Nepal Energy Situation

Capital:

Kathmandu

Region:

Coordinates:

26.5333° N, 86.7333° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

Nepal has no known major oil, gas, or coal reserves, and its position in the Himalayas makes it hard to reach remote and extremely remote communities. Consequently, most Nepali citizens have historically met their energy needs with biomass, human labor, imported kerosene, and/or traditional water powered vertical axis mills, yet per capita energy consumption is thus “startlingly low” at one-third the average for Asia as a whole and less than one-fifth the worldwide average. In 2010, Nepal’s electrification rate was only 53 percent (leaving 12.5 million people without electricity) and 76 percent depended on fuelwood for cooking (meaning 20.22 million people placed stress on Nepali forests for their fuel needs). This situation has led some experts to call the country’s energy portfolio “medieval” in the fuels it uses and “precarious” in the load shedding that occurs throughout Kathmandu, due to an imbalance between electricity supply and demand. Nepal, however, has all it needs to escape these problems. Large markets for improved cookstoves, biogas digesters, and solar lanterns exist throughout the country. Independent scientific studies have calculated that the country could meet all if its own energy needs—indeed, even the potential needs of Nepal plus many of its neighbors—if it tapped its solar resources or its hydroelectric resources (and potentially its wind resources). These efforts could be complemented with attempts to strengthen energy efficiency planning, with significant potential for transmission upgrades and retrofits and more efficient lighting practices.[1]

Energy Situation

[Show/hide] Energy Consumption

Nepal's total energy consumption in 2010 was about 428 PJ (10,220 ktoe). New renewable energy sources (excluding large hydropower) such as biogas, micro hydro and solar energy contributed about 0.7% to the national balance in 2008/09 altogether. Although the share is still small, it has increased by 40 % since 2005.

[1]The use of primary energy sources is distributed as follows: [2]

| Biomass | 85 % |

| Petroleum products | 9 % |

| Coal | 3 % |

| Hydro Electricity | 2 % |

| Renewables | 1 % |

Between 2001 and 2009, the total energy consumption was growing at a rate of 2.4 % per year in average. Although there is a considerable lack of efficiency in energy use, Nepal accounts for relatively low CO2 emissions compared to other countries in the region. The reason is the high proportion of renewable energy sources (biomass and hydro power) in primary energy consumption. 43.6 % (2009) of Nepalese population has access to electricity; 81.0 % (2012) depend on traditional fuels (wholly or partially).[3]

Energy consumption in economic sectors (2010)[1]

| Residential | 87% |

| Transport | 6% |

| Industry | 5% |

| Commercial (services) | 1% |

| Agriculture |

1% |

Energy Consumption on Household Level

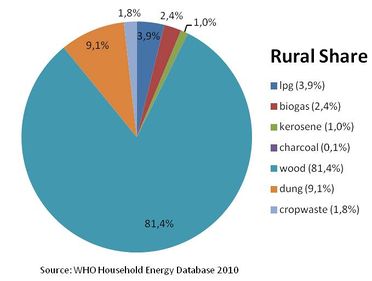

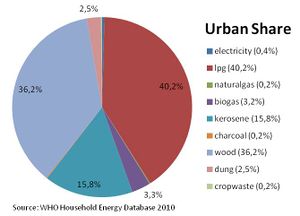

Percentage of energy types used for cooking in rural[4] and urban[4] areas

82% of population use solid fuels (charcoal, coal, cropwaste, dung and wood) as cooking energy. In rural areas this percentage goes up to 90%, whereas only 33% of the urban dwellers use solid fuels for cooking. [5][6]

Impact of Solid Fuel on Health

Total annual deaths attributable to solid fuel use: 7500 persons;

Percentage of national burden of diseases attributable to solid fuel use: 2,7%[7]

According to the Global Alliance for Clean Cookstoves, 85 % of the Nepali population use solid fuels for cooking (mostly wood).[1]

►Go To Top

[Show/hide] Energy Efficiency

With about 1 TOE for every $1,000 of GDP, Nepal has the poorest energy intensity among all South Asian countries (IEA, 2012). It thus has very large energy efficiency potential, though the United Nations warns that “energy efficiency efforts in the country are still at its infancy.” The NEA currently pursues a “loss reduction” strategy of rehabilitating 27 feeders and distribution lines, and plans for solar-powered street lamps and replacing incandescent light bulbs with compact fluorescent ones have been discussed, but not fully implemented. Nepal thus has a number of barriers to energy efficiency that it must overcome, including “absence of a legal framework,” “low levels of public awareness,” and “lack of capable human resources.”

Renewable Energy

[Show/hide] Biomass

Biomass is by far the most important primary energy source in Nepal. Biomass comprises wood, agricultural residues and dung. 95 % of the biomass is predominantly and traditionally used for cooking and heating purposes in households.

According to estimates by WECS the national biomass balance is in deficit: From 2000 to 2005 the deforestation rate was 2.1 % which was the highest rate in the region followed by Pakistan and Sri Lanka. The estimated wood consumption in 2005 was about 17 million tons. Over-exploitation of wood resources is declared to be approximately 10 million tons. This indicates that only about 40 % of the firewood comes from sustainable supply. However, there are clear regional differences. In the Terai region, only 19 % of consumption can re-grow sustainably, while this value reaches between 60 % and 80 % in the mountain regions. According to WECS, these figures are not certain and therefore only indicative.

Land Area Covered by Forest: 25.4%

Forest Annual Rate of Change: -1.23% (1990-2005); 0% (2005-2010) [8]

[Show/hide] Biogas

The Nepali farming system is heavily dependent on livestock, with at least 1.2 million households owning cattle and buffalo, with technical biogas potential for at least one million household-size plants, 57 percent located in the Terai plains, 37 percent in the hills and 6 percent in remote hills.

According to the Alternative Energy Promotion Center, as of July 2011, 241,920 biogas plants were installed in more than 2,800 Village Development Committees and in all 75 Districts under their Biogas Support Program. In addition, 2,907 biogas plants were installed under the Gold Standard Biogas Project (GSP).

Still, other estimates of Nepali biogas utilization have calculated that potential for family-sized biogas plants, operating on agricultural residues could fuel at least another 200,000 units.[1]

►Go To Top[Show/hide]Solar

Nepal has great potential for at least four types of solar energy technology: grid-connected PV, solar water heaters, solar lanterns and solar home systems. Nepal receives 3.6 to 6.2 kWh of solar radiation per square meter per day, with roughly 300 days of sun a year, making it ideal for solar energy.

The country also has a large market for solar water heaters, with 185,000 units installed and operating as of 2009.[1]

[Show/hide]Fossil Fuels

Petroleum Products

Petroleum is the second largest energy fuel in Nepal after firewood and accounts for 8% of primary energy consumption in Nepal. All petroleum products are imported from India. The government has signed an agreement with the British company Cairns Energy PLC for petroleum exploitations but the exploitation works have not been initiated up to now.

At the moment, the import of petroleum products is transacted exclusively between the “Nepal Oil Corporation” and the “Indian Oil Corporation”. 75 % of the imports are diesel, kerosene and gasoline. Due to the high energy demand in the country the dependence on petroleum imports is increasing. In 2006, Nepal had to spend 53 % of its foreign currency for importing petroleum products which is almost double than 2001. More than 62 % of the petroleum products are used in the transportation sector. Besides that, petroleum products constitute important energy sources for cooking purposes in households. The price rises during the last years made the import dependency more and more precarious for the economy of the country. The price instability also increased the vulnerability of households, especially of the urban poor, for which kerosene has become the principle source of cooking energy. The amount these households have to spend for kerosene has more than doubled from 2003 to 2009.

In recent years, subsidized fuels for cooking such as Liquefied Petroleum gas (LPG) have been utilized widely not only in urban but also in rural areas. But due to price rises in international oil markets, fossil fuels have become too costly. In 2010, the Nepal Oil Corporation reports that almost 40% of high speed diesel is used for electricity generation in captive gensets. As a result, diesel imports have therefore doubled from 2008 to 2010, creating opportunity costs of around NR 41 billion (US$ 490 million) annually.[1]

Coal

Coal accounts for 2 % of the total energy consumption and is almost exclusively consumed by the industrial sector, primarily for heating and boiling processes in brick, lime and cement production as well as in steel processing. Apart from some minor coal reserves, coal for industrial needs is imported from India. In the year 2008/09, Nepal imported about 293,000 tons of coal.

[Show/hide]Electricity

The state owned Nepal Electricity Authority (NEA) is responsible for the electricity supply through the national grid. Electricity supply is limited to 43.6 % of the population (2009) [3] which lives mainly in urban areas. Only 8 % of people in rural areas have access to electricity. The low level of electrification hampers both economic development and access to information and education in rural areas.

Beside the national grid, thousands of small installations (diesel gensets, solar home systems, small island mini grids etc.) are installed in Nepal. Therefore, the NEA serves only 15 % of the total population of Nepal. For this small number of customers, average electricity supply is less than eight hours per day, with load shedding accounting for up to 16 hours during winter. In December 2008 the Nepal Government declared a “national energy crisis” and approved an Energy Crisis Management Action Plan. In January 2009, things got even worse as drought in one part of the country reduced water available for hydroelectricity generation, and floods in another part breached the embankments of the Koshi River, toppling a crucial transmission line importing power from India. Such events provoked the World Bank to declare that “Nepal is

experiencing an energy crisis of unprecedented severity, caused by years of underinvestment and sharp growth in electricity demand.”90 Other recent studies have concluded that “Nepal has strikingly low levels of access and electricity consumption compared to many other developing countries.”[3]

Electricity Demand

The electricity consumption and the number of consumers increase at a rate of approximately 9 % per year, according to the Nepal Electricity Authority (NEA). Because of increasing household consumption, the evening peak demand has risen dramatically. Due to the continuously rising demand and stagnation in creating additional power generation capacities, a noticeable shortage of power supply since 2007 has been the consequence, which forced the NEA in early 2009 to cut power for up to 20 hours per day in some regions including urban centres.

The NEA as the major electricity utility faces an immense increase in electricity demand, whereas at the same time production and transmission capacities are limited. Though, ambitious development targets are announced by politics, the development of plants and transmission lines cannot keep up with economic development and its induced demand increase.

Between 2001 and 2011 (estimated figures) peak demand has more than doubled from 391 to 946 MW. Likewise, national annual energy demand has leveled at 4883 GWh. Compared to 2010, this represents an increase in 6.87% and 10.67% respectively.

In the same period of time annual electricity production increased from 1868 GWh to 3851 GWh. Out of these, 3157 GWh (81.58%) have been produced domestically, while 694 GWh (18.42%) have been imported from India. The resulting gap between demand and supply of 982 GWh (20.33% of demand) had to be bridged by load-shedding, which led to power outages up to 14 hours/day in Kathmandu.

Generation & Installed Capacity

Production is heavily dependent on hydropower, as nearly 83% of the total electricity will be generated by either NEA-owned or private hydropower plants in 2011 (despite high costs per unit installed due to topography and unfavorable hydrology and geology). In order to meet the growing hunger for more electricity, imports from India have become more important during the last decade. In 2011 they accounted for 18.42 % of total energy production. Whereas private and state-owned hydropower generation has doubled in the last ten years, power imports from India almost tripled (from 266 GWh in 2001 to 694 GWh in 2011). [9]

A similar picture can be drawn in terms of installed generation capacity. Currently, 652 out of 706 MW installed capacity is hydropower. Around 478 MW (~68%) of hydropower capacity is NEA-owned, while 175 MW (~25%) is privately owned and operated. Due to rising fuel prices two diesel power plants with a total installed capacity of 53.4 MW were almost abandoned within the last years. Following figure gives a comprehensive overview on the installed capacity by fuel type.[9]

Hydro

One major technical barrier to fully harnessing Nepal’s hydroelectric potential is the country’s hydrology. The rugged and mountain alpine terrain endows Nepal with plentiful moving water, but the South-West monsoon delivering it is inconsistent. About 80 percent of the country’s rain occurs from June to September, the remaining 20 percent falls as snow during the dry season. This mismatch between when water is available and when it is needed year-round to generate hydroelectricity creates a complicated engineering challenge, leading severe load shedding particularly in winter, of up to 18 hours at times.

A list of installed and planned hydro power plants has been published by Federation of Nepalese Chambers of Commerce and Industry (FNCCI):

| Total Major Hydro Grid Connected | 472,994 kW |

| Total Small Hydro Isolated (NEA) | 4,536 kW |

| Total hydro IPP | 158,315 kW |

| Total Hydro -Nepal | 635,845 kW |

A prevalence of water with high rates of silt and lack of sufficient crews to conduct maintenance lead to an average capacity factor of hydro plant - the amount of time a dam is actually producing electricity - is around 59 %.[3]

[Show/hide]Solar

943 medium-size solar PV units provide 1.2 MWp of electricity for the communications sector. Solar lanterns, popularly known as solar tuki, with 155,000 units in use as of 2010 constituting 737 kWp of capacity. 225,000 of solar home systems are used throughout Nepal across 2600 villages with an output of 5.36 MWp.[1]

Wind

The first wind turbine generator of 20 kW capacity (10 kW each) installed Kagbeni of Mustang Distrcit in 1989 (Within the three months of operation, blade and tower of the wind generator were broken). Other, wind turbines were installed in Chisapani of Shivapuri National Park and the Club Himalaya in Nagarkot, both of which are not functional anymore.Within the Asian Development Bank Renewable Village Program, two 5KW wind turbines in Dhaubadi village of Nawalparasi District were installed.[10]

Potential of Renewable Energy

The potential is as follows (UNDP, 2012)[3]:

Total Installed Capacity 710 MW (mostly hydro)

Technical Renewable Energy Potential 77,949 MW

Annual Total Electricity Generation 3,851 GWh

Annual Renewable Energy Potential 226,460 GWh

Notes: 2,100 MW of solar PV, 716 MW of wind, 42,133 MW of hydro. At a capacity factor of 17 percent, those solar facilities would generate 3,127 GWh. At a capacity factor of 30 percent, those wind farms would generate 1,882 GWh. At a capacity factor of 60 percent, those dams would generate 221,451 GWh.

Nepalese hydropower potential in detail[11]:

| River Basin | Nomber of project sites | Economic potential [MW] |

| Sapta Koshi | 40 | 10,260 |

| Sapta Gandaki | 12 | 5,270 |

| Karnali and Mahakali | 9 | 25,125 |

| Southern River | 5 | 878 |

| Total | 66 | 42,133 |

The theoretical overall potential is 83,290 MW and the technical feasable potential is 45,610 MW from which 42,133 MW is economically to realise.

Nepalese Wind potential:

The Renewable Energy and Energy Efficiency Partnership published in 2012 Nepal has substantial wind potential in one study wth at least 200 to 300 MW of capacity possible and extreme wind speeds of 46 meters per second in some areas recorded, with the best sites in the Mustang district (though many of these sites are remote from existing roads and transmission networks). A second, more thorough assessment looked at wind resources in the Annapurna Conservation Area and estimated at least 716 MW of capacity within 10 kilometers of the NEA grid. A third study done jointly by the Department of Geology at Tribhuvan Universityand the Ministry of Physical Planning and Works found at least, 3,000 MW of technical wind potential and 448 MW of potential that could be quickly and commercially exploited.[1]

Regional Disparities

In 2008/09 consumption of electricity was almost balanced between industrial (manufacturing) sector (37.37 %) and households (45.52 %), while the commercial sector consumed only 6.6 %.[12] However, the industrialized and urban areas account for the majority of electricity demand.

Around 28 % of electricity produced in Nepal in the year 2005 was consumed in the Kathmandu Valley alone.[13] The vast majority of electricity is currently consumed in the central and eastern region. Therefore an elaborated system of transmission lines is required as few hydropower plants are situated close to areas of high demand. Middle- (70 MW), Lower-Marshyangdi (69 MW) as well as Kali-Gandaki A (144 MW) as the biggest hydropower projects are all situated in the western part of the country. At the same time, this power cannot be transmitted to the central and eastern part due to bottlenecks in the transmission network between Bharatpur – Hetauda – Dhalkebar. Especially the eastern region has become totally dependent on power imported from India.[14] Besides low generation capacity, the poor transmission network seems to be the major bottleneck in the Nepalese electricity sector.

[Show/hide] Power Shortage & Load-Shedding

The general shortage of electricity is manifesting itself in scheduled power cuts (so-called load-shedding), which became an incremental part of power supply in Nepal within the last years. Especially during dry-season Nepal’s dependence on hydropower becomes obvious, forcing the NEA to cut power in Kathmandu up to 16 hours per day (as in April 2011). The situation has even worsened as only two hydropower plants with an installed capacity of 92 MW are storage types, while the rest are run-off river plants.[15]

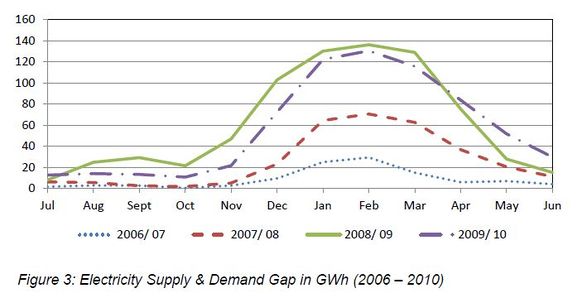

Follwoing figure illustrates the growing gap between electricity demand and supply and corresponds with the appearance of load-shedding. Since 2006/07 the supply gap increased from 105 GWh to 678 GWh in 2009/10, with the temporary peak in 2008/09 with 745 GWh. Furthermore, the figure shows the seasonal fluctuations due to irregular run-off rivers. Due to glacier melt and intensive rainfall during the monsoon season, electricity supply almost matches the demand between June and October. However, during the winter (where precipitation is far less) generation capacity decreases along with diminishing run-off rivers.

Coping with load-shedding is challenging both the industrial and commercial sector. Despite preferential treatment of the industrial sector (which is partly spared from load-shedding), manufacturing suffers hard from the power crisis. Newspapers report, that manufacturing industries have to cut their production between 25 and 80 % in peak times. Small commercial businesses are similarly affected by load-shedding, as many are dependent on power and are thus forced to use generators or backup systems.[16] The long-term impact of poor power supply is observable as the share of manufacturing sector among GDP declined from 9 to 6 % since 2000/01.[17]

As the construction period for new power generation projects and new import transmission capacities is very long, a rapid improvement of energy supply cannot be expected. An emergency supply through diesel power plants is unrealistic, because of the high power generation costs associated. Therefore, the power supply crisis affects public life and especially economic development negatively. Electricity provides nearly one fourth of the total industrial energy consumption. It has to be expected that more industrial enterprises and service providers make themselves independent from the unreliable public power supply by using diesel generators. Although this costly practice allows at least profitable companies to maintain their business, it places a huge burden on the national economy as additional fuel imports will be necessary.

Demand Forecast & Outlook

According to estimations of the NEA energy demand will grow in the next 17 years with an average annual rate of 8.34 %. The current demand of 4430 GWh annually is expected to double until 2018 and exceed 17,400 GWh by 2027. Along with the growing demand it is projected that system peak load will increase with similar annual growth rates, reaching 3679 MW in 2027.[9]

These estimations require an immense increase in the exploitation of the vast hydropower resources in Nepal. Of the 42,000 MW of economically feasible hydropower resources only the relatively small share of 1.7 % is tapped.[15] Despite long term development plans targeting to reach 10,000 MW of installed capacity by 2020 (according to the 10-years hydropower development plan), current development of the sector draw a rather different picture.

Currently, projects with a total capacity of 547 MW are under construction. NEA projects account for the major share (500 MW) of it. Planned and proposed projects would furthermore increase the capacity by 1422 MW. But considering the relatively slow deployment of new projects in Nepal, it seems unlikely that until 2020 more than 7000 MW of capacity will be contributed by projects that even have not been proposed until now.

Though, actions to upgrade generation capacity within the next ten years were taken, the current situation of load-shedding is likely to persist and may even get worse in the near future. Chamelia and Kulekhani-III with a capacity of 30 and 14 MW respectively are expected to be completed in 2011. However, the first one is situated in the Far-Western region and is thus unable to contribute to the major demand in the central and eastern part of the country. If at all, relief can be expected when the Upper Tamakoshi project is connected to the national grid. With a total capacity of 456 MW it is expected to contribute 2281.2 GWh annually. Developed as a PPP it is scheduled to start production in 2013/14.[9] Considering the estimated growth of energy demand, capacity will hardly meet peak demand even after completion of the three above mentioned projects. Especially, in the dry seasons plants will operate far below their maximum capacity, resulting in load-shedding or an immense increase of power imports from India.

As all projects that are currently under construction are run-off-river types, the Nepalese power sector will be even more dependent on seasonal fluctuations of river flows. Furthermore, it is unclear how climate change will affect water security in Nepal. Linked to many uncertainties, climate change affects run-off rivers by (a) glacier retreat and (b) changes in rainfall intensity and patterns. Projections estimate that run-off could be reduced by 14 % due to climate change, reducing both generation capacity and economically feasible hydropower potential.[18]

Limited financing: Inabilities to procure financing and foreign investment are major barriers. One assessment calculated that if you take all of the available capital in Nepali markets - this for everything, not just energy - and directed it solely at building hydropower projects, you would not even have enough for 200 MW. UNDP surveyed key lenders in the sector and noted that commercial banks and financial institutions are “generally not interested” in investing in energy. A separate evaluation commented that Nepal lacked “long-term debt financing” for energy projects and that the major lenders, the Agricultural Development Bank and National Commercial Bank, have already “maxed out” their lending for microhydro, solar PV, and biogas. A third study remarked that in Nepal, “financial institutions are not readily motivated to invest in renewable energy technologies because of the immature business models, market insecurity and implementation and usage risks.”[3]

Electricity Demand and Supply in the Household Sector

NEA provides approximately 1.5 million households with electricity. The subscriber growth rate was about 10% per year in recent years. Private households account for 43.4 % of national electricity consumption. The average daily household consumption is about 2 kWh which is used mainly for lighting. The other uses being running radios, TVs and to some extent cooking and water heating.

The electricity tariffs for households with 4 to 10 NRs / kWh (approx. 0.04 - 0.10 EUR / kWh) are low to moderate in international comparison. However, because of the high fixed monthly minimum rate households are not motivated to save electricity.

The electricity supply crises leads to cut offs that affect particularly large numbers of consumers, especially during evening peak load hours. The households are disadvantaged in two ways. They have to pay a high monthly minimum rate for an unreliable supply and moreover, they have additional expenses on lighting alternatives such as kerosene lamps, candles or battery lighting. The increasing use of electrical appliances such as refrigerators, water pumps, rice cookers and water heaters lead to power supply overload. Due to the lack of minimum standards for energy efficient appliances and a lack of labeling of the devices regarding their electricity consumption, private households can make no conscious purchase decisions with regard to operation costs of the appliances. Inefficient domestic appliances are usually cheaper than those with a higher energy-efficiency. Therefore, costumers who have no access to information about the operating costs usually buy the cheaper but inefficient appliances. As a consequence, households have to bear high operation costs, and the energy service companies have to make higher power generation capacities available.

A social norm against collecting revenue for electricity further inhibits the profitability of hydro schemes. Many believe hydroelectric facilities should serve the community for free, and that poor families should not have to pay for electricity. The problem with this view is that it creates social opposition to charging rural households for hydroelectricity.[3]

[Show/hide]Rural Electrification

Rural electrification in Nepal is very expensive due to the topographical conditions and at the same time the purchasing power of the consumers very low. This unfortunate combination of obstacles is documented in the hard fact that 56.7 % of the Nepalese population has no access to electricity. In rural arears of Nepal, 17 million peole are without electricity. [3]

State funds are insufficient to cope with the problem at hand, therefore in 2003/04 GoN adopted a policy and created the Community Electrification Program to accelerate the electrification process. The model is that communities buy power in bulk from NEA and manage/operate the local system through village organizations called Community Rural Electrification Entities (CREE).The price the CREEs pay for the bulk power is lower than the lowest consumer tariff. The revenue can be spend for operation and maintenance of the system.

230 communities positively responded to this initiative and have deposited 5 % (as a pre-condition to be part of the program) of the anticipated costs to the Community Rural Electrification Department of NEA. Another 188 agreements have already been signed, and additional 444 community applications have been registered. 116 communities have already got access to electricity under this arrangement (20 % local contribution, 80 % grants from GoN). Among the 230 communities having paid 5 % already, a large number will not be able to comply with their obligation to come up with the remaining 15 %. In addition, the communities usually lack the necessary management and technical skills to operate and manage the system properly.

Institutional Set-up and Actors in the Energy Sector

[Show/hide]Public Institutions

Several ministries have mandates affecting energy policy issues and the use of energy. These are the Ministry of Energy (MoE), the Ministry of Environment, Science & Technology (MoEST) and the Ministry of Industry. The Ministry of Forest and Soil Conservation (MoFSC) plays a role in the biomass sector and the Ministry of Housing (MoH) in the building sector. The Ministry of Commerce and Supplies is responsible for questions regarding the use of fossil fuels.

The Nepal Electricity Authority (NEA), the state-owned utility, dominates the electricity sector and is responsible for all planning, construction, and operation of electricity supply. The NEA also acts as the sole buyer of electricity from all IPPs, and it acts as the agent for all power purchase agreements for energy exchanges with India. The Ministry of Water Resources has the responsibility for all public and private activities related to hydroelectricity supply. The Nepal Oil Corporation has a monopoly to sell and distribute all petroleum products throughout the country. Apart from these three main actors, the Ministry of Energy was recently created in 2009 to “manage Nepal’s energy sector” and “develop energy resources to accelerate development,” including activities such as policy design, planning, regulation, and research. It has within it a Department of Energy Development which is supposed to ensure transparent energy regulations and facilitate private sector involvement. The Ministry of Environment enforces all environmental impact assessments, and coordinates climate change adaptation and mitigation programs. The National Development Council issues macroeconomic policy directives to the National Planning Commission for the development of annual and five-year plans. A Water and Energy Commission, Water Resources Development Council, and Environmental Protection Council all enforce regulations relating to either water resources and permitting or environmental permitting. The Department of Industry, lastly, plays a minor role and has been tasked with overseeing energy efficiency audits and efforts in the industrial sector. Though not an independent, high-level ministry, the Alternative Energy Promotion Center (AEPC), established under the Ministry of Environment, Science, and Technology, gets special mention as it is the “nodal” agency for the promotion and dissemination of all renewable energy in the country, as well as all major off-grid electrification programs.[1]

Civil unrest lasted 11 years and stopped with the formal end of the monarchy in Nepal and the establishment of the “People’s Republic of Nepal” in 2006. as of November 2011, the government was still in “crisis” without an elected Prime Minister. As a result, experts have noted that “for the past three months, the economy has come to a grinding halt, nothing is happening, no funds have been allocated to Nepal Electricity Authority or to energy.” Although the new budget published in November 2010 allocated 16.69 billion Nepalese Rupees to power generation and transmission systems, the Independent Power Producers of Nepal already stated that it is insufficient to bring any projects online.[3]

UNDP has noted that “no single institution” could “provide the horizontal alignment and necessary focus on linkages between energy poverty” and give “overall direction to a collective pro-poor energy strategy”. UNDP also documented a lack of

centralized energy planning, duplication of efforts resulting from lack of coordination, and disputes between local and national institutions over energy planning.[3]

Nepal Electricity Authority (NEA)

The state-owned utility NEA was founded in 1985. Its task is the generation, transmission and distribution of electricity and the development and operation of the electricity grid. Furthermore, the NEA is co-responsible in the preparation of energy planning and in education and training of professionals in the field of power generation, transmission and distribution.

The NEA cannot decide on electricity tariffs, but depends on the decisions of the “Electricity Tariff Fixation Commission” (EFTC). The revenues from electricity tariffs are not cost covering. The last tariff adjustment was approved in 2001. According to its own data, the total indebtedness of the NEA amounted to 7.1 billion NRs (about 700 million EUR) at the end of the financial year 2007/2008.

The NEA is affiliated with the MoE. It is headed by a Board of Directors, whose Chairman is the Minister of Energy. Further members include the Secretary of Finance, the Managing Director of the NEA, two representatives from the industrial / banking / trade and consumer protection sector as well as two energy experts.

Due to the daily power cuts, the NEA is publically criticized. It tries to bridge the gap between electricity demand and supply by importing electricity from India. Therefore, a contract for the provision of 150 MW was stipulated. However, due to technical problems during transmission this capacity currently cannot be retrieved.

Alternative Energy Promotion Center (AEPC)

The Alternative Energy Promotion Center (AEPC) was founded in 1996 to promote the development and deployment of renewable energies and alternative energy technologies in Nepal. It is a semi-autonomous institution formally attached to the Ministry of Environment. AEPC acts as an intermediary institution between the operational level NGOs / private promoters of renewable energy and the policy decision levels in relevant ministries. It`s activities include renewable energy policy formulation, planning and facilitating the implementation of the policies/plans. It also responsible for the delivery of subsidies and financial assistance for off-grid Rural Electrification and also monitoring, evaluation and quality control during the process of electrification projects. Beyond that, AEPC is responsible for the standardization, quality assurance and monitoring of RE programs

The highest body is a board with representatives from government sector, industry sector and non-governmental organizations. . An executive director leads the operational business. AEPC mainly focuses its activities on rural areas. For that purpose it operates so-called “District Energy and Environment Units” in currently 32 districts of Nepal.

AEPC receives basic funding from the Nepalese government. Moreover, it is financed to a large extend by international cooperation projects. Perhaps the most important project is the implementation of the Energy Sector Assistance Program (ESAP), mainly financed by DANIDA and NORAD. This program aims at improving the rural energy supply (solar home systems, small hydro power plants, biogas plants, efficient stoves). ESAP manages the Rural Energy Fund, which makes the partial financing of investments in rural electrification measures possible. The German KfW is participates in the promotion of SHS with a financial contribution to ESAP. Another important program is the Rural Electrification Development Programme (REDP) by UNDP and World Bank which is supporting the government in implementing the Rural Energy Policy in all districts. The Renewable Energy Project (REP), a joint effort by the European Union and the government of Nepal focuses on the provision of solar energy systems in rural areas. Furthermore, there are additional smaller projects focusing on improved watermills, biogas and climate change adaption strategies.

Water and Energy Commission Secretariat (WECS)

The Water and Energy Commission (WEC) was founded in 1975 with the aim of advancing the development of energy and water resources in Nepal in an integral way. Six years later, a permanent secretariat (WECS) was established, which is responsible for the formulation of the water and energy strategy and policy of the country as well as for the implementation of planning processes in the water and energy sectors. Originally, WECS was organizationally affiliated with the Ministry of Water Resources (MoWR), which is by now merged into the new established Ministry of Energy (MoE). The Commission consists of state secretaries of almost all ministries and representatives of the Planning Commission, the Federation of Nepalese Chamber of Commerce (FNCCI), the Nepal Engineering Association, a technical university and two experts from NGOs. Chairman is the Minister of the MoE.

The WECS has the following mandates:

- Formulation of policies and strategies in the sectors of water and energy

- Preparation of legislative proposals in these sectors

- Coordination of policy dialogue in these sectors

- Identification of energy projects

- Analysis of the portfolio of bilateral and multilateral development projects in the sectors of energy and water

- Energy planning and preparation of energy demand studies

[Show/hide]Activities of Donors

Energising Development (EnDev)

Please see the regularly updated web activities of EnDev in Nepal.

Micro Hydropower Debt Fund Component - EnDev Nepal

German Government

Advisory towards energy efficiency, 2009 - 2014 (implemented by GIZ)

Global Sustainable Electricity Partnership (GSEP) [19]

Energy for Education Project [20]

Project activities:

- Installation of two PV systems and construction of a computer room (including computer) at the local schools in the Matela VDC of Surkhet District in western Nepal and in addition distribution of small solar home systems (clean portable lamps) to students and residents of Matela displace the use of kerosene lamps. Fees for the use of these lanterns and the computers, according to the beneficiary aibility to pay, contribute to the financing of the project.

- Beautiful Nepal Association (BNA), a local NGO, and the Malika U Ma Vi School’s Management Committee are responsible to ensure maintenance and provide supervision to quality and sustainability.

Timeline:

- 10-14th December, 2012, 29 technical training workshop on stand-alone photovoltaic (PV) systems, participants from all over Nepal

- 16 December 2012, groundbreaking ceremony

- 16 April 2013, inauguration ceremony, project completed.

Key objectives:

- To demonstrate the potential of solar energy as a viable power source for improving education in the region.

- To use the energy from photovoltaic system for lighting and to launch a computer program in two rural schools.

- To provide clean portable small solar home systems for students and residents of rural Matela, significantly reducing the emission of toxic gases from the current use of kerosene lamps.

Distribution of Solar Home Systems within SE4ALL initiative[21]

GSEP, in partnership with the Global BrightLight Foundation (GBLF), distributes already (status 03 February 2014) 5000 solar home systems across Nepal within the SE4ALL initiative.

Policy Framework, Laws and Regulations

Poverty Reduction Strategy

Up to now the development policy of the Nepalese government has been codified in five-year plans. The last plan 2002/03 - 2006/07, which was also a Poverty Reduction Strategy Paper (PRSP), mentioned the following main objectives:

- poverty alleviation as the overarching goal

- economic growth

- improvement of social indicators

- market-based regulatory policy and

- good governance as a basic orientation.

The realization of those development plans suffered from implementation weaknesses, financial constraints and too ambitious goals in detail.

A major constraint for the implementation of the development strategy is still the fragile political and security situation.

-> Click on the link to download the PRSP

[Show/hide] Energy Policy

To date, there is no “National Energy Strategy” for Nepal. A draft forwarded to the parliament is not approved, yet. Up to now, the energy policy objectives are set up as a part of the general 5-Year Plans by the National Planning Commission. The energy policy of the current 3-Year Interim Plan (2007/08 – 2009/10) deals exclusively with electricity, and therefore development budgets are allocated exclusively to the development of the electricity sector. Targets for the sustainable use of energy from biomass (as the most important primary energy source) or the efficient use of commercial energy sources are not discussed. Likewise, no opportunities to understand the consumer side as the addressee of an energy policy are considered.

The objectives regarding electricity and energy in the Interim Plan are:

- creation of an environment conductive to investment in the development of hydropower

- ensure reliable and easily accessible electricity services for the majority of the people in rural areas

- completion of ongoing hydropower projects adding 105 MW generation capacity (85 MW by public sector, 20 MW by private sector)

- initiation of construction of new hydropower projects with an additional capacity of 2,115 MW with the objective to abandon the practice of load-shedding in 2013/14

- provision of electricity to additional 10 % of the population (in total, 58.5 %) in 500 additional VDCs through extension of the national grid

- expansion of per captia consumption to 100 KWh

The realization of these objectives is delayed.

The tariffs and prices for electricity and petroleum products are politically determined. They are geared to the lower limit of acquisition costs or not cost covering at all. Tariff increase has been denied to the Nepal Electricity Authority (NEA) since 2001. Therefore, the electricity sale is in deficit and has to be balanced by the state budget. In December 2011 the Nepalese Government finally decided to hike electricity prices and from 15th of January 2012 a 20% increase in power tariffs will be in effect. However, the minimum tariff of 80 NPR per 20 kWh per month will be left unchanged.

From 2008 to 2010, the “Water and Energy Commission Secretariat” (WECS) worked on a “National Energy Strategy”, in whose regard a broad consultation process was undergoing. The budget provided for this by the government was approximately 150,000 EUR. Furthermore, according to statements by the WECS, the formulation of a “National Energy Policy” shall follow after the adoption of the “National Energy Strategy”.

The 10th five-year plan (2002/03 - 2006/07) aimed strongly towards poverty reduction. The objectives derived for the energy sector development were limited to the electricity sector as well. They provided for the grid extension to rural areas and for the expansion of hydro power capacity. A confrontation of quantitative key targets with the realized outcome is disillusioning.

| Measure | Target figure | Realized | Quote |

| Development of hydro power plants | 315 MW | 40 MW | 13 % |

| Extension of high voltage transmission lines | 420 km | 47 km | 11 % |

| Extension of distribution lines | 8672 km | 2100 km | 24 % |

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 _ Cite error: Invalid

<ref>tag; name "UNDP Country brief" defined multiple times with different content Cite error: Invalid<ref>tag; name "UNDP Country brief" defined multiple times with different content Cite error: Invalid<ref>tag; name "UNDP Country brief" defined multiple times with different content Cite error: Invalid<ref>tag; name "UNDP Country brief" defined multiple times with different content Cite error: Invalid<ref>tag; name "UNDP Country brief" defined multiple times with different content Cite error: Invalid<ref>tag; name "UNDP Country brief" defined multiple times with different content Cite error: Invalid<ref>tag; name "UNDP Country brief" defined multiple times with different content Cite error: Invalid<ref>tag; name "UNDP Country brief" defined multiple times with different content Cite error: Invalid<ref>tag; name "UNDP Country brief" defined multiple times with different content - ↑ Renewable Energy and Energy Efficiency Partnership (REEEP) Clean Energy Information Portal, Energy Profile Nepal (Vienna: REEEP Secretariat, 2012)

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 3.7 3.8 3.9 _

- ↑ 4.0 4.1 WHO 2010: WHO Household Energy Database Cite error: Invalid

<ref>tag; name "WHO 2010" defined multiple times with different content - ↑ According to WHO 2010 http://apps.who.int/gho/data/?theme=country&vid=14500

- ↑ WHO 2007

- ↑ WHO (2006): Fuel for Life - Household Energy and Health

- ↑ http://rainforests.mongabay.com/deforestation/

- ↑ 9.0 9.1 9.2 9.3 National National Electricity Authority (NEA), 2011. A Year in Review, Fiscal 2009/ 2010. Kathmandu, Nepal. Cite error: Invalid

<ref>tag; name "NEA 2011" defined multiple times with different content Cite error: Invalid<ref>tag; name "NEA 2011" defined multiple times with different content Cite error: Invalid<ref>tag; name "NEA 2011" defined multiple times with different content - ↑ Saroj Dhakal, WindPower Nepal Pvt. Ltd., http://www.renewable-world.org/sites/default/files/Session%201%20Saroj%20Dhakal%20WindPower%20Nepal%20-%20Wind%20Energy%20in%20Nepal_0.pdf

- ↑ Surendra, K.C. et al. (2011). Current Status of Renewable Energy in Nepal: Opportunities and Challenges. Renewable and Sustainable Energy Reviews 15, pp. 4107-4117.

- ↑ Ministry of Finance (MoF), 2010. Economic Survey Fiscal Year 2009 - 2010. Kathmandu. Nepal.

- ↑ Shrestha, Ram M. and Salony Rajbhandari, 2010. Energy and environmental implications of carbon emission reduction targets: Case of Kathmandu Valley, Nepal. in Energy Policy, Volume 38, Issue 9. September 2010, Pages 4818-4827.

- ↑ The Kathmandu Post, 2011(b). Lack of political will behind outage. published 7/4/2011. Kathmandu, Nepal.

- ↑ 15.0 15.1 Water and Energy Commission Secretariat (WECS), 2010. Energy Synopsis Report. Kathmandu, Nepal. Cite error: Invalid

<ref>tag; name "WECS 2010" defined multiple times with different content - ↑ The Kathmandu Post, 2010. Parsa-Bara industrial area crippled by Power Crisis, Sshankar Acharya. published 31/12/2010. Kathmandu, Nepal.

- ↑ The Himalayan Times, 2011. Power crisis breaks backbone of economy, Kuvera Chalise. published 8/3/2011. Kathmandu, Nepal.

- ↑ Pathak, Mahesh, 2010. Climate Change: Uncertainty for Hydropower Development in Nepal. in Hydro Nepal, Issue No. 6, p. 31 – 34, Kathmandu, Nepal.

- ↑ www.globalelectricity.org

- ↑ http://www.globalelectricity.org/en/index.jsp?p=121&f=373

- ↑ http://www.globalelectricity.org/upload/File/news_release_2014_nepal_solar_lantern_distribution.pdf