Difference between revisions of "Microfinance Institutions - Financing Renewable Energy"

***** (***** | *****) m |

***** (***** | *****) m |

||

| Line 5: | Line 5: | ||

Thus lending increased over the last five years. In the years from 2002 to 2004 avergae new lending per year amounted to less than $250 million; between 2005 and 2007 avergae new lending increased to $500 million per year. In 2008, new lending exceeded<br>$1 billion, with an increase in larger, standalone projects (see Figure). | Thus lending increased over the last five years. In the years from 2002 to 2004 avergae new lending per year amounted to less than $250 million; between 2005 and 2007 avergae new lending increased to $500 million per year. In 2008, new lending exceeded<br>$1 billion, with an increase in larger, standalone projects (see Figure). | ||

| + | <br> | ||

| + | [[Image:WBG hydropower investment.JPG|frame|left|446x322px|Value of WBG Contribution to Multipurpose Hydropower Components]] | ||

| − | + | | |

| − | |||

| − | | ||

Since 2003 67 hydropower projects have been approved amounting to 3.7 billion USD in WBG contributions (US$3.2 billion for hydropower components) to support almost 9700 MW in project investments. | Since 2003 67 hydropower projects have been approved amounting to 3.7 billion USD in WBG contributions (US$3.2 billion for hydropower components) to support almost 9700 MW in project investments. | ||

| Line 15: | Line 15: | ||

The majority of the projects have been approved in Africa (Senegal, Democratic Republic of Congo, Sierra Leone, and Uganda) and Asia (People’s Democratic Republic of Laos, India), as well as several rehabilitation projects in Eastern Europe (Ukraine, Macedonia, and Georgia). | The majority of the projects have been approved in Africa (Senegal, Democratic Republic of Congo, Sierra Leone, and Uganda) and Asia (People’s Democratic Republic of Laos, India), as well as several rehabilitation projects in Eastern Europe (Ukraine, Macedonia, and Georgia). | ||

| − | + | <br> | |

<br> | <br> | ||

| Line 23: | Line 23: | ||

| | ||

| − | | + | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| + | = Reconstruction Loan Corporation (German Kreditanstalt für Wiederaufbau KfW) = | ||

| + | = Regional Development Banks = | ||

| − | == | + | == European Investment Bank == |

| + | == Asian Development Bank == | ||

| + | == African Development Bank == | ||

| − | == Inter-American Development Bank == | + | == Inter-American Development Bank == |

Revision as of 10:25, 23 March 2012

World Bank Group

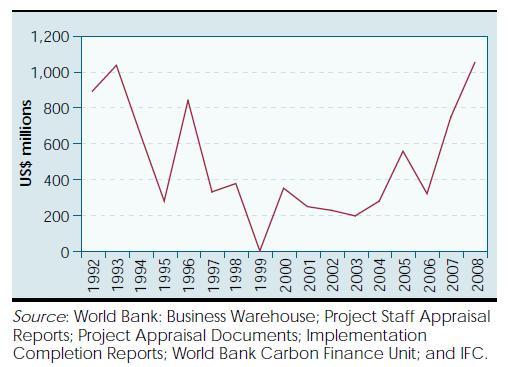

The World Banks investments in hydropower projects reflects international trends and demands. In the 1990 hydropower projects were strongly criticised throughout the world since social domains and investments in environmental protection were neglected and human rights have been infringed. Therefore lendings in hydropower during the 1990s significantly decreased accompanied by a shift to projects with fewer environmental and social impacts.By the early 2000s, however, several policies repositioned the World

Bank Group in terms of infrastructure and risk, and established a renewed framework for hydropower.

Thus lending increased over the last five years. In the years from 2002 to 2004 avergae new lending per year amounted to less than $250 million; between 2005 and 2007 avergae new lending increased to $500 million per year. In 2008, new lending exceeded

$1 billion, with an increase in larger, standalone projects (see Figure).

Since 2003 67 hydropower projects have been approved amounting to 3.7 billion USD in WBG contributions (US$3.2 billion for hydropower components) to support almost 9700 MW in project investments.

The majority of the projects have been approved in Africa (Senegal, Democratic Republic of Congo, Sierra Leone, and Uganda) and Asia (People’s Democratic Republic of Laos, India), as well as several rehabilitation projects in Eastern Europe (Ukraine, Macedonia, and Georgia).