Difference between revisions of "Wind Energy Country Analysis Argentina"

***** (***** | *****) m |

***** (***** | *****) |

||

| Line 54: | Line 54: | ||

[[Wind_Energy_Country_Analysis_Argentina#Overview|►Go to Top]] | [[Wind_Energy_Country_Analysis_Argentina#Overview|►Go to Top]] | ||

| + | |||

== Further Information == | == Further Information == | ||

*[[Wind Energy Map (country-specific wind energy facts)|Wind Energy Map (country-specific wind energy facts)]]<br/> | *[[Wind Energy Map (country-specific wind energy facts)|Wind Energy Map (country-specific wind energy facts)]]<br/> | ||

| + | *[[Wind_Energy_Fact_Sheet_Argentina|Wind Energy Fact Sheet Argentina]]<br/> | ||

*[[Portal:Wind|Portal:Wind]]<br/> | *[[Portal:Wind|Portal:Wind]]<br/> | ||

| − | [[ | + | [[Wind Energy Country Analysis Argentina#Overview|►Go to Top]] |

| + | |||

== References == | == References == | ||

Revision as of 11:48, 13 August 2014

Overview

The wind energy sector represents the most promising alternative for renewable energy production in the country. The central government has already initiated the first steps to evaluate, analyze and use the large wind potential in the country.

Wind Energy Potential

According to the last report[1] elaborated by the Cara Argentina de Energias Renovables (CADER) on the status of the wind industry in Argentina, 70 % of Argentina’s territory is suitable for wind energy utilization with an annual average wind speed of 6 m/s (measured at 50 meter height). Best sites are located in the southern part of the country, particularly in the middle and southern Patagonia where average wind speeds reach values of 9 m/s and 12 m/s respectively[2]. One of the main problems detected for the development of wind farms is the fact that generation points are far away from densely populated areas and industrial centres, and thus grid problems arise (grid connections, grid capacity, high costs for transmission lines, large energy losses etc.). Wind maps are currently also available for two provinces in the southern part of the country (Chubut and La Pampa). The compilation of a comprehensive wind atlas for the entire country constitutes an essential component of the national wind energy plan. Aiming at improving the planning of wind power projects, the Regional Centre for Wind Energy (CREE) in Chubut province was called upon in 2005 to compile the atlas which was finished in 2006. The atlas can be accessed via their homepage (www.eeolica.com.ar). Argentina’s government estimates that 300 MW of wind energy capacity can be implemented by 2012.

Framework Conditions for Wind Energy

The precarious economic situation in 2001 – 2002 seriously compromised the development of the wind energy industry in the country and paralysed a lot of studies and projects. To reactivate the sector, the government has established an integral plan to develop the wind industry (National Wind Energy Strategic Plan, PENEE) at national level aiming not only at an increase of installed capacity but also to reactivate the wind industry within the nation (being an economic niche almost unexplored up to that moment by national investment).

The PENEE contains the official development programme of wind parks and shall lead to the construction of at least 300 MW of wind energy projects. Initial actions of this development involve the creation of the wind atlas and the project Vientos de la Patagonia 1 and 2. Both wind farms are financed by the government with additional funding from the provinces where they are located. The wind farm Vientos de la Patagonia 1 is 80 % property of ENARSA and 20 % of the Chubut province and is structured in two phases. Phase 1, already in construction and foreseen to be finished by 2009, aims at the installation and certification of two prototype turbines from local manufacturers, one from the company IMPSA Wind and the other from NRG Patagonia. Phase 2 considers the installation of a 60 MW wind farm in Chubut using the certified turbines in Phase 1. Wind farm Vientos de Patagonia 233 with a capacity of 20 MW is located in the province of Santa Cruz. Studies regarding prospection and analysis of the wind resources are currently being carried out.

Wind Energy Legislation

- National Law No. 26 190: as stated before, this law grants economical support to energy generated through renewable sources. In the case of wind energy, it specifies some small subsidies (0.26 €cent/kWh for wind) and tax benefits (such as the accelerated amortization or exemption of VAT payment) for the wind projects.

- Provincial Law of Chubut (Ley Provincial no 4 389): this regulation specifies additional subsidies and tax benefits and also establishes the percentage34 of wind turbine components that must be manufactured or assembled within the province. The subsidies amount to 0.089 €cent/kWh, on top of the national subsidy.

- Provincial Law of Buenos Aires (Ley Provincial no 12 603) specifies additional subsidies for wind energy. The subsidies amount to 0.089 €cent / kWh, on top of national subsidy.

- Provincial Law of Santa Cruz (Ley Provincial no 2 796): as stated in the previous chapter this regulation provides for tax exemptions (50 – 100 % depending on local content) and small subsidies (0.18 – 0.54 €cent, also depending on local content) for renewable energy projects.

Current Use of Wind Energy and Project Pipeline

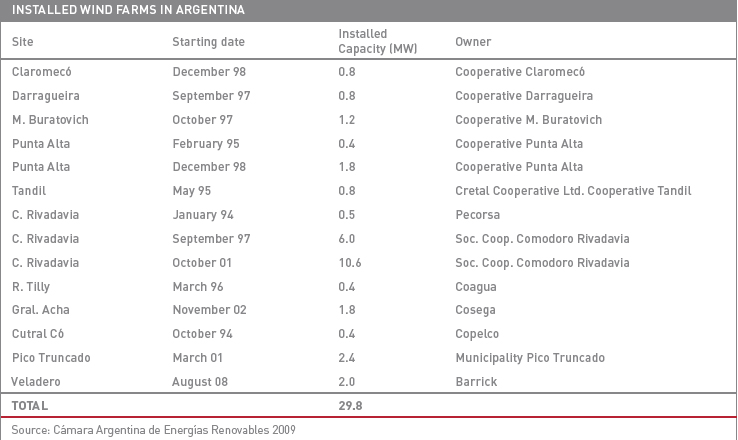

The current installed wind energy capacity amounts to 30 MW with projects mainly developed within the period from 1994 to 2002[3] and set up by electric cooperatives[4]. The last wind equipment installed in the country has been a 2 MW turbine for the company Barrick in its mine located in the province of San Juan. The following table presents a short description of existing wind projects in the country.

After a few years of inactivity due to the economic crisis, the wind energy development is gathering momentum which is reflected by a remarkable project pipeline. Apart from Vientos de Patagonia described above, the following projects are planned:

The Arauco Wind Farm is a project located in the province of La Rioja and developed by the company IMPSA. The project foresees the installation of 12 wind turbines (each with 2.1 MW capacity) reaching a total capacity of 25.2 MW and performed in two stages, finishing by May 2010. In an extended phase, the installation of 90 MW are being considered. The Malaspina project is developed by the company Central Eolica de Malaspina SA. This project will be based on 40 wind turbines (Vestas V-80 with a rated capacity 2 MW each) located in the Pampa Malaspina, approximately 130 km north of the city of Comodoro Rivaldiva in Chubut. It is foreseen that the park will be operating by 2010/2011. The Vientos del Secano project is going to be developed by the company ABO Wind and will be located in the proximities of the municipality of Ing. Buratovich (territory of Villarino). The wind park will have a total capacity of 50 MW and construction will begin by the end of 2010. It is foreseen to start running by 2011. Another project planned is the construction of the wind park Diadema in the proximities of the city of Comodoro Rivadavia with a total capacity of 6.3 MW (comprising 7 turbines ENERCON E-44 with 900 kW capacity each) and an average generation rate of 22 GWh per year. In addition to the wind farm, the construction of a hydrogen plant is being considered. It is planned that the project will initiate operations by 2010 although some sources mention that the project is currently on halt.

Active Local Companies

On the Argentinean wind market, there are currently three local turbine manufacturers:

The company IMPSA owns a production facility which produces wind turbines (≥ 1.5 MW). The plant is located in Mendoza and allows the company to build 75 wind turbines including blades per year. The company has developed different types of turbines (1 MW, 1.5 MW and 2.1 MW) for different types of wind characteristics. IMPSA is currently working on the development of turbines with a rated power of more than 4 MW. IMPSA Wind is the largest wind technology developer in Brazil with 13 wind farms adding up to a total capacity of 317 MW distributed on the north east and south of the country. In Argentina, the company is actively participating in projects located in the provinces of Buenos Aires, Chubut, Cordoba, Neuquen, San Luis and Santa Cruz. In the Patagonic region IMPSA has installed one turbine (1.5 MW) and intends to install a wind farm (90 MW) in the province of La Rioja (enough to supply 45 % of the provincial electricity demand).

The company NRG Patagonia commercializes the model NRG 1500 with a capacity of 1.5 MW. This technology has been specifically designed and classified in Germany to operate in strong wind locations, such as in some areas of Patagonia, commonly defined as IEC Type I+ or Type „S“. Using a reinforced structure of the turbine Type 1+, NRG Patagonia has developed a Type II with a 77 m diameter rotor and a Type I with a 70 m rotor. At present NRG Patagonia is in its final stage to develop the first unit that should be installed and certified for the development of project Vientos de Patagonia I.

The company INVAP develops mostly large and medium size turbines. INVAP is very advanced in the development of a 1.5 MW turbine (EOLIS 15) for strong class winds (Class 1). The developed turbine will be particularly useful for the centre and south regions in Patagonia and the Atlantic coast in the province of Buenos Aires. INVAP has also planned the development of a 2 MW turbine suitable for Class 2 winds (less intense than the ones existing in Patagonia).

Further Information

References

- ↑ Cámara Argentina de Energías Renovables - CADER (2009) Estado de la Industria Eólica en Argentina, retrieved 28.7.2011 [[1]]

- ↑ Asociacion Argentina de Energia Eólica (2009) Energia Eólica in Argentina, retrieved 28.7.2011 [[2]]

- ↑ The economic crisis in the period 2001 – 2002 slowed down investments infckLRwind energy. As the Argentinean economy is slowly recovering, market conditionsfckLRstart to foster again this kind of investments.

- ↑ Electric cooperatives are defined as organisations of investors who gather infckLRcooperatives in order to increase size and economic capability to be able tofckLRparticipate in large projects and to create an effective lobby group to defendfckLRtheir interests.