Financing Opportunities for Energy Access Companies in Mozambique

Access to Financial Services and Products

Access to finance is difficult for renewable energy companies in Mozambique due to sectoral and legal framework conditions, high interest rates, required collateral and lack of information.

According to World Bank’s Doing Business report, Mozambique scores 25 with regard to getting credit (with 0 being the lowest and 100 the highest score). The degree to which collateral and bankruptcy laws protect the rights of borrowers and lenders, and thus facilitate lending, is especially low with an index of 1 (out of 12). Furthermore, only 7.6% of individuals and firms are listed in a credit registry.[1]

Commercial banks have high lending rates[2], making it difficult for small retailers and micro- or medium entrepreneurs to get access to working capital, e.g. for stocking products. According to the findings of the FinScope MSME Survey Mozambique 2012, about 75% of micro enterprises and 50% of small enterprises lack access to financial services and products in the country.[3]

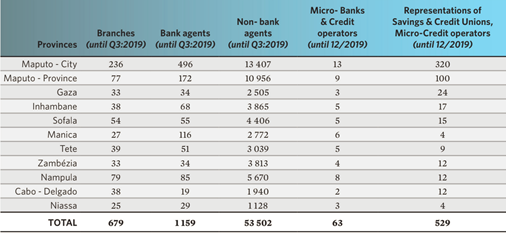

However, the lack of access to finance is not only hampered by high interest and required collateral, but also due to the mere fact that banking institutions are not easy to reach in rural areas nor do all provinces have the same coverage of bank branches.

For an overview about the accessibility of financial services for individuals, read the article about end-user finance.

Mozambique’s financial sector is comprised by the following Credit institutions and financial companies:

| 2019[4] | |

| Commercial banks | 19 |

| Micro-banks | 9 |

| Credit unions | 9 |

| Electronic money institutions | 3 |

| Savings and loan organisations | 12 |

| Representations of Savings and Credit Unions, Micro-credit operators | 529 |

Provincial distribution of bank branches as of 2019[5]

Micro Finance

The microfinance sector is still small and concentrates predominantly on Maputo city and Maputo province. High interest rates make credit from Micro Finance Institutions (MFI) very expensive. Given the difficulties in accessing local credit, most off-grid solar companies either depend on their own finances or are raising international capital.[6]

The lack of affordable loans limits the ability of energy access enterprises to manage their inventory levels, give credit to dealers, expand their distribution networks and invest in the marketing of their products. It also limits the ability of SMEs to import larger quantities of stock and thereby secure better price offers from their suppliers. This in turn leads to higher prices that are often unaffordable for low-income groups.[6]

Credit Lines in Place

State-owned Banco Nacional de Investimento (BNI) is Mozambique’s development and investment bank. It offers a range of credit products to projects that contribute to the sustainable development of Mozambique. BNI finances infrastructures with inter-sector links, such as energy, agriculture or transportation, for example. As of September 2021, there was no online information available about interest rates or specific credit lines.[7]

In 2018, Banco Comercial e de Investimentos (BCI) launched a credit line “Eco Ambiental” for renewable energy production projects. This credit line will be available until 20 December 2024 and has in total 3 million Euros available.[8] The credit line also finances energy efficient equipment, if CO2 emissions are reduced for at least 15%, or if renewable energy use is involved. Beneficiaries include private customers, micro and small and medium enterprises (SMEs), single entrepreneurs as wells as large corporations. While individuals can get from MZN 5.000 to 5 million Meticais, companies can get up to 20 million Meticais, at a fixed rate of 15%.[9]

References

- ↑ World Bank (2020): Ease of Doing Business in Mozambique https://www.doingbusiness.org/en/data/exploreeconomies/mozambique#.

- ↑ U.S. International Trade Administration, “Mozambique -Country Commercial Guide.”

- ↑ Republic of Mozambique (2016): National Financial Inclusion Strategy 2016-2022 https://thedocs.worldbank.org/en/doc/469371468274738363-0010022016/original/MozambiqueNationalFinancialInclusionStrategy20162022.pdf.

- ↑ FinScope Report Mozambique (2019): https://drive.google.com/file/d/1TYp_gAuemR2rUVUNWeYyA2N9hG5U7qUS/view.

- ↑ FinScope Report Mozambique (2019): https://drive.google.com/file/d/1TYp_gAuemR2rUVUNWeYyA2N9hG5U7qUS/view.

- ↑ 6.0 6.1 ECA/Green Light (2018): Off-Grid Solar Market Assessment in Mozambique https://www.lightingafrica.org/wp-content/uploads/2019/07/Mozambique_off-grid-assessment.pdf.

- ↑ https://www.bni.co.mz/en/development-banking/. Visited September 2021

- ↑ https://www.aler-renovaveis.org/pt/comunicacao/noticias/bci-lanca-linha-de-credito-eco-ambiental/

- ↑ https://www.bci.co.mz/bci-exclusivo-pme/#1619531279903-c3fa3f7c-4114. Accessed in September 2021