Difference between revisions of "Fuel Prices Sri Lanka"

***** (***** | *****) m (1 revision) |

***** (***** | *****) m |

||

| (5 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

{{Fuel Price Factsheet | {{Fuel Price Factsheet | ||

|Fuel Price Country=Sri Lanka | |Fuel Price Country=Sri Lanka | ||

| + | |Fuel Pricing Policies=“Pricing policy: Following a balance-of-payment crisis, government adopted a pricing formula, which was abandoned in 2004. The formula was revived in Jul 2007 for two months before it was abandoned again. LPG price increases require prior authorization by Consumer Affairs Authority. Government sets base prices, uniform throughout the country, of gasoline, diesel, and kerosene sold by Ceylon Petroleum Corporation (CPC). Lanka Indian Oil Corporation (IOC) is free to set its prices, but given that CPC controls two-thirds of the market and is the price setter, CPC’s prices effectively limit Lanka IOC’s price movement. The VAT on gasoline was reduced from 15% to 5% in Jan 2008 and then increased to 12% in Jan 2009. CPC did not adjust prices in 2010, except that of subsidized fuel oil supplied to Ceylon Electricity Board (CEB). CPC froze prices of other fuels between Dec 2009 and April 2011. CPC made only two price adjustments (both increases) in 2011 and two in 2012, the second one of which in Dec involved a price increase only for 90 RON gasoline. Import duties are frequently reduced or waived, particularly on gasoline, to compensate oil companies for losses suffered. Social Responsibility Levy and VAT on gasoline imports were removed in 2010. Government increased the prices of gasoline (by 9%), diesel (37%), kerosene (49%), and fuel oil (80%) in Feb 2012. Although the price of fuel oil sold to CEB was raised by 50% in Feb 2012, it remains subsidized. | ||

| + | |||

| + | Protests: The large price increases in Feb 2012 sparked protests. Some private bus operators stopped operating, and violence broke out when fishermen protested, killing one. | ||

| + | |||

| + | Social protection: The national poverty alleviation program, Samurdhi, provides a monthly allowance for kerosene to households without electricity, raised from SL Rs 100 (US$0.85) to SL Rs 200 (US$1.71) in February 2012. | ||

| + | |||

| + | Compensation: Following a 37% price increase, government in Feb 2012 agreed to provide 50 liters of fuel per day to short-distance buses and 80 liters to long-distance buses at the old diesel price. In addition, SL Rs 1,550 (US$13) will be provided to each short-distance private bus owner and SL Rs 2,480 (US$21) to each long-distance private bus owner. Government also granted per-liter subsidies of SL Rs 25 (US$0.21) and SL Rs 12 (US$0.10) to fishing boats fueled by kerosene and diesel, respectively. | ||

| + | |||

| + | Hedging: CPC entered into a series of contracts to hedge a portion of its oil imports beginning in 2007, increasing the amount hedged over time to about one-third of oil imports. Lanka IOC also hedged. As long as oil prices were rising, hedging was advantageous, but hedging proved to be extremely costly once oil prices began to crash in the last few months of 2008. In the end, Sri Lanka’s treasury was exposed to about US$464 million in claims from three foreign and two local banks. The perception that the hedging deals were unfairly structured and that the public was being asked to pay for the hedging losses through higher retail prices and not benefiting from falling oil prices rapidly gained wide acceptance, and petitions to that effect were filed. The cabinet appointed a risk management committee to review all hedging contracts and to minimize the losses in Nov 2008. The supreme court ordered a temporary suspension of the CPC chairman and payments to the banks until two petitions, alleging fraud and corruption in the hedging deals, had been dealt with. The supreme court ordered the treasury to handle fuel imports between Dec 2008 and Nov 2009. Lanka IOC also reported losses from hedging. | ||

| + | |||

| + | Consequences of subsidies: CPC’s operational losses were SL Rs26 billion (US$0.23 billion) in 2009, SL Rs27 billion (US$0.24 billion) in 2010, and SL Rs94 billion (US$0.85 billion) in 2011, due to provision of heavily subsidized fuel oil to the power sector, price control, and non-payment by several institutions, particularly CEB. SL Rs55 billion (US$480 million) worth of treasury bonds were issued in Jan 2012 to settle outstanding debts owed to CPC by CEB and other state-owned enterprises (source Central Bank of Sri Lanka). | ||

| + | |||

| + | Information: Historical prices are posted on CPC’s Web site. The Central Bank of Sri Lanka in its reports regularly provides statistics on subsidies. | ||

| + | “ | ||

| + | |||

| + | (Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.) | ||

|Fuel Currency=LKR | |Fuel Currency=LKR | ||

|Fuel Price Exchange Rate=111.543 | |Fuel Price Exchange Rate=111.543 | ||

| − | |||

| − | |||

| − | |||

|Fuel Price Composition Annotation=No information available. | |Fuel Price Composition Annotation=No information available. | ||

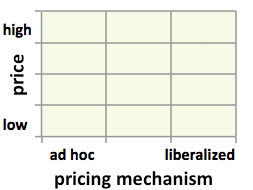

| − | |Fuel Pricing | + | |Fuel Matrix Pricing Mechanism=2 |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

|Fuel Matrix Price Level=2 | |Fuel Matrix Price Level=2 | ||

| − | |||

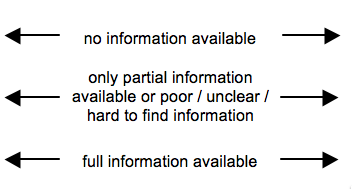

|Fuel Transparency Price Composition=1 | |Fuel Transparency Price Composition=1 | ||

|Fuel Transparency Pricing Mechanism=2 | |Fuel Transparency Pricing Mechanism=2 | ||

| Line 33: | Line 37: | ||

|Fuel Price Factsheet Source Link=http://www.ceypetco.gov.lk/ | |Fuel Price Factsheet Source Link=http://www.ceypetco.gov.lk/ | ||

}} | }} | ||

| + | |||

| + | [[Category:Sri_Lanka]] | ||

Latest revision as of 12:52, 23 September 2014

Part of: GIZ International Fuel Price database

Also see: Sri Lanka Energy Situation

Fuel Pricing Policies

| Local Currency: | LKR |

| Exchange Rate: | 111.543

|

| Last Update: |

“Pricing policy: Following a balance-of-payment crisis, government adopted a pricing formula, which was abandoned in 2004. The formula was revived in Jul 2007 for two months before it was abandoned again. LPG price increases require prior authorization by Consumer Affairs Authority. Government sets base prices, uniform throughout the country, of gasoline, diesel, and kerosene sold by Ceylon Petroleum Corporation (CPC). Lanka Indian Oil Corporation (IOC) is free to set its prices, but given that CPC controls two-thirds of the market and is the price setter, CPC’s prices effectively limit Lanka IOC’s price movement. The VAT on gasoline was reduced from 15% to 5% in Jan 2008 and then increased to 12% in Jan 2009. CPC did not adjust prices in 2010, except that of subsidized fuel oil supplied to Ceylon Electricity Board (CEB). CPC froze prices of other fuels between Dec 2009 and April 2011. CPC made only two price adjustments (both increases) in 2011 and two in 2012, the second one of which in Dec involved a price increase only for 90 RON gasoline. Import duties are frequently reduced or waived, particularly on gasoline, to compensate oil companies for losses suffered. Social Responsibility Levy and VAT on gasoline imports were removed in 2010. Government increased the prices of gasoline (by 9%), diesel (37%), kerosene (49%), and fuel oil (80%) in Feb 2012. Although the price of fuel oil sold to CEB was raised by 50% in Feb 2012, it remains subsidized.

Protests: The large price increases in Feb 2012 sparked protests. Some private bus operators stopped operating, and violence broke out when fishermen protested, killing one.

Social protection: The national poverty alleviation program, Samurdhi, provides a monthly allowance for kerosene to households without electricity, raised from SL Rs 100 (US$0.85) to SL Rs 200 (US$1.71) in February 2012.

Compensation: Following a 37% price increase, government in Feb 2012 agreed to provide 50 liters of fuel per day to short-distance buses and 80 liters to long-distance buses at the old diesel price. In addition, SL Rs 1,550 (US$13) will be provided to each short-distance private bus owner and SL Rs 2,480 (US$21) to each long-distance private bus owner. Government also granted per-liter subsidies of SL Rs 25 (US$0.21) and SL Rs 12 (US$0.10) to fishing boats fueled by kerosene and diesel, respectively.

Hedging: CPC entered into a series of contracts to hedge a portion of its oil imports beginning in 2007, increasing the amount hedged over time to about one-third of oil imports. Lanka IOC also hedged. As long as oil prices were rising, hedging was advantageous, but hedging proved to be extremely costly once oil prices began to crash in the last few months of 2008. In the end, Sri Lanka’s treasury was exposed to about US$464 million in claims from three foreign and two local banks. The perception that the hedging deals were unfairly structured and that the public was being asked to pay for the hedging losses through higher retail prices and not benefiting from falling oil prices rapidly gained wide acceptance, and petitions to that effect were filed. The cabinet appointed a risk management committee to review all hedging contracts and to minimize the losses in Nov 2008. The supreme court ordered a temporary suspension of the CPC chairman and payments to the banks until two petitions, alleging fraud and corruption in the hedging deals, had been dealt with. The supreme court ordered the treasury to handle fuel imports between Dec 2008 and Nov 2009. Lanka IOC also reported losses from hedging.

Consequences of subsidies: CPC’s operational losses were SL Rs26 billion (US$0.23 billion) in 2009, SL Rs27 billion (US$0.24 billion) in 2010, and SL Rs94 billion (US$0.85 billion) in 2011, due to provision of heavily subsidized fuel oil to the power sector, price control, and non-payment by several institutions, particularly CEB. SL Rs55 billion (US$480 million) worth of treasury bonds were issued in Jan 2012 to settle outstanding debts owed to CPC by CEB and other state-owned enterprises (source Central Bank of Sri Lanka).

Information: Historical prices are posted on CPC’s Web site. The Central Bank of Sri Lanka in its reports regularly provides statistics on subsidies. “

(Source: Kojima, Masami. (2013, forthcoming). “Petroleum product pricing and complementary policies:Experience of 65 developing countries since 2009.” Washington DC: World Bank.)

Fuel Prices and Trends

| Gasoline 95 Octane | Diesel | |

|---|---|---|

| in USD* |

|

|

| in Local Currency |

|

|

* benchmark lines: green=US price; grey=price in Spain; red=price of Crude Oil

Fuel Price Composition

Price composition.

No information available.

At a Glance

| Regulation-Price-Matrix |

| ||||

|

|

|

| ||

Sources to the Public

| Type of Information | Web-Link / Source |

|---|---|

| Other Information | http://www.ceypetco.gov.lk/ |

| Pump prices and margins | http://www.ceypetco.gov.lk/Marketing.htm |

| Pump prices and margins | http://www.ceypetco.gov.lk/History.htm |

Contact

Please find more information on GIZ International Fuel Price Database and http://www.giz.de/fuelprices