. The national electricity system is managed by PLN. This state owned utility company holds a monopoly for the power generation, transmission, and distribution, as well as power retail-ing. PLN currently operates 5,233 power plants, which comprise around 44% of the genera-tion capacity outside the Java-Bali network, It means that the average plant size is less than 5 MW. PLN is managing at least 600 mini-grids. PLN is currently unable to expand its power-generating capacity due to financial difficulties. NGOs play an important role in Indonesia’s energy sector. They are advisers, project devel-opers, and managers of energy programs. NGOs are active in different RE fields.

Donor Engagement

- The World Bank has been supporting clean energy and clean development in Indonesia since the mid-1990s. One of the first WB-executed RE projects was the Indonesia Solar Home Program with the aim to provide PV systems for 200,000 Indonesian homes. However, the project was not very successful. WB published in 2005 a study “Electricity for All: Options for Increasing Access in Indonesia”. Based on the findings WB is supporting grid expansion in rural areas.

- The Netherlands, Denmark, Australia, UK and Canada support the Green PNPM. The Green PNPM is the five years (2008 – 2012) US$54.8 million environmental pilot-project of the GOI's Program Nasional Pemberdayaan Masyarakat–Rural (PNPM-Rural), or the National Program for Community Empowerment in Rural Areas. The pilot-project disburses block grants and provides technical assistance to beneficiaries within target locations in eight provinces on the islands of Sulawesi and Sumatra for community investments in ‘green sub-projects’ – activities focused on natural resource management (NRM), environmental conservation, and renewable energy (RE).

- The Asian Development Bank (ADB) is active in a range of projects from upstream gas field development to off-grid rural electrification using renewable energy. A project initiated in 2002 provided over $150 million in lending for connecting about 76,000 new customers to the power grid, including providing 10,000 low-income families in Indonesia’s outer islands with solar home systems and hydro based mini-grids.

- The Netherlands have financed the “Casindo” program which supports regional multi stakeholder forums to plan energy investment and support local universities and vocational school in the field of renewable energies and a number of other projects however have meanwhile phased out from energy sector.</span>

- Denmark is supporting in addition to the Green PNPM an energy efficiency program and recently had a planning mission to support new projects in the field of NRM.

- The EC-ASEAN Energy Facility (EAEF) had supported some projects. However, the program ended in 2007.

- IFC has showing increasing interest in financing and providing advisory services to climate change initiatives, clean energy development and energy efficiency options, and are implementing advisory services in the geothermal and biomass fields.

- Different other actors as UNDP (Integrated Microhydro Development and Application Program - IMIDAP) have been active in the MHP sector in the past, but have phased out now.

- MCC´s $332.5 million Green Prosperity Project is designed to increase productivity and reduce dependence on fossil fuels by expanding grid connected bigger renewable energy schemes, to increase productivity and reduce land-based greenhouse gas emissions by improving land use practices and management of natural resources.

- NORAD development cooperation is primarily focused on climate and forests. In 2010 Norway and Indonesia signed a declaration with the 4 main pillars: (1) cooperation on international political issues, (2) focus on energy and climate, (3) democracy and good governance and (4) economic cooperation. Cooperation potential exists in an exchange programme through which villages are electrified against clear forest protection and rehabilitation activities.

- Energising Development - EnDev - the impact-oriented initiative between the Netherlands, Germany, Norway, Australia, the United Kingdom and Switzerland is active in Indonesia since 2005. Up to 2012 EnDev supported the development of the Micro-Hydro-Power sector for Minigrids. Since 2012 EnDev engagement in Rural Electrification was extended by a component which support the installation of Photovoltaic Minigrids. Hereby EnDev plays a significant role in quality control and improvement. In 2013 EnDev Indonesia started also to support the implementation of the Indonesion Domestiv Biogas Programm (IDBP / BIRU).

- BMZ is funding the Renewable Energy Support Programme for ASEAN (ASEAN– RESP), a regional project aiming to accelerate the exchange and best practises in the ASEAN region. This project can be used to disseminate results from the ENDEV measure to other ASEAN countries with low electrification ratios like Laos, Cambodia and Myanmar and vice versa. The Hydro Power Competence Center which was established under this project in Bandung is equipped with a hydro power laboratory and can be essential in providing high quality training and testing of equipment for ENDEV projects worldwide. BMU is funding the project Least Cost Renewables (LCORE), which has been commissioned in March 2012. This project is aiming to promote renewables in those fields where they are already cost competitive like replacement of diesel generated power. There is good potential for cooperation with ENDEV especially regarding upscaling of pilot projects.

- The National Metrology Institute of Germany (Physikalisch-Technische Bundesanstalt - PTB) is carrying out a project to strengthen the quality infrastructure - i.e. standardization, metrology, testing, certification, inspection and accreditation - for the photovoltaic sector in Indonesia in cooperation with the Directorate General for New and Renewable Energy and Energy Conservation (EBTKE) under the Ministry of Energy and Mineral Resources (ESDM). The first project phase from 2016 to 2020 supported amongst others the establishment of a testing laboratory for PV modules at the National Laboratory for Energy Conversion Technology (B2TKE) that is part of the Agency for the Assessment and Application of Technology (BPPT). A second project phase is planned to be implemented from the end of 2020 to 2023.

Further Information

- Publication: Priorities for Quality Infrastructure Development for Photovoltaics in Indonesia. PTB 2019

- Publication: Quality and Safety Criteria Applied in Financing Photovoltaic Projects: A practical appraisal of information on the examples of India and Indonesia. PTB 2016

References

- EnDev Indonesia

- For further questions: mhpp2@giz.de