Knowledge fuels change - Support energypedia!

For over 10 years, energypedia has been connecting energy experts around the world — helping them share knowledge, learn from each other, and accelerate the global energy transition.

Today, we ask for your support to keep this platform free and accessible to all.

Even a small contribution makes a big difference! If just 10–20% of our 60,000+ monthly visitors donated the equivalent of a cup of coffee — €5 — Energypedia would be fully funded for a whole year.

Is the knowledge you’ve gained through Energypedia this year worth €5 or more?

Your donation keeps the platform running, helps us create new knowledge products, and contributes directly to achieving SDG 7.

Thank you for your support, your donation, big or small, truly matters!

Difference between revisions of "Vietnam Energy Situation"

***** (***** | *****) (Created page with " == Overview<br/> == {| cellspacing="0" cellpadding="0" border="1" style="font-size: 14px; width: 400px; float: right;" |- | colspan="4" style="text-align: center;" | <span s...") |

***** (***** | *****) |

||

| (159 intermediate revisions by 12 users not shown) | |||

| Line 1: | Line 1: | ||

| − | == | + | {{CES Country|CES Country Name=Vietnam |

| + | |CES Country Capital=Hanoi | ||

| + | |CES Country Region=East Asia & Pacific | ||

| + | |CES Country Coordinates=21.0333° N, 105.8500° E | ||

| + | }} | ||

| − | + | = Introduction<br/> = | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | During the last 25 years Viet Nam’s economic growth reached more than 6% each year. At the same time, the energy demand increased almost twice as fast as the GDP. With an expected continuous increase of energy demand in the next years, Viet Nam’s energy sector will have to face many challenges, such as limited domestic fossil ressources, air pollution and climate change, causing amongst other things water scarcity. Viet Nam has been ranked among the five countries, that will be most affected by climate change.<ref name="Dara (2012): Climate Vulnerability Monitor 2nd. http://daraint.org/climate-vulnerability-monitor/climate-vulnerability-monitor-2012/country-profile/?country=Vietnam">Dara (2012): Climate Vulnerability Monitor 2nd. http://daraint.org/climate-vulnerability-monitor/climate-vulnerability-monitor-2012/country-profile/?country=Vietnam</ref> Another issue is the country's unreliable power supply, especially in rural areas. In order to face these challenges, legislative conditions have to be adopted and the framework conditions for investments have to be reformed to strengthen foreign investments and eventually stimulate the expansion of renewable energy generation capacity.<br/> | |

| − | |||

| − | [ | + | Further information about Viet Nam see: [[:Category:Vietnam|All articles about Viet Nam on energypedia]]<br/> |

| − | | | + | [[Vietnam Energy Situation#toc|►Go to Top]]<br/> |

| − | |||

| − | |||

| − | + | <br/> | |

| − | |||

| − | + | <br/> | |

| − | |||

| − | |||

| − | + | = General Overview of Viet Nam's Energy Situation<br/> = | |

| − | |||

| − | + | A reliable power supply is an important requirement for an emerging market like Viet Nam. By the end of 2014, 34 GW generation capacity was installed in the country, producing around 146 TWh electricity. Assumptions of the Power Development Plan VII (PDP VII) predict an overall power demand increase by a factor of almost 2.4 in the next 5 years, reaching a demand of 350 TWh in 2020, with an installed capacity of 75 GW. According to the PDP, coal power plants will mainly contribute to the essential capacity expansion, surpassing hydropower as primary resource for electricity generation.<br/> | |

| − | |||

| − | |||

| − | + | Currently, the power production is still dominated by hydropower with a share of 41% in electricity generation, followed by natural gas with 31% and coal with 26%. Due to limited domestic coal and gas resources, Viet Nam’s fossil import dependency will increase. Except for hydropower, markets for renewable energies such as for wind and solar power are in a very early stage of development. Knowledge and reliable information about project development or regulative processes is very limited. <ref name="PDP VII: Prime Minister decision No. 1208/QD-TTg. http://www.nti.org/media/pdfs/VietnamPowerDevelopmentPlan2030.pdf?_=1333146022">PDP VII: Prime Minister decision No. 1208/QD-TTg. http://www.nti.org/media/pdfs/VietnamPowerDevelopmentPlan2030.pdf?_=1333146022 </ref><br/> | |

| − | |||

| − | + | '''Fig. 1: Electricity Production and Installed Capacity 2014 by Generation Technology'''<br/> | |

| − | |||

| − | |||

| − | | | + | [[File:Vietnams Power Generation Sources 2014 new.png|thumb|left|500px|alt=Vietnams Power Generation Sources 2014 new.png]]<br/> |

| − | + | <div style="clear: both">[[Vietnam Energy Situation#toc|►Go to Top]]<br/></div> | |

| + | <br/> | ||

| − | + | = Governance and Market Structure<br/> = | |

| − | |||

| − | |||

| − | + | The Vietnamese electricity market is monopolistic, dominated by the state-owned-enterprise EVN, which is supervised by the Ministry of Industry and Trade (MoIT). In the generation market, EVN is single-buyer and power transmission and distribution systems are exclusively operated by subsidiary companies of the utility. However, the goal of the government is to develop a competition-based generation, wholesale and retail market until 2023, in particular in order to attract private and foreign investments in the energy sector. The average electricity selling price continuously increased in the last years, but with 1622 VND/kWh (incl. VAT; approx. 7.5 USCent/kWh) it is still too low to finance overall electricity generation costs. EVN operated at a deficit of 790 million US$ in 2014.<ref name="Vietnamnews.vn (2015): Viet Nam News. EVN reports loss $789.6 milion in 2014. Onlineartikel vom 14. Januar 2015 verfügbar unter: http://vietnamnews.vn/economy/265192/evn-reports-loss-of-7896-million-in-2014.html (zuletzt abgerufen am 4. April 2015).">Vietnamnews.vn (2015): Viet Nam News. EVN reports loss $789.6 milion in 2014. Onlineartikel vom 14. Januar 2015 verfügbar unter: http://vietnamnews.vn/economy/265192/evn-reports-loss-of-7896-million-in-2014.html (zuletzt abgerufen am 4. April 2015).</ref><br/> | |

| − | |||

| − | + | '''Fig. 2: Institutional Framework of the Electricity Sector'''<br/> | |

| − | |||

| − | |||

| − | | | + | [[File:Vietnam Power Market Actors 2014.png|thumb|left|500px|alt=Vietnam Power Market Actors 2014.png]]<br/> |

| − | + | <div style="clear: both">[[Vietnam Energy Situation#toc|►Go to Top]]</div> | |

| + | <br/> | ||

| − | |||

| − | + | = Renewable Energies in Viet Nam<br/> = | |

| − | |||

| − | |||

| − | + | <span>In 2014, renewable energies (including hydropower) contributed with 41% to Viet Nam’s electricity demand, but this share was almost exclusively accounted for by hydropower. According to the MoIT Small Hydropower (SHP) can still be expanded, but in general Viet Nam’s hydropower potential is nearly exploited. In contrast, wind, solar and biomass expansion potentials are high and to a great extent untapped. In the PDP VII, expansion targets for renewable energy generation capacities are set until 2030 as shown in the figure below.</span><ref name="PDP VII: Prime Minister decision No. 1208/QD-TTg. http://www.nti.org/media/pdfs/VietnamPowerDevelopmentPlan2030.pdf?_=1333146022">PDP VII: Prime Minister decision No. 1208/QD-TTg. http://www.nti.org/media/pdfs/VietnamPowerDevelopmentPlan2030.pdf?_=1333146022 </ref><br/> | |

| − | |||

| − | + | '''Fig. 3: Renewables Capacity Targets until 2030 (according to PDP VII)'''<br/> | |

| − | |||

| − | |||

| − | | | + | [[File:Vietnam Power Source Capacity Targets 2014 new.png|thumb|left|500px|Vietnam Power Source Capacity Targets 2014 new.png]]<br/> |

| − | + | <div style="clear: both"><br/></div> | |

| − | + | The government also has incentives for solar projects until mid 2019 and for wind project up to 2021. Vietnam aims to have solar and wind instablled capacity of 0.8MW and 0.85MW respectively by 2020. However, a total of 2.8GW wind and 10GW solar power plants have already been approved until February 2019. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | | | + | [[Vietnam Energy Situation#toc|►Go to Top]]<br/> |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | == Wind Power<br/> == | |

| − | |||

| − | |||

| − | + | Although potential for wind power development in Vietnam is high, only 190 MW have been put into operation up until now. While many projects are in the planning phase, they face substantial market barriers, such as deficient wind measurement data reliability and a low feed-in-tariff for wind energy of only 7.8 Ct/kWh. On September 2018, Vietnam increase the FIT from 7.8 to 8.5 US cents/kWh for onshore, and 9.8 US cents/kWh for offshore wind power projects, according to Decision No.39/2018/QD-TTg. The FIT is implement from 1 Nov 2018 and will be valid for 20 years from the commencement of the wind projects. The wind power that commenced operation before 1 Nov 2018 will be able to apply for this new tariff for the remaining period of their Power Purchase Agreement (PPA).<ref> https://www.vietnam-briefing.com/news/vietnam-increases-feed-in-tariffs-for-wind-projects.html/</ref> | |

| − | |||

| − | | | + | Further information are provided on [[Wind Energy Country Analysis Vietnam|Wind Energy Country Analysis Vietnam]]. [[Vietnam Energy Situation#toc|►Go to Top]]<br/> |

| − | + | <br/> | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | <br/> | |

| − | + | <br/> | |

| − | |||

| − | |||

| − | == | + | == Bioenergy<br/> == |

| − | + | According to the PDP7 a bioenergy generation capacity of 500 MW will be installed until 2020. The largest regional feedstock potential is located in the Mekong delta region. Feed-in tariffs for electricity co-generation and municipal-solid-waste projects are already established, but projects are mostly in an early planning phase. It is assumed that the support mechanism and framework conditions have to be adopted and expanded on further applications and feedstock in order to strengthen biomass power deployment in Viet Nam.<br/> | |

| − | + | '''Fig. 5: Theoretical Potential of Power from Biomass in Viet Nam'''<br/> | |

| − | + | [[File:Vietnam Biomass Power Potential 2010.png|thumb|left|500px|alt=Vietnam Biomass Power Potential 2010.png]]<br/> | |

| − | + | <div style="clear: both">[[Vietnam Energy Situation#toc|►Go to Top]]<br/></div> | |

| − | + | <br/> | |

| − | |||

| − | |||

| − | + | == Solar Power<br/> == | |

| − | + | In general, Viet Nam can be considered as a country with high solar energy potential. The solar resources are comparable to countries like Italy, Spain, and California or – staying in the region – China or Thailand. However, the current Vietnamese solar PV market is estimated to be only around 5 MWp, with 80% off-grid applications in rural areas.<br/> | |

| − | + | Solar energy is not yet integrated into political energy development strategies, such as the national Power Development Plan (PDP). However, solar energy will possibly be included in the revision of the PDP VII. According to press releases, larger ground-mounted PV systems are under development.<br/> | |

| − | |||

| − | |||

| − | |||

| − | |||

| + | Further information are provided on [[Solar Energy Country Analysis Vietnam|Solar Energy Country Analysis Vietnam]].<br/> | ||

| + | <div style="clear: both">[[Vietnam Energy Situation#toc|►Go to Top]]<br/></div> | ||

<br/> | <br/> | ||

| − | |||

| − | + | = Transmission and Distribution System<br/> = | |

| − | + | The national transmission and distribution grid has to be extended in synchronization with increasing power demand and generation capacity in order to reduce power outages, losses and increase the quality of supply. During the period of 2014-2020 an investment volume of around 12.4 billion US$ is estimated to be needed for expansion. Viet Nam’s rural electrification rate was 97.3% by the end of 2013. The government aims at 100% by 2020. According to the PDP 7 Viet Nam wants to implement a cooperation and connectivity program with neighbouring countries and Mekong sub-region power grids. High voltage line connections with Laos, Cambodia and China already exist.<br/> | |

| − | |||

| − | |||

| − | |||

| − | The | ||

| − | |||

| − | |||

| − | In | + | In terms of power reliability Viet Nam is currently ranked 113 out of 144 countries.<ref name="World Economic Forum (2012); The Global Competitiveness Report 2012-2013, Geneva. http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2012-13.pdf">World Economic Forum (2012); The Global Competitiveness Report 2012-2013, Geneva. http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2012-13.pdf</ref> In rural areas, power shortages and blackouts, lasting longer than 5 min occurred around 20 times per year in 2013.<ref name="Asian Development Bank (2014); Sector Assessment (Summary): Energy. http://www.adb.org/sites/default/files/linked-documents/46391-001-ssa.pdf">Asian Development Bank (2014); Sector Assessment (Summary): Energy. http://www.adb.org/sites/default/files/linked-documents/46391-001-ssa.pdf</ref><br/> |

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | [[Vietnam Energy Situation#toc|►Go to Top]]<br/> | |

| − | + | = Legal Documents<br/> = | |

| − | + | There are a number of legal documents relevant for the implementation of Renewable Energy projects in Viet Nam. Some of these documents are listed below:<br/> | |

| − | + | '''The Prime Minister’s Decision No. 1208/QD-TT''', Approving The National Master Plan for Power Development in The 2011-2020 Period, With Considerations to 2030, Legal Document, Hanoi, 21 July 2011 | |

| − | + | '''The Prime Minister’s Decision No. 63/2013/QD-TTg,''' Providing for the roadmaps, conditions and structure and level of electricity market in Vietnam, Legal Document, Hanoi, 8 November 2011 | |

| − | + | '''The Prime Minister‘s Decision No. 37/2011/QD-TTg''', The Mechanism Supporting the Development of Wind Project in Vietnam, Legal Document, Hanoi, 29 June 2011.<br/> | |

| − | + | '''The Ministry of Industry and Trade‘s Circular No. 06/2013/TT-BCT''', Regulation on Content, Order, Procedures for Formulation, Appraising and Approving Wind Power Development Planning, Legal Document, Hanoi, 08 March 2013<br/> | |

| − | + | '''The Government‘s Decision No. 24/2014/QD-TTg''', On Support Mechanism for Development of Biomass Power Projects in Vietnam, Legal Document, Hanoi, 24 March 2014 | |

| − | + | '''The Ministry of Industry and Trade‘s Circular No. 31/2011/TT-BCT''', Providing for The Adjustment of Electricity Sale Prices According to Basic Input Parameters, Legal Document, Hanoi, 24 March 2014<br/> | |

| − | + | [[Vietnam Energy Situation#toc|►Go to Top]] | |

| − | |||

| − | |||

| − | |||

| − | |||

<br/> | <br/> | ||

| − | |||

| − | |||

<br/> | <br/> | ||

| − | <br/> | + | = Events<br/> = |

| + | <div>'''TÜV SÜD Vietnam - Wind Energy Workshop – Status, Forecast, Challenges and its Relevance to Vietnam'''<br/>'''Date''': 2nd June 2015<br/>'''Venue''': The Vissai Saigon Hotel, 144 Nguyen Van Troi Street, Ward 8, Phu Nhuan District, Ho Chi Minh City<br/>'''Application''': by 29th May 2015 to [mailto:loi.dang@tuv-sud.vn loi.dang@tuv-sud.vn]<br/></div> | ||

| + | '''Wind energy in Vietnam – New chances by a new feed-in-tariff'''<br/>'''Date''': Tuesday 30th July 2015<br/>'''Venue''': GIZ-Repräsentanz, Reichpietschufer 20, 10785 Berlin, Germany<br/>'''Application''': by16th july by email to pep-suedostasien@giz.de<br/>The event located in Berlin (Germany) is addressing framework conditions and project possibilities for wind energy in Vietnam.<br/>The participation is for free. Event language will be German, English and Vietnamese (simultaneous translation).<br/> | ||

| − | <br/> | + | = Further Information<br/> = |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | = | + | *[[Wind Energy Country Analysis Vietnam|Wind Energy Country Analysis Vietnam]]<span dir="auto"></span> |

| + | *[[Solar Energy Country Analysis Vietnam|Solar Energy Country Analysis Vietnam]] | ||

| − | + | = References<br/> = | |

| − | + | <references /><br/> | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

<br/> | <br/> | ||

| − | + | [[Vietnam Energy Situation#toc|►Go to Top]]<br/> | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | [[Category:East_Asia_and_Pacific]] | |

Latest revision as of 14:00, 25 March 2019

Capital:

Hanoi

Region:

Coordinates:

21.0333° N, 105.8500° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

During the last 25 years Viet Nam’s economic growth reached more than 6% each year. At the same time, the energy demand increased almost twice as fast as the GDP. With an expected continuous increase of energy demand in the next years, Viet Nam’s energy sector will have to face many challenges, such as limited domestic fossil ressources, air pollution and climate change, causing amongst other things water scarcity. Viet Nam has been ranked among the five countries, that will be most affected by climate change.[1] Another issue is the country's unreliable power supply, especially in rural areas. In order to face these challenges, legislative conditions have to be adopted and the framework conditions for investments have to be reformed to strengthen foreign investments and eventually stimulate the expansion of renewable energy generation capacity.

Further information about Viet Nam see: All articles about Viet Nam on energypedia

General Overview of Viet Nam's Energy Situation

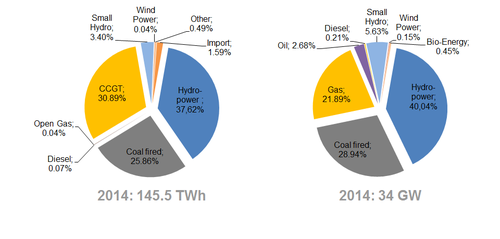

A reliable power supply is an important requirement for an emerging market like Viet Nam. By the end of 2014, 34 GW generation capacity was installed in the country, producing around 146 TWh electricity. Assumptions of the Power Development Plan VII (PDP VII) predict an overall power demand increase by a factor of almost 2.4 in the next 5 years, reaching a demand of 350 TWh in 2020, with an installed capacity of 75 GW. According to the PDP, coal power plants will mainly contribute to the essential capacity expansion, surpassing hydropower as primary resource for electricity generation.

Currently, the power production is still dominated by hydropower with a share of 41% in electricity generation, followed by natural gas with 31% and coal with 26%. Due to limited domestic coal and gas resources, Viet Nam’s fossil import dependency will increase. Except for hydropower, markets for renewable energies such as for wind and solar power are in a very early stage of development. Knowledge and reliable information about project development or regulative processes is very limited. [2]

Fig. 1: Electricity Production and Installed Capacity 2014 by Generation Technology

Governance and Market Structure

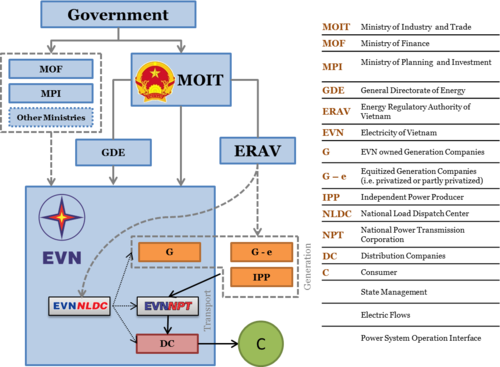

The Vietnamese electricity market is monopolistic, dominated by the state-owned-enterprise EVN, which is supervised by the Ministry of Industry and Trade (MoIT). In the generation market, EVN is single-buyer and power transmission and distribution systems are exclusively operated by subsidiary companies of the utility. However, the goal of the government is to develop a competition-based generation, wholesale and retail market until 2023, in particular in order to attract private and foreign investments in the energy sector. The average electricity selling price continuously increased in the last years, but with 1622 VND/kWh (incl. VAT; approx. 7.5 USCent/kWh) it is still too low to finance overall electricity generation costs. EVN operated at a deficit of 790 million US$ in 2014.[3]

Fig. 2: Institutional Framework of the Electricity Sector

Renewable Energies in Viet Nam

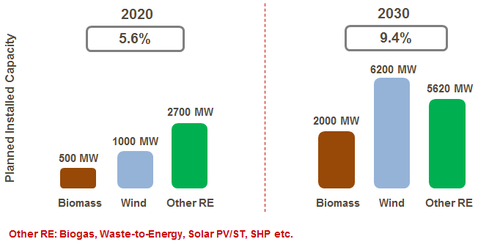

In 2014, renewable energies (including hydropower) contributed with 41% to Viet Nam’s electricity demand, but this share was almost exclusively accounted for by hydropower. According to the MoIT Small Hydropower (SHP) can still be expanded, but in general Viet Nam’s hydropower potential is nearly exploited. In contrast, wind, solar and biomass expansion potentials are high and to a great extent untapped. In the PDP VII, expansion targets for renewable energy generation capacities are set until 2030 as shown in the figure below.[2]

Fig. 3: Renewables Capacity Targets until 2030 (according to PDP VII)

The government also has incentives for solar projects until mid 2019 and for wind project up to 2021. Vietnam aims to have solar and wind instablled capacity of 0.8MW and 0.85MW respectively by 2020. However, a total of 2.8GW wind and 10GW solar power plants have already been approved until February 2019.

Wind Power

Although potential for wind power development in Vietnam is high, only 190 MW have been put into operation up until now. While many projects are in the planning phase, they face substantial market barriers, such as deficient wind measurement data reliability and a low feed-in-tariff for wind energy of only 7.8 Ct/kWh. On September 2018, Vietnam increase the FIT from 7.8 to 8.5 US cents/kWh for onshore, and 9.8 US cents/kWh for offshore wind power projects, according to Decision No.39/2018/QD-TTg. The FIT is implement from 1 Nov 2018 and will be valid for 20 years from the commencement of the wind projects. The wind power that commenced operation before 1 Nov 2018 will be able to apply for this new tariff for the remaining period of their Power Purchase Agreement (PPA).[4]

Further information are provided on Wind Energy Country Analysis Vietnam. ►Go to Top

Bioenergy

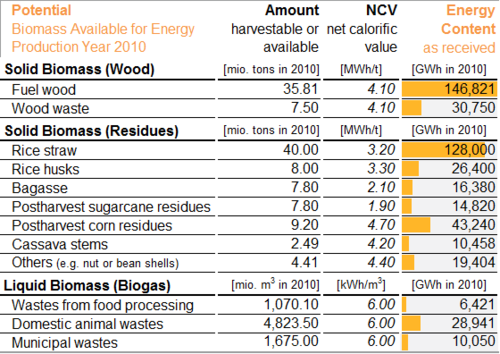

According to the PDP7 a bioenergy generation capacity of 500 MW will be installed until 2020. The largest regional feedstock potential is located in the Mekong delta region. Feed-in tariffs for electricity co-generation and municipal-solid-waste projects are already established, but projects are mostly in an early planning phase. It is assumed that the support mechanism and framework conditions have to be adopted and expanded on further applications and feedstock in order to strengthen biomass power deployment in Viet Nam.

Fig. 5: Theoretical Potential of Power from Biomass in Viet Nam

Solar Power

In general, Viet Nam can be considered as a country with high solar energy potential. The solar resources are comparable to countries like Italy, Spain, and California or – staying in the region – China or Thailand. However, the current Vietnamese solar PV market is estimated to be only around 5 MWp, with 80% off-grid applications in rural areas.

Solar energy is not yet integrated into political energy development strategies, such as the national Power Development Plan (PDP). However, solar energy will possibly be included in the revision of the PDP VII. According to press releases, larger ground-mounted PV systems are under development.

Further information are provided on Solar Energy Country Analysis Vietnam.

Transmission and Distribution System

The national transmission and distribution grid has to be extended in synchronization with increasing power demand and generation capacity in order to reduce power outages, losses and increase the quality of supply. During the period of 2014-2020 an investment volume of around 12.4 billion US$ is estimated to be needed for expansion. Viet Nam’s rural electrification rate was 97.3% by the end of 2013. The government aims at 100% by 2020. According to the PDP 7 Viet Nam wants to implement a cooperation and connectivity program with neighbouring countries and Mekong sub-region power grids. High voltage line connections with Laos, Cambodia and China already exist.

In terms of power reliability Viet Nam is currently ranked 113 out of 144 countries.[5] In rural areas, power shortages and blackouts, lasting longer than 5 min occurred around 20 times per year in 2013.[6]

Legal Documents

There are a number of legal documents relevant for the implementation of Renewable Energy projects in Viet Nam. Some of these documents are listed below:

The Prime Minister’s Decision No. 1208/QD-TT, Approving The National Master Plan for Power Development in The 2011-2020 Period, With Considerations to 2030, Legal Document, Hanoi, 21 July 2011

The Prime Minister’s Decision No. 63/2013/QD-TTg, Providing for the roadmaps, conditions and structure and level of electricity market in Vietnam, Legal Document, Hanoi, 8 November 2011

The Prime Minister‘s Decision No. 37/2011/QD-TTg, The Mechanism Supporting the Development of Wind Project in Vietnam, Legal Document, Hanoi, 29 June 2011.

The Ministry of Industry and Trade‘s Circular No. 06/2013/TT-BCT, Regulation on Content, Order, Procedures for Formulation, Appraising and Approving Wind Power Development Planning, Legal Document, Hanoi, 08 March 2013

The Government‘s Decision No. 24/2014/QD-TTg, On Support Mechanism for Development of Biomass Power Projects in Vietnam, Legal Document, Hanoi, 24 March 2014

The Ministry of Industry and Trade‘s Circular No. 31/2011/TT-BCT, Providing for The Adjustment of Electricity Sale Prices According to Basic Input Parameters, Legal Document, Hanoi, 24 March 2014

Events

Date: 2nd June 2015

Venue: The Vissai Saigon Hotel, 144 Nguyen Van Troi Street, Ward 8, Phu Nhuan District, Ho Chi Minh City

Application: by 29th May 2015 to loi.dang@tuv-sud.vn

Wind energy in Vietnam – New chances by a new feed-in-tariff

Date: Tuesday 30th July 2015

Venue: GIZ-Repräsentanz, Reichpietschufer 20, 10785 Berlin, Germany

Application: by16th july by email to pep-suedostasien@giz.de

The event located in Berlin (Germany) is addressing framework conditions and project possibilities for wind energy in Vietnam.

The participation is for free. Event language will be German, English and Vietnamese (simultaneous translation).

Further Information

References

- ↑ Dara (2012): Climate Vulnerability Monitor 2nd. http://daraint.org/climate-vulnerability-monitor/climate-vulnerability-monitor-2012/country-profile/?country=Vietnam

- ↑ 2.0 2.1 PDP VII: Prime Minister decision No. 1208/QD-TTg. http://www.nti.org/media/pdfs/VietnamPowerDevelopmentPlan2030.pdf?_=1333146022

- ↑ Vietnamnews.vn (2015): Viet Nam News. EVN reports loss $789.6 milion in 2014. Onlineartikel vom 14. Januar 2015 verfügbar unter: http://vietnamnews.vn/economy/265192/evn-reports-loss-of-7896-million-in-2014.html (zuletzt abgerufen am 4. April 2015).

- ↑ https://www.vietnam-briefing.com/news/vietnam-increases-feed-in-tariffs-for-wind-projects.html/

- ↑ World Economic Forum (2012); The Global Competitiveness Report 2012-2013, Geneva. http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2012-13.pdf

- ↑ Asian Development Bank (2014); Sector Assessment (Summary): Energy. http://www.adb.org/sites/default/files/linked-documents/46391-001-ssa.pdf