Financial Instruments & Support for Renewable Energy

► Back to Financing & Funding Portal

Overview

There are various types of financing instruments that exist to support the scaling up of renewable energy technologies (RETs). The choice and availability of instruments largely depends on if the project is being undertaken in a developed or developing country, and also on the stage of development of the technologies or projects in question. These can be broadly grouped into those that can be used in addressing financing barriers; those used to address the risks of RET investments; and those that address both simultaneously.[1]

Most renewable energy (RE) financing instruments fall under three main categories:

- Energy Market Instruments (Feed-in Tariffs, Premium, Renewable obligations, Tenders, Fiscal incentives);

- Equity Finance Mechanisms (Venture Capital, Equity, R&D Grants, Capital/Project Grants, Contingent Grants);

- Debt Finance Mechanisms (Mezzanine Debt, Senior Debt, Guarantees).[2]

The Need for Renewable Energy Finance

Finance is essential for renewable energy technology (RET) projects in two ways[3]:

- Without funds projects would not materialize, and

- With inadequate financing structure and conditions the disadvantage in competitiveness of RET would even increase, as the costs of electric power utilizing renewable energy technologies are highly sensitive to financing terms.

Demand Profile for Renewable Energy Financing

The typical demand for RE financing has the following characteristics[3]:

- Client: Investors, entrepreneurs or households with limited experience and track-record

- Type of Funds: “patient capital”, either credit or equity or equivalent

- Amounts: Depending on project and RE type, from micro-finance till major project finance

- External Financing Share: High, due to limited own capital

- Maturity: Very Long term

- Interest Rate: Lower Range of the market, due to limited return of investment.

- Security and Collateral: Limited capacity for collateral, preferably on base of cash-flow

This profile sets the benchmark for checking to which extent the local financial system with its funds and instruments can match the needs of RE financing[3].

On-Grid Renewable Energy Finance

Generally, large and medium-scale renewable-energy projects need to operate within the same financing rules applied to conventional fossil-fueled energy projects. A key issue for financing on-grid renewables investments is how to create a price support mechanism that provides stability and predictability over the medium and long term. Achieving this will reduce the risk premium in the cost of capital, which will increase the amount of investment in renewables and lower the price that consumers have to pay for renewable energy. Policy interventions are taking a range of forms including market-based mechanisms such as carbon emissions trading and renewable obligation arrangements.

Fixed-price schemes such as the Feed-in Laws in Germany and Spain have demonstrated the impact a reliable regulatory environment can have on increasing the share of renewables.

Each market has a different ‘tipping point’ where smart money sitting on the fence can be induced to enter the sector. The most effective incentives are those that get markets past this tipping point. The US Production Tax Credit for wind, when in place, is a good example of a small incentive that has had a significant impact on wind investment. Unfortunately, its application has been inconsistent.

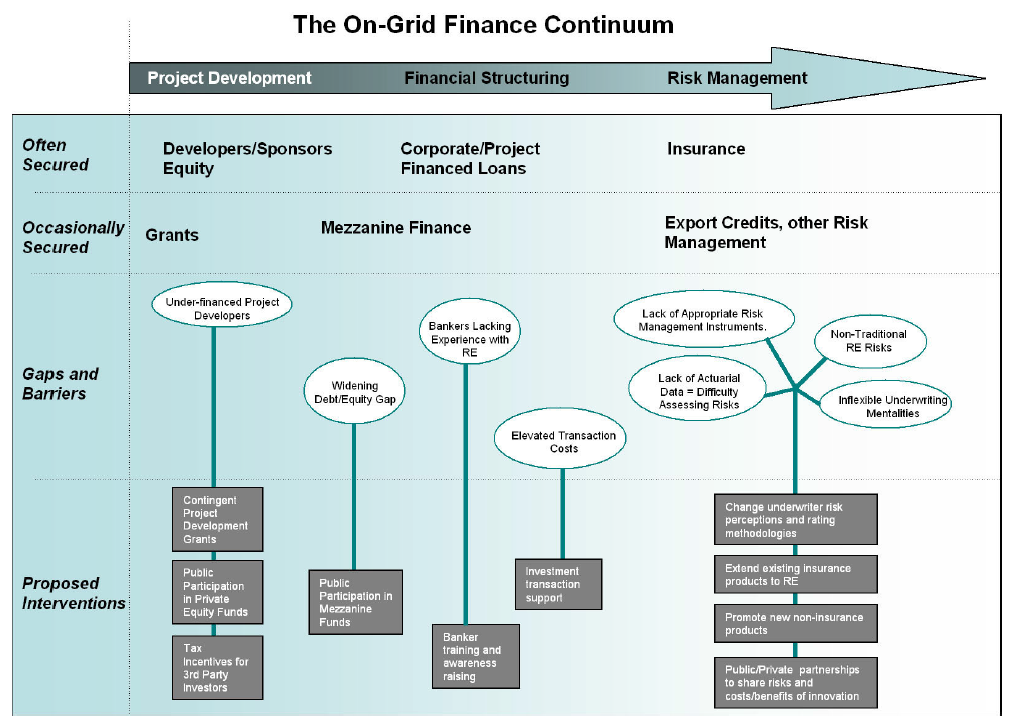

The On-Grid RE Finance Continuum (Sonntag-O’Brien, et al., 2004)

Numerous forms of capital are involved in the finance continuum of a grid-connected RE plant, as is shown in Figure 213. The conventional power-sector finance continuum includes the following sources of capital:

• equity provided by the companies involved in the project, as well as in some cases by institutional and strategic investors;

• corporate or project-financed loans provided by commercial banks or special purpose funds;

• guarantees perhaps provided by an export credit agency (ECA) to cover specific cross-border risks;

• insurance provided by an insurer or insurance broker;

• key parties to the transaction, such as fuel suppliers or power purchasers, who have entered into long-term contracts with the project.

For RE on-grid projects the finance continuum is actually quite incomplete, and the gaps can often only be filled with niche financial products, some of which already exist and some of which need to be created. Figure 2 shows which types of finance are often secured by on-grid projects, which types are occasionally secured, and the current gaps and barriers in the continuum. Finally, the figure proposes some interventions that might be supported by public sources to close the gaps in the continuum.

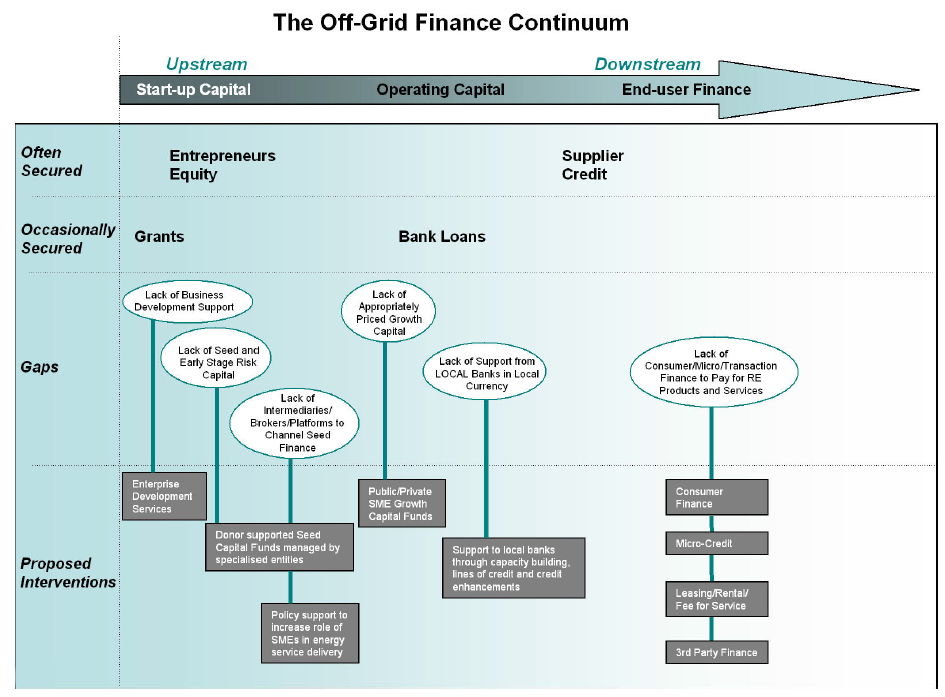

Off-Grid Renewable Energy Finance

Further Information

References

- ↑ The World Bank, 2013. Financing Renewable Energy - Options for Developing Financing Instruments Using Public Funds. Available at: http://bit.ly/UFHIPy

- ↑ de Jager, D. et al., 2011. Financing Renewable Energy in the European Market, Brussels: ECOFYS.

- ↑ 3.0 3.1 3.2 Lindlein, P. & Mostert, W., 2005. Financing Renewable Energies - Instruments, Strategies, Practice Approaches, Frankfurt am Main: KfW.