Click here to register!

Difference between revisions of "South Africa Energy Situation"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 122: | Line 122: | ||

<br/> | <br/> | ||

| + | |||

== Biomass == | == Biomass == | ||

| Line 127: | Line 128: | ||

South Africa has tremendous biofuel potential when considering the capacity to grow total plant biomass (all lignocellulosic plant biomass. According to conservative estimates, South Africa produces about 18 million tonnes of agricultural and forestry residues every year. The South African biofuels target for 2008‐2013, according to Industrial Biofuels Strategy (2007), has been fixed at 2% penetration level in the national liquid fuel supply, which corresponds to 400 million litres per annum. When considering the use of 50‐70% of this plant biomass with second generation biochemical and thermochemical technologies, South Africa has the potential to substitute the bulk of its current liquid fossil fuel usage (currently 21.2 BL/annum) with renewable biofuels. However, the only real activity has been US$437 million investment by the South Africa’s Industrial Development Corporation (IDC) and Energy Development Corporation (EDC) in two biofuels projects that will collectively produce 190 million litres of bioethanol from sugarcane and sugarbeet.<ref>http://cleantechsolutions.wordpress.com/2011/12/27/biomass-energy-in-south-africa/</ref> | South Africa has tremendous biofuel potential when considering the capacity to grow total plant biomass (all lignocellulosic plant biomass. According to conservative estimates, South Africa produces about 18 million tonnes of agricultural and forestry residues every year. The South African biofuels target for 2008‐2013, according to Industrial Biofuels Strategy (2007), has been fixed at 2% penetration level in the national liquid fuel supply, which corresponds to 400 million litres per annum. When considering the use of 50‐70% of this plant biomass with second generation biochemical and thermochemical technologies, South Africa has the potential to substitute the bulk of its current liquid fossil fuel usage (currently 21.2 BL/annum) with renewable biofuels. However, the only real activity has been US$437 million investment by the South Africa’s Industrial Development Corporation (IDC) and Energy Development Corporation (EDC) in two biofuels projects that will collectively produce 190 million litres of bioethanol from sugarcane and sugarbeet.<ref>http://cleantechsolutions.wordpress.com/2011/12/27/biomass-energy-in-south-africa/</ref> | ||

| − | |||

| − | |||

| − | |||

== <span data-scaytid="48" data-scayt_word="biogas">Biogas</span> == | == <span data-scaytid="48" data-scayt_word="biogas">Biogas</span> == | ||

Revision as of 14:37, 6 May 2014

| South Africa | |||

|---|---|---|---|

| Capital | Pretoria | ||

| Official Languages(s) |

11 Official languages with Zulu being the most spoken language | ||

| Government | Democratic Republic | ||

| President | Jacob Zuma[1] | ||

| 'Total Area '( km²) | 1211037[2] | ||

| Population | 52981991[3] | ||

| Rural Population | (year) | ||

| GDP (Nominal) | US $ 471178 Billion (2011)[4] | ||

| GDP Per Capita | US $ (year) | ||

| Currency | Rand | ||

| Time Zone | UTC/GMT +2 hours | ||

| Electricity Generation | TWh/year (year) | ||

| Access to Electricity | 75 % | ||

| Wind energy (installed capacity) | MW (year) | ||

| Solar Energy (installed capacity) | MW (year) | ||

Overview

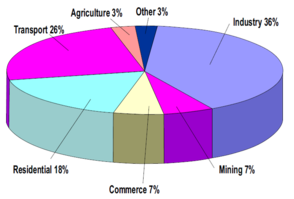

- Coal supplies 65.7% of the primary energy*

- Followed by crude oil with 21.6%

- Renewable and wastes with 7.6 %

- Gas with 2.8%

- Nuclear 0.4%

- Hydro 0.1%[5]

Economy General

- 1 Euro ~ 14 south African Rand (ZAR) (January 2014).

- GDP ~ 3080 Billion ZAR ~ 280 Billion Euro.

- Exports amounted to 24% of GDP in 2010.

- Large and active stock exchange that ranks 17th in the world.[6]

- Active member of BRICS

- BRICS is an international political organisation of leading emerging economies with a developing middle income status and it comprises of Brazil, Russia, India, China and South Africa.

Hydropower

Till date hydropower contributes only 0.1% of the South African Energy supply.[7]

The Baseline Study on Hydropower in South Africa, an assessment conducted by the DME in 2002, indicated that specific areas in the country show significant potential for the development of all categories of hydropower in the short and medium term.

The Eastern Cape and KwaZulu-Natal are endowed with the best potential for the development of small, i.e. less than 10MW hydropower plants. The advantages and attractiveness of these plants are that they can either be standalone or in a hybrid combination with other renewable energy sources. Advantage can be derived from the association with other uses of water (water supply, irrigation, flood control, etc.), which are critical to the future economic and socio-economic development of South Africa.

The Southern African Power Pool (SAPP) allows the free trading of electricity between Southern African Development Community (SADC) member countries, providing South Africa with access to the vast hydropower potential in the countries to the north, notably the significant potential in the Congo River (Inga Falls).[8]

Solar Energy

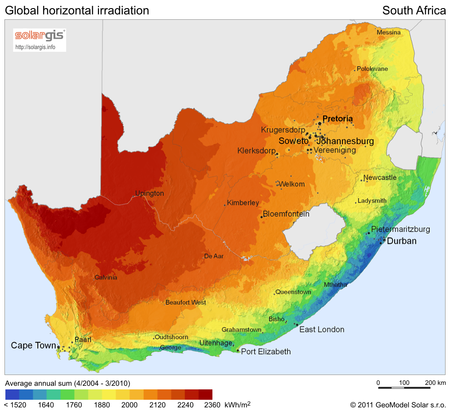

Most areas in South Africa average more than 2 500 hours of sunshine per year, and average solar-radiation levels range between 4.5 and 6.5kWh/m2 in one day.

The southern African region, and in fact the whole of Africa, has sunshine all year round. The annual 24-hour global solar radiation average is about 220 W/m2 for South Africa, compared with about 150 W/m2 for parts of the USA, and about 100 W/m2 for Europe and the United Kingdom. This makes South Africa's local resource one of the highest in the world. [9]The South-west region has the most potential for solar in South Africa as can be seen from the above graph.

Market Entry Barrier

There are no particular barriers for entering the market but following Steps need to be followed for setting up a Solar Power Plant/Project:

- Application-Department of Energy(DOE) invite Potential developers to submit their application/ proposals

- Allotment -DOE with then assign a particular developer for the project after considering thier prices, proposals etc. It is a confidential process within DOE.

- PPA-The successful bidders / developer then signs Power Purchase agreement (PPA) with Eskom(South africa biggest utility).

- Land Acquisition

- EPC- The sucessful bidder/project owner/ developer then hire an Engineering, Procurement and Constrcution (EPC) company for sucessful implementation of the project.

- Commissioning- EPC handover the project to the owner after commisoning of the project and connecting it to the Grid .

Biomass

South Africa has tremendous biofuel potential when considering the capacity to grow total plant biomass (all lignocellulosic plant biomass. According to conservative estimates, South Africa produces about 18 million tonnes of agricultural and forestry residues every year. The South African biofuels target for 2008‐2013, according to Industrial Biofuels Strategy (2007), has been fixed at 2% penetration level in the national liquid fuel supply, which corresponds to 400 million litres per annum. When considering the use of 50‐70% of this plant biomass with second generation biochemical and thermochemical technologies, South Africa has the potential to substitute the bulk of its current liquid fossil fuel usage (currently 21.2 BL/annum) with renewable biofuels. However, the only real activity has been US$437 million investment by the South Africa’s Industrial Development Corporation (IDC) and Energy Development Corporation (EDC) in two biofuels projects that will collectively produce 190 million litres of bioethanol from sugarcane and sugarbeet.[10]

Biogas

The Southern African Biogas Industry Association is a public, non-profit organisation established for the sole object of promoting the sustainable growth of the biogas industry in Southern Africa with a potential to generate 2500 MW of power. The association was launched during Q1 of 2013 and is in the process of establishing itself. Currently, SABIA has 12 corporate members. In October 2013 SABIA organised the first Biogas National Conference. http://biogasassociation.co.za/

Wind Energy

South Africa has an excellent wind resource which is dispersed geographically.

Cost of wind power already competitive with New coal and shall reach grid parity by 2016/2017 Wind Atlas for South Africa. [1]

Supporting renewable energy in South Africa

With a national commitment to lowering greenhouse gas emissions and increase energy security through the introduction of more diverse energy supply sources, South Africa tackled the issue of deploying renewable energy in all seriousness from 2010.

Various national policies pertaining to renewable energy support the efforts to harness South Africa’s abundant renewable energy sources. The Constitution (Act No. 108 of 1996) requires that Government establish a national energy policy to ensure that national energy resources are adequately tapped and delivered to cater for the needs of the nation; further, the production and distribution of energy should be sustainable and lead to an improvement in the standard of living of citizens. The Government’s overarching energy policy has been set out in its White Paper on Energy Policy of the Republic of South Africa[i]. The White Paper on Renewable Energy (2003) supplements the White Paper on Energy Policy, which recognised that the medium and long-term potential of renewable energy is significant. More recent important policies are the National Development Plan (NDP) and the New Growth Path (NGP) which provides comprehensive support for renewable energy, including appropriate pricing policies and encouragement of local production. To this end the Green Economy Accord was published as part of the NGP, which outlines the commitment from Government to the procurement of renewable energy. The Green Economy Accord commits to achieving industry-wide localization of at least 35% by 2016 with increasing local content in the following years towards an aspirational target of 75%.

The Integrated Resource Plan (IRP) 2010-2013 (revised November 2013) made important adjustments which will influence energy planning and implementation in South Africa. The latest IRP include a downwardly-revised electricity and peak demand and also recommends the continuation of the current renewable energy bidding programme with additional annual rounds of 1000 MW PV capacity; 1000 MW wind capacity and 200 MW CSP capacity. The revised IRP generated vigorous debate, also in the wind industry in South Africa which argued that the allocation to wind power should be increased, seeing that wind is now 30% cheaper per kilowatt-hour than electricity generated from Medupi[ii]. An estimated minimum allocation of 500 MW per year is required to stimulate the development of a sustainable wind energy industry, which will enable job creation and sectoral growth.

South Africa’s Renewable Energy Programme Implementation programme

South Africa’s renewable energy sector experienced explosive growth in the past few years with investment of more than $5.5 billion in 2012, up from a meagre $30 million in 2011- representing an impressive increase of 20,500%. South Africa’s leading position has been secured through a supportive policy environment, coupled with a secure investment framework established by National Treasury and the Department of Energy’s (DoE) Renewable Energy Independent Power Producer Procurement Programme or REI4P.

The Department of Energy launched the REI4P in 2011 and aims to award power purchase agreements for projects with an overall capacity of 3725 MW to be installed by the end of 2016. Provision has been made for five consecutive bidding windows. Preferred bidders under windows 1 and 2 have reached financial close while preferred bidders under window three have been announced. In total, 62 wind projects have been allocated under the first three windows. The total allocation to wind energy for the REI4P programme amounts to 3 320 MW of which 1 984 MW was allocated under the first three bidding windows. In line with the revised IRP, an additional annual allocation of 1000 MW to wind will be made from 2014 onwards. The price of wind energy has also steadily decreased:

|

Wind Energy |

Bid Window 1 |

Bid Window 2 |

Bid Window 3 | ||||

|

Price fully indexed (Av. R/kWh base April 2011 |

R1, 243 |

R0.897 |

R0.656 | ||||

|

Price fully indexed (Av. R/kWh base April 2013 |

R1, 284 |

R1,008 |

R0,737 | ||||

Source: Rycroft (2013)

Wind projects show an average price decrease of 42%[iii] and are cheaper than electricity from Medupi. – current wind energy costs 74 ZAR cents per kilowatt hour on average (van den Bergh, 2014). The current 62 wind energy projects created an estimated 19.108 FTE for construction and 34.936 for O&M (or 1.747 permanent jobs for 20 years). Wind energy projects also showed steady increases in local content across the three bidding windows:

|

Wind Energy |

Bid Window 1 |

Bid Window 2 |

Bid Window 3 | ||||

|

Local content value |

R2391 –m |

R1638-m |

R5627-m | ||||

|

Local content |

21.7% |

36.7% |

46.9% | ||||

Source: Rycroft (2013)

[i]3. Department of Minerals and Energy. 1998. White Paper on Energy for the Republic of South Africa.

[ii] 4. van den Berg, J. 2014. Wind power costs drop further below coal. 25o Degrees. Volume 8 number 6. December/January 2014

[iii] 5. Rycroft, M. 2013. Summary of REIPPPP round three projects. Energize. December 2013 page 7-9.

South Africa’s wind farms

The following provides a highlight of some of the wind farms in South Africa:

- Metrowind Van Stadens Wind Farm, 30km west of Port Elizabeth, was the first to be constructed. The location gets strong wind from the Indian Ocean at levels higher than anywhere in the area. The installation features nine 90m high turbines with three blades each. The first turbine was hoisted into place by the largest crane ever used in SA, and came online in August 2013, and will begin feeding 27 MW into the national grid from 2014 – at an estimation of 80 000 MW hours per year. The R475 million construction contract is held by Basil Read Matomo. www.metrowind.co.za

- Kouga Wind Farm, near St Francis Bay: Construction at Kouga began in 2013, and turbine delivery is scheduled for late 2013 to mid-2014. The turbines are set to be completed in September 2014, with the whole project set to be complete in November 2014. The project belongs to Red Cap, and investors include Standard Bank, Inspired Evolution and The Kouga Wind Farm Community Development Trust. www.kougawindfarm.co.za

- Jeffreys Bay Wind Farm: Construction began mid-2013 on 60 wind turbines at Jeffreys Bay, and the project will provide 138 MW into the national grid once completed in mid-2014. www.jeffreysbaywindfarm.co.za

Other wind farms include Red Cap Gibson Bay, Longyuan Mulio De Aar 2 north wind, Nojoli, Khobab, Noupoort and Loeriesfontein.

Geothermal Energy

There is, currently, no large-scale geothermal production in South Africa, since coal is abundant and relatively cheap, supplying the largest part of the country’s energy requirements. However, the Renewable Energy Policy Network for the 21st Century, or REN21, ‘Renewables 2010 Global Status Report’ states that, as the geothermal market continues to broaden, a significant acceleration in installations is expected, with advanced technologies enabling the development of geothermal power projects in new countries.[12]

Key Problems of the Energy Sector

Policy Framework, Laws and Regulations

- 2003--Renewable Energy White Paper (2003) targetted 10000 GWh(4%) of Renewable Energy by 2013

- January 2010--Integrated Resource Plan (IRP 1) targettted 1025 MW Private sector Renewable Energy by 2013

- October 2010--IRP 2010 targetting 7200MW(16%) Renewable Energy by 2030

- March 2011--> South Africa approved its Integrated Resource Plan (IRP) for the energy sector. The plan outlines the government's strategy for electricity generation by 2030. It sets a further ambitious target of 21,5 GW of new installed renewable energy generation capacity by 2030, comprising 9200 MW of wind capacity, 8400 MW of solar PV capacity, 1200 MW of solar CSP capacity.[13]

General Energy Policy, Energy Strategy

Important Laws and Regulations

Specific Strategies

(Biomass, Renewable Energies, Rural Electrification, Energy Access Strategy, Poverty Reduction Strategy etc.)

Institutional Set-up in the Energy Sector

Activities of Donors and Implementing Agencies

Further Information

Industry Associations

- Southern Africa Solar Thermal and Electricity Association (SASTELA): http://www.sastela.org/main.html

- South African Wind Energy Association (SAWEA): http://www.sawea.org.za/

- Southern African Biogas Industry Association (SABIA): http://biogasassociation.co.za/

- Sustainable Energy Society Southern Africa (SESSA): http://www.sessa.org.za/

- South African Photovoltaic Industry Association (SAPVIA): http://www.sapvia.co.za/

National Business Initiative (NBI): www.nbi.org.za - Energy Intensive User Group (EIUG) http://www.eiug.org.za/

National Government

- Department of Environmental Affairs (DEA): https://www.environment.gov.za/

- Department Of Energy (DOE): http://www.energy.gov.za/home.html

- Integrated Resource Plan: http://www.doe-irp.co.za/ & http://www.energy.gov.za/files/irp_frame.html

- CEF: http://www.cef.org.za/

- Economic Development Department (EDD): http://www.economic.gov.za/

- South African National Energy Development Institute (SANEDI): http://www.sanedi.org.za/

- Wind Atlas for South Africa (WASA) SANEDI http://www.wasaproject.info/

- RECORD: http://www.record.org.za

- ESCo/Cogen Facilitator: http://www.sanedi.org.za/esco-cogen-facilitator/

- NERSA: http://www.nersa.org.za/

- Eskom: http://www.eskom.co.za

- National Treasury http://www.treasury.gov.za/

- National Planning Commission (NPC): http://www.npconline.co.za/

- South Africa Government Online: http://www.gov.za/

- Department: Trade and Industry http://www.thedti.gov.za/

- Department of Science and Technology (DST): www.dst.gov.za

- Cooperative Governance Traditional Affairs: www.cogta.gov.za

- Department of Public Works: www.publicworks.gov.za

Financing institutions

- Industrial Development Corporation (IDC): http://idc.co.za/

- Development Bank of Southern Africa (DBSA): http://www.dbsa.org/Pages/default.aspx

- The African Development Bank (AfDB): http://www.afdb.org/en/

- Global Environmental Facility (GEF): http://www.thegef.org/gef/

- Clean Technology Fund - The World Bank: http://www.climateinvestmentfunds.org/cif/node/2

- Agence Française de Développement (AFD) http://www.afd.fr/lang/en/home/pays/afrique/geo-afr/afrique-du-sud

- Swiss Development Cooperation (SDC): http://www.swiss-cooperation.admin.ch/southernafrica/

Provincial Government

- Eastern Cape: www.greenenergy-ec.co.za

- Western Cape: http://www.westerncape.gov.za/110green/

- & WESGRO: http://wesgro.co.za/investor/sectors/renewable-energy

- KZN Sustainable Energy Forum http://www.kznenergy.org.za/

- Gauteng Province Infrastructure Development: http://www.did.gpg.gov.za

Local Government

- City Energy Support Unit: http://www.cityenergy.org.za/

- Association of Municipal Electricity Utilities (AMEU): http://www.ameu.co.za/

- South African Local Government Association (SALGA): http://www.salga.org.za/

NGOs

- Earthlife Africa: http://www.earthlife.org.za/

- Greenpeace: http://www.greenpeace.org/africa/en/

- Southern African AlternativeEnergy Association: http://www.saaea.org/

- Electricity Governance Initiative: http://www.egi-sa.org.za/

- http://www.treasurethekaroo.co.za/news/press-statements

- Koeberg Alert Alliance: http://koebergalert.org/

- WWF South Africa - Climate Change: http://www.wwf.org.za/what_we_do/climate_change/

- Sustainable Energy Africa (SEA): http://www.sustainable.org.za/

- Green Building Council of South Africa (GBCSA): http://www.gbcsa.org.za/

- SOLTRAIN: http://www.soltrain.co.za

Online platform

- Energy blog http://www.energy.org.za/

Research & University

- Energy Research Centre: http://www.erc.uct.ac.za/

- Centre for Renewable & Sustainable Energy Studies: http://www.crses.sun.ac.za/

- CSIR www.csir.co.za

- National Cleaner Production Centre (NCPC): www.ncpc.csir.co.za

- Johannesburg University Sustainable energy Technology and Research (SeTAR) Centre http://www.uj.ac.za/EN/Newsroom/News/Pages/UJlaunchesSustainableenergyTechnologyandResearch(SeTAR)Centre201003231.aspx

- UKZN http://research.ukzn.ac.za/ResearchFocusAreas/EnergyandTechnologyforSustainableDevelopment.aspx

- University of Witswatersrand WITS, Johannesburg: http://www.wits.ac.za

Training

- South African Renewable Energy Technology Centre (SARETEC), Cape Peninsula University of Technology: http://www.cput.ac.za/academic/shortcourses/saretec

- http://www.energytrainingfoundation.co.za/Home.aspx

- Council of Measurement and Verification Professionals of South Africa (CMVPSA): http://www.cmvpsa.org.za/

- Technical University of Tshwane (TUT)/ M&V Unit: http://www.tut.ac.za

Private & industry sector

- The Green Business Guide: http://www.greenbusinessguide.co.za/

- SANEA: http://www.sanea.org.za/

- Independent Power Producers Association SAIPPA: http://www.saippa.org.za/main.html

- DCD WindTowers: http://www.dcd.co.za/miningandenergy/DCDWindTowers.aspx

Solairedirect SA: http://www.solairedirect.com/international-presence/southern-africa

- South African Association of Energy Services Companies (SAAEs): http://www.esco.org.za

- Ellis Park Stadium Johannesburg: http://www.lionsrugby.co.za/content/4115/4074/ellis-park-stadium

- The Southern African Association for Energy Efficiency: http://www.saee.org.za

Climate change

- Climate Change Awareness Campaign COP17 (DEA): http://www.climateaction.org.za/

- WWF South Africa - Climate Change: http://www.wwf.org.za/what_we_do/climate_change/

Regional

- SAPP: http://www.sapp.co.zw/

- Infrastructure and Energy African Union: http://ie.au.int/

International

- Renewable Energy and Energy Efficiency Partnership (REEEP): http://www.reeep.org/

- EU Energy Initiative Partnership Dialogue Facility - EUEI Partnership Dialogue Facility (PDF): http://www.euei-pdf.org/

- REN21: http://www.ren21.net/ & Country Energy Profile South Africa - Clean Energy Information Portal – reegle: http://www.reegle.info/countries/south-africa-energy-profile/ZA

- CIF: https://www.climateinvestmentfunds.org/cifnet/?q=country/south-africa

Conferences

- Windaba: http://www.windaba.co.za/

- Solar Indaba: http://www.greenpowerconferences.com

- SASEC: http://www.sasec.org.za/

- SAEEC: http://www.convention.saee.org.za

References

- ↑ http://en.wikipedia.org/wiki/South_Africa

- ↑ http://en.wikipedia.org/wiki/South_Africa

- ↑ http://en.wikipedia.org/wiki/South_Africa

- ↑ http://data.worldbank.org/country/south-africa

- ↑ Sources: Department of Energy, South African Energy Synopsis, 2010fckLRhttp://www.energy.gov.za/files/media/explained/2010/South_African_Energy_Synopsis_2010.pdffckLR

- ↑ Sources: World Bank, http://data.worldbank.org/country/south-africafckLRUS Department of State – Background note South Africa, fckLRhttp://www.state.gov/r/pa/ei/bgn/2898.htmfckLR

- ↑ http://www.energy.gov.za/files/media/explained/2010/South_African_Energy_Synopsis_2010.pd

- ↑ http://bit.ly/18o4fqP

- ↑ http://www.energy.gov.za/files/esources/renewables/r_solar.html

- ↑ http://cleantechsolutions.wordpress.com/2011/12/27/biomass-energy-in-south-africa/

- ↑ http://www.windlab.com/node/360

- ↑ http://www.engineeringnews.co.za/article/south-africas-geothermal-prospects-2010-10-15

- ↑ Department of Energy (DOE), South Africa