Click here to register!

Wind Energy Country Analysis Vietnam

Overview - Wind Energy Potential

Vietnam’s wind energy potential is considerably higher compared to Thailand, Laos or Cambodia[1]. A World Bank survey estimated the total potential of wind power at 513 360 MWequivalent to 200 times the output of Southeast Asia’s largest power plant, the Son La Hydroelectric Plant in northern Vietnam and ten times the entire national capacity forecast for 2020. Vietnam’s wind potential is significant in the central coastal region including Quang Binh, Quang Tri, Thua Thien-Hue and Binh Dinh and the south, including Ninh Thuan, Binh Thuan, Lam Dong, Tra Vinh and Soc Trang. Since the 1980s, the Institute of Energy (IE) was commissioned by the Ministry of Electricity (now Ministry of Industry and Trade) to review the erection of wind turbines on islands and in remote grid connected areas. Observations and calculations showed that around 28 000 square kilometres of Vietnam have average wind speeds of 7 m/s to 9 m/s at a height of 65 meters. For instance, the average speeds at 65 meters is 7.6 m/s in Bach Long Vi, 6.3 m/s in Spratley, 6.8 m/s in Phu Quy, 4.9 m/s in Hon Dau, 4.4 m/s in Co To.

Framework Conditions for Wind Energy

Goal for the use of wind energy

The Ministry of Trade and Industry has published the Revised Power Development Master plan VII for the period 2011 - 2020, with vision to 2030[2].

Under this plan, the proportion of electricity generated from renewable energy sources (excluding large-scale, medium-scale and pumped storage hydro power) will increase up to around 7% in 2020 and above 10% in 2030.

Sub-targets regarding the share of electricity production and installed capacity are set for wind energy, solar energy, biomass and hydro power. The total capacity of installed wind power is declared to reach 800 MW in 2020, 2000 MW in 2025 and 6000 MW in 2030, which account for 0.8% of the share of produced electricity in 2020, 1% in 2025 and 2.1% in 2030[3].

Legal conditions and support instruments

In Vietnam, the main laws governing wind power development are the Investment Law, the Construction Law, the Land law, and the Law on Environmental protection. There are several indirect support mechanisms aimed at renewable energy technologies in general such as non-tariff incentives from the government. These financial incentives include:

- Exemptions of coperate income tax

- Years 1-4: complete exemption

- Years 5-13: 50% tax reduction

- Exemptions of equipment import duties

- Varying levels of import tax, depending on the type of imported goods

- Exemption on goods forming fixed assets, which cannot be produced locally

- 50% reduction for Escrow accounts

- Free land provision or reduced lease fee as part of the licinsing agreement

First incentives, specifically for wind power where introduced in 2011 when the Prime Minister issued Decision 37/2011/QD-TTg. A feed-in-tariff (FiT) of 1,614 VND/kWh (fixed at US Cents 7.8 /kWh) was implemented. The FiT is applicable to projects for a limited period of 20 years. An amount of 207VND (fixed at 1US cent) is subsidized via the Vietnam Environment protection Fund (VEPF). It is also stated that the power purchaser must buy all electricity generated from wind power projects which meet the eligibility criteria indicated in this Decision.

The following year, the Circular 96/2012/TT-BTC from the Ministry of Finance (MoF) was issued to instruct the financial mechanisms for tariff support/subsidies for gridconnected wind power projects. Regulations on project development and a Standard Purchase Power Agreement (SPPA) were provided in the Circular 32/2012/TT-BCT by MOIT.

Even though the first important step had been initiated via the Decision 37 and other relevant Circulars, until now, little development has been taken place. Wind project developers and investors still perceive the market as being too nascent and financial conditions is not attractive enough to realize their projects. The Government of Viet Nam is thus considering an increase of the existing FIT and seeking support from GIZ for revising the current one.

Project Development procedures

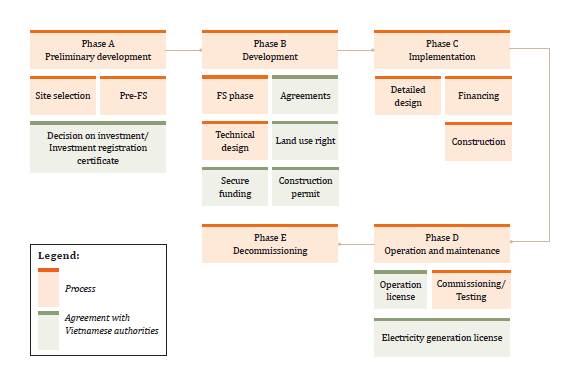

The guidelines for potential wind power developers in Vietnam have been published by the MOIT/GIZ Support to the Up-Scaling of Wind Power in Vietnam[4]. The permitting procedures for energy projects are relatively complex and act as a disincentive for potential investors. The following figure summarizes the wind power project development process and shows where agreements with Vietnamese authorities are requiered.

Current Use of Wind Energy and Project Pipeline

Up to now more than 20 wind power projects are under way in Vietnam, with a capacity ranging from 6 MW to 150 MW. The most advanced project has been developed by the Vietnamese company REVN.[5] The first five 1.5 MW turbines from the German manufacturer Fuhrländer have been installed in Binh Thuan province. An extension of this project is already planned.

Furthermore, around ten thousand 200-W battery charging wind turbines have been installed for household use, mainly in the central and southern regions. In addition a number of 150-W battery charging wind turbines have been installed at households in coastal areas of Quang Ninh and Hai Phong.

Wind energy projects in operation:

- The Bach Long Vy wind power plant with capacity of 800 kW has been in operation since the end of 2004;

- The first five turbines with a total capacity of 7.5 MWwind power project in Tuy Phong district, Binh Thuan province have been installed by Fuhrlaender Vietnam Joint Stock Company of Germany and joined the national grid in August 2009[6]. The project’s investor Renewable Energy of Vietnam Joint Stock Company (REVN) will install seven additional turbines to reach a capacity of 18 MW in the first phase. The project to which 80 more turbines will be added to raise its total capacity to 120 MW, is expected to come into operation in 2011.

Wind energy projects under development in Vietnam include:

- The 55 MW Phuong Mai 3 wind power plant locatedin the central province of Binh Dinh province was stated to be constructed in September 2007. The in-vestor of this project is Central Region Wind Power JS Company;

- The 30 MW Cau Dat Wind Power Plant located in Da Lat City, the Central Highlands province of Lam Dong is expected to be in operation in June 2011. The investor of this project is Cavico Transport Corporation;

- 2 MW wind power installation in Ly Son Island: Thefeasibility study has been completed by the Institute of Energy. EVN is the main project investor;

- 15 MW wind farm in Binh Dinh Province: The tender for equipment supply is currently open. The feasibility study was prepared by Phuong Mai Company;

- 84 MW Wind Power Project in Phuong Mai: The main investor is Grabowski Renewable Energy Company no. 1 Ltd;

- 2.5 MW wind project in Phu Quoc Island;

- 15 MW wind farm in Phu Yen Province. The project is owned by VINACONEX. IE prepared the feasibil ity study;

- 2.5 MW Wind Project in Co Dao Island: IE is currently undertaking the feasibility study.

Business Climate

Market Players

Below is a list of companies involved in wind energy development in Vietnam. Vietnam Wind Power Joint Stock Company[7] offers services including:

- Building wind measurement stations for collecting wind data at a height of 40 - 60m;

- Producing and trading electricity through investing, constructing and operating small and medium wind power plants;

- Producing, assembling and trading wind energy equipments;

- Providing advice on technology transference in the field of wind power;

Asia Petroleum Energy Corporation is a producer, whole- sale supplier, exporter and importer of wind power equipment. Their services include construction, engineering and project development for clean energy.

Bach-Khoa Investment and Development of Solar Energy Co Ltd (BK-IDSE) is a manufacturer of small wind turbines for battery charging (from 200 W up to 3.2kW) and specialises in R&D. Moreover, BK-IDSE offers consultancy service for wind resource assessments. GE - is investing in a factory for wind turbine generators.

Structural Conditions

Vietnam has had experience with small scale wind technology through the Research Centre for Thermal Equipment and Renewable Energy (RECTERE) of Ho Chi Minh City Technical University. For twenty years, RECTERE has manufactured and installed household wind energy systems with a rated power of 100 W – 500 W. The technical and investment requirements associated with these systems are extremely different to those associated with large scale grid connected wind farms. The development of large scale grid connected wind farms is in the experimental phase, including the Wind Power Development in Vietnam Institutional, Policy and Market study and an EC-ASEAN Energy Facility (EAEF) project. The EAEF project aims to promote wind energy development and facilitate investments in wind energy projects in Vietnam through feasibility assessments and capacity building.[8]

There are currently no manufacturers of large scale wind turbines in Vietnam. However, CS Wind Vietnam Co[9] a Korean manufacturer of small scale wind turbines and towers, established its first wind tower factory in Vietnam and is now recognized as one of the leading wind tower manufacturers in the country. Fuhrlaender is investigating the possibility to manufacture its 1.5 MW turbine in Viet Nam. Currently they are negotiating the conditions with the government. Wind developers must import technology and gain expertise from abroad due to the limited technical expertise available in Vietnam and thereby assume significant risk in the development of wind farms. Thermal power and Hydro power generators do not face these barriers as Vietnam already has an established industry in these technologies.

Human Resources Conditions and Education

Vietnam currently does not have the necessary skilled labour to adequately maintain the specialized equipment of which each wind generating unit is comprised. In order to fulfil the ongoing maintenance requirements of the equipment it is necessary for project developers to sign a maintenance agreement with the turbine suppliers. As a result, the project developers rely on the foreign manufacturer to provide quality maintenance services.

Financing Possibilities

All important projects are supported by the state bank of Vietnam but financial support is also possible from the World Bank and the Asian Development Bank.

Further Information

- Wind Portal on energypedia

- Wind Energy Map (country-specific wind energy facts

- Vietnam Energy Situation

References

- ↑ UPI Asia - Energy Resources Vietnam’s high wind power potential, Article, July 2009, Retrieved 28.7.2011 [[1]]

- ↑ GIZ(2016) Decision - Approval of the Revised National Power Development Master Plan (PDP VII revised) http://gizenergy.org.vn/en/knowledge-resources/giz-publications

- ↑ GIZ(2016) Highlights of the PDP 7 revised http://gizenergy.org.vn/en/knowledge-resources/giz-publications

- ↑ GIZ (2016) Wind Investment Guidelines Vol 1. Energy Support Program, Hanoi, http://gizenergy.org.vn/en/knowledge-resources/giz-publications

- ↑ World Wind Energy Association 2009

- ↑ Solely wind energy project registered as a CDM project (see section 1.5): FirstfckLRsales of electricity from the wind farm will be from the 7.5MW first stage infckLRJanuary 2009, the 22.5MW second stage will commence sale of electricity infckLRMarch of 2009.

- ↑ Vietnam Wind Power Joint Stock Company [[2]]

- ↑ EC-ASEAN energy facility 2007

- ↑ [[3]]