Difference between revisions of "FATE Financial Assessment Tool for Electrification"

***** (***** | *****) m Tag: 2017 source edit |

***** (***** | *****) m Tag: 2017 source edit |

||

| Line 15: | Line 15: | ||

[[Category:Solar]] | [[Category:Solar]] | ||

[[Category:Financing Solar]] | [[Category:Financing Solar]] | ||

| + | [[Category:Financing SourcesDB]] | ||

Revision as of 07:16, 5 June 2023

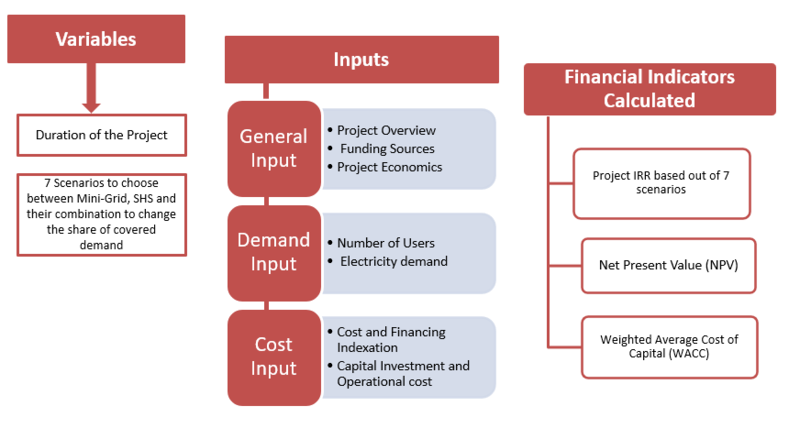

With MEI’ FATE Tool, project developers, policy makers, and financiers will be able to model and evaluate the economic viability of mini-grid investments. The model only displays the most important features, allowing for an easy input of all key data, as well as providing sufficient feedback to fully understand and analyse the economic performance of the target mini-grid project. It allows consideration of up to three different cash-flows, which may reflect three villages with different economic conditions and performances. To increase the scope of scalability, an unlimited number of villages can be considered for each of the three different cash-flows, representing clusters of villages that have the same economic conditions and performances. All cash-flows of the considered sites are consolidated in the Financial Model to display the company’s overall economic performance. By adding the company’s overhead costs and financing conditions, the income statement and balance sheet of the mini-grid investment can be produced and financial indicators like the Project Internal Return Rate (IRR), the Equity IRR, the Net Present Value (NPV) and the Debt Service Coverage Ratio (DSCR) are calculated.

- download link 1 to tool (Excel file) #

- download link 2 to user manual# (still under development)

- Video with guidance# (still under development)

Click here to visit the FATE financing source database entry.