Difference between revisions of "Ethiopia Energy Situation"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 165: | Line 165: | ||

=== Hydropower === | === Hydropower === | ||

| − | It is estimated that Ethiopia's hydropower potential with up to 45,000 MW is the 2<sup>nd</sup> highest in Africa (only DR. Congo has a higher potential). Approximately 30,000 MW are estimated to be economically feasible which is equivalent to an electricity generation of 162 TWh<ref>Ministerial Conference on Water for Agriculture and Energy in Africa (2008): The Challenges of Climate Change: Hydropower Resource Assessment of Africa.</ref><ref name="BÖLLI" />. The current production of 3.98 TWh thus equals an exploitation of only 2.5%. In general, Ethiopia’s terrain is advantageous for hydropower projects. A vast potential is not just given for large hydropower projects but also for small scale schemes, particularly in remote areas, which are not connected to the national grid. The total theoretical potential for micro hydropower schemes is 100 MW<ref>EEA (2003): Energy Access Project: Baseline Survey, Monitoring and Evaluation Framework and Hydro Market Development Strategy.</ref>. | + | It is estimated that Ethiopia's hydropower potential with up to 45,000 MW is the 2<sup>nd</sup> highest in Africa (only DR. Congo has a higher potential). Approximately 30,000 MW are estimated to be economically feasible which is equivalent to an electricity generation of 162 TWh<ref>Ministerial Conference on Water for Agriculture and Energy in Africa (2008): The Challenges of Climate Change: Hydropower Resource Assessment of Africa.</ref><ref name="BÖLLI" />. The current production of 3.98 TWh thus equals an exploitation of only 2.5%. In general, Ethiopia’s terrain is advantageous for hydropower projects. A vast potential is not just given for large hydropower projects but also for small scale schemes, particularly in remote areas, which are not connected to the national grid. The total theoretical potential for micro hydropower schemes is 100 MW<ref>EEA (2003): Energy Access Project: Baseline Survey, Monitoring and Evaluation Framework and Hydro Market Development Strategy.</ref>. |

| + | |||

| + | <br> | ||

| + | |||

| + | {| class="FCK__ShowTableBorders" cellspacing="1" cellpadding="1" width="450" border="0" | ||

| + | |- | ||

| + | | bgcolor="#cc0000" | '''<span style="color: rgb(255,255,255)">Terminology</span>''' | ||

| + | | bgcolor="#cc0000" | '''<span style="color: rgb(255,255,255)">Capacity limits</span>''' | ||

| + | | bgcolor="#cc0000" | '''<span style="color: rgb(255,255,255)">Unit</span>''' | ||

| + | |- | ||

| + | | bgcolor="#ffcc66" | Large | ||

| + | | bgcolor="#ffcc66" | >30 | ||

| + | | bgcolor="#ffcc66" | MW | ||

| + | |- | ||

| + | | Medium | ||

| + | | 10 - 30 | ||

| + | | MW | ||

| + | |- | ||

| + | | bgcolor="#ffcc66" | Small | ||

| + | | bgcolor="#ffcc66" | 1 - 10 | ||

| + | | bgcolor="#ffcc66" | MW | ||

| + | |- | ||

| + | | Mini | ||

| + | | 501 - 1,000 | ||

| + | | kW | ||

| + | |- | ||

| + | | bgcolor="#ffcc66" | Micro | ||

| + | | bgcolor="#ffcc66" | 11 - 500 | ||

| + | | bgcolor="#ffcc66" | kW | ||

| + | |- | ||

| + | | Pico | ||

| + | | ≤10 | ||

| + | | kW | ||

| + | |} | ||

| + | |||

| + | | ||

The costs to explore hydropower potential are relatively low. In fact, hydro installation in Ethiopia costs about US$1,200 per installed kW, or about half the cost of most other plants being built in eastern Africa. The largest project in the pipeline is the controversial dam and hydropower plant Gilgel Gibe III (MW 1870), which recently came close to financial closure with an agreement between Ethiopia and China. Another big hydro project is the renaissance Dam, formerly known as Great Millenium Dam. This Hydro project shall have a maximum capacity of 5.25GW, starting with 700MW in 2015. | The costs to explore hydropower potential are relatively low. In fact, hydro installation in Ethiopia costs about US$1,200 per installed kW, or about half the cost of most other plants being built in eastern Africa. The largest project in the pipeline is the controversial dam and hydropower plant Gilgel Gibe III (MW 1870), which recently came close to financial closure with an agreement between Ethiopia and China. Another big hydro project is the renaissance Dam, formerly known as Great Millenium Dam. This Hydro project shall have a maximum capacity of 5.25GW, starting with 700MW in 2015. | ||

Revision as of 14:54, 11 July 2011

Overview

| Federal Democratic Republic of Ethiopia | |||

| Ethiopia Flag.gif |

Ethiopia Situation.gif | ||

|

Capital |

Addis Ababa (9° 1′ 48″ N, 38° 44′ 24″ E) | ||

|

Official language(s) |

Amharic | ||

|

Government |

Federal Parliamentary Republic | ||

|

President |

Girma Wolde-Giorgis | ||

|

Prime Minister |

Meles Zenawi | ||

|

Total area |

1,104,300 km2 | ||

|

Population |

85,237,338 (2010 estimate) 73,918,505 (2007 census) | ||

|

GDP (nominal) |

$30.599 billion (2010 estimate) | ||

|

GDP Per capita |

$360 | ||

|

Currency |

Birr (ETB) | ||

|

Time zone |

EAT (UTC+3) | ||

|

Calling code |

+251 | ||

Introduction

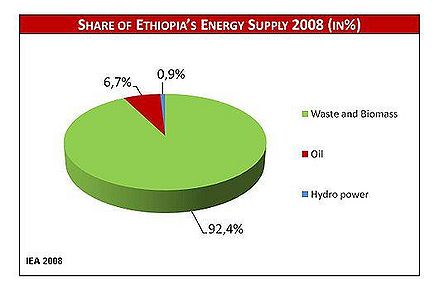

Ethiopia, ranked 157th on the 2010 Human Development Index, is one of the least developed countries in the world. With an average annual income of 120 US$ per capita, approximately 40% of its 85 million inhabitants live below the poverty line[1][2]. Ethiopia has one of the lowest rates of access to modern energy services, its energy supply is primarily based on biomass. With a share of 92.4% of Ethiopia’s energy supply, waste and biomass are the country’s primary energy sources, followed by oil (6.7%) and hydropower (0.9%)[3] (see Fig. 1).

Fig. 1:

|

99% of households, 70% of industries and 94% of service enterprises use biomass as energy source. Households account for 88% of total energy consumption, industry 4%, transport 3% and services and others 5%. The installed electricity generating capacity in Ethiopia is about 2060 MW (88% hydro, 11% diesel and 1% thermal) and production covers only about 10% [Ethiopia team to confirm] of national energy demand.The country is completely reliant on imports to meet its petroleum requirements. According to the World Bank only an estimated 12% of the Ethiopian population has access to electricity[4][5]. With almost 85% of the Ethiopians living in rural areas, there is a significant bias between the power supply of urban and rural population: only 2% of the rural but 86% of the urban residents has access to electricity[6][7]. The overloading of the network frequently disrupts the power supply of large commercial and industrial customers. There is a need for substantial investments in the power system. Ethiopia is well endowed with renewable energy resources (solar, wind, hydro and geothermal). To date, however, there is a complete lack of economic viability of renewable energy applications. The policy framework for household energy is set by the Ethiopian Energy Policy, the Environmental Policy of Ethiopia and the Conservation Strategy of Ethiopia, which address energy conservation and energy efficiency in order to reduce the consumption of fuelwood.

Problem situation

Biomass is the single most resource meeting the energy needs of the Ethiopian households. It is used mainly for cooking applications on traditional three-stone open fires. The staple food in Ethiopia’s Highlands is Injera. About 50% of the country’s primary energy consumption is used for Injera preparation mostly on traditional open fire stoves, wasting more than 90% of the fuel in an unsafe and unhealthy manner. Household users are exposed to high levels of smoke emissions in poorly ventilated kitchens and other health risks emanating from fire burns and poor kitchen hygiene. Due to their continuous use forest resources have declined to a surface coverage of 0,2% for natural forests and 6% for woodlands.

One of the SUN Program components is Energy, which is actually working in two Regions, Oromiya and Amhara. Before, from February 2004 to June 2006 a similar component was run in Tigray with the support of the SHELL Foundation. The current activities in Amhara and Oromiya are funded by a Co-financement by DGIS with a total value of 2,5 Mio Euros from October 2005 to December 2008. The energy component of the GTZ SUN Energy is jointly implemented by GTZ and the Ethiopian Federal Ministry of Agriculture and Rural Development under a bilateral cooperation agreement.

The approach of SUN Energy is mainly focused on urban and periurban environment, because availability of material sand and cement, given purchasing power and lower transportation costs.

Up to now a certain penetration of rural areas was achieved with the support of home agents, development agents or other stakeholders. Continuing this approach, the impact of the fuel saving stoves in rural areas will be limited. But 85 to 90% of the population of Ethiopia is living in rural areas. The felt free of cost availability of biomass as fuel in rural areas is hampering also one of the best sales arguments for stoves. If fuel wood is bought on the market, the stove is paying back itself within 3 to 4 months.

Access to biomass fuels is increasingly difficult. In rural areas, women and children spend an estimated 5 to 6 hours a day collecting fuel wood. This time could otherwise be used for education or income-generating activities. In urban areas where biofuels are purchased, the money spent on fuels - about 20% of household expenditure - could otherwise be used for education, health etc. These national figures disguise regional differences. The situation is severe on the highlands of the country, which constitute about 33% of the countries surface area and is inhabited by more than 75% of the population, and is specifically acute on the northern highlands. In addition, current patterns of biofuel consumption lead to high levels of indoor air pollution and hence to a high prevalence of respiratory diseases. Moreover, the growing demand for fuelwood resulting from the importance of biomass for energy supply and high population growth has serious impacts on natural resources. Even now the estimated demand for fuelwood is five to six times the sustainable supply. Most Ethiopian forests, including the Forest Priority Areas, are already highly degraded. The natural forest cover of the country has diminished to less than 3% of the total land area within a few decades, and the rate of depletion is estimated at 150.000 to 200.000 ha per annum. Dense and homogeneous patches of forest cover remain only on steep slopes and in remote areas. The expansion of farmlands and pastures and the dense population heavily drain on the forest resources. The demand for wood products, especially fuel wood, is expected to increase at about the same rate as the population, around 3% annually.

The vast majority of Ethiopia's energy needs are met from natural sources. Nationally, biomass fuels constitute more than 94% of the final energy consumption, with 77% being derived from woody biomass, 8.7% from crop residues and 7.7% from dung. Per capita energy consumption in Ethiopia is among the lowest in the world (0.30 toe). However, the energy requirements of the large and fast growing population and the fact that the major proportion is supplied by traditional energy sources have serious implications on the natural resource base. Looking at biomass supply and demand balances, there is a huge and constantly widening gap between demand and sustainable fuel wood supply. Without substantial mitigation measures, major fuel deficits are likely to result, leading to intensified "energy poverty". Already there is a notable fuel deficit in certain areas. In the Tigray region, for example, fuel-wood has become so scarce that households are digging up roots for fuel. Also, agricultural residues and dung are widely used as fuel alternatives far above what is considered normal. The use of these resources as fuel instead of fertilizer has been identified as one of the major factors for the exacerbated diminishing soil fertility, lower agricultural productivity and food security problems. Inadequate supply of fuel-wood and inefficient use in cooking of fuel-wood directly impacts rural women's health and workload. At household level access for the traditional energy resources is becoming increasingly remote.

The electricity sector

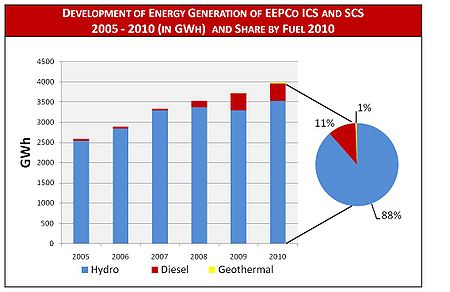

According to the Ethiopian Electric Power Corporation (EEPCo), Ethiopia’s total electricity generation in 2010 was 3,981.07 GWh. Although hydropower contributes only 0.9% to the total energy supply, it generates 88% of electricity and is thus the country’s dominating electricity resource, followed by Diesel (11%) and geothermal (1%) electricity generation (see fig. 2).

Fig. 2:

|

In the ICS (interconnected system) EEPCo currently operates 11, primarily large, hydropower-, one geothermal- and 15 diesel grid-connected power plants with a total capacity of 1842.6 MW, 7.3 MW and 172.3 MW respectively. Another three hydropower- and several diesel off-grid power plants with a capacity of 6.15 MW and 31.34 MW respectively operate as self-contained systems (SCS). The ICS is expanding whereas the SCS is shrinking due to the interconnection of previously SCS served towns to the ICS. As of July 2010, a total of 5163 towns and villages and a total of 1,896,265 costumers were connected to the ICS and SCS by EEPCo . Approx. 87% of costumers are domestic, 12% commercial and 1.1% industrial whereas only 0.1% is used for street lightning[8]. Average consumption per connected household is rather low (KWh/a 747) or 47 Kwh/year per capita, leaving a lot of potential for further growth by deepening the current network and by increasing the level of power consumption. 500Kwh/yr is considered the average minimum level of consumption per- capita for reasonable quality of life in the country.

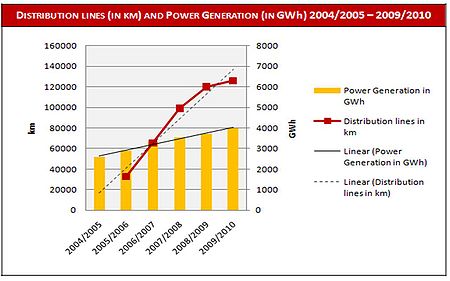

In 2005 EEPCo launched the Universal Electrification Access Program (UEAP), with the goal to connect a total of 6878 towns and villages to the grid and to increase the energy generation capability to 6386 GWh by 2010. Although the aspired target was not fully met, electricity generation increased 53% from 2,587.2 GWh in 2005 to 3,981.07 GWh in 2010[9][8]. However, the production increase does not keep pace with the grid extension activities. Transmission lines increased from a total length of 8,003.93 km in 2006 to 10,884.24 km in 2010, distribution lines’ total length even quadrupled from 33,000 km in 2005 to 126,038 km in 2010 (see fig.3).

|

Fig. 3: |

Although electricity generation is steadily increasing this creates a bias between the grid extension and the load of power generated, which results in a shortage of electricity and thus frequent power cuts. Furthermore, transmission and distribution losses of the ICS are high: 20% were lost in the period between 2001 and 2005. Most of the loss happens during distribution from the national grid to end users. Due to the hence limited electricity service, people’s willingness to pay might decrease significantly and makes more reliable power supply in isolated systems more attractive[8][10][11].

The current 5-year Growth and Transformation Plan (GTP), launched in 2010 and running until 2015, targets to increase Ethiopia’s total generating capacity to 8,000 to 10,000 MW by 2015[12]. This would quadruple or even quintuple the country’s current capacity of approximately 2000 MW. To this effect, the plan includes the installation of 8 large hydropower schemes (8737 MW total capacity), 7 wind plants (866 MW total capacity) and a 70 MW geothermal power plant[13]. The number of connected costumers is planned to be more than doubled: the target is to connect 4 million costumers by 2015[12]. Moreover the plan includes further development of the renewable energy sector.

Renewable energy sources

Ethiopia is well endowed with renewable energy sources. These include first of all hydro, but also wind, geothermal, solar as well as biomass. As of August 2009, only 7% of the estimated 54 GW economically exploitable power generation resources was either developed or committed to be developed[11].

Hydropower

It is estimated that Ethiopia's hydropower potential with up to 45,000 MW is the 2nd highest in Africa (only DR. Congo has a higher potential). Approximately 30,000 MW are estimated to be economically feasible which is equivalent to an electricity generation of 162 TWh[14][10]. The current production of 3.98 TWh thus equals an exploitation of only 2.5%. In general, Ethiopia’s terrain is advantageous for hydropower projects. A vast potential is not just given for large hydropower projects but also for small scale schemes, particularly in remote areas, which are not connected to the national grid. The total theoretical potential for micro hydropower schemes is 100 MW[15].

| Terminology | Capacity limits | Unit |

| Large | >30 | MW |

| Medium | 10 - 30 | MW |

| Small | 1 - 10 | MW |

| Mini | 501 - 1,000 | kW |

| Micro | 11 - 500 | kW |

| Pico | ≤10 | kW |

The costs to explore hydropower potential are relatively low. In fact, hydro installation in Ethiopia costs about US$1,200 per installed kW, or about half the cost of most other plants being built in eastern Africa. The largest project in the pipeline is the controversial dam and hydropower plant Gilgel Gibe III (MW 1870), which recently came close to financial closure with an agreement between Ethiopia and China. Another big hydro project is the renaissance Dam, formerly known as Great Millenium Dam. This Hydro project shall have a maximum capacity of 5.25GW, starting with 700MW in 2015.

Solar energy

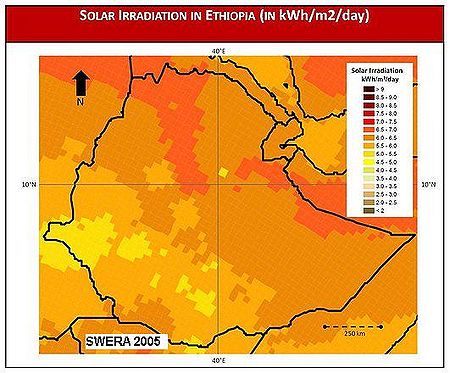

Ethiopia receives a solar irradiation of 5000 – 7000 Wh/m² according to region and season and thus has great potential for the use of solar energy[10] (see fig. 6). Although the growth rate is increasing (from <5% since the early 1990s to 15 – 20% in the last few years), primarily driven by the telecommunication sector which contributes 70% to the installed capacity, the solar PV market

|

Fig. 6: |

is still at its early stage. With an installed capacity of approximately 5 MW and an estimated PV market potential of 52 MW, with a majority in the solar home system (SHS) market and a further expansion of the telecommunication sector, not even 10% of the potential is exploited. Costs for SHS are relatively high and unlike costs for MHP systems, cannot be reduced by connecting more costumers. In the near future, larger and particularly grid-connected solar energy systems will thus compete with small-scale hydropower systems . Next to the PV SHSs, there is also a market for solar water heating (SWH) systems that use solar irradiation to heat up water, which can significantly reduce fuel wood and electricity consumption. Unlike PV systems, SWH systems have not been monitored in the past and thus accurate data is missing. Nevertheless it is estimated that 5,000 units are installed, which is equivalent to an area of 10,000 m² [16][10]. The 2010 – 2015 GTP of the Ethiopian government furthermore includes the dissemination of 153,000 SHSs and 3 million solar lanterns[17].

Biomass

Biomass resources include wood, agro-industrial residue, municipal waste and bio fuels. Wood and agricultural as well as livestock residue are used beyond sustainable yield with negative environmental impacts. There is however an energy production potential from agro-processing industries (processing sugar cone bagasse, cotton stalk, coffee hull and oil seed shells)[11]. Up to date, no grid-connected biomass power plants exist. Several sugar factories have however been using sugar cane bagasse for station supply since the 1950s. A total of 30 MW of capacity surplus could be fed in the grid by sugar factories[18]. Municipal waste and bio fuels on the other hand are barely used as energy resources. No estimation of municipal waste power production potential is available at the time, power production potential of landfill gas is estimated to be 24 MW [11]. The current GTP plans to disseminate 25,000 domestic biogas plants, 10,000 vegetable oil stoves and 9.4 million improved stoves by 2015[17].

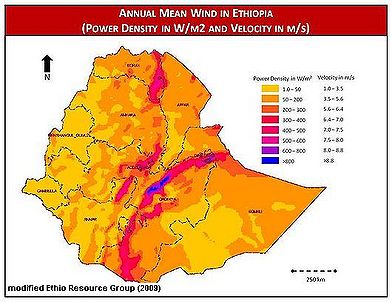

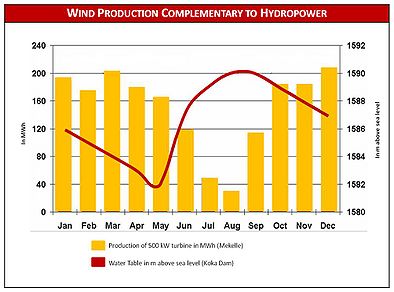

Wind energy

Ethiopia has good wind resources with velocities ranging from 7 to 9 m/s[19]. Its wind energy potential is estimated to be 10,000 MW[18] (see fig. 7). Up till now, no commercial wind energy power plants exist, nevertheless EEPCo is planning to develop seven wind sites that are in close proximity to the ICS by 2015, ranging between 50 and 300 MW. In sum, the installed wind power capacity would be approximately 720 MW [20]. Wind energy is considered a promising complementation to hydro power, since the two resources unfold their potential anti-cyclic: in rainy seasons the hydropower potential is high whereas low winds prevail. Vice versa hydropower potential is low in the dry season whereas the wind potential is high (see fig. 8). Unlike large hydropower plants, wind energy plants do not have any negative environmental impacts[19].

|

Fig. 7: |

Fig. 8: |

Geothermal energy

Ethiopia’s geothermal resources are estimated to be 5 GW of which 700 MW are suitable for electric power generation[11][18]. Geothermal resources are primarily located in the Rift Valley area, where temperatures of 50 – 300°C prevail in a depth of 1,300 – 2,500 m. Only one 7.3 MW geothermal power plant has been commissioned so far, which started operating in 1998/1999 but was shut down due to lacking technical maintenance in 2002 [9][11][18]. Operation was taken up again, but only at a much reduced generation rate. Exploration of geothermal resources is still ongoing.

Recommendations

In looking at the possible future uses of these sources, three potential types of applications can be considered: in conventional rural electrification; in complementary rural electrification; and in the provision of non-electrical energy. One of the most important weaknesses in the work carried out to date is an almost complete lack of analysis of the economic viability of renewable energy applications and their competitiveness relative to their conventional alternatives. Nor has there been any significant amount of investigation into whether potential markets exist for the technologies or how such markets might be developed. Hence it is very important to consider facilitating for proper and sustained mechanisms for data collection, analysis and knowledge management to establish the feasibility and market potentials of different RE applications.

Policy framework, laws and regulations

The government’s declared aim is a huge expansion of the infrastructure in the energy sector. A crucial reference framework for the government’s aims and for developments on the electricity market is provided by the Five-Year Development Plan (PASDEP), EEPCo’s five-year plan, and the power sector development programmes for 2005-2010. The main target for the period 2005 to 2010 is to increase the electricity access rate from 16% to 50% by the augmentation of energy generation from MW 791 to MW 2,218 and the expansion of the grid. The improvement of efficiency of the existing energy resources is another target. The energy loss is to be reduced from 20% (2005) to the international average, 13%, during the same period of time. In the last years, the government tried to pave the way for more private investors to generate electricity and feed it into the grid. Proclamation 37/1997 opens domestic investors the possibility to invest in plant capacities of up to 25MW. Only foreign organisations are permitted to invest in power stations with a capacity of over 25 MW. Council of Ministers Regulations No. 7/1996 and No. 36/1998 introduced additional tax relief and improved import regulations as incentives for private investment. Nonetheless, the electricity sector is still controlled by the state. Following are some of the major highlights from the policies and strategies of the country.

Energy development

- a. Fuel wood plantation: encouragement of the private sector and different communities to be involved in plantation schemes,

- b. Conversion of biomass in different forms of energy purposes: enhancing conversion efficiency in charcoal making, encourage and promote the modern use of agricultural residues and dung (Biogas etc.),

- c. Hydro power development: utilization of the vast hydropower potentials (of which only about 2 % is currently utilized),

- d. Other Energy sources: the policy states that whenever the economic potential is realized geothermal, coal, solar, wind and other sources of energy shall be used to generate electricity or other energy services,

- e. Oil exploration and development of the natural gas potential.

Energy conservation and efficiency

- a. Improving the energy efficiency in the transport sector, the agriculture sector, the industry and at household level is to be enhanced,

- b. Regarding the household sector, enhancing the supply of fuel wood, encouraging fuel wood substitution and taking other measures to narrow the gap between energy demand and supply, such as the promotion of fuel efficient stoves.

Encouragement of private sector to be involved in energy sector

The Energy policy also dedicates a special section for the encouragement of the private sector to be involved in the development of the Energy resources of the country specially by being involved in the construction of energy structures, a field that has been and still is seen to be mainly the responsibility of the government.

Environmental Policy of Ethiopia

The policies are:

- a. To adopt an inter-sectoral process of planning and development which integrates energy development with energy conservation, environmental protection and sustainable utilization of renewable resources,

- b. To promote the development of renewable energy sources and reduce the use of fossil energy resources both for ensuring sustainability and for protecting the environment, as well as for their continuation into the future.

Forest, Woodland and Tree Resources

The policies are:

a. To ensure that forestry development strategies integrate the development, management and conservation of forest resources with those of land and water resources, energy resources, ecosystems and genetic resources, as well as with crop and livestock production,

b. To find substitutes for construction and fuel wood whenever capabilities and other conditions allow, in order to reduce pressure on forests.

Conservation Strategy of Ethiopia

a. Boost technical and social research on the design of improved cooking stoves,

b. Promote local manufacture and distribution of improved charcoal and biomass stoves,and

c. Locate, develop, adopt or adapt energy sources and technologies to replace biomass fuels.

Development of Alternative Energy Resources and their utilization are to: Acquire, develop, test and disseminate appropriate and improved energy use technologies (e.g. improved stoves, charcoal kilns, solar powered cookers and heaters). Capacity Building and Institutional Strengthening are to:

a. Strengthen research, planning and project implementation capability of the federal and regional energy agencies,

b. Establish a centre for testing alternative and efficient energy sources, technologies and appliances,

c. Promote and assist the private sector to assemble and manufacture energy development facilities and end-use appliances.

Institutional set up in the energy sector, activities of other donors

Institutional set up

At the Federal Government level, there exists a number of institutions involved in the energy sector in the Country. The Ministry of Mines and Energy (MoME) is responsible for the overall development of the energy sector in the country. For matters relating to rural electrification the Ministry of Rural Development also has a role to play. The Ministry of Water Resources is responsible for the protection and utilisation of the nation’s water resources.

The MoME has six main agencies and departments that deal with energy issues:

1. Ethiopian Rural Energy Development and Promotion Centre (EREDPC) – with the mandate to carry out national energy resources studies, data collection and analysis, rural energy policy formulation, technology research and development and to promote appropriate renewable energy technologies in rural areas; the Centre also serves as the Executive arm of the Rural Electrification Fund (REF).

2. To assess and implement projects under the REF the EREDPC has established a core team as the Rural Electrification Executive Secretariat REES. The REES being responsible for project appraisal shall also provide advisory services, capacity building, and training to Regional Energy Bureaus and cooperatives.

3. Rural Electrification Fund (REF) - to enable the private and cooperative engagement in rural electrification activities through loan based finance and technical support. The REF received US$ 15 million in funding from the World Bank and GEF under the Energy Access Program. This allowed the granting of loans and the promotion of energy projects in rural areas in collaboration with private actors and local authorities. In formal terms it is administered by the Rural Electrification Board (REB) and the Rural Electrification Executive Secretariat (REES). The REB determines the criteria for project promotion and coordinates cooperation with other programmes. The Board also decides on whether to proceed with the submitted project proposals. The REB’s members are employees of the Ministry of Water Resources, the Ministry of Mines and Energy, the EEA and the EREDPC and representatives of the private sector. The resources available to the REF are used to subsidise 85 % of the cost of rural electrification projects. Renewable energy sources are entitled to a higher subsidy of 95 %. Most of the projects that receive assistance, however, are based on electricity generation with diesel generators.

4. Energy and Regulation Department – to formulate energy policies, energy regulations, and monitoring of implementations of these;

5. Petroleum Operation Department – for petroleum exploration and development, licensing, and project coordination;

6. Ethiopian Electricity Agency (EEA) – to regulate the electricity generation, transmission, distribution and sale of electricity. The EEA is responsible for setting the tariffs and regulating and supervising access by private operators to the electricity grid, which includes the approval of power purchase agreements (PPAs). EEA controls quality, standards of electricity, licensing of electricity operators and contractors including tariff settings. It is also responsible for organising programmes in the field of rural electrification and establishing the framework conditions for private investors. On account of structural shortcomings and a lack of personnel, however, the EEA is not yet in a position to perform these tasks to the full.

MoME is working closely with two public enterprises: the Ethiopia Electric Power Corporation (EEPCO) for the electricity sub-sector, and the Ethiopian Petroleum Enterprise (EPE) for the petroleum sub-sector. EEPCo is mandated to generate, transmit, distribute, and sell electricity. The corporation disseminates electricity through two different power supply systems: the Interconnected System (ICS) and the Self-Contained System (SCS). The ICS, which is largely generated by hydropower plants, is the major source of electric power generation. The SCS is mainly based on diesel generators and to a minor portion on small and medium hydropower plants. EEPCo’s financial situation is considered to be weak. In 2006, electricity tariffs were increased by 22 percent across the board, except for the life-line tariff (consumption up to 50kWh/month) which remained unchanged. The weighted average tariff is estimated at 0.06US$/kWh. The overall billing collection rate at present is estimated at around 98 percent. Electricity revenue increased to US$150 million. Operating profit after depreciation was US$35.2 million. Operating profit per kWh sales to end-use customers was at 0.014US$/kWh. According to the World Bank,11 EEPCo has a strong technical and stable management team, and is operating profitably with an internal cash generation of about US$50 million per year. Its operating costs are low since generation is predominantly hydro, which also reduces exposure to oil price volatility. At a regional level, energy activities are mainly supported by regional energy bureaus, which are part of regional governments, and by regional energy institutions, such as the Oromia Mines & Energy Agency and the Regional Rural Electrification Executive Secretariat Offices with support and advice from the EREDPC. There are only few private companies active in the energy sector. The number of manufacturers, assemblers and dealers of renewable energy technologies in Ethiopia is in all technology area lower than 10.

Activities of other donors

For years the World Bank was the main international donor in the energy sector working closely with GoE and EEPCo to rationalize the power sector investment program, and to assist in the funding of new projects. Currently the World Bank financing the Electricity Access--Rural Expansion Phase II programme(2007 - 2011): The development objective of the 2nd Electricity Access Rural Expansion Project is to establish a sustainable programme for expanding access to electricity in rural communities. The Project is intended to significantly expand access to and services provided by electricity in rural towns and villages. The Project has several components: (i) The Urban Distribution and Load Dispatch component will receive US$l37 million to upgrade the distribution network and associated substations in seven additional cities along with Addis Ababa. This will increase the reliability, efficiency and capacity of those urban networks, allowing new consumers to be connected in these cities; (ii) the Grid Based Rural Electrification component will receive US$30 million to increase the population’s access to electricity in rural areas. This component will electrify about 50 new villages and connect more than 70,000 consumers in those villages; (iii) the Renewable Energy component will receive US$lO million to evaluate and appraise the geothermal resource base of Ethiopia and to assess whether its energy production capacity can be diversified using this renewable energy resource base; (iv) the Institutional Capacity Building component will receive US$3 million to update the Power Sector Master Plan of Ethiopian Electric Power Corporation (EEPCo), finance training cost of EEPCo, and strengthen the planning and procurement capacity of EEPCo. Under this project a total of about 700,000 consumers are expected to be connected through intensification of connections in urban and rural areas. EEPCo will finance the cost of connection from the project and shall recover it from consumers over a period of time. In addition, the World Bank, acting as administrator for the Global Partnership on Output-Based Aid (GPOBA), has signed a grant agreement for US$8 million with the Ethiopian Electric Power Corporation (EEPCo) to support increased access to electricity in rural towns and villages with grid access, within the context of the Universal Electricity Access Programme (UEAP). Up to 228,571 low-income households will benefit from the scheme through a new or regularized electricity connection and the provision of two energy-efficient Compact Fluorescent Lamps (CFLs). Energy Access Project (GEF): This project‘s main objective is to contribute to the reduction of greenhouse gas as a portion of the diesel used for power generation would be displaced by the renewable energy. The Energy Access project will also provide affordable electricity to a large number of rural and small town dwellers on a sustainable basis, and support income-generating activities made possible by the new power supply. It will target villages and rural centres where local distribution grids are appropriate. In recent years, after the GoE publicly blamed the World Bank for powershedding and World Banks reluctance to participate in the financing of Gibe III the relations have cooled down considerably. The African Development Bank is still an important partner, not only for generation projects, but as well for the financing of the international interconnectors. China has become a strategic partner of Ethiopia in the energy sector. The extent of Chinese cooperation in the Ethiopian market was underlined not only by the recent signing for Gibe III, but a series of new major contracts for financing hydro plants and substations. Chinese companies led by Sinohydro Corporation are working on a number of hydroelectric power (HEP) projects – successfully challenging the traditional big players in Ethiopia. Chinese firms can offer low prices and financing – with The Export-Import Bank of China (China Eximbank).

The Government of Japan is willing to develop the geothermal resource base of Ethiopia. The Japan ExternalTrade Organization (JETRO) recently financed a surface survey of Aluto Langano geothermal site which indicated a potential geothermal resource base to support at least 35 MW power plant. The World Bank, the Government of Japan and the Government of Ethiopia will co-finance the appraisal and well testing to determine the level of geothermal resource available at that site. The OFID (OPEC Fund for International Development)agreed to co-finance the Urban Distribution Component to support rehabilitation and access of new consumers in EEPCo system. Italy has supported several hydropower plants and the development of the sector – and their own supplier – with considerable financial packages. France finances grid extension projects. In May 2009 Ethiopia has signed a financing agreement with France amounting to 210 million Euros for the implementation of the Ashegoda Wind Power Project in Tigray State. Coordination with EnDev Activities It has been agreed with the MoME to promote the current and planned joint interventions to the level of national programmes, namely a national Pico to Small Hydropower as well as a national solar energy programme in order to harness the momentum created by the EnDev intervention and utilize the synergy with other interventions. The planned development of a national biomass development strategy is also a similar undertaking.

Other major activities in the country financed by BMZ or DGIS

BMZ

In the focal areas of bilateral development cooperation in Ethiopia, the following programmes are implemented: Urban Governance and Decentralization Programme (UGDP), Engineering Capacity Building Programme (ECBP), Sustainable Land Management Programme (SLM).

DGIS

SNV is implementing a National Biogas Programme in Ethiopia in partnership with the Ethiopian Rural Energy Promotion & Development Centre (EREDPC). Implementation started in May 2008 with the construction of 100 demonstration biogas plants in 4 regions (Tigray, Oromia, Southern region and Amhara). In an initial phase (2008-2013), constructing a total of 14.000 biogas plants is targeted.

The Netherlands Embassy (DGIS) temporarily finances the Horn of Africa Regional Environmental Centre (Addis Ababa University initiative) that is involved in stimulating carbon financing in some of its own developed energy projects and as part of a small platform pushing on carbon/CDM problem solving. Other partners of the platform are the Min. M&E, UNDP, EPA, GTZ.

References

- ↑ UNDP (2010a): http://hdr.undp.org/en/statistics

- ↑ UNDP (2010b): http://hdrstats.undp.org/en/countries/profiles/ETH.html

- ↑ IEA (2008): http://www.iea.org/country/n_country.asp?COUNTRY_CODE=ET

- ↑ World Bank (2008): http://siteresources.worldbank.org/INTSTATINAFR/Resources/LDB-Africa-12-2-08.pdf

- ↑ Contrary to the 12% mentioned in the cited 2008 Word Bank report, EEPCo (Ethiopian Electric Power Cooperation) uses a figure of 41% current “electric energy access”. EEPCo bases this figure on the number of people within the reach of low-voltage distribution lines, not the actual number of directly connected people.

- ↑ UN Data (2007): http://data.un.org/CountryProfile.aspx?crName=Ethiopia

- ↑ Hathaway, T. (2008): What costs Ethiopia’s Dam Boom? A look inside the Expansion of Ethiopia’s Energy Sector.

- ↑ 8.0 8.1 8.2 EEPCo (2011): http://www.eepco.gov.et/eepco.php

- ↑ 9.0 9.1 EEPCo (2005): Universal Electrification Access Program.

- ↑ 10.0 10.1 10.2 10.3 Bölli et al. (2008)

- ↑ 11.0 11.1 11.2 11.3 11.4 11.5 Ethio Research Group (2009): Diversity and security for the Ethiopian Power System: A preliminary assessment of risks and opportunities for the power sector.

- ↑ 12.0 12.1 Ministry of Finance and Economic Development (MoFED) (2010): Growth and Transformation Plan (GTP) 2010/11-2014/15

- ↑ Ethio Research Group (2011): National Energy Network: Energy for Growth and Transformation.

- ↑ Ministerial Conference on Water for Agriculture and Energy in Africa (2008): The Challenges of Climate Change: Hydropower Resource Assessment of Africa.

- ↑ EEA (2003): Energy Access Project: Baseline Survey, Monitoring and Evaluation Framework and Hydro Market Development Strategy.

- ↑ GTZ (2009): Target Market Analysis: Ethiopia’s Solar Energy Market.

- ↑ 17.0 17.1 Ethio Research Group (2011): National Energy Network: Energy for Growth and Transformation.

- ↑ 18.0 18.1 18.2 18.3 Loy et al. (2007): Energiepolitische Rahmenbedingungen für Strommärkte und erneuerbare Energien 23 Länderanalysen Kapitel Äthiopien.

- ↑ 19.0 19.1 Walelu, K. (2006): EEPCo Wind energy projects in Ethiopia.

- ↑ Walelu, K. et al.(2011): Ethiopia Wind Profile.